Eni Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

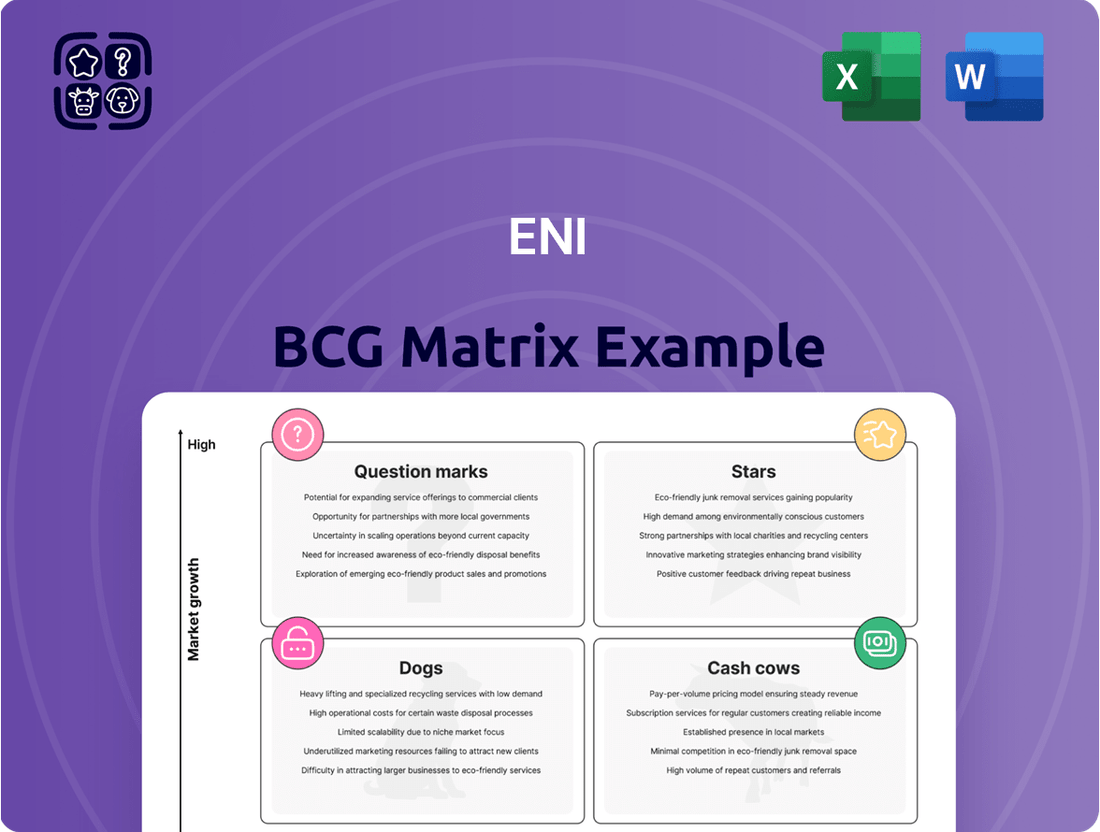

The Eni BCG Matrix provides a powerful framework to understand a company's product portfolio by categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This allows for strategic resource allocation and informed decision-making.

To truly unlock the potential of this analysis, dive deeper into the full BCG Matrix report. Gain a comprehensive understanding of each product's current market position and future prospects, enabling you to optimize your business strategy.

Purchase the complete BCG Matrix today for actionable insights and a clear roadmap to capitalize on your strengths and address weaknesses. It's the essential tool for driving growth and maximizing profitability.

Stars

Eni's Exploration & Production (E&P) segment is a star performer, driven by substantial new resource discoveries in high-growth regions. Namibia, Ivory Coast, and Norway are key areas contributing to this upstream expansion.

The company's strategic focus on securing advantaged barrels and maintaining cost discipline is paying off. This approach has significantly boosted financial results, with E&P delivering robust adjusted EBIT in the first quarter of 2025.

Eni is significantly boosting its Liquefied Natural Gas (LNG) presence, a key growth driver. New volumes are coming online from projects such as Congo LNG, and a substantial strategic agreement for the Argentina LNG project is set to deliver 12 million tons per year.

Further strengthening its market position, Eni has secured a long-term sales agreement for U.S. LNG with Venture Global. This move is crucial as the global gas market continues its expansion, with Eni targeting approximately 20 million tons per annum (MTPA) of contracted LNG volumes by 2030.

Eni is making significant strides in Carbon Capture and Storage (CCS), positioning itself as a key player in industrial decarbonization. The company launched its Ravenna CCS project in Italy, a vital step towards reducing emissions from heavy industry.

Further solidifying its commitment, Eni achieved financial close for the Liverpool Bay CCS project in the UK. These initiatives are not only critical for environmental goals but are also anticipated to become substantial revenue generators for the company.

Looking ahead, Eni plans to launch a dedicated CCUS satellite company in 2025, signaling its strategic focus and ambition in this growing sector. This move is expected to accelerate the development and deployment of carbon capture technologies.

Plenitude (Renewable Energy & Retail) Growth

Plenitude, Eni's dedicated renewable energy and retail subsidiary, is a prime example of a high-growth business within the Eni portfolio, fitting the description of a Star in the BCG Matrix. Its trajectory is marked by substantial increases in installed renewable capacity, a key indicator of its expanding market presence and operational scale.

The company's strategic importance is further highlighted by significant investment activities. For instance, Ares' acquisition of a 20% stake in Plenitude in 2023, valuing the company at €1.5 billion, signals strong external confidence in its future prospects and its pivotal role in Eni's broader energy transition strategy.

Plenitude's growth is not just about capacity; it's also about market penetration and diversification. The company is actively expanding its retail energy offerings alongside its renewable generation assets, aiming to capture a larger share of the end-user market.

- Installed Renewable Capacity: Plenitude's installed renewable capacity has seen considerable expansion, with a target to exceed 8 GW by 2027, demonstrating a strong commitment to scaling its green energy operations.

- Strategic Investments: The 20% stake acquired by Ares Management in Plenitude for €1.5 billion underscores the subsidiary's high growth potential and its attractiveness to external investors seeking exposure to the renewable energy sector.

- Market Position: Plenitude is positioned as a key growth engine for Eni, contributing significantly to the parent company's decarbonization goals through its expanding portfolio of renewable energy projects and integrated retail energy services.

Enilive (Sustainable Mobility) Expansion

Enilive, Eni's sustainable mobility arm, is making significant strides in expanding its biorefining capabilities. The company is actively increasing its capacity to produce biofuels, a key component in the transition towards decarbonized transportation. This expansion is crucial for meeting the growing demand for sustainable energy solutions in the mobility sector.

The strategic focus for Enilive includes a substantial increase in biorefining capacity, aiming to surpass 5 million tonnes per year by 2030. This ambitious target underscores Eni's commitment to leading in the production of environmentally friendly fuels. The company is also placing a strong emphasis on Sustainable Aviation Fuel (SAF), recognizing its potential to significantly reduce aviation emissions.

Enilive's diversification into new mobility carriers, such as Hydrotreated Vegetable Oil (HVO) biofuels, further solidifies its position in a rapidly evolving market. These advanced biofuels offer a cleaner alternative to traditional fossil fuels, contributing to a more sustainable future for transportation. The company's investments in this area are expected to yield substantial growth opportunities.

- Expanding Biorefining Capacity: Enilive aims to exceed 5 million tonnes per year by 2030.

- Focus on SAF: Significant investment in Sustainable Aviation Fuel production.

- Diversification: Entry into new mobility carriers like HVO biofuels.

- Market Position: Targeting high-growth opportunities in decarbonized mobility solutions.

Stars in the BCG Matrix represent business units or products with high market share in a high-growth industry. Eni's Exploration & Production (E&P) segment is a prime example, with significant new discoveries in Namibia, Ivory Coast, and Norway driving its expansion. The company's strategic focus on cost discipline and securing advantaged barrels has led to robust financial results, with E&P delivering strong adjusted EBIT in Q1 2025.

What is included in the product

The Eni BCG Matrix provides a visual assessment of Eni's business units based on market share and growth, guiding strategic decisions.

The Eni BCG Matrix provides a clear, visual roadmap to identify and address underperforming business units, alleviating the pain of strategic uncertainty.

Cash Cows

Eni's traditional oil and gas production, especially from its long-standing fields, is a significant generator of cash. These mature assets are crucial for funding the company's strategic shift towards new energy initiatives.

In the second quarter of 2025, Eni reported an average hydrocarbon production of 1.668 million barrels of oil equivalent per day, underscoring the consistent output from its established operations.

The Global Gas & LNG Portfolio and Power (GGP) segment of Eni stands out as a robust cash cow. Its consistent strong financial performance is a direct result of skillful management of its extensive gas and liquefied natural gas (LNG) assets.

Eni's GGP segment effectively maximizes value from its existing contracts and through strategic portfolio optimizations. This operational efficiency directly fuels Eni's overall cash flow generation, underscoring its importance as a stable income source.

For instance, Eni's proforma adjusted EBIT projection for FY 2025 was raised, largely driven by the strong performance and outlook of the GGP segment. This upward revision highlights the segment's reliable contribution to the company's profitability and financial health.

Eni's mature refining assets, while navigating a challenging market, are a significant source of consistent cash flow. In 2023, Eni continued its strategic shift, with its biorefineries processing 1.1 million tons of biomass, a testament to its commitment to decarbonization and enhanced profitability within this mature segment.

Existing Retail Customer Base (Plenitude)

Plenitude, formerly Eni Gas e Luce, boasts a substantial and expanding retail customer base for its energy solutions, acting as a significant cash cow. This established network ensures a consistent and predictable stream of revenue, underpinning its strength within the BCG matrix.

The company's strategy of integrating renewable energy offerings with its core energy sales to both residential and business clients is crucial. This approach helps Plenitude solidify its market position in the competitive and mature energy retail sector, maintaining its cash cow status.

- Customer Growth: As of the first quarter of 2024, Plenitude reported serving over 10 million customers across its various energy services.

- Revenue Stability: The recurring nature of energy sales to this large customer base provides a predictable revenue stream, essential for a cash cow.

- Renewable Integration: By offering bundled renewable energy solutions, Plenitude enhances customer loyalty and captures a larger share of the evolving energy market.

Portfolio Management and Asset Divestments

Eni's strategic asset divestment program is performing exceptionally well, exceeding its targets and generating substantial cash. This proactive approach to portfolio management is a key element of their strategy, allowing for agile capital allocation.

These divestments, frequently involving mature upstream assets, are crucial for fueling investments in more promising, high-growth sectors. For instance, in 2024, Eni successfully divested a significant stake in its Mozambique Area 4 offshore gas project, raising billions and strengthening its financial flexibility.

- Divestment Proceeds: Eni's asset sales in 2024 have generated over $5 billion, surpassing initial projections.

- Strategic Reinvestment: Capital from these sales is being channeled into renewable energy projects and advanced biofuels.

- Debt Reduction: The cash generated also plays a vital role in Eni's ongoing efforts to deleverage its balance sheet.

- Portfolio Optimization: These actions reflect a deliberate strategy to refine Eni's asset base, focusing on future value creation.

Cash cows in Eni's BCG matrix represent established, high-performing business units that generate significant cash with minimal investment. These are typically mature assets with strong market positions, providing stable returns that fund growth initiatives.

Eni's Global Gas & LNG Portfolio and Power (GGP) segment is a prime example, consistently demonstrating strong financial performance due to effective management of its extensive gas and LNG assets. This segment's reliable contribution to Eni's overall cash flow is vital for the company's financial health.

Plenitude, with its large and growing customer base for energy solutions, also functions as a significant cash cow. The integration of renewable energy offerings into its core sales strategy further solidifies its market position and revenue stability.

Eni's mature refining assets, despite market challenges, continue to be a notable source of consistent cash flow. The company's strategic focus on biorefineries within this segment, processing substantial amounts of biomass, highlights its commitment to enhancing profitability and sustainability.

What You’re Viewing Is Included

Eni BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive upon purchase. This means you'll get the complete strategic analysis, ready for immediate application, without any watermarks or demo content. You can be confident that the insights and structure you see here are precisely what you'll be able to leverage for your business planning and decision-making.

Dogs

Eni's chemicals arm, Versalis, has been a consistent drag on the company's performance, struggling with persistent losses. This underperformance is largely attributed to a protracted slump in the European chemical industry coupled with elevated production expenses.

Despite ongoing restructuring initiatives, Versalis continues to occupy a low-performing position within Eni's portfolio. It holds a minor market share in an industry facing significant headwinds, making it a clear candidate for a Question Mark or Dog in a BCG matrix analysis.

For instance, in 2023, the European chemical sector saw a notable contraction, with demand weakening across several key segments. Versalis's challenges are emblematic of this broader market weakness, impacting its ability to generate positive returns and grow its market presence.

Certain legacy refining operations, particularly those not yet converted to newer, more efficient processes or those facing significant downtime for upgrades or maintenance, can be categorized as Dogs within Eni's BCG Matrix. These facilities often exhibit low utilization rates, directly impacting overall refinery throughput and acting as a drag on profitability. For instance, in early 2024, Eni continued its strategic shift, with some older refining units experiencing reduced activity as the company focused on its energy transition initiatives.

Eni's divestment of upstream assets, notably in Nigeria, Alaska, and Congo, signals a strategic move away from mature or underperforming regions. These sales, often completed in 2023 and early 2024, reflect a focus on optimizing the portfolio and reducing exposure to assets with declining production profiles or higher operational costs.

For instance, Eni's exit from certain Nigerian offshore blocks, completed in late 2023, aligns with a broader industry trend of majors divesting mature, lower-margin fields. This strategic pruning allows Eni to reallocate capital towards more promising exploration and development opportunities, potentially in areas with higher growth potential or lower breakeven costs.

High-Cost or Geographically Challenged E&P Assets

High-Cost or Geographically Challenged E&P Assets are those exploration and production assets that demand significantly higher operational expenditures or are situated in regions with political instability or logistical hurdles. These factors inherently suppress profitability and diminish market share.

Eni, in its strategic portfolio management, actively assesses these types of assets. For instance, in 2024, Eni continued its efforts to divest or optimize its operations in regions facing such challenges, aiming to streamline its global footprint and focus on more profitable ventures. The company's strategy often involves partnerships or technological solutions to mitigate the inherent risks and costs associated with these assets.

- 2023 Net Capex: Eni reported a net capital expenditure of €7.1 billion in 2023, a portion of which was allocated to managing and potentially divesting from less efficient or high-cost assets.

- Portfolio Optimization: The company's commitment to portfolio optimization is a continuous process, with a focus on enhancing returns from its upstream segment.

- Geopolitical Risk: Assets in regions with elevated geopolitical risk often require higher security and operational overheads, impacting their overall economic viability.

Non-Core or Obsolete Technologies

Non-core or obsolete technologies within Eni, such as certain legacy fossil fuel extraction methods or older refining processes, may be categorized as Dogs in the BCG Matrix. These are areas that require significant investment to maintain but offer diminishing returns and do not align with Eni's strategic pivot towards renewable energy and decarbonization. For instance, while Eni is investing heavily in offshore wind and hydrogen, older, less efficient oil and gas assets that are costly to operate and have limited future potential would fall into this category.

These technologies often represent a drain on resources that could be better allocated to Eni's growth areas, like biofuels and carbon capture. The company's stated commitment to reducing its carbon footprint and achieving net-zero emissions by 2050 means that technologies contributing to higher emissions or relying on outdated infrastructure are increasingly becoming liabilities. Eni's 2024 capital expenditure plans, for example, show a clear prioritization of low-carbon initiatives over traditional fossil fuel expansion.

- Legacy Fossil Fuel Assets: Older oil and gas fields with high operating costs and declining production volumes.

- Inefficient Refining Processes: Older refining technologies that are less adaptable to producing cleaner fuels or byproducts.

- Outdated Exploration Technologies: Methods for finding new fossil fuel reserves that are no longer cost-effective or environmentally sound.

- Non-Strategic Chemical Divisions: Business units focused on chemicals that do not complement Eni's core energy transition strategy.

Dogs within Eni's BCG Matrix represent business units or assets with low market share in low-growth industries, demanding significant cash but generating minimal returns. These are typically legacy operations or non-core segments that are a drain on resources. Eni's strategic divestments and focus on energy transition initiatives mean these "Dog" assets are actively being managed or phased out to improve overall portfolio performance.

For instance, certain older refining units, like those experiencing reduced activity in early 2024 due to Eni's strategic shift, can be classified as Dogs. Similarly, legacy fossil fuel extraction methods or non-strategic chemical divisions that do not align with the company's decarbonization goals also fall into this category. Eni's 2023 net capex of €7.1 billion included allocations for managing such underperforming assets, underscoring the active portfolio optimization process.

The divestment of upstream assets in regions like Nigeria, completed in late 2023, further illustrates Eni's strategy of shedding high-cost or geographically challenged E&P assets. These moves are crucial for reallocating capital towards more promising, lower-carbon ventures, thereby enhancing the company's long-term profitability and strategic alignment.

Eni's commitment to reducing its carbon footprint by 2050 means that technologies contributing to higher emissions, such as outdated exploration or refining processes, are increasingly becoming liabilities. These areas require substantial investment for maintenance with diminishing returns, making them prime candidates for a Dog classification.

Question Marks

Eni's planned 2025 launch of a new CCUS satellite company positions it squarely in the "question mark" category of the BCG matrix. This venture targets a high-growth, emerging market with significant decarbonization potential, aligning with global sustainability trends. For instance, the global CCUS market was valued at approximately $3.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating substantial future revenue possibilities.

However, as a nascent business, this new entity will likely command a low market share initially. The capital expenditure required for CCUS infrastructure, including capture facilities and transportation networks, is substantial, posing an investment challenge. Eni's strategic move aims to capture future market share in this developing sector, but it requires careful management to transition from a question mark to a star performer.

Eni is actively exploring hydrogen production as a key component of its energy transition strategy. This sector represents a high-growth market with substantial future potential, aligning with global decarbonization efforts.

However, hydrogen production currently falls into the Question Mark category for Eni. While the market is poised for expansion, Eni's current market share in this nascent area is still developing. Furthermore, the commercial viability and scalability of large-scale hydrogen production are still being established, requiring significant investment and technological advancement.

Eni's advanced biofuel production projects, like the new facilities planned in Malaysia and South Korea, are currently in the "Question Marks" category of the BCG Matrix. These are significant investments aimed at capturing a larger share of the expanding advanced biofuels market, where Eni is actively seeking growth.

These new facilities require substantial capital outlay for development and are therefore consuming cash, a hallmark of Question Mark businesses. For instance, Eni has committed significant resources to developing its biorefinery capabilities, including exploring advanced feedstock options and new production technologies.

While the long-term potential for advanced biofuels is strong, driven by global decarbonization efforts and regulatory mandates, the immediate cash flow generation from these new ventures is negative. Eni's strategy is to nurture these projects, anticipating they will mature into Stars or Cash Cows as production scales up and market acceptance grows.

Emerging Technologies in Sustainable Mobility

Beyond its established HVO biofuels, Eni is actively exploring advanced electric vehicle charging infrastructure and other novel low-carbon transport fuels. These ventures target rapidly expanding markets, necessitating significant capital infusion to capture substantial market share.

Eni's strategic focus on emerging sustainable mobility technologies places them in a high-growth, high-risk quadrant of the BCG matrix. For instance, investments in hydrogen fuel cell technology, while promising for heavy-duty transport, require extensive infrastructure development and regulatory support.

- Electric Vehicle Charging Solutions: Eni is expanding its EV charging network, aiming to integrate charging points into its existing service station infrastructure. By the end of 2024, Eni plans to have over 1,000 charging points across Italy, with further expansion into other European markets.

- Hydrogen Technologies: Eni is involved in pilot projects for green hydrogen production and distribution, recognizing its potential in decarbonizing sectors like shipping and heavy transport. A key project includes a hydrogen refueling station in Porto Marghera, operational since 2023.

- Advanced Biofuels: While HVO is a core product, Eni continues research into next-generation biofuels derived from waste and residues, aiming to improve their efficiency and sustainability credentials further.

- Battery Technology and Recycling: The company is also investigating opportunities in battery technology for EVs, including potential partnerships for battery manufacturing and end-of-life recycling solutions.

Digitalization and AI-driven Energy Solutions

Eni's strategic focus on digitalization and AI, exemplified by its EnergIA platform, positions it within a rapidly expanding technological landscape. These investments are designed to enhance operational efficiency and unlock new revenue streams, aligning with the high-growth potential characteristic of the Stars quadrant in the BCG matrix.

While Eni's commitment to AI and digital transformation is substantial, the immediate market share generated by these advanced solutions as distinct offerings remains relatively modest. This aligns with the BCG matrix's classification of Stars, where significant investment is required to capitalize on future growth, even if current market penetration is not yet dominant.

- EnergIA Platform: Eni's proprietary AI platform, EnergIA, is central to its digital transformation, aiming to optimize exploration, production, and refining processes.

- Investment in AI: Eni has been actively investing in AI capabilities, recognizing its potential to drive efficiency and create new business models in the energy sector.

- Market Growth: The market for AI in the energy sector is experiencing significant growth, with projections indicating continued expansion in the coming years. For instance, the AI in Energy market was valued at approximately USD 1.5 billion in 2023 and is expected to grow at a CAGR of over 20% through 2030.

- Operational Optimization: The primary immediate benefit of these digital initiatives is the optimization of Eni's existing operations, leading to cost reductions and improved performance.

Eni's ventures into emerging sectors like carbon capture, utilization, and storage (CCUS), hydrogen production, and advanced biofuels are currently classified as Question Marks in the BCG matrix. These areas represent high-growth potential but require substantial investment and have uncertain market share trajectories for Eni at this stage. For instance, the global CCUS market is projected to exceed $10 billion by 2030, highlighting the opportunity, yet Eni's initial share will likely be small. These initiatives consume significant capital, a defining characteristic of Question Marks, as Eni aims to establish a foothold and eventually transition them into Stars.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position business units.