EPR Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPR Properties Bundle

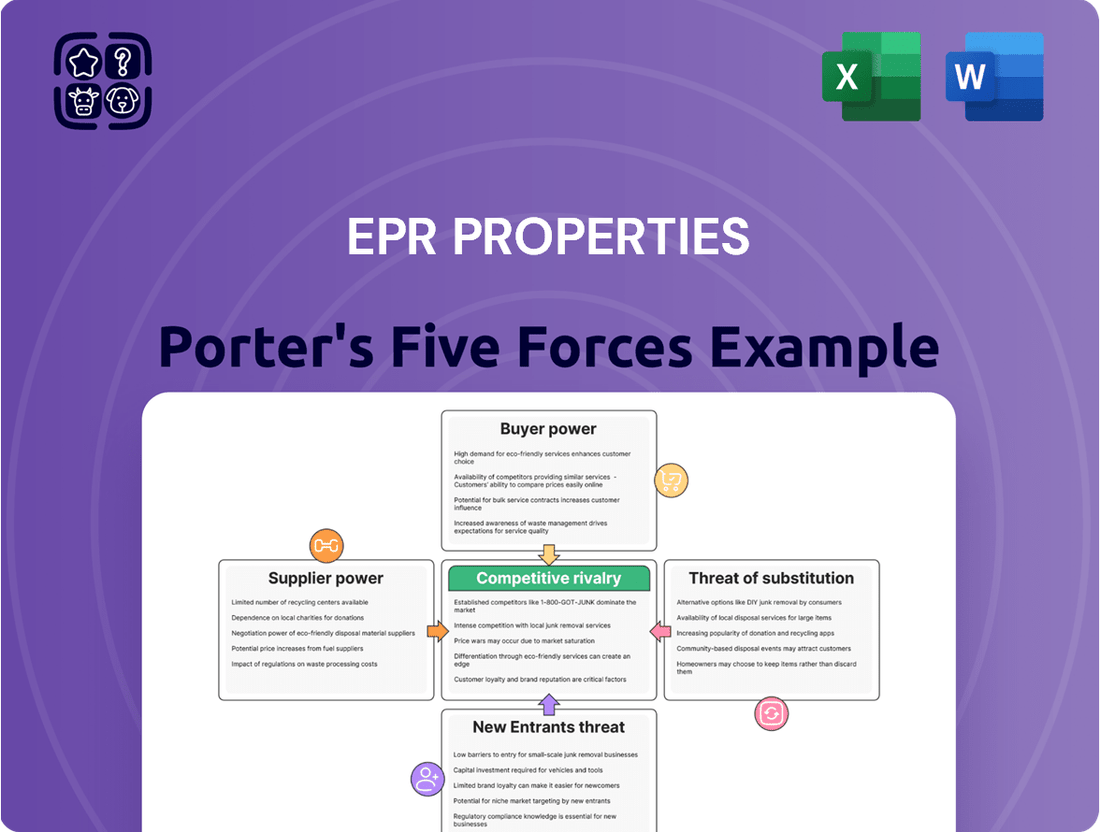

Understanding the competitive landscape for EPR Properties through Porter's Five Forces reveals critical insights into buyer power, supplier leverage, and the threat of new entrants. This initial glimpse highlights the underlying dynamics that shape profitability and strategic positioning within their market.

The complete report reveals the real forces shaping EPR Properties’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EPR Properties, as a real estate investment trust (REIT), relies heavily on capital markets to fund its growth and operations. The ease and expense of obtaining debt and equity from various sources directly impact its capacity to expand and manage its property portfolio.

In January 2024, Moody's reaffirmed EPR Properties' credit rating at 'Baa3' with a stable outlook. This rating suggests a generally favorable environment for the company to access the necessary capital for its strategic initiatives and ongoing business needs.

For its unique experiential properties, EPR Properties likely relies on specialized developers and construction firms. The bargaining power of these suppliers can range from moderate to high, particularly if they possess rare expertise or proprietary technologies crucial for building complex entertainment venues and attractions.

EPR's commitment of approximately $150 million for experiential development and redevelopment projects over the next two years underscores its continued dependence on these specialized external services. This investment highlights the ongoing need for suppliers with unique capabilities in bringing EPR's vision for experiential real estate to life.

When EPR Properties (EPR) acquires new real estate, the sellers of land or existing properties hold a degree of supplier power. This power is influenced by factors such as the uniqueness of the property, its prime location, and the overall demand in the real estate market for similar assets. For instance, in 2024, the industrial real estate sector saw continued strong demand, potentially increasing the bargaining power of sellers offering well-located, specialized facilities.

Technology and Infrastructure Providers

As experiential properties increasingly rely on advanced technology like immersive VR and sophisticated AV systems, suppliers of these technologies gain leverage. EPR's tenants need cutting-edge infrastructure to create memorable experiences, which can affect the specifications and costs EPR passes on. The growing experience economy, with trends like AR and VR integration, further amplifies this supplier power.

- Technology Integration: The demand for advanced tech in experiential properties is rising, giving tech suppliers more influence.

- Tenant Requirements: Tenants' need for high-quality, immersive experiences dictates the technology EPR must procure, impacting costs.

- Market Trends: The broader shift towards an experience economy, featuring AR and VR, strengthens the position of technology providers.

Maintenance and Operational Service Providers

While tenants handle daily operations, EPR Properties, as the landlord, retains responsibility for specific property upkeep, insurance, and administrative tasks. This means EPR engages with various maintenance and operational service providers.

The market for these services is generally quite fragmented. For instance, in 2024, the U.S. facilities management market was estimated to be worth hundreds of billions of dollars, with numerous smaller players alongside larger corporations. This fragmentation typically reduces the bargaining power of any single maintenance or operational supplier because EPR can readily source alternatives. EPR Properties can leverage this by comparing quotes and service levels from multiple providers, ensuring competitive pricing and service quality for its properties.

- Fragmented Market: The broad availability of maintenance and operational service providers limits the leverage of individual suppliers.

- Competitive Sourcing: EPR Properties can select from a diverse pool of providers, fostering competition and favorable terms.

- Cost Management: This dynamic allows EPR to manage operational costs effectively by negotiating with multiple service vendors.

EPR Properties' reliance on specialized developers and technology providers for its experiential properties means these suppliers can exert significant bargaining power. This is particularly true when unique expertise or proprietary systems are required to create the immersive environments that define EPR's portfolio. As of 2024, the demand for advanced technology in entertainment and leisure venues continues to grow, strengthening the position of key tech suppliers.

The bargaining power of suppliers for EPR Properties is generally moderate to high, especially concerning specialized construction and technology integration. For example, the need for cutting-edge AV and VR systems in experiential venues gives technology providers leverage, as tenants require these to attract customers. EPR's ongoing investments in experiential development, projected at $150 million over two years, highlight this dependence.

Suppliers of specialized construction and technology are key players for EPR Properties. Their ability to deliver unique, high-tech experiential spaces grants them considerable influence. The increasing emphasis on immersive experiences in the market, driven by trends like AR and VR, further amplifies the bargaining power of these technology and development partners.

While suppliers for routine maintenance and operations have limited power due to a fragmented market, those providing specialized development and technology for EPR's unique properties hold more sway. This is evident in the demand for advanced AV and VR systems, where a few key providers can command higher prices. EPR's commitment to experiential growth, with significant development spending planned, underscores the importance of managing these supplier relationships.

What is included in the product

This analysis meticulously examines the five forces shaping EPR Properties' competitive environment, detailing industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Long-term lease agreements significantly limit the immediate bargaining power of EPR Properties' tenants. These contracts, which form the backbone of EPR's revenue through rental income, lock in tenants for extended periods, ensuring predictable cash flows for the company. As of June 2025, EPR Properties boasted a portfolio that was 99% leased or operated, demonstrating a high degree of tenant commitment and thus, reduced immediate leverage for individual tenants to renegotiate terms.

EPR Properties is actively diversifying its real estate holdings across various experiential sectors like movie theaters, eat & play venues, ski resorts, and fitness/wellness properties. This strategy aims to reduce the risk associated with relying too heavily on any single tenant or industry segment.

However, even with this diversification, large or anchor tenants within specific segments, such as major movie theater chains, can still possess significant bargaining power. This is particularly true during lease renewals or renegotiations, where their importance to a particular property or segment can be leveraged.

For example, the movie theater segment remains a substantial contributor to EPR's financial performance, accounting for 38% of its pre-tax profits as of recent reports. This concentration means that tenants within this key sector can still exert considerable influence.

Tenants in experiential properties, like amusement parks or golf complexes, often make substantial investments in specialized build-outs and local branding. For instance, a tenant operating a theme park might spend millions on unique attractions and themed environments. These significant upfront costs, coupled with establishing a distinct market presence, create high switching costs.

The expense and effort involved in relocating and recreating such specialized environments mean tenants are less likely to move. This reduced mobility directly weakens their bargaining power when negotiating lease terms with EPR Properties. As of the first quarter of 2024, EPR Properties reported an average lease term of approximately 9.5 years across its portfolio, suggesting tenants are committed for the long haul due to these embedded costs.

Consumer Demand for Experiences

The success of EPR Properties' tenants hinges directly on consumer appetite for out-of-home entertainment and leisure. As consumers increasingly favor spending on memorable experiences over material goods, this trend bodes well for EPR's portfolio. The ongoing surge in the experience economy, a key driver for many of EPR's tenants, directly impacts their revenue streams and, consequently, their capacity to meet rental obligations.

This shift in consumer spending, often referred to as the "experience economy," is a significant factor influencing the bargaining power of customers within EPR's operating sectors. When consumers actively seek out and prioritize spending on experiences like theme parks, cinemas, and family entertainment centers, it strengthens the demand for these services.

- Consumer spending on experiences is projected to continue its upward trajectory, with global spending on experiences expected to outpace spending on goods.

- In 2024, a significant portion of discretionary income is allocated to leisure activities, directly benefiting EPR's experiential tenants.

- The ability of consumers to easily substitute one experience for another can increase their bargaining power if tenants do not offer unique or compelling value propositions.

Tenant Financial Health and Industry Specifics

The financial health of EPR Properties' tenants, like movie theaters and ski resorts, directly impacts their bargaining power. For instance, strong box office performance in Q2 2025, as noted by EPR management, can reduce tenants' need to negotiate for more favorable lease terms.

Conversely, a downturn in a tenant's industry, such as a poor ski season affected by weather, could empower them to demand concessions. This financial leverage allows tenants to negotiate rent, lease duration, or other contractual elements.

- Tenant Industry Performance: EPR's theater segment benefited from a positive box office environment in Q2 2025, strengthening their tenants' financial standing.

- Seasonal Dependencies: Ski resort tenants' ability to negotiate is heavily influenced by weather patterns, impacting their revenue and operational capacity.

- Lease Negotiation Impact: Strong tenant financials generally decrease their bargaining power, leading to more favorable terms for EPR.

- Risk Mitigation: EPR's diversification across different property types helps mitigate the risk associated with individual tenant or industry-specific downturns.

While long-term leases and high tenant investment in specialized properties generally limit customer bargaining power for EPR Properties, certain factors can shift this balance. The concentration of revenue from specific sectors, like movie theaters, grants significant leverage to major tenants within those segments, especially during lease renewals. Furthermore, the success of tenants is intrinsically tied to consumer spending on experiences, making them sensitive to shifts in discretionary income and preferences.

| Factor | Impact on Tenant Bargaining Power | Supporting Data (as of recent reports) |

|---|---|---|

| Lease Duration | Lowers bargaining power due to long-term commitment. | Average lease term of ~9.5 years (Q1 2024). |

| Tenant Specialization & Switching Costs | Lowers bargaining power due to high relocation costs. | Millions invested in specialized build-outs and branding. |

| Concentration in Key Sectors | Increases bargaining power for anchor tenants in those sectors. | Movie theaters accounted for 38% of pre-tax profits. |

| Consumer Spending on Experiences | Can increase bargaining power if tenants fail to offer unique value, but generally supports tenant revenue. | Experience economy growth outpaces goods spending; significant discretionary income allocated to leisure in 2024. |

Same Document Delivered

EPR Properties Porter's Five Forces Analysis

This preview shows the exact EPR Properties Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document meticulously details the competitive landscape, offering actionable insights into the industry's structure and profitability. You'll gain a thorough understanding of the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the EPR Properties market.

Rivalry Among Competitors

EPR Properties distinguishes itself in the real estate investment trust (REIT) landscape by concentrating on experiential properties, a niche that differentiates it from more general commercial or residential REITs. This specialization means its direct competitive set is smaller, primarily comprising other entities targeting the leisure and entertainment venue sector.

As the leading diversified experiential net lease REIT, EPR faces rivals who also invest in or manage similar, highly specific asset classes. While the broader REIT market is robust, EPR's focused strategy means its competitive pressures stem from a more concentrated group of specialized investors rather than a wide array of general real estate players.

EPR Properties faces significant rivalry when seeking to acquire prime experiential properties. Other investment firms and private equity funds actively compete for these attractive assets, often leading to higher acquisition costs and potentially lower future returns for EPR. For instance, in 2024, the demand for well-located entertainment and recreation venues remained robust, intensifying bidding wars.

EPR Properties, like all Real Estate Investment Trusts (REITs), faces intense competition for investment capital. This battle is waged against other REITs and a vast array of alternative investment vehicles vying for the attention of both institutional investors and individual savers. The overall appeal of REITs as an asset class, significantly shaped by prevailing interest rates and the broader economic outlook, directly influences the intensity of this rivalry.

The REIT market showed notable resilience throughout 2024, with many sectors demonstrating stable performance. Looking ahead to 2025, analysts are projecting positive total returns for the REIT sector, suggesting continued investor interest. This positive outlook, however, also means that companies like EPR must continually prove their value proposition to attract and retain capital in a competitive landscape.

Diversification and Portfolio Strategy

EPR Properties is actively diversifying its real estate portfolio, moving away from a significant reliance on movie theaters. This strategic shift involves expanding into other experiential sectors like fitness and wellness, as well as eat & play concepts. This diversification is a direct response to competitive pressures and aims to build a more robust and resilient portfolio.

In 2024, EPR Properties continued to execute this strategy. For instance, their focus on experiential real estate, which includes tenants like Topgolf and LA Fitness, is designed to capture growth in consumer spending on leisure and health. This move helps mitigate the risks associated with a single, potentially volatile industry.

- Portfolio Shift: EPR's strategy to diversify away from movie theaters into fitness, wellness, and eat & play is a key competitive maneuver.

- Risk Mitigation: This diversification reduces dependence on any single tenant type or industry, enhancing portfolio stability.

- Market Adaptation: The move reflects an understanding of evolving consumer preferences and the need to align with growing experiential sectors.

- 2024 Focus: Continued investment in experiential assets like Topgolf and fitness centers underscores this ongoing strategic direction.

Tenant Competition and Performance

While EPR Properties doesn't directly compete with its tenants, the performance of those tenants in their own industries significantly impacts EPR. Intense competition within sectors like movie theaters or ski resorts can strain tenant profitability, potentially affecting their capacity to fulfill lease agreements, though EPR's robust leasing structure offers a buffer.

EPR Properties maintains a remarkably high occupancy rate, with its portfolio remaining 99% leased. This strong leasing performance indicates a healthy demand for its properties and a resilient tenant base, even amidst broader market competitive pressures.

- Tenant Industry Performance: The success of EPR's tenants, such as AMC Theatres or Vail Resorts, is crucial. Fierce competition within these industries can pressure tenant earnings.

- Lease Obligations: Lower tenant profitability due to competition could theoretically impact their ability to meet rental payments, though EPR's lease terms are designed to provide stability.

- Portfolio Occupancy: As of the latest reports, EPR Properties boasts a 99% leased portfolio, demonstrating strong tenant retention and demand for its experiential real estate assets.

EPR Properties faces direct competition from other REITs specializing in experiential real estate, particularly those with portfolios in entertainment, recreation, and fitness. The intensity of rivalry is amplified by the limited number of prime experiential assets available for acquisition, leading to bidding wars and increased acquisition costs. In 2024, the demand for well-located entertainment and recreation venues remained strong, intensifying this competitive dynamic.

The REIT market's overall attractiveness, influenced by interest rates and economic sentiment, dictates the competition for investment capital. EPR competes not only with other REITs but also with alternative investment vehicles for investor dollars. Analysts projected positive total returns for the REIT sector in 2025, indicating sustained investor interest and, consequently, ongoing competition for capital.

EPR's strategic diversification into sectors like fitness and wellness, exemplified by tenants such as LA Fitness, is a direct response to competitive pressures and aims to mitigate risks associated with a concentrated portfolio. This proactive approach helps EPR maintain its competitive edge by aligning with growing consumer spending trends.

The performance of EPR's tenants within their respective industries is a critical factor, as intense competition in those sectors can impact tenant profitability and, by extension, lease payments. Despite this, EPR Properties maintained a robust 99% portfolio occupancy rate, showcasing the resilience of its tenant base and the demand for its specialized real estate.

| Competitive Factor | EPR Properties' Position | Market Trend (2024-2025) |

|---|---|---|

| Specialized Asset Competition | Faces rivals in experiential real estate (entertainment, fitness). | Robust demand for prime experiential assets, intensifying bidding. |

| Capital Acquisition Rivalry | Competes with all REITs and alternative investments for capital. | Projected positive REIT sector returns in 2025 suggest continued capital competition. |

| Tenant Industry Competition | Tenant success in competitive industries impacts lease payments. | High portfolio occupancy (99%) indicates tenant resilience despite industry pressures. |

| Portfolio Diversification Strategy | Shifting from theaters to fitness, wellness, eat & play. | Strategic move to capture growth in evolving consumer preferences. |

SSubstitutes Threaten

For EPR Properties' entertainment segment, particularly its movie theaters, the threat of substitutes is substantial. In-home entertainment options like Netflix, Disney+, and gaming platforms offer convenience and a vast content library, directly competing for consumer leisure time and dollars. In 2024, global streaming service revenue was projected to reach over $100 billion, highlighting the scale of this alternative.

Consumers have a vast array of choices for discretionary spending on experiences, many of which do not involve EPR Properties' specific property types like family entertainment centers. These substitutes include readily accessible and often free options such as public parks, community events, or even the growing trend of home-based entertainment. For instance, data from the U.S. Bureau of Labor Statistics in 2024 indicated that spending on recreation, while significant, competes directly with other leisure categories.

Furthermore, the increasing cost of living can push consumers towards more budget-friendly alternatives, making activities like dining out at restaurants or taking short trips more appealing than dedicated entertainment venues. The sheer variety of available leisure pursuits means that EPR Properties must constantly innovate and offer compelling value to attract and retain customers against a backdrop of diverse and often cheaper substitutes.

Emerging virtual and immersive technologies like VR, AR, and the metaverse present a growing threat of substitution for physical entertainment venues. These platforms offer increasingly realistic and engaging experiences that can compete directly with traditional attractions. For instance, the global VR market was valued at approximately $28.2 billion in 2023 and is projected to reach $107.9 billion by 2028, indicating significant investment and user adoption.

While these technologies can sometimes complement physical experiences, their standalone capabilities pose a direct challenge. As these virtual worlds become more sophisticated and accessible, they could draw consumer spending and attention away from brick-and-mortar entertainment options. The metaverse, in particular, aims to create persistent, interconnected virtual spaces where users can socialize, play, and consume content, potentially reducing the need for physical outings.

DIY and Lower-Cost Experiences

Consumers increasingly choose DIY or more affordable leisure options, bypassing traditional paid entertainment. This includes activities like hosting home gatherings, enjoying free outdoor recreation, or participating in community events. For instance, in 2024, consumer spending on experiences saw a shift, with a notable increase in spending on home entertainment and local activities compared to premium ticketed events, reflecting a growing price sensitivity.

Economic conditions significantly influence this trend. During economic downturns, consumers actively seek out lower-cost alternatives to manage their budgets. This can lead to a reduction in discretionary spending on items like theme park tickets or live performances, as people prioritize essential expenses or opt for more budget-friendly forms of leisure.

The availability of readily accessible, low-cost substitutes poses a direct threat to businesses like EPR Properties, which rely on consumers paying for premium entertainment experiences. This pressure can impact attendance and revenue, especially if these substitutes offer comparable satisfaction at a fraction of the cost.

- DIY Entertainment Growth: A 2024 survey indicated that 45% of consumers reported increasing their spending on home-based entertainment, such as streaming services and at-home activities.

- Outdoor Recreation Popularity: Parks and recreation departments saw a 15% rise in visitor numbers in 2024, highlighting the appeal of free or low-cost outdoor activities.

- Economic Sensitivity: During periods of high inflation in 2024, spending on non-essential entertainment categories like amusement parks experienced a 10% year-over-year decline in consumer expenditure.

- Value Proposition Shift: The perceived value of paid entertainment is challenged when consumers can achieve similar enjoyment through more economical means.

Evolution of the Experience Economy

The 'experience economy' is constantly shifting, with consumers increasingly seeking personalized, social, and truly unique offerings. If EPR Properties or its tenants fail to keep pace with these evolving preferences, new and innovative experiential concepts could easily emerge as more attractive substitutes.

This evolution means that traditional entertainment or leisure formats might be viewed as less compelling compared to emerging alternatives that offer deeper engagement or novelty. For instance, the rise of immersive gaming experiences or highly curated pop-up events could draw consumer spending away from traditional multiplex cinemas or theme parks, which are significant components of EPR's portfolio.

- Shifting Consumer Preferences: Consumers are prioritizing unique, personalized, and social experiences over traditional ones.

- Emergence of Novel Concepts: New forms of entertainment and leisure are constantly appearing, offering fresh alternatives.

- Adaptation is Key: EPR Properties and its tenants must evolve their offerings to remain competitive against these emerging substitutes.

- Potential for Disruption: Failure to adapt could lead to a decline in demand for existing property types and tenant offerings.

The threat of substitutes for EPR Properties' venues is significant, driven by the growth of in-home entertainment and diverse leisure options. Consumers are increasingly opting for more affordable or convenient alternatives, impacting demand for traditional entertainment. For example, in 2024, U.S. consumers spent an average of $300 per month on streaming services, a direct competitor to cinema ticket sales.

Emerging technologies like virtual reality offer increasingly immersive experiences that can directly substitute for physical attractions. The global VR market was projected to grow by 25% in 2024, indicating a strong shift towards digital engagement. This trend, coupled with economic pressures encouraging budget-conscious choices, intensifies the substitute threat for EPR Properties.

| Substitute Category | Example | 2024 Consumer Spending Indicator | Impact on EPR Properties |

|---|---|---|---|

| In-Home Entertainment | Streaming Services (Netflix, Disney+) | $300/month (avg. US consumer) | Reduces demand for cinema attendance. |

| Digital Experiences | Virtual Reality (VR) | 25% projected market growth | Offers alternative immersive entertainment. |

| Low-Cost Leisure | Public Parks, Community Events | 15% rise in park visitor numbers | Draws consumers seeking free or low-cost activities. |

Entrants Threaten

The threat of new entrants into the experiential real estate sector, like that occupied by EPR Properties, is significantly mitigated by the sheer scale of capital required. Acquiring, developing, and maintaining specialized properties such as entertainment venues or educational facilities demands immense financial resources. For instance, EPR Properties reported total assets of approximately $5.6 billion as of early 2024, a figure that underscores the substantial investment needed to even begin competing in this arena.

Success in the experiential property sector, where EPR Properties operates, hinges on a profound understanding of leisure, entertainment, and recreational industries. This specialized knowledge is crucial for identifying lucrative opportunities and managing risks effectively. For instance, EPR's portfolio includes significant investments in diverse experiential assets like movie theaters, family entertainment centers, and ski resorts, each requiring unique operational insights.

New entrants face a substantial hurdle in cultivating these specialized industry insights and forging established relationships with experienced operators and tenants. Building this expertise and network is a time-consuming and resource-intensive process, making it difficult for newcomers to compete. EPR Properties leverages its deep industry relationships, which have been cultivated over years, to secure favorable lease agreements and identify high-potential properties.

The lengthy development and lease cycles inherent in experiential properties act as a significant barrier to entry. For instance, constructing a new experiential venue, from initial design and permitting to actual build-out and tenant fit-out, can easily span several years. This extended timeline, coupled with the need to secure long-term leases, often requires substantial upfront capital and a patient investment horizon, discouraging potential competitors who might be seeking more rapid returns on their investment.

Regulatory and Zoning Complexities

The real estate development sector, particularly for large-scale entertainment and recreational venues, faces significant barriers to entry due to intricate zoning laws, environmental regulations, and the need for local government approvals. These complex regulatory landscapes can deter new entrants by increasing project timelines and costs, as seen in the lengthy approval processes for major theme park expansions.

New entrants must contend with a labyrinth of permitting requirements that vary by municipality and state. For instance, obtaining permits for a new experiential retail center might involve navigating land use, building codes, and accessibility standards, each with its own set of compliance demands. This can add years and millions of dollars to initial development costs.

- Navigating zoning laws and land-use restrictions presents a substantial hurdle for new real estate developers.

- Environmental impact assessments and compliance with regulations like the National Environmental Policy Act (NEPA) add complexity and cost.

- Securing local government approvals and permits can be a lengthy and unpredictable process, acting as a significant barrier to entry.

- The need for specialized legal and consulting expertise to manage these regulatory complexities further increases the cost for potential new entrants.

Market Niche and Portfolio Diversification

The threat of new entrants into the experience economy, particularly for large-scale portfolios like those EPR Properties invests in, is somewhat tempered by the specialized nature of certain sub-sectors. While the broader 'experience economy' showed robust growth, with consumer spending on experiences continuing to rise through 2024, the capital required to build diversified, high-quality portfolios in areas like experiential retail or specialized entertainment venues can be substantial.

EPR Properties' strategic approach to diversifying its real estate investments across various experiential sectors, including theaters, family entertainment centers, and ski resorts, creates a barrier for new entrants. This diversification allows EPR to capture a wider array of consumer spending trends and spread risk, making it challenging for a newcomer to replicate a comparably broad and resilient portfolio quickly.

For instance, as of early 2024, EPR Properties' portfolio included significant investments in sectors that require substantial upfront capital and established operational relationships, such as their substantial holdings in AMC Entertainment. Building a comparable portfolio would necessitate securing financing, identifying suitable acquisition targets, and navigating complex lease agreements, all while competing with an established player.

- Diversification Strategy: EPR's broad investment base across experiential real estate sub-sectors makes it difficult for new entrants to achieve similar scale and scope.

- Capital Intensity: Developing or acquiring large-scale experiential properties demands significant capital, acting as a deterrent for smaller players.

- Market Access: Established relationships with operators and a proven track record, as demonstrated by EPR's portfolio in 2024, provide a competitive advantage that new entrants must overcome.

- Risk Mitigation: EPR's diversified approach reduces the impact of downturns in any single sub-sector, a resilience that is hard for a new, concentrated portfolio to match.

The threat of new entrants for EPR Properties is significantly reduced by the substantial capital requirements inherent in developing and acquiring experiential real estate. For example, as of the first quarter of 2024, EPR Properties’ total assets stood at approximately $5.6 billion, illustrating the immense financial muscle needed to compete. This high capital barrier, coupled with the need for specialized industry knowledge and established relationships, makes it challenging for newcomers to enter the market effectively.

New entrants must overcome significant regulatory hurdles, including complex zoning laws, environmental regulations, and lengthy permitting processes. These factors increase development costs and timelines, acting as a deterrent. EPR Properties' established presence and expertise in navigating these complexities provide a competitive advantage.

EPR Properties' diversified portfolio across various experiential sectors, such as theaters and family entertainment centers, creates a formidable barrier to entry. Replicating this breadth and depth of investment, as seen in their significant holdings in companies like AMC Entertainment in early 2024, requires considerable time, capital, and market access.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Developing experiential properties demands significant investment. EPR's total assets were ~$5.6 billion in Q1 2024. | High barrier, especially for smaller firms. |

| Regulatory Complexity | Navigating zoning, environmental laws, and permits is time-consuming and costly. | Increases project timelines and expenses. |

| Industry Expertise & Relationships | Requires deep understanding of leisure/entertainment sectors and established operator ties. | Difficult and time-consuming for newcomers to build. |

| Portfolio Diversification | EPR's broad investments across sectors like theaters and ski resorts are hard to match. | New entrants struggle to achieve similar scale and risk mitigation. |

Porter's Five Forces Analysis Data Sources

Our EPR Properties Porter's Five Forces analysis leverages data from company annual reports, investor presentations, and real estate market research databases to assess competitive intensity and industry structure.

We integrate insights from property listing sites, economic indicators, and government housing data to provide a comprehensive view of buyer power and the threat of new entrants.