EPR Properties Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPR Properties Bundle

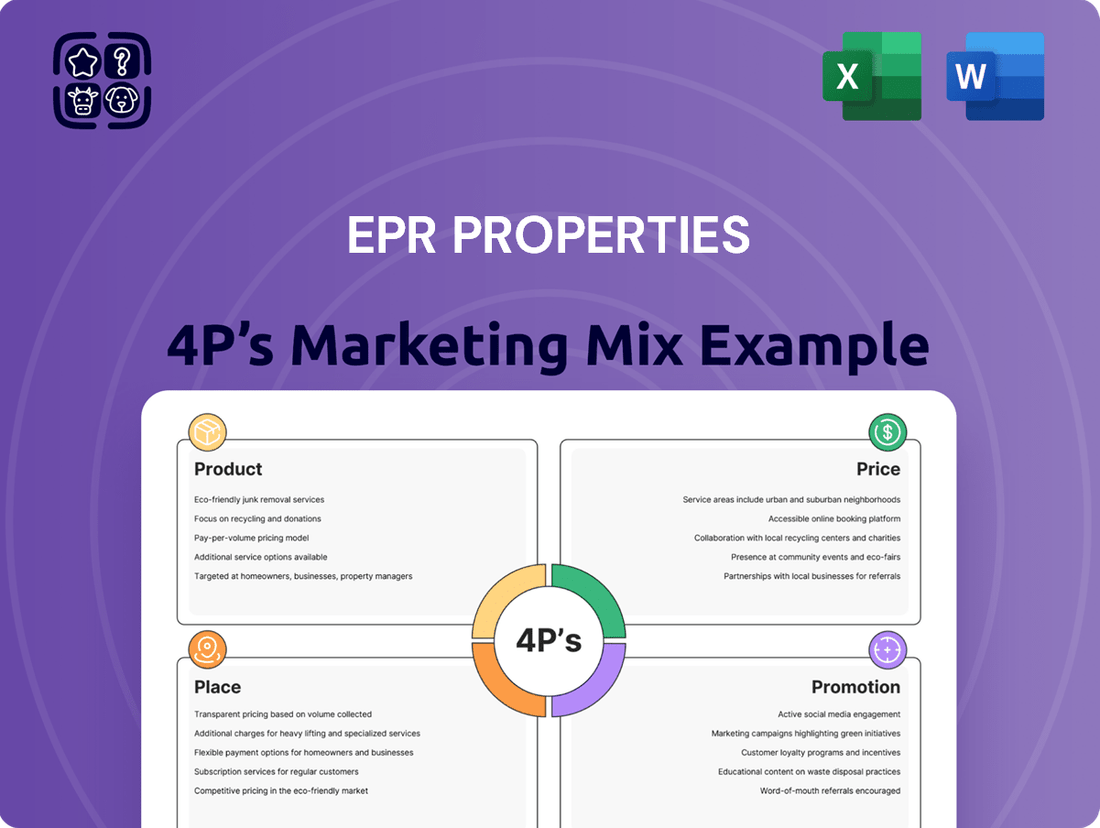

Unlock the secrets behind EPR Properties' market dominance with our comprehensive 4Ps Marketing Mix Analysis. We delve into their product innovation, strategic pricing, effective distribution, and impactful promotions, revealing the synergy that drives their success.

Go beyond the surface and gain a strategic advantage. Our full analysis provides actionable insights, real-world examples, and a structured framework to understand and replicate EPR Properties' winning marketing formula.

Save valuable time and resources. This ready-to-use, editable report offers a deep dive into EPR Properties' marketing execution, perfect for business professionals, students, and consultants seeking to elevate their strategic planning.

Product

EPR Properties' product is a diverse portfolio of experiential real estate, designed to support out-of-home leisure and entertainment businesses. This includes a wide array of venues like movie theaters, golf entertainment complexes, and ski resorts, offering specialized spaces for these industries.

The core offering is the provision of high-quality, tailored real estate solutions that enable unique consumer experiences. This focus on specialized properties differentiates EPR in the real estate market, catering to specific tenant needs within the experiential sector.

As of the second quarter of 2025, EPR's commitment to experiential assets is evident, with 94% of its total investments allocated to this segment. This robust portfolio comprises 151 theaters, 58 eat & play venues, 25 attractions, 11 ski resorts, 4 experiential lodging properties, and 23 fitness & wellness properties, showcasing significant diversification within the experiential niche.

Long-term lease agreements are fundamental to EPR Properties' product strategy, offering a stable revenue stream. These contracts, often spanning 10-20 years, provide predictability crucial for Real Estate Investment Trusts (REITs).

EPR's emphasis on triple net leases (NNNs) is a key differentiator. Under these agreements, tenants bear the brunt of property operating expenses, including taxes, insurance, and maintenance. This structure significantly reduces EPR's operational burdens and enhances the reliability of its net operating income.

As of the first quarter of 2024, EPR Properties reported that approximately 99% of its rental revenue was derived from NNN leases. This high percentage underscores the success of their product strategy in securing consistent and robust cash flows, a vital component for investor confidence.

EPR Properties is strategically diversifying its real estate portfolio, moving beyond its historical concentration in movie theaters. This evolution is a key aspect of its product strategy, aiming to reduce reliance on a single sector.

The company is actively recycling capital from the sale of theater and education properties. For instance, in 2023, EPR completed dispositions totaling $440 million, a significant portion of which was directed towards new experiential assets.

This capital is being reinvested into growth areas like fitness and wellness centers, as well as traditional golf venues. This shift reflects a proactive approach to capturing evolving consumer spending trends in the experiential real estate market.

By diversifying into these newer property types, EPR aims to mitigate risks associated with the traditional cinema sector and enhance overall portfolio resilience. This strategy is designed to capitalize on a broader spectrum of consumer engagement and entertainment preferences.

Development and Redevelopment Initiatives

EPR Properties' product offering extends beyond just leasing existing spaces; it actively engages in the development and redevelopment of properties. This strategic approach allows them to not only enhance their current assets but also to create entirely new, modern venues designed for experiential entertainment and dining. By committing capital to these initiatives, EPR ensures its portfolio stays competitive and appealing to top-tier tenants while adapting to changing consumer preferences.

This commitment to growth is evident in their investment activities. For example, during the first quarter of 2025, EPR's investment spending included significant outlays for an attraction property acquisition and the purchase of land designated for a new build-to-suit eat & play property. This demonstrates a forward-looking strategy focused on expanding and modernizing their experiential real estate holdings.

- Capital Commitment: EPR actively invests in build-to-suit projects and redevelopments to maintain portfolio relevance.

- Q1 2025 Investments: Spending included an attraction property acquisition and land for a new eat & play venue.

- Tenant & Consumer Focus: Redevelopment ensures properties meet the needs of high-quality tenants and evolving consumer demands.

Underwriting and Investment Criteria

EPR Properties' product, its portfolio of experiential real estate, is built upon a foundation of stringent underwriting and investment criteria. This ensures each property acquired or developed meets specific standards for industry, property type, and tenant cash flow, aiming for resilience and consistent rental income.

The company prioritizes properties that are mission-critical to their tenants' operations. This focus on essentiality aims to reduce vacancy risk and enhance the stability of rental revenue streams, a key component of EPR's growth strategy.

For instance, in the first quarter of 2024, EPR Properties reported a robust occupancy rate of 96.8% across its portfolio, underscoring the effectiveness of its tenant selection and property essentiality focus. The REIT's commitment to high-quality tenants and properties that are integral to their business models is a core element of its product offering.

- Focus on Essential Properties: EPR targets real estate that is critical for tenant operations, minimizing the likelihood of lease termination.

- Rigorous Underwriting Standards: The company employs strict criteria for industry, property type, and tenant financial health.

- Cash Flow Stability: Investment decisions are heavily influenced by the projected stability and strength of rental income.

- Portfolio Diversification: While focusing on essentiality, EPR also maintains a diversified portfolio across different experiential sectors.

EPR Properties' product is its specialized portfolio of experiential real estate, designed to cater to out-of-home entertainment and leisure. This includes a diverse range of venues like movie theaters, golf entertainment complexes, and ski resorts, all offering tailored spaces for specific tenant needs.

The company's strategy centers on providing high-quality, specialized properties, with a significant 94% of its investments in experiential assets as of Q2 2025. This vast portfolio encompasses 151 theaters, 58 eat & play venues, and 11 ski resorts, demonstrating a deep commitment to this niche.

EPR's product is further defined by its reliance on triple net leases (NNNs), where tenants cover operating expenses, ensuring stable net operating income for EPR. In fact, approximately 99% of their rental revenue stemmed from NNN leases in Q1 2024, highlighting the success of this model.

The product also reflects a strategic diversification away from a heavy reliance on movie theaters, with capital actively recycled from theater and education property sales into growth areas like fitness and wellness centers. This evolution ensures the portfolio remains relevant and resilient.

| Property Type | Number of Properties (Q2 2025) | Percentage of Experiential Investments (Q2 2025) |

|---|---|---|

| Theaters | 151 | 94% |

| Eat & Play | 58 | |

| Attractions | 25 | |

| Ski Resorts | 11 | |

| Experiential Lodging | 4 | |

| Fitness & Wellness | 23 |

What is included in the product

This analysis provides a comprehensive examination of EPR Properties' marketing strategies through the lens of the 4Ps (Product, Price, Place, Promotion), offering actionable insights for strategic decision-making.

Simplifies complex marketing strategies by clearly outlining Product, Price, Place, and Promotion, alleviating the confusion of how to approach market entry.

Place

EPR Properties' 'place' is defined by its strategically located, directly owned real estate assets. As of December 31, 2024, this portfolio spanned 44 U.S. states and two Canadian provinces, Ontario and Quebec. This extensive geographic reach across 329 properties represents approximately $6.9 billion in total investments, underscoring a commitment to prime locations that drive tenant demand and operational efficiency.

EPR Properties strategically selects locations that draw consumers for out-of-home leisure and recreation. This focus targets high-traffic areas ideal for entertainment venues like movie theaters and family centers, as well as experiential destinations such as ski resorts.

The company prioritizes properties with enduring appeal, aiming to foster value creation by tapping into consumer discretionary spending. For instance, in 2024, EPR's portfolio continued to benefit from the resurgence in experiential spending post-pandemic, with key entertainment properties showing robust attendance and revenue growth.

The 'place' for EPR Properties' ultimate consumers, the patrons of experiential venues, is directly facilitated by its tenants who operate these properties. EPR ensures its locations are readily accessible through its tenants' established distribution networks, encompassing physical sites for movie theaters, golf courses, ski resorts, and other entertainment activities.

This tenant-driven accessibility is a cornerstone of EPR's strategy. The company boasts a remarkably high occupancy rate of 99% across its diverse portfolio as of the first quarter of 2024, underscoring the effectiveness of its tenant operations and the resulting strong consumer access to these entertainment destinations.

Capital Recycling and Geographic Optimization

EPR Properties strategically manages its 'place' through capital recycling, a process involving the sale of underperforming or non-core assets, such as certain theater and education properties. The capital generated from these dispositions is then strategically redeployed into acquiring and developing experiential real estate in markets offering superior growth potential and favorable demographic trends. This active portfolio management enhances geographic diversification and strengthens the company's overall market presence.

This approach is evident in EPR's financial outlook, with projected disposition proceeds for 2025 anticipated to fall within the range of $130 million to $145 million. This capital is earmarked for reinvestment, allowing EPR to continually optimize its property portfolio and capitalize on emerging opportunities in high-demand experiential sectors and attractive geographic locations.

- Capital Recycling: Selling select theater and education assets to fund new investments.

- Geographic Optimization: Reinvesting proceeds into more favorable markets.

- 2025 Disposition Guidance: Expecting $130 million to $145 million in disposition proceeds.

- Portfolio Enhancement: Shifting towards experiential assets and improving market positioning.

Focus on Experiential Hubs

EPR Properties' marketing strategy heavily leans into creating experiential hubs, recognizing that consumers increasingly seek engaging leisure activities. This focus is evident in their property selections, which are often situated in high-traffic areas catering to entertainment and recreation. Their portfolio continues to prioritize categories such as eat & play, attractions, and fitness & wellness, which benefit from being in community-focused, easily accessible locations.

This strategic emphasis on experience is backed by tangible investments. For instance, in the first quarter of 2025, EPR Properties made key acquisitions, including a new attraction property in New Jersey and land designated for an eat & play development in Virginia. These moves underscore their commitment to expanding their footprint in sectors that drive consumer engagement and provide memorable experiences.

- Experiential Focus: EPR Properties prioritizes properties offering unique consumer experiences, aligning with current leisure trends.

- Key Categories: Continued investment in eat & play, attractions, and fitness & wellness segments.

- Q1 2025 Acquisitions: Added a new attraction property in New Jersey and land for an eat & play venue in Virginia.

EPR Properties' 'place' strategy centers on owning and operating a geographically diverse portfolio of experiential real estate. As of Q1 2025, the company held 329 properties across 44 U.S. states and two Canadian provinces, representing approximately $6.9 billion in investments. This expansive physical presence is curated to attract consumers seeking out-of-home leisure and entertainment, with a focus on high-traffic, accessible locations.

The company actively manages its property portfolio through capital recycling, divesting non-core assets like certain theater and education properties. For 2025, EPR anticipates $130 million to $145 million in disposition proceeds, which will be reinvested into experiential real estate in markets with strong demographic trends and growth potential, thereby optimizing its geographic footprint and market positioning.

| Metric | Q1 2024 | 2024 (Est.) | Q1 2025 |

| Occupancy Rate | 99% | N/A | N/A |

| Total Properties | 329 | 329 | 329 |

| Geographic Reach | 44 US States, 2 Canadian Provinces | 44 US States, 2 Canadian Provinces | 44 US States, 2 Canadian Provinces |

| Total Investments | ~$6.9 Billion | ~$6.9 Billion | ~$6.9 Billion |

| 2025 Disposition Guidance | N/A | N/A | $130M - $145M |

Full Version Awaits

EPR Properties 4P's Marketing Mix Analysis

The preview shown here is the actual EPR Properties 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. This comprehensive document details Product, Price, Place, and Promotion strategies for EPR Properties, offering actionable insights. You can be confident that what you see is exactly what you get, ready for immediate application.

Promotion

EPR Properties prioritizes clear communication with its investor base, a key element in its marketing mix. This commitment is evident in their regular investor relations activities and detailed financial reporting. For instance, their second quarter 2024 earnings call, held in August 2024, provided investors with crucial updates on performance and outlook.

The company's investor center serves as a central hub for essential financial data, including their Form 10-K filings and quarterly earnings releases. These documents offer a deep dive into operational performance and strategic direction, empowering financially-literate decision-makers to make informed choices. In Q1 2024, EPR Properties reported total revenue of $165.7 million, demonstrating their ongoing operational activity.

EPR Properties highlights its commitment to shareholder returns through a consistent dividend policy, a significant promotional tool for attracting investors. The company offers monthly cash dividends to common shareholders, a feature particularly attractive to those seeking regular income streams.

This regularity in dividend payments, including the recently declared July 2025 monthly dividend of $0.295 per common share, signals financial health and a dedication to rewarding investors. EPR's track record of paying dividends for 29 consecutive years underscores this reliability.

EPR Properties actively manages its strategic communications through press releases and investor presentations, effectively showcasing its financial performance, portfolio developments, and forward-looking growth plans. These efforts are crucial in articulating EPR's unique value proposition and its disciplined approach to investing within the experiential real estate market.

By participating in key industry events such as Nareit's REITweek and the Citi Global Property CEO Conference, EPR Properties ensures its market positioning and strategic direction are clearly communicated to a broad audience of investors and industry professionals. For instance, in their 2024 investor communications, EPR highlighted a strong occupancy rate across its experiential properties, demonstrating resilience and strategic portfolio management.

Highlighting Portfolio Diversification and Resilience

EPR Properties champions portfolio diversification, a key element in its marketing mix, by highlighting its resilience against market volatility. This strategy is designed to appeal to investors seeking stable returns, even when specific sectors face headwinds.

The company's proactive approach includes a strategic pivot from a heavy concentration in theaters to a broader spectrum of experiential real estate. This shift is a testament to their adaptability and forward-thinking risk management, aiming to capture growth across varied consumer engagement platforms.

Recent financial disclosures underscore this strategy's success. For instance, Q1 2024 earnings revealed that ski properties, a key diversified asset, demonstrated robust performance, contributing positively to overall results. This highlights the tangible benefits of their capital recycling efforts.

- Diversified Experiential Assets EPR's portfolio spans experiential properties, reducing reliance on single sectors.

- Market Resilience The diversified approach aims to buffer against economic downturns and sector-specific challenges.

- Strategic Capital Recycling Efforts to redeploy capital from underperforming or mature assets into growth areas are ongoing.

- Strong Performance in Ski Properties Q1 2024 results showed significant contributions from their ski resort holdings.

Analyst Coverage and Market Perception

EPR Properties benefits from significant Wall Street analyst coverage, shaping how the market views the company. This coverage, including consensus ratings and price targets, directly impacts investor confidence and the company's appeal. For instance, as of mid-2024, EPR Properties often held a Moderate Buy consensus rating from analysts, reflecting a generally positive outlook.

These analyst reports frequently highlight EPR's strategic strengths, such as its disciplined management approach and a clear focus on effective capital allocation. Such insights are crucial for potential investors trying to gauge the company's long-term viability and growth prospects. The detailed financial analyses provided by these professionals offer a deeper understanding of EPR's operational efficiency and market positioning.

- Analyst Consensus: Typically a Moderate Buy rating in mid-2024, indicating positive analyst sentiment.

- Price Targets: Published price targets provide benchmarks for investor expectations.

- Key Strengths Highlighted: Disciplined management and strategic capital allocation are frequently cited.

- Investor Influence: Analyst reports significantly influence market perception and investor confidence.

EPR Properties utilizes a multi-faceted promotional strategy to engage its diverse investor base. This includes consistent communication of its dividend policy, which offers monthly cash dividends, a key draw for income-seeking investors. The company's Q2 2024 earnings call in August 2024, alongside regular investor presentations, ensures transparency and keeps stakeholders informed about performance and strategic initiatives. Their active participation in industry events like REITweek further amplifies their market presence and strategic messaging.

| Promotional Activity | Key Information/Data | Impact on Investors |

|---|---|---|

| Dividend Policy | Monthly cash dividends; July 2025 dividend of $0.295 per share. 29 consecutive years of dividend payments. | Attracts income-focused investors, signals financial stability. |

| Investor Communications | Q2 2024 earnings call (August 2024); Investor center with Form 10-K, quarterly releases. | Provides transparency, detailed financial data for informed decisions. |

| Industry Event Participation | Nareit's REITweek, Citi Global Property CEO Conference. | Enhances market positioning, communicates strategic direction to a broad audience. |

Price

The primary 'price' component for EPR Properties is the rental income generated through its extensive portfolio of experiential properties. This revenue stream is bolstered by long-term lease agreements, ensuring a stable income base. For instance, EPR Properties saw its rental revenue climb by $4.1 million in the first quarter of 2025 compared to the same period in 2024, a growth attributed to strategic investment spending and enhanced percentage rent collections.

EPR's reliance on triple net leases significantly influences its pricing strategy and financial predictability. Under these lease structures, tenants are responsible for most property-related operating expenses, such as taxes, insurance, and maintenance. This arrangement translates into more consistent and reliable cash flows for EPR, as a larger portion of the rent received directly contributes to its net operating income.

EPR Properties' investor pricing performance is closely watched through non-GAAP metrics like Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) per share. These figures are crucial for understanding the company's true profitability and its capacity to generate cash, which directly influences dividend payouts and future investment funding.

For the second quarter of 2025, EPR reported FFO as adjusted per diluted share at $1.26, and AFFO at $1.24 per share. These results represent a positive trend, indicating an increase in these key performance indicators compared to the same period in the prior year.

EPR Properties offers investors a direct return through its dividend payout, structured as a monthly distribution. This payment schedule is particularly appealing to those seeking regular income from their investments.

As of July 2025, EPR Properties declared an annualized dividend of $3.54 per common share, translating to a yield of 6.43%. This yield provides a significant income stream for shareholders.

The company's dividend payout ratio stood at 71% in mid-2025. This figure suggests that the dividend is comfortably supported by the company's cash flow, indicating a sustainable distribution policy.

Investment Spending and Capital Allocation

EPR Properties views investment spending as its 'price' for future growth and portfolio enhancement. The company is strategically allocating capital to expand and upgrade its diverse real estate assets.

For 2025, EPR Properties anticipates investing between $200 million and $300 million in new property acquisitions. This significant capital deployment is designed to bolster its portfolio's income-generating capacity and market position.

- Planned 2025 Investment: $200 million to $300 million in new properties.

- Experiential Development Funding: Approximately $109 million committed over the next 18 months for experiential and redevelopment projects.

- Strategic Allocation: Funds are directed towards expanding and enhancing the portfolio to drive future rental income growth.

Cost of Capital and Disposition Proceeds

EPR Properties' cost of capital directly shapes how it prices its acquisitions and development projects. A lower cost of capital, a key financial metric, enables EPR to be more assertive in pursuing new investment opportunities, potentially leading to more favorable deal terms.

The REIT's ability to generate disposition proceeds is also crucial for its financial flexibility and pricing power. For 2025, EPR Properties anticipates disposition proceeds in the range of $130 million to $145 million. These funds are vital for financing new ventures and reducing outstanding debt, thereby bolstering the company's overall financial standing.

- Cost of Capital Influence: Directly impacts acquisition and development pricing strategies.

- Aggressive Investment Pursuit: An improved cost of capital allows for more proactive investment opportunities.

- Disposition Proceeds Projection (2025): Estimated between $130 million and $145 million.

- Capital Allocation: Proceeds are used for new investments and debt reduction, enhancing financial health.

The core of EPR Properties' pricing strategy revolves around the rental income derived from its diverse portfolio, primarily through long-term leases. This approach ensures a predictable revenue stream, further supported by the triple net lease structure where tenants cover operating expenses, directly boosting EPR's net operating income.

EPR's investor valuation is heavily influenced by non-GAAP metrics like FFO and AFFO per share, which reflect its true cash-generating ability and dividend capacity. For Q2 2025, FFO as adjusted per diluted share was $1.26, and AFFO was $1.24 per share, showing positive performance trends.

The company's dividend policy, with an annualized payout of $3.54 per common share as of July 2025 (yielding 6.43%), offers investors a consistent income stream. The payout ratio of 71% in mid-2025 indicates a sustainable dividend supported by cash flow.

EPR Properties strategically prices its future growth through significant investment spending. The company plans $200 million to $300 million in new property acquisitions for 2025 and has committed approximately $109 million for experiential and redevelopment projects over the next 18 months.

| Key Financial Metrics | Q2 2025 | Annualized Dividend (July 2025) | Projected 2025 Dispositions |

| FFO as adjusted per diluted share | $1.26 | N/A | N/A |

| AFFO per share | $1.24 | N/A | N/A |

| Dividend Yield | N/A | 6.43% | N/A |

| Dividend Payout Ratio | 71% (mid-2025) | N/A | N/A |

| Planned Property Investment | N/A | N/A | $200M - $300M |

| Experiential Development Funding | N/A | N/A | ~$109M (next 18 months) |

| Projected Disposition Proceeds | N/A | N/A | $130M - $145M |

4P's Marketing Mix Analysis Data Sources

Our EPR Properties 4P's Marketing Mix Analysis leverages a robust blend of proprietary market research, direct company disclosures, and publicly available financial data. We meticulously examine official reports, investor communications, and industry-specific databases to ensure accuracy.