Eni SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

Eni's strengths lie in its integrated energy model and global presence, but it faces significant opportunities in renewable energy expansion and challenges from volatile oil prices and regulatory shifts. Want the full story behind Eni's competitive edge and potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Eni's status as an integrated energy company is a significant strength, covering everything from finding and extracting oil and gas (upstream) to refining, selling products, and even chemical manufacturing (downstream). This broad reach across the energy spectrum allows Eni to capture value at multiple stages, creating efficiencies and a more stable business model. For instance, in 2023, Eni reported significant upstream production volumes, which directly fed into its refining and marketing operations, demonstrating the seamless flow of resources within the company.

Eni has established a robust decarbonization strategy with ambitious goals, targeting net-zero emissions by 2050. This includes a significant interim objective of reducing its upstream Scope 1+2 emissions by 50% by 2024, relative to a 2018 baseline.

The company is demonstrating its commitment through substantial investments in crucial areas of the energy transition. These investments are directed towards expanding renewable energy capacity, advancing biorefining technologies, and developing carbon capture and storage (CCS) solutions, showcasing a proactive stance on sustainability.

Eni demonstrates a robust financial standing, notably with its net debt significantly decreasing. This financial strength is underpinned by historically low leverage ratios, providing a stable foundation for its operations and strategic initiatives.

The company's dedication to shareholder returns is evident through its consistent increases in dividends and substantial share buyback programs. These actions are well-supported by Eni's strong cash flow generation, a direct result of disciplined capital allocation strategies that prioritize profitable investments and efficient resource management.

Global Presence and Diversified Portfolio

Eni's global presence is a significant strength, with operations spanning across 30 countries as of early 2024. This extensive geographical diversification, encompassing exploration, production, refining, and marketing, shields the company from localized economic downturns and geopolitical instability. For instance, its operations in Africa, Europe, and the Americas provide a balanced revenue stream.

The company boasts a diversified portfolio that extends beyond traditional oil and gas. Eni is actively investing in renewable energy sources and biofuels, aiming to transition towards a more sustainable energy mix. This strategic diversification is crucial for long-term resilience and growth in an evolving energy landscape. By 2023, Eni had increased its renewable energy capacity significantly, contributing to its broader energy transition goals.

- Global Operations: Active in over 30 countries worldwide.

- Diversified Assets: Engaged in exploration, production, refining, marketing, and renewables.

- Risk Mitigation: Reduced reliance on single markets through geographical spread.

- Energy Transition: Growing investments in biofuels and renewable energy sources.

Focus on Gas and LNG Portfolio Expansion

Eni is strategically prioritizing the expansion of its natural gas and Liquefied Natural Gas (LNG) portfolio. This focus is evident in its ambitious target to have natural gas represent over 90% of its total production by 2050, underscoring a significant shift in its energy mix.

The company is actively pursuing new projects and securing agreements to bolster its gas and LNG offerings. This proactive approach is designed to capitalize on the increasing global demand for natural gas, which is widely recognized as a crucial transition fuel in the ongoing energy evolution.

- Strategic Gas Focus: Eni aims for natural gas to comprise over 90% of its production by 2050.

- Portfolio Growth: The company is actively expanding its gas and LNG assets through new developments and partnerships.

- Transition Fuel Demand: Eni is positioning itself to meet the rising global need for natural gas as a bridge to lower-carbon energy sources.

Eni's integrated business model, spanning upstream to downstream, provides significant operational synergies and resilience. This allows the company to manage the entire value chain, from resource extraction to product delivery, enhancing efficiency and stability. In 2023, Eni's upstream segment successfully supplied its downstream operations, demonstrating this integrated strength.

The company's strong financial health, characterized by a decreasing net debt and historically low leverage ratios, provides a solid foundation for its strategic initiatives and shareholder returns. This financial discipline supports Eni's ability to invest in growth and navigate market fluctuations.

Eni's commitment to decarbonization and diversification into renewables and biofuels is a forward-looking strength, positioning it for long-term sustainability in a changing energy landscape. Investments in these areas are growing, reflecting a strategic pivot towards lower-carbon solutions.

| Strength | Description | Supporting Data (2023/Early 2024) |

|---|---|---|

| Integrated Business Model | Covers upstream (exploration & production) to downstream (refining & marketing). | Seamless flow of resources from upstream to downstream operations. |

| Financial Strength | Decreasing net debt and low leverage ratios. | Provides stability for operations and strategic investments. |

| Decarbonization & Diversification | Ambitious net-zero targets and growing investments in renewables and biofuels. | Targets Scope 1+2 emissions reduction by 50% by 2024 (vs. 2018 baseline). Increased renewable energy capacity. |

| Global Presence | Operations in over 30 countries. | Diversified revenue streams, mitigating geopolitical and market risks. |

What is included in the product

Delivers a strategic overview of Eni’s internal and external business factors, highlighting its strengths in integrated energy operations and opportunities in the energy transition, while also acknowledging weaknesses in legacy assets and threats from volatile energy markets.

Offers a clear, actionable framework for identifying and addressing Eni's strategic challenges and opportunities.

Weaknesses

Despite its stated transition goals, Eni's continued substantial investment in hydrocarbon exploration and production, particularly in areas like the North Sea and Mozambique, anchors its revenue streams to the volatile oil and gas market. In 2023, upstream activities still represented a significant portion of its operational focus, contributing to a substantial part of its reported operating income.

Eni's chemical division, Versalis, has been a consistent source of challenges, negatively affecting the company's overall financial health. This segment has historically weighed down profitability, despite ongoing efforts to turn things around.

While Versalis is targeting breakeven by 2025 and positive EBIT in 2026 through restructuring, its past performance has been a significant drag. For instance, in the first half of 2023, the chemicals segment reported an adjusted EBITDA of €273 million, a notable decrease from €811 million in the same period of 2022, highlighting the ongoing difficulties.

Eni's financial results are highly sensitive to the volatility of global crude oil prices, a key driver of its revenue. For instance, in the first quarter of 2024, a notable drop in oil prices directly impacted the company's profitability, underscoring this inherent vulnerability.

Furthermore, fluctuations in currency exchange rates, especially the EUR/USD, present another significant challenge. A weaker euro against the dollar can negatively affect Eni's reported earnings, as a substantial portion of its costs are denominated in euros while revenues are often linked to dollar-denominated commodities.

High Employee Turnover

Eni has faced challenges with high employee turnover, exceeding typical industry benchmarks. This trend can significantly inflate expenses related to hiring new personnel and their subsequent training. For instance, in 2023, Eni's voluntary turnover rate for its global workforce was reported to be around 12%, which is notably higher than the energy sector average of approximately 8-10%.

This elevated turnover rate presents a substantial hurdle in retaining experienced and skilled employees. The loss of institutional knowledge and the disruption to project continuity can negatively impact operational efficiency. Furthermore, the constant need to onboard and train replacements diverts valuable resources and can slow down innovation and project execution.

- Increased Recruitment and Training Costs: Higher turnover necessitates greater investment in attracting and developing new talent.

- Loss of Skilled Personnel: The departure of experienced employees can lead to a deficit in critical skills and operational expertise.

- Impact on Operational Efficiency: Frequent staff changes can disrupt workflows and reduce overall productivity.

- Knowledge Transfer Challenges: Retaining institutional memory becomes difficult when employees frequently leave the organization.

Slower Pace of Renewable Energy Investment Compared to Targets

Eni's commitment to renewable energy is evident, but the pace of its investment may fall short of ambitious targets. For the 2025-2028 period, capital expenditure in renewables is reportedly lower than initially outlined, potentially hindering the company's capacity expansion plans. This slower investment trajectory could be a point of concern for investors and stakeholders prioritizing rapid decarbonization efforts.

This recalibration of investment could mean Eni might not reach its projected renewable capacity by key milestones. For instance, if initial plans aimed for a significant increase in solar and wind power generation by 2028, a reduced capex could delay or reduce that output. This could affect Eni's standing in the competitive renewable energy market.

- Slower Investment Pace: Eni's capital expenditure for renewables between 2025 and 2028 is anticipated to be less than previously communicated.

- Impact on Targets: This could impede Eni's ability to achieve its stated long-term renewable energy capacity goals.

- Stakeholder Perception: A slower investment rate might be viewed unfavorably by investors and groups focused on accelerating the energy transition.

Eni's ongoing reliance on fossil fuels, despite its transition strategy, leaves it exposed to the inherent price volatility of oil and gas markets, impacting revenue stability. The company's chemical division, Versalis, continues to be a financial drain, with its adjusted EBITDA falling significantly in the first half of 2023 compared to the previous year, indicating persistent profitability challenges. Furthermore, Eni faces difficulties in retaining experienced staff, with a reported voluntary turnover rate of around 12% in 2023, which is higher than the industry average and leads to increased recruitment and training costs, as well as potential loss of operational efficiency and knowledge. Finally, a potentially slower pace of investment in renewable energy capacity between 2025 and 2028, compared to earlier projections, could hinder Eni's ability to meet its decarbonization targets and maintain competitiveness in the evolving energy landscape.

Preview Before You Purchase

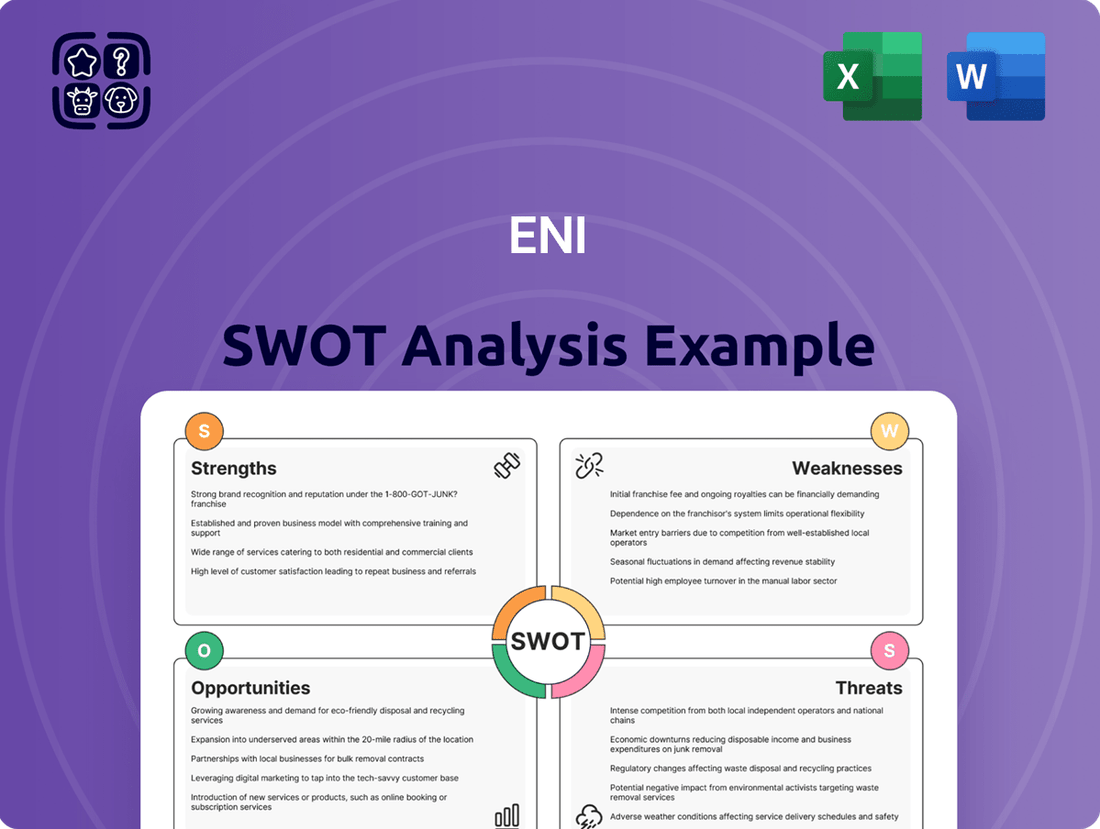

Eni SWOT Analysis

The preview you see is the actual Eni SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed analysis provides a comprehensive overview of Eni's strategic position. Invest in this valuable tool to gain actionable insights for your business decisions.

Opportunities

Eni is strategically positioned to capitalize on the growing renewable energy sector. The company has ambitious plans, aiming to reach 8 GW of installed renewable capacity by 2027 and a substantial 60 GW by 2050, demonstrating a clear commitment to expanding its clean energy portfolio.

Furthermore, Eni is significantly increasing its bio-refining operations. By 2024, it is set to double its bio-refining capacity, with a forward-looking goal of surpassing 5 million tons per year by 2030. This expansion includes a focus on sustainable aviation fuel (SAF), directly addressing the global push for decarbonization and offering a pathway for growth in the aviation sector.

The global appetite for natural gas as a cleaner transition fuel is on the rise, creating a significant tailwind for Eni. This increasing demand offers a prime opportunity for the company to leverage its existing infrastructure and expertise.

Eni is actively bolstering its Liquefied Natural Gas (LNG) portfolio. By 2025, the company anticipates a substantial increase in contracted LNG volumes, further solidifying its competitive edge in the international gas arena. This strategic expansion includes the development of new, promising projects.

Eni's strategic focus on developing Carbon Capture and Storage (CCS) solutions presents a significant growth opportunity. The company plans to establish a new CCS satellite company in 2025, aiming to significantly expand its CO2 storage capacity by 2030 and 2050. This move positions Eni to capitalize on the growing demand for decarbonization technologies in challenging industrial sectors.

Leveraging Satellite Business Model for Value Creation

Eni's unique satellite business model is a key opportunity for value creation. This structure enables the company to attract specialized capital and allows management to concentrate on specific geographic regions and business segments, like Plenitude and Enilive. This focused approach is crucial for driving strategic growth and realizing value through potential divestments or partnerships.

The satellite model enhances Eni's financial resilience by creating a balance between internally generated cash flows and the need for external investments. This diversification of capital sources and strategic focus positions Eni to better navigate market volatility and pursue growth opportunities across its diverse portfolio.

- Attracting Capital: The model facilitates the attraction of new capital for specific ventures, as seen with Plenitude's ongoing development and potential future fundraising activities.

- Geographic and Business Focus: Enables dedicated management attention to distinct operational areas, improving efficiency and strategic execution.

- Value Realization: Provides a pathway for unlocking value through strategic divestments or partial sales of these satellite businesses.

- Financial Resilience: Balances internal cash generation with external investment needs, strengthening the overall financial position.

Digitalization and Efficiency Improvements

Eni has a significant opportunity to boost its performance by embracing digitalization and investing in efficiency improvements across its entire value chain. This strategic focus can streamline operations from exploration and production to its retail networks, ultimately driving down costs and increasing output. For instance, by implementing advanced analytics and AI in exploration, Eni can improve the success rate of finding new reserves, a critical factor in the energy sector.

The company can leverage digital technologies to optimize its upstream operations, such as predictive maintenance for drilling equipment, which can prevent costly downtime. In its midstream and downstream segments, digital solutions can enhance supply chain visibility and logistics, ensuring more efficient product delivery and reduced waste. This drive for efficiency is also a key enabler for Eni's decarbonization targets, as optimized processes often lead to lower energy consumption and emissions.

Eni's commitment to digital transformation is already showing results. In 2023, the company reported significant progress in its digital initiatives, with a focus on enhancing operational efficiency and customer experience.

- Digitalization of Upstream: Implementing AI and machine learning for seismic data analysis and reservoir management to improve exploration success rates and production optimization.

- Efficiency in Operations: Utilizing IoT sensors and data analytics for predictive maintenance in refineries and offshore platforms, aiming to reduce unplanned downtime by up to 10% in key facilities by 2025.

- Supply Chain Optimization: Enhancing logistics and inventory management through digital platforms to reduce transportation costs and improve delivery times for refined products and chemicals.

- Decarbonization through Efficiency: Leveraging digital tools to monitor and reduce energy consumption and flaring across its operations, contributing to its greenhouse gas reduction targets.

Eni's strategic expansion into renewable energy, targeting 8 GW by 2027 and 60 GW by 2050, positions it to capture growth in a rapidly expanding market.

The company's doubling of bio-refining capacity by 2024, with a focus on sustainable aviation fuel, taps into the increasing demand for lower-carbon alternatives in transportation.

Leveraging the global demand for natural gas as a transition fuel, coupled with a growing LNG portfolio anticipated to increase contracted volumes by 2025, presents a significant revenue opportunity.

Eni's investment in Carbon Capture and Storage (CCS) solutions, including a new satellite company planned for 2025, addresses the critical need for decarbonization technologies in heavy industries.

The unique satellite business model, exemplified by Plenitude and Enilive, allows for focused management, specialized capital attraction, and potential value realization through strategic partnerships or divestments.

Digitalization initiatives across Eni's value chain, aimed at improving efficiency from exploration to retail, offer substantial cost reduction and output enhancement opportunities, with digital transformation showing reported progress in 2023.

Threats

The global energy market is experiencing heightened volatility, driven by ongoing geopolitical tensions, particularly the conflict in Ukraine, and persistent supply-demand imbalances. This instability directly impacts Eni, exposing the company to fluctuations in oil and gas prices, which can affect its revenue streams and the profitability of its exploration and production activities. For instance, Brent crude oil prices have seen significant swings, trading around $80-$90 per barrel in early 2024, a stark contrast to the lower levels seen in previous years, creating an unpredictable operating environment.

Global efforts to combat climate change are intensifying, leading to more stringent environmental regulations and heightened scrutiny for companies like Eni. This trend is particularly impactful for fossil fuel producers, as governments worldwide push for decarbonization.

Eni faces the tangible threat of rising compliance expenses and the potential imposition of carbon taxes. These pressures could significantly impact the profitability of its core hydrocarbon business, especially as it navigates the imperative to accelerate its energy transition strategies.

The burgeoning renewable energy sector presents a significant competitive challenge for Eni. The International Energy Agency reported that renewable capacity additions in 2024 are projected to increase by 11% compared to 2023, reaching nearly 510 gigawatts globally. This rapid expansion means more companies, including specialized renewable energy firms, are vying for market share, skilled personnel, and capital investment, potentially impacting Eni's established position in the energy landscape.

Cybersecurity Risks and Data Breaches

Eni's extensive digital infrastructure, crucial for its operations as a major integrated energy company, exposes it to significant cybersecurity risks. A notable data breach reported in April 2024 underscores the persistent threat of cyberattacks.

These cyber threats can have severe consequences for Eni, including disruptions to critical operations, substantial financial losses, and damage to its overall reputation. The company must continually invest in robust cybersecurity measures to mitigate these evolving dangers.

- Increased Sophistication of Cyberattacks: Threat actors are constantly developing more advanced methods to breach corporate defenses.

- Operational Disruption Potential: A successful attack could halt production, impact supply chains, and disrupt energy delivery.

- Financial Ramifications: Costs associated with breach response, recovery, regulatory fines, and potential lawsuits can be immense.

- Reputational Damage: Loss of customer trust and negative publicity can have long-term effects on market standing and brand value.

Public Perception and Brand Image Challenges

Eni, like other major oil and gas companies, grapples with significant public perception challenges. Growing environmental activism and societal demands for a swift energy transition create a difficult landscape for maintaining a positive brand image.

This negative sentiment can directly affect Eni's business operations. It can erode customer loyalty, making it harder to retain or attract consumers in a market increasingly conscious of environmental impact.

Furthermore, investor relations are particularly sensitive to public perception. Negative press or activism can deter potential investors and impact Eni's ability to secure the capital needed for its operations and future energy projects. For instance, in 2024, many energy companies faced increased scrutiny from ESG-focused funds, which could affect their market valuation and borrowing costs.

- Environmental Activism: Increased public pressure for decarbonization directly impacts the perceived sustainability of Eni's core business.

- Brand Image: Negative public sentiment can lead to boycotts or reduced consumer engagement, affecting revenue streams.

- Investor Relations: Growing emphasis on Environmental, Social, and Governance (ESG) criteria means negative public perception can hinder access to capital and increase the cost of financing.

Eni operates in a highly volatile energy market, susceptible to geopolitical events and supply-demand shifts, as seen with Brent crude prices fluctuating around $80-$90 per barrel in early 2024. The company also faces intensifying climate change regulations and the rising costs of compliance, including potential carbon taxes, which directly impact its hydrocarbon business profitability.

The accelerating growth of renewables, with global capacity additions projected to rise 11% in 2024 to nearly 510 GW, intensifies competition for Eni. Furthermore, sophisticated cyberattacks pose a significant threat, as evidenced by a data breach in April 2024, risking operational disruptions, financial losses, and reputational damage.

Negative public perception and environmental activism create challenges for Eni's brand image and investor relations, particularly with the increasing focus on ESG criteria by funds in 2024, potentially affecting market valuation and capital access.

SWOT Analysis Data Sources

This Eni SWOT analysis is built upon a robust foundation of diverse data sources, including Eni's official financial reports, comprehensive market intelligence, and insights from industry experts. We also incorporate analysis of geopolitical trends and regulatory changes impacting the energy sector to provide a well-rounded perspective.