Enphase PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

Navigate the complex external forces shaping Enphase's future with our expert PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors create both opportunities and challenges for the company. Gain a strategic advantage by identifying key trends and their potential impact. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

Government incentives and tax credits play a crucial role in shaping Enphase Energy's market. The federal solar investment tax credit (ITC) continues to be a significant driver, and the Inflation Reduction Act (IRA) has further bolstered this by offering enhanced credits. For instance, the IRA provides a 30% ITC for solar installations, with potential for additional bonus credits, up to 70% in some cases, for projects utilizing domestically manufactured components, directly benefiting Enphase's U.S. production efforts.

These policies directly influence the upfront cost of Enphase's solar and battery storage solutions for consumers and businesses, making them more accessible and stimulating demand. The IRA's focus on domestic manufacturing is particularly impactful, incentivizing Enphase to expand its U.S.-based operations and supply chains, which can lead to more predictable costs and potentially higher profit margins.

Trade policies, especially tariffs on components, present a notable hurdle for Enphase. For instance, a substantial 145% tariff on battery imports from China, anticipated to take effect in 2025, is projected to squeeze the company's gross margins, potentially causing a dip in earnings during the second and third quarters of 2025.

In response to these evolving trade dynamics, Enphase is proactively strengthening its supply chain resilience. This includes a strategic push to expand its manufacturing footprint within the United States, aiming to lessen its dependence on imported materials and buffer against the financial impact of tariffs.

Geopolitical tensions and evolving international trade relations can introduce significant volatility into the renewable energy sector, directly impacting companies like Enphase. As a global player, Enphase navigates a landscape of diverse regional policies and the potential for shifts in trade agreements, which can affect supply chains and market access.

Enphase's strategic approach involves actively expanding into promising international markets. For instance, their focus on markets like Vietnam and Malaysia in 2024 and 2025 aims to build a more diversified revenue base, thereby mitigating risks associated with over-reliance on any single geographic region.

Energy Policy and Grid Modernization

Government initiatives promoting grid modernization and resilience, including incentives for grid-interactive solutions and virtual power plant (VPP) programs, are a significant tailwind for Enphase. These policies directly support Enphase's integrated platform, which is designed to enhance grid stability and reliability.

Policies such as California's Net Energy Metering Transition (NEM-MT) program, implemented in April 2023, are particularly beneficial. This program incentivizes grid resilience and energy storage, aligning perfectly with Enphase's storage-centric business model. The program's structure encourages homeowners to adopt solutions that can provide backup power and support the grid during peak demand or outages, areas where Enphase excels.

- Grid Modernization Incentives: Federal and state programs offer tax credits and rebates for energy storage and smart grid technologies, directly boosting demand for Enphase products. For instance, the Investment Tax Credit (ITC) under the Inflation Reduction Act of 2022 provides a 30% credit for qualifying solar and storage systems.

- Virtual Power Plant (VPP) Programs: Utilities are increasingly launching VPP programs, which aggregate distributed energy resources like Enphase-powered home batteries to provide grid services. In 2024, VPPs are projected to become a more significant revenue stream for homeowners and a key market for Enphase's bidirectional capabilities.

- Resilience-Focused Policies: California's NEM-MT program, effective from April 2023, shifts compensation for solar energy generation, making storage more economically attractive. This policy encourages the adoption of battery systems for self-consumption and grid support, a core offering for Enphase.

- Interconnection Standards: Evolving interconnection standards that facilitate the integration of distributed energy resources, including storage, into the grid are crucial. These standards streamline the process for deploying Enphase systems and participating in grid services.

Domestic Manufacturing Initiatives

The drive to bolster domestic manufacturing, significantly influenced by policies such as the Inflation Reduction Act's (IRA) Domestic Content Bonus Credit, is actively encouraging companies like Enphase Energy to ramp up their production within the United States. This strategic shift allows projects to access enhanced tax credits, thereby aligning with national objectives for clean energy development.

Enphase has demonstrably expanded its U.S. manufacturing capabilities for both microinverters and battery storage systems. For instance, by the end of 2023, Enphase reported that over 70% of its microinverters sold in the U.S. were manufactured domestically, a figure projected to increase. This expansion directly supports the creation of skilled American jobs and strengthens the domestic clean energy supply chain.

- IRA Impact: The IRA's bonus credits incentivize domestic production, making U.S.-made components more competitive.

- Enphase's U.S. Expansion: Enphase has invested heavily in U.S. manufacturing facilities, increasing local output of key products.

- Job Creation: These manufacturing initiatives are directly contributing to job growth in the American clean energy sector.

- Supply Chain Resilience: Increased domestic production enhances Enphase's supply chain resilience and reduces reliance on overseas manufacturing.

Government incentives, particularly the Inflation Reduction Act (IRA), are a major boon for Enphase, driving demand through tax credits like the 30% ITC, with bonuses for domestic content. This policy directly encourages Enphase's U.S. manufacturing expansion, aiming to increase the percentage of domestically produced microinverters and batteries. For example, Enphase reported over 70% of its U.S. microinverter sales were domestically manufactured by the end of 2023, a trend expected to continue, bolstering the domestic clean energy supply chain and creating jobs.

Trade policies, such as anticipated tariffs on battery imports from China in 2025, pose a challenge, potentially impacting Enphase's gross margins. In response, Enphase is enhancing supply chain resilience by increasing U.S. production, a strategy supported by national clean energy objectives and incentives for domestic content.

Policies promoting grid modernization and resilience, including virtual power plant (VPP) programs and net metering reforms like California's NEM-MT, are significant tailwinds. These initiatives align with Enphase's integrated solar and storage solutions, making them more attractive for homeowners and grid operators alike, especially as VPPs are projected to be a key market for Enphase's bidirectional capabilities in 2024.

| Policy/Program | Impact on Enphase | Data/Example |

|---|---|---|

| Inflation Reduction Act (IRA) | Boosts demand via tax credits (e.g., 30% ITC), incentivizes domestic manufacturing. | IRA's Domestic Content Bonus Credit encourages U.S. production. |

| U.S. Domestic Manufacturing Push | Increases Enphase's U.S. production, enhances supply chain resilience. | Over 70% of Enphase's U.S. microinverter sales were domestically manufactured by end of 2023. |

| Trade Tariffs | Potential negative impact on gross margins due to import costs. | Anticipated 145% tariff on Chinese battery imports in 2025 could affect Q2/Q3 2025 earnings. |

| Grid Modernization & VPP Programs | Drives demand for integrated storage and grid services solutions. | VPPs projected as a significant revenue stream for homeowners and a key market for Enphase in 2024. |

| Net Energy Metering Transition (NEM-MT) | Increases economic attractiveness of energy storage. | California's NEM-MT (effective April 2023) favors storage for self-consumption and grid support. |

What is included in the product

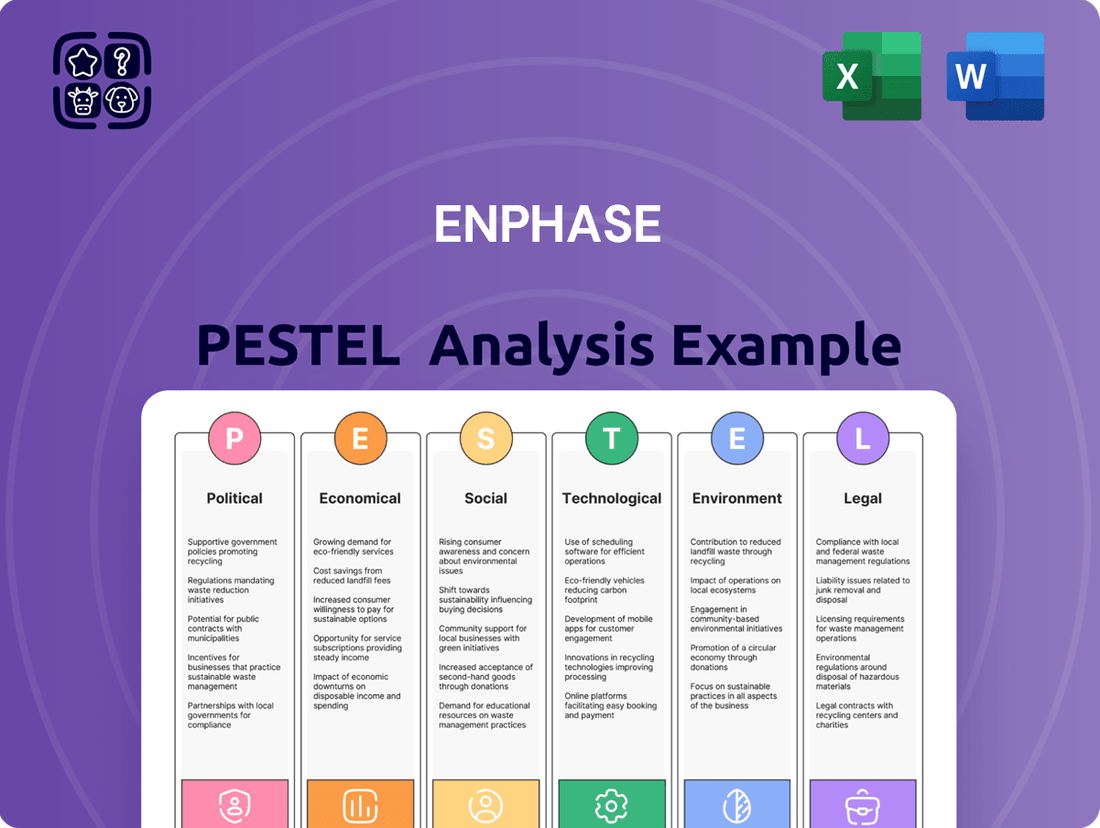

This Enphase PESTLE analysis explores how external macro-environmental factors uniquely affect the company across six dimensions: Political, Economic, Social, Technological, Environmental, and Legal.

Each section is backed by relevant data and current trends, offering forward-looking insights to support scenario planning and proactive strategy design.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Enphase's strategy.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal forces affecting Enphase.

Economic factors

Rising interest rates directly impact the affordability of solar installations, a significant concern for homeowners and businesses. As borrowing costs increase, the overall expense of financing a solar system, often a substantial upfront investment, becomes less attractive to potential customers. This can lead to a slowdown in demand, even as Enphase's innovative products contribute to declining system prices.

For instance, the Federal Reserve continued its tightening cycle through much of 2023 and into early 2024, with benchmark interest rates reaching levels not seen in decades. This environment makes loans for solar projects more expensive, potentially dampening consumer enthusiasm for adopting renewable energy solutions.

Enphase has proactively addressed this challenge by diversifying its financing options, notably through partnerships for third-party leasing models. These arrangements allow customers to benefit from solar energy without the burden of high upfront costs or direct financing, while still qualifying for valuable tax incentives like the Investment Tax Credit (ITC).

A general slowdown in the global economy often translates to decreased consumer spending, which can directly impact demand for solar equipment. This softening demand presents a significant challenge for companies like Enphase.

While Enphase reported strong revenue growth in the second quarter of 2025, the company anticipates headwinds in the U.S. residential solar market. This suggests a cautious outlook despite recent positive performance.

Furthermore, Enphase experienced a decline in European revenue during the first quarter of 2025. This downturn was attributed to softening regional demand, underscoring the sensitivity of the solar market to broader economic conditions.

Inflationary pressures and rising supply chain costs directly impact Enphase's profitability. For instance, in Q4 2023, Enphase reported a gross margin of 41.6%, a slight decrease from 41.9% in Q4 2022, partly attributed to these cost headwinds.

The company has experienced margin compression due to factors like reciprocal tariffs and increased component expenses. This was evident as Enphase navigated higher material costs throughout 2023, impacting its ability to maintain previous margin levels.

To counter these challenges, Enphase is actively diversifying its supply chain and bolstering domestic production capabilities. This strategy aims to mitigate the impact of global cost fluctuations and improve cost predictability for its operations.

Energy Prices and Consumer Savings

Rising traditional electricity prices directly boost demand for solar energy solutions like Enphase's. As utility costs climb, homeowners see greater value in energy independence and long-term savings, making Enphase products a more compelling investment. For instance, the average residential electricity price in the US reached approximately 17.3 cents per kilowatt-hour in early 2024, a notable increase from previous years, highlighting this trend.

Enphase's microinverter technology and battery storage systems offer a distinct advantage in regions experiencing significant electricity price hikes. By enabling consumers to generate and store their own power, these solutions mitigate the impact of escalating grid-tied energy costs, enhancing Enphase's market position.

- Increased Demand: Higher electricity bills incentivize consumers to explore alternative energy sources, directly benefiting solar providers.

- Cost Savings: Enphase systems allow homeowners to reduce their reliance on expensive grid electricity, leading to tangible savings.

- Energy Independence: Consumers gain greater control over their energy consumption and costs, especially in areas with volatile or rising utility rates.

Currency Fluctuations and International Sales

Currency market fluctuations directly impact Enphase Energy's international revenue and profitability. When the US dollar strengthens against other currencies, sales made in those foreign currencies translate into fewer dollars, potentially reducing reported revenue and profit margins. Conversely, a weaker dollar can boost international earnings when converted back to USD.

As Enphase continues to expand its global footprint, particularly in regions like Europe and Australia, changes in exchange rates become a more significant factor. For instance, if the Euro weakens against the dollar, Enphase's European sales will be worth less in dollar terms. This volatility necessitates careful financial management and hedging strategies.

Enphase's strategy of diversifying its international markets serves as a crucial mechanism to balance its exposure to any single currency's volatility. By operating in multiple countries with different currency dynamics, the company can mitigate the impact of adverse movements in any one currency. For example, strong performance in a market where the local currency strengthens against the USD could offset weaker results in a market with a depreciating currency.

- Impact on Revenue: A stronger USD in 2024 could reduce the dollar value of Enphase's international sales, impacting its reported top-line growth.

- Profitability Concerns: Fluctuations can also affect the cost of goods sold if components are sourced in different currencies, impacting gross margins.

- Geographic Diversification: Enphase's presence in over 30 countries helps to naturally hedge some currency risk, as varied currency movements can offset each other.

Economic factors present a mixed bag for Enphase. Rising interest rates, exemplified by the Federal Reserve's continued tightening through early 2024, increase financing costs for solar installations, potentially slowing demand despite Enphase's efforts in diversifying financing options. A general economic slowdown also poses a risk, as seen with Enphase anticipating headwinds in the U.S. residential market and experiencing a revenue decline in Europe during Q1 2025 due to softening demand.

Conversely, increasing traditional electricity prices, with U.S. residential rates reaching around 17.3 cents per kWh in early 2024, directly benefit Enphase by making solar solutions more attractive for cost savings and energy independence. Inflationary pressures and supply chain costs, however, continue to impact profitability, contributing to a slight gross margin decrease from 41.9% in Q4 2022 to 41.6% in Q4 2023, necessitating strategies like supply chain diversification and domestic production.

| Economic Factor | Impact on Enphase | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Interest Rates | Increased financing costs, potential demand slowdown | Federal Reserve tightening cycle through early 2024; U.S. benchmark rates at multi-decade highs. |

| Economic Growth | Reduced consumer spending, softened demand | Anticipated U.S. residential market headwinds; European revenue decline in Q1 2025 attributed to softening demand. |

| Electricity Prices | Increased demand for solar, enhanced value proposition | Average U.S. residential electricity price ~17.3 cents/kWh in early 2024. |

| Inflation/Supply Chain Costs | Margin compression, increased operating expenses | Gross margin slight decrease from 41.9% (Q4 2022) to 41.6% (Q4 2023). |

What You See Is What You Get

Enphase PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Enphase PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain critical insights into market trends, competitive landscapes, and strategic opportunities.

Sociological factors

Growing environmental awareness is a significant sociological driver for Enphase. Public concern over climate change and a desire for sustainable lifestyles are directly fueling demand for renewable energy technologies. This trend is evident in the increasing adoption of solar power and battery storage systems, areas where Enphase is a key player.

Consumers are actively seeking ways to lower their environmental impact, making solutions that offer energy independence and reduced carbon emissions highly attractive. Enphase's mission to advance a sustainable future resonates strongly with this societal shift, positioning the company to benefit from a growing market segment prioritizing ecological responsibility.

Data from 2024 indicates a continued surge in renewable energy investments globally, with solar power leading the charge. For instance, projections suggest the global solar PV market could reach over $300 billion by 2025, underscoring the powerful societal push towards cleaner energy sources that directly benefits companies like Enphase.

Societal attitudes are increasingly favoring renewable energy, with a growing number of consumers, particularly homeowners, actively seeking to adopt solar and battery storage solutions. This trend is directly fueling market expansion for companies like Enphase, which provide integrated home energy systems.

The desire for greater energy independence and a reduced carbon footprint is a significant driver. In 2024, surveys indicated that over 60% of homeowners in key markets expressed interest in installing solar panels, with battery storage being a priority for nearly half of those considering a solar purchase, demonstrating a clear demand for Enphase's offerings.

Societal trends are increasingly prioritizing energy independence and resilience, especially in areas susceptible to power disruptions or those with less stable electrical grids. This growing demand is a significant driver for solutions that offer reliable backup power.

Enphase's product ecosystem, featuring advanced battery storage and its signature microinverter technology, directly addresses this societal shift. These systems empower homeowners to maintain power during outages and gain granular control over their energy consumption, enhancing self-sufficiency.

For instance, in 2023, Enphase reported that its revenue from storage products saw substantial growth, reflecting the market's strong embrace of these resilient energy solutions. This indicates a clear consumer preference for systems that provide security and autonomy in their energy supply.

Changing Lifestyles and Home Energy Management

Modern lifestyles are increasingly embracing smart home technologies, with consumers seeking more control over their energy usage. This trend is evident in the growing adoption of connected devices, aiming for convenience and efficiency in managing household utilities. Enphase's integrated energy management software directly addresses this demand, offering a user-friendly platform to optimize solar production and consumption.

The desire for greater control and cost savings drives consumer interest in home energy management systems. For instance, a significant portion of homeowners in the US are interested in smart home technology that can help manage energy consumption, with studies showing upwards of 60% expressing such interest. Enphase's solutions, which include features like intelligent battery storage and load control, align perfectly with these evolving consumer preferences, making energy management more accessible and effective.

- Growing Smart Home Adoption: The global smart home market is projected to reach over $200 billion by 2025, indicating a strong consumer appetite for connected home solutions.

- Consumer Demand for Optimization: A substantial percentage of homeowners are actively looking for ways to reduce energy bills and improve home efficiency through technology.

- Enphase's Platform Appeal: Enphase's software offers a streamlined approach to managing solar energy, battery storage, and home loads, catering to the need for integrated and intuitive energy solutions.

Community Engagement and Social Responsibility

Enphase Energy demonstrates a strong commitment to corporate social responsibility, focusing on initiatives that provide equitable access to clean energy. Their programs often target low-income communities, aiming to boost brand reputation and attract consumers prioritizing social impact. For instance, Enphase's participation in programs offering enhanced tax credits for projects in underserved areas directly supports these objectives.

This focus on community engagement and social responsibility is increasingly important for consumer purchasing decisions. A significant portion of consumers, particularly younger demographics, actively seek out brands that align with their values. Enphase's efforts in this area can translate into a competitive advantage in a market where sustainability and ethical practices are highly regarded.

- Brand Reputation: Initiatives promoting clean energy access in low-income areas bolster Enphase's image as a socially conscious company.

- Consumer Appeal: Socially responsible practices attract a growing segment of consumers who prioritize ethical and sustainable brands.

- Policy Alignment: Participation in programs offering additional tax credits for projects in low-income areas reinforces Enphase's commitment to equitable energy solutions.

Societal shifts toward environmental consciousness and energy independence are profoundly influencing Enphase's market. Growing public concern over climate change fuels demand for renewable energy solutions, a trend amplified by increased consumer interest in solar and battery storage. This societal push is a significant tailwind for Enphase's integrated home energy systems.

The desire for energy resilience, particularly in the face of grid instability, is another key sociological factor. Consumers are increasingly seeking reliable backup power, making Enphase's battery storage solutions highly attractive. This demand is further supported by the widespread adoption of smart home technologies, where consumers want greater control over their energy usage and costs.

Enphase's commitment to corporate social responsibility, including initiatives for equitable clean energy access, also resonates with consumers. This focus on social impact enhances brand reputation and appeals to a growing segment of the market that prioritizes ethical and sustainable brands. For instance, participation in programs offering enhanced tax credits for projects in underserved areas aligns with these values.

| Sociological Factor | Description | Impact on Enphase | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Environmental Awareness | Increasing public concern for climate change and sustainability. | Drives demand for solar and battery storage solutions. | Global solar PV market projected to exceed $300 billion by 2025. |

| Energy Independence & Resilience | Desire for reliable backup power and reduced reliance on traditional grids. | Boosts adoption of Enphase's battery storage systems. | Over 60% of US homeowners interested in solar, with battery storage a priority for nearly half. |

| Smart Home Integration | Growing consumer interest in connected devices for energy management and control. | Enhances appeal of Enphase's integrated software platform. | Global smart home market projected to exceed $200 billion by 2025. |

| Social Responsibility | Consumer preference for brands with ethical practices and community engagement. | Strengthens brand reputation and market appeal. | Growing consumer segment prioritizes brands aligned with their values. |

Technological factors

Enphase's competitive strength is deeply rooted in its ongoing advancements in microinverter technology. The introduction of next-generation products like the IQ8 series significantly boosts system efficiency and reliability.

These innovations, including enhanced grid-forming capabilities and improved energy harvesting, are crucial for maintaining Enphase's market leadership. Future iterations, such as the anticipated IQ9, will further refine integration and performance, solidifying Enphase's technological advantage.

The continuous evolution of battery storage technology is a key technological factor for Enphase. The recent introduction of their 4th-generation IQ Battery 10C, featuring enhanced energy density and the adoption of Lithium Iron Phosphate (LFP) chemistry, directly addresses market needs.

These technological leaps are vital as they improve the capacity, safety, and overall lifespan of Enphase's storage solutions. This directly supports the increasing consumer desire for greater energy independence and resilience, a trend that has seen significant growth in 2024.

Enphase's commitment to its Enlighten energy management software, bolstered by significant investments in AI and machine learning, represents a crucial technological advantage. This software is designed to offer users real-time insights into their energy consumption and production, enabling smarter decisions.

The integration of AI allows for dynamic optimization of energy usage across the Enphase ecosystem, from solar production to battery storage and EV charging. This intelligent management not only enhances efficiency but also contributes to a more seamless and user-friendly experience for homeowners and installers alike.

By continuously refining its software capabilities, Enphase is positioning itself to capitalize on the growing demand for intelligent, connected home energy solutions. For instance, Enphase reported a 20% year-over-year increase in software revenue for Q1 2024, highlighting the market's positive reception to these technological advancements.

Integration of EV Charging Solutions

Enphase's strategic move into EV charging, exemplified by products like the IQ EV Charger 2, shows a keen understanding of evolving consumer demands in the clean energy sector. This integration directly addresses the burgeoning electric vehicle market, allowing homeowners to seamlessly incorporate charging into their existing solar and battery setups.

The synergy between solar, battery storage, and EV charging offers significant advantages. By enabling homeowners to charge their EVs using self-generated solar power or stored battery energy, Enphase's solutions can substantially reduce reliance on grid electricity, leading to lower monthly utility bills. This smart energy management is particularly appealing as EV adoption accelerates.

- Market Growth: The global electric vehicle market is projected to reach over 30 million units sold annually by 2025, creating a substantial customer base for integrated charging solutions.

- Cost Savings: Studies indicate that charging an EV with home solar can reduce charging costs by up to 70% compared to using grid electricity, a key selling point for consumers.

- Product Expansion: Enphase's IQ EV Charger 2, launched in 2023, represents a direct technological response to the increasing demand for smart, connected EV charging infrastructure.

Manufacturing Process Innovation and Automation

Enphase is heavily investing in manufacturing process innovation and automation to boost its production capabilities. This focus is crucial for meeting the surging demand for its energy systems and for driving down costs. By enhancing efficiency, Enphase aims to improve product quality and accelerate the rollout of its solutions.

The company's strategy includes scaling its U.S. production facilities, which not only increases output but also positions Enphase to benefit from domestic content incentives. These incentives are becoming increasingly important as governments worldwide encourage local manufacturing.

- Automation in manufacturing has been a key driver for Enphase, allowing for more consistent product quality.

- Scaling U.S. production facilities is a strategic move to capture domestic content incentives, potentially reducing costs.

- Innovations in manufacturing processes are directly linked to Enphase's ability to meet growing market demand efficiently.

- Faster deployment of systems is a direct benefit of streamlined and automated production lines.

Enphase's technological edge is continuously sharpened by its advanced microinverter technology, with the IQ8 series offering superior grid-forming capabilities and efficiency. The company's ongoing development, including the anticipated IQ9, aims to further integrate and enhance performance, solidifying its market position.

The company's Enlighten energy management software, boosted by AI and machine learning, provides users with real-time energy insights for optimized usage across solar, battery, and EV charging. This intelligent management enhances efficiency and user experience, with Enphase reporting a 20% year-over-year increase in software revenue for Q1 2024.

Enphase's expansion into EV charging, with products like the IQ EV Charger 2, aligns with the accelerating EV market. This integration allows homeowners to charge EVs using solar or stored battery power, reducing reliance on the grid and utility costs, a significant advantage as EV adoption grows globally.

| Technology Area | Key Innovation | Impact/Benefit |

|---|---|---|

| Microinverters | IQ8 Series (Grid-Forming) | Enhanced system efficiency, reliability, and grid independence. |

| Battery Storage | IQ Battery 10C (LFP Chemistry) | Improved energy density, safety, and lifespan, meeting demand for energy resilience. |

| Energy Management Software | AI/ML Integration in Enlighten | Real-time insights, dynamic energy optimization, seamless user experience. |

| EV Charging | IQ EV Charger 2 | Integration with solar/battery for cost-effective EV charging, reduced grid reliance. |

Legal factors

Enphase Energy must meticulously adhere to federal tax legislation, particularly the Investment Tax Credit (ITC) and the Inflation Reduction Act (IRA). These laws significantly influence the financial viability of solar and battery storage systems, directly impacting Enphase's customer base and its market competitiveness. For instance, the IRA extended the ITC through 2032 and introduced new credits for energy storage, providing a substantial tailwind for the industry.

Ensuring Enphase's products and installation partners meet the evolving qualification criteria for these tax incentives, including the domestic content bonuses introduced by the IRA, is paramount. These bonuses can add a significant percentage to the tax credit, making Enphase systems more attractive to consumers and businesses alike, thereby driving demand and sales volume.

Enphase must navigate a complex web of international trade regulations and tariffs, which directly affect its global operations and component sourcing. For instance, the significant 145% tariff imposed on battery imports from China in 2023, as part of broader trade policies, forces Enphase to re-evaluate its supply chain strategies. This tariff directly impacts the cost of key components, potentially influencing product pricing and overall profitability for the company.

Enphase navigates a complex web of state and local energy regulations across its markets. These rules cover everything from building codes to how solar systems connect to the grid, known as interconnection standards. For instance, California's Net Energy Metering 3.0 (NEM 3.0) policy, implemented in April 2023, significantly altered compensation for solar energy exported to the grid, impacting system economics and requiring Enphase to adapt its offerings and customer guidance.

Product Safety and Certification Standards

Enphase must adhere to evolving product safety and certification standards globally to ensure the reliable and secure operation of its sophisticated energy systems. These regulations are critical for market access and consumer trust, particularly for microinverters and battery storage solutions. For instance, compliance with Brazil's ABNT NBR 17193 fire safety standard is a key element of their operational framework.

Meeting these rigorous requirements involves significant investment in testing and validation. In 2023, the company continued to secure certifications across various international markets, a process that directly impacts product launch timelines and manufacturing costs. Failure to meet these standards can lead to costly recalls or market exclusion.

- Global Compliance: Enphase actively pursues certifications for its products in key markets, demonstrating a commitment to international safety norms.

- ABNT NBR 17193: Compliance with this specific Brazilian fire safety standard is crucial for market penetration in that region.

- Operational Costs: Maintaining compliance involves ongoing expenses for testing, documentation, and potential product modifications.

- Market Access: Meeting safety standards is a prerequisite for selling products in many countries, directly influencing revenue potential.

Intellectual Property and Patents

Protecting its intellectual property, particularly its innovative microinverter technology and energy management software, is paramount for Enphase Energy's sustained competitive edge. The company actively pursues legal avenues to safeguard these core innovations, thereby deterring infringement and reinforcing its position as a market leader in the solar energy sector.

Enphase's robust patent portfolio is a significant asset. As of early 2024, the company held hundreds of granted patents globally, with a substantial portion covering its unique microinverter architecture and advanced software algorithms for energy optimization and grid services. This legal protection is vital in a rapidly evolving and competitive clean energy market.

- Global Patent Portfolio: Enphase maintained a significant number of granted patents worldwide by early 2024, covering its core microinverter and software technologies.

- Infringement Defense: Legal actions are taken to prevent competitors from replicating Enphase's patented technologies, ensuring market differentiation.

- Market Leadership: The strength of its intellectual property rights helps Enphase maintain its leadership position and command premium pricing for its differentiated products.

- R&D Investment Protection: Patents safeguard the substantial investments Enphase makes in research and development, encouraging continued innovation.

Enphase Energy's operations are heavily influenced by government incentives and trade policies. The Inflation Reduction Act (IRA), which extended the Investment Tax Credit (ITC) through 2032 and added credits for energy storage, provides a significant boost to the solar and storage market, directly benefiting Enphase's customer base and sales. For instance, the IRA's domestic content bonus can increase tax credits by up to 10%, making Enphase systems more appealing to consumers and driving demand.

Navigating international trade regulations and tariffs is crucial for Enphase's global supply chain and pricing. Tariffs, such as the 145% imposed on Chinese battery imports in 2023, directly impact component costs and necessitate strategic adjustments to sourcing and manufacturing to maintain competitiveness.

Compliance with a patchwork of state and local energy regulations, including interconnection standards and net metering policies, is essential for market access and revenue generation. California's NEM 3.0 policy, effective April 2023, significantly altered solar economics, requiring Enphase to adapt its product offerings and customer guidance to navigate these evolving regulatory landscapes.

Protecting its intellectual property, particularly its patented microinverter technology, is vital for Enphase's sustained market leadership. By early 2024, Enphase held hundreds of global patents, safeguarding its innovations and deterring competitors, which allows the company to maintain premium pricing and continue investing in R&D.

Environmental factors

Enphase is a key player in reducing global carbon footprints through its clean energy solutions. Its microinverter technology enables efficient solar power generation and storage, directly contributing to lower greenhouse gas emissions. By the end of 2023, Enphase systems had helped avoid an estimated 13.4 million metric tons of CO2e, a significant step towards a sustainable future.

Enphase's commitment to environmental stewardship is evident in its resource management and sustainable manufacturing. The company actively seeks to minimize its ecological footprint through strategic operational choices.

A key initiative for Enphase is the reduction of its Scope 2 emissions. This is being achieved by prioritizing the sourcing of renewable energy for its global facilities. Furthermore, Enphase is increasing its on-site generation capacity, directly contributing to a more sustainable energy ecosystem.

Enphase Energy is increasingly focused on waste reduction and recycling across its operations. In 2023, the company reported diverting 87% of its manufacturing waste from landfills, a significant step towards a circular economy. This commitment is crucial as global regulations on electronic waste (e-waste) become more stringent, with many regions aiming for higher recycling rates for solar components by 2025.

Climate Change Adaptation and Grid Resilience

Enphase's energy storage solutions are increasingly crucial for adapting to climate change, bolstering grid resilience against extreme weather. As communities experience more frequent disruptions from events like hurricanes and heatwaves, the need for reliable backup power is escalating. For instance, in 2024, the US saw a significant increase in weather and climate disaster costs, underscoring the urgency for such technologies.

The market for distributed energy resources, including battery storage, is projected for substantial growth. By 2025, the global energy storage market is expected to reach hundreds of billions of dollars, driven by climate adaptation needs and renewable energy integration. Enphase's systems directly address this by offering:

- Enhanced Grid Stability: Providing localized power during grid outages caused by severe weather.

- Backup Power: Ensuring essential services and homes remain operational during climate-related disruptions.

- Demand Charge Management: Helping to reduce strain on the grid during peak demand periods, which are often exacerbated by climate events.

Product Lifecycle Environmental Impact

Environmental considerations throughout a product's entire journey, from initial design and manufacturing to its eventual disposal, are increasingly critical. This lifecycle approach helps identify and mitigate potential ecological harm at every stage. For Enphase, this means scrutinizing every component and process for its environmental footprint.

Enphase's strategic choice to utilize lithium iron phosphate (LFP) battery chemistry is a prime example of this focus. LFP is favored not only for its enhanced safety and extended lifespan compared to some other lithium-ion chemistries, but also for its more sustainable material composition, reducing reliance on cobalt. This contributes to a product that is inherently more environmentally friendly over its operational life.

The company's commitment extends to reducing waste and promoting circular economy principles within its operations. For instance, Enphase aims to design products for easier disassembly and recycling, extending the useful life of materials. Their 2023 Sustainability Report highlighted a focus on reducing manufacturing waste, with specific targets set for waste diversion from landfills.

Key environmental considerations for Enphase include:

- Material Sourcing: Ensuring responsible sourcing of raw materials used in their energy storage systems and microinverters.

- Manufacturing Efficiency: Implementing processes that minimize energy consumption and waste generation in their production facilities.

- Product Longevity and Recyclability: Designing for durability and ease of repair, alongside developing end-of-life recycling programs for their products.

- Energy Efficiency of Products: Continuously improving the energy efficiency of their microinverters and battery systems to reduce overall energy consumption during operation.

Enphase's environmental impact is largely positive, driven by its clean energy solutions. The company's microinverters and storage systems directly contribute to reducing greenhouse gas emissions. By the close of 2023, Enphase systems had facilitated the avoidance of approximately 13.4 million metric tons of CO2e, a substantial achievement in combating climate change.

The company is actively working to minimize its operational footprint, with a strong focus on reducing Scope 2 emissions by prioritizing renewable energy sources for its facilities and increasing on-site generation. Furthermore, Enphase is committed to waste reduction, having diverted 87% of its manufacturing waste from landfills in 2023, aligning with increasing global e-waste regulations expected to tighten by 2025.

Enphase's energy storage solutions are vital for grid resilience against climate change impacts, offering backup power and demand charge management. The global energy storage market is anticipated to surge by 2025, reaching hundreds of billions of dollars, indicating a strong demand for Enphase's offerings.

PESTLE Analysis Data Sources

Our Enphase PESTLE analysis is built on a robust foundation of data from leading energy industry research firms, government regulatory bodies, and economic forecasting agencies. We integrate insights from market trend reports, technological innovation databases, and environmental impact assessments to provide a comprehensive view.