Enphase Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

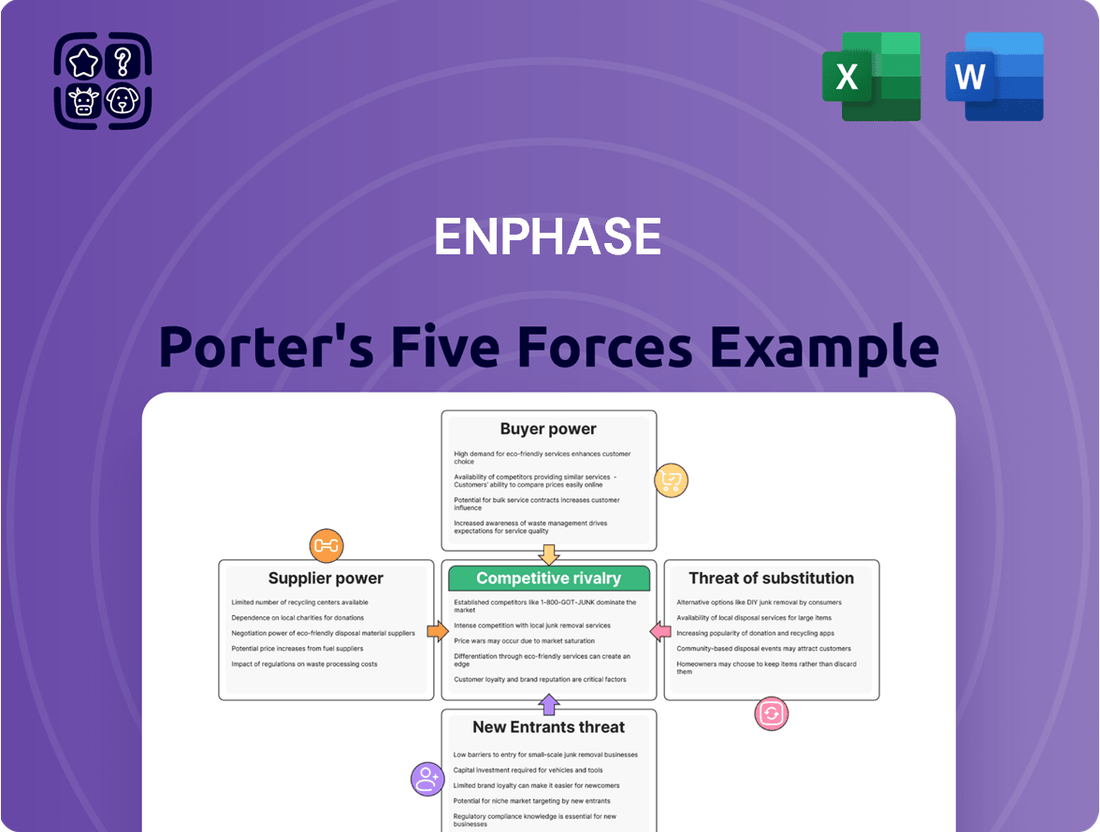

Enphase operates in a dynamic energy sector, facing significant competitive pressures. Understanding the interplay of buyer power, supplier leverage, the threat of new entrants, substitutes, and existing rivalry is crucial for navigating this landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Enphase’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Enphase Energy's dependency on a global supply chain for critical components, especially semiconductor-based microinverter parts and battery cells, significantly amplifies supplier bargaining power. The availability and pricing of these specialized inputs directly impact Enphase's manufacturing expenses and profitability.

Disruptions or substantial price hikes from key component suppliers can directly affect Enphase's operational efficiency and profit margins. For instance, in 2024, the ongoing global semiconductor shortage continued to present challenges, with lead times for certain advanced chips extending, potentially increasing costs for manufacturers like Enphase.

Enphase is actively working to diversify its supply chain, particularly for critical components like battery cells. This move away from over-reliance on single geographic regions, such as China, is a key strategy to lessen the leverage individual suppliers hold over the company.

By spreading production and sourcing across multiple locations and suppliers, Enphase can better navigate potential disruptions and reduce the impact of price increases dictated by concentrated supply bases. This diversification directly counters the bargaining power of suppliers, fostering greater cost control and operational stability.

Enphase is strategically increasing its U.S. manufacturing for microinverters and boosting domestic content in products like the IQ Battery 5P. This initiative directly addresses supplier power by reducing reliance on foreign components and potentially lowering production costs.

By aligning with the Inflation Reduction Act and the Build America, Buy America Act, Enphase aims to leverage tax credits. This can significantly improve its cost structure, making it less susceptible to price hikes or supply disruptions from overseas suppliers, thereby strengthening its bargaining position.

Supplier Switching Costs

Supplier switching costs for Enphase, while decreasing due to diversification efforts, remain a factor. For highly specialized or integrated components, the expense and time associated with re-tooling manufacturing lines, obtaining new certifications, and rigorous quality assurance can be substantial. This can grant existing suppliers a degree of leverage.

Enphase's strategic moves to broaden its supplier network are a direct response to mitigate these switching cost barriers. By cultivating relationships with multiple vendors for critical parts, the company aims to reduce its dependence on any single supplier and enhance its negotiating power.

- Component Specialization: The need for highly specialized components in Enphase's advanced energy solutions often means fewer alternative suppliers exist.

- Re-tooling and Certification: Switching suppliers for these specialized parts requires significant investment in new equipment and lengthy re-certification processes.

- Quality Assurance Investment: Ensuring consistent quality with a new supplier demands dedicated resources for testing and validation, adding to the overall switching cost.

- Strategic Diversification: Enphase's proactive strategy to onboard new suppliers is designed to lower these switching costs over time, increasing operational flexibility.

Supplier Concentration within Specific Technologies

The concentration of suppliers for highly specialized components essential to Enphase Energy's microinverter and battery storage systems can grant those suppliers significant leverage. If only a few companies can produce critical semiconductors or advanced materials meeting Enphase's stringent performance and reliability standards, these suppliers hold considerable bargaining power.

Enphase's strategic approach involves continuous investment in research and development. This focus on innovation allows them to not only define precise technical specifications for their components but also to explore and qualify a wider array of potential suppliers. By actively seeking out and nurturing relationships with multiple vendors, Enphase aims to mitigate the risk of over-reliance on any single supplier and thereby reduce their individual bargaining power.

- Limited Supplier Pool: For highly proprietary technologies, a small number of qualified suppliers can exert increased pricing and negotiation power.

- Enphase's R&D Influence: Through ongoing R&D, Enphase can shape component specifications, potentially expanding the supplier base over time.

- Strategic Sourcing: Diversifying the supplier network is a key strategy to counter supplier concentration and maintain favorable terms.

The bargaining power of suppliers for Enphase Energy is substantial due to the specialized nature of components like semiconductor microinverters and battery cells, with limited alternative suppliers available. This concentration means suppliers can influence pricing and terms, impacting Enphase's profitability, especially when supply chains face disruptions.

In 2024, the persistent global semiconductor shortage continued to affect lead times and costs for critical chips, a key input for Enphase's microinverters. This situation directly amplified the leverage held by semiconductor manufacturers.

Enphase is actively mitigating this by diversifying its supply chain, particularly for battery cells, and increasing U.S. manufacturing to reduce reliance on specific regions and suppliers. This strategy aims to build resilience and improve its negotiating position against powerful suppliers.

| Factor | Impact on Enphase | Mitigation Strategy |

|---|---|---|

| Component Specialization | Limited suppliers for advanced microinverters and battery cells grant them leverage. | R&D to define specs that allow for broader supplier qualification. |

| Supplier Concentration | Few qualified vendors for proprietary technologies can dictate terms. | Strategic diversification of the supplier network. |

| Switching Costs | High costs for re-tooling and certification when changing suppliers for specialized parts. | Cultivating relationships with multiple vendors to reduce dependence. |

What is included in the product

This analysis dissects the competitive forces impacting Enphase, revealing the intensity of rivalry, the power of buyers and suppliers, and the barriers to entry and substitutes within the solar energy market.

Effortlessly visualize competitive intensity with a dynamic, interactive dashboard, transforming complex Porter's Five Forces data into actionable insights for strategic planning.

Customers Bargaining Power

The residential solar market has encountered significant challenges, notably higher interest rates and regulatory changes like California's NEM 3.0. These factors have contributed to a noticeable slowdown in demand, making both consumers and installers much more sensitive to pricing. This heightened price sensitivity can directly translate into increased bargaining power for customers, who may then push for more competitive pricing from companies like Enphase.

Enphase Energy's customer base is quite varied, encompassing solar distributors, large installation companies, original equipment manufacturers (OEMs), strategic allies, and even individual homeowners. This diversity generally dilutes the power of any single customer.

However, significant players within this spectrum, such as major solar distributors or large-scale installers, can wield considerable bargaining power. Their ability to purchase in high volumes means they can negotiate for better pricing or more favorable terms, impacting Enphase's margins.

For instance, in 2023, Enphase reported that its top three customers accounted for approximately 46% of its total revenue, highlighting the concentrated influence of a few large entities within its diverse customer segments.

Enphase's strategy of offering highly differentiated products, such as its microinverter-based solar systems and integrated battery storage, significantly bolsters its position against customer bargaining power. These solutions provide unique advantages like panel-level optimization and enhanced safety, making it less appealing for customers to switch to competitors based solely on price.

The integration of energy management software further solidifies this advantage, offering customers comprehensive control over their energy usage. This holistic approach creates a sticky ecosystem that reduces the perceived value of standalone, less integrated alternatives, thereby diminishing customer leverage.

Availability of Competing Technologies

The availability of competing technologies significantly influences the bargaining power of customers in the solar inverter market. Customers can opt for traditional string inverters or central inverters from rivals such as SolarEdge, Huawei, and Sungrow. These alternatives, while differing in their technical specifications and benefits, offer customers viable choices.

This technological diversity directly impacts Enphase's ability to dictate pricing. For instance, SolarEdge's power optimizer technology, while distinct from Enphase's microinverters, competes for market share and customer preference. In 2023, SolarEdge reported revenues of approximately $7.5 billion, demonstrating the substantial market presence of a key competitor.

- Customer Choice: The existence of multiple inverter technologies, including string and central inverters, provides customers with alternatives to Enphase's microinverter solutions.

- Competitive Landscape: Key competitors like SolarEdge, Huawei, and Sungrow offer comparable or alternative technologies, intensifying market competition.

- Pricing Influence: The availability of these competing technologies limits Enphase's pricing power, as customers can switch to more cost-effective or feature-comparable options.

- Market Dynamics: Competitors' market performance, such as SolarEdge's significant 2023 revenue, underscores the competitive pressures Enphase faces due to technological alternatives.

Impact of Government Incentives and Policies

Government incentives, such as tax credits and rebates, significantly shape customer purchasing decisions in the solar industry. For instance, the U.S. Investment Tax Credit (ITC) has been a major driver of residential solar adoption, with its extension providing continued demand support. However, the potential expiration or modification of such programs, like the ITC's step-down in future years, can empower customers by creating a sense of urgency or prompting them to seek better deals before incentives change, thereby increasing their bargaining power.

The impact of these policies is tangible. In 2023, the U.S. solar market saw substantial growth, partly attributed to the Inflation Reduction Act which extended and enhanced the ITC. Yet, uncertainty surrounding the longevity or future value of these incentives can lead to customers delaying installations, hoping for more favorable terms or new programs. This anticipation allows them to negotiate more effectively with installers.

- Government incentives, like the U.S. Investment Tax Credit (ITC), directly influence customer demand for solar products.

- The potential for these incentives to change or expire grants customers leverage to negotiate better terms or delay purchases.

- In 2023, the U.S. solar market experienced significant growth, partly due to supportive policies like the Inflation Reduction Act.

The bargaining power of customers for Enphase is influenced by market conditions and the availability of alternatives. For instance, rising interest rates and regulatory shifts like California's NEM 3.0 in 2023 made consumers more price-sensitive, increasing their leverage. While Enphase's diverse customer base generally dilutes individual power, large distributors and installers, who accounted for about 46% of Enphase's revenue in 2023 through its top three customers, can negotiate favorable terms due to their volume purchasing. The presence of competitors like SolarEdge, which reported $7.5 billion in revenue in 2023, offering alternative technologies, also limits Enphase's pricing power.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2023/2024) |

|---|---|---|

| Market Conditions | Increases power due to price sensitivity | Higher interest rates, NEM 3.0 impact |

| Customer Concentration | High power for large volume buyers | Top 3 customers ~46% of revenue |

| Competitive Alternatives | Limits pricing power | SolarEdge revenue: $7.5 billion |

Preview the Actual Deliverable

Enphase Porter's Five Forces Analysis

This preview showcases the complete Enphase Five Forces Analysis, offering a detailed examination of the competitive landscape within the solar energy industry. You're looking at the actual document, so what you see here is precisely what you'll receive instantly upon purchase, ensuring no surprises and immediate usability. This professionally formatted analysis is ready to empower your strategic decision-making without any further setup required.

Rivalry Among Competitors

The solar energy technology landscape is fiercely competitive, with Enphase Energy navigating intense rivalry from major established players. Companies like SolarEdge Technologies, Huawei, and Sungrow are formidable competitors, actively contesting market share across both microinverter technology and the wider solar inverter and energy storage sectors.

In 2023, SolarEdge Technologies reported revenue of approximately $2.9 billion, showcasing its significant presence. Huawei, though facing geopolitical challenges, remains a strong contender, particularly in global inverter shipments. Sungrow Power Supply Co., Ltd. also demonstrated robust growth, with its 2023 revenue reaching around $6.3 billion, highlighting the scale of competition Enphase faces.

Competitive rivalry in the solar energy sector is intensely fueled by rapid technological innovation. Companies are constantly pushing the envelope, releasing newer, more efficient inverters, advanced battery storage solutions, and sophisticated energy management systems. This relentless pace means that staying competitive requires a consistent stream of product upgrades and new offerings.

Enphase Energy, for example, is actively engaged in this innovation race. Their ongoing development and rollout of products such as the IQ8 and IQ9 microinverters, alongside their latest battery storage technologies, are crucial for maintaining their market position. These advancements are not just about incremental improvements; they represent significant leaps in performance and integration, directly impacting customer adoption and Enphase's competitive edge.

Recent market slowdowns in the residential solar sector, particularly in 2023 and early 2024, have significantly amplified competitive rivalry. Elevated interest rates and shifts in government incentives, like the phasing out of certain tax credits in some regions, have dampened demand. This has directly impacted microinverter shipments, with Enphase reporting a decline in Q4 2023 compared to the previous year.

The intensified competition forces companies to engage in aggressive pricing strategies to maintain market share. This cost management focus is evident across the industry, as players strive to protect their margins in a contracting market. For Enphase, this translates to increased pressure on its average selling prices, impacting overall revenue and profitability.

Geographic Expansion and Market Share Battles

Competitive rivalry is intensifying as companies like Enphase aggressively pursue geographic expansion to secure new markets and bolster their global market share. This push involves not only entering new territories but also strengthening existing ones.

Enphase, for instance, is actively expanding its footprint in key European markets, aiming to capitalize on the region's growing demand for solar energy solutions. Simultaneously, the company is reinforcing its strong position within the United States. This dual strategy includes leveraging domestic manufacturing capabilities and forging strategic partnerships to enhance its competitive edge.

- Enphase's European Expansion: The company has been strategically increasing its presence in countries like Germany and France, which are leading the charge in renewable energy adoption.

- U.S. Market Reinforcement: Enphase's commitment to domestic manufacturing, including its recent investments in U.S.-based production facilities, aims to reduce supply chain risks and improve cost competitiveness.

- Market Share Dynamics: As more players enter the microinverter and battery storage market, the battle for market share becomes more pronounced, pushing companies to innovate and offer compelling value propositions.

Ecosystem Development and Integrated Solutions

Competitive rivalry in the solar industry is intensifying as companies build out integrated ecosystems. Many competitors are now offering combined solar panel, battery storage, and energy management software solutions. This trend creates comprehensive energy management platforms for homeowners, aiming to simplify and optimize their energy usage.

Enphase's competitive advantage stems from its established all-in-one platform. This system seamlessly connects solar generation, battery storage, and sophisticated energy management software. The goal is to deliver a unified and highly optimized user experience, setting Enphase apart from rivals who may offer more fragmented solutions.

- Integrated Solutions: Competitors are increasingly bundling solar, storage, and software, creating unified home energy systems.

- Ecosystem Play: The focus is shifting towards offering a complete ecosystem rather than just individual components.

- Enphase's Advantage: Enphase's strength is its existing, integrated platform that manages generation, storage, and consumption for a seamless user experience.

- Differentiation: This integrated approach aims to provide superior value and convenience compared to less cohesive offerings from competitors.

Competitive rivalry is a significant force for Enphase, driven by rapid technological advancements and a growing number of players entering the market. The solar energy sector, particularly for microinverters and energy storage, sees intense competition from companies like SolarEdge, Huawei, and Sungrow, all vying for market share. This pressure is amplified by market slowdowns, leading to aggressive pricing strategies and a constant need for product innovation to maintain a competitive edge.

| Competitor | 2023 Revenue (Approx.) | Key Product Focus |

|---|---|---|

| SolarEdge Technologies | $2.9 billion | Inverters, Optimizers, Storage |

| Sungrow Power Supply Co., Ltd. | $6.3 billion | Inverters, Storage, EV Charging |

| Huawei | (Not Publicly Disclosed for Solar Segment) | Inverters, Energy Management |

SSubstitutes Threaten

Traditional central and string inverters represent the most direct substitutes for Enphase's microinverters. These alternatives are often favored for larger solar projects because their initial cost is generally lower, and they are simpler to deploy when dealing with uniform solar panels. For instance, in 2023, the global solar inverter market, which includes string inverters, was valued at approximately $15.7 billion, highlighting their substantial presence.

While Enphase microinverters boast benefits like panel-level optimization and enhanced safety features, string inverters continue to hold a significant market share. This is particularly true in utility-scale and large commercial installations where the upfront cost savings can be a deciding factor. Despite the technological advancements of microinverters, the established infrastructure and cost-effectiveness of string inverters ensure they remain a formidable substitute.

While solar energy is a dominant force in residential power, other renewable sources present a threat of substitution. Wind power, particularly through micro-turbines, and geothermal systems offer alternative pathways for homeowners to generate their own electricity. These options can appeal to those seeking diversification in their energy portfolio or who have specific site advantages.

Investments in home energy efficiency, like improved insulation and smart thermostats, directly reduce a homeowner's overall energy needs. For instance, the U.S. Department of Energy estimates that smart thermostats alone can save consumers between $45 and $180 annually on their energy bills. This reduction in demand can lessen the perceived necessity for substantial solar panel or battery storage installations, presenting an indirect substitute for Enphase's core energy supply solutions.

Grid Electricity and Utility Services

For many households and businesses, the existing grid electricity remains the most convenient and default choice. This is especially true when electricity prices are stable or declining, as seen in various regions during 2024. For instance, some areas experienced slight decreases in average residential electricity prices compared to the previous year, making the grid a cost-effective substitute for alternatives.

The threat of substitutes for Enphase, primarily from grid electricity, is influenced by several factors:

- Economic Viability: The cost-competitiveness of solar-plus-storage versus grid electricity is a major driver. If grid electricity prices remain low, the payback period for alternative solutions extends, weakening the threat.

- Policy and Regulation: Net metering policies and solar incentives significantly impact the economic attractiveness of distributed generation. Unfavorable changes, such as reduced credits for exported solar power, can make the grid a more compelling option.

- Reliability and Convenience: The grid offers a high degree of reliability and requires no upfront investment or ongoing maintenance from the consumer, presenting a strong convenience factor.

- Resilience Needs: Conversely, grid outages can drive demand for alternatives like solar-plus-storage, especially in areas prone to severe weather events. The perceived reliability of the grid during such times can be a weakness exploited by substitutes.

Emerging Hybrid Energy Systems and Grid Defection

The rise of hybrid energy systems, combining solar panels with battery storage and sometimes generators, presents a significant threat of substitution for traditional utility services. This concept, often referred to as grid defection, allows homeowners to become largely independent of the main power grid.

In areas with high electricity prices, such as California, this self-sufficiency is becoming increasingly cost-effective. For instance, by 2024, the upfront cost of a typical residential solar-plus-storage system can range from $20,000 to $35,000, but the long-term savings on electricity bills can make it a compelling alternative to purchasing power from utilities.

- Grid Defection Viability: Homeowners can achieve energy independence by integrating solar, battery storage, and backup generators.

- Economic Attractiveness: High electricity rates in certain U.S. regions, like California, are making these hybrid systems economically viable substitutes for utility reliance.

- Market Trends: The market for residential energy storage is projected to grow substantially, with installations expected to reach over 10 gigawatts by 2025, indicating a clear trend towards greater consumer adoption of these alternative energy solutions.

The threat of substitutes for Enphase is multifaceted, encompassing direct technological alternatives and broader energy solutions. Traditional string inverters remain a significant substitute, particularly in large-scale projects where initial cost is paramount, as evidenced by the global solar inverter market's $15.7 billion valuation in 2023. Additionally, other renewable sources like wind and geothermal offer alternative home energy generation pathways.

Home energy efficiency measures, such as smart thermostats that can save consumers $45-$180 annually, reduce overall energy demand, thereby lessening the perceived need for solar installations. Furthermore, the existing electricity grid itself serves as a primary substitute, especially when grid prices are stable or declining, as observed in various regions during 2024. The convenience and reliability of the grid, coupled with evolving policy landscapes, continue to shape consumer choices in the energy market.

| Substitute Type | Key Characteristics | Enphase Advantage | Market Relevance (2023/2024 Data) |

|---|---|---|---|

| String Inverters | Lower upfront cost, simpler for large uniform installations | Panel-level optimization, enhanced safety, modularity | Global solar inverter market valued at ~$15.7 billion (2023) |

| Other Renewables (Wind, Geothermal) | Diversification, site-specific advantages | Integrated solar-plus-storage ecosystem, grid services | N/A (Niche residential markets) |

| Energy Efficiency | Reduced energy consumption | Maximizing solar generation and storage utilization | Smart thermostats save $45-$180 annually per user |

| Grid Electricity | Convenience, reliability, no upfront investment | Resilience during outages, potential for grid services revenue | Stable or declining prices in some regions (2024) |

Entrants Threaten

Entering the sophisticated microinverter and energy storage market, where Enphase operates, requires significant capital. New companies need to invest heavily in advanced manufacturing facilities, cutting-edge research and development, and establishing a reliable supply chain. For instance, building a state-of-the-art semiconductor fabrication plant can cost billions of dollars.

Enphase's commitment to continuous innovation, evidenced by its substantial R&D spending, and its extensive patent portfolio create formidable financial and technological hurdles. This intellectual property protection makes it exceptionally difficult for new players to replicate Enphase's product performance and market position without facing significant legal and development challenges.

Enphase's core microinverter technology represents a substantial barrier to new entrants due to its highly specialized and proprietary nature. Developing comparable, reliable, and efficient technology requires deep engineering expertise spanning power electronics, software, and semiconductor design, a significant hurdle for any newcomer.

Furthermore, new entrants would need to navigate Enphase's existing intellectual property rights, which are extensive and crucial to their competitive advantage. This legal landscape adds another layer of complexity and cost, making market entry particularly challenging.

Enphase benefits from significant brand recognition, a crucial barrier for new entrants. Building this level of trust and awareness takes years and substantial investment, making it difficult for newcomers to gain traction quickly.

Established distribution channels are another formidable hurdle. Enphase's deep relationships with solar installers and distributors worldwide provide unparalleled market access. New companies would struggle to replicate this extensive network, facing lengthy processes to build similar partnerships and secure product placement.

Furthermore, Enphase's installer certification programs foster loyalty and ensure quality installations, creating a sticky ecosystem that new entrants would find challenging to penetrate. This established infrastructure and installer confidence represent a significant competitive advantage.

Regulatory and Policy Compliance Complexities

The renewable energy sector, including solar technology where Enphase operates, is heavily influenced by intricate and frequently changing regulatory landscapes. New companies entering this market must contend with a multitude of requirements, such as rigorous product certifications, stringent safety standards, and the dynamic nature of government incentives and tariffs. For instance, the Inflation Reduction Act (IRA) in the U.S. offers significant tax credits for clean energy components, but understanding and adhering to its specific manufacturing and sourcing requirements is crucial for any new entrant to leverage these benefits effectively. Similarly, navigating the nuances of policies like the Buy America, Build America (BABA) Act presents another layer of complexity.

Enphase's established history of proactive compliance with such legislative frameworks, including the IRA's domestic content provisions, grants it a distinct competitive edge. This preparedness allows Enphase to more readily capitalize on government support programs and maintain market access, a hurdle that can significantly deter or delay new entrants. The sheer effort and expertise required to ensure ongoing compliance can act as a substantial barrier, making it more difficult for newcomers to establish a foothold and compete on a level playing field.

- Regulatory Hurdles: Navigating complex product certifications and safety standards in the renewable energy sector poses a significant challenge for new entrants.

- Government Incentives and Tariffs: Understanding and complying with evolving government incentives, such as the IRA, and potential tariffs requires specialized knowledge and resources.

- Compliance as a Competitive Advantage: Enphase's proactive approach to compliance, demonstrated by its alignment with acts like the IRA and BABA Act, provides a distinct advantage over emerging competitors.

- Barriers to Entry: The substantial investment in legal, technical, and administrative resources needed for regulatory compliance acts as a considerable barrier, limiting the threat of new entrants.

Economies of Scale in Manufacturing and Sourcing

Enphase benefits significantly from economies of scale in its manufacturing and component sourcing, a direct result of its substantial production volumes. This allows the company to negotiate better prices for raw materials and achieve greater efficiency in its production processes. For instance, in 2023, Enphase reported a revenue of $711 million in the third quarter, indicating continued strong demand and production capacity.

New entrants would likely struggle to match Enphase's per-unit costs. Without comparable production scale, they would face higher initial expenses for manufacturing and sourcing essential components. This cost disadvantage would make it challenging to compete on price in a market where cost-effectiveness is a key purchasing driver for consumers and installers, potentially impacting their profitability from the outset.

- Economies of Scale: Enphase leverages large production volumes for cost advantages in manufacturing and sourcing.

- Competitive Pricing: New entrants face higher per-unit costs, hindering their ability to compete on price.

- Profitability Challenges: Initial cost disadvantages can squeeze profit margins for new players in the market.

- Market Sensitivity: The solar market is price-sensitive, making cost competitiveness crucial for success.

The threat of new entrants into Enphase's market is relatively low due to several significant barriers. The high capital investment required for advanced manufacturing and R&D, coupled with Enphase's strong patent portfolio, creates substantial financial and technological hurdles. Furthermore, established brand recognition and extensive distribution networks, reinforced by installer loyalty programs, make it difficult for newcomers to gain market access and trust.

| Barrier Type | Description | Impact on New Entrants | Enphase's Advantage |

|---|---|---|---|

| Capital Requirements | High investment in manufacturing, R&D, and supply chains. | Significant financial barrier. | Established infrastructure and scale. |

| Technology & IP | Proprietary microinverter tech and extensive patents. | Replication is difficult and costly; legal challenges. | Years of R&D and patent protection. |

| Brand & Distribution | Strong brand recognition and established installer networks. | Challenging to build trust and market access. | Years of relationship building and market penetration. |

| Regulatory Landscape | Complex certifications, safety standards, and evolving incentives (e.g., IRA). | Requires specialized knowledge and resources for compliance. | Proactive compliance and expertise in navigating regulations. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Inability to match Enphase's pricing and profitability. | Negotiating power for materials and production efficiency. |

Porter's Five Forces Analysis Data Sources

Our Enphase Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Enphase's own investor relations materials, SEC filings, and reports from reputable industry research firms like Wood Mackenzie and BloombergNEF. This blend of primary and secondary data allows for a comprehensive understanding of market dynamics and competitive pressures.