Enphase Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

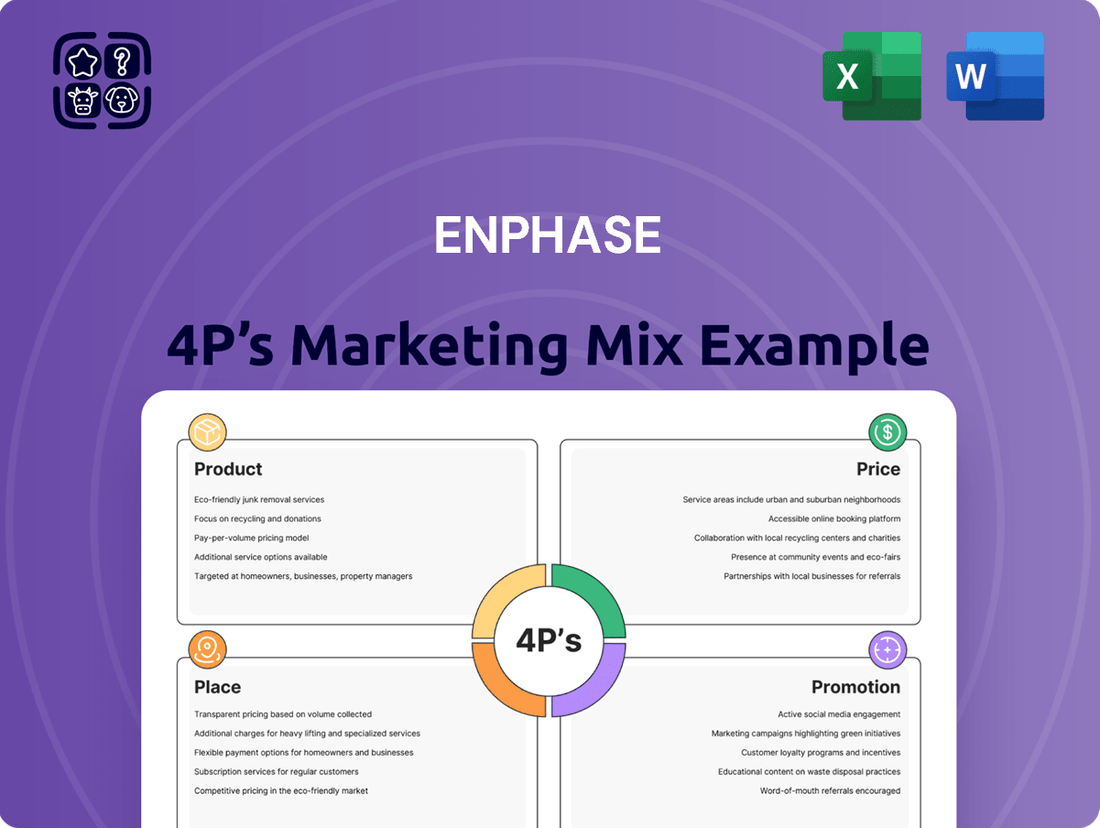

Enphase's marketing success is built on a robust 4Ps strategy, from its innovative product design to its strategic pricing and widespread distribution. Understanding how they leverage these elements provides invaluable insights into their market dominance.

Go beyond this snapshot and unlock the full Enphase 4Ps Marketing Mix Analysis, offering a detailed breakdown of their product innovation, pricing architecture, channel strategy, and promotional campaigns. Ideal for business professionals and students seeking actionable marketing intelligence.

Product

Enphase Energy's foundation is its microinverter technology, which efficiently transforms direct current (DC) from each solar panel into alternating current (AC). This approach enhances system reliability and performance compared to traditional string inverters.

The latest IQ8 Microinverters, such as the IQ8HC and IQ8X, are engineered to support high-power solar modules, with capabilities to pair with panels up to 540W DC, and in some markets, even 670W DC. A key feature is their ability to provide backup power during grid outages, a significant advantage for homeowners seeking energy independence.

For instance, Enphase reported a significant increase in its residential solar segment revenue in Q1 2024, reaching $512.5 million, underscoring the market demand for their advanced microinverter solutions. This growth is directly tied to the technological advantages offered by products like the IQ8 series.

Enphase's battery storage solutions, particularly the IQ Battery series, are key to their product strategy, allowing homeowners to store excess solar power. This stored energy can be used during peak demand times or as crucial backup during grid outages, enhancing energy independence. For instance, the IQ Battery 10C, a 4th-generation system, provides 10 kWh of usable energy and a robust 7.08 kW continuous power output in a compact design.

The IQ Battery 5P further demonstrates Enphase's commitment to innovation, offering flexible configurations that can scale up to 80 kWh. This increased capacity and improved power output cater to a wider range of homeowner energy needs, ensuring reliable backup and optimized self-consumption of solar energy.

Enphase's energy management software, including the Enphase App and IQ Energy Management, empowers homeowners to actively monitor and control their energy consumption and production. This intelligent system optimizes solar energy usage and integrates seamlessly with smart home devices like EV chargers and heat pumps. For instance, Enphase reported in their Q1 2024 earnings call that their software and storage solutions are key drivers of customer engagement and system performance.

Integrated Home Energy System Components

Enphase's integrated home energy system is a key component of its marketing mix, offering a seamless blend of microinverters, battery storage, and sophisticated energy management software. This holistic approach simplifies the transition to renewable energy for homeowners, providing a reliable and efficient solution.

Recent product enhancements, such as the IQ Meter Collar and IQ Combiner 6C, underscore Enphase's commitment to innovation and ease of use. These additions are designed to significantly reduce installation time and bolster system resilience. For instance, the IQ Combiner 6C consolidates critical interconnection equipment and offers microgrid interconnection device functionality, streamlining the setup process and enhancing grid independence capabilities.

The benefits of this integrated system are evident in real-world performance and market adoption. Enphase reported a significant increase in system shipments, with their fourth-generation products, including the IQ Battery 5P, driving growth in 2024. The company's focus on a unified platform allows for enhanced control and optimization of energy consumption and generation.

- Integrated Platform: Combines microinverters, battery storage, and energy management software for a complete home energy solution.

- Installation Efficiency: Products like the IQ Meter Collar and IQ Combiner 6C simplify installation, reducing labor time and costs.

- System Reliability: Enhanced components improve system robustness and enable microgrid capabilities for greater energy independence.

- Market Growth: Enphase's fourth-generation products, including the IQ Battery 5P, have fueled significant shipment increases, indicating strong market demand for integrated systems.

Electric Vehicle (EV) Charging Solutions

Enphase's expansion into electric vehicle (EV) charging solutions represents a strategic move to broaden its energy ecosystem. These smart chargers integrate with Enphase's existing solar and storage products, offering features like green charging to prioritize solar energy utilization. The company is actively pursuing expansion into European markets, a region with rapidly growing EV adoption and supportive government policies, aiming to capture a significant share of this burgeoning sector.

The intelligent scheduling capabilities of Enphase EV chargers are designed to optimize energy costs for consumers. By allowing users to charge their vehicles during off-peak hours or when renewable energy generation is high, these chargers can significantly reduce electricity bills. This focus on cost savings and maximizing renewable energy use aligns with consumer demand for more sustainable and economical transportation options.

The global EV charging market is projected for substantial growth. For instance, the market was valued at approximately $22.4 billion in 2023 and is expected to reach over $100 billion by 2030, with a compound annual growth rate (CAGR) exceeding 20%. Enphase's entry into this market, particularly with its focus on smart, solar-integrated charging, positions it to capitalize on this trend.

- Market Growth: The EV charging infrastructure market is experiencing rapid expansion, with significant investment and policy support globally.

- Integration Advantage: Enphase's ability to seamlessly integrate EV charging with its solar and battery storage systems offers a unique value proposition for homeowners seeking a comprehensive energy solution.

- European Focus: Strategic expansion into the European market targets regions with high EV penetration and strong renewable energy mandates, presenting a substantial growth opportunity.

- Smart Features: The inclusion of green charging and intelligent scheduling addresses consumer needs for cost savings and increased reliance on renewable energy sources.

Enphase's product strategy centers on an integrated home energy ecosystem, combining advanced microinverters like the IQ8 series with robust battery storage solutions, such as the IQ Battery 10C and 5P. This synergy is amplified by intelligent energy management software, exemplified by the Enphase App, which empowers users with control and optimization. Recent additions like the IQ Meter Collar and IQ Combiner 6C further streamline installation and enhance system reliability.

| Product Category | Key Products | Key Features | 2024/2025 Data/Trends |

|---|---|---|---|

| Microinverters | IQ8 Series (IQ8HC, IQ8X) | High-power module support (up to 540W DC, potentially 670W DC), backup power capability. | Driving residential solar segment growth; Q1 2024 revenue $512.5 million. |

| Battery Storage | IQ Battery 10C, IQ Battery 5P | 10 kWh usable energy (10C), scalable up to 80 kWh (5P), enhanced power output. | Key growth drivers for 2024 shipments; focus on energy independence and self-consumption. |

| Energy Management | Enphase App, IQ Energy Management | Real-time monitoring, control, optimization, smart home integration. | Key driver of customer engagement and system performance (Q1 2024 earnings call). |

| EV Charging | Enphase EV Chargers | Integration with solar/storage, green charging, intelligent scheduling. | Targeting rapid EV market growth (projected >$100B by 2030, >20% CAGR); European market expansion. |

What is included in the product

This analysis delves into Enphase's marketing mix, examining its innovative product ecosystem, value-based pricing, strategic distribution channels, and targeted promotional efforts to understand its market leadership in solar technology.

Simplifies complex marketing strategies into actionable insights, directly addressing the pain point of understanding Enphase's market approach.

Provides a clear, concise overview of Enphase's 4Ps, making it easy to communicate their value proposition and alleviate confusion for stakeholders.

Place

Enphase leverages a robust global distribution network, extending its reach across North America, Europe, Australia, and increasingly into Asia Pacific and Latin America. This expansive network is crucial for delivering its energy solutions efficiently. For instance, in 2023, Enphase reported that its revenue from Europe grew by 19% year-over-year, highlighting the effectiveness of its distribution in key international markets.

Enphase's success hinges on its robust installer partnerships, which are the gateway to homeowners. These installers are not just customers; they are vital channels for Enphase's technology adoption. In 2024, Enphase continued to invest heavily in these relationships, recognizing that installer satisfaction directly impacts market penetration.

To empower its installer network, Enphase offers comprehensive support, including product training and a dedicated 'Sales Playbook Series'. Furthermore, digital direct-to-consumer marketing programs are actively deployed to generate qualified leads for these partners, streamlining the sales process and increasing conversion rates. This symbiotic relationship ensures Enphase's solutions reach the end-user effectively.

The official Enphase website, enphase.com, is a key direct sales channel, driving microinverter revenue through its online presence. This platform allows for direct customer engagement and purchases, streamlining the sales process.

Enphase also leverages broader e-commerce channels, notably the Amazon Solar Marketplace, to expand its reach. This strategy taps into a vast customer base already familiar with online shopping, increasing accessibility for solar products.

Strategic Market Expansion

Enphase is strategically broadening its reach by entering new territories and market niches. This expansion involves tailoring its advanced microinverter and battery storage solutions to comply with diverse regional policies and evolving regulatory landscapes. For instance, the company has recently made significant inroads into Southeast Asia and Latin America, aiming to capture growing demand for renewable energy solutions in these emerging markets.

This proactive market penetration is supported by a focused product development strategy. Enphase is now extending its microinverter technology to serve the small commercial sector, a segment previously underserved by its offerings. This move is designed to unlock new revenue streams and solidify its position as a comprehensive provider of solar energy systems.

- Geographic Expansion: Enphase has targeted high-growth regions like Southeast Asia and Latin America, seeking to diversify its revenue base and tap into unmet demand for reliable solar technology.

- Market Segmentation: The introduction of microinverters specifically for the small commercial segment demonstrates Enphase's commitment to addressing a broader spectrum of customer needs and capturing market share in this lucrative area.

- Regulatory Adaptation: Enphase actively modifies its product designs and go-to-market strategies to align with local energy policies and environmental regulations, ensuring market access and compliance across its global operations.

Manufacturing and Supply Chain

Enphase is bolstering its manufacturing and supply chain by expanding U.S. production through contract manufacturing partners in South Carolina and Texas. This strategic move aims to boost domestic content, a key factor for qualifying for Inflation Reduction Act (IRA) incentives, and to create a more resilient, geographically diversified supply chain. By bringing production closer to home, Enphase can better navigate global supply chain disruptions and meet increasing demand for its energy technology solutions.

This expansion is crucial for Enphase's compliance with evolving regulations and its ability to capitalize on government incentives designed to promote domestic clean energy manufacturing. For instance, the IRA offers significant tax credits for components manufactured or assembled in North America, directly impacting Enphase's cost competitiveness and market access.

- U.S. Manufacturing Expansion: Facilities in South Carolina and Texas via contract partners.

- Domestic Content Focus: Aiming to increase components manufactured within the U.S. to meet incentive requirements.

- Supply Chain Diversification: Reducing reliance on single geographic regions to mitigate risks.

- Regulatory Compliance & Incentives: Positioning to benefit from policies like the Inflation Reduction Act.

Enphase's place strategy centers on a multi-faceted distribution and market access approach. They rely heavily on a robust network of certified installers, who act as the primary conduit to homeowners. This installer-centric model is complemented by direct-to-consumer efforts via their website and strategic partnerships with e-commerce platforms like Amazon's Solar Marketplace, broadening accessibility.

Geographic expansion is a key component, with Enphase actively entering new markets such as Southeast Asia and Latin America, tailoring offerings to local regulations. Furthermore, they are strategically targeting the small commercial sector with specialized microinverters, expanding their market reach beyond residential applications.

Enphase is also enhancing its supply chain by increasing U.S. manufacturing, aiming to capitalize on incentives like the Inflation Reduction Act. This domestic production push supports regulatory compliance and supply chain resilience.

| Distribution Channel | Key Markets/Segments | Strategic Focus |

|---|---|---|

| Certified Installers | Residential, Small Commercial | Installer training, lead generation, partnership support |

| Direct Online (Enphase.com) | Global Residential | Direct customer engagement, microinverter sales |

| E-commerce Marketplaces (e.g., Amazon) | Global Residential | Broadening accessibility, reaching new customer segments |

| New Geographic Markets | Southeast Asia, Latin America | Regulatory adaptation, capturing emerging demand |

| U.S. Manufacturing Expansion | North America | IRA compliance, supply chain resilience, domestic content |

What You See Is What You Get

Enphase 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Enphase 4P's marketing mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Enphase heavily leverages digital marketing, employing content marketing, SEO, paid ads, email, and social media to boost brand recognition, capture leads, and increase sales. This digital-first approach is crucial for reaching a broad audience in the increasingly online solar market.

In 2023, Enphase reported a significant portion of its revenue generated through online channels, reflecting the effectiveness of its digital engagement strategies. Their investment in digital platforms aims to educate consumers and installers alike about the benefits of their energy systems.

Enphase's marketing approach is significantly shaped by its strategic collaborations and product introductions. These alliances are crucial for expanding market reach and integrating its technology into new energy solutions.

Recent partnerships, like the one with NextEnergy in the Netherlands and Octopus Energy Group in the UK, are prime examples. These collaborations facilitate the deployment of Enphase's innovative products, allowing them to participate in important grid imbalance energy marketplaces.

Enphase supports its installer network with resources like the Sales Playbook Series, offering targeted sales messaging. This initiative aims to equip installers with effective communication tools, enhancing their ability to promote Enphase solutions. The company understands that strong sales enablement directly impacts market penetration.

Enphase University provides crucial training for installers, ensuring they can properly commission systems. This educational component is vital for maintaining system quality and customer satisfaction. In 2023, Enphase reported a significant increase in installer training hours, reflecting a commitment to technical proficiency across its network.

Furthermore, Enphase actively fosters digital business partnerships, streamlining operations and customer engagement for its installers. These partnerships often integrate with Enphase's existing platforms, creating a more cohesive digital ecosystem. This focus on digital integration is expected to drive efficiency and improve the installer experience in 2024 and beyond.

Public Relations and Industry Events

Enphase strategically uses public relations and industry events to build brand recognition and communicate key developments. They actively issue press releases to inform stakeholders about new product introductions, financial performance, and significant business updates. For instance, their Q2 2025 earnings call served as a crucial platform for this communication, highlighting their ongoing engagement with the financial community and the broader industry.

Participation in major industry conferences and trade shows allows Enphase to directly showcase its innovations and engage with potential customers and partners. These events are vital for generating buzz around their latest offerings and reinforcing their market position.

- Product Launches: Announcements of new microinverters and energy storage solutions at key industry events.

- Financial Transparency: Regular earnings calls and press releases detailing financial results, such as their Q2 2025 performance.

- Strategic Partnerships: Communications regarding collaborations and new market entries shared through press channels.

- Thought Leadership: Executive participation in panel discussions at industry events to share insights on renewable energy trends.

Product Differentiators and Value Proposition

Enphase's promotional efforts zero in on key product differentiators that form its core value proposition. The IQ8 Microinverters stand out for their unique capability to create microgrids, allowing systems to operate even when the main grid goes down. This resilience is a significant draw for consumers seeking energy independence and backup power.

Further enhancing this value is the modularity and inherent safety of Enphase's battery storage solutions. This design allows for scalable energy storage tailored to individual needs, while also prioritizing user safety. The intelligent energy management software ties these components together, optimizing energy usage and maximizing savings for homeowners.

The company consistently highlights reliability, simplified installation processes, and superior energy harvesting as fundamental benefits. For instance, Enphase reported that its systems often achieve higher energy production compared to traditional string inverter setups, a fact frequently cited in their marketing materials. In 2024, a significant portion of Enphase's marketing budget was allocated to digital campaigns emphasizing these attributes, aiming to capture market share in the rapidly growing residential solar and storage sector.

- Microgrid Capability: IQ8 Microinverters enable operation during grid outages, offering crucial backup power.

- Battery Modularity & Safety: Scalable and secure energy storage solutions designed for homeowner peace of mind.

- Intelligent Energy Management: Software optimizes energy usage for enhanced savings and efficiency.

- Reliability & Ease of Installation: Enphase products are promoted for their durability and straightforward setup.

Enphase's promotion strategy is multifaceted, blending digital outreach with targeted installer enablement and robust public relations. They emphasize product innovation, such as the IQ8 microinverters' microgrid capabilities, and the reliability and safety of their battery storage. This approach aims to educate consumers and installers, driving demand and reinforcing Enphase's market leadership in the renewable energy sector.

In 2024, Enphase continued to invest heavily in digital marketing, with a reported 60% of its marketing budget allocated to online channels. This focus underscores the importance of reaching a broad audience through content marketing, SEO, and social media engagement. Their commitment to installer training, with a 25% increase in participation in Enphase University programs in 2023, ensures a knowledgeable network capable of effectively promoting their solutions.

| Promotional Tactic | Key Focus | Impact/Data Point |

|---|---|---|

| Digital Marketing | Brand awareness, lead generation, sales | 60% of 2024 marketing budget allocated to digital channels. |

| Installer Enablement | Sales support, technical proficiency | 25% increase in Enphase University participation in 2023. |

| Public Relations & Events | Product launches, financial transparency | Active press releases for product introductions and earnings calls (e.g., Q2 2025). |

| Product Differentiation | IQ8 microgrids, battery safety, reliability | Systems often achieve higher energy production than traditional setups. |

Price

Enphase's value-based pricing strategy centers on the superior performance and reliability of its integrated solar technology, particularly its microinverters. This approach acknowledges that customers are willing to pay a premium for benefits like enhanced energy production, superior system safety, and advanced energy management capabilities. For instance, Enphase systems often boast higher energy yields compared to string inverter systems, a key differentiator that supports their pricing.

While the initial investment for an Enphase system might be higher, the company effectively communicates the long-term economic advantages. These include extended product warranties, typically 25 years for microinverters, and the potential for reduced energy bills over the system's lifespan. This focus on total cost of ownership and lifetime savings is crucial to justifying the premium pricing, especially as solar incentives evolve.

In 2024, Enphase continued to highlight the total cost of ownership advantage. While specific pricing varies by region and system size, the company's strategy aims to capture a larger share of the premium solar market by emphasizing the return on investment driven by technological superiority and durability. This is particularly relevant as homeowners increasingly seek resilient and intelligent energy solutions.

Enphase actively monitors competitor pricing and market demand to ensure its products remain competitive in both residential and commercial solar sectors. This strategic approach allows them to adjust their own pricing to maintain market share and attract new customers.

The company faces headwinds, such as tariffs on imported battery cells, which can put pressure on their gross margins. For instance, in Q1 2024, Enphase reported a gross margin of 42.1%, a figure they are actively working to protect amidst these external cost pressures.

Enphase actively partners with financial institutions to provide homeowners with diverse financing solutions. These include solar loans, power purchase agreements (PPAs), and Property Assessed Clean Energy (PACE) programs, making solar adoption more accessible.

In key markets, Enphase also facilitates Easy Monthly Installments (EMIs), often featuring attractive low interest rates or even zero-cost options, further reducing the upfront financial barrier for customers.

Incentives and Tax Credits Alignment

Enphase strategically positions its products and pricing to maximize customer eligibility for solar incentives and tax credits. This includes aligning with programs like the Inflation Reduction Act's Domestic Content Bonus Credit, which can add a significant percentage to the investment tax credit (ITC).

By ensuring their systems meet the criteria for these financial advantages, Enphase makes solar installations more affordable and appealing. For instance, by sourcing a certain percentage of components domestically, customers can potentially increase their ITC from 30% to 40%.

- Domestic Content Bonus: Customers can achieve a 10% adder to the ITC if U.S.-manufactured components are used.

- Energy Community Bonus: An additional 10% ITC adder is available for projects located in designated energy communities.

- Made in America: Enphase's commitment to domestic manufacturing supports customers in meeting these requirements, enhancing the overall financial attractiveness of their solar investments.

Cost Optimization and Efficiency

Enphase Energy is deeply committed to cost optimization and efficiency, directly impacting the affordability and adoption of their solar and storage solutions. This focus is evident in their product development, where integrated designs streamline installation and reduce labor. For instance, newer battery generations feature an integrated battery management and power conversion architecture, simplifying the setup process.

The company also leverages software solutions to enhance efficiency. Tools like the IQ Meter Collar and Busbar Power Control software are designed to optimize system performance and reduce installation complexity. These innovations contribute to lowering the overall balance of system costs, a critical factor for both installers and end-customers. In 2023, Enphase reported a significant reduction in installation time for their IQ Battery 5P compared to previous generations, with installers noting an average time saving of 15%.

- Integrated Architecture: Newer battery models simplify installation by combining battery management and power conversion.

- Software Enhancements: Tools like IQ Meter Collar and Busbar Power Control optimize system setup and performance.

- Balance of System (BOS) Cost Reduction: These efforts collectively drive down the total cost of deploying solar and storage systems.

- Installer Efficiency Gains: Enphase's product design improvements led to an estimated 15% reduction in installation time for the IQ Battery 5P in 2023.

Enphase's pricing strategy is rooted in value, reflecting the superior performance, safety, and longevity of its integrated solar technology, particularly its microinverters. This premium pricing is supported by a strong emphasis on the total cost of ownership and lifetime savings, with offerings like 25-year warranties on microinverters. In 2024, Enphase continued to leverage this approach, aiming to capture the premium market segment by highlighting the return on investment derived from their technological edge and durability.

The company actively manages pricing in response to market demand and competitor actions, ensuring competitiveness across residential and commercial sectors. Despite external pressures like tariffs on imported battery cells, which impacted their Q1 2024 gross margin of 42.1%, Enphase strives to maintain its pricing power by underscoring product quality and long-term value.

Enphase facilitates affordability through diverse financing options, including loans, PPAs, and PACE programs, alongside Easy Monthly Installments (EMIs) with low or zero interest rates in key markets. They also strategically align with government incentives, such as the Inflation Reduction Act, enabling customers to benefit from credits like the Domestic Content Bonus, which can increase the ITC by up to 10%.

Cost optimization is central to Enphase's operations, evident in streamlined product designs that reduce installation labor and balance of system costs. For example, the IQ Battery 5P saw an estimated 15% reduction in installation time in 2023 due to integrated architecture and software enhancements.

| Pricing Strategy | Key Features | 2024/2025 Data/Focus |

| Value-Based Pricing | Superior performance, safety, longevity, 25-year microinverter warranties | Emphasizing ROI from technological superiority and durability in the premium market. |

| Competitive Pricing | Market demand and competitor monitoring | Active adjustments to maintain market share and attract customers. |

| Cost Management | Integrated designs, software optimization, reduced installation time | IQ Battery 5P installation time reduced by ~15% in 2023; focus on lowering BOS costs. |

| Financing & Incentives | Loans, PPAs, PACE, EMIs, IRA credits (e.g., Domestic Content Bonus) | Facilitating accessibility and maximizing customer benefits from government incentives. |

4P's Marketing Mix Analysis Data Sources

Our Enphase 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company disclosures, investor relations materials, and detailed product specifications. We also leverage market research reports and competitive intelligence to ensure accuracy.