EPR Properties SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPR Properties Bundle

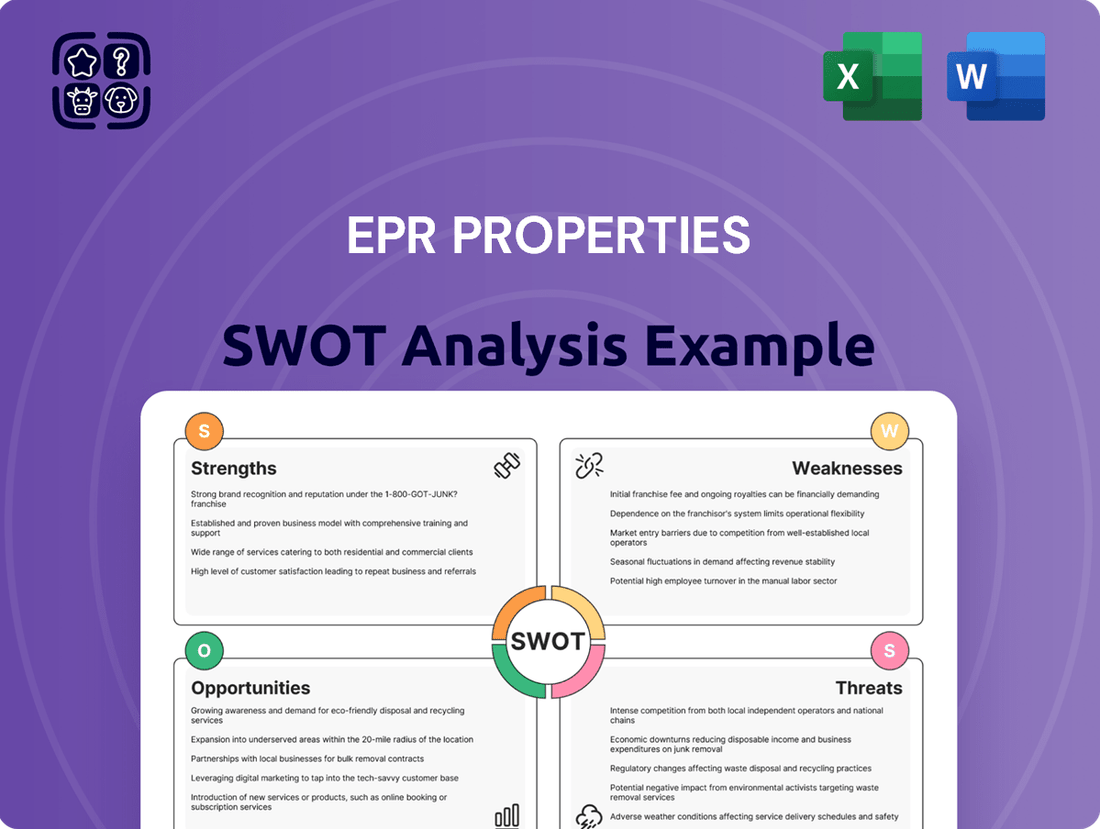

EPR Properties' current SWOT analysis reveals a dynamic market position, highlighting key strengths in its diverse portfolio and significant opportunities for expansion. However, it also points to potential challenges and threats that demand strategic attention.

Want the full story behind EPR Properties' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

EPR Properties boasts a highly diversified experiential portfolio, encompassing movie theaters, golf entertainment, ski areas, and a range of other leisure venues. This broad exposure across different entertainment sectors significantly reduces the risk tied to any single industry's performance, thereby bolstering the stability of its rental income streams.

The company's strategic focus on experiential real estate is evident, with this segment representing a substantial 94% of its total investments as of June 30, 2025. This deep commitment to experiential properties underscores its core business strategy and its confidence in the long-term viability of these entertainment-focused assets.

EPR Properties has shown a solid track record of revenue growth, with total revenue reaching $178.1 million in the second quarter of 2025, an increase from $173.1 million in the same period of 2024. This upward trend highlights the company's ability to consistently expand its top line.

The company's financial performance is further bolstered by its strong gross profit margins, indicating efficient operations and pricing power. This financial health is a key strength, allowing for sustained business operations and investment.

Furthermore, EPR Properties has a history of rewarding shareholders, having maintained consistent dividend payments for an impressive 29 consecutive years. This long-standing commitment to dividends underscores the company's financial stability and shareholder value focus.

EPR Properties excels at strategic capital recycling, a process where they sell off less profitable or non-core assets, such as certain theater and education properties, to fund investments in more promising experiential real estate. This approach not only optimizes their portfolio but has also led to substantial net gains from these asset sales.

The company boasts a robust investment pipeline, demonstrating its commitment to future growth. EPR Properties has allocated over $100 million for experiential development and redevelopment projects, with funding scheduled over the next 18 months, signaling a proactive stance in expanding its high-return asset base.

Improved Cost of Capital and Liquidity

EPR Properties has benefited from a notably lower cost of capital, enhancing its capacity for strategic investments and larger transactions. This improved financial footing provides greater flexibility in capital allocation.

The company’s robust liquidity position, bolstered by substantial cash reserves and ample availability under its revolving credit facility, ensures effective management of upcoming debt obligations. For instance, as of the first quarter of 2024, EPR Properties reported approximately $1.1 billion in total liquidity.

- Improved Cost of Capital: Lower borrowing costs allow for more attractive investment returns.

- Strong Liquidity: Approximately $1.1 billion in total liquidity as of Q1 2024 provides financial resilience.

- Debt Management: Sufficient cash and credit availability facilitate the refinancing or repayment of maturing debt.

Resilient Consumer Demand for Experiential Spending

Even with economic jitters, consumers are still keen on spending money on experiences outside the home. This is great news for EPR Properties because their business is built around these kinds of venues. As people continue to value doing things over owning things, it keeps the demand strong for the variety of places EPR owns and operates.

This shift in consumer preference directly supports EPR's portfolio, which includes entertainment centers, theme parks, and ski resorts. For instance, in 2024, the U.S. travel and tourism sector, a key indicator of experiential spending, saw continued growth, with leisure travel spending projected to increase by 4.7% over 2023 according to pre-release data from the U.S. Travel Association. This robust demand for out-of-home activities directly translates to higher occupancy and rental income for EPR's properties.

- Sustained Consumer Preference: Consumers are prioritizing spending on experiences like entertainment, dining, and recreation.

- Portfolio Alignment: EPR Properties' diverse portfolio of experiential venues, including movie theaters, theme parks, and family entertainment centers, directly benefits from this trend.

- Resilience in Spending: Despite economic headwinds, spending on experiential activities has shown remarkable resilience, supporting consistent revenue streams for EPR.

EPR Properties' diversified experiential portfolio, including entertainment, ski, and golf venues, significantly mitigates sector-specific risks. This broad exposure underpins stable rental income, a core strength. The company's strategic focus on experiential real estate, representing 94% of its investments as of June 30, 2025, highlights its commitment to this resilient sector.

The company demonstrates strong financial health with a revenue increase to $178.1 million in Q2 2025 from $173.1 million in Q2 2024, alongside robust gross profit margins. Furthermore, EPR Properties has maintained consistent dividend payments for 29 consecutive years, showcasing financial stability and a shareholder-centric approach.

Strategic capital recycling, selling non-core assets to fund growth in experiential properties, has generated substantial net gains. A robust investment pipeline, with over $100 million allocated for development over the next 18 months, signals proactive expansion of its high-return asset base.

EPR Properties benefits from an improved cost of capital and a strong liquidity position, with approximately $1.1 billion in total liquidity reported as of Q1 2024, ensuring financial resilience and debt management capabilities.

| Metric | Q2 2024 | Q2 2025 |

|---|---|---|

| Total Revenue | $173.1 million | $178.1 million |

| Experiential Investments % | ~94% (as of June 30, 2025) | ~94% (as of June 30, 2025) |

| Consecutive Dividend Payments | 29 years | 29 years |

What is included in the product

Analyzes EPR Properties’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Despite efforts to diversify, EPR Properties' theater segment remains a significant part of its business, accounting for 38% of its portfolio and pre-tax profits as of June 30, 2025. This reliance on movie theaters means the company is susceptible to the ups and downs of the film industry, including how well movies perform at the box office and the growing influence of streaming platforms.

EPR Properties' significant exposure to experiential properties makes its revenue streams highly sensitive to discretionary consumer spending. This means that when the economy tightens, or people feel less confident about their finances, they tend to cut back on entertainment and leisure activities. For example, if inflation continues to be a concern throughout 2024 and into 2025, consumers might reduce visits to movie theaters or theme parks, directly impacting the rental income EPR collects from these tenants.

EPR Properties, as a Real Estate Investment Trust (REIT), is inherently sensitive to shifts in interest rates. These fluctuations directly impact its borrowing expenses and the overall valuation of its property portfolio. For instance, in the second quarter of 2025, EPR reported losses stemming from its interest rate swap agreements, underscoring the tangible financial consequences of a rising rate environment.

Operational Challenges in Specific Segments

EPR Properties faces operational headwinds in specific segments, notably the eat-and-play sector, which saw year-over-year declines. For instance, the Kartrite Hotel, a key property, has encountered significant operational challenges, impacting its performance. While the majority of EPR's portfolio operates smoothly, these isolated issues can affect individual tenant success and necessitate continuous oversight.

These operational difficulties can translate into financial strain for affected tenants, potentially impacting rental income for EPR. The company must actively manage these underperforming assets to mitigate negative impacts on its overall financial health.

- Eat-and-play sector experiencing year-over-year declines.

- Kartrite Hotel facing specific operational challenges.

- Isolated property issues impacting tenant performance.

- Need for ongoing management attention to address these weaknesses.

Potential for Asset Impairment Charges

EPR Properties has faced challenges with asset impairment, notably recognizing charges related to its education properties. This has impacted its financial statements, reflecting the evolving market conditions and operational realities within certain segments.

The company's joint ventures have also been affected by significant weather-related damage. Such events can necessitate substantial write-downs, directly affecting the carrying value of its assets and potentially leading to unexpected hits to profitability.

- Property Impairment: Recognized charges on specific assets, particularly within the education sector.

- Joint Venture Damage: Significant weather events have impacted properties held in joint ventures.

- Financial Impact: Potential for unexpected write-downs and negative effects on asset values and earnings.

EPR Properties' reliance on specific sectors, like experiential entertainment, exposes it to significant risks. The company's portfolio is heavily weighted towards theaters, which accounted for 38% of its total portfolio and pre-tax profits as of June 30, 2025. This concentration makes EPR vulnerable to shifts in consumer behavior and the competitive landscape of the film industry, including the increasing prevalence of streaming services.

Furthermore, EPR's exposure to experiential properties means its revenue is closely tied to discretionary consumer spending. A downturn in the economy, characterized by persistent inflation throughout 2024 and into 2025, could lead consumers to reduce spending on entertainment, directly impacting rental income from tenants like movie theaters and theme parks.

The company also faces challenges with specific underperforming segments. The eat-and-play sector has seen year-over-year declines, with notable operational difficulties at properties like The Kartrite Hotel. These isolated issues require ongoing management attention and can affect tenant viability and rental income.

EPR has also recognized asset impairment charges, particularly on its education properties, and experienced significant weather-related damage to joint venture assets. These events can lead to asset write-downs, negatively impacting the company's financial statements and overall asset valuation.

| Segment Exposure | Impact of Economic Conditions | Operational Challenges | Asset Impairment & Damage | |

|---|---|---|---|---|

| Theaters (38% of portfolio, June 30, 2025) | Susceptible to box office performance and streaming growth | Reliance on discretionary consumer spending | Eat-and-play sector declines | Education property impairment charges |

| Experiential properties | Reduced rental income during economic downturns | Kartrite Hotel operational issues | Weather damage to joint venture assets | |

| Impact of inflation on consumer spending | Need for ongoing management of underperforming assets | Potential for asset write-downs |

Same Document Delivered

EPR Properties SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual EPR Properties SWOT analysis, ensuring transparency and quality. Purchase unlocks the complete, in-depth report.

Opportunities

EPR Properties can capitalize on evolving consumer interests by expanding into new experiential categories like fitness and wellness centers. This diversification could tap into growing markets, potentially offering new avenues for revenue growth beyond their established entertainment and amusement assets.

EPR Properties' improved cost of capital, potentially reflecting favorable market conditions in late 2024 or early 2025, allows for more aggressive pursuit of strategic acquisitions. This could involve acquiring established experiential properties or portfolios that align with their growth strategy, enhancing scale and market penetration.

A robust development pipeline, likely bolstered by pre-leasing successes and favorable construction economics in the 2024-2025 period, positions EPR to initiate new, large-scale experiential projects. These developments are crucial for expanding their footprint in high-demand sectors like entertainment and family attractions, driving future rental income streams.

By strategically deploying capital into both acquisitions and new developments, EPR Properties aims to solidify its market leadership and capture emerging opportunities within the evolving experiential real estate landscape. This proactive approach is designed to deliver sustained long-term growth and value appreciation for shareholders.

Consumer confidence is showing a strong upward trend, encouraging more spending on leisure activities. This is particularly beneficial for EPR Properties as people return to out-of-home entertainment venues.

The North American box office saw a significant rebound in 2023, grossing over $9 billion, a substantial increase from previous years. With promising film releases scheduled for 2024 and 2025, EPR Properties is well-positioned to benefit from higher attendance, which directly translates to increased percentage rent income from its cinema tenants.

Optimizing Capital Structure and Debt Management

EPR Properties' robust liquidity position and the absence of substantial debt maturities in the immediate future present a prime opportunity to refine its capital structure. This financial flexibility allows for strategic debt management, potentially including the issuance of bonds during periods of favorable market conditions. Such actions could further bolster the company's financial adaptability and access to capital.

By proactively managing its debt, EPR Properties can optimize its cost of capital and enhance its overall financial health. This strategic approach not only strengthens its balance sheet but also positions the company to capitalize on future growth opportunities. For instance, as of the first quarter of 2024, EPR Properties reported total debt of approximately $5.1 billion, with no significant maturities before 2027, underscoring its stable debt profile.

- Strategic Debt Issuance: Explore issuing new bonds when interest rates are advantageous to refinance existing debt or fund new investments.

- Capital Structure Optimization: Analyze the debt-to-equity ratio and other leverage metrics to ensure an optimal balance that minimizes risk and maximizes returns.

- Liquidity Management: Maintain strong liquidity reserves to comfortably meet operational needs and debt obligations, even in uncertain economic environments.

Leveraging Technology for Enhanced Guest Experiences

EPR Properties can seize an opportunity by integrating advanced technologies like AI into its portfolio to elevate guest experiences. This could translate into more personalized services, streamlined operations, and ultimately, increased revenue. For instance, AI-powered chatbots can handle guest inquiries 24/7, freeing up staff for more complex tasks.

The entertainment and experiential real estate sectors are increasingly adopting tech solutions. In 2024, investments in AI for customer service and operational efficiency across various industries are projected to rise significantly, with some estimates suggesting a global market value of over $200 billion for AI in customer service alone. This trend indicates a growing expectation from consumers for tech-enhanced interactions.

By embracing these technological advancements, EPR Properties can differentiate itself and cater to evolving consumer demands. Consider these potential applications:

- Personalized recommendations: AI can analyze guest preferences to suggest tailored activities or dining options.

- Smart building management: IoT devices and AI can optimize energy consumption and maintenance schedules, reducing costs.

- Enhanced on-site engagement: Augmented reality (AR) experiences or interactive digital displays can create more memorable visits.

EPR Properties is well-positioned to benefit from the ongoing recovery and growth in the experiential real estate sectors, particularly entertainment and family attractions. The company's strategic focus on these areas, coupled with a strong development pipeline and favorable market conditions anticipated through 2025, presents significant opportunities for expansion and increased rental income.

The company's financial flexibility, demonstrated by its robust liquidity and lack of near-term debt maturities as of early 2024, allows for strategic capital deployment. This includes pursuing acquisitions and optimizing its capital structure, potentially through advantageous debt issuance in 2024-2025, to fund growth initiatives and enhance shareholder value.

Consumer spending on leisure activities is projected to remain strong, supported by rising consumer confidence. This trend, alongside the continued rebound in sectors like North American box office revenue, which exceeded $9 billion in 2023 and is expected to see strong performance in 2024-2025, directly benefits EPR Properties' tenant base and its percentage rent income streams.

Integrating advanced technologies, such as AI and AR, into its properties offers a substantial opportunity for EPR Properties to enhance guest experiences and operational efficiency. This aligns with broader industry trends and consumer expectations for tech-enabled engagement, potentially driving increased visitation and revenue.

| Opportunity Area | Key Driver | Projected Impact (2024-2025) | EPR Relevance |

|---|---|---|---|

| Experiential Sector Growth | Rising consumer confidence, increased leisure spending | Continued recovery and expansion of entertainment/attraction venues | Directly benefits cinema, family entertainment, and amusement tenants |

| Capital Structure Optimization | Favorable interest rate environment, strong liquidity | Lower cost of capital for acquisitions and development | Enables strategic growth and financial flexibility |

| Technological Integration | Consumer demand for enhanced experiences, AI/AR advancements | Improved guest satisfaction, operational efficiencies | Differentiates properties, potentially increases revenue |

| Development Pipeline Execution | Pre-leasing success, favorable construction economics | Expansion of high-demand experiential assets | Drives future rental income and market share |

Threats

A significant threat facing EPR Properties is the possibility of a global recession or economic downturn. Such an event could sharply curtail consumer spending on non-essential items, including entertainment and leisure activities, which are the core business of many of EPR's tenants.

This reduction in discretionary spending would directly impact the rental income and occupancy rates of EPR Properties' experiential venues, such as movie theaters, family entertainment centers, and ski resorts. For instance, if consumers cut back on going to the movies or amusement parks, the revenue generated by these venues would decline, potentially leading to defaults or requests for rent concessions from tenants.

The economic outlook for 2024 and into 2025 suggests continued inflationary pressures and interest rate uncertainty, which could dampen consumer confidence and spending power. While some forecasts predict modest growth, the risk of a slowdown remains, making this a persistent threat for real estate investment trusts focused on experiential real estate.

The increasing popularity of digital streaming services and at-home entertainment options presents a significant challenge to traditional out-of-home entertainment venues, such as cinemas. This trend could potentially reduce foot traffic and overall demand for properties heavily reliant on these experiences.

While live events and other non-digital entertainment formats have demonstrated resilience, a prolonged shift in consumer behavior towards digital consumption could negatively affect the occupancy and rental income for certain EPR Properties assets, particularly those focused on movie exhibition.

The experiential real estate sector, where EPR Properties operates, is inherently competitive. Existing players and new entrants are constantly seeking prime locations and desirable tenants, intensifying the market dynamics. This heightened competition can directly impact EPR Properties by potentially suppressing rental income and occupancy rates.

For instance, a surge in new developments or aggressive expansion by competitors could lead to downward pressure on rental rates, directly affecting EPR Properties' revenue streams. Furthermore, increased competition for tenants might necessitate higher tenant improvement allowances or more favorable lease terms, further squeezing profit margins. This competitive pressure is a significant factor that could impact the company's overall profitability and future growth trajectory.

Rising Operating Expenses and Inflationary Pressures

EPR Properties is contending with increasing operating expenses, a factor that directly squeezes its profit margins. This is particularly concerning as the company's business model relies on the profitability of its leased properties.

Persistent inflation presents a significant threat, potentially driving up essential costs such as property maintenance, utility bills, and labor wages. For instance, the Consumer Price Index (CPI) in the US saw a notable increase throughout 2023 and into early 2024, impacting these very categories.

- Rising Maintenance Costs: Inflationary pressures can escalate the price of materials and services needed for property upkeep, directly impacting net operating income.

- Increased Utility Expenses: Higher energy prices, a common component of inflation, directly increase the cost of operating leased spaces, especially for experiential properties.

- Labor Cost Inflation: A tight labor market, often exacerbated by inflation, can force companies like EPR to pay higher wages to attract and retain staff for property management and operations.

Tenant Financial Health and Lease Renewals

The financial well-being of EPR Properties' tenants is a cornerstone of its revenue stability. Deterioration in tenant financial health can directly translate into lease defaults, increased vacancies, and a subsequent dip in rental income, impacting overall profitability. For instance, a significant downturn in the entertainment or experiential retail sectors, which house many of EPR's tenants, could heighten these risks.

Securing favorable terms during lease renewals presents an ongoing challenge. As leases expire, EPR must negotiate new agreements, and the leverage in these negotiations can shift based on market conditions and individual tenant performance. This dynamic requires constant strategic engagement to maintain or improve rental income streams.

- Tenant Financial Distress: A key threat is the potential for widespread financial difficulties among EPR's tenant base, particularly those in sectors like experiential entertainment and family entertainment centers, which are sensitive to economic fluctuations.

- Lease Renewal Uncertainty: The company faces the risk of not being able to renew leases at current or improved rental rates, especially if tenants experience financial strain or if market demand for certain property types weakens.

- Vacancy Risk: Tenant defaults or non-renewals can lead to vacant properties, resulting in lost rental income and incurring costs associated with re-leasing and property maintenance.

- Economic Sensitivity: EPR's reliance on experiential tenants makes its revenue streams vulnerable to economic downturns, which can impact consumer spending on entertainment and leisure activities.

EPR Properties faces significant threats from a slowing economy and potential recessions, which could curb consumer spending on experiential services. The ongoing shift towards digital entertainment also poses a risk to traditional venues like cinemas. Furthermore, rising operating costs due to inflation, particularly for maintenance and utilities, could squeeze profit margins.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data/Outlook |

|---|---|---|---|

| Economic Downturn | Reduced Consumer Spending | Lower rental income, increased vacancies | Inflationary pressures and interest rate uncertainty persist, impacting consumer confidence. |

| Industry Shifts | Digital Entertainment Growth | Decreased demand for physical entertainment venues | Continued growth in streaming services and at-home entertainment options. |

| Operational Costs | Inflationary Pressures | Increased property maintenance, utility, and labor expenses | US CPI saw notable increases in 2023 and early 2024, impacting operating costs. |

| Tenant Financial Health | Lease Defaults/Non-renewals | Lost rental income, increased vacancy risk | Experiential sectors are sensitive to economic fluctuations, increasing tenant distress risk. |

SWOT Analysis Data Sources

This EPR Properties SWOT analysis is built upon a foundation of comprehensive data, incorporating official company financial filings, robust market research reports, and expert industry analyses to ensure accuracy and strategic relevance.