Eni Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

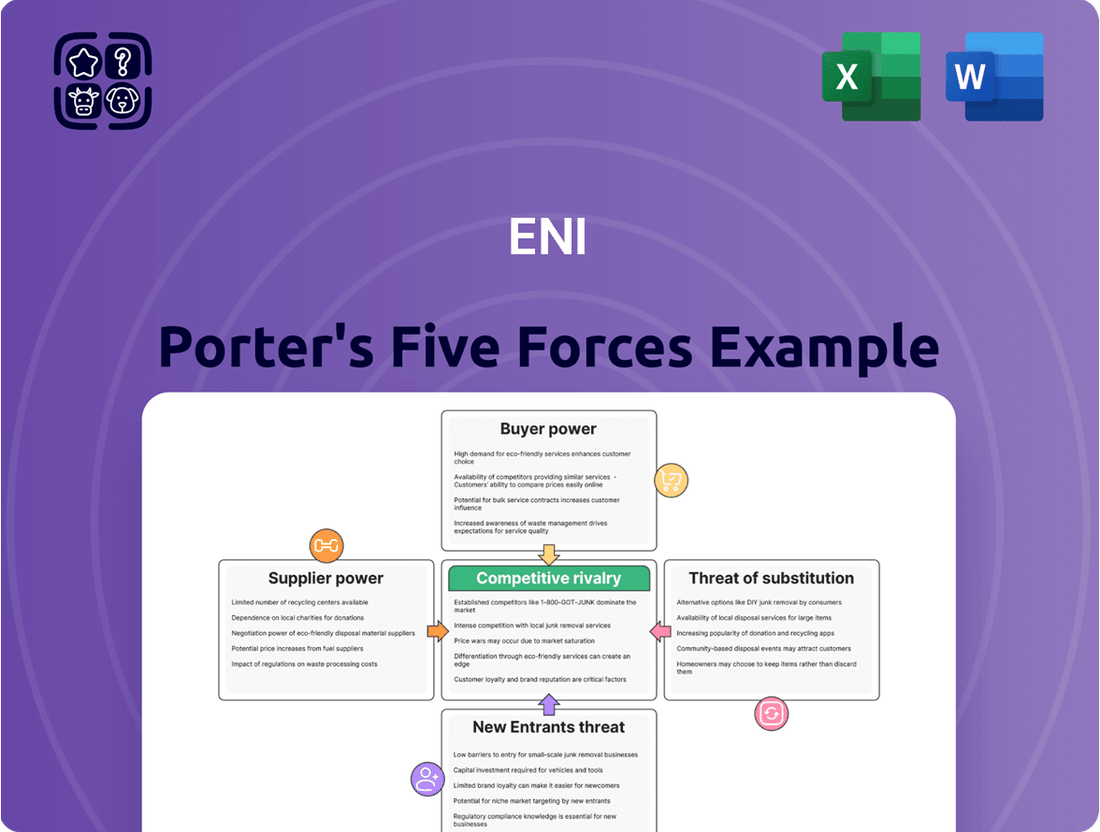

Porter's Five Forces provides a powerful lens to understand the competitive landscape of Eni. By examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, we can uncover the underlying forces shaping Eni's industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eni’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Eni's reliance on highly specialized equipment and technology for its intricate oil and gas operations grants significant bargaining power to certain suppliers. These specialized providers, particularly those offering advanced IoT sensors for drilling or unique processing technologies, can command higher prices due to their critical role.

The ongoing digital transformation within the energy sector amplifies this leverage. Demand for cutting-edge hardware components to support initiatives like predictive maintenance and remote monitoring means suppliers of these advanced solutions often have considerable pricing power, impacting Eni's operational costs.

Governments and national oil companies (NOCs) in resource-rich nations wield considerable influence as suppliers of access to vital oil and gas reserves. Their capacity to dictate terms, levy taxes, and manage licensing agreements directly impacts Eni's operational expenses and overall profitability, a factor that has been increasingly evident in 2024 as geopolitical shifts influenced resource access and pricing.

For instance, in 2023, Eni reported that taxes and duties represented a significant portion of its operating costs, underscoring the direct financial impact of governmental supplier power. Eni's strategic focus on diversification into renewable energy and its pursuit of strategic partnerships are key initiatives designed to lessen the leverage these state-controlled entities can exert on its business model.

The energy sector, especially upstream operations, relies heavily on a specialized and skilled workforce. Think engineers, geologists, and various technical experts. A scarcity of this talent, or the presence of strong labor unions, can significantly boost the bargaining power of these employees. For instance, in 2024, the global demand for experienced petroleum engineers remained robust, with many companies reporting challenges in filling critical roles, which naturally pushes up compensation expectations.

Infrastructure and Logistics Providers

Infrastructure and logistics providers, such as pipeline operators and shipping companies, wield considerable bargaining power. This is largely due to the substantial capital required and the complex regulatory environments that make it difficult to establish alternative services. For a company like Eni, which relies on these services for its global operations, especially for transporting oil and gas, this power is significant.

Eni, while possessing its own extensive infrastructure, still depends on third-party logistics for specific parts of its supply chain, particularly in international markets. The efficiency of these logistics directly impacts Eni's ability to deliver products to market on time and at a competitive cost. For instance, in 2024, global shipping rates for oil tankers saw fluctuations, demonstrating the leverage logistics providers can exert.

- High Capital Investment: Establishing new pipelines or port facilities requires billions of dollars, creating high barriers to entry for potential competitors.

- Regulatory Hurdles: Obtaining permits and approvals for infrastructure projects can be a lengthy and complex process, further limiting alternatives.

- Criticality of Services: Uninterrupted logistics are essential for Eni's operations; any disruption can lead to significant financial losses.

- Market Dependence: Eni’s reliance on external logistics providers for certain international routes means these suppliers can influence delivery times and costs.

Energy Transition Technology Providers

As Eni diversifies into areas like renewable energy, biofuels, and carbon capture, it increasingly depends on suppliers for new technologies and specialized components. This reliance is particularly pronounced in emerging markets where certain technology providers may hold significant sway due to unique or patented solutions. For instance, Eni's ambitious targets for expanding renewable generation capacity, aiming for 65 GW by 2030, underscore this growing dependence on suppliers of solar panels, wind turbines, and battery storage systems.

- Proprietary Technology: Suppliers with unique or patented technologies for renewable energy generation or storage can command higher prices and favorable terms.

- Limited Competition: In niche segments of the energy transition market, a small number of suppliers may dominate, increasing their bargaining power.

- High Switching Costs: Eni might face substantial costs and operational disruptions if it needs to switch suppliers for specialized equipment or integrated systems.

- Supplier Concentration: The concentration of key technology providers in specific geographic regions or within a few large corporations can amplify their negotiation leverage.

Suppliers of specialized technology and equipment, particularly those crucial for advanced drilling or processing, hold significant leverage over Eni due to the high capital investment and regulatory hurdles involved in creating alternatives. This is amplified by the global demand for skilled labor in the energy sector, with shortages of experienced petroleum engineers in 2024 driving up compensation expectations.

Governments and national oil companies also exert considerable power as suppliers of access to vital reserves, dictating terms and impacting Eni's profitability, as seen in 2023 when taxes and duties were a substantial cost. Furthermore, infrastructure and logistics providers, essential for Eni's global operations, can influence delivery times and costs due to the immense capital required and complex regulations governing their services.

Eni's growing reliance on suppliers for renewable energy components, such as solar panels and battery storage, for its 2030 targets, further increases supplier bargaining power, especially where proprietary technology and limited competition exist.

| Supplier Type | Key Factors Influencing Power | Impact on Eni | Relevant 2024 Data/Trend |

|---|---|---|---|

| Specialized Technology Providers | High R&D costs, proprietary tech, limited competition | Higher prices for critical equipment, potential delays | Continued demand for advanced IoT sensors and processing tech |

| Governments/NOCs | Control over resource access, taxation policies | Significant impact on operating costs and profitability | Geopolitical shifts influencing resource access and pricing |

| Labor (Skilled Engineers) | Scarcity of talent, unionization | Increased wage demands, potential operational disruptions | Robust global demand for experienced petroleum engineers |

| Infrastructure/Logistics | High capital investment, regulatory barriers, criticality of service | Influence on delivery costs and timelines | Fluctuations in global oil tanker shipping rates |

| Renewable Energy Component Suppliers | Proprietary technology, limited competition in niche markets | Higher prices for renewable tech, potential switching costs | Eni's aim for 65 GW renewable capacity by 2030 |

What is included in the product

Eni Porter's Five Forces Analysis provides a comprehensive framework for understanding the competitive intensity and attractiveness of the energy sector, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Pinpoint competitive threats and opportunities with a visual, easy-to-understand breakdown of industry power dynamics.

Customers Bargaining Power

Eni's customers, particularly those in the industrial and energy sectors, are highly attuned to global commodity prices. This price sensitivity means that Eni's ability to set prices is largely dictated by international benchmarks like Brent crude and European regional gas prices. For instance, in Q1 2025, Eni's financial performance was directly influenced by these global dynamics, with higher European gas prices providing a partial buffer against the impact of lower oil prices on its revenue streams.

Eni's broad customer base, spanning industrial clients, power generators, residential users, and the transportation sector, significantly dilutes the bargaining power of any individual customer segment. This diversification means no single group can exert undue influence over Eni's pricing or terms. For instance, as of the first quarter of 2024, Eni's upstream production contributed substantially to its overall revenue, with a significant portion of this output serving diverse markets, underscoring the wide reach of its customer engagement.

For many traditional energy products such as gasoline or natural gas, the direct costs for an end-user to switch might seem low. However, the extensive infrastructure required to deliver and utilize these products, like natural gas pipelines or gasoline fueling stations, creates significant barriers. This existing infrastructure effectively locks in customers to a degree, making it less appealing to switch away from established energy sources.

The landscape is evolving, though. The rapid growth of electric vehicles (EVs) and the increasing integration of renewable energy solutions are actively lowering switching costs in specific market segments. For instance, as EV charging infrastructure becomes more widespread, the inconvenience and cost associated with switching from internal combustion engine vehicles to EVs diminish, empowering consumers.

By mid-2024, global EV sales were projected to exceed 15 million units for the year, a substantial increase from previous years. This trend directly impacts the bargaining power of customers in the automotive sector, as the availability and accessibility of charging infrastructure reduce the perceived switching costs from traditional fuel to electric power.

Regulatory and Policy Influence

Government regulations and policies, particularly those focused on the energy transition and decarbonization, exert considerable influence over customer demand and preferences. For example, initiatives like the European Union's Fit for 55 package, which aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly encourage a shift towards cleaner energy sources. This policy environment can significantly alter customer choices, steering them away from traditional fossil fuels and impacting the sales volumes of Eni's conventional energy products.

These regulatory shifts can empower customers by increasing the availability and attractiveness of alternative energy solutions. As governments implement incentives for renewable energy adoption and electric vehicle infrastructure, consumers gain more options and are often financially motivated to switch. This dynamic directly affects Eni's market position, as it must adapt its product offerings and strategic investments to align with evolving customer behaviors driven by these policy changes. In 2024, the global push for net-zero emissions continues to accelerate policy development, making regulatory compliance and adaptation a critical factor in managing customer bargaining power.

The impact of these policies on Eni's bargaining power with customers can be seen in several ways:

- Shifting Demand: Policies promoting electric vehicles and renewable energy sources directly reduce demand for traditional gasoline and diesel, giving customers more leverage to negotiate prices or switch suppliers.

- Increased Competition: Government support for new energy technologies fosters competition from renewable energy providers and EV manufacturers, providing customers with a wider array of choices.

- Price Sensitivity: Incentives and subsidies for green technologies can make them more price-competitive, increasing customer sensitivity to the pricing of conventional energy products.

- Regulatory Compliance Costs: While not directly customer-facing, Eni's costs associated with meeting new environmental regulations can indirectly influence pricing and product availability, affecting customer choices.

Growth of Renewable Energy Customers

As Eni's renewable energy and retail power business, Plenitude, grows, its customer base is becoming more diverse, potentially increasing customer bargaining power. This is particularly true for large industrial and commercial clients actively seeking clean energy solutions. For instance, in 2024, the demand for corporate power purchase agreements (PPAs) continued to surge, allowing these buyers to negotiate more favorable terms for their long-term energy needs.

Customers, especially those with significant energy consumption, can leverage the expanding renewable energy market to their advantage. They have more options to choose from, including direct sourcing or through various intermediaries, which empowers them to demand better pricing and service agreements. This trend is amplified as companies increasingly prioritize sustainability and seek reliable, cost-effective green energy supplies.

- Increased Customer Choice: The proliferation of renewable energy providers and technologies offers customers more alternatives, reducing their reliance on any single supplier.

- Corporate PPA Demand: In 2024, the market saw robust activity in corporate PPAs, with major corporations securing long-term contracts that often include price floors and caps, demonstrating significant buyer leverage.

- Negotiating Power: Large-scale buyers can negotiate for customized solutions, better payment terms, and performance guarantees, directly impacting Eni's profitability in its retail and renewable segments.

The bargaining power of Eni's customers is influenced by several factors, including price sensitivity, switching costs, and the availability of alternatives. While Eni's diverse customer base in 2024 generally limits individual customer leverage, evolving market dynamics, particularly in renewable energy and electric vehicles, are shifting this balance.

The increasing adoption of electric vehicles and renewable energy sources is lowering switching costs for consumers in certain segments. For instance, by mid-2024, global EV sales were projected to exceed 15 million units for the year, indicating a growing consumer preference for alternatives to traditional fuels, thereby increasing their bargaining power.

Government policies promoting decarbonization, such as the EU's Fit for 55 package, further empower customers by encouraging cleaner energy choices and increasing the availability of competitive green energy solutions. This regulatory environment directly impacts demand for Eni's conventional products and necessitates adaptation to meet evolving customer preferences driven by sustainability goals.

The growth of Eni's renewable energy arm, Plenitude, and the surge in corporate power purchase agreements (PPAs) in 2024 demonstrate how larger customers can negotiate more favorable terms. This trend highlights how increased choice and a focus on sustainability are enhancing the negotiating power of significant energy consumers.

| Factor | Impact on Customer Bargaining Power | 2024 Context/Data |

|---|---|---|

| Price Sensitivity | High for commodity energy products, tied to global benchmarks. | Q1 2025 European gas prices partially offset lower oil prices for Eni, reflecting customer sensitivity. |

| Switching Costs (Infrastructure) | High for traditional energy delivery, creating customer lock-in. | Existing pipeline and fueling infrastructure remains a significant barrier to switching. |

| Switching Costs (Emerging Tech) | Decreasing due to EV infrastructure growth and renewable energy accessibility. | Global EV sales projected over 15 million units in 2024, lowering barriers to EV adoption. |

| Availability of Alternatives | Increasing with renewable energy market growth and government support for green tech. | Surge in corporate PPA demand in 2024 indicates growing customer ability to secure alternative energy. |

| Government Regulations | Empowers customers by promoting cleaner energy and increasing choice. | EU's Fit for 55 package and global net-zero pushes accelerate policy development, influencing customer choices. |

Preview Before You Purchase

Eni Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, comprehensive Porter's Five Forces Analysis, detailing each force's impact on the industry. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

Eni faces fierce rivalry from other global integrated energy majors, often referred to as IOCs, and powerful national oil companies (NOCs). These competitors, like ExxonMobil, Shell, and Saudi Aramco, vie for resources and market share across all segments of the energy sector, from upstream exploration to downstream refining and marketing.

The competition extends into the burgeoning renewable energy space, where majors are increasingly investing in solar, wind, and hydrogen projects. This broad competitive landscape demands significant capital investment and operational excellence from Eni to maintain its market position and profitability.

For instance, in 2024, major integrated energy companies continued to report substantial capital expenditures, with many allocating billions towards both traditional oil and gas projects and their expanding low-carbon portfolios, highlighting the scale of investment required to compete effectively.

In commodity markets like oil and gas, price competition is fierce because products are largely undifferentiated. Companies like Eni often battle for market share by adjusting prices, particularly when supply outstrips demand or when demand is unpredictable. This intense price pressure means that even small shifts in global energy prices can significantly affect a company's profitability.

Eni's financial results, for instance, are closely tied to the price of Brent crude and European natural gas. In Q1 2025, Eni's performance reflected these market dynamics, with its earnings directly influenced by the prevailing energy prices. This sensitivity underscores how critical price management is for maintaining competitiveness in the sector.

The global push for energy transition has dramatically heated up competition. Established players like Eni are now heavily investing in renewable energy, biofuels, and carbon capture technologies, putting them in direct competition with specialized renewable energy firms. For instance, Eni's 2024-2027 strategic plan prioritizes accelerating the development of new, profitable, and high-growth ventures within the energy transition space.

Geopolitical and Regulatory Landscape

Geopolitical tensions and varying regulatory frameworks globally create significant hurdles for companies like Eni. These factors directly influence where Eni can operate, how its supply chains function, and the strategic decisions regarding investments. For instance, the ongoing conflict in Eastern Europe and shifting trade policies in 2024 continue to create uncertainty around energy demand and the stability of operations.

Eni must constantly adapt to a volatile international market. Evolving trade agreements and the potential for new sanctions can disrupt commodity flows and impact pricing. The company's ability to navigate these complexities is crucial for maintaining operational efficiency and profitability.

- Geopolitical Instability: Conflicts in regions crucial for energy production and transit can lead to supply disruptions and price volatility, affecting Eni's upstream and downstream operations.

- Regulatory Diversity: Navigating different environmental regulations, tax laws, and local content requirements across various operating countries adds significant compliance costs and complexity.

- Trade Policy Shifts: Changes in international trade policies and tariffs can impact the cost of imported equipment and the competitiveness of exported products, influencing Eni's global market access.

- Energy Transition Policies: Differing national approaches to climate change and the energy transition influence investment in renewable versus fossil fuel assets, requiring strategic flexibility.

Technological Advancements and Innovation

Technological advancements are a major battleground in the energy sector. Companies are constantly innovating to improve efficiency and cut costs, especially with the rise of renewable energy sources. For instance, advancements in solar panel efficiency, with some modules now exceeding 23% efficiency in commercial applications as of early 2024, directly impact competitive positioning.

The drive for innovation extends to developing new products and services, such as advanced battery storage solutions and digital oilfield technologies. Companies that fail to embrace these new technologies, like the increasing adoption of AI in energy exploration and production which saw significant investment growth in 2023, risk falling behind competitors who are more agile and forward-thinking.

- Innovation in renewable energy technologies, such as perovskite solar cells, is rapidly improving efficiency and reducing costs.

- Digitalization and AI are transforming operations, leading to cost savings and improved resource management for energy companies.

- Companies investing in R&D for areas like carbon capture and hydrogen production are positioning themselves for future market leadership.

Competitive rivalry within the energy sector is intense, driven by global integrated majors and national oil companies vying for market share across all energy segments. This competition extends to the rapidly growing renewable energy sector, demanding substantial capital and operational excellence. For example, in 2024, major energy firms continued to invest billions in both traditional and low-carbon energy projects.

Price competition is a significant factor, especially in undifferentiated commodity markets like oil and gas. Companies often adjust prices to gain market share, making profitability highly sensitive to global energy price fluctuations. Eni's Q1 2025 performance, for instance, directly reflected the impact of prevailing energy prices.

The energy transition has intensified competition, with established players like Eni investing heavily in renewables, biofuels, and carbon capture. This puts them in direct competition with specialized renewable firms. Eni's 2024-2027 strategic plan specifically targets accelerating growth in these transition areas.

Technological innovation is another key battleground, with companies focusing on improving efficiency and reducing costs. Advancements in solar panel efficiency, with some modules exceeding 23% in commercial applications by early 2024, directly influence competitive standing. The adoption of AI in exploration and production, which saw significant investment growth in 2023, further highlights this trend.

| Competitor Type | Key Focus Areas | Example Companies | Impact on Eni |

|---|---|---|---|

| Global Integrated Majors (IOCs) | Upstream, Midstream, Downstream, Renewables | ExxonMobil, Shell, BP | Direct competition for resources, market share, and talent. |

| National Oil Companies (NOCs) | Upstream dominance, national resource management | Saudi Aramco, PetroChina, Equinor | Influence global supply dynamics and access to key reserves. |

| Specialized Renewable Energy Firms | Solar, Wind, Hydrogen, Battery Storage | Ørsted, NextEra Energy, Iberdrola | Challenge traditional energy models and drive innovation in green technologies. |

SSubstitutes Threaten

The most significant threat of substitution for traditional energy sources comes from the rapidly advancing renewable energy sector, encompassing solar, wind, and hydropower. These alternatives are not only becoming more cost-competitive but are also increasingly favored due to environmental concerns.

By 2024, a remarkable 91% of new renewable energy projects demonstrated greater cost-effectiveness compared to fossil fuel alternatives. Specifically, solar photovoltaic (PV) and onshore wind technologies emerged as significantly cheaper options than their fossil fuel counterparts, underscoring the economic viability of renewables.

This cost advantage is driving an accelerated adoption rate, with projections indicating that renewables are on track to surpass coal as the primary global power source by 2025. This shift represents a substantial substitution threat, impacting the long-term demand for conventional energy products and services.

The increasing popularity of electric vehicles (EVs) presents a significant threat to Eni's traditional business of refining and selling gasoline and diesel. By 2024, projections indicate that EV sales will continue their upward trajectory, impacting fuel demand. This trend directly challenges Eni's core revenue streams from petroleum products.

As EVs become more affordable, with purchase prices and overall ownership costs nearing parity with internal combustion engine vehicles in many major markets, the long-term demand for gasoline and diesel is expected to decline. This shift is a critical factor for Eni to consider in its strategic planning.

Consequently, Eni must accelerate its investments in areas like electric mobility infrastructure, including charging stations, and expand its offerings in biofuels to adapt to this evolving energy landscape and mitigate the threat posed by substitutes.

Improvements in energy efficiency are increasingly acting as a substitute for traditional energy sources. For instance, advancements in building insulation and smart home technology can significantly lower electricity demand in the residential sector. In 2024, the global energy efficiency market was valued at over $400 billion, indicating substantial investment and adoption of these technologies.

Industrial processes are also becoming more efficient, reducing the need for raw energy inputs. Optimized manufacturing techniques and the adoption of energy-saving equipment are key drivers here. This trend directly competes with the demand for primary energy commodities like oil and natural gas.

The transportation sector is seeing a surge in electric vehicles (EVs) and more fuel-efficient internal combustion engines. By 2024, EV sales represented a significant portion of new vehicle registrations in many developed markets, directly substituting for gasoline and diesel consumption. This shift significantly impacts the demand for fossil fuels.

Biofuels and Sustainable Aviation Fuels (SAF)

Biofuels and Sustainable Aviation Fuels (SAF) present a significant threat of substitution for Eni's conventional petroleum products. Eni itself is actively investing in these alternatives through its Enilive segment, demonstrating an awareness of this market shift.

The company has ambitious targets, aiming for over 5 million tonnes of biofuel production capacity by 2030, with a substantial portion, over 2 million tonnes, dedicated to SAF. This internal development underscores the competitive pressure from these emerging, more sustainable fuel sources.

- Eni's Strategic Pivot: Eni's investment in biofuels and SAF through Enilive directly addresses the threat of substitution for its traditional oil and gas products.

- Production Capacity Goals: Eni targets over 5 million tonnes of biofuel production capacity by 2030, with over 2 million tonnes specifically for SAF.

- Market Recognition: This internal development signifies Eni's acknowledgment of the growing demand and competitive landscape for sustainable fuels.

Hydrogen and Other Emerging Fuels

The long-term threat of substitutes for traditional energy sources, including natural gas, is evolving with the rise of emerging fuels. Green hydrogen, produced using renewable energy, presents a significant potential substitute, particularly in industrial processes and power generation where high temperatures or specific chemical reactions are required. While currently a nascent market, substantial global investments are fueling its development, signaling a future where it could displace natural gas in these sectors.

Global investment in the hydrogen economy is accelerating. For example, by early 2024, the International Energy Agency reported that over $500 billion in public and private investment had been announced for hydrogen projects worldwide, with a significant portion focused on green hydrogen production and infrastructure. This robust financial backing underscores the growing recognition of hydrogen's potential to disrupt existing energy markets.

- Green hydrogen's potential to replace natural gas in high-temperature industrial applications like steel and cement manufacturing is a key concern.

- Investments in hydrogen production and infrastructure are projected to reach hundreds of billions of dollars globally by 2030, indicating a serious competitive threat.

- The cost-competitiveness of green hydrogen is improving, driven by falling renewable energy prices, making it an increasingly viable substitute.

The threat of substitutes for traditional energy is substantial, driven by the growing cost-effectiveness and environmental appeal of renewables like solar and wind. By 2024, 91% of new renewable projects were more cost-effective than fossil fuels, with solar and onshore wind being significantly cheaper.

Electric vehicles are another major substitute, directly impacting Eni's gasoline and diesel sales. As EV prices approach parity with internal combustion engine vehicles, demand for traditional fuels is expected to decline, prompting Eni to invest in charging infrastructure and biofuels.

Energy efficiency improvements and emerging fuels like green hydrogen further challenge Eni's existing business model. Global investments exceeding $500 billion in the hydrogen economy by early 2024 highlight its potential to displace natural gas in industrial applications.

| Substitute Category | Key Technologies/Examples | Impact on Traditional Energy | 2024 Data/Projections |

|---|---|---|---|

| Renewable Energy | Solar PV, Onshore Wind | Cost-competitiveness, reduced emissions | 91% of new projects more cost-effective than fossil fuels |

| Electrification | Electric Vehicles (EVs) | Reduced demand for gasoline/diesel | EV purchase costs nearing parity with ICE vehicles in many markets |

| Energy Efficiency | Smart home tech, improved insulation | Lower overall energy consumption | Global energy efficiency market valued over $400 billion |

| Alternative Fuels | Biofuels, Sustainable Aviation Fuel (SAF), Green Hydrogen | Displacement of petroleum products and natural gas | Eni targets >5 million tonnes biofuel capacity by 2030; >$500 billion global investment in hydrogen economy by early 2024 |

Entrants Threaten

The energy sector, especially oil and gas exploration, demands massive initial investments. Think billions for seismic surveys, drilling rigs, and production facilities. This financial hurdle significantly discourages newcomers from even attempting to enter the market, making it tough to compete with incumbents like Eni.

The energy sector, particularly for established players like Eni, is characterized by stringent regulations and complex permitting processes. Obtaining the necessary licenses for exploration, production, and distribution is a time-consuming and resource-intensive endeavor. This high barrier to entry, requiring specialized knowledge and substantial capital, effectively deters many potential new competitors from entering the market.

Established players like Eni leverage extensive existing infrastructure, including vast pipeline networks, refining capacity, and established distribution channels, creating a high barrier to entry. In 2024, Eni's integrated operations across the energy value chain allow for significant cost advantages. For instance, their refining capacity of approximately 240,000 barrels per day in Italy contributes to economies of scale that new entrants would struggle to replicate quickly or cost-effectively.

Access to Resources and Markets

New companies entering the oil and gas sector face significant hurdles in securing access to commercially viable reserves. Established players often control the most promising exploration areas through existing licenses and long-term agreements, making it difficult for newcomers to acquire the necessary resources. For instance, in 2024, major oil companies continued to dominate exploration acreage, with many governments prioritizing established operators for new licensing rounds.

Establishing reliable supply chains and market access for refined products and power presents another formidable barrier. Existing infrastructure, such as pipelines, refineries, and distribution networks, is largely controlled by incumbent firms. These companies benefit from economies of scale and established customer relationships, which new entrants struggle to replicate. In 2023, the global refining capacity was heavily concentrated among a few multinational corporations, highlighting the entrenched nature of market access.

- Resource Control: Dominant companies often hold exclusive rights to prime oil and gas reserves, limiting opportunities for new entrants.

- Infrastructure Dominance: Existing players control critical infrastructure like pipelines and refineries, creating high barriers to entry for market access.

- Contractual Advantages: Long-standing relationships and supply contracts held by established firms are difficult for new companies to penetrate.

- Market Share: In 2023, the top 10 oil producers accounted for over 50% of global crude oil output, demonstrating significant market concentration.

Brand Loyalty and Customer Relationships

Established players like Eni often benefit from deeply ingrained brand loyalty and robust customer relationships, especially in consumer-facing sectors such as retail and power distribution. This loyalty acts as a significant deterrent for newcomers. For instance, Eni's Plenitude, its retail energy arm, has cultivated a substantial customer base over years of operation, making it challenging for new entrants to attract and retain customers without substantial incentives or unique value propositions.

The power and retail segments, in particular, demand considerable investment in building trust and fostering long-term customer engagement. New companies entering these markets must overcome the inertia of existing customer preferences and the established reputation of incumbents. This can translate into higher marketing and customer acquisition costs, effectively raising the barrier to entry.

- Brand Recognition: Eni's long-standing presence has built significant brand equity.

- Customer Relationships: Existing customer loyalty in Plenitude and Enilive segments is a key barrier.

- Acquisition Costs: New entrants face higher costs to attract customers away from established brands.

- Trust Factor: Building trust in the energy sector takes time and consistent performance.

The threat of new entrants for companies like Eni is generally low due to substantial capital requirements for exploration and infrastructure development. High regulatory hurdles and complex permitting processes further deter new players. Existing players also benefit from established infrastructure and resource control, making it difficult for newcomers to compete effectively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including publicly available financial statements, industry expert interviews, and market research reports.