EPR Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPR Properties Bundle

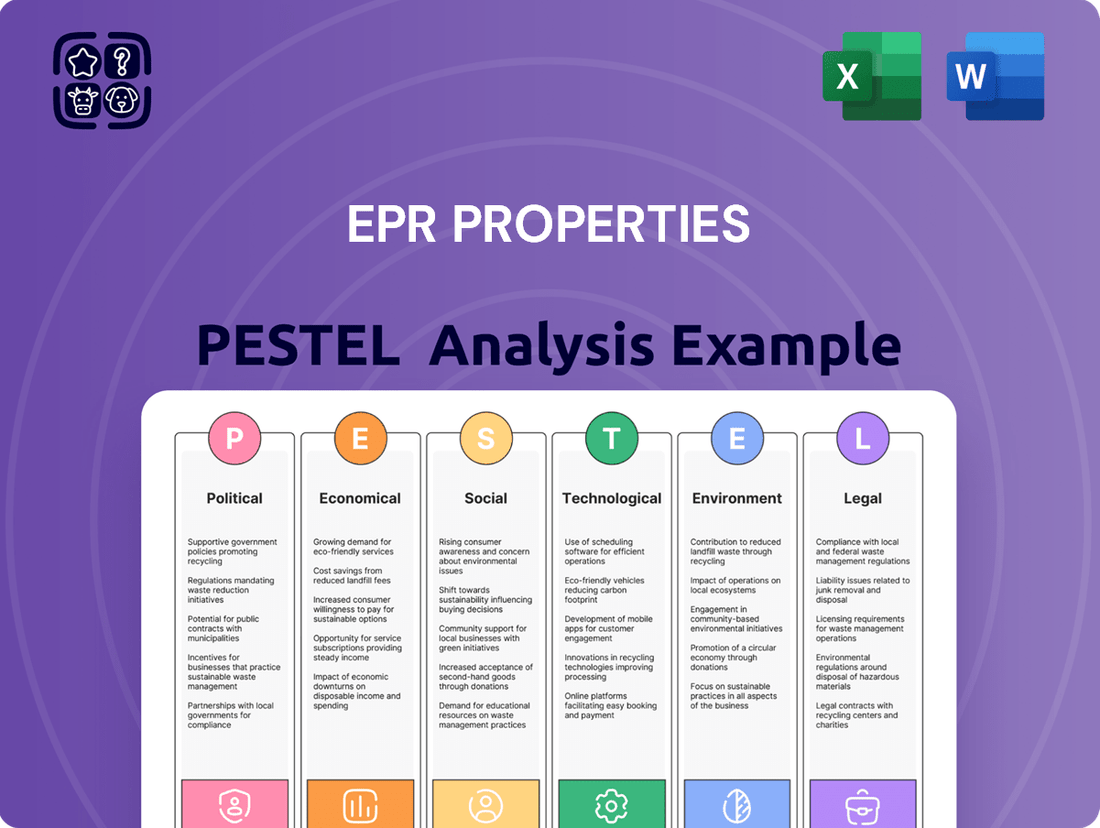

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping EPR Properties's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Equip yourself with foresight and a strategic advantage—download the full report now for immediate insights.

Political factors

Government regulations, especially those affecting Real Estate Investment Trusts (REITs), play a crucial role in shaping EPR Properties' operational landscape and investment decisions. Recent adjustments to the domestically controlled REIT regulations, effective April 24, 2024, have introduced new requirements for real estate funds and foreign investment in U.S. real estate.

These updated rules mandate that a REIT must now 'look through' specific taxable domestic corporations to ascertain its domestically controlled status. This change effectively raises the foreign ownership threshold from 25% to 50%, potentially impacting the capital access and ownership structure for REITs like EPR Properties.

Changes in U.S. corporate tax rates directly influence EPR Properties' net income and the overall appeal of its real estate investments to shareholders. For instance, while specific 2024 or 2025 corporate tax rate changes haven't been finalized as of mid-2025, any adjustments could impact EPR's earnings per share and dividend distribution capacity.

The Foreign Investment in Real Property Tax Act (FIRPTA) remains a key consideration for attracting foreign capital. Equity interests in a domestically controlled Real Estate Investment Trust (REIT), which EPR Properties is structured as, are generally exempt from FIRPTA withholding. This exemption is vital for maintaining access to international investor pools, especially as global capital flows are closely monitored in 2024 and 2025.

EPR Properties' expansion hinges on navigating a patchwork of local zoning and land use rules. For instance, in 2024, the company faced scrutiny over a proposed development in a city with strict height restrictions, potentially increasing construction costs and delaying timelines. These regulations directly influence where and how EPR can build or acquire its experiential venues, impacting project feasibility.

These local policies are not static; they can shift, affecting both new ventures and existing properties. A change in zoning in a key market in early 2025 could necessitate costly retrofits for an existing entertainment center or halt plans for a new cinema complex. Understanding and adapting to these evolving land use frameworks is crucial for managing development risks and costs.

Cultural and Entertainment Policy Shifts

Government policies on cultural and entertainment sectors directly shape demand for EPR Properties' venues. For instance, in 2024, several municipalities explored tax incentives for live performance venues to boost local economies, potentially increasing foot traffic and tenant viability. Conversely, new regulations on capacity limits for indoor entertainment spaces, which emerged in some regions during 2023-2024, could constrain revenue streams for cinema tenants.

These shifts can significantly impact EPR's rental income by affecting tenant performance. A notable trend in 2025 is the increased focus on local arts funding, with some states allocating an additional 5-10% of tourism budgets to support cultural events, which could benefit experiential entertainment properties. However, potential restrictions on large-scale public gatherings, a concern carried over from previous years, remain a factor to monitor for event-driven venues.

- Government support for live entertainment venues: Some cities are offering property tax abatements for venues hosting a minimum number of performances annually, a trend observed in early 2025.

- Impact of attendance regulations: Policies affecting cinema capacity or concert attendance numbers directly influence tenant revenue, a critical factor for EPR's income generation.

- Shifting entertainment consumption: Evolving consumer preferences, influenced by cultural trends and government advisories, can alter demand for specific types of entertainment venues.

- Subsidies for cultural industries: The availability of federal or state grants for arts and cultural organizations can indirectly support the success of entertainment-focused real estate.

International Relations and Trade Policies

While EPR Properties' portfolio is predominantly U.S.-based, global political stability and trade policies can still exert indirect influence. For instance, increased international trade friction or geopolitical instability could dampen overall economic sentiment, potentially impacting consumer confidence and discretionary spending on entertainment and experiential real estate, which are key drivers for EPR's tenants.

Geopolitical tensions, such as ongoing conflicts or shifts in international alliances, can affect global tourism patterns and cross-border real estate investment flows. Even if EPR Properties doesn't directly operate internationally, these global dynamics can indirectly shape the economic landscape and investor sentiment that influences the U.S. real estate market.

- Global Economic Impact: Disruptions from international trade disputes or political unrest can create broader economic headwinds, potentially reducing consumer spending on leisure activities.

- Tourism and Travel: Geopolitical instability can deter international travel, indirectly affecting the performance of entertainment venues and experiential properties that rely on a diverse customer base.

- Investment Climate: Shifts in global economic stability due to international political factors can influence capital flows and investor appetite for U.S. real estate assets.

Government regulations, particularly concerning REITs and foreign investment, directly influence EPR Properties' capital access and ownership structures. Recent updates to domestic control rules, effective April 2024, require REITs to look through specific corporations, raising the foreign ownership threshold to 50% and potentially impacting capital sourcing.

Changes in U.S. corporate tax rates affect EPR Properties' net income and investment appeal; while specific 2024-2025 rate adjustments are pending, any shifts will impact earnings per share and dividend capacity.

The Foreign Investment in Real Property Tax Act (FIRPTA) exemption for domestically controlled REITs, which EPR Properties is, remains crucial for attracting international capital, especially as global investment flows are closely monitored in 2024 and 2025.

Local zoning and land use policies significantly impact EPR's development pipeline. For example, in 2024, height restrictions in a specific city increased construction costs and delayed a proposed development, highlighting the need to adapt to evolving land use frameworks.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting EPR Properties, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, helping to identify potential threats and opportunities within the current market and regulatory landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on the external factors impacting EPR properties.

Helps support discussions on external risk and market positioning during planning sessions, easing the burden of complex environmental, political, and economic analysis.

Economic factors

Interest rate fluctuations significantly impact EPR Properties' cost of capital for new ventures and the valuation of its current assets. For instance, the Federal Reserve's monetary policy adjustments in 2024, including potential rate holds or gradual decreases, directly influence borrowing expenses for acquisitions and development projects.

Higher interest rates in 2024 have presented challenges, increasing the cost of capital and potentially dampening growth prospects for real estate investment trusts (REITs) like EPR. This can affect profitability due to increased expenses on variable-rate debt or interest rate swaps, as seen in the broader REIT market's reaction to monetary policy tightening.

Conversely, a scenario of moderating interest rates in late 2024 or early 2025 could improve mortgage affordability, thereby stimulating housing demand. This, in turn, can positively influence investor sentiment towards real estate, indirectly benefiting EPR Properties' investment opportunities and portfolio valuations.

EPR Properties' financial health is closely tied to how much consumers are willing to spend on non-essential items and activities. This sector, known as consumer discretionary spending, directly impacts EPR's revenue streams from places like movie theaters, golf courses, and ski resorts. A robust economy often sees consumers feeling confident enough to allocate more funds to these experiences.

Recent data from 2024 indicates a continued strong preference for experiential spending. For instance, the global market for experiences is projected to grow significantly, with many consumers actively seeking out unique and memorable activities. This trend is a tailwind for EPR, as it suggests a sustained demand for the types of entertainment venues they own and operate.

The shift towards prioritizing experiences over material possessions, a trend that gained momentum post-pandemic, remains a key driver. By mid-2024, reports showed that spending on experiences had not only recovered but, in many cases, exceeded pre-pandemic benchmarks, underscoring the resilience and appeal of the experiential economy for companies like EPR Properties.

Inflation presents a dual impact on EPR Properties. Rising operating costs for tenants, particularly in sectors like experiential retail and entertainment, could strain their ability to pay rent. However, many of EPR's leases are structured with built-in rent escalations, often tied to inflation indices, which can help offset rising costs and maintain rental income streams. For instance, a significant portion of EPR's portfolio features leases with annual rent increases, providing a degree of protection against the erosive effects of inflation.

Economic Growth and Employment Rates

Strong economic growth and robust employment figures are generally positive for EPR Properties, as they tend to boost consumer spending on entertainment and experiences. In the U.S., the economy has shown resilience, with GDP growth projected to be around 2.1% for 2024, according to the Congressional Budget Office. This environment typically translates to higher discretionary income for consumers, leading to increased attendance at EPR's tenant properties like movie theaters and family entertainment centers.

Conversely, a weakening economy or rising unemployment can negatively affect EPR's performance. If consumers have less disposable income, they may cut back on entertainment spending, impacting tenant revenues and potentially their ability to pay rent. The U.S. unemployment rate has remained historically low, hovering around 3.9% in early 2024, which supports consumer confidence. However, any significant uptick in job losses could pose a risk.

- U.S. GDP Growth Projection (2024): Approximately 2.1% (Congressional Budget Office).

- U.S. Unemployment Rate (Early 2024): Around 3.9%.

- Impact on Experiential Real Estate: Higher consumer confidence and discretionary income support attendance at entertainment venues.

- Economic Downturn Risk: Reduced consumer spending and potential tenant financial strain.

Real Estate Market Dynamics

Broader real estate market trends significantly shape EPR Properties' strategic decisions regarding acquisitions and dispositions. Factors like property appreciation, the interplay of supply and demand across different sectors, and emerging investment opportunities directly influence these strategies.

The real estate landscape is in a period of rapid evolution, with forecasts pointing towards sustained growth. This expansion is anticipated to be fueled by ongoing technological advancements and significant shifts in demographic patterns.

- Property Appreciation: National home prices saw a notable increase, with the S&P CoreLogic Case-Shiller Home Price Index reporting a 6.5% year-over-year gain in March 2024, indicating robust market appreciation.

- Supply and Demand: While demand remains strong, particularly for experiential properties, supply chain issues and construction costs continue to present challenges, impacting new development pipelines.

- Investment Opportunities: Sectors like entertainment venues and family entertainment centers, which EPR Properties specializes in, are showing resilience and potential for growth as consumer spending patterns adapt post-pandemic.

- Market Outlook: Projections for 2024 suggest continued, albeit potentially moderating, growth in commercial real estate, with a focus on properties offering unique experiences and strong tenant demand.

Monetary policy continues to be a significant factor, with interest rate decisions by central banks in 2024 influencing borrowing costs for EPR Properties. For instance, the Federal Reserve's stance on rates affects the cost of capital for new acquisitions and development projects, impacting overall profitability and asset valuations.

Consumer spending, particularly on discretionary items and experiences, directly fuels EPR's revenue. The resilience of experiential spending in 2024, with many consumers prioritizing unique activities, supports demand for EPR's tenant properties like entertainment centers and theaters.

Inflationary pressures in 2024 can increase operating costs for tenants, but EPR's lease structures, often including rent escalations tied to inflation, provide a buffer. This mechanism helps maintain rental income streams even as broader economic conditions fluctuate.

| Economic Factor | 2024/2025 Data/Trend | Impact on EPR Properties |

|---|---|---|

| Interest Rates | Federal Reserve policy in 2024 has kept rates elevated, with potential for gradual decreases later in the year or into 2025. | Increases cost of capital for new ventures; higher borrowing expenses. Potential rate cuts could improve affordability and investor sentiment. |

| Consumer Spending | Strong preference for experiential spending continues, with many sectors exceeding pre-pandemic benchmarks. | Directly boosts revenue from entertainment and leisure properties; supports tenant performance. |

| Inflation | Inflationary pressures persist, impacting operating costs. | Lease escalations tied to inflation help offset rising costs and maintain rental income. |

| GDP Growth | U.S. GDP projected around 2.1% for 2024 (CBO). | Supports consumer confidence and discretionary income, leading to increased attendance at tenant venues. |

| Unemployment Rate | U.S. unemployment rate around 3.9% in early 2024. | Low unemployment generally indicates strong consumer spending power. |

Full Version Awaits

EPR Properties PESTLE Analysis

The preview shown here is the exact EPR Properties PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This detailed analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting EPR Properties, providing a comprehensive strategic overview.

What you’re previewing here is the actual file, offering a deep dive into the external forces shaping the real estate market for EPR Properties.

Sociological factors

A major societal shift sees consumers prioritizing experiences over possessions, a trend that strongly favors EPR Properties. Their entire portfolio, encompassing movie theaters, golf entertainment, and ski resorts, directly taps into this desire for memorable activities.

This preference for experiences is fueled by a growing emphasis on personal growth and building meaningful connections, as evidenced by the continued strong performance in the entertainment sector. For instance, the global market for experiential travel alone was projected to reach over $1.5 trillion by 2023, showcasing the scale of this consumer behavior.

The growing influence of Generation Z, a cohort known for its digital fluency and preference for experiences over possessions, directly shapes demand for EPR Properties' diverse portfolio. This demographic's inclination towards unique, engaging activities means properties offering immersive entertainment and leisure are likely to see increased utilization.

Shifting lifestyle trends, such as the projected rise in leisure time and a heightened focus on personal well-being, further bolster the appeal of experiential venues. For instance, a growing segment of the population prioritizing health and wellness might seek out properties that integrate fitness, outdoor activities, or educational components into their offerings, aligning with EPR's strategic focus on diverse entertainment and leisure assets.

Urbanization continues to reshape where people live and spend their leisure time, directly impacting EPR Properties' portfolio. As populations concentrate in cities, demand for entertainment and experiential venues within these urban cores can increase. For instance, in 2024, many major metropolitan areas are experiencing renewed interest in downtown revitalization, which could benefit EPR's urban-centric properties.

Conversely, suburban development patterns also play a crucial role. The migration to suburban areas, often driven by affordability and lifestyle preferences, means EPR must carefully consider the accessibility of its properties to these growing suburban populations. By 2025, projections indicate continued suburban growth in many regions, necessitating strategic property placement to capture these expanding demographics.

Social Values and Community Engagement

The increasing societal focus on community well-being, diversity, and inclusivity directly impacts how experiential properties, like those owned by EPR Properties, are viewed and patronized. There's a growing expectation for these venues to be more than just entertainment spaces; they are increasingly seen as community hubs that should foster positive social interaction and reflect the diversity of the populations they serve.

EPR Properties, therefore, faces pressure to ensure its portfolio actively contributes to local community development and that its properties are designed and operated with accessibility and welcoming environments for all demographic groups in mind. This translates to a need for thoughtful tenant selection and property management practices that align with these evolving social values.

For instance, in 2024, surveys indicated that over 70% of consumers consider a company's social responsibility when making purchasing decisions, a figure that is likely to grow. This trend suggests that EPR's success will be increasingly tied to its demonstrated commitment to social values.

- Community Investment: Growing demand for properties that offer tangible benefits to local communities, such as job creation or support for local businesses.

- Inclusivity and Accessibility: Expectations for properties to be universally accessible and to cater to a wide range of cultural backgrounds and abilities.

- Social Impact Metrics: Potential for investors and the public to scrutinize EPR's performance based on its social impact, not just financial returns.

- Tenant Alignment: A need for EPR to partner with tenants whose values and business practices align with broader societal expectations for social responsibility.

Work-Life Balance and Leisure Time

Societal shifts prioritizing work-life balance directly influence consumer spending on leisure and entertainment, impacting demand for properties like those owned by EPR Properties. As individuals seek more personal time, they are likely to invest in experiences and activities, potentially boosting patronage at entertainment venues and resorts. This trend is supported by data indicating a growing emphasis on well-being; for instance, a 2024 survey found that 65% of employees consider work-life balance a top priority when choosing an employer.

This societal value placed on leisure time can translate into increased rental income for EPR Properties, as more people allocate resources to recreational pursuits. For example, the experiential economy continues to grow, with consumer spending on experiences projected to outpace spending on goods in the coming years. This suggests a favorable environment for entertainment-focused real estate.

- Increased Demand: A greater emphasis on work-life balance fuels consumer desire for entertainment and recreational activities.

- Revenue Growth: This societal trend can lead to higher occupancy and rental income for EPR Properties' entertainment-focused assets.

- Experiential Economy: Consumer spending on experiences is a growing market segment, benefiting leisure-oriented real estate.

- Employee Priorities: Data from 2024 shows a significant percentage of employees prioritizing work-life balance, indicating a widespread cultural shift.

The increasing societal emphasis on community well-being and inclusivity directly shapes consumer expectations for experiential properties. EPR Properties' portfolio is increasingly viewed not just as entertainment venues but as community hubs that should foster positive social interactions and reflect diverse populations. This means a growing demand for properties that are universally accessible and cater to a wide range of cultural backgrounds and abilities.

This societal focus translates into pressure for EPR to ensure its properties contribute to local development and are managed with accessibility and welcoming environments for all. For instance, in 2024, over 70% of consumers considered a company's social responsibility in purchasing decisions, a trend likely to grow and influence EPR's success through tenant alignment with societal values.

| Societal Factor | Impact on EPR Properties | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Community Well-being | Demand for properties offering local benefits (e.g., job creation). | Growing expectation for corporate social responsibility. |

| Inclusivity & Accessibility | Need for universally accessible and culturally diverse venues. | Consumers increasingly scrutinize accessibility and representation. |

| Social Impact | Potential for performance scrutiny based on social impact metrics. | Investors and public demand transparency on social contributions. |

| Tenant Alignment | Requirement for tenants whose values match societal expectations. | 70%+ consumers consider social responsibility in 2024 purchasing. |

Technological factors

Advances in virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) are significantly reshaping the entertainment landscape, offering novel avenues to enrich visitor engagement within various venues. These technological leaps enable the creation of deeply immersive environments, interactive gameplay, and highly tailored experiences that can be strategically employed by EPR Properties' tenants to draw in and keep patrons.

For instance, the global VR and AR market was projected to reach $100 billion by 2025, indicating substantial growth and adoption. This surge means tenants operating in areas like theme parks or entertainment centers can integrate these technologies to offer unique attractions, such as AR overlays that bring static exhibits to life or VR simulations that transport guests to entirely different worlds, thereby driving foot traffic and increasing revenue.

The ongoing digital transformation of entertainment venues, turning them into 'smart' environments, is a significant technological factor. This includes integrating technologies like the Internet of Things (IoT), robust 5G connectivity, and advanced real-time data analytics.

These technological advancements are designed to optimize operational efficiency, enhance the movement of guests within venues, and unlock novel revenue opportunities. For example, improved fan engagement through digital platforms and the widespread adoption of cashless payment systems are direct results of this digital shift.

The ongoing surge in online streaming and digital content consumption presents a notable challenge for EPR Properties, given its substantial investment in entertainment venues like movie theaters. In 2024, global digital ad spending alone was projected to reach $687.7 billion, highlighting the shift in consumer attention and spending towards digital platforms. This trend could potentially impact attendance and revenue for traditional brick-and-mortar entertainment options within EPR's portfolio.

However, it's important to note that despite this digital shift, non-digital entertainment formats still command a significant portion of consumer spending. For instance, the global live entertainment market, which includes experiences like concerts and theme parks, is expected to grow, indicating a continued demand for out-of-home and experiential entertainment. This suggests that while digital content is growing, there remains a resilient market for physical, in-person experiences that EPR Properties can leverage.

Data Analytics and Personalization

Data analytics is transforming how entertainment venues operate, allowing them to deeply understand their patrons and deliver tailored experiences. This means more than just knowing what people like; it's about anticipating needs and offering personalized recommendations that drive engagement. For EPR Properties' tenants, this translates into a significant competitive advantage.

By leveraging data analytics, tenants can refine their service offerings, implement dynamic pricing strategies that maximize revenue, and cultivate stronger customer loyalty. For instance, data can reveal peak times for certain attractions or preferences for specific types of events, enabling more efficient resource allocation and targeted marketing campaigns. This enhanced operational efficiency and customer satisfaction directly contribute to the stability and growth of EPR's rental income streams.

Consider the impact on tenant revenue: a 2024 report by Statista indicated that personalized marketing campaigns can increase customer spending by up to 20%. Furthermore, analytics-driven pricing adjustments in the entertainment sector are projected to boost profitability by an average of 5-10% in the coming year. These improvements mean tenants are better positioned to meet their lease obligations, providing a solid foundation for EPR's financial performance.

Key benefits for EPR's tenants include:

- Enhanced Customer Understanding: Gaining deep insights into consumer behavior patterns and preferences.

- Personalized Experiences: Offering tailored recommendations and services that boost customer satisfaction and repeat business.

- Optimized Operations: Improving pricing strategies and resource allocation based on data-driven insights.

- Increased Revenue and Loyalty: Driving higher spending and fostering long-term customer relationships, which in turn supports consistent rental income for EPR.

Technological Advancements in Property Management

Technological advancements are significantly reshaping property management for companies like EPR Properties. Innovations such as smart building systems, which can automate climate control and security, are becoming more prevalent. For instance, a 2024 report indicated that adoption of IoT devices in commercial real estate is projected to grow by 25% annually, leading to enhanced operational efficiency and cost savings through optimized energy consumption.

These smart technologies directly contribute to reducing operational expenses for both EPR Properties and its tenants by minimizing energy waste and streamlining maintenance. Furthermore, advanced evaluation tools, including AI-powered analytics for property performance and tenant satisfaction, are providing deeper insights for strategic decision-making.

The integration of these technologies also strongly supports Environmental, Social, and Governance (ESG) initiatives. By enabling precise monitoring of energy usage, water consumption, and waste generation, EPR Properties can better track and report on its environmental impact, aligning with increasing investor and regulatory demands for sustainability. This focus on ESG metrics is becoming a critical factor in attracting investment and maintaining brand reputation in the current market.

- Smart Building Systems: Increased adoption of IoT sensors for real-time monitoring and control of building functions, leading to an estimated 15-20% reduction in energy costs.

- Energy-Efficient Solutions: Implementation of advanced HVAC, LED lighting, and smart metering technologies to lower utility expenses and environmental footprint.

- Advanced Evaluation Tools: Utilization of AI and data analytics for predictive maintenance, tenant experience optimization, and asset performance assessment.

- ESG Integration: Technologies that facilitate transparent reporting on environmental impact, supporting sustainability goals and investor relations.

Technological advancements are revolutionizing the entertainment sector, with VR, AR, and AI creating immersive experiences that draw visitors. The global VR and AR market was projected to hit $100 billion by 2025, signaling significant tenant opportunities for EPR Properties' entertainment venues to innovate and increase foot traffic.

Digital transformation is turning venues into smart environments, leveraging IoT and 5G for operational efficiency and enhanced guest experiences. This shift includes widespread adoption of cashless payments, improving overall venue functionality and revenue streams.

Data analytics offers tenants deep patron insights, enabling personalized experiences and optimized operations. By leveraging these insights, tenants can improve pricing strategies and customer loyalty, directly benefiting EPR Properties through consistent rental income.

Legal factors

EPR Properties, operating as a Real Estate Investment Trust (REIT), navigates a landscape of specific tax and operational regulations crucial for its structure and income distribution. These rules dictate how it must function to maintain its favorable tax status.

The recent final regulations concerning 'domestically controlled REITs,' implemented on April 24, 2024, introduce a 'look-through' approach for certain domestic corporations. This change, along with a 10-year transition period for existing arrangements, necessitates careful adaptation by EPR Properties to ensure ongoing compliance.

Adherence to these evolving legal frameworks is paramount for EPR Properties to preserve its REIT designation and the associated tax benefits, directly impacting its financial performance and investment appeal.

EPR Properties' reliance on long-term lease agreements means contract law is central to its operations. The enforceability of these leases directly impacts revenue streams. In 2023, EPR's total rental revenue was $1.5 billion, underscoring the critical nature of these legal frameworks.

The company's focus on triple net leases introduces specific legal considerations. Tenants are obligated to cover property taxes, insurance, and maintenance. Ensuring tenant compliance with these contractual terms is vital for mitigating operational risks and maintaining property value.

EPR Properties, like all companies operating experiential properties, must adhere to a complex web of health and safety regulations. These include stringent building codes, fire safety standards, and public health guidelines designed to protect visitors. Failure to comply can result in significant fines and operational disruptions.

For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to enforce workplace safety standards, which directly impact how tenants in EPR's properties, such as entertainment venues and family entertainment centers, must operate. Ensuring ongoing compliance often necessitates capital expenditures for property upgrades and maintenance, a factor EPR must consider in its financial planning and tenant agreements.

Antitrust and Competition Laws

EPR Properties, as a major operator in experiential real estate, must carefully adhere to antitrust and competition laws. These regulations are crucial for maintaining a fair marketplace, especially as EPR engages in property acquisitions and manages its tenant portfolio. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively scrutinize mergers and acquisitions to prevent undue market concentration.

These laws directly impact EPR's growth strategies by setting boundaries on how it can expand and acquire new properties or businesses. The goal is to prevent any single entity from gaining excessive market power, which could lead to higher prices or reduced choices for consumers and other businesses. Failure to comply can result in significant fines and legal challenges.

- Merger Review: EPR's acquisitions, particularly those involving significant market share in specific experiential real estate sectors, are subject to review by antitrust authorities like the FTC and DOJ.

- Tenant Agreements: Lease agreements and other contractual arrangements with tenants are monitored to ensure they do not create anti-competitive effects, such as exclusive dealing arrangements that stifle competition.

- Market Dominance: EPR must avoid practices that could be construed as monopolistic or an abuse of a dominant market position within its operational segments.

- Regulatory Scrutiny: In 2024, antitrust enforcement globally remained robust, with regulators focusing on digital markets but also maintaining vigilance over traditional sectors like real estate where consolidation can occur.

Environmental Regulations and ESG Mandates

Environmental regulations are increasingly shaping the commercial real estate landscape, directly affecting companies like EPR Properties. Governments worldwide are implementing stricter rules concerning emissions, waste management, and resource consumption, pushing the industry towards more sustainable operations. For instance, the EU's Green Deal and similar initiatives globally are setting ambitious targets for carbon neutrality, which will necessitate significant investments in energy-efficient retrofits and green building technologies for existing properties and new developments.

These evolving ESG mandates present both challenges and opportunities for EPR Properties. Compliance with new standards, such as enhanced energy performance certificates or stricter waste recycling protocols, could increase operational costs. However, properties that proactively adopt sustainable practices often attract a wider pool of investors and tenants who prioritize ESG credentials. By 2025, many jurisdictions are expected to have updated building codes requiring higher levels of energy efficiency, potentially impacting the valuation and marketability of older, less compliant assets within EPR's portfolio.

- Increased Compliance Costs: Adapting to new environmental standards may require capital expenditures for upgrades and ongoing operational adjustments.

- Investor Demand for ESG: A growing segment of institutional investors, managing trillions in assets, are prioritizing ESG-compliant real estate investments, potentially increasing demand for EPR's sustainable properties.

- Regulatory Incentives: Governments are offering tax credits and subsidies for green building and energy efficiency improvements, which EPR Properties can leverage to offset costs and enhance returns.

- Tenant Preferences: A significant portion of commercial tenants, particularly larger corporations, are setting their own ESG goals, preferring to lease space in buildings that align with their sustainability objectives.

EPR Properties' REIT status is governed by specific tax laws, including recent updates in April 2024 regarding domestically controlled REITs, necessitating compliance for tax benefits. Contract law is fundamental, with $1.5 billion in rental revenue in 2023 directly tied to lease enforceability and tenant adherence to triple net lease terms.

Health and safety regulations, enforced by bodies like OSHA in 2024, impact tenant operations and require capital expenditures for property upkeep. Antitrust laws, overseen by the FTC and DOJ, scrutinize acquisitions to prevent market dominance, influencing EPR's expansion strategies.

Environmental regulations are increasingly important, with global initiatives pushing for sustainability. By 2025, updated building codes for energy efficiency will likely affect property valuations. Investor and tenant demand for ESG-compliant properties is rising, with potential regulatory incentives available for green building initiatives.

Environmental factors

Climate change presents significant physical risks to EPR Properties' portfolio, particularly impacting assets like ski resorts and coastal attractions. For instance, the 2023-2024 ski season saw reduced snowfall in many North American regions, directly affecting revenue for properties dependent on winter sports. This unpredictability in weather patterns, including warmer winters and increased frequency of extreme events, can lead to shorter operating seasons and higher insurance premiums, as seen with rising property damage claims across the real estate sector.

The commercial real estate sector, including EPR Properties' portfolio, is experiencing a significant push towards environmental sustainability. This includes a growing emphasis on green building standards and energy-efficient operations. For instance, LEED (Leadership in Energy and Environmental Design) certifications are becoming a benchmark, with a notable increase in certified projects globally.

EPR Properties could face mounting pressure from various stakeholders, including investors, tenants, and regulatory bodies, to prioritize sustainable retrofits and new developments. This pressure stems from the need to reduce carbon footprints and enhance resource efficiency, aligning with broader climate goals and investor ESG (Environmental, Social, and Governance) mandates. In 2024, the global green building market was valued at over $1.2 trillion, with projections indicating continued robust growth.

Experiential properties, such as golf courses and ski resorts, often have substantial water and energy needs, making them susceptible to resource scarcity. For instance, in 2023, the average golf course in the US used approximately 1.5 million gallons of water per day, highlighting a significant demand. This increasing focus on resource limitations and escalating utility prices could directly affect the operating costs for EPR Properties' tenants, pushing for greater efficiency in resource management.

Waste Management and Pollution Control

Effective waste management and pollution control are increasingly critical for commercial properties, including those managed by EPR Properties. Adherence to evolving environmental regulations is paramount, pushing companies to adopt practices that reduce waste and prevent pollution. For instance, in 2023, the US generated over 292 million tons of municipal solid waste, highlighting the scale of the challenge.

EPR Properties and its tenants may need to invest in advanced recycling programs and explore waste-to-energy solutions to meet these demands. Such initiatives can lead to significant cost savings through reduced disposal fees and potential revenue from recycled materials. By 2025, the global waste management market is projected to reach over $2.5 trillion, indicating a strong economic incentive for proactive environmental strategies.

- Regulatory Compliance: Staying ahead of environmental laws regarding waste disposal and emissions is crucial to avoid penalties.

- Investment in Sustainability: Implementing robust recycling and waste reduction programs can improve operational efficiency and brand image.

- Waste-to-Energy Potential: Exploring technologies that convert waste into energy offers a dual benefit of waste reduction and resource generation.

- Tenant Collaboration: Engaging tenants in waste management efforts fosters a shared responsibility for environmental stewardship.

Biodiversity and Land Use Impacts

EPR Properties' large experiential properties, such as entertainment venues and resorts, can significantly affect local ecosystems and how land is utilized. This is a key environmental consideration. For instance, a new development might require clearing land that is home to specific plant or animal species, or it could alter natural water drainage patterns.

Growing regulatory pressure and public awareness around biodiversity net gain, aiming to leave nature in a better state than before development, are shaping industry practices. For EPR Properties, this means future land acquisitions and how they plan and build new properties will likely need to incorporate more robust environmental assessments and mitigation strategies. By 2024, many jurisdictions are implementing stricter rules; for example, the UK's Environment Act 2021 mandates a minimum 10% biodiversity net gain for most new developments, a standard that could influence global real estate practices and investor expectations.

- Land Use Changes: Development of large experiential properties often involves significant alterations to existing land use, potentially impacting agricultural land, natural habitats, or recreational areas.

- Biodiversity Impact: Construction and operation can lead to habitat loss, fragmentation, and disturbance for local flora and fauna.

- Regulatory Influence: Stricter environmental regulations, such as biodiversity net gain requirements, are increasingly influencing property development and acquisition strategies for companies like EPR Properties.

- Public Sentiment: Growing public concern for environmental stewardship and conservation puts pressure on companies to demonstrate responsible land management practices.

Climate change poses significant physical risks, affecting weather-dependent attractions like ski resorts. For instance, the 2023-2024 ski season experienced reduced snowfall in many areas, directly impacting revenue for properties reliant on winter sports. This unpredictability, including warmer winters and more extreme weather events, can shorten operating seasons and increase insurance costs due to higher damage claims.

The real estate sector, including EPR Properties' portfolio, is increasingly focused on environmental sustainability, with a growing emphasis on green building standards and energy efficiency. LEED certifications are becoming a key benchmark, with a notable rise in certified projects globally. In 2024, the global green building market was valued at over $1.2 trillion, indicating substantial growth.

EPR Properties and its tenants face pressure to adopt sustainable practices, driven by investor ESG mandates and climate goals. Experiential properties, such as golf courses, have high water and energy demands; in 2023, the average US golf course used about 1.5 million gallons of water daily. Rising utility costs further incentivize greater resource efficiency.

Waste management and pollution control are critical, requiring adherence to evolving environmental regulations. In 2023, the US generated over 292 million tons of municipal solid waste. Investing in advanced recycling and waste-to-energy solutions can offer cost savings and revenue opportunities, as the global waste management market is projected to exceed $2.5 trillion by 2025.

| Environmental Factor | Impact on EPR Properties | Key Data/Trend (2023-2025) | Mitigation/Opportunity |

| Climate Change & Weather Volatility | Reduced operating seasons, increased insurance costs for weather-dependent assets (e.g., ski resorts). | 2023-2024 ski season saw reduced snowfall in North America. | Invest in weather-resilient infrastructure, diversify property types. |

| Sustainability & Green Building | Pressure to adopt energy-efficient operations and green building standards (e.g., LEED). | Global green building market valued over $1.2 trillion in 2024. | Pursue LEED certifications, implement energy-saving retrofits. |

| Resource Scarcity (Water & Energy) | Higher operating costs for water-intensive properties (e.g., golf courses). | US golf courses used ~1.5 million gallons of water daily in 2023. | Implement water conservation technologies, explore renewable energy sources. |

| Waste Management & Pollution Control | Need for compliance with stricter regulations, potential for cost savings. | US generated >292 million tons of municipal solid waste in 2023; waste management market projected >$2.5 trillion by 2025. | Enhance recycling programs, explore waste-to-energy solutions. |

PESTLE Analysis Data Sources

Our EPR Properties PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable real estate market reports, and industry-specific research. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both accurate and relevant to the property sector.