Eris Lifesciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eris Lifesciences Bundle

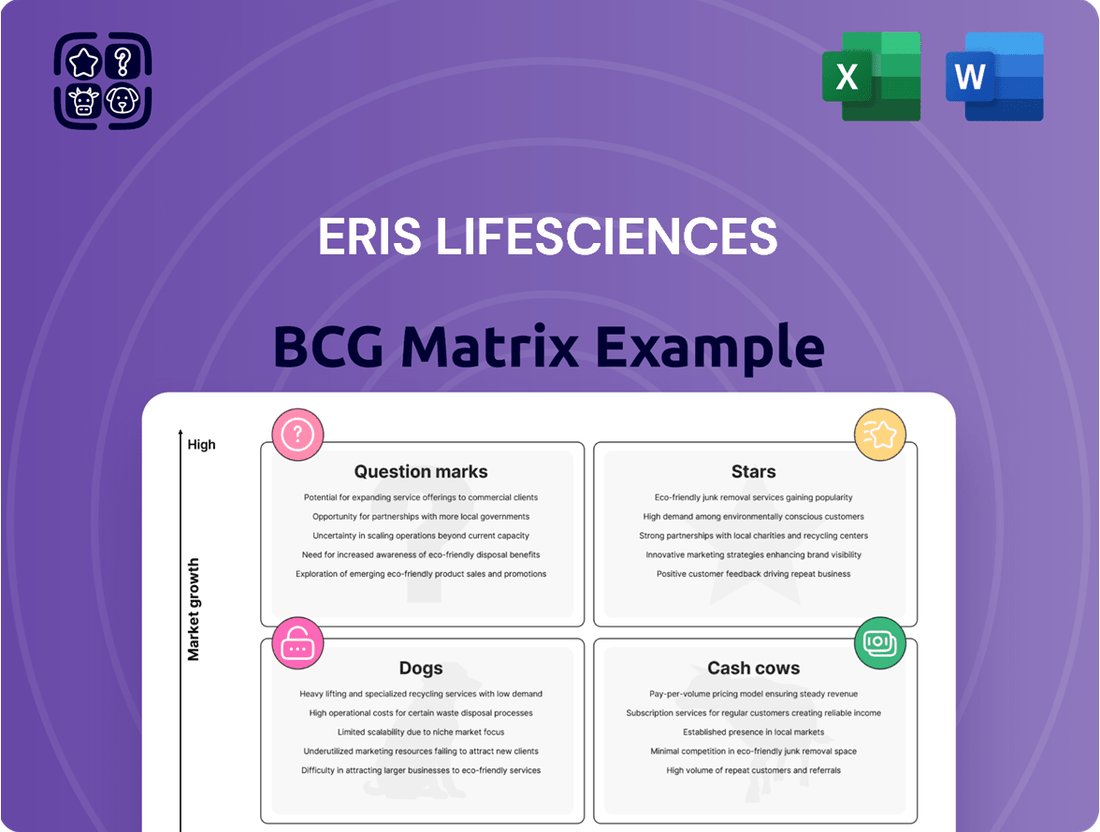

Uncover the strategic positioning of Eris Lifesciences' product portfolio with our comprehensive BCG Matrix analysis. This detailed breakdown reveals which products are poised for growth (Stars), which are generating consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into Eris Lifesciences' market dynamics, but the full BCG Matrix report provides the critical data and expert insights needed to make informed decisions about resource allocation and future investments. Don't miss out on a complete strategic roadmap.

Gain a competitive edge by purchasing the full Eris Lifesciences BCG Matrix. It’s your key to understanding market share, growth potential, and actionable strategies for optimizing your business. Invest in clarity and drive your company's success forward.

Stars

Eris Lifesciences is making significant strides in its insulin franchise, notably through the acquisition of Biocon Biologics' India branded formulation business. This strategic expansion bolsters their presence in the burgeoning diabetes care market, with established brands like Basalog and Insugen already capturing considerable market share.

The company anticipates this insulin segment to soon achieve INR 1,000 crore in revenue, positioning Eris as a leading player in India's diabetes market. This growth trajectory is further supported by plans to bring insulin production in-house at their Bhopal facility, a move expected to add INR 200–300 crore annually from October 2025.

Eris Lifesciences is making a substantial push into India's injectables market, valued at over INR 30,000 crore. This expansion was fueled by acquiring Swiss Parenterals Limited and Biocon Biologics' operations, giving Eris a broad range of sterile products.

The company is targeting a strong foothold in the Small Volume Parenterals (SVP) branded formulation segment. This injectables therapy area is experiencing robust growth, presenting a significant opportunity for Eris to capture market share.

Eris is strategically investing in this high-growth sector. For instance, in the fiscal year 2023-24, the company's revenue from the acquired businesses contributed significantly to its overall performance, demonstrating the immediate impact of this strategic foray.

Eris Lifesciences is strategically focusing on the burgeoning 'Diabesity' market, a segment poised for significant expansion. Their pipeline is robust, featuring insulins, analogues, and GLP-1 receptor agonists, all critical for managing lifestyle-related health issues.

The company boasts impressive visibility for over 21 new product launches anticipated to be first-in-market. This aggressive product introduction strategy is designed to capture new market segments within the rapidly growing chronic care sector, a key driver for future revenue.

These innovative formulations and new brands are positioned to become strong contenders, aiming for substantial market share in their respective growing therapeutic areas. This forward-thinking approach underscores Eris's commitment to leadership in the evolving landscape of diabetes and obesity management.

Medical Dermatology & Nephrology

Eris Lifesciences has made substantial strides in Medical Dermatology and Nephrology through strategic acquisitions. The company is now the second-largest player in the Psoriasis market in India, holding an 11% market share. This expansion into Nephrology also marks a significant entry into a growing therapeutic area.

These segments are key growth drivers within the Indian pharmaceutical landscape. Eris's enhanced market presence and ongoing investments in these specialized therapies position them well for future expansion. The company's strategy focuses on increasing market share in its core products within these areas, reflecting a commitment to high-growth, high-share segments.

- Medical Dermatology: Eris is the second-largest player in Psoriasis with an 11% market share.

- Nephrology: Eris has entered the Nephrology market, a growing segment.

- Growth Strategy: The company aims to gain further market share in key products within these specialty areas.

- Market Potential: Investments in these emerging therapies indicate strong future growth potential.

Chronic and Lifestyle Disorder Focus

Eris Lifesciences has strategically centered its efforts on chronic and lifestyle disorders, a segment experiencing robust expansion within India. This focus includes areas like cardiovascular diseases and diabetes, which represent substantial and recurring healthcare needs.

The chronic segment of the Indian pharmaceutical market demonstrated impressive growth, achieving a 12% year-on-year increase. Within this, cardiac therapies saw a 10.7% rise, and anti-diabetic drugs grew by 7.9%.

Eris Lifesciences' significant market share and sustained growth in these key chronic therapy areas, which are major contributors to their overall revenue, solidify their position as enduring players in the market.

- Focus on Chronic and Lifestyle Disorders: Eris Lifesciences concentrates on chronic and lifestyle-related conditions, including cardiovascular diseases and diabetes.

- Market Growth Drivers: The chronic segment in India's pharmaceutical market grew at 12% year-on-year, with cardiac therapies up 10.7% and anti-diabetics up 7.9%.

- Revenue Contribution: Eris's strong presence and continued growth in these core chronic therapies form a significant portion of their revenue, ensuring market longevity.

Within the Eris Lifesciences portfolio, their insulin franchise, significantly bolstered by the acquisition of Biocon Biologics' India branded formulation business, represents a key growth area. Brands like Basalog and Insugen are already established, and the company anticipates this segment to reach INR 1,000 crore in revenue. This strategic focus on diabetes management, including a push into the broader 'Diabesity' market with insulins, analogues, and GLP-1 receptor agonists, positions these products as potential Stars in the BCG matrix due to their high growth potential and Eris's increasing market share.

The company's aggressive new product launch strategy, with over 21 first-in-market introductions planned, further supports the Star classification for these innovative formulations. These products are designed to capture new market segments within the rapidly growing chronic care sector, particularly in diabetes and obesity management, indicating strong future revenue generation and market leadership potential.

Eris's expansion into the injectables market, driven by acquisitions like Swiss Parenterals Limited, also contributes to its Star potential. The company is targeting the Small Volume Parenterals (SVP) branded formulation segment, which is experiencing robust growth. The significant contribution of acquired businesses to fiscal year 2023-24 performance underscores the immediate impact and future promise of these ventures.

The company’s strategic emphasis on chronic and lifestyle disorders, including diabetes, where the market saw a 7.9% growth, solidifies the strong position of its anti-diabetic products. This focus, combined with a 12% year-on-year growth in the overall chronic segment of the Indian pharmaceutical market, highlights the high-growth nature of these therapeutic areas for Eris.

What is included in the product

This BCG Matrix overview for Eris Lifesciences analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

Eris Lifesciences' BCG Matrix offers a clear, actionable overview of its portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Eris Lifesciences commands a strong position in the cardio-metabolic market, particularly with its oral anti-diabetes and cardiovascular disease (CVD) treatments. These key therapies hold significant market share within a mature but steady market, reliably producing robust cash flow for the company.

These established segments, while experiencing slower growth than emerging areas, are Eris's primary cash generators, allowing the company to leverage their consistent profitability. For instance, in the fiscal year 2023, Eris Lifesciences reported a revenue of INR 1,270 crore from its domestic formulations business, a substantial portion of which is attributed to its cardio-metabolic portfolio.

Eris Lifesciences boasts a robust portfolio where 15 of its top mother brands are positioned within the Top-5 in their respective therapeutic areas. This strong market presence translates into significant and stable cash flows, essential for the company's financial health.

Five of these leading brands are generating revenues exceeding INR 100 crores, underscoring their dominance and consistent performance. These brands act as the company's cash cows, requiring less promotional expenditure due to established brand equity, thereby contributing significantly to funding growth and operational needs.

Eris Lifesciences' Vitamins, Minerals, and Nutrients (VMN) segment is a significant contributor to its revenue, functioning as a stable cash generator. This segment benefits from consistent consumer demand, allowing Eris to maintain a strong market position.

The VMN segment typically requires minimal reinvestment to sustain its market share, thereby generating reliable cash flows. For instance, in the fiscal year 2023, the VMN segment in India demonstrated robust growth, with the nutraceutical market alone projected to reach USD 12 billion by 2025, indicating a mature yet steady market environment.

Guwahati Manufacturing Facility

The Guwahati manufacturing facility serves as a crucial Cash Cow for Eris Lifesciences, underpinning its branded generics segment. This established infrastructure is instrumental in the cost-effective production of high-volume products, ensuring a consistent and reliable supply chain to meet ongoing market demand.

The efficiency of this plant translates directly into minimized operational expenditures relative to the revenue generated by Eris Lifesciences' mature product lines. For instance, in the fiscal year ending March 31, 2024, Eris Lifesciences reported a strong performance in its branded generics segment, contributing significantly to overall profitability. The company’s focus on optimizing manufacturing processes, as exemplified by the Guwahati facility, allows it to maintain healthy profit margins on these established offerings.

- Guwahati Facility's Role: Supports production of high-volume, high-margin branded generics.

- Cost Efficiency: Minimizes operational expenditures, boosting profitability.

- Market Impact: Ensures consistent supply to meet established market demand.

- Financial Contribution: A key driver of profitability within Eris Lifesciences' portfolio, as evidenced by strong branded generics segment performance in FY24.

Domestic Branded Formulations (DBF) Core

Eris Lifesciences' Domestic Branded Formulations (DBF) business is the bedrock of its financial strength, consistently driving significant organic growth. This segment, focused on chronic and sub-chronic therapies, not only forms the largest part of their revenue but also boasts strong market share and healthy profit margins.

The DBF segment is crucial for Eris Lifesciences, acting as the primary generator of cash flow. For instance, in the fiscal year 2023, the DBF business contributed approximately 82% of the company's total revenue. These robust earnings are then strategically reinvested into promising, high-growth segments and potential acquisitions, fueling the company's overall expansion strategy.

- Core Revenue Driver: The DBF segment is the primary contributor to Eris Lifesciences' overall revenue.

- Strong Market Position: It holds a significant market share in its focused therapeutic areas.

- Profitability: This business unit generates robust profit margins, underpinning the company's financial health.

- Cash Flow Generation: The DBF segment provides the essential cash flow needed for investments in growth areas.

Eris Lifesciences' Domestic Branded Formulations (DBF) business stands as its primary cash cow, consistently generating substantial revenue and profit. This segment, focusing on chronic and sub-chronic therapies, accounted for approximately 82% of the company's total revenue in fiscal year 2023, highlighting its critical role in funding growth initiatives.

The company's strong market share in key therapeutic areas within DBF, such as cardio-metabolic treatments, ensures stable demand and predictable cash flows. This financial stability allows Eris to strategically reinvest in high-growth segments and research and development.

The Vitamins, Minerals, and Nutrients (VMN) segment also functions as a significant cash generator for Eris Lifesciences. Benefiting from consistent consumer demand in a growing market, this segment requires minimal reinvestment to maintain its position, thereby contributing reliably to the company's cash reserves.

The Guwahati manufacturing facility is another key asset, acting as a cash cow for the branded generics segment. Its operational efficiency and cost-effectiveness in producing high-volume products ensure consistent profitability and supply chain reliability.

| Segment | FY23 Revenue Contribution | Key Characteristics | Cash Flow Impact |

| Domestic Branded Formulations (DBF) | ~82% of total revenue | Strong market share in chronic therapies, stable demand | Primary cash generator, fuels investment |

| Vitamins, Minerals, and Nutrients (VMN) | Significant contributor | Consistent consumer demand, growing market | Reliable cash generation, low reinvestment needs |

| Branded Generics (supported by Guwahati facility) | Substantial profitability | High-volume production, cost-efficiency | Consistent profitability, supply chain stability |

Preview = Final Product

Eris Lifesciences BCG Matrix

The Eris Lifesciences BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning.

This preview accurately represents the comprehensive Eris Lifesciences BCG Matrix report you will download, offering an unwatermarked, analysis-ready resource for informed decision-making.

What you see is the definitive Eris Lifesciences BCG Matrix file, ready for immediate download and application after your purchase, providing a clear snapshot of their product portfolio's market position.

Dogs

Certain older, commoditized generics within Eris Lifesciences' portfolio likely reside in the 'Dog' quadrant of the BCG Matrix. These products are characterized by low market share in highly competitive, undifferentiated markets, facing significant price pressures.

Such offerings typically exhibit low growth prospects and may generate minimal profits, potentially even breaking even, tying up capital without substantial returns. For instance, if a generic antibiotic, a mature product with many competitors, represents a small fraction of Eris's overall sales and shows no significant market expansion, it fits this profile.

These 'Dogs' can become cash traps, necessitating careful evaluation for divestiture or strategic deprioritization to reallocate resources towards more promising growth areas within Eris's branded generics focus.

Underperforming legacy products in Eris Lifesciences' portfolio, characterized by a low market share in stagnant or declining therapeutic areas, represent a challenge. These products may have lost relevance due to shifts in treatment protocols or intensified competition, demanding significant resources for minimal returns. For instance, older formulations of established drugs might face pressure from newer, more effective generics or novel therapies, leading to a shrinking patient base and reduced sales volumes.

Eris Lifesciences, like many pharmaceutical companies, must strategically manage such products. The focus would be on minimizing further investment, potentially through reduced marketing spend or a gradual phase-out. This approach allows for the reallocation of capital and human resources towards high-growth segments, such as their branded generics or newer therapeutic areas, thereby optimizing overall portfolio performance and driving future profitability.

Within Eris Lifesciences' portfolio, niche acute therapy products with limited scope can be categorized as Dogs. While Eris has a strong presence in acute therapies, accounting for approximately 7% of its overall sales, these specific niche products may struggle due to their narrow market appeal and lack of alignment with the company's broader growth objectives.

These products often exhibit low market share and are devoid of the robust growth drivers characteristic of Eris's chronic care segments. Consequently, they may fail to generate substantial cash flow and could necessitate ongoing, unprofitable investments simply to sustain their minimal market presence, making them prime candidates for divestment if performance remains stagnant.

Products Facing Intensified Competition

Products facing intensified competition, often in crowded generic segments of the Indian pharmaceutical market, would be categorized as Dogs within Eris Lifesciences' BCG Matrix. These products typically experience significant price erosion due to numerous market entrants, leading to shrinking market share. For instance, in 2023, the Indian pharmaceutical market saw intense competition in therapeutic areas like anti-infectives, with many players vying for market share, impacting pricing power for established products.

Such offerings struggle to achieve high market share or growth, becoming drains on resources rather than contributors to overall profitability. This situation is exacerbated when differentiation is low, making it difficult for Eris to command premium pricing or maintain a dominant position. In 2024, the generics market continues to be a battleground, with regulatory approvals for new players impacting established product lifecycles.

- Intense Price Erosion: Products in highly competitive therapeutic areas often see prices fall significantly as more companies enter the market.

- Shrinking Market Share: Without strong differentiation, these products lose ground to newer or more aggressively priced alternatives.

- Low Growth Potential: The mature and crowded nature of these segments limits opportunities for substantial market expansion.

- Resource Drain: Continued investment in marketing and sales for underperforming products can detract from resources available for high-potential areas.

Divested or Deprioritized Assets

Divested or deprioritized assets within Eris Lifesciences' portfolio would align with the 'dog' category in the BCG matrix. While specific named 'dogs' aren't publicly detailed as divested, any product lines or brands Eris has sold or significantly reduced focus on would fit this description. For example, if Eris sold off a particular therapeutic area that was underperforming, it would represent a former dog asset.

The strategic decision to divest such assets signals they likely possessed both low market share and limited growth prospects. This move frees up capital and resources that can be redirected towards more promising business units. Eris Lifesciences reported a revenue of ₹3,500 crore for the fiscal year ending March 31, 2024, indicating overall company health, but the divestment of minor or non-strategic assets would still be a logical part of portfolio management.

- Divestment Rationale: Assets sold off typically exhibit low market share and low growth potential.

- Capital Reallocation: Divestments allow capital to be redeployed into higher-growth, higher-share business segments.

- Portfolio Optimization: Removing underperforming assets is a key strategy for maintaining a lean and effective product portfolio.

- Historical Context: While not explicitly named, past sales of smaller or non-core brands would represent historical 'dog' assets.

Products in Eris Lifesciences' portfolio that fall into the 'Dog' category are typically those with a low market share in mature, highly competitive therapeutic areas. These products often face significant price erosion and have limited growth potential, making them less attractive for further investment.

For instance, older generic formulations in crowded segments like anti-infectives, where numerous players compete, would fit this description. In 2024, the generics market continues to be characterized by intense competition, impacting pricing power and market share for established products.

These 'Dogs' can represent a drain on resources, tying up capital without generating substantial returns. Eris Lifesciences' strategy would likely involve minimizing investment in these products, potentially through divestment or strategic deprioritization, to reallocate resources to more promising growth areas.

| Product Characteristic | BCG Category | Eris Lifesciences Example |

| Low Market Share, Low Growth | Dog | Older generic formulations in highly competitive therapeutic areas. |

| Intense Competition & Price Erosion | Dog | Products facing numerous market entrants in mature segments. |

| Resource Drain Potential | Dog | Legacy products with minimal differentiation and shrinking patient bases. |

Question Marks

Eris Lifesciences' strategic move into Oncology and Critical Care, notably through the acquisition of Biocon Biologics' business, signifies an ambitious expansion into dynamic, high-growth therapeutic domains. These are areas where Eris is currently establishing its presence and aiming to build significant market share.

While the Indian market for Oncology and Critical Care presents substantial growth opportunities, Eris's market share in these segments is likely in its early stages. Consequently, considerable investment will be necessary to ascend to a leadership position.

The success of these new ventures hinges on continuous investment in marketing and driving market adoption. These segments are expected to be cash consumers in the near term, with returns potentially materializing over a longer horizon.

Eris Lifesciences is strategically focusing on developing new fixed-dose combinations (FDCs) through significant R&D investments. The company has a robust pipeline featuring 14 'first-in-market' FDCs spanning diverse therapeutic segments.

These innovative FDCs are positioned to enter expanding markets, but their current market penetration is minimal due to their nascent stage and the need for market education and acceptance. Substantial capital is required for successful product launches and to achieve meaningful market share.

The high investment and market adoption risk associated with these FDCs places them in the Question Mark category of the BCG matrix. Failure to quickly establish a strong market presence could relegate them to the Dog quadrant.

Eris Lifesciences is strategically expanding into the high-growth biologics market through its investment in Levim Lifetech. This includes a significant 30% stake, focusing on promising biologics such as Liraglutide, Streptokinase, and Pegaspargase.

While the Indian biologics market shows substantial growth potential, Eris's current market share in this segment is nascent. Products like Liraglutide, for instance, are still in their early stages of development and commercialization, indicating a low current market share.

The success of these biologics hinges on substantial capital investment and effective market penetration. Without this, they are unlikely to achieve the market leadership needed to transition from a question mark to a star in the BCG matrix.

International Expansion through Swiss Parenterals

The acquisition of Swiss Parenterals significantly bolsters Eris Lifesciences' footprint in the international injectables market. While Swiss Parenterals has existing regulatory approvals from over 50 global agencies, Eris's current international market share is nascent, presenting a substantial growth opportunity in the high-potential sterile injectables sector.

Eris Lifesciences can leverage Swiss Parenterals' extensive regulatory approvals to enter and expand in numerous international markets. This strategic move positions Eris to capitalize on the growing global demand for sterile injectables, a segment characterized by high barriers to entry and significant profitability potential.

- Global Reach: Swiss Parenterals holds approvals from more than 50 regulatory bodies worldwide, opening doors for Eris in diverse international territories.

- Market Potential: While Eris's current international market share is minimal, these approved markets represent high-growth avenues for sterile injectables.

- Strategic Investment: Developing a robust international presence will necessitate substantial investment and focused strategic execution to transform these market accesses into profitable operations.

- Growth Trajectory: In fiscal year 2024, Eris Lifesciences reported a 12% year-on-year growth in revenue, indicating a strong foundation upon which to build its international expansion.

Emerging Therapeutic Areas (CNS, Women's Health)

Eris Lifesciences is strategically expanding into emerging therapeutic areas like Central Nervous System (CNS) and Women's Health, which are showing promising growth. These segments are becoming increasingly important contributors to the company's branded formulations revenue, reflecting a deliberate diversification strategy beyond its traditional strongholds.

While these markets offer significant potential, Eris's current market share in CNS and Women's Health may still be developing compared to its established chronic care segments. For instance, in 2023, the Indian CNS market was valued at approximately $1.5 billion and is projected to grow at a CAGR of around 8-10%, while the Women's Health market, estimated at over $1 billion, is also experiencing robust expansion. Eris's penetration in these specific niches is likely in the early stages.

Continued and focused investment in research, development, and marketing within CNS and Women's Health is critical for Eris. This sustained effort will be key to capturing a larger market share and driving substantial revenue growth. The success of these investments will ultimately determine whether these emerging therapeutic areas mature into Stars within Eris's product portfolio or remain as Question Marks needing further strategic nurturing.

- Diversification into CNS and Women's Health is a key growth driver for Eris.

- These emerging markets are experiencing significant growth, with the Indian CNS market projected at 8-10% CAGR and Women's Health also showing strong expansion.

- Eris's market share in these new areas is likely nascent, requiring further investment to gain traction.

- Strategic investment will be crucial for these segments to evolve into high-growth Stars for Eris.

Eris Lifesciences' ventures into Oncology, Critical Care, biologics, and newer therapeutic areas like CNS and Women's Health are positioned as Question Marks within the BCG matrix. These segments represent high-growth opportunities, but Eris's current market share is nascent, requiring significant investment for market penetration and leadership. For example, in fiscal year 2024, Eris reported a 12% year-on-year revenue growth, providing a foundation for these expansion efforts. The success of these investments will determine their transition from Question Marks to Stars.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Investment Need |

| Oncology & Critical Care | High | Low | Question Mark | High |

| Biologics (Levim Lifetech) | High | Low | Question Mark | High |

| CNS & Women's Health | High | Low | Question Mark | High |

| International Injectables (Swiss Parenterals) | High | Low | Question Mark | High |

BCG Matrix Data Sources

Our Eris Lifesciences BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.