Enphase SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

Enphase Energy, a leader in solar microinverter technology, boasts significant strengths in its innovative product design and strong brand reputation. However, understanding the full scope of its opportunities and potential threats is crucial for strategic decision-making.

Want the full story behind Enphase's market position, including its competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment or business planning.

Strengths

Enphase Energy commands a substantial share of the global microinverter market, solidifying its position as a frontrunner in the increasingly important solar-plus-storage segment. This leadership is underpinned by its cutting-edge microinverter technology, which consistently demonstrates superior efficiency and reliability.

The company's microinverters are designed to optimize energy production from each individual solar panel, leading to enhanced overall system performance and greater energy harvest. This technological superiority offers a distinct competitive advantage, particularly as the renewable energy sector continues its rapid expansion and innovation.

Enphase's strength lies in its comprehensive energy management platform, seamlessly integrating solar generation, battery storage, and sophisticated software. This unified approach empowers customers to effortlessly monitor and control their energy, optimizing both how much they produce and consume. For instance, Enphase's solutions are designed to simplify complex energy systems, making them more accessible and user-friendly for a wider audience.

Enphase Energy has shown remarkable financial strength, even amidst a tough market. The company consistently achieves healthy gross margins and generates significant free cash flow, which is crucial for its operations and expansion plans.

Looking at Q2 2025, Enphase reported a notable increase in revenue, coupled with robust profitability. This performance highlights their effective cost management and their capacity to maintain a strong financial standing, providing a solid foundation for future growth initiatives.

Growing Global Presence and Brand Recognition

Enphase's growing global presence is a significant strength, underscored by its impressive shipment numbers and widespread market penetration. As of early 2024, the company had shipped over 83.1 million microinverters, demonstrating substantial product adoption.

This expansive reach, spanning more than 160 countries, translates directly into strong brand recognition. This global footprint is crucial for capitalizing on the accelerating worldwide demand for solar and battery storage technologies.

- Global Reach: Over 83.1 million microinverters shipped globally.

- Market Penetration: Presence established in more than 160 countries.

- Brand Recognition: Strong and growing worldwide brand awareness.

- Diversification: Reduced reliance on any single market, particularly the U.S.

Strategic U.S. Manufacturing for IRA Benefits

Enphase is strategically increasing its U.S. manufacturing for microinverters and batteries, a move designed to capitalize on Inflation Reduction Act (IRA) tax credits. This focus on domestic production is key to unlocking significant financial advantages and bolstering its market position. By aligning with IRA incentives for domestic content, Enphase aims to improve its cost competitiveness within the United States.

This expansion directly addresses potential tariff impacts and strengthens Enphase's supply chain resilience. The company's commitment to U.S.-based production is projected to yield substantial benefits, especially as the IRA incentives become more influential in the renewable energy sector's cost dynamics. For instance, the IRA offers a 10% domestic content bonus credit for solar projects that use domestically manufactured components, which Enphase is positioning itself to leverage.

- IRA Benefits: Enphase's U.S. manufacturing expansion targets Inflation Reduction Act tax credits, enhancing its financial incentives.

- Cost Mitigation: Domestic production helps offset potential tariff costs and improves overall cost structure in the U.S. market.

- Competitiveness: Qualifying for domestic content bonuses under the IRA boosts Enphase's competitive edge against international rivals.

Enphase's market leadership is built on its advanced microinverter technology, delivering superior efficiency and reliability. This technological edge optimizes individual solar panel performance, maximizing energy harvest and providing a clear competitive advantage in the growing renewable energy market.

The company's integrated energy management platform, combining solar, storage, and software, simplifies energy control for users. This holistic approach enhances customer experience and accessibility, further solidifying Enphase's strong market position.

Enphase demonstrates robust financial health with consistent healthy gross margins and significant free cash flow generation, as evidenced by its Q2 2025 revenue increase and strong profitability. This financial stability supports ongoing growth and operational expansion.

Enphase's global footprint is extensive, with over 83.1 million microinverters shipped across more than 160 countries by early 2024. This broad market penetration fosters strong brand recognition and reduces reliance on any single geographic market.

| Metric | Value | Period |

|---|---|---|

| Microinverters Shipped | 83.1 million+ | Early 2024 |

| Countries Served | 160+ | Early 2024 |

| Q2 2025 Revenue Growth | Notable Increase | Q2 2025 |

What is included in the product

Analyzes Enphase’s competitive position through key internal and external factors, highlighting its strong product innovation and market leadership while also considering potential supply chain vulnerabilities and emerging competition.

Offers a clear, actionable SWOT breakdown to identify and address critical market vulnerabilities and capitalize on emerging opportunities.

Weaknesses

Enphase Energy's heavy reliance on the residential solar market presents a significant vulnerability. This sector is highly sensitive to economic conditions, including consumer discretionary spending and interest rate changes, which directly influence homeowners' purchasing decisions. For instance, a notable slowdown in U.S. residential solar installations during late 2023 and early 2024 has demonstrably affected Enphase's top-line performance, highlighting the impact of these market fluctuations.

Enphase continues to grapple with supply chain volatility, a persistent issue that can delay product availability and increase costs. The company is particularly exposed to tariffs on key imported components, such as batteries sourced from China.

These tariffs, with some reaching as high as 145% on battery imports, represent a significant headwind. Analysts project these tariffs could shave off substantial percentages from Enphase's corporate gross margins, directly impacting its bottom line and potentially reducing profitability in the near term.

Enphase has been grappling with elevated microinverter channel inventory in recent quarters. This situation suggests that the company might be producing more units than are being sold through to end customers, potentially due to slower market adoption or increased competition. For instance, in their Q1 2024 earnings call, management highlighted that channel inventory levels were higher than desired, impacting their ability to recognize revenue from all manufactured units.

Managing these high inventory levels is a critical challenge for Enphase. Excess inventory can lead to significant pricing pressure as the company tries to move stock, which in turn can erode profit margins. Furthermore, substantial inventory ties up valuable working capital, limiting the company's financial flexibility for other investments or operations. The company's focus in 2024 has been on actively working with distributors and installers to reduce these stockpiles.

Intense Competition in Battery Storage Solutions

While Enphase holds a strong position in microinverters, the battery storage sector presents a significant competitive landscape. Established companies and new players are aggressively entering this burgeoning market, intensifying the challenge for Enphase to capture substantial market share.

Key competitors such as Tesla and LG Chem boast considerable market presence and robust shipment volumes for their battery solutions. This necessitates continuous innovation and clear differentiation from Enphase to effectively compete and expand its footprint in the energy storage segment.

- Market Share Dynamics: Enphase faces pressure from competitors with established battery shipment records, like Tesla, which reported shipping approximately 1,412 MWh of battery storage in Q1 2024.

- Innovation Imperative: To counter rivals, Enphase must consistently enhance its battery technology and value proposition, focusing on integration, safety, and performance to stand out.

- Pricing Pressures: The competitive intensity can lead to pricing challenges, potentially impacting Enphase's profit margins on its battery storage products if it cannot maintain a strong value-for-money perception.

Sensitivity to Government Incentives and Policy Shifts

Enphase Energy's reliance on government incentives makes its financial performance vulnerable. For instance, changes in solar tax credits or net metering rules can significantly sway consumer decisions, directly affecting Enphase's revenue streams and market standing.

The company's growth is closely tied to the stability of renewable energy policies. A shift in government support, such as the reduction or elimination of investment tax credits (ITCs) in key markets, could dampen demand for solar installations, impacting Enphase's sales figures.

- Policy Dependence: Enphase's revenue is directly influenced by government policies and incentives for renewable energy adoption.

- Market Volatility: Changes in tax credits, net metering, and other regulatory frameworks can create unpredictable swings in demand.

- Competitive Impact: Policy shifts can alter the competitive landscape, potentially favoring or disadvantaging Enphase's product offerings.

- Geographic Risk: Dependence on specific regional policies exposes Enphase to risks associated with policy changes in those particular areas.

Enphase's significant reliance on the residential solar market makes it susceptible to economic downturns and interest rate hikes, as seen with the slowdown in U.S. installations in late 2023 and early 2024. The company also faces challenges from elevated microinverter channel inventory, which can lead to pricing pressures and reduced profit margins. Furthermore, intense competition in the battery storage sector, with players like Tesla reporting substantial shipment volumes, requires Enphase to continuously innovate and differentiate its offerings to maintain market share and avoid pricing erosion.

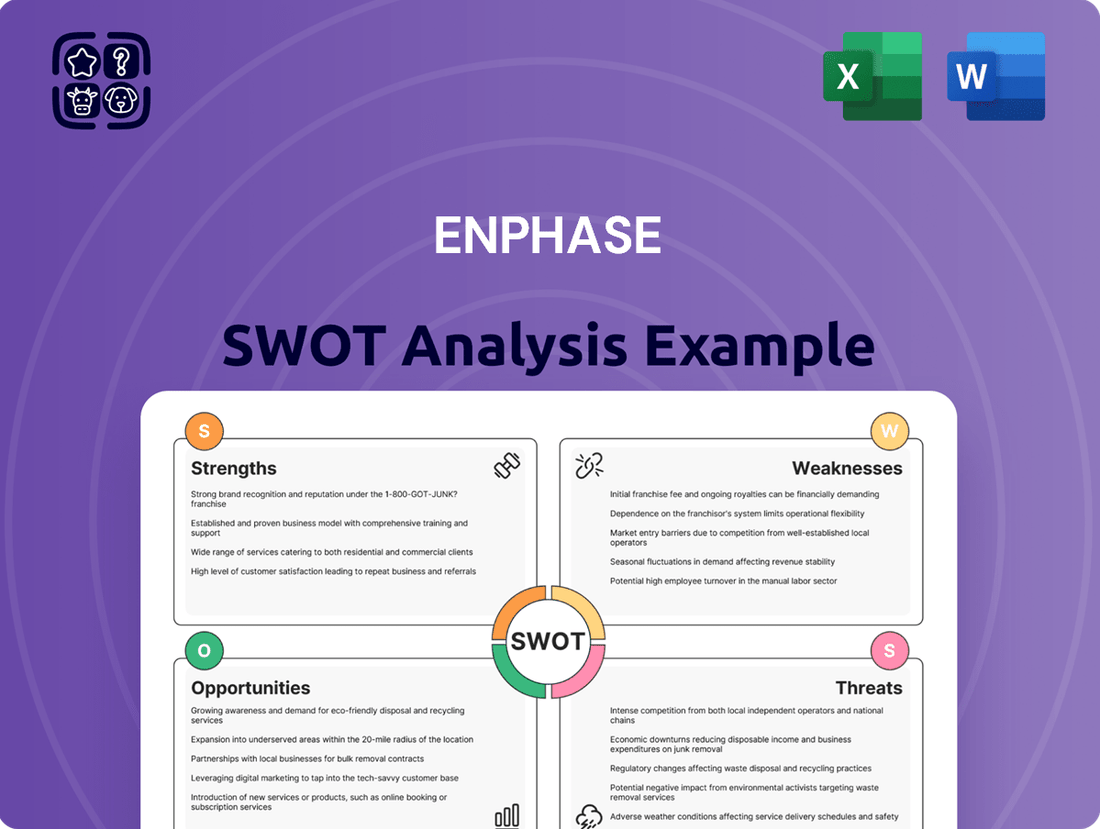

Preview Before You Purchase

Enphase SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global transition to renewable energy is a significant tailwind for Enphase. The demand for integrated solar and storage solutions is rapidly increasing as more consumers and nations prioritize energy independence and sustainability. This trend is expected to drive substantial market expansion for Enphase's offerings.

In 2023, the global solar PV market installed a record 413 GW, a 37% increase year-over-year, according to S&P Global Commodity Insights. Similarly, the energy storage market is projected to grow significantly, with Wood Mackenzie forecasting that cumulative energy storage capacity in the US alone will reach over 100 GW by 2030.

Enphase Energy has a significant runway for international growth, with the United States still accounting for a large share of its revenue. This presents a prime opportunity to expand its footprint in key regions like Europe, where renewable energy adoption is accelerating, and in emerging economies with increasing demand for reliable and sustainable energy solutions.

The company’s strong brand reputation and its leading-edge technology, particularly its microinverter systems, position it well to capture new market share across the globe. For instance, in 2023, Enphase reported that its international revenue grew by approximately 15% year-over-year, indicating a positive trend in its global expansion efforts.

Enphase's dedication to research and development fuels the continuous introduction of innovative products. For instance, their fourth and fifth-generation IQ batteries and advanced microinverters showcase this commitment, enhancing performance and customer value. This focus on innovation is crucial for staying competitive in the rapidly evolving clean energy market.

Expanding into adjacent markets presents significant growth opportunities. The company's venture into electric vehicle (EV) charging solutions and the development of more sophisticated energy management software can unlock new revenue streams. These strategic diversifications not only broaden Enphase's market reach but also strengthen its integrated energy ecosystem, offering customers a more comprehensive solution.

Strategic Partnerships and Collaborations

Enphase is actively pursuing strategic partnerships to expand its reach and integrate its solutions into larger energy frameworks. For instance, collaborations with utilities can lead to pilot programs and preferred vendor status, potentially unlocking significant demand. These alliances are crucial for scaling adoption and demonstrating the value of Enphase's technology within evolving grid infrastructures.

These partnerships are vital for embedding Enphase's products into diverse energy ecosystems, thereby enhancing their appeal to end-users. By working with established players, Enphase can accelerate the market penetration of its smart grid technologies and energy management solutions. Such collaborations are expected to be a key driver for growth in the coming years.

- Utility Integration: Partnerships with utilities can streamline the adoption of Enphase's distributed energy resource management systems (DERMS), potentially leading to increased deployment in grid services.

- Energy Provider Alliances: Collaborations with energy providers can bundle Enphase's hardware with new service offerings, creating a more comprehensive value proposition for consumers.

- Ecosystem Expansion: Strategic alliances with smart home technology providers and electric vehicle (EV) charging companies can create integrated energy solutions, broadening Enphase's market appeal.

Leveraging Grid Modernization and VPP Programs

Enphase is well-positioned to capitalize on the growing global movement towards grid modernization and the expansion of Virtual Power Plant (VPP) programs. These initiatives are creating new opportunities for distributed energy resources, and Enphase's integrated technology is a perfect fit.

The company's smart energy solutions, including its IQ Gateway and IQ Battery, enable homeowners to seamlessly participate in VPPs. This allows them to provide valuable grid services, such as demand response and frequency regulation, thereby generating additional income streams. For instance, by aggregating these home-based energy assets, utilities can achieve greater grid stability and reduce reliance on traditional, less flexible power sources.

The market for VPPs is experiencing rapid growth. By 2025, the global VPP market is projected to reach over $10 billion, with a compound annual growth rate exceeding 30%. This expansion is driven by increasing renewable energy penetration, the need for grid resilience, and supportive government policies. Enphase's ability to offer a comprehensive, user-friendly platform for VPP participation gives it a distinct advantage in capturing a significant share of this burgeoning market.

- Grid Modernization: Enphase's technology supports grid modernization efforts by enabling bidirectional power flow and intelligent energy management at the household level.

- VPP Participation: Homeowners using Enphase systems can actively participate in VPP programs, contributing to grid stability and earning revenue.

- Economic Benefits: These programs offer homeowners financial incentives, making solar and battery storage solutions even more attractive investments.

- Market Growth: The VPP market is expanding rapidly, presenting a substantial growth opportunity for Enphase's integrated energy ecosystem.

The global shift towards renewable energy sources, particularly solar power, presents a massive opportunity for Enphase. With a record 413 GW of solar PV installed globally in 2023, up 37% year-over-year, the market is expanding rapidly. Enphase's integrated solar and storage solutions are perfectly aligned with this trend, catering to the increasing demand for energy independence and sustainability.

International expansion is a key growth avenue, as Enphase's revenue is still heavily concentrated in the US. Europe, in particular, is seeing accelerated renewable energy adoption, and emerging economies are showing growing demand for reliable energy solutions. Enphase's international revenue saw a healthy 15% year-over-year growth in 2023, signaling strong potential in these markets.

Enphase's focus on innovation, exemplified by its advanced microinverters and fourth and fifth-generation IQ batteries, allows it to capture new market share. Furthermore, venturing into adjacent markets like EV charging and developing enhanced energy management software can unlock significant new revenue streams, strengthening its comprehensive energy ecosystem.

Threats

The solar sector is particularly susceptible to swift and unforeseen shifts in government policies, incentives, and regulations. For instance, changes to investment tax credits, net metering rules, or domestic content mandates can quickly diminish the appeal of solar projects, directly impacting Enphase's sales volumes and financial performance.

Enphase faces a fierce market with many established and new companies selling solar inverters and energy storage. This tough competition often forces prices down, squeezing profit margins and making it harder to keep customers. For instance, in the first quarter of 2024, Enphase reported a revenue of $263 million, a significant drop from the previous year, partly due to increased competition impacting sales volume and pricing.

Economic downturns, persistent inflation, and high interest rates are significant threats to Enphase. These factors can curb consumer spending on major purchases like solar installations, as higher financing costs make these investments less attractive for homeowners. For instance, the Federal Reserve's continued efforts to combat inflation through interest rate hikes, with rates remaining elevated in 2024 and projected to stay higher for longer into 2025, directly increase the cost of loans for residential solar projects, potentially dampening demand.

Risk of Technological Obsolescence

The relentless speed of technological progress in renewable energy presents a significant risk of obsolescence for Enphase's current product lines. Competitors are constantly introducing newer, more efficient, and potentially lower-cost solutions, which could quickly erode Enphase's market share if it fails to keep pace. For instance, advancements in microinverter efficiency or energy storage integration by rivals could render Enphase's offerings less attractive to consumers and installers.

To counter this, Enphase faces the imperative of sustained, substantial investment in research and development. This is crucial for maintaining its technological leadership. Failure to innovate aggressively could see Enphase lose its competitive edge, particularly as the market matures and demand for cutting-edge performance grows. The company's ability to anticipate and respond to emerging trends, such as advancements in grid-edge intelligence or integration with electric vehicle charging, will be key.

- R&D Investment: Enphase's commitment to R&D is evident, with significant capital allocated to developing next-generation products. For example, in Q1 2024, the company reported R&D expenses of $60.7 million, a testament to its focus on innovation.

- Competitive Landscape: The renewable energy sector is highly competitive, with numerous players vying for market dominance. Companies like SolarEdge, Huawei, and emerging startups are continuously pushing the boundaries of inverter and energy management technology.

- Product Lifecycles: The rapid pace of technological development can shorten product lifecycles, necessitating a continuous stream of new and improved offerings to remain relevant and competitive in the market.

Geopolitical Tensions and Trade Barriers

Geopolitical tensions and trade barriers pose a significant threat to Enphase Energy. The company's reliance on global supply chains, particularly for components manufactured in regions like China, makes it vulnerable to disruptions. For instance, escalating trade disputes or unexpected tariff changes could directly impact Enphase's cost of goods sold and its ability to maintain competitive pricing. In 2023, a substantial portion of the solar industry's supply chain, including critical components for inverters and microinverters, originated from Asia, highlighting this dependency.

These geopolitical risks can lead to increased operational costs and production delays, affecting Enphase's financial performance and market position. For example, a sudden imposition of tariffs on solar components could inflate Enphase's manufacturing expenses, potentially forcing price adjustments that could dampen demand in key markets. The company's ability to navigate these complex international relations and diversify its manufacturing base will be crucial in mitigating these threats.

- Supply Chain Vulnerability: Enphase's dependence on components from China and other global regions exposes it to trade wars and tariffs.

- Cost Increases: Geopolitical events can lead to higher manufacturing costs, impacting profitability and pricing strategies.

- Production Disruptions: Trade barriers and international instability can interrupt the flow of essential components, delaying product delivery.

- Market Uncertainty: Escalating tensions create an unpredictable business environment, making long-term planning more challenging.

Enphase faces significant threats from evolving government policies and regulations impacting the solar industry. Shifts in investment tax credits or net metering rules can directly affect sales volumes. For example, changes to these incentives can quickly alter the economic viability of solar projects for consumers.

Intense competition from both established players and new entrants in the solar and energy storage markets is a major concern. This pressure often leads to price reductions, impacting Enphase's profit margins. In Q1 2024, Enphase's revenue dropped to $263 million, partly due to competitive pricing pressures.

Economic headwinds, including inflation and high interest rates, dampen consumer spending on major purchases like solar installations. Elevated interest rates in 2024 and projected into 2025 increase financing costs for solar projects, potentially reducing demand.

The rapid pace of technological advancement poses a risk of product obsolescence. Competitors are consistently introducing more efficient and cost-effective solutions, necessitating continuous innovation from Enphase to maintain its market position.

SWOT Analysis Data Sources

This Enphase SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence reports, and expert industry forecasts, ensuring a data-driven and accurate strategic assessment.