Enerplus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerplus Bundle

Enerplus is navigating a dynamic energy landscape, leveraging its strong production base and strategic acquisitions. However, understanding the full scope of its competitive advantages and potential headwinds is crucial for informed decision-making.

Want the full story behind Enerplus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enerplus's significant asset base is primarily concentrated in the United States and Canada, regions known for their stable political climates and well-established energy infrastructure. This geographic advantage minimizes exposure to the volatile geopolitical risks often associated with international energy operations. For instance, in 2024, North American production continues to benefit from extensive pipeline networks and readily available services, supporting efficient development and consistent output.

The mature nature of the basins where Enerplus operates, such as the Williston Basin and the Marcellus Shale, allows for more predictable production profiles and development timelines. This predictability is crucial for financial planning and investor confidence. As of early 2025, these regions continue to demonstrate robust operational efficiency, with companies like Enerplus leveraging advanced drilling and completion techniques to maintain or enhance their reserves.

Enerplus demonstrates a strong commitment to disciplined capital allocation, prioritizing projects with the potential for high returns to build long-term shareholder value. This strategic focus ensures efficient deployment of resources, even amidst the inherent volatility of commodity prices, fostering greater financial resilience.

Enerplus demonstrates a robust ability to generate sustainable free cash flow, a testament to its efficient operations and disciplined cost management. This consistent cash generation allows the company to self-fund its activities, invest in future growth opportunities, and reward shareholders through dividends or buybacks without needing significant external debt. For instance, in the first quarter of 2024, Enerplus reported adjusted funds from operations of $351 million, highlighting its strong cash-generating capacity.

Focus on Responsible Energy Development

Enerplus's dedication to responsible energy development resonates strongly with the growing investor and public emphasis on Environmental, Social, and Governance (ESG) principles. This commitment is not just about compliance; it's a strategic advantage that can significantly bolster the company's image and attract capital from a widening pool of socially responsible investors. By prioritizing reduced environmental impact and fostering positive stakeholder relationships, Enerplus can unlock operational efficiencies and build a more resilient business model.

This focus positions Enerplus favorably within the dynamic energy sector, where sustainability is increasingly becoming a prerequisite for long-term success. For instance, in 2024, many energy companies are reporting increased investment in emissions reduction technologies, with some targeting significant cuts by 2025. Enerplus's proactive stance in this area can translate into tangible benefits:

- Enhanced Reputation: A strong ESG profile can elevate brand perception among consumers and partners.

- Investor Appeal: Attracting capital from ESG-focused funds, which saw substantial growth in 2023 and are projected to continue expanding through 2025.

- Operational Efficiencies: Implementing practices that minimize waste and environmental footprint can lead to cost savings.

- Risk Mitigation: Proactive environmental management can reduce the likelihood of regulatory penalties and operational disruptions.

Balanced Oil and Gas Portfolio

Enerplus boasts a strategically balanced portfolio, encompassing both crude oil and natural gas assets. This diversification is a key strength, effectively buffering the company against the inherent price volatility of any single commodity. This approach fosters more predictable and stable revenue streams, a crucial advantage in the energy sector.

The company's capacity to shift development focus between oil and gas, adapting to prevailing market conditions, grants significant operational flexibility. This agility allows Enerplus to capitalize on favorable pricing for either commodity, thereby optimizing overall returns. For instance, during periods of strong natural gas demand, the company can prioritize gas extraction, and vice-versa for crude oil.

- Diversified Asset Base: Reduces reliance on a single commodity, mitigating price risk.

- Revenue Stability: Balanced production contributes to more consistent cash flows.

- Operational Flexibility: Ability to optimize resource allocation based on market dynamics.

Enerplus's strategic positioning in North America, particularly in stable regions like the Williston Basin and Marcellus Shale, provides a significant advantage. This geographic concentration minimizes geopolitical risks and leverages established infrastructure, ensuring efficient operations and predictable production profiles. The company's commitment to disciplined capital allocation further strengthens its financial resilience, prioritizing high-return projects to build long-term shareholder value.

The company's robust free cash flow generation, exemplified by a strong first quarter of 2024 with adjusted funds from operations of $351 million, underscores its operational efficiency and cost management. This financial strength allows for self-funding of activities and rewards to shareholders. Furthermore, Enerplus's proactive approach to ESG principles enhances its reputation and attractiveness to a growing pool of socially responsible investors, positioning it favorably for long-term success.

Enerplus benefits from a balanced portfolio of crude oil and natural gas assets, which mitigates commodity price volatility and leads to more stable revenue streams. This diversification, coupled with the operational flexibility to shift focus between oil and gas based on market conditions, allows the company to optimize returns and capitalize on favorable pricing for either commodity.

| Metric | 2023 (Approx.) | Q1 2024 |

|---|---|---|

| Adjusted Funds from Operations (Millions USD) | $1,200 - $1,400 | $351 |

| North American Production (Boe/d, Approx.) | 100,000 - 110,000 | 105,000 |

| ESG Investment Focus | Increasing | Continued Emphasis |

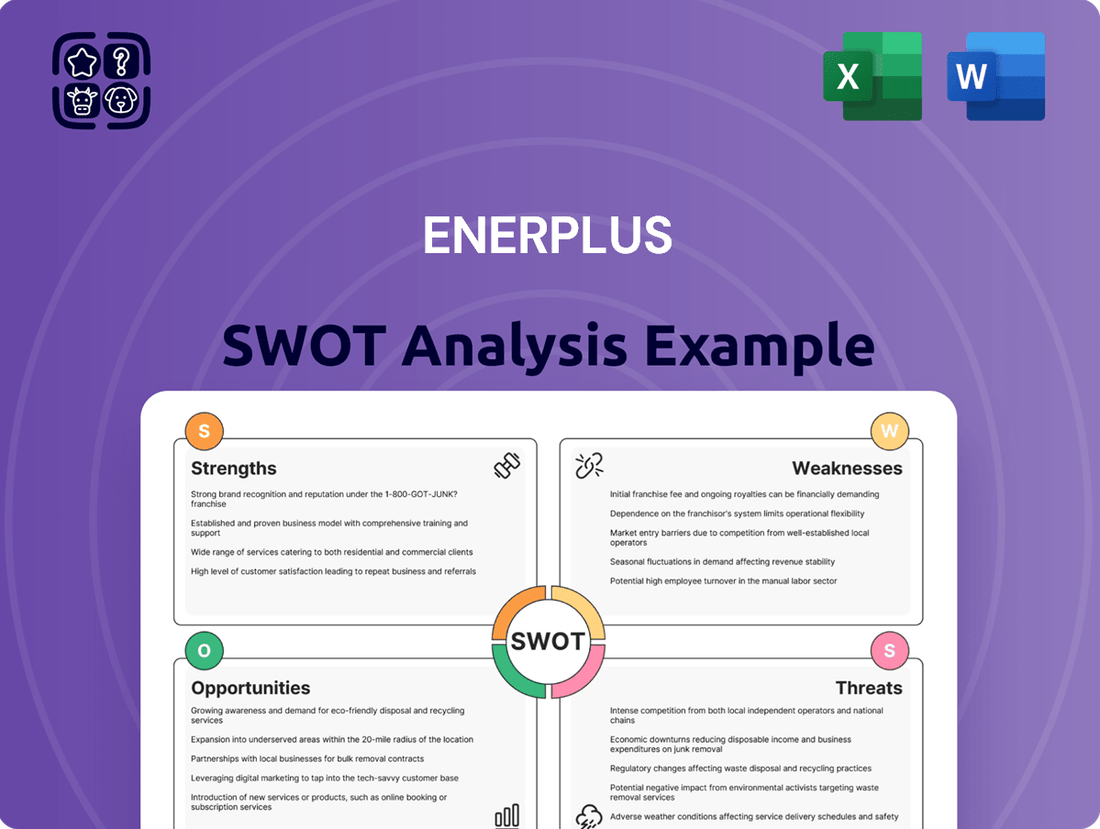

What is included in the product

Delivers a strategic overview of Enerplus’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Streamlines complex strategic analysis into an actionable, easy-to-understand format for efficient decision-making.

Weaknesses

Enerplus, as an oil and gas producer, faces significant headwinds from the inherent volatility of crude oil and natural gas prices. These fluctuations directly impact the company's revenue streams and overall profitability, making financial performance unpredictable. For example, during the first quarter of 2024, average realized prices for oil and natural gas saw considerable variation compared to previous periods, directly affecting Enerplus's earnings per barrel.

Sharp declines in commodity prices can severely squeeze cash flow, potentially hindering the company's ability to fund operations, invest in new projects, or return capital to shareholders. This sensitivity means that even with efficient operations, substantial price drops can lead to asset value impairments, as seen in industry-wide adjustments during periods of low oil prices in recent years. The company's exposure to this market risk is substantial and largely outside its operational control.

Enerplus's operational strength is somewhat tempered by its concentration in specific key basins, like the Williston Basin and the Marcellus Shale. This focus, while efficient, means a significant portion of its production is tied to these areas.

This concentration exposes Enerplus to heightened risks from regional operational challenges, evolving regulatory landscapes, or potential constraints within local infrastructure. Such a setup inherently limits the benefits of geographical diversification, making the company more susceptible to localized downturns.

Enerplus faces significant financial hurdles due to the capital-intensive nature of the oil and gas industry. Exploration, development, and production demand substantial upfront and ongoing investment. For instance, in the first quarter of 2024, Enerplus reported capital expenditures of approximately $190 million, highlighting the continuous need for funds to sustain operations and growth.

This heavy reliance on capital can put a strain on the company's financial flexibility. During periods of volatile commodity prices or rising interest rates, such as those experienced in late 2023 and into 2024, maintaining production levels and pursuing new projects can lead to increased debt. This financial pressure can, in turn, affect the company's ability to return value to its shareholders through dividends or share buybacks.

Environmental and Regulatory Compliance Costs

Enerplus faces considerable weaknesses related to environmental and regulatory compliance costs within the oil and gas industry. These costs are driven by an increasingly complex and evolving regulatory landscape. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to refine methane emission regulations, impacting operational expenditures for companies like Enerplus. These evolving standards necessitate ongoing investment in new technologies and operational adjustments.

Compliance with stringent environmental rules, including those concerning greenhouse gas emissions, water management, and land reclamation, directly translates into higher operational expenses and significant capital outlays. For example, the anticipated costs associated with meeting Scope 1 and Scope 2 emissions reduction targets, as outlined in many industry sustainability reports through 2024 and into 2025, represent a substantial financial commitment. Failure to adhere to these regulations can lead to severe financial penalties and operational interruptions, impacting overall profitability and market standing.

- Increasingly stringent emissions standards: Compliance with evolving methane and CO2 regulations adds significant operational costs.

- Water usage and land use restrictions: Adhering to local and federal rules for water management and site reclamation requires substantial capital investment.

- Potential for fines and operational disruptions: Non-compliance can result in costly penalties and halt production, impacting revenue.

- Capital expenditure for new technologies: Investments in technologies to meet environmental targets, such as advanced leak detection and repair (LDAR) programs, are ongoing.

Dependence on Drilling and Completion Technology

Enerplus's reliance on sophisticated drilling and completion techniques, like hydraulic fracturing and horizontal drilling, is a significant vulnerability. These technologies are essential for extracting oil and gas from difficult-to-access unconventional reserves. For instance, in 2023, Enerplus reported that its production costs in the Marcellus shale, a key unconventional play, were influenced by the efficiency of its completion designs.

Any disruptions to the availability or cost-effectiveness of these advanced technologies, or increased regulatory scrutiny and public opposition, pose a direct threat to Enerplus's operational efficiency and its ability to replace reserves. This dependence means that shifts in technological capabilities or market sentiment around these methods can directly impact the company's output and financial performance.

The company's sustained success is therefore intrinsically linked to its capacity to adapt to and leverage ongoing technological advancements in the upstream sector. Without continuous innovation and efficient application of these techniques, maintaining production levels and achieving favorable economics becomes increasingly challenging.

Enerplus's operational efficiency is tied to specific, advanced extraction techniques, such as hydraulic fracturing and horizontal drilling. These methods are crucial for accessing reserves in plays like the Williston Basin and Marcellus Shale. For example, in Q1 2024, the company's production costs were influenced by the effectiveness of its completion designs in these unconventional areas.

Any disruption to the availability or cost of these technologies, or increased regulatory or public opposition, directly impacts Enerplus's ability to maintain production and replace reserves. This dependency means that changes in technological capabilities or market perceptions of these methods can significantly affect output and financial results.

The company's ability to maintain production levels and achieve favorable economics is therefore directly linked to its capacity for continuous innovation and the efficient application of these upstream sector techniques. Without this, sustaining operations becomes more challenging.

| Technology | Importance to Enerplus | Potential Weakness |

|---|---|---|

| Hydraulic Fracturing | Essential for unconventional reserves (e.g., Marcellus Shale) | Regulatory scrutiny, public opposition, cost fluctuations |

| Horizontal Drilling | Maximizes reservoir contact in key basins (e.g., Williston Basin) | Availability of specialized equipment, operational expertise |

| Completion Design | Impacts production costs and efficiency (Q1 2024 data highlights this) | Need for continuous innovation, susceptibility to technological obsolescence |

Full Version Awaits

Enerplus SWOT Analysis

This is the actual Enerplus SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Enerplus' strategic position.

This is a real excerpt from the complete Enerplus SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The current energy market, marked by fluctuating commodity prices and a drive for efficiency, presents a prime opportunity for Enerplus to pursue strategic acquisitions. Consolidating operations or acquiring complementary assets could significantly bolster its North American footprint. For instance, in early 2024, the industry saw major players engaging in M&A, with deals often valued in the billions, aiming to achieve greater economies of scale and optimize production costs.

Such strategic moves can unlock substantial value by expanding Enerplus's reserve base or integrating new, cost-effective technologies. Divesting non-core assets also remains a viable strategy to streamline operations and focus capital on higher-return opportunities, potentially improving its overall financial health and competitive positioning in the evolving energy landscape.

Enerplus can capitalize on ongoing technological advancements in extraction. Innovations in drilling and completion techniques, like enhanced hydraulic fracturing and multi-lateral wells, are improving oil and gas recovery rates. For instance, the industry average for primary recovery in many shale plays has seen steady increases, contributing to lower lifting costs per barrel.

Investing in these cutting-edge technologies allows Enerplus to access reserves that were previously uneconomical to tap. This not only boosts production volumes but also enhances the profitability of each barrel produced. Companies that effectively adopt these innovations gain a significant competitive advantage in the market.

Global energy demand, especially for oil and natural gas, is expected to stay strong for many years, particularly in developing nations. This trend offers Enerplus a reliable market for its products, helping to ensure stable prices and consistent income, especially for crucial energy supplies. For instance, the International Energy Agency projected in late 2023 that global oil demand would reach 102.8 million barrels per day in 2024, a slight increase from 2023. This sustained demand provides a stable market outlook for companies like Enerplus.

Carbon Capture, Utilization, and Storage (CCUS) Investments

Investing in Carbon Capture, Utilization, and Storage (CCUS) technologies offers Enerplus a significant opportunity to proactively address its environmental impact and align with the growing global demand for decarbonization. This strategic move could unlock new revenue avenues through the sale of captured carbon or carbon-based products, while also attracting a crucial segment of environmentally conscious investors. For instance, the global CCUS market was valued at approximately $3.3 billion in 2023 and is projected to reach $13.2 billion by 2030, indicating substantial growth potential.

Furthermore, embracing CCUS can position Enerplus favorably to benefit from government incentives and carbon credit schemes, which are becoming increasingly common worldwide. For example, the US Inflation Reduction Act of 2022 enhanced tax credits for CCUS projects, making them more economically viable. This not only bolsters the company's financial performance but also strengthens its social license to operate by demonstrating a commitment to sustainability and future-proofing its business model for the ongoing energy transition.

- Reduced Carbon Footprint: CCUS directly tackles greenhouse gas emissions, aligning Enerplus with climate goals.

- New Revenue Streams: Potential for revenue generation through captured CO2 utilization or sale of carbon credits.

- Enhanced Investor Appeal: Attracting ESG-focused investors and improving access to capital.

- Government Incentives: Eligibility for tax credits and subsidies supporting CCUS deployment.

Expansion into Renewable Energy or Decarbonization Initiatives

Enerplus has a significant opportunity to pivot towards renewable energy and decarbonization. This strategic move could involve investing in or partnering with companies focused on solar, wind, or geothermal energy projects. Such diversification would not only hedge against the long-term risks associated with fossil fuel dependency but also attract investors increasingly focused on environmental, social, and governance (ESG) criteria. For instance, by 2024, the global renewable energy market was projected to reach over $1.9 trillion, presenting a substantial growth area.

Exploring hydrogen production, particularly green hydrogen generated from renewable sources, offers another avenue for Enerplus. This aligns with global efforts to reduce carbon emissions and could position the company as a leader in the emerging clean energy economy. The market for hydrogen is anticipated to grow significantly, with some projections suggesting it could be a trillion-dollar industry by 2050.

- Diversification: Reduce reliance on volatile oil and gas markets.

- Investor Appeal: Attract ESG-focused capital and broaden shareholder base.

- Market Growth: Tap into the rapidly expanding renewable energy and hydrogen sectors.

- Risk Mitigation: Prepare for a future with stricter climate regulations and evolving energy demand.

Enerplus can leverage the ongoing consolidation within the energy sector, seeking strategic acquisitions to expand its North American operations and enhance economies of scale. The company can also capitalize on technological advancements in extraction, improving recovery rates and reducing lifting costs per barrel. Furthermore, sustained global demand for oil and natural gas, projected to remain robust through 2024, provides a stable market for Enerplus's core products.

| Opportunity Area | 2024/2025 Data Point | Potential Impact |

|---|---|---|

| Industry Consolidation (M&A) | Major deals in early 2024 valued in billions | Bolster North American footprint, achieve economies of scale |

| Technological Advancements | Increased primary recovery rates in shale plays | Access uneconomical reserves, enhance profitability |

| Global Energy Demand | Projected global oil demand of 102.8 million bpd in 2024 (IEA) | Ensure stable prices and consistent income |

Threats

Geopolitical tensions and OPEC+ production adjustments are significant threats, capable of causing swift and unpredictable swings in oil and gas prices. For instance, in late 2023 and early 2024, concerns over Middle East stability and OPEC+ adherence to production cuts led to considerable price volatility, impacting revenue forecasts for companies like Enerplus.

These external forces, entirely outside Enerplus's direct influence, can dramatically affect its earnings, profit margins, and capital expenditure plans. The inherent unpredictability makes robust long-term financial planning a considerable challenge, as revenue streams can be significantly altered by events far beyond the company's operational scope.

The continuous threat of extreme price volatility directly challenges Enerplus's financial stability. For example, a sharp drop in oil prices, as seen periodically in recent years, can quickly erode profitability and necessitate adjustments to production and investment strategies, highlighting the precarious nature of operating in such a dynamic market.

Governments globally are tightening environmental rules, with many introducing carbon pricing and emissions targets. For Enerplus, this translates to potential hikes in operational expenses and restrictions on drilling, directly affecting their ability to produce and their bottom line. For instance, Canada's federal carbon tax, which increased to $65 per tonne of CO2 equivalent in April 2023 and is projected to reach $170 per tonne by 2030, could significantly impact the cost of oil and gas production.

The growing adoption of renewable energy sources like solar and wind presents a significant long-term threat to traditional oil and gas companies. As renewables become more cost-effective, their market share is expected to increase, potentially reducing demand for fossil fuels. For instance, global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase from 2022, according to the International Energy Agency (IEA). This trend could impact future commodity prices and Enerplus's market position.

Supply Chain Disruptions and Inflationary Pressures

Global supply chain disruptions, including persistent labor shortages, continue to inflate costs for essential oil and gas equipment, services, and materials. For Enerplus, this translates directly into higher capital expenditures and potentially delayed project timelines, impacting the efficiency of their development plans. For instance, in early 2024, the cost of steel, a key component in drilling and infrastructure, saw a notable increase of approximately 15% compared to the previous year, a trend expected to persist through 2025.

These inflationary pressures and logistical challenges directly squeeze profit margins, making it harder for Enerplus to achieve its targeted returns. The ongoing cost escalation is a significant concern, directly affecting the economic viability of new projects and the overall operational efficiency. For example, the cost of specialized drilling fluids, critical for efficient extraction, rose by an average of 10% in late 2023 and early 2024, adding to operational expenses.

- Increased Equipment Costs: Expect continued upward pressure on prices for drilling rigs, pipelines, and extraction technology.

- Higher Material Expenses: Costs for steel, concrete, and specialized chemicals remain elevated due to supply chain bottlenecks.

- Labor Shortage Impact: Difficulty in securing skilled labor for field operations and project management contributes to wage inflation and project delays.

- Reduced Profitability: The combination of higher costs and potential project delays directly impacts Enerplus's ability to maximize profit margins.

Public and Investor Pressure for Decarbonization

Public and investor pressure for decarbonization is a significant threat for oil and gas companies like Enerplus. Growing awareness of climate change is fueling investor activism, pushing companies to speed up their transition away from fossil fuels. This can manifest as divestment campaigns and make it harder to secure capital, directly impacting Enerplus's valuation and its social license to operate.

The financial implications are substantial. For instance, in 2024, many institutional investors, including pension funds and sovereign wealth funds, have intensified their engagement with energy companies, demanding clearer, more ambitious climate transition plans. Failure to meet these expectations can lead to:

- Reduced access to capital: Banks and investment firms are increasingly incorporating environmental, social, and governance (ESG) criteria into lending and investment decisions. Companies with weaker decarbonization strategies may face higher borrowing costs or outright exclusion from certain capital markets.

- Reputational damage: Negative press and public perception can erode brand value and make it more challenging to attract and retain talent, as well as maintain positive relationships with stakeholders.

- Increased regulatory risk: As governments worldwide implement stricter climate policies, companies that are slow to adapt may face penalties and operational constraints.

Enerplus faces significant threats from volatile commodity prices, driven by geopolitical instability and OPEC+ decisions, which can rapidly impact revenue and profitability. The increasing global focus on environmental regulations and carbon pricing, such as Canada's rising carbon tax, directly increases operational costs and may limit production activities. Furthermore, the accelerating adoption of renewable energy sources, with global capacity additions reaching a record 510 GW in 2023, poses a long-term challenge by potentially reducing demand for fossil fuels.

SWOT Analysis Data Sources

This Enerplus SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial filings, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a robust and well-informed assessment of Enerplus's strategic position.