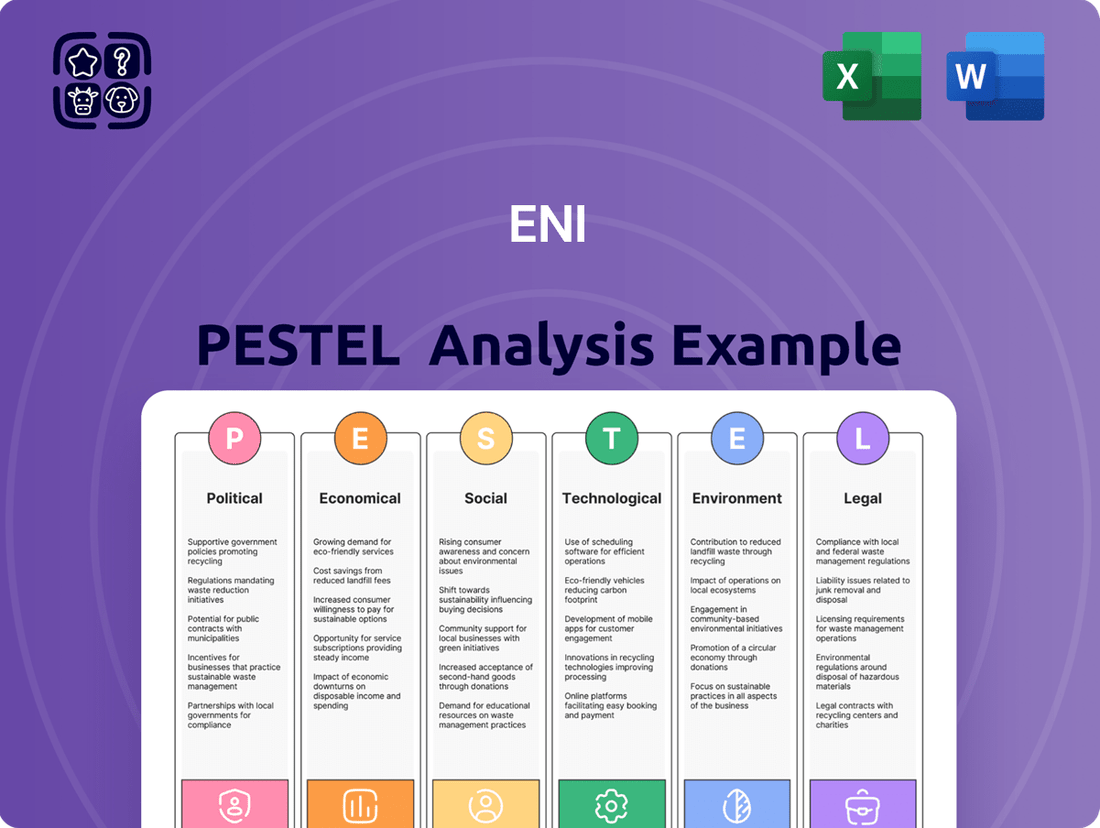

Eni PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

Navigate Eni's dynamic future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping this energy giant, and gain a crucial competitive advantage. Download the full report to unlock actionable intelligence and make informed strategic decisions.

Political factors

Eni's operations are heavily shaped by government policies and regulations worldwide. Shifts in energy strategies, incentives for green energy, and limitations on fossil fuel activities directly influence its business. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), effective from 2024, mandates detailed sustainability reporting, impacting how Eni communicates its environmental and social performance.

Geopolitical stability is paramount for Eni, given its substantial oil and gas operations spanning regions like Africa and the Middle East. Instability in these areas directly threatens Eni's supply chains and production capabilities, potentially escalating operational risks and expenses.

For instance, Eni's significant financial commitments, such as its 2024 payments to energy-producing nations, underscore its deep involvement in countries like Libya, Algeria, and Nigeria, all of which can be subject to geopolitical volatility.

International trade agreements and potential sanctions are critical political factors for Eni. These can significantly influence Eni's global trading operations, affecting its market access and profitability. For instance, the European Union's evolving trade policies and energy security initiatives directly shape Eni's operational landscape.

New sanctions or changes to existing ones can disrupt Eni's import and export activities, impacting its supply chains and revenue streams. The company's significant presence in regions like North Africa, where it has partnerships with entities like Algeria's Sonatrach, highlights the sensitivity to geopolitical stability and bilateral trade relations.

Government Support for Energy Transition

Governments worldwide are increasingly prioritizing the energy transition, offering substantial support for low-carbon technologies and renewable energy sources. This commitment is crucial for companies like Eni as they navigate their diversification strategies. Financial incentives, supportive regulatory frameworks, and collaborative initiatives are key drivers enabling the shift towards more sustainable energy systems.

Eni's strategic direction directly reflects these governmental priorities. For instance, their 2024-2027 strategic plan earmarks significant capital for advancements in sustainable chemistry, biorefining, and energy storage solutions. This aligns Eni's business objectives with the broader global push for decarbonization and a cleaner energy future.

- Governmental Focus: Over €60 billion in EU recovery funds were allocated to green initiatives and energy transition projects by mid-2024, signaling strong political will.

- Eni's Investment: Eni plans to invest €25 billion in energy transition initiatives between 2023 and 2026, with a focus on renewables and decarbonization technologies.

- Policy Impact: Favorable feed-in tariffs and tax credits for renewable energy projects, introduced in various European nations throughout 2024, directly benefit companies developing such infrastructure.

- Regulatory Alignment: The European Union's Fit for 55 package, with its ambitious emissions reduction targets for 2030, creates a clear regulatory landscape that encourages Eni's investments in sustainable solutions.

Nationalization Risks and Resource Nationalism

Eni faces ongoing risks related to nationalization and resource nationalism in countries where it operates significant oil and gas assets. Governments may seek to assert greater control over their natural resources, potentially leading to renegotiated contracts, higher taxes, or even expropriation of assets. This dynamic directly impacts Eni's long-term investment security and operational autonomy.

For instance, in 2024, Eni's substantial payments to various governments underscore the critical need for robust diplomatic engagement and strong relationships in resource-rich nations. These financial interactions are not merely transactional but represent a strategic effort to navigate the complex political landscape and mitigate the potential for adverse governmental actions. The company's ability to maintain favorable terms and operational access hinges on its skillful management of these intergovernmental relationships.

The potential for resource nationalism is a persistent concern for international energy companies like Eni.

- Increased Taxation: Governments may unilaterally increase taxes on oil and gas production, directly reducing Eni's profitability.

- Contract Renegotiation: Existing production sharing agreements or concessions could be subject to renegotiation, potentially altering Eni's revenue share and operational terms.

- Expropriation Risk: In extreme cases, governments might nationalize assets, leading to a complete loss of investment and operational control for Eni.

- Local Content Requirements: Stricter local content regulations can mandate increased use of domestic labor and supplies, potentially raising operational costs and complexity for Eni.

Political stability and government policies are critical for Eni's global operations, influencing everything from exploration rights to market access. Shifts in energy policy, such as the EU's drive towards decarbonization, directly impact Eni's strategic investments and operational focus. For example, the European Green Deal, with its ambitious climate targets for 2030, sets a clear direction for energy companies like Eni, encouraging investments in renewables and low-carbon technologies.

Geopolitical events and international relations also play a significant role, affecting supply chains and operational security. Eni's substantial presence in North Africa, for instance, makes it sensitive to regional stability and bilateral agreements with countries like Algeria. The company's 2024 strategic plan reflects this by emphasizing diversified energy sources and resilient supply chains to mitigate geopolitical risks.

Governmental support for the energy transition, including subsidies and favorable regulations for renewable energy projects, is a key enabler for Eni's diversification efforts. By mid-2024, the European Union had allocated over €60 billion in recovery funds specifically for green initiatives, providing a robust financial incentive for companies like Eni to invest in sustainable solutions. Eni itself committed €25 billion to energy transition initiatives between 2023 and 2026, demonstrating alignment with these political priorities.

| Political Factor | Impact on Eni | Example/Data (2024-2025) |

|---|---|---|

| Energy Transition Policies | Drives investment in renewables and low-carbon tech | EU Green Deal targets; Eni's €25bn investment (2023-2026) in transition |

| Geopolitical Stability | Affects supply chains and operational security | Eni's operations in North Africa; sensitivity to regional politics |

| Governmental Support/Incentives | Facilitates diversification and green projects | EU recovery funds for green initiatives (>€60bn by mid-2024) |

| Resource Nationalism/Taxation | Impacts profitability and asset security | Potential for increased taxes or contract renegotiations in resource-rich nations |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Eni, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions and decision-making.

Economic factors

Global oil and natural gas prices are a critical factor for Eni, directly influencing its financial performance. For instance, during 2024, a notable decline in hydrocarbon prices significantly impacted the company's profitability. This sensitivity means Eni's revenue and net profit are closely tied to the volatility of these energy markets.

The global economy's trajectory is a significant driver for Eni. For instance, in 2024, the International Monetary Fund projected global GDP growth of 3.2%, a figure that directly correlates with increased energy consumption. This robust economic activity translates into higher demand for Eni's oil and gas products, bolstering its core business segments and providing capital for its renewable energy expansion.

When economies expand, industries ramp up production and consumers increase spending, both of which require more energy. This heightened demand is a positive signal for Eni, impacting its sales volumes across its portfolio. Even as Eni diversifies into renewables, sustained economic growth supports investment in these cleaner energy sources as well, creating a dual benefit.

Looking ahead, projections for 2025 suggest continued, albeit potentially moderated, global economic expansion. This ongoing growth environment is crucial for Eni, as it underpins the demand for both its fossil fuel operations and its burgeoning renewable energy projects, such as its solar and wind initiatives in Italy and abroad.

Inflationary pressures directly impact Eni's operational expenses. For instance, the global inflation rate, which saw significant spikes in 2022 and 2023, continued to influence commodity prices in early 2024, potentially increasing Eni's costs for raw materials like oil and gas, as well as labor and transportation.

Rising interest rates pose a challenge for Eni's capital-intensive projects. Central banks, including the European Central Bank, maintained higher interest rate environments throughout much of 2023 and into 2024 to combat inflation, making it more expensive for Eni to finance large-scale investments in exploration, production, and renewable energy initiatives.

Eni's financial performance in 2024 demonstrates resilience. The company reported strong results, with adjusted EBITDA for the first quarter of 2024 reaching €3.7 billion, reflecting its capacity to adapt and capitalize on market dynamics, even amidst these economic headwinds.

Investment in Renewable Energy and Diversification

Eni's economic performance is increasingly linked to its renewable energy investments and diversification efforts. The company is actively expanding its portfolio in areas like biorefining and sustainable chemistry, aiming for robust growth in these transition-focused sectors. Eni's 2024-2027 strategic plan specifically targets high-return, high-growth opportunities within the energy transition landscape.

The company's commitment to diversification is evident in its substantial investments. For instance, Eni's capital expenditure for 2024 is projected to be around €10.5 billion, with a significant portion allocated to accelerating its energy transition strategy, including renewables and low-carbon initiatives. This strategic allocation underscores the growing importance of these diversified businesses to Eni's overall economic health and future profitability.

- Renewable Energy Expansion: Eni aims to increase its installed capacity of power from renewables and recycled materials to 6 GW by 2025 and 15 GW by 2030, demonstrating a clear growth trajectory in this segment.

- Diversified Business Growth: Investments in biorefining and sustainable chemistry are key components of Eni's strategy to build new, high-growth revenue streams, contributing to economic resilience.

- Strategic Financial Allocation: The 2024-2027 plan prioritizes capital for energy transition projects, signaling a strong economic commitment to these diversified activities as drivers of future returns.

- Economic Impact of Diversification: Successful expansion in these areas is crucial for Eni's economic performance, providing a hedge against traditional fossil fuel market volatility and capturing new market opportunities.

Currency Exchange Rate Fluctuations

Eni's global operations expose it to significant currency exchange rate fluctuations. As a company dealing in multiple currencies, changes in exchange rates can directly impact its reported financial performance.

For instance, a strengthening euro against other major currencies like the US dollar would mean that earnings generated in dollars translate into fewer euros, potentially reducing Eni's reported profits. Conversely, a weaker euro could boost reported earnings when converting foreign currency revenues.

In 2024, the euro experienced volatility against the US dollar, trading within a range that could have impacted Eni's reported earnings. For example, if Eni's significant revenue streams are denominated in US dollars, a sustained appreciation of the euro against the dollar during the year would have presented a headwind to its euro-denominated financial statements.

- Global Operations Exposure: Eni's international presence necessitates transactions in various currencies, making it vulnerable to exchange rate volatility.

- Impact on Reported Profits: A stronger euro can diminish the euro equivalent of earnings generated in foreign currencies, negatively affecting reported financial results.

- 2024 Euro-Dollar Dynamics: The euro's fluctuating performance against the US dollar in 2024 directly influenced the translation of Eni's foreign earnings into its reporting currency.

- Strategic Hedging: Companies like Eni often employ hedging strategies to mitigate the risks associated with currency fluctuations, aiming to stabilize financial outcomes.

Eni's financial performance is intrinsically linked to global economic conditions, which dictate energy demand. Projections for 2024 and 2025 indicate continued, though potentially moderated, global GDP growth, supporting energy consumption. This sustained economic activity directly benefits Eni by increasing demand for its oil and gas products while also providing capital for its expanding renewable energy ventures.

Same Document Delivered

Eni PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis for Eni.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Eni.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic decision-making regarding Eni.

Sociological factors

Public perception significantly impacts Eni's operations, particularly concerning fossil fuels and climate change. Negative sentiment can translate into heightened scrutiny and challenges in securing a social license to operate, essential for project development and expansion.

Eni's commitment to addressing these concerns is evident in its 'Eni for 2024 – A Just Transition' report. This initiative underscores the company's focus on environmental sustainability, fostering industrial growth, and ensuring social inclusion, aiming to build a more positive public image.

Eni's operational efficiency and future growth are significantly influenced by the availability of a skilled workforce and evolving labor market demographics, especially as the company pivots towards new energy technologies. In 2024, Eni continued to prioritize investments in upskilling its employees, aiming to align their capabilities with the demands of sustainable energy sectors.

The company's strategy involves dedicating its highly skilled workforce to higher-value, more sustainable activities, reflecting a broader industry trend. As of the first half of 2025, Eni reported that over 60% of its training programs were focused on digital transformation and renewable energy competencies, underscoring this commitment.

Eni's commitment to community engagement is vital for its operational success and social license to operate. By fostering positive relationships with local populations, Eni can mitigate risks and build trust.

In 2024, Eni actively supported local development by implementing over 100 projects spanning 21 countries. These initiatives focused on critical areas like improving access to energy, clean water, healthcare services, and educational opportunities, demonstrating a tangible contribution to the well-being of the communities where it operates.

Consumer Preferences and Energy Consumption Patterns

Consumer preferences are shifting significantly towards sustainability, directly impacting energy consumption patterns. This trend is compelling companies like Eni to adapt their strategies, with a growing emphasis on cleaner energy sources and environmentally friendly products.

The increasing demand for renewable energy and biofuels is a prime example of this shift. This influences Eni's strategic investments, notably in its renewable energy subsidiary, Plenitude, and its biorefining business, Enilive. For instance, by the end of 2023, Plenitude had installed 8.4 GW of capacity, with a target of 15 GW by 2026, showcasing a clear commitment to renewables.

- Growing Demand for Renewables: Global investment in renewables reached $600 billion in 2023, a figure expected to rise as consumer preference solidifies.

- Biofuel Market Expansion: The global biofuel market is projected to grow at a CAGR of 6.5% from 2024 to 2030, driven by environmental regulations and consumer choices.

- Eni's Strategic Investments: Eni's investment in Plenitude aims to capture this growing market, with the company targeting 15 GW of installed capacity by 2026.

- Consumer Awareness: Surveys consistently show that a majority of consumers, particularly in Europe, are willing to pay a premium for sustainable energy solutions.

Health, Safety, and Human Rights Standards

Eni's commitment to upholding robust health, safety, and human rights standards across its worldwide operations is a key sociological consideration. In 2024, the company intensified efforts to combat violence against women and ensure community benefits in its host nations, reflecting a growing societal expectation for corporate responsibility.

Adherence to these principles is paramount, as any lapse can trigger severe reputational harm, costly legal battles, and significant operational interruptions, impacting stakeholder trust and long-term sustainability.

Eni's 2024 initiatives underscore a proactive approach to these critical areas, aiming to align business practices with evolving global norms and expectations for ethical conduct.

Sociological factors significantly shape Eni's operational landscape, influencing public perception, workforce dynamics, and consumer preferences. The company's response to these evolving societal expectations, particularly regarding sustainability and ethical conduct, directly impacts its social license to operate and long-term viability. Eni's strategic investments and community engagement efforts in 2024 and early 2025 highlight its adaptation to these critical sociological trends.

| Sociological Factor | Eni's Response/Data (2024-2025) | Impact |

|---|---|---|

| Public Perception & Climate Change | 'Eni for 2024 – A Just Transition' report; focus on sustainability and social inclusion. | Influences social license to operate; requires proactive communication on environmental efforts. |

| Workforce Skills & Demographics | Over 60% of training programs focused on digital transformation and renewables (H1 2025). | Ensures operational efficiency and future growth in new energy sectors. |

| Community Engagement | Implemented over 100 development projects in 21 countries (2024). | Mitigates operational risks and builds stakeholder trust. |

| Consumer Preferences (Sustainability) | Investment in Plenitude (8.4 GW installed capacity by end-2023, target 15 GW by 2026). | Drives strategic shift towards renewable energy and biofuels. |

| Health, Safety & Human Rights | Intensified efforts against violence against women and ensuring community benefits (2024). | Protects reputation, avoids legal issues, and maintains operational continuity. |

Technological factors

Eni benefits significantly from ongoing technological leaps in exploration and production. Enhanced seismic imaging, for instance, allows for more precise identification of hydrocarbon reserves, while advanced drilling techniques, like those employed in the deepwater Zohr field, enable access to previously unreachable resources. These innovations directly translate to higher recovery rates and lower extraction costs for Eni.

Eni's strategy heavily relies on advancements in renewable energy, particularly solar, wind, and bioenergy. The company is investing in and innovating to create more efficient and affordable ways to generate renewable power and produce sustainable fuels.

This commitment is evident in Eni's subsidiary, Plenitude, which has set an ambitious target of achieving 15 gigawatts (GW) of installed renewable capacity by the year 2030. This focus positions Eni to capitalize on the growing global demand for cleaner energy sources.

The advancement and implementation of Carbon Capture, Utilization, and Storage (CCUS) technologies are vital for Eni to shrink its carbon emissions and achieve its decarbonization goals, especially concerning its existing oil and gas activities. Eni is making significant strides in this area, notably with its Ravenna CCS project in Italy, which aims to capture CO2 from industrial sources.

Digital Transformation and AI Integration

Eni is heavily investing in digital transformation, notably through its advanced supercomputing capabilities. The company's HPC6, for instance, is designed to accelerate complex simulations and data analysis, crucial for optimizing exploration and production processes. This digital push aims to streamline operations and foster more data-driven decision-making across the organization.

The integration of Artificial Intelligence (AI) is a key component of Eni's strategy to enhance efficiency and unlock new insights. By leveraging AI, Eni is working to improve predictive maintenance for its assets, optimize energy trading, and develop more sustainable energy solutions. This focus on cutting-edge technology is expected to yield significant operational improvements and cost savings.

Eni's commitment to future technologies is also evident in its quantum computing initiatives, such as Eniquantic. This exploration into quantum computing signals a forward-thinking approach to tackling highly complex problems, potentially revolutionizing areas like materials science for new energy technologies and advanced climate modeling. These investments position Eni at the forefront of technological innovation in the energy sector.

- HPC6 Utilization: Eni's supercomputers are instrumental in accelerating seismic data processing, aiming for faster and more accurate resource identification.

- AI in Operations: The company is deploying AI for predictive maintenance, targeting a reduction in unplanned downtime for its offshore platforms and refineries.

- Quantum Computing Research: Eniquantic is exploring quantum algorithms for potential applications in chemical process optimization and the discovery of new materials for batteries and catalysts.

- Digitalization Investment: Eni has allocated significant capital towards its digital transformation roadmap, with a focus on cloud infrastructure and data analytics platforms to support AI integration.

Biofuel and Sustainable Aviation Fuel (SAF) Production

Technological progress in biorefining and the creation of Sustainable Aviation Fuels (SAF) are crucial for Eni's move into less carbon-intensive transportation. Eni is investing heavily in these areas to support its energy transition strategy.

Eni has set ambitious targets, aiming to reach over 5 million tonnes per year of biorefining capacity by 2030. This expansion is directly linked to increasing their output of SAF, a key component in decarbonizing the aviation sector.

- Biorefining Capacity Target: Eni aims to surpass 5 million tonnes/year by 2030.

- SAF Production Growth: The company is focused on significantly increasing its SAF output.

- Technological Focus: Advancements in biorefining processes are central to Eni's strategy.

Technological advancements are reshaping Eni's operational landscape, from optimizing hydrocarbon extraction with sophisticated seismic imaging to pioneering sustainable energy solutions. The company's significant investment in digital transformation, including its HPC6 supercomputer, is designed to accelerate complex simulations and data analysis, thereby enhancing efficiency across its value chain.

Eni's strategic focus on AI integration aims to bolster predictive maintenance, streamline energy trading, and drive innovation in sustainable energy. Furthermore, its exploration into quantum computing through Eniquantic signals a commitment to tackling highly complex challenges, potentially revolutionizing materials science and climate modeling for future energy technologies.

The company's commitment to decarbonization is underpinned by advancements in Carbon Capture, Utilization, and Storage (CCUS) technologies, exemplified by its Ravenna CCS project. Simultaneously, Eni is aggressively expanding its biorefining capacity, targeting over 5 million tonnes per year by 2030, to boost the production of Sustainable Aviation Fuels (SAF) and contribute to the aviation sector's decarbonization efforts.

| Area | Key Technology | Eni's Target/Activity | Impact |

| Exploration & Production | Advanced Seismic Imaging | Precise reserve identification | Higher recovery rates, lower costs |

| Renewable Energy | Solar & Wind Efficiency | 15 GW installed capacity by 2030 (Plenitude) | Capitalizing on clean energy demand |

| Decarbonization | CCUS | Ravenna CCS Project | Reducing industrial emissions |

| Digital Transformation | HPC6 Supercomputing | Accelerating simulations, data analysis | Optimized operations, data-driven decisions |

| Sustainable Fuels | Biorefining & SAF | >5 million tonnes/year biorefining capacity by 2030 | Decarbonizing transportation |

Legal factors

Eni navigates a dense landscape of environmental rules and emissions targets globally. These cover air and water quality, waste disposal, and greenhouse gas output, demanding substantial investment in eco-friendly technologies and rigorous adherence. For instance, Eni's 2024 Sustainability Report highlights its compliance with the new European Sustainability Reporting Standards (ESRS), demonstrating a commitment to transparency and regulatory alignment.

Eni operates under stringent health and safety legislation, a critical factor given its involvement in high-risk sectors like oil and gas exploration and production. Compliance with these regulations is non-negotiable, aiming to prevent accidents, safeguard employees, and avert significant legal repercussions and damage to its public image.

The company's dedication to occupational safety is a recurring theme in its sustainability reporting, underscoring its proactive approach to managing inherent risks. For instance, Eni's 2023 sustainability report detailed a reduction in its Lost Time Injury Frequency Rate (LTIFR) to 0.48 per million hours worked across its upstream operations, demonstrating a tangible commitment to worker well-being.

Eni, as a major integrated energy player, operates under stringent antitrust and competition laws globally. These regulations are designed to foster fair market practices and prevent any single entity from gaining monopolistic control. This means Eni's strategic moves, like mergers, acquisitions, and even its day-to-day market strategies, are carefully reviewed to ensure they don't stifle competition. For instance, during 2024, regulatory bodies in various jurisdictions continued to closely examine large energy sector transactions, with potential fines for non-compliance reaching billions of euros.

International Energy Treaties and Agreements

Eni's global operations are significantly shaped by international energy treaties and agreements, which govern resource access, production sharing, and cross-border energy trade. These legal frameworks are crucial for navigating the complex geopolitical dynamics of global energy supply and demand. For instance, Eni's long-standing partnerships with national oil companies, such as its collaboration with Algeria's Sonatrach, exemplify how these international agreements facilitate operational continuity and resource development.

These agreements often stipulate terms for exploration, production, and the transportation of energy resources, directly impacting Eni's investment decisions and operational strategies. The stability and predictability offered by these international legal structures are vital for securing long-term energy projects. For example, Eni's involvement in projects like the Zohr field in Egypt is underpinned by concession agreements that align with international energy law principles.

The evolving landscape of international energy law, including climate change accords and sanctions regimes, also presents both opportunities and challenges. Eni must continually adapt its strategies to comply with these varying legal obligations and leverage international cooperation frameworks. In 2023, Eni continued to emphasize its commitment to energy transition initiatives, aligning with global efforts to reduce carbon emissions, as reflected in its participation in various international forums discussing sustainable energy policies.

- International Treaties: Eni operates within a framework of bilateral and multilateral agreements that define terms for resource exploration and production.

- Production Sharing Agreements: Many of Eni's international ventures are governed by PSAs, which outline the division of oil and gas between the host country and the investing company.

- Cross-Border Trade: Treaties facilitate the secure and regulated flow of energy resources across national borders, essential for Eni's supply chain.

- Geopolitical Influence: International energy agreements play a critical role in shaping geopolitical relationships and ensuring energy security for participating nations.

Corporate Governance and Reporting Requirements

Eni is subject to rigorous corporate governance standards and extensive reporting mandates, encompassing both financial performance and sustainability initiatives. These obligations were further amplified by the implementation of the European Corporate Sustainability Reporting Directive (CSRD) starting in 2024, which mandates more comprehensive and standardized sustainability disclosures.

The CSRD requires companies like Eni to report on a wide array of environmental, social, and governance (ESG) factors, aligning with EU sustainability goals. This directive aims to enhance transparency and comparability of sustainability information across the EU, impacting Eni's reporting processes and data collection methodologies.

- CSRD Implementation: The CSRD, effective from January 1, 2024, for many large companies, mandates detailed sustainability reporting.

- Increased Disclosure Scope: Eni must now report on a broader range of ESG topics, including climate change, biodiversity, and social impact.

- Assurance Requirements: Sustainability statements will require external assurance, adding another layer of scrutiny to Eni's reporting.

- Alignment with EU Taxonomy: Reporting must align with the EU Taxonomy for sustainable activities, ensuring consistency in environmental performance metrics.

Eni's legal framework is complex, encompassing global environmental regulations, strict health and safety standards, and antitrust laws designed to ensure fair market competition. The company must also adhere to international energy treaties and production sharing agreements, which are crucial for its global operations and resource development. Furthermore, the implementation of directives like the European Corporate Sustainability Reporting Directive (CSRD) from 2024 onwards mandates more extensive and standardized ESG disclosures, increasing transparency and accountability.

Environmental factors

The intensifying global commitment to combating climate change and the growing imperative for decarbonization significantly shape Eni's strategic landscape, posing both hurdles and avenues for growth. This translates into substantial pressure to curtail greenhouse gas emissions throughout its extensive operations and to channel investments into developing and deploying low-carbon energy solutions. Eni has publicly committed to achieving carbon neutrality by 2050, a target that necessitates a profound transformation of its business model.

Demonstrating tangible progress, Eni reported a remarkable 55% reduction in net Scope 1 and 2 emissions within its Upstream segment by the end of 2023, measured against its 2018 baseline. This achievement underscores the company's proactive approach to emission reduction and its dedication to meeting ambitious environmental goals.

Eni's extensive operations, particularly in exploration and production, carry the inherent risk of impacting biodiversity and delicate ecosystems. Recognizing this, the company has implemented a robust Biodiversity and Ecosystem Services (BES) management model to systematically assess, prevent, and mitigate these potential adverse effects.

A significant aspect of Eni's commitment is its 'no-go' policy, which strictly prohibits oil and gas exploration and development activities within natural sites designated as UNESCO World Heritage. This policy underscores a proactive approach to safeguarding areas of exceptional universal value.

Water scarcity is a significant environmental challenge impacting industries globally, including Eni's operations which rely heavily on water for refining and chemical production. The company recognizes this and is actively pursuing strategies for efficient water management.

Eni has set an ambitious target to achieve water positivity at 30% of its high-consumption sites located in water-stressed regions by the year 2035. This commitment underscores their dedication to responsible resource utilization in the face of growing environmental pressures.

Pollution Control and Waste Management

Eni is actively addressing pollution control and waste management, a critical aspect of its environmental strategy. The company is committed to minimizing emissions, treating wastewater, and responsibly handling hazardous waste generated from its extensive operations. This commitment is driven by stringent regulatory requirements and a proactive approach to reducing its environmental impact.

In 2023, Eni reported a reduction in specific pollutant emissions, aligning with its sustainability targets. For instance, its Scope 1 and Scope 2 greenhouse gas emissions saw a decrease compared to previous years, reflecting investments in cleaner technologies and operational efficiencies. The company's waste management efforts in 2023 focused on increasing recycling rates and diverting waste from landfills, with a target to further enhance these metrics in the coming years.

- Pollution Reduction: Eni aims to decrease air emissions and wastewater pollutants through advanced treatment technologies and process optimization.

- Waste Management: The company is enhancing its waste management systems to boost recycling and reuse, minimizing landfill dependency.

- Regulatory Compliance: Strict adherence to national and international environmental regulations is a cornerstone of Eni's operational framework.

- Sustainability Investments: Significant capital is allocated annually to implement and upgrade pollution control infrastructure and waste management solutions.

Transition to Circular Economy and Sustainable Resources

The global push for a circular economy and the growing need for sustainable resources are significantly reshaping Eni's operational strategy. This transition creates new avenues for growth, particularly in areas like waste-to-energy initiatives, advanced recycling technologies, and the integration of renewable feedstocks into its chemical and biorefining processes.

Eni's strategic vision for its chemical subsidiary, Versalis, explicitly targets the creation of innovative chemical platforms focused on renewable and circular products. This aligns with broader industry trends and regulatory pressures aiming to reduce reliance on virgin fossil fuels and minimize waste generation.

Key initiatives include:

- Expanding waste-to-energy capacity: Eni is investing in technologies to convert various waste streams into energy, contributing to both waste management and renewable energy production.

- Developing advanced recycling for plastics: The company is focusing on chemical recycling methods to process plastic waste back into valuable raw materials for new products.

- Increasing use of bio-based feedstocks: Eni is actively exploring and implementing the use of renewable raw materials, such as biomass, in its biorefining and chemical production to reduce its carbon footprint.

- Versalis's circular product portfolio: By 2024, Versalis aims to significantly increase its offering of chemicals and polymers derived from recycled and bio-based sources, targeting a substantial portion of its portfolio. For instance, by the end of 2023, Versalis reported a 30% increase in its circular product sales compared to the previous year.

Eni's environmental strategy is heavily influenced by global decarbonization efforts and the push for sustainability. The company is actively investing in low-carbon solutions and has committed to carbon neutrality by 2050. Eni has made significant strides in reducing its emissions, reporting a 55% decrease in net Scope 1 and 2 emissions in its Upstream segment by the end of 2023, compared to 2018 levels.

The company is also focused on responsible resource management, particularly water. Eni aims for water positivity at 30% of its high-consumption sites in water-stressed regions by 2035. Furthermore, Eni is enhancing its pollution control and waste management practices, increasing recycling rates and diverting waste from landfills, with a 30% increase in circular product sales reported by Versalis in 2023.

| Environmental Focus | 2023/2024 Target/Status | Key Initiatives |

|---|---|---|

| Scope 1 & 2 Emissions Reduction (Upstream) | 55% reduction by end of 2023 (vs. 2018 baseline) | Investments in cleaner technologies, operational efficiencies |

| Water Positivity | 30% of high-consumption sites in water-stressed regions by 2035 | Efficient water management strategies |

| Circular Economy (Versalis) | 30% increase in circular product sales (vs. previous year) by end of 2023 | Expanding waste-to-energy, advanced plastic recycling, bio-based feedstocks |

| Biodiversity Protection | No-go policy for UNESCO World Heritage sites | Robust Biodiversity and Ecosystem Services management model |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eni is meticulously constructed using data from official energy ministries, international financial institutions like the IMF and World Bank, and reputable industry-specific research firms. This ensures a comprehensive view of political, economic, social, technological, legal, and environmental factors impacting the energy sector.