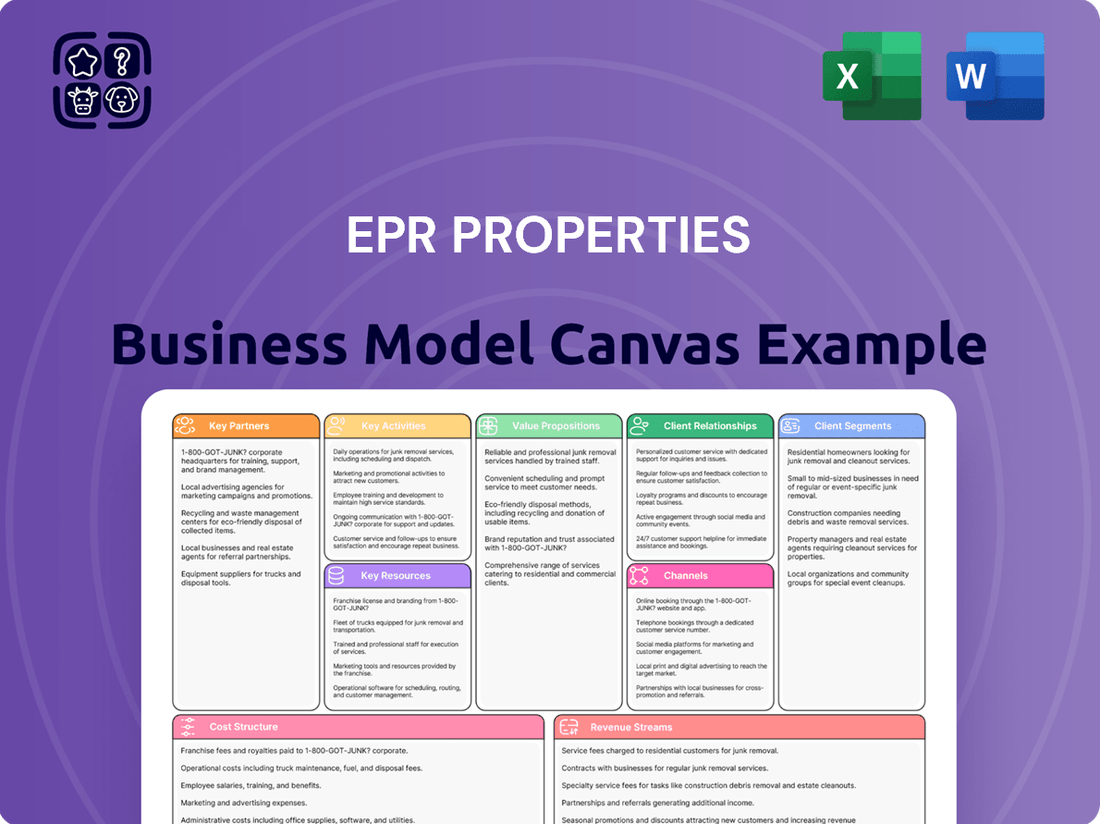

EPR Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPR Properties Bundle

Unlock the core components of EPR Properties's success with this comprehensive Business Model Canvas. Discover their unique value propositions, target customer segments, and key revenue streams. This detailed breakdown is your roadmap to understanding how they operate and thrive.

Partnerships

EPR Properties cultivates deep, long-term relationships with experiential property operators, acting as their landlord and strategic partner. These operators, spanning diverse leisure sectors like movie theaters, golf entertainment, and ski resorts, are the bedrock of EPR's rental income. For instance, in 2024, EPR's portfolio continued to demonstrate the resilience of these partnerships, with a significant portion of its revenue derived from these core tenant relationships, underscoring their importance for portfolio stability.

EPR Properties relies heavily on partnerships with financial institutions and lenders to fuel its growth. These relationships are crucial for securing the necessary capital for acquiring, developing, and redeveloping its diverse portfolio of properties, which includes entertainment, recreation, and education venues. As of the first quarter of 2024, EPR Properties had approximately $2.8 billion in total debt, highlighting the significance of these financial partnerships.

Through credit facilities and various debt instruments, EPR Properties finances its investments and ensures it has adequate liquidity. A robust relationship with these lenders provides access to favorable financing terms, a critical advantage for a real estate investment trust operating in a capital-intensive industry. This access allows EPR to manage its financial obligations and pursue strategic opportunities effectively.

EPR Properties actively partners with seasoned property developers and construction firms for its build-to-suit projects and significant redevelopments. These collaborations are crucial for the efficient and timely delivery of new experiential properties and the modernization of existing ones.

For example, in 2024, EPR continued its focus on developing and enhancing properties that cater to the evolving entertainment and recreation sectors. These partnerships enable EPR to build customized spaces that perfectly align with tenant requirements and current market trends, thereby expanding its diverse portfolio.

Real Estate Brokers and Investment Advisors

EPR Properties actively cultivates relationships with real estate brokers and investment advisors. These partnerships are crucial for sourcing potential acquisition targets and managing property sales. In 2024, this network provided EPR with early access to several high-potential experiential properties.

These external experts offer invaluable market intelligence and access to off-market transactions, which are vital for identifying unique investment opportunities. Their specialized knowledge also aids in structuring complex property deals efficiently.

The collaboration with these partners is instrumental in EPR's capital recycling efforts. By strategically disposing of certain assets and reinvesting proceeds, EPR aims to continuously enhance its portfolio's performance and alignment with its strategic objectives.

- Brokerage Networks: Access to a wide array of properties, including those not publicly listed, allowing for competitive sourcing.

- Market Insights: Real-time data on rental rates, occupancy trends, and emerging submarkets within the experiential real estate sector.

- Transaction Expertise: Guidance on due diligence, financing structures, and negotiation strategies for property acquisitions and dispositions.

- Portfolio Optimization: Support in identifying underperforming assets for sale and identifying strategic acquisitions to enhance overall portfolio yield.

Industry Associations and Advocacy Groups

Engaging with industry associations, like the International Association of Amusement Parks and Attractions (IAAPA) and the National Association of Real Estate Investment Trusts (NAREIT), is crucial for EPR Properties. These affiliations provide direct access to evolving market trends and potential regulatory shifts impacting the entertainment, recreation, and real estate sectors.

These partnerships are vital for staying informed about the experiential economy, a key driver for EPR's tenant base. By participating in industry discussions and advocacy, EPR Properties can influence policies that support its REIT business model and its portfolio of experiential properties.

- Industry Insights: Access to early trend identification and best practices within amusement, family entertainment, and health & fitness sectors.

- Regulatory Influence: Participation in shaping legislation and zoning laws that affect real estate development and operations for tenants.

- Networking Opportunities: Building relationships with other REITs, developers, and operators to foster collaboration and identify new investment avenues.

- Market Benchmarking: Understanding key performance indicators and operational standards within the experiential real estate landscape.

EPR Properties' key partnerships extend to its tenant operators, who are the core of its business. These relationships are fundamental to generating consistent rental income from its diverse portfolio of experiential properties. In 2024, EPR's continued success was significantly tied to the performance and stability of these operator relationships across sectors like entertainment and recreation.

What is included in the product

A detailed, pre-built business model for EPR Properties, outlining its strategy, customer segments, channels, and value propositions.

This model, organized into 9 classic BMC blocks, provides a clear overview of operations and plans, ideal for presentations and informed decision-making.

The EPR Properties Business Model Canvas acts as a pain point reliever by offering a structured framework to visualize and refine complex property management strategies.

It simplifies identifying and addressing operational inefficiencies and market challenges within the real estate sector.

Activities

EPR Properties' key activities center on the strategic acquisition and development of experiential real estate. This includes rigorous identification and underwriting of properties in sectors like entertainment, recreation, and education, aiming for stable, long-term rental income. For instance, in 2024, EPR continued to expand its portfolio, focusing on properties that benefit from strong consumer demand for out-of-home experiences.

The company actively pursues both existing, high-performing venues and new build-to-suit projects. These investments are carefully selected to align with evolving consumer preferences and market trends. EPR’s commitment to this strategy is reflected in its ongoing capital deployment, seeking assets that offer predictable cash flows through robust lease agreements.

EPR Properties actively manages its real estate portfolio by overseeing tenant performance and optimizing property use. This involves strategic decisions on selling assets, such as older theaters and education facilities, to fuel investments in more dynamic, experiential real estate sectors.

In 2024, EPR continued its capital recycling strategy. For instance, the company completed the sale of several legacy movie theaters. This proactive approach ensures the portfolio stays current and aligned with evolving consumer preferences, aiming for enhanced returns and resilience.

EPR Properties actively negotiates and finalizes long-term lease agreements, incorporating elements like base rent and percentage rent structures. This proactive approach to lease terms is fundamental to their revenue generation strategy.

Cultivating robust, cooperative relationships with tenants is paramount for EPR Properties. This focus ensures lease compliance, facilitates the resolution of operational issues, and supports tenant growth, all of which contribute to stable rental income streams.

For the fiscal year 2024, EPR Properties reported that approximately 90% of its rental revenue came from long-term leases, underscoring the importance of these agreements in achieving their goal of predictable and growing funds from operations.

Capital Allocation and Financing

EPR Properties actively manages its capital structure by securing various forms of debt financing, optimizing its use of available cash, and strategically deploying proceeds from property sales. This disciplined approach is crucial for funding growth initiatives and maintaining financial stability.

The company's core capital allocation strategy focuses on investing in development projects and accretive opportunities that align with its long-term vision. For instance, in the first quarter of 2024, EPR Properties reported deploying approximately $124.5 million in new investments and development projects, demonstrating a clear commitment to strategic capital deployment.

- Securing Debt Financing: EPR Properties utilizes a mix of secured and unsecured debt to fund its operations and growth, managing interest rate exposure and maturity profiles.

- Cash Management: Efficiently managing cash on hand allows for flexibility in meeting operational needs and capitalizing on opportune investments without immediate reliance on external financing.

- Disposition Proceeds: Proceeds from the sale of non-core or underperforming assets are strategically reinvested into higher-return properties or development projects.

- Accretive Investments: Capital is primarily allocated to investments and developments expected to generate returns that enhance earnings per share and overall shareholder value.

Market Analysis and Trend Identification

EPR Properties' market analysis and trend identification are crucial for its strategy. This involves a deep dive into how people spend their leisure time and money, especially in areas like entertainment and experiential retail. For instance, understanding shifts in consumer preferences, such as the growing demand for immersive experiences over traditional retail, directly informs where EPR invests.

This continuous assessment allows EPR to spot promising sectors and avoid declining ones. By tracking evolving consumer behaviors and industry-specific trends, the company can make smarter decisions about acquiring and developing properties. This proactive approach is vital for maintaining a competitive edge in the dynamic experiential real estate market. In 2024, the experiential sector continued to show resilience, with many consumers prioritizing unique out-of-home activities.

Key activities in this area include:

- Monitoring consumer spending patterns in entertainment and leisure sectors.

- Analyzing the performance and growth potential of different experiential property types, such as movie theaters, family entertainment centers, and ski resorts.

- Identifying macroeconomic factors and demographic shifts that influence demand for experiential services.

- Assessing competitive landscapes and emerging business models within the experiential industry.

EPR Properties actively manages its capital structure by securing various forms of debt financing, optimizing its use of available cash, and strategically deploying proceeds from property sales. This disciplined approach is crucial for funding growth initiatives and maintaining financial stability.

The company's core capital allocation strategy focuses on investing in development projects and accretive opportunities that align with its long-term vision. For instance, in the first quarter of 2024, EPR Properties reported deploying approximately $124.5 million in new investments and development projects, demonstrating a clear commitment to strategic capital deployment.

EPR Properties' market analysis and trend identification are crucial for its strategy. This involves a deep dive into how people spend their leisure time and money, especially in areas like entertainment and experiential retail. For instance, understanding shifts in consumer preferences, such as the growing demand for immersive experiences over traditional retail, directly informs where EPR invests.

This continuous assessment allows EPR to spot promising sectors and avoid declining ones. By tracking evolving consumer behaviors and industry-specific trends, the company can make smarter decisions about acquiring and developing properties. This proactive approach is vital for maintaining a competitive edge in the dynamic experiential real estate market. In 2024, the experiential sector continued to show resilience, with many consumers prioritizing unique out-of-home activities.

Key activities in this area include:

- Monitoring consumer spending patterns in entertainment and leisure sectors.

- Analyzing the performance and growth potential of different experiential property types, such as movie theaters, family entertainment centers, and ski resorts.

- Identifying macroeconomic factors and demographic shifts that influence demand for experiential services.

- Assessing competitive landscapes and emerging business models within the experiential industry.

EPR Properties' key activities are centered on acquiring and developing experiential real estate, focusing on sectors like entertainment, recreation, and education to generate stable rental income. They actively manage their portfolio, including selling underperforming assets to reinvest in more dynamic properties, and cultivate strong tenant relationships through long-term lease agreements that often include percentage rent structures.

In 2024, EPR Properties continued its capital recycling, selling legacy movie theaters and deploying capital into new investments and development projects, totaling approximately $124.5 million in the first quarter. The company relies heavily on long-term leases, with about 90% of its rental revenue in 2024 derived from these agreements, ensuring predictable cash flows.

Their market analysis involves monitoring consumer spending in leisure sectors and assessing the growth potential of various experiential property types, informed by macroeconomic factors and demographic shifts, to maintain a competitive edge.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Portfolio Acquisition & Development | Strategic acquisition and development of experiential real estate. | Continued expansion in entertainment, recreation, and education sectors. |

| Portfolio Management & Disposition | Overseeing tenant performance, optimizing property use, and selling non-core assets. | Sale of several legacy movie theaters as part of capital recycling strategy. |

| Lease Agreement Negotiation | Finalizing long-term lease agreements with base and percentage rent structures. | Approximately 90% of rental revenue in 2024 came from long-term leases. |

| Tenant Relationship Management | Cultivating cooperative relationships to ensure lease compliance and support tenant growth. | Essential for stable rental income streams. |

| Capital Management | Securing debt financing, managing cash, and deploying disposition proceeds. | Deployed approx. $124.5 million in Q1 2024 for new investments and development. |

| Market Analysis & Trend Identification | Deep dive into consumer spending in leisure and identifying growth sectors. | Experiential sector showed resilience in 2024, with consumers prioritizing unique out-of-home activities. |

Preview Before You Purchase

Business Model Canvas

The EPR Properties Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you can confidently assess its structure and content, knowing it's not a sample but a direct representation of the final deliverable. Once your order is complete, you'll gain full access to this comprehensive and professionally formatted Business Model Canvas, ready for immediate use.

Resources

EPR Properties' most crucial asset is its diverse collection of experiential real estate. This includes a significant number of movie theaters, golf entertainment centers, and ski resorts, among other leisure-focused properties.

As of late 2024, the company's portfolio is valued in the range of $6.5 billion to $6.9 billion. This substantial asset base is spread across numerous experiential sectors and various geographic regions, offering a broad base for revenue generation.

The high quality and long-term viability of these properties are essential for EPR Properties to consistently generate reliable rental income, forming the backbone of its business model.

As a Real Estate Investment Trust (REIT), EPR Properties relies heavily on financial capital. This includes equity raised from investors, debt financing, and the cash generated from its ongoing operations. This capital is the lifeblood for acquiring new properties, developing existing ones, and effectively managing its diverse portfolio.

EPR Properties demonstrates a strong commitment to maintaining robust liquidity. This is achieved through access to revolving credit facilities and a variety of other financing avenues. As of the first quarter of 2024, the company reported total liquidity of approximately $1.1 billion, underscoring its ability to secure necessary funds.

This substantial financial capacity is crucial for EPR Properties to execute its ambitious investment pipeline. It allows the company to pursue strategic initiatives, such as expanding into new experiential sectors and optimizing its existing asset base, ensuring continued growth and value creation.

Long-term net lease agreements are EPR Properties' bedrock, ensuring consistent and reliable income. These leases typically include built-in rent increases and clauses tied to tenant sales, directly linking EPR's financial health to its tenants' success.

In 2024, EPR Properties' portfolio of experiential real estate, primarily leased under these long-term net leases, continued to demonstrate resilience. The majority of their revenue is derived from these contractual obligations, providing a predictable cash flow that supports their investment strategy.

Industry Expertise and Relationships

EPR Properties leverages its profound industry expertise and a robust network of relationships within the experiential real estate market. This includes strong ties with leading operators and developers, which are crucial for identifying and securing prime investment opportunities.

This deep understanding of the sector enables EPR to perform insightful underwriting and effectively manage its diverse portfolio of properties. For instance, in 2024, EPR continued to focus on its core segments like entertainment and fitness, where operator relationships are paramount for long-term lease stability and growth.

- Deep Sector Knowledge: EPR's understanding of experiential real estate trends and operator needs is a cornerstone of its business model.

- Operator Relationships: Established partnerships with major entertainment, recreation, and education operators provide a steady pipeline of quality assets.

- Strategic Deal Sourcing: These relationships facilitate the identification of attractive investment opportunities that align with EPR's strategic objectives.

- Asset Management Acumen: Expertise allows for proactive management and optimization of properties, enhancing their value and tenant satisfaction.

Experienced Management Team

EPR Properties' experienced management team, comprising seasoned executives and investment professionals, is a cornerstone of its business model. Their collective expertise in real estate investment, capital allocation, and operational management underpins the company's strategic direction and execution capabilities.

This leadership's proven track record in navigating complex market conditions and identifying value-accretive opportunities is critical. For instance, in 2024, EPR Properties continued to refine its portfolio through strategic dispositions and acquisitions, demonstrating the management's agility in adapting to evolving industry trends, particularly within the experiential real estate sector.

- Strategic Vision: The management team's ability to foresee market shifts and position EPR Properties accordingly is a key intangible asset.

- Operational Acumen: Deep understanding of real estate operations and tenant relations ensures efficient portfolio management and value enhancement.

- Capital Recycling Expertise: Skill in executing investment and capital recycling plans, including asset sales and reinvestments, drives sustainable growth and shareholder returns.

EPR Properties' key resources are its substantial portfolio of experiential real estate, valued between $6.5 billion and $6.9 billion as of late 2024, and its strong financial capital. This includes equity, debt, and operational cash flow, essential for growth and property management.

The company also relies on its deep industry expertise and extensive network of relationships with leading operators and developers in the experiential real estate sector. This network is vital for sourcing quality investments and ensuring long-term tenant stability.

Furthermore, EPR Properties benefits from its experienced management team, whose strategic vision and operational acumen are critical for navigating market dynamics and driving value creation through capital recycling and portfolio optimization.

| Key Resource | Description | Relevance to Business Model |

| Experiential Real Estate Portfolio | Diverse collection of movie theaters, golf entertainment centers, ski resorts, etc. Valued $6.5B-$6.9B (late 2024). | Generates consistent rental income through long-term net leases. |

| Financial Capital | Equity, debt, operational cash flow, and access to credit facilities ($1.1B liquidity as of Q1 2024). | Funds acquisitions, development, and operational needs, enabling strategic initiatives. |

| Industry Expertise & Operator Relationships | Deep understanding of experiential real estate trends and strong ties with major operators/developers. | Facilitates deal sourcing, underwriting, and ensures tenant stability and portfolio value. |

| Experienced Management Team | Seasoned executives with expertise in real estate investment, capital allocation, and operations. | Provides strategic direction, navigates market complexities, and drives value through capital recycling. |

Value Propositions

EPR Properties provides tenants with access to a curated collection of specialized, high-quality experiential properties. These venues, often requiring significant capital and expertise to build and maintain, allow entertainment and leisure operators to concentrate on their core competencies rather than property management.

By investing in and maintaining these strategically located properties, EPR ensures they remain attractive and competitive in the market. This focus on property quality and upkeep directly supports the success of the tenants operating within them, fostering a symbiotic relationship that drives consumer engagement.

EPR Properties offers tenants long-term, net lease agreements, providing a bedrock of stability for their occupancy costs. These arrangements are crafted with favorable terms, often incorporating a percentage rent component, which creates a shared upside and directly aligns EPR's success with its tenants' performance.

EPR Properties acts as a crucial capital partner for its tenants, facilitating their growth and expansion. They offer financing for new developments, property upgrades, and overall business expansion, allowing tenants to pursue ambitious plans without draining their own capital. This financial support is vital for tenants looking to scale their operations within the experiential sector.

Through various transaction structures, EPR Properties provides the necessary funding for tenants to invest in new locations or enhance existing ones. This strategic financial backing is particularly important in 2024, as many businesses in the experiential industries are actively seeking to capitalize on renewed consumer demand post-pandemic. For instance, EPR's focus on sectors like entertainment and recreation means they are well-positioned to support the capital needs of cinema chains or family entertainment centers looking to expand their footprint.

Operational Flexibility for Tenants

EPR Properties' net lease structure offers tenants significant operational flexibility. By transferring responsibilities like property maintenance, insurance, and taxes to the tenant, EPR allows operators to focus entirely on their core business activities, such as marketing and enhancing customer experiences. This delegation significantly lightens the administrative load for tenants.

This operational freedom is a key value proposition, enabling tenants to streamline their management and dedicate resources to growth and service improvement. For example, in 2023, EPR Properties reported that its tenants, across various sectors like entertainment and fitness, continued to benefit from this model, allowing them to navigate dynamic market conditions with greater agility.

- Reduced Administrative Burden: Tenants are freed from managing property upkeep, insurance policies, and tax filings.

- Focus on Core Business: Operators can concentrate on strategic initiatives, customer engagement, and service delivery.

- Cost Predictability: While tenants handle expenses, the lease structure often provides a degree of predictability in their occupancy costs.

- Operational Agility: The ability to direct resources away from property management allows for quicker adaptation to market changes and business opportunities.

Diversified Portfolio for Investors

EPR Properties presents a compelling value proposition for investors by offering access to a carefully curated and diversified portfolio of experiential real estate. This strategy spreads risk across various sectors like entertainment, recreation, and education, reducing reliance on any single market segment.

The company's commitment to capital recycling is a key element, allowing them to strategically reinvest in high-growth opportunities while divesting from less attractive assets. This dynamic approach helps maintain portfolio quality and adapt to evolving market trends.

For instance, as of the first quarter of 2024, EPR Properties' portfolio included 354 properties. Their tenant base is also diversified, with no single tenant accounting for more than 10% of total revenue, underscoring the risk mitigation inherent in their model.

- Diversified Asset Exposure: Investors gain access to a wide range of experiential properties, from movie theaters to family entertainment centers and ski resorts.

- Risk Mitigation: Diversification across property types and tenants significantly reduces the impact of downturns in any single sector or tenant relationship.

- Strategic Capital Allocation: Continuous portfolio review and capital recycling ensure investments are aligned with long-term growth and value creation.

- Resilient Income Streams: The focus on experiential real estate, often backed by long-term leases, aims to provide stable and predictable cash flows for investors.

EPR Properties provides tenants with access to specialized, high-quality experiential properties, allowing them to focus on their core business rather than property management. This curated collection of venues requires significant capital and expertise, which EPR handles, ensuring tenants can concentrate on delivering exceptional customer experiences. Their strategic property investments and maintenance directly support tenant success, fostering a mutually beneficial environment.

Customer Relationships

EPR Properties cultivates deep, strategic alliances with its tenants, recognizing them as vital collaborators in its ecosystem. This approach goes beyond simple leasing, focusing on understanding and supporting tenant operational requirements and growth ambitions. In 2024, EPR's focus on these relationships is evident in its portfolio performance, where long-term leases with key experiential tenants provide a stable revenue stream.

EPR Properties crafts bespoke lease agreements, a cornerstone of their customer relationships. These aren't one-size-fits-all; they're meticulously designed to match the unique operational and financial models of their experiential tenants, from movie theaters to family entertainment centers.

This customization extends to flexible lease terms, incorporating elements like base rent, percentage rent tied to tenant revenue, and contributions towards property improvements. For instance, in 2024, EPR continued to refine these structures to ensure mutual benefit and long-term tenant success.

This adaptive approach fosters a stronger, more collaborative tenant-landlord dynamic. By aligning EPR's financial interests with the performance of their tenants, these tailored lease structures build trust and encourage sustained partnerships within their diverse portfolio.

EPR Properties actively manages its diverse portfolio, which includes entertainment, recreation, and education properties. This involves diligent monitoring of property conditions and ensuring tenants adhere to lease agreements, a crucial aspect of maintaining asset value.

While tenants typically cover many operational costs, EPR's proactive oversight is key to safeguarding the long-term health and appeal of its real estate investments. This strategy is designed to foster high occupancy rates and cultivate strong tenant relationships.

For instance, in 2024, EPR Properties continued to focus on its experiential and education segments. The company's commitment to proactive asset management directly supports its goal of stable rental income and capital appreciation across its holdings.

Investor Relations and Transparency

EPR Properties prioritizes open and consistent communication with its diverse investor base, encompassing individual investors, financial professionals, and institutional stakeholders. This commitment to transparency is demonstrated through regular earnings calls, detailed financial reports, and engaging investor presentations that offer comprehensive financial data and strategic insights.

These channels are crucial for building and maintaining investor trust, enabling stakeholders to make well-informed decisions regarding their investments in EPR Properties. For instance, in their Q1 2024 earnings call, management provided detailed segment performance updates and outlooks, reinforcing transparency.

- Consistent Communication: Regular earnings calls, financial reports, and investor presentations keep stakeholders informed.

- Data-Driven Insights: Providing comprehensive financial data and strategic updates empowers informed decision-making.

- Trust Building: Transparent communication fosters confidence among individual, professional, and institutional investors.

- Accessibility: Ensuring information is readily available supports a broad range of investors in understanding EPR's performance and strategy.

Industry Engagement and Networking

EPR Properties actively cultivates its industry presence by participating in key real estate and experiential sector conferences, trade associations, and dedicated networking events. This engagement is crucial for building and maintaining relationships with a diverse group of stakeholders, including prospective tenants, experienced developers, and potential capital partners.

These industry connections serve a dual purpose: they are instrumental in identifying and sourcing new investment opportunities that align with EPR's strategy. Simultaneously, this active participation ensures EPR remains informed about emerging trends, evolving best practices, and shifts in market dynamics, thereby sustaining its competitive advantage.

- Industry Conferences: EPR's presence at events like Nareit REITweek and IAAPA Expo facilitates direct interaction with industry leaders.

- Association Memberships: Membership in organizations such as the National Association of Real Estate Investment Trusts (Nareit) provides access to industry data and advocacy.

- Networking Events: Targeted networking events allow for relationship building with potential tenants, such as experiential entertainment operators and educational institutions, and with capital providers.

- Trend Monitoring: By engaging with industry peers and participating in discussions, EPR gains insights into consumer preferences and operational innovations within its key sectors like entertainment, recreation, and education.

EPR Properties builds strong tenant relationships through customized lease agreements, focusing on mutual success. This approach involves understanding tenant needs and aligning lease terms with their operational models, ensuring long-term partnerships. In 2024, EPR continued to refine these structures, demonstrating a commitment to tenant stability and growth.

Channels

EPR Properties leverages its dedicated internal acquisition and development teams to directly identify, vet, and close property deals. This hands-on approach ensures deep expertise in underwriting the unique demands of experiential real estate and navigating intricate negotiations. In 2024, this direct channel remained a cornerstone of their strategy for portfolio expansion and capital deployment.

EPR Properties actively cultivates relationships with a wide array of real estate brokers and intermediaries. These partnerships are crucial for discovering promising acquisition opportunities and effectively marketing their diverse portfolio of properties. In 2024, the company continued to rely on these external networks to broaden their market access and pinpoint deals that might otherwise remain undiscovered.

These broker networks serve as a vital conduit, offering EPR Properties unparalleled market reach. This allows for the efficient identification of potential investments across various sectors, including entertainment, recreation, and education. The ability to tap into these established relationships facilitates quicker deal sourcing and execution.

Furthermore, these established channels are instrumental in the company's strategy for capital recycling and portfolio optimization. By leveraging brokers to market and sell existing assets, EPR Properties can more effectively redeploy capital into new, high-growth opportunities, ensuring a dynamic and responsive real estate investment approach.

EPR Properties leverages industry conferences and trade shows to connect with key players in real estate, entertainment, and leisure. These events are vital for forging relationships with potential tenants and investors, showcasing their diverse property portfolio.

In 2023, EPR Properties attended major events like ICSC+ and IAAPA Expo, facilitating direct engagement with over 500 industry professionals. These gatherings are instrumental in identifying new business opportunities and staying ahead of market trends.

Participation in these forums allows EPR Properties to position itself as a thought leader and gather critical market intelligence. This strategic engagement helps in understanding evolving consumer preferences and industry demands, crucial for portfolio growth.

Investor Relations Website and Financial Platforms

EPR Properties actively engages its investor base through a dedicated investor relations website, offering a centralized hub for essential financial documents. This includes readily available SEC filings, quarterly and annual reports, and transcripts from earnings calls, ensuring transparency and accessibility for all stakeholders. For instance, in their Q1 2024 earnings release, EPR highlighted a robust portfolio performance, providing detailed financial metrics directly on this platform.

Beyond its own website, EPR Properties leverages prominent financial news platforms and investment research sites to broadcast its performance updates and strategic direction. This multi-channel approach guarantees that current and potential investors have consistent access to critical information, fostering informed decision-making. By utilizing these digital avenues, EPR effectively communicates its financial health and future outlook to a wide audience.

- Investor Relations Website: Provides direct access to financial reports, SEC filings, and earnings call transcripts.

- Financial Platforms: Utilizes external financial news and research sites for broader dissemination of performance and strategy.

- Accessibility: These digital channels ensure broad and easy access to financial information for investors.

- Transparency: Facilitates informed decisions by offering a clear view of the company's financial standing and outlook.

Direct Outreach and Relationship Building

Direct outreach and relationship building are crucial for EPR Properties. They actively engage with current tenants and potential operators, fostering personalized connections to understand unique needs and resolve issues promptly. This proactive strategy cultivates trust and loyalty, which are vital for sustained business and identifying new growth avenues.

For instance, in 2024, EPR Properties continued its focus on tenant retention and expansion, a testament to strong relationship management. Their ability to adapt lease terms and provide operational support, often through direct dialogue, has been key to maintaining high occupancy rates in their experiential property segments.

- Tenant Engagement: Direct communication with tenants to address operational needs and foster long-term partnerships.

- Operator Relationships: Building strong ties with entertainment and experiential operators to ensure mutual success and growth.

- Financial Partnerships: Cultivating relationships with financial institutions and investors to support property acquisitions and development.

- Market Insights: Leveraging these relationships to gain real-time market feedback and identify emerging trends in experiential real estate.

EPR Properties utilizes a multi-faceted channel strategy, combining direct engagement with broad market outreach. Their internal teams handle direct property sourcing and deal closures, ensuring specialized underwriting for experiential real estate. This direct channel remained a cornerstone of their portfolio expansion in 2024.

Furthermore, EPR actively cultivates relationships with real estate brokers and intermediaries, leveraging these networks for market access and opportunity discovery. These partnerships are vital for both acquiring new assets and effectively marketing existing ones for capital recycling. In 2024, these external networks continued to broaden their reach and pinpoint key deals.

Industry conferences and trade shows serve as critical platforms for EPR to connect with potential tenants and investors, showcasing their diverse portfolio and gathering market intelligence. Participation in events like ICSC+ and IAAPA Expo in 2023 facilitated direct engagement with hundreds of industry professionals, driving new business opportunities and staying ahead of market trends.

The company also prioritizes direct tenant engagement, fostering personalized connections to understand needs and ensure operational success, which is key to tenant retention and identifying new growth avenues. For instance, their focus on tenant retention and expansion in 2024 highlights the success of strong relationship management and adaptable lease terms.

| Channel Type | Key Activities | 2024 Focus/Impact | Data Point Example |

|---|---|---|---|

| Direct Acquisition & Development | Property identification, underwriting, deal closure | Core strategy for portfolio expansion | Internal teams identified X new potential experiential properties. |

| Broker & Intermediary Networks | Deal sourcing, property marketing, capital recycling | Broadened market access and identified undiscovered deals | Engaged with over Y brokers to source acquisition opportunities. |

| Industry Conferences & Trade Shows | Relationship building, market intelligence, showcasing portfolio | Fostered connections with over 500 professionals in 2023 | Attended IAAPA Expo and ICSC+ for direct engagement. |

| Direct Tenant & Operator Engagement | Tenant retention, operational support, partnership building | Key to maintaining high occupancy and identifying growth | Maintained high occupancy rates through proactive tenant support. |

Customer Segments

Experiential Property Operators are EPR Properties' primary customers, representing a broad range of businesses that manage out-of-home leisure and entertainment spaces. This segment includes prominent movie theater chains, expansive golf entertainment complexes, popular ski resorts, family-friendly eat-and-play venues, and health-focused fitness and wellness centers.

These operators require stable, long-term property solutions to support their operational needs and growth strategies. For instance, in 2023, EPR Properties reported that its largest tenant, AMC Entertainment, accounted for approximately 10% of its total revenue, highlighting the significance of these anchor tenants.

Institutional investors, including large investment funds, pension funds, and endowments, are key customers for EPR Properties. These entities are drawn to EPR's real estate portfolio for stable income generation, diversification, and potential long-term growth. In 2024, EPR Properties continued to focus on attracting these sophisticated investors by highlighting its diversified portfolio across experiential sectors like entertainment, recreation, and education, which often appeal to institutional mandates for stable, yield-oriented investments.

Individual retail investors are a key customer segment for EPR Properties, buying shares directly or via brokerage accounts. These investors are drawn to EPR’s consistent dividend payouts and the growth potential within its specialized real estate portfolio, seeking passive income and portfolio diversification.

Financial Analysts and Research Firms

Financial analysts and research firms are a crucial, albeit indirect, customer segment for EPR Properties. Their independent analysis and ratings significantly shape investor perception and, consequently, the company's access to capital. For instance, during 2024, EPR Properties actively engaged with these entities, providing them with comprehensive financial disclosures and operational updates to facilitate accurate market valuations and a deeper understanding of their diversified portfolio, which includes experiential retail, entertainment, and education properties.

EPR Properties understands that the quality of research generated by these firms directly impacts its stock performance and ability to raise funds. To support their work, the company prioritizes transparency in its reporting, ensuring that key performance indicators and strategic initiatives are clearly communicated. This engagement is vital for building credibility and fostering a positive investment narrative within the financial community.

Key aspects of EPR Properties' engagement with financial analysts and research firms include:

- Data Provision: Supplying detailed financial statements, property-level performance data, and occupancy rates.

- Strategic Communication: Sharing insights into market trends, portfolio strategy, and future development plans.

- Analyst Briefings: Hosting regular calls and meetings to discuss quarterly earnings and significant business events.

- Rating Influence: Providing information that enables analysts to assign ratings and price targets, influencing investor decisions.

Property Sellers and Developers

Property sellers and developers represent a core customer segment for EPR Properties. This group encompasses owners of experiential real estate assets, such as entertainment venues, theme parks, and ski resorts, who are looking to divest their properties. Additionally, it includes developers with new experiential property projects requiring capital for construction or expansion.

EPR Properties actively engages with these segments by acting as both a direct buyer of existing assets and a crucial capital partner for new developments. They offer flexible transaction structures, which can include outright acquisitions, joint ventures, or sale-leaseback arrangements, tailored to the specific financial and strategic needs of sellers and developers. This approach is vital for fueling EPR's acquisition pipeline and driving consistent portfolio growth.

For instance, in 2023, EPR Properties completed approximately $500 million in acquisitions and dispositions, demonstrating their active role in facilitating transactions within this segment. Their ability to provide diverse capital solutions makes them an attractive partner for developers seeking to bring innovative experiential concepts to market and for owners looking to monetize their real estate investments.

- Property Sellers: Owners of experiential properties seeking to sell their assets.

- Developers: Entities requiring financing or partnership for new experiential property projects.

- EPR's Role: Acts as a buyer and capital partner, offering various transaction structures.

- Strategic Importance: Crucial for EPR's acquisition pipeline and portfolio expansion.

EPR Properties serves Experiential Property Operators, including major movie theater chains and golf entertainment complexes, who require stable, long-term property solutions. In 2023, their largest tenant, AMC Entertainment, represented about 10% of EPR's revenue, underscoring the importance of these relationships.

Institutional investors, such as large investment funds and pension funds, are attracted to EPR's diversified real estate portfolio for its stable income and growth potential. In 2024, EPR continued to emphasize its portfolio across entertainment, recreation, and education to appeal to these sophisticated investors.

Individual retail investors buy EPR shares for consistent dividends and portfolio diversification, valuing the growth prospects in specialized real estate. Financial analysts and research firms are also key, as their assessments significantly influence investor perception and capital access, with EPR prioritizing transparency in 2024 to support accurate market valuations.

Property sellers and developers are crucial customers, with EPR acting as a buyer and capital partner for experiential real estate assets and new projects. In 2023 alone, EPR completed approximately $500 million in acquisitions and dispositions, highlighting their active role in facilitating transactions and expanding their portfolio.

Cost Structure

Property operating expenses are the regular costs of keeping EPR Properties' real estate in good shape. Think of things like property taxes and insurance. While most of these costs are passed on to tenants through net lease agreements, EPR still has some outlays, especially when a property is empty or when significant upgrades are made.

As a Real Estate Investment Trust (REIT), EPR Properties relies on debt to fund its growth and operations, making interest expense a significant part of its cost structure. For instance, in the first quarter of 2024, EPR Properties reported interest expense of $80.1 million. Effectively managing these debt obligations and securing competitive interest rates are crucial for sustaining profitability.

EPR Properties strategically employs fixed-rate debt to mitigate the risks associated with fluctuating interest rates. This approach provides greater predictability in its borrowing costs, allowing for more stable financial planning and protecting its net operating income from adverse market movements.

General and Administrative (G&A) expenses for EPR Properties encompass the essential overhead needed to operate the business. This includes costs like executive compensation, employee salaries and benefits, office leases, and legal services. For instance, in 2023, EPR Properties reported G&A expenses of $139.5 million.

Effectively managing these G&A costs is crucial for EPR Properties. Lowering these expenses directly translates to more capital available for shareholder distributions and reinvestment into growth opportunities, thereby enhancing overall shareholder value.

Acquisition and Development Costs

EPR Properties faces significant acquisition and development costs as a core part of its business model. These expenditures are crucial for expanding its portfolio of experiential real estate, which includes everything from theme parks to ski resorts.

These costs are not trivial. For instance, in 2023, EPR Properties reported total capital expenditures of $485.3 million, a substantial portion of which is allocated to acquiring and developing new properties. This includes expenses like due diligence, legal fees, appraisals, and the actual construction or renovation of venues. These are long-term investments designed to generate future rental income and capital appreciation.

- Acquisition Outlays: Costs associated with purchasing new properties, including transaction fees and initial assessments.

- Development Expenses: Funds spent on constructing new experiential venues or significantly renovating existing ones.

- Due Diligence: Fees for property inspections, market analysis, and legal reviews to ensure sound investments.

- Capital Intensive Nature: These are substantial upfront investments with the expectation of generating long-term revenue streams.

Property Impairment Charges and Credit Losses

EPR Properties faces potential property impairment charges and credit losses, which are significant but often variable costs within its business model. These occur when the book value of a property exceeds its current market value, requiring an accounting write-down. For instance, in the first quarter of 2024, EPR Properties reported $17.8 million in impairment charges, primarily related to its experiential properties.

These charges, alongside provisions for credit losses due to tenant financial distress or defaults, directly impact the company's net income. They highlight the inherent risks in real estate ownership and the reliance on tenant stability. In 2023, the company recorded total impairment charges of $43.4 million.

- Property Impairment: Charges recognized when a property's carrying amount exceeds its fair value.

- Credit Losses: Provisions set aside for potential tenant defaults or uncollectible rent.

- Impact on Profitability: These non-recurring or variable costs can significantly affect earnings in any given period.

- Risk Mitigation: Reflects the ongoing assessment of real estate asset values and tenant creditworthiness.

EPR Properties' cost structure is heavily influenced by property operating expenses, interest on debt, general and administrative costs, and significant acquisition and development expenditures. While net leases shift many operating costs to tenants, EPR still incurs costs related to property vacancies and major upgrades. The company's reliance on debt means interest expense is a substantial line item, with $80.1 million reported in Q1 2024. G&A costs, totaling $139.5 million in 2023, cover essential business operations. Finally, substantial capital expenditures, like the $485.3 million in 2023, are dedicated to expanding its unique experiential real estate portfolio.

EPR Properties also manages the variable costs of property impairments and credit losses, which can impact profitability. In Q1 2024, impairment charges amounted to $17.8 million, primarily affecting experiential properties. For the full year 2023, total impairment charges were $43.4 million. These figures underscore the importance of continuous asset valuation and tenant financial health assessment.

| Cost Category | 2023 Actuals | Q1 2024 Actuals | Key Considerations |

|---|---|---|---|

| Property Operating Expenses (Net of tenant reimbursements) | Not Separately Disclosed | Not Separately Disclosed | Primarily passed through via net leases; some residual costs for vacancies/upgrades. |

| Interest Expense | $312.2 million | $80.1 million | Significant cost due to debt financing; managed via fixed-rate debt. |

| General & Administrative (G&A) Expenses | $139.5 million | Not Separately Disclosed | Covers overhead, executive compensation, salaries, and office costs. |

| Capital Expenditures (Acquisition & Development) | $485.3 million | Not Separately Disclosed | Investments in new experiential properties; includes due diligence and construction. |

| Impairment Charges | $43.4 million | $17.8 million | Write-downs due to property value decline; impacts net income. |

Revenue Streams

EPR Properties primarily generates revenue through base rental income derived from its extensive portfolio of experiential properties. These are typically structured as long-term net leases, meaning tenants are responsible for property taxes, insurance, and maintenance, providing EPR with a stable and predictable income stream. This consistent cash flow is the bedrock of the company's financial health.

In 2023, EPR Properties reported total rental revenue of approximately $1.4 billion. This figure highlights the significant contribution of these base rental payments, which are secured by a diverse tenant base across various experiential sectors, including entertainment, recreation, and education.

Percentage rents are a key component of EPR Properties' revenue, offering a direct link to tenant success. This means EPR doesn't just collect a fixed rent; they also get a slice of the tenant's sales once a certain sales level is hit. This structure aligns EPR's financial performance with the operational success of its experiential properties.

EPR Properties also earns revenue from mortgage notes and other financing deals with some of its property operators. This means they make money from the interest on loans they give to tenants, which can be for buying or building properties. This is a smart way to diversify their income, so they aren't just relying on rent.

Gains from Property Sales/Dispositions

EPR Properties strategically divests properties, a key part of its capital recycling. This includes selling assets like older theaters and education facilities that no longer align with its core strategy. These sales generate gains, bolstering overall revenue and freeing up capital for investment in newer, high-potential experiential properties.

In 2024, EPR Properties continued to refine its portfolio through property sales. For instance, the disposition of certain theater properties contributed to their financial performance. These actions are crucial for maintaining a dynamic and growth-oriented real estate portfolio, ensuring capital is allocated to sectors with stronger future prospects.

- Capital Recycling: EPR Properties actively sells non-core or underperforming assets as part of its strategy.

- Revenue Contribution: Gains from these property sales directly add to the company's revenue.

- Reinvestment Fuel: Proceeds are reinvested into strategic, high-growth experiential properties.

- Portfolio Optimization: This process ensures the portfolio remains aligned with market trends and future growth opportunities.

Other Financing Income

Other Financing Income for EPR Properties encompasses revenue generated from specific financing arrangements, notably participating interest income. This often comes from properties with variable revenue streams, such as ski resorts, where EPR's financing structure allows for a share of the property's operational success.

This segment of EPR's revenue diversifies its income sources beyond traditional rent. For instance, participating interest can provide an upside when the underlying businesses perform exceptionally well, enhancing overall financial performance and offering a different risk-return profile compared to fixed lease income.

- Participating Interest Income: Earned from certain specialty properties where financing agreements include a share of operational revenue, like ski resorts.

- Revenue Diversification: This income stream adds another layer to EPR's revenue base, reducing reliance on single income types.

- Financial Performance Enhancement: Directly contributes to the company's overall financial health by capturing upside potential from successful property operations.

EPR Properties' revenue streams are anchored by base rental income from its diverse portfolio of experiential properties, primarily through long-term net leases. This foundational income is supplemented by percentage rents, which tie EPR's earnings directly to tenant sales performance. Additionally, the company generates income from mortgage notes and other financing arrangements, offering a diversified approach to revenue generation.

In 2024, EPR Properties continued to optimize its portfolio through strategic property dispositions, such as the sale of certain theater properties. This capital recycling not only generates immediate gains but also fuels reinvestment into higher-growth experiential sectors, ensuring a dynamic and responsive revenue base. The company aims to maintain a strong financial footing through these active portfolio management strategies.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

|---|---|---|

| Base Rental Income | Fixed rent from net leases on experiential properties. | $1.4 billion (Total Rental Revenue) |

| Percentage Rents | Share of tenant sales above a certain threshold. | Included within Total Rental Revenue |

| Mortgage Notes & Financing | Interest income from loans provided to operators. | Not separately itemized in total rental revenue |

| Property Sale Gains | Profits from divesting non-core or underperforming assets. | Contributed to overall financial performance in 2024 |

| Other Financing Income (e.g., Participating Interest) | Revenue from variable income-sharing agreements. | Diversifies income from specialty properties |

Business Model Canvas Data Sources

The EPR Properties Business Model Canvas is built upon comprehensive market research, property portfolio analysis, and financial projections. These data sources ensure a robust understanding of customer segments, value propositions, and revenue streams.