Enphase Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

Curious about Enphase's product portfolio performance? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks, but the real strategic advantage lies within the full BCG Matrix.

Unlock a comprehensive understanding of Enphase's market position and identify actionable insights for optimized resource allocation. Purchase the complete BCG Matrix for a detailed breakdown and strategic recommendations that will drive your business forward.

Don't miss out on the opportunity to gain a competitive edge. Get the full Enphase BCG Matrix report today and equip yourself with the knowledge to make informed investment and product decisions.

Stars

Enphase's IQ8 microinverters are a standout product within the expanding solar microinverter sector. This market is anticipated to hit $5.67 billion by 2025, growing at a compound annual rate of 14.1%. Enphase commands a substantial portion of this market, estimated around 40%, highlighting their strong competitive position.

The IQ8 series, featuring advanced grid-forming capabilities and a 25-year warranty, continues to attract significant customer demand. This product is a primary contributor to Enphase's revenue expansion, particularly in the European market, demonstrating its market appeal and technological advantage.

The Enphase IQ Battery 10C, a recent addition to their lineup, boasts 10 kWh of usable energy and 7.08 kW of continuous power, all within a more compact design. This enhanced energy density and reduced footprint position it strongly within the booming residential energy storage sector. The market is expected to expand from $0.91 billion in 2024 to $1.08 billion in 2025, a substantial 18.9% compound annual growth rate.

Enphase Energy's integrated platform, a seamless blend of microinverters, battery storage, and sophisticated energy management software, solidifies its position as a frontrunner in holistic home energy solutions. This all-encompassing ecosystem directly addresses the surging consumer interest in combined solar and storage systems, a market segment that saw an impressive 44% expansion in 2024.

The platform's inherent strength lies in its capacity to intelligently manage both energy generation and consumption, significantly enhancing efficiency for homeowners. Features like the IQ Meter Collar, designed for straightforward backup power integration, further contribute to Enphase's commanding market share within the residential solar-plus-storage sector.

European Market Expansion

Enphase is making significant strides in its European market expansion, targeting countries like Germany, France, and the Netherlands. These regions are showing robust demand for solar and battery storage systems, aligning perfectly with Enphase's product offerings.

This strategic geographical diversification is a key driver of Enphase's overall revenue growth. For instance, European revenue saw an approximate 11% increase in the second quarter of 2025, underscoring the success of this expansion strategy.

By focusing on these growing renewable energy markets, Enphase is well-positioned to leverage supportive government policies and increasing consumer adoption of clean energy solutions.

- Target Markets: Germany, France, Netherlands

- Revenue Impact: ~11% European revenue growth in Q2 2025

- Strategic Advantage: Capitalizing on strong demand and favorable policies for solar and battery solutions

U.S. Manufacturing Capabilities

Enphase Energy has made a significant investment in U.S. manufacturing for its microinverters and batteries. This domestic production capability is a key strength, especially with substantial shipments originating from its U.S. facilities.

This localized approach allows Enphase to capitalize on domestic content incentives provided by the Inflation Reduction Act (IRA). For example, in 2023, Enphase reported that over 30% of its revenue came from U.S.-manufactured products, a figure expected to grow. This aligns perfectly with IRA provisions designed to boost domestic clean energy production.

- IRA Benefits: Enphase's U.S. manufacturing directly supports its eligibility for IRA tax credits and incentives, enhancing cost competitiveness.

- Tariff Mitigation: Producing domestically reduces exposure to international tariffs and supply chain disruptions, ensuring more stable pricing and availability for U.S. customers.

- Market Advantage: By aligning with U.S. government policies and consumer preferences for locally made goods, Enphase strengthens its competitive position in the rapidly expanding U.S. residential solar market.

Enphase's IQ8 microinverters and IQ Battery 10C are clear Stars in the BCG matrix, demonstrating high growth and strong market share. The solar microinverter market is projected to reach $5.67 billion by 2025, with Enphase holding around 40% of this expanding sector. Similarly, the residential energy storage market, expected to grow from $0.91 billion in 2024 to $1.08 billion in 2025, benefits from Enphase's advanced battery solutions.

These products are driving significant revenue for Enphase, fueled by technological innovation and increasing consumer demand for integrated home energy systems. The company's strategic focus on U.S. manufacturing, supported by the Inflation Reduction Act, further solidifies their competitive advantage in these high-growth segments.

| Product Category | Market Growth Rate | Enphase Market Share | Key Differentiator |

|---|---|---|---|

| Solar Microinverters | 14.1% (2025 est.) | ~40% | IQ8 grid-forming capabilities, 25-year warranty |

| Residential Energy Storage | 18.9% (2024-2025 est.) | High (integrated platform) | IQ Battery 10C, compact design, enhanced energy density |

What is included in the product

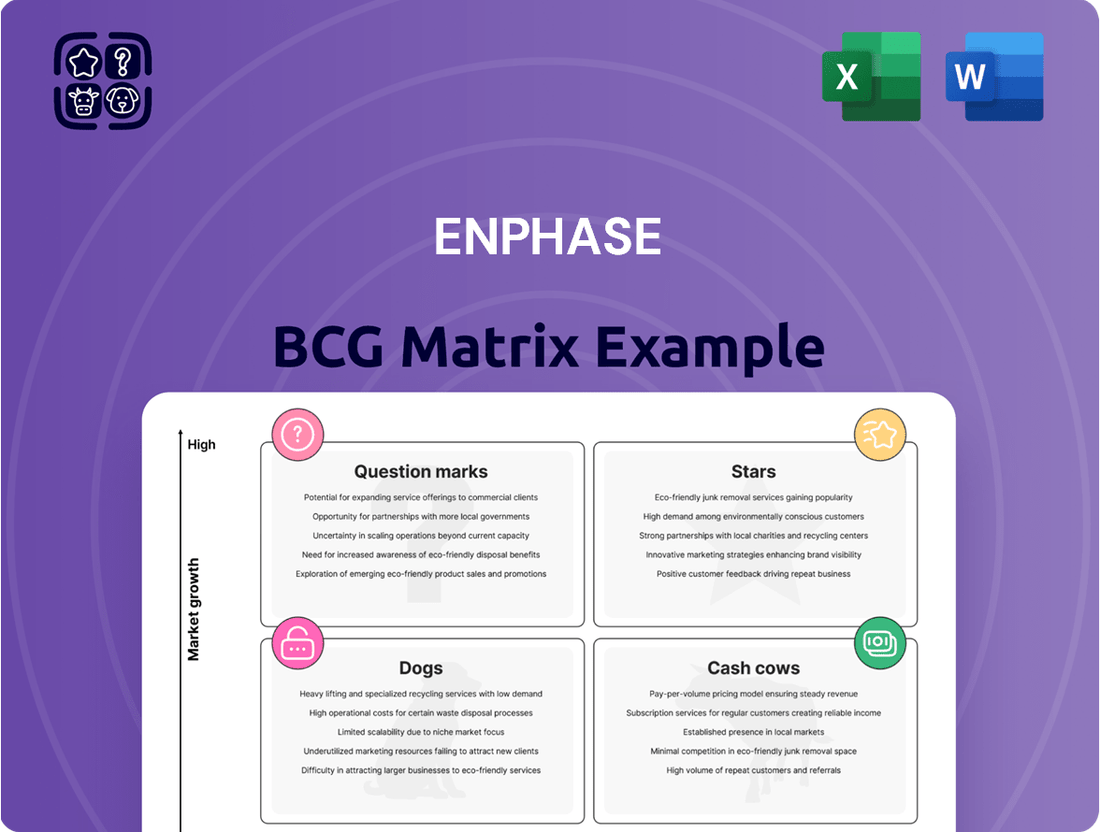

The Enphase BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investment, divestment, and resource allocation for each product category.

The Enphase BCG Matrix provides a clear, one-page overview, alleviating the pain of scattered business unit data.

Cash Cows

Older generation microinverters, such as Enphase's IQ7 series, represent significant cash cows. Despite the newer IQ8 series taking center stage, the IQ7s benefit from a vast installed base, ensuring ongoing revenue from replacements and servicing existing systems. Their established reliability and market share mean they require minimal marketing spend, leading to strong profit margins.

The Enlighten monitoring service from Enphase is a prime example of a cash cow. This cloud-based platform offers homeowners a way to easily track and manage their energy consumption, providing a consistent and reliable revenue stream for the company.

Enphase boasts a dominant market share for Enlighten among its own system owners, a testament to its seamless integration and the clear value it delivers. This strong customer adoption means the service requires minimal new investment in marketing or sales to maintain its position.

As a mature product, Enlighten generates significant profit margins due to its low ongoing operational costs. This allows Enphase to benefit from a steady and predictable cash flow, a hallmark of a successful cash cow.

Enphase's legacy product upgrade programs are strong contenders for cash cows within the BCG matrix. These initiatives effectively tap into their existing customer base, encouraging a move towards advanced microinverter and battery solutions. This strategy capitalizes on established relationships, leading to revenue generation with comparatively lower customer acquisition expenses.

The primary goal for these upgrade programs is efficient customer retention and smooth transitions. By offering incentives for existing users to adopt newer technologies, Enphase ensures a consistent and predictable cash flow. This approach minimizes the need for extensive marketing to new demographics, focusing instead on maximizing value from their current installed base.

Established Distributor Network

Enphase's established distributor network acts as a significant cash cow, providing a reliable sales channel for its foundational microinverter products.

This mature distribution system, bolstered by direct ties to major installers, guarantees a steady sales volume and predictable operational expenses. The network's efficiency directly translates into robust profit margins and substantial cash flow for Enphase.

- Distributor Network Strength: Enphase leverages its extensive network of solar distributors and direct relationships with large installers.

- Sales Stability: This mature channel ensures a consistent and predictable flow of sales for core microinverter products.

- Operational Efficiency: The well-established network contributes to stable operational costs and high profit margins.

- Cash Generation: Enphase's 2023 revenue reached $2.19 billion, with its microinverter business forming the backbone of its cash generation.

Core Residential Microinverter Business (Pre-IQ8)

Enphase's core residential microinverter business, even before the introduction of IQ8 technology, represented a significant cash cow. This segment boasted a high market share within a relatively mature market, demonstrating the company's established dominance.

While growth in this established segment might have moderated compared to newer product lines, its consistent sales were driven by strong brand equity, deep installer relationships, and a reputation for reliability. This translated into substantial and predictable cash flow for Enphase.

- High Market Share: Enphase held a leading position in the residential microinverter market prior to IQ8.

- Mature Segment: The market for these established microinverters was mature, indicating stable demand.

- Strong Brand and Loyalty: Brand recognition and installer loyalty ensured continued sales.

- Low Promotional Costs: Market dominance allowed for reduced marketing spend, boosting profitability.

Enphase's established microinverter technology, particularly the IQ7 series, continues to function as a cash cow. This is due to a large installed base requiring ongoing replacements and servicing, generating consistent revenue with minimal new investment. The Enlighten monitoring service also contributes significantly, offering a reliable revenue stream from its integrated user base.

The company's legacy product upgrade programs effectively leverage existing customer relationships to drive sales of newer technologies, ensuring predictable cash flow. Furthermore, Enphase's mature distributor network provides a stable sales channel for its core microinverter products, resulting in high profit margins and substantial cash generation.

Enphase's 2023 revenue reached $2.19 billion, with its established microinverter business being a primary driver of this financial success. The company's strong market share in the residential microinverter sector prior to the IQ8 launch further solidified its position as a consistent cash generator.

| Product/Service | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) |

|---|---|---|---|

| IQ7 Series Microinverters | Cash Cow | Large installed base, replacement sales, low marketing cost | Significant portion of $2.19B total revenue |

| Enlighten Monitoring | Cash Cow | Recurring subscription revenue, high customer adoption | Steady, predictable cash flow |

| Legacy Upgrade Programs | Cash Cow | Customer retention, cross-selling opportunities | Contributes to stable revenue streams |

| Distributor Network | Cash Cow | Mature sales channel, operational efficiency | Supports consistent sales of core products |

What You See Is What You Get

Enphase BCG Matrix

The Enphase BCG Matrix preview you are currently viewing is the identical, fully finalized document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently assess the depth and presentation of this report, knowing the purchased version offers the same high-quality, actionable insights for your business planning. This ensures transparency and guarantees that the strategic tool you acquire perfectly matches the preview you've evaluated.

Dogs

Enphase's U.S. residential market share has dipped from 55% in 2023 to 47% in 2024. This decline is partly attributed to intensifying competition, notably from Tesla's Powerwall 3.

The U.S. residential solar market is facing challenges, including fewer incentives and higher consumer financing costs. These factors contribute to a contraction in this segment.

Products heavily dependent on this shrinking residential market, without significant unique selling propositions, could be categorized as .

Certain older, less efficient Enphase microinverter models might be considered Dogs within the BCG matrix. These units, often struggling to keep pace with the rapid advancements in solar technology, may hold a low market share in today's booming microinverter sector.

Their functionality, while present, is overshadowed by newer, more powerful alternatives. This makes them less attractive to consumers and installers, leading to a diminished competitive edge and potentially reduced profitability for Enphase to actively market.

For instance, if these older models only support up to 300W solar modules, they are significantly outpaced by current offerings that handle 400W+ modules, a common standard in 2024. This technological gap makes them less desirable, pushing them towards a phase-out or lower priority status in Enphase's product strategy.

Enphase's reliance on imported, fully assembled battery units faces significant headwinds due to a substantial 145% tariff. This tariff is projected to compress corporate gross margins, particularly in the second and third quarters of 2025. Products that are heavily dependent on these imported batteries and lack readily available domestic manufacturing alternatives or the ability to absorb these increased costs without severe margin erosion could be categorized as cash traps.

Specific Niche Products with Low Adoption

Specific niche products with low adoption for Enphase, if any have been introduced and failed to gain traction, would represent a challenge within their product portfolio. These hypothetical offerings would likely exhibit a low market share and contribute negligibly to revenue, potentially indicating a need for strategic review.

Should Enphase have introduced specialized products that didn't resonate with a broad customer base, these could be classified as Question Marks or even Dogs in a BCG-like analysis. For instance, if a new energy storage solution tailored for a very specific industrial application saw minimal uptake, it would fit this description. Data from 2024 would be crucial here, perhaps showing if such a niche product achieved less than 5% market penetration in its target segment, while its associated R&D costs remained significant.

- Low Market Share: Products failing to capture even a small percentage of their intended market.

- Minimal Revenue Contribution: These items would likely account for less than 1% of Enphase's total revenue in 2024.

- Potential for Divestiture: Such offerings might be candidates for discontinuation or sale if they don't show signs of growth.

- Resource Drain: Continued investment in low-adoption products could divert resources from more promising areas.

High-Cost, Low-Margin Legacy Offerings

High-cost, low-margin legacy offerings in Enphase's portfolio might include older inverter models or accessories that, while still functional, are no longer competitive. These products often face pressure from newer, more efficient technologies, leading to reduced sales volumes and the need for aggressive pricing to move inventory. Consequently, their profit margins shrink considerably.

Maintaining these older product lines also incurs significant operational costs. This includes continued support, warranty claims, and managing legacy component inventory. For instance, if a legacy product line represents only 5% of Enphase's revenue but consumes 15% of its customer support resources, it's a clear drain. In 2023, the solar inverter market saw intense price competition, with average selling prices for string inverters decreasing by an estimated 10-15% year-over-year, impacting margins on older, less differentiated models.

- Thin Profit Margins: Legacy products may operate with gross margins below 15%, compared to newer offerings potentially exceeding 30%.

- High Operational Costs: Continued investment in manufacturing, support, and inventory for products with declining demand.

- Resource Allocation: Capital and human resources tied up in these offerings could be redirected to R&D for next-generation technologies or expansion into high-growth markets.

- Market Dynamics: Increased competition and technological advancements render older products less attractive, forcing price reductions.

Products classified as Dogs in Enphase's portfolio are those with low market share and minimal growth potential, often older or less competitive offerings. These products contribute negligibly to revenue, potentially less than 1% in 2024, and may consume disproportionate resources in terms of support and inventory management. Given their weak market position and declining relevance, they could be candidates for divestiture or phasing out to reallocate capital to more promising ventures.

Older microinverter models that struggle to keep pace with technological advancements, such as supporting only lower wattage solar modules (e.g., 300W vs. current 400W+ standards), exemplify Enphase Dogs. These products face intense competition and diminishing consumer appeal due to their lower efficiency and feature set compared to newer alternatives. Their continued presence in the market represents a drain on resources without significant return.

The challenges in the U.S. residential solar market, including reduced incentives and higher financing costs, further pressure products heavily reliant on this segment. If these products lack strong differentiation, they risk becoming Dogs, especially if competitors offer more compelling solutions. The decline in Enphase's U.S. residential market share from 55% in 2023 to 47% in 2024 highlights this vulnerability.

Legacy products with high operational costs and thin profit margins, potentially below 15% gross margin in 2024, also fall into the Dog category. These items, while functional, are often outcompeted by newer technologies, forcing price reductions and eroding profitability. Such products can tie up valuable capital and human resources that could be better utilized in R&D or expansion into high-growth areas.

Question Marks

The Enphase IQ Battery 5P with FlexPhase is positioned within the rapidly expanding residential energy storage sector, a market experiencing significant growth but also intense competition. While Enphase has a strong foothold in microinverters, its market share in energy storage is notably smaller, placing the IQ Battery 5P in a challenging, yet opportunity-rich, segment of the BCG matrix.

Increased shipments of the IQ Battery 5P, especially in Europe, indicate growing demand and market acceptance. The innovative FlexPhase architecture, designed to support both single and three-phase systems, is a key differentiator aimed at capturing a larger share of this dynamic market.

Despite these advancements, the IQ Battery 5P faces formidable competition from established players like Tesla. To secure a dominant market position, Enphase will likely need to continue substantial investment in production, distribution, and further technological development to outpace rivals in this evolving energy landscape.

Enphase's IQ EV Chargers are positioned in the Question Marks category of the BCG Matrix. While they seamlessly integrate with Enphase's existing solar and battery ecosystems, enabling optimized charging from surplus solar power, the EV charging market, despite its high growth potential, represents a newer venture for Enphase. As of early 2024, the global EV charging market is projected to reach over $100 billion by 2027, but Enphase's specific market share within this rapidly expanding segment is likely nascent.

To elevate the IQ EV Chargers from a Question Mark to a Star, Enphase will need to make substantial investments in marketing and expanding its distribution channels. This strategic push is crucial for capturing a more significant market share in the competitive EV charging landscape and realizing the product's full potential within the company's portfolio.

The Solargraf software platform, designed to streamline design, proposals, and permitting for solar installers, signifies Enphase's expansion into software-as-a-service. While it strengthens Enphase's integrated offering, its current market penetration within the vast solar software sector is probably modest, positioning it as a Question Mark in the BCG matrix.

Given its niche focus and the competitive landscape of solar design and permitting software, Solargraf likely holds a small standalone market share. For example, by late 2024, the global solar software market was projected to reach approximately $2.5 billion, with numerous established players already capturing significant portions.

To elevate Solargraf from a Question Mark, Enphase needs to strategically invest in its development and aggressively pursue adoption among installers who may not exclusively use Enphase hardware. This expansion beyond the existing customer base is critical to unlocking its growth potential and improving its market standing.

IQ Balcony Solar Kit

The IQ Balcony Solar Kit, an innovative solution for urban residents, targets a burgeoning market of apartment dwellers keen on renewable energy. While its niche appeal positions it as a potential growth area, its current market penetration is likely modest, reflecting its novelty. Enphase will need to invest heavily in consumer awareness and education to foster adoption, determining whether this product can ascend to a market-leading 'Star' or remain a specialized offering.

- Market Potential: The global market for residential solar is expanding, with urban and multi-family dwellings representing a significant, yet often underserved, segment.

- Current Market Share: As a relatively new product category, the IQ Balcony Solar Kit's market share is expected to be minimal in 2024, requiring substantial effort to gain traction.

- Growth Prospects: Continued innovation and supportive urban energy policies could propel this product into a high-growth category, potentially shifting its position in the BCG matrix over time.

New Commercial Microinverter Offerings

In 2024, Enphase Energy expanded its reach by launching microinverters specifically designed for the small commercial sector, a significant move beyond its established residential stronghold. This entry into the commercial solar market, a segment poised for substantial growth, represents a new frontier for the company.

While the commercial solar market offers considerable expansion potential, Enphase's penetration in this area is currently minimal when contrasted with its leading position in the residential market. For these new commercial microinverter offerings to ascend to the status of Stars within the BCG matrix, they will necessitate considerable strategic investment.

- Product Development: Continued innovation to meet the unique demands of commercial installations.

- Sales Channels: Building robust partnerships and distribution networks tailored for the commercial segment.

- Market Penetration: Aggressive marketing and sales strategies to capture market share in this competitive space.

Enphase's IQ EV Chargers represent a strategic move into a high-growth market, but their current market share is likely small. The global EV charging market is projected to exceed $100 billion by 2027, indicating substantial future potential. To transition from a Question Mark to a Star, Enphase must invest heavily in marketing and distribution to capture a significant portion of this expanding sector.

The Solargraf software platform is another Question Mark, aiming to streamline solar installations. While the global solar software market was estimated around $2.5 billion by late 2024, Solargraf's current penetration is modest. Aggressive development and broader installer adoption, even those not exclusively using Enphase hardware, are crucial for its growth.

The IQ Balcony Solar Kit targets urban dwellers and a growing niche market. Its current market share is minimal, necessitating significant investment in consumer education and awareness. Supportive urban energy policies could further boost its prospects, potentially shifting it from a Question Mark to a higher-growth category.

Enphase's new commercial microinverters are entering a market poised for substantial growth, but their current penetration is minimal. To move these products to Star status, Enphase needs dedicated investment in product development, specialized sales channels, and aggressive market penetration strategies to compete effectively.

| Product Category | BCG Matrix Position | Key Considerations for Growth | Market Data Point (2024/2027 Projections) |

| IQ EV Chargers | Question Mark | Increased marketing and distribution investment | Global EV charging market projected over $100 billion by 2027 |

| Solargraf Software | Question Mark | Broader installer adoption, development investment | Global solar software market ~ $2.5 billion (late 2024 projection) |

| IQ Balcony Solar Kit | Question Mark | Consumer awareness, urban policy support | Niche market, minimal current share, potential for urban segment growth |

| Commercial Microinverters | Question Mark | Product dev, commercial sales channels, market penetration | Entering a high-growth sector, currently minimal penetration |

BCG Matrix Data Sources

Our Enphase BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.