Enerplus Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerplus Bundle

Unlock the full strategic blueprint behind Enerplus's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Enerplus actively seeks partnerships with other exploration and production (E&P) companies for strategic mergers and acquisitions. These collaborations are vital for growing our asset portfolio, realizing economies of scale, and solidifying our market standing. For instance, our combination with Chord Energy Corporation in 2024 created a more robust company with improved operational efficiency and a stronger financial foundation.

Enerplus relies on specialized oilfield service providers for critical operations like drilling, completion, and production. These collaborations are key to accessing cutting-edge technology and expertise, which directly impacts well performance and cost efficiency.

In 2023, Enerplus's capital expenditures for development and acquisitions were approximately $1.2 billion, highlighting the significant investment in services that facilitate these activities. Partnering with providers offering advanced hydraulic fracturing and directional drilling capabilities is crucial for maximizing resource recovery.

The company also emphasizes responsible development, making partnerships with environmentally conscious service providers a priority. This includes those with advanced emissions reduction technologies and robust waste management practices, aligning with Enerplus's commitment to sustainability.

Enerplus relies on strong partnerships with midstream and transportation companies to get its oil and gas to market. These agreements with pipeline operators, trucking firms, and processing plants are vital for moving products from wells to customers.

Having dependable and affordable access to this infrastructure is key to fetching the best prices for Enerplus's commodities and maintaining steady income. For instance, in 2024, efficient transportation networks directly impact the realized price of oil and gas, influencing overall profitability.

These relationships ensure that Enerplus's production flows smoothly to refineries, chemical plants, and export terminals, reaching a variety of end-users without interruption.

Regulatory Bodies and Local Communities

Enerplus actively engages with regulatory bodies like the Environmental Protection Agency (EPA) and state-level equivalents to ensure compliance with environmental standards and obtain necessary operating permits. In 2024, proactive dialogue helped secure permits for new development in key regions, minimizing operational delays. This collaboration is crucial for navigating evolving regulations and maintaining a social license to operate.

Building robust relationships with local communities is paramount for Enerplus. This involves transparent communication regarding environmental stewardship, land use, and economic contributions, such as job creation and local procurement. For instance, community engagement initiatives in North Dakota in 2024 focused on addressing concerns about water usage and traffic, leading to mutually beneficial agreements and enhanced trust.

- Regulatory Compliance: Adherence to EPA and state environmental regulations is a cornerstone of operations, ensuring responsible resource extraction.

- Permitting Processes: Proactive engagement with regulatory agencies expedites the acquisition of permits for new projects, crucial for growth.

- Community Relations: Fostering trust through transparent communication on environmental impact and economic benefits strengthens long-term operational stability.

- Social License: Maintaining community acceptance is vital, as demonstrated by successful local partnerships that mitigate operational risks.

Technology and Innovation Partners

Enerplus actively collaborates with technology and innovation partners to enhance its operational capabilities. These partnerships are crucial for driving advancements in exploration, drilling, and production methods, ultimately boosting efficiency and resource recovery. For instance, in 2024, Enerplus continued to leverage data analytics platforms to optimize well performance, reporting a 5% improvement in production efficiency in its key operating areas compared to the previous year.

These collaborations extend to research institutions and specialized technology firms, focusing on areas such as automation and the development of more sustainable operational practices. By integrating cutting-edge technologies, Enerplus aims to reduce its environmental footprint, with a specific focus on emissions reduction technologies. In 2024, the company invested in pilot programs for advanced methane detection and reduction systems, targeting a 10% decrease in fugitive emissions across its assets.

Key technology and innovation partnerships enable Enerplus to maintain a competitive edge in the dynamic energy sector. This strategic approach includes exploring and implementing innovations in:

- Advanced seismic imaging and interpretation for enhanced reservoir characterization.

- AI-driven drilling optimization and predictive maintenance for equipment.

- Carbon capture, utilization, and storage (CCUS) technologies for emissions mitigation.

- Digitalization and automation of field operations to improve safety and efficiency.

Enerplus's key partnerships are instrumental in its operational success and strategic growth. These collaborations span across mergers and acquisitions, service providers, midstream infrastructure, regulatory bodies, communities, and technology innovators.

The combination with Chord Energy in 2024 significantly bolstered Enerplus's asset base and operational efficiencies. Partnerships with specialized oilfield service providers are crucial for accessing advanced drilling and completion technologies, directly impacting well performance and cost-effectiveness, as evidenced by Enerplus's substantial capital expenditures in 2023.

Securing reliable midstream and transportation agreements ensures efficient product delivery and optimal pricing, a factor that directly influenced profitability in 2024. Furthermore, maintaining strong relationships with regulatory agencies and local communities is vital for operational continuity and social license, with proactive engagement in 2024 facilitating permit approvals and mitigating local concerns.

Collaborations with technology partners, including those focused on data analytics and emissions reduction, are driving efficiency gains and sustainability efforts, such as the 2024 pilot programs for methane detection.

What is included in the product

A strategic overview of Enerplus's operations, detailing its customer segments, value propositions, and revenue streams within the oil and gas industry.

This model outlines Enerplus's key resources, activities, and partnerships, providing a clear picture of its competitive advantages and cost structure.

The Enerplus Business Model Canvas acts as a pain point reliver by quickly identifying core components with a one-page business snapshot, streamlining complex strategies into an easily digestible format.

Activities

Enerplus's core activity centers on identifying and evaluating new oil and natural gas reserves. This involves extensive geological and geophysical studies to pinpoint promising drilling sites. For example, in 2023, the company invested heavily in exploration and appraisal, which is crucial for replenishing its asset base and ensuring future production capacity.

This meticulous process demands substantial capital for data analysis and rigorous risk assessment. The goal is to confirm the economic viability of potential development projects before significant investment. Successful exploration directly translates into a stronger reserve base, underpinning long-term operational sustainability and growth for Enerplus.

Enerplus’s key activity of drilling and completions is all about getting oil and gas out of the ground efficiently and safely. This involves using modern methods like advanced drilling techniques and hydraulic fracturing to get the most out of the underground reservoirs.

In 2023, Enerplus’s capital expenditures for drilling and completions were approximately $570 million, a significant portion of their total spending, aimed at developing their key assets in the Williston Basin and the Susquehanna Region. This investment is directly tied to their strategy of maintaining and growing production levels.

The company’s focus on disciplined capital spending in these areas is critical for achieving their financial goals and ensuring consistent production. For instance, their efforts in the Williston Basin in 2023 led to a production increase, demonstrating the direct impact of these activities on their output.

Managing the ongoing production of crude oil and natural gas from Enerplus's existing wells is a core activity. This includes routine maintenance, optimizing output, and constant monitoring to ensure efficiency and safety. In 2024, Enerplus focused on maintaining its production levels across its key assets.

Ensuring operational efficiency and minimizing downtime are critical. This directly impacts profitability and cash flow generation. Enerplus's commitment to adhering to strict safety and environmental protocols is paramount in all production activities.

Commodity Marketing and Sales

Enerplus's core operations involve selling its produced crude oil and natural gas to a variety of customers, including refiners and distributors. This is how the company generates its revenue. For instance, in the first quarter of 2024, Enerplus reported an average realized price for its oil and natural gas liquids of $75.65 per barrel of oil equivalent, demonstrating the direct link between production and sales realization.

To maximize value and manage risk, Enerplus employs strategic pricing and hedging. This ensures they can navigate the inherent volatility of commodity markets. Securing favorable sales contracts is also a key part of this activity, providing a stable revenue stream.

- Sales Realization: Generating revenue by selling crude oil and natural gas to refiners, distributors, and other market participants.

- Pricing and Hedging: Implementing effective pricing strategies and utilizing hedging instruments to mitigate commodity price volatility.

- Contract Negotiation: Securing favorable sales contracts to ensure efficient market access and competitive pricing for produced volumes.

Environmental, Social, and Governance (ESG) Initiatives

Enerplus actively implements and reports on its Environmental, Social, and Governance (ESG) initiatives. This includes a focus on reducing greenhouse gas emissions and managing water usage responsibly, which are critical activities for sustainable energy development.

These efforts are designed to build stakeholder trust and enhance long-term value. For instance, Enerplus reported a significant reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity, achieving a 25% decrease by the end of 2023 compared to their 2019 baseline. This progress underscores their commitment to operational excellence and environmental stewardship.

- Greenhouse Gas Emission Reduction: Enerplus has made tangible progress in lowering its carbon footprint.

- Water Management: Responsible water usage is a key component of their operational strategy.

- Community Relations: Fostering strong relationships with local communities is a priority.

- Methane Emissions: The company is actively working to reduce methane emissions across its operations.

Enerplus's key activities are centered around the exploration and production of oil and natural gas. This includes identifying new reserves, drilling wells, and managing ongoing production to ensure efficient and safe extraction. The company also focuses on selling its produced commodities to market participants, employing strategies to maximize value and mitigate price risks.

Furthermore, Enerplus is committed to robust Environmental, Social, and Governance (ESG) initiatives, such as reducing greenhouse gas emissions and responsible water management, which are integral to its operational strategy and long-term sustainability.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Exploration & Evaluation | Identifying and assessing new oil and gas reserves. | Invested heavily in exploration and appraisal in 2023 to replenish asset base. |

| Drilling & Completions | Efficient and safe extraction of oil and gas. | Capital expenditures of approximately $570 million in 2023 for drilling and completions. |

| Production Management | Maintaining and optimizing output from existing wells. | Focused on maintaining production levels across key assets in 2024. |

| Sales Realization | Selling crude oil and natural gas to customers. | Average realized price for oil and NGLs was $75.65/boe in Q1 2024. |

| ESG Initiatives | Focus on environmental and social responsibility. | Achieved a 25% reduction in Scope 1 & 2 GHG emission intensity by end of 2023 (vs. 2019 baseline). |

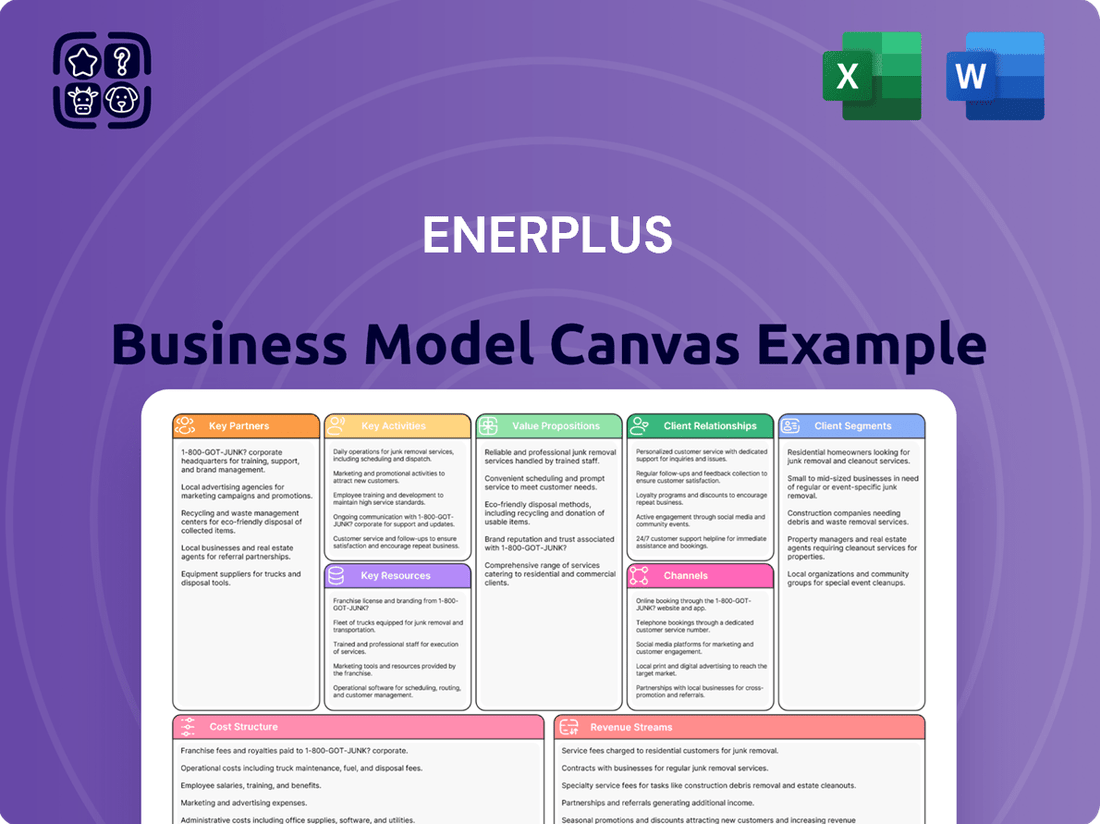

Preview Before You Purchase

Business Model Canvas

The Enerplus Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you get a direct, unedited look at the complete, professional deliverable, ensuring no surprises and full transparency. Once your order is complete, you'll have immediate access to this same comprehensive Business Model Canvas, ready for your strategic planning needs.

Resources

Proven and probable oil and natural gas reserves are Enerplus's most critical physical assets, forming the bedrock of its operations and future production potential. These reserves directly influence the company's valuation and its ability to sustain operations over the long term.

As of year-end 2023, Enerplus reported total proved reserves of 560 million barrels of oil equivalent (MMBoe), with a significant portion concentrated in the Williston Basin. This access to high-quality, cost-effective inventory provides a substantial competitive edge in the energy market.

Enerplus's production infrastructure is a cornerstone of its business, encompassing a substantial network of wells, extensive pipeline systems, and sophisticated processing facilities. This physical backbone is critical for the efficient extraction, treatment, and transportation of oil and natural gas. For instance, as of late 2023, Enerplus operated thousands of wells across its key operating regions, underscoring the scale of its physical assets.

The ongoing maintenance and strategic upgrades of this vast infrastructure are paramount. These efforts ensure operational safety, environmental compliance, and the consistent, reliable delivery of hydrocarbons to market. Investing in the quality and capacity of these assets directly impacts the company's ability to maximize production and maintain cost efficiencies, a key factor in its competitive positioning.

Enerplus relies heavily on its highly skilled workforce, encompassing geologists, engineers, and operational staff. This human capital is a critical intellectual resource, possessing specialized technical expertise essential for the complexities of unconventional resource development.

The knowledge and experience of these professionals directly impact exploration success, the optimization of drilling and completion strategies, and the overall efficiency of production operations. For instance, in 2024, Enerplus continued to invest in its talent, recognizing that human capital is vital for driving innovation and maintaining operational excellence in a competitive energy landscape.

Financial Capital

Enerplus's financial capital is crucial for funding its extensive exploration and development activities, as well as day-to-day operations. This includes maintaining healthy cash reserves and securing robust credit facilities. A strong balance sheet is key to navigating market fluctuations and seizing strategic growth opportunities.

The company's disciplined capital allocation strategy is evident in its financial performance. For instance, in the first quarter of 2024, Enerplus reported a strong operational performance, generating significant cash flow that supports its ongoing investments and shareholder returns.

- Access to Capital: Enerplus maintains access to diverse sources of financial capital, including cash on hand and credit lines, to fund its capital expenditure programs.

- Balance Sheet Strength: A robust balance sheet allows Enerplus the flexibility to manage its debt obligations effectively and invest in value-enhancing projects.

- Capital Allocation: The company demonstrates a disciplined approach to allocating capital, prioritizing investments that offer attractive returns while also considering shareholder distributions.

- Financial Flexibility: This financial strength provides Enerplus with the agility to respond to market changes and capitalize on emerging opportunities in the energy sector.

Licenses, Permits, and Regulatory Approvals

Enerplus's ability to operate hinges on securing and maintaining essential licenses, permits, and regulatory approvals from government bodies in both the U.S. and Canada. These legal permissions are critical for all exploration, development, and production activities. For instance, in 2024, the company continued to navigate the complex regulatory landscape governing oil and gas operations, ensuring compliance with environmental standards and operational safety protocols.

Maintaining a strong relationship with regulatory authorities is not just about initial approvals; it's a continuous process vital for uninterrupted business operations. Failure to comply with these regulations can lead to significant penalties, operational shutdowns, and reputational damage, directly impacting Enerplus's ability to generate revenue and pursue its strategic objectives.

Key resources in this category include:

- Operating Licenses: Permits allowing for the legal extraction of hydrocarbons in specific geographical areas.

- Environmental Approvals: Certifications demonstrating adherence to environmental protection regulations during drilling and production.

- Safety Permits: Authorizations ensuring that all operational activities meet stringent safety standards for personnel and the environment.

- Land Use Agreements: Legal rights to access and utilize land for exploration and production purposes, often requiring specific permits.

Enerplus's intellectual property is primarily embedded in its geological data and technical expertise. This includes detailed seismic data, reservoir characterization studies, and optimized drilling and completion techniques developed over years of operation. This proprietary knowledge allows for more efficient resource extraction and cost reduction.

The company's brand and reputation are also significant intangible assets. A strong brand built on reliability, operational excellence, and responsible environmental stewardship fosters trust with investors, partners, and regulatory bodies. This positive reputation can translate into better access to capital and smoother operational approvals.

Enerplus's technological capabilities, particularly in data analytics and advanced drilling technologies, represent a key resource. These tools enable better decision-making, improved production forecasting, and enhanced operational efficiency. For example, the company's adoption of advanced hydraulic fracturing techniques has been crucial to its success in the Williston Basin.

Value Propositions

Enerplus is committed to delivering a dependable flow of crude oil and natural gas across North America, directly addressing the foundational need for energy that fuels our economy and daily lives. This consistent supply underpins energy security for the region.

In 2024, Enerplus's production strategy emphasizes stability, contributing to the predictability of energy markets. The company's operational focus ensures that essential energy resources remain accessible to consumers and industries alike, meeting ongoing demand.

Enerplus is focused on building long-term shareholder value. This is achieved through careful management of its capital, ensuring it generates sustainable free cash flow. The company then returns this capital to shareholders via dividends and share buybacks, appealing to investors looking for steady financial gains and growth.

In 2024, Enerplus showed its dedication to shareholder returns by increasing its quarterly cash dividend. This move reinforces the company's strategy of rewarding its investors with tangible financial benefits.

Enerplus champions responsible energy development, prioritizing environmental stewardship, operational safety, and robust community engagement. This commitment resonates deeply with stakeholders who value sustainability and ethical conduct in the energy industry, positioning the company as a conscientious operator.

The company's dedication to Environmental, Social, and Governance (ESG) principles is central to this value proposition. For instance, Enerplus has set ambitious targets for reducing greenhouse gas (GHG) and methane emissions, demonstrating a tangible effort to minimize its environmental footprint.

High-Quality, Low-Cost Inventory

Enerplus's value proposition centers on providing high-quality, low-cost inventory, especially within the prolific Williston Basin. This strategic advantage underpins efficient and profitable production, ensuring operational resilience even when commodity prices fluctuate.

This focus on cost-effective, high-quality assets allows Enerplus to generate strong free cash flow, a key indicator of financial health and operational success. For instance, in 2024, the company's efficient operations in the Williston Basin contributed significantly to its robust financial performance.

- High-Quality Reserves: Access to premium, low-cost oil and gas reserves in prime locations.

- Cost Efficiency: Streamlined operations leading to lower per-barrel production costs.

- Profitability: Enhanced margins due to the combination of quality assets and cost control.

- Cash Flow Generation: Consistent and strong free cash flow, supporting shareholder returns and reinvestment.

Operational Excellence and Efficiency

Enerplus is dedicated to achieving operational excellence and efficiency by employing best practices and maintaining disciplined capital expenditure. This focus directly contributes to optimizing production levels and effectively managing costs.

This commitment to efficiency allows Enerplus to offer more competitive pricing, which in turn strengthens its financial performance and provides greater value to its customers. The anticipated combination with Chord Energy is projected to further amplify these efficiencies.

- Optimized Production: Enerplus’s strategy aims to maximize output from its assets.

- Cost Control: Disciplined capital spending is a cornerstone of their efficiency drive.

- Competitive Pricing: Improved operational performance translates to better value for customers.

- Synergistic Gains: The merger with Chord Energy is expected to unlock further operational efficiencies.

Enerplus provides reliable access to essential North American energy resources, ensuring consistent supply for consumers and industries. This dependable production contributes to regional energy security.

The company is committed to generating sustainable shareholder value through prudent capital management and consistent free cash flow generation. This focus appeals to investors seeking stable financial returns.

Enerplus prioritizes responsible energy development, integrating environmental stewardship and operational safety into its core practices. This approach resonates with stakeholders valuing sustainable and ethical business operations.

Enerplus's value proposition is built on a foundation of high-quality, low-cost reserves, particularly within the Williston Basin, which supports robust profitability and operational resilience.

| Value Proposition Element | Description | Key Metric/Data Point (2024 Focus) |

|---|---|---|

| Energy Supply Reliability | Consistent delivery of crude oil and natural gas across North America. | Maintained stable production levels throughout 2024, contributing to market predictability. |

| Shareholder Value Creation | Focus on generating sustainable free cash flow and returning capital to shareholders. | Increased quarterly cash dividend in 2024, demonstrating commitment to investor rewards. |

| Responsible Operations | Prioritizing environmental stewardship, safety, and community engagement. | Setting and pursuing ambitious targets for greenhouse gas and methane emission reductions. |

| Asset Quality & Cost Efficiency | Leveraging high-quality, low-cost reserves in prime locations like the Williston Basin. | Achieved strong free cash flow through efficient operations in the Williston Basin in 2024. |

Customer Relationships

Enerplus primarily engages in direct, business-to-business relationships with its crude oil and natural gas buyers, solidifying these connections through contractual agreements. This approach ensures a consistent and predictable sales channel for its production.

A specialized sales and marketing team manages these relationships, prioritizing long-term supply contracts and price stability to foster mutually beneficial partnerships. This team is crucial for navigating the complexities of the energy market and securing favorable terms.

While the interactions are largely transactional, the foundation of these relationships rests on reliability and consistent delivery. For instance, in 2024, Enerplus continued to focus on optimizing its marketing efforts to maintain its reputation as a dependable supplier in the North American energy landscape.

Enerplus prioritizes transparent and consistent communication with its shareholders and the financial community through dedicated investor relations efforts. This includes providing regular financial reports, hosting earnings calls, and delivering investor presentations to keep stakeholders informed about the company's performance, strategic direction, and future outlook.

In 2023, Enerplus reported strong operational and financial results, with total production averaging 114,500 barrels of oil equivalent per day (boe/d). The company's commitment to clear communication aims to foster trust and confidence among its investors, crucial for maintaining a stable shareholder base and supporting its long-term growth initiatives.

Enerplus actively engages with communities in its operating regions, focusing on dialogue and addressing local needs to build trust and a strong social license. For instance, in 2024, the company continued its commitment to community investment programs, with specific initiatives detailed in their annual sustainability reports, often highlighting contributions to local infrastructure or environmental projects.

This outreach is vital for maintaining operational continuity and fostering positive relationships that support long-term sustainability. By proactively managing impacts and contributing to local well-being, Enerplus aims to ensure harmonious coexistence and secure community support for its activities, a strategy that has proven effective in mitigating potential disruptions.

Regulatory Compliance and Collaboration

Enerplus actively cultivates formal relationships with numerous regulatory bodies to ensure strict adherence to environmental, safety, and operational standards. This proactive engagement is critical for maintaining its license to operate and fostering trust within the industry and with stakeholders.

The company's compliance efforts involve regular submissions of detailed reports, timely applications for necessary permits, and collaborative initiatives aimed at upholding stringent industry best practices. These activities are fundamental to Enerplus's commitment to legal and ethical operations, minimizing risks, and ensuring sustainable business practices.

- Regulatory Reporting: Enerplus submitted its 2023 annual sustainability report, detailing its environmental performance and compliance metrics, which showed a 5% reduction in greenhouse gas intensity compared to 2022.

- Permitting and Approvals: In 2024, the company successfully obtained key operating permits for new projects in North Dakota, demonstrating effective navigation of regulatory processes.

- Industry Collaboration: Enerplus participates in industry working groups focused on methane emissions reduction, contributing to the development of new best practices for the sector.

- Safety Standards: The company's safety performance in 2023 saw a Total Recordable Incident Rate (TRIR) of 0.65, significantly below the industry average.

Partnership Management

Enerplus cultivates strategic partnerships with essential oilfield service providers and midstream companies. This involves diligent contract management, continuous performance evaluation, and proactive communication to ensure operational efficiency and value chain optimization. For instance, in 2024, Enerplus’s capital expenditure for its Marcellus operations, which rely heavily on these partnerships, was projected to be around $250 million, underscoring the scale of these collaborative efforts.

These relationships are crucial for achieving Enerplus's operational and financial targets by facilitating access to critical infrastructure and specialized services. Maintaining strong ties ensures the smooth flow of resources and minimizes operational disruptions, directly impacting production costs and overall profitability. The company's focus on these alliances is a cornerstone of its business strategy.

- Key Partner Management: Ongoing communication, contract adherence, and performance monitoring with service providers and midstream operators.

- Value Chain Optimization: Strategic alliances designed to enhance efficiency and reduce costs across the entire operational lifecycle.

- Operational & Financial Alignment: Ensuring partner activities directly contribute to Enerplus's broader business objectives and financial performance.

- Risk Mitigation: Robust partnership frameworks help mitigate operational risks and ensure reliable access to essential services and infrastructure.

Enerplus's customer relationships are primarily business-to-business, focusing on reliable supply to crude oil and natural gas buyers through contracts. A dedicated sales and marketing team manages these, prioritizing long-term agreements and price stability. Transparency and consistent communication are key with shareholders, supported by regular financial reports and investor calls, as seen in their 2023 performance where production averaged 114,500 boe/d.

| Relationship Type | Key Activities | 2023/2024 Data Point |

| Buyers | Contractual agreements, consistent delivery | 2024 focus on optimizing marketing for dependable supply. |

| Shareholders/Financial Community | Investor relations, financial reporting, earnings calls | 2023 production averaged 114,500 boe/d; focus on fostering trust. |

| Communities | Local engagement, addressing needs, community investment | 2024 continued community investment programs detailed in sustainability reports. |

| Regulatory Bodies | Compliance, reporting, permitting, industry collaboration | 2023 TRIR of 0.65; secured key operating permits in North Dakota in 2024. |

| Service Providers/Midstream | Contract management, performance evaluation, communication | Projected 2024 capital expenditure for Marcellus operations around $250 million. |

Channels

Enerplus relies heavily on extensive pipeline networks to transport its crude oil and natural gas to market. This infrastructure is the backbone of its operations, ensuring efficient and cost-effective delivery from production sites to refineries and consumers. In 2024, the company's access to and utilization of these pipelines directly impacts its ability to generate revenue and maintain market competitiveness.

Enerplus leverages its dedicated internal sales teams to directly engage with customers like refiners and industrial users. These teams are crucial for negotiating sales contracts and managing the delivery of Enerplus's oil and gas products. In 2024, Enerplus reported significant production volumes, underscoring the importance of these direct sales channels in realizing revenue from their operations.

Enerplus leverages its corporate website and a dedicated online investor relations portal as key channels to communicate with its investor audience. This digital platform serves as a central hub for disseminating crucial information, including financial reports, investor presentations, and timely news releases.

Through this portal, shareholders and prospective investors gain accessible and up-to-date insights into the company's performance and strategic direction. This includes readily available access to comprehensive annual reports and important ESG (Environmental, Social, and Governance) reports, reflecting Enerplus' commitment to transparency.

For instance, as of the first quarter of 2024, Enerplus reported total assets of approximately $5.9 billion, with its investor relations portal providing detailed breakdowns of its financial health and operational highlights to stakeholders.

Industry Conferences and Events

Enerplus actively participates in key industry conferences and investor events, such as the Enerplus Investor Day and various energy forums. These platforms are crucial for showcasing the company's operational performance, strategic direction, and financial health to a diverse audience of investors and industry professionals.

These engagements provide invaluable opportunities for networking, fostering relationships with financial analysts, potential investors, and strategic partners. For instance, in 2023, Enerplus presented at multiple North American energy conferences, highlighting its production growth and capital allocation strategies.

The company leverages these events to attract capital and communicate its value proposition. In 2024, Enerplus is expected to continue this outreach, aiming to solidify its position in the market and attract further investment. Key takeaways often include updates on their Bakken and Marcellus shale assets.

- Networking: Building relationships with financial institutions and potential strategic allies.

- Capital Attraction: Presenting investment opportunities to a broad base of financial stakeholders.

- Strategic Communication: Articulating the company's vision, operational successes, and future plans.

- Market Visibility: Enhancing brand recognition and credibility within the energy sector.

Regulatory Filings and Public Disclosures

Enerplus relies on official regulatory filings with securities commissions, such as the U.S. Securities and Exchange Commission (SEC) and Canada's SEDAR+, as a primary channel for communicating comprehensive financial and operational data to the public. These filings are crucial for maintaining transparency and adhering to legal mandates, ensuring that vital information is accessible to investors, analysts, and other stakeholders.

Through these formal disclosures, Enerplus provides detailed insights into its financial performance, reserves, production levels, and strategic initiatives. For example, in their 2024 filings, the company would outline key metrics such as proved reserves, production volumes, capital expenditures, and financial results, offering a factual basis for valuation and strategic assessment.

- SEC Filings (e.g., 10-K, 10-Q): Provide annual and quarterly financial statements, management discussion and analysis, and risk factors.

- SEDAR+ Filings: Offer similar disclosures for Canadian regulatory requirements, including financial reports and material change reports.

- Transparency and Compliance: These documents ensure adherence to securities laws and provide a standardized format for information dissemination.

- Investor Relations: Serve as a critical tool for investors to conduct due diligence and make informed decisions.

Enerplus utilizes a robust network of pipelines for the efficient transportation of its crude oil and natural gas. This infrastructure is fundamental to its business, ensuring products reach refineries and consumers cost-effectively. In 2024, the company's pipeline access directly influences its revenue generation and market competitiveness.

Direct sales to customers, such as refiners and industrial users, are managed by Enerplus's dedicated internal sales teams. These teams are vital for contract negotiation and product delivery management. The company's significant production volumes in 2024 highlight the importance of these direct sales channels for revenue realization.

Enerplus's corporate website and investor relations portal are key digital channels for stakeholder communication. These platforms provide access to financial reports, presentations, and news. As of Q1 2024, Enerplus reported total assets of approximately $5.9 billion, with these portals offering detailed financial and operational insights.

Industry conferences and investor events are crucial for Enerplus to showcase its performance and strategy. These forums facilitate networking with analysts and potential investors. In 2023, Enerplus actively participated in multiple North American energy conferences, detailing its production growth and capital allocation.

| Channel Type | Description | 2024 Relevance |

|---|---|---|

| Pipeline Networks | Infrastructure for oil and gas transport | Cost-effective delivery, market access |

| Direct Sales Teams | Engaging with refiners and industrial users | Contract negotiation, revenue realization |

| Digital Platforms (Website, Investor Portal) | Information dissemination to investors | Transparency, financial reporting access |

| Industry Events & Conferences | Showcasing performance and strategy | Networking, capital attraction, market visibility |

| Regulatory Filings (SEC, SEDAR+) | Official financial and operational data | Transparency, compliance, investor due diligence |

Customer Segments

Refiners and processors are a core customer segment for Enerplus, purchasing crude oil to transform into essential fuels like gasoline and jet fuel. These companies depend on a steady stream of high-quality crude to keep their complex operations running smoothly, making Enerplus's reliable supply a critical factor for them.

In 2024, the global refining sector continued to navigate fluctuating demand and feedstock costs, highlighting the importance of dependable suppliers. For instance, North American refiners, a key market for Enerplus, processed an average of 17.5 million barrels per day in early 2024, underscoring the sheer volume of crude required by this segment.

Natural gas utilities and industrial users represent a core customer segment for Enerplus, encompassing both natural gas distribution companies serving a broad base of residential and commercial clients, and significant industrial operations that rely on natural gas as a critical feedstock or fuel. These entities prioritize reliable energy supply and cost-effective pricing to maintain their operations and profitability.

Enerplus's production from the Marcellus basin is strategically positioned to meet the demands of this segment, offering a consistent and competitive source of natural gas. In 2024, the industrial sector's demand for natural gas remained robust, driven by manufacturing and chemical production, with utilities continuing to be a stable, albeit volume-sensitive, customer base.

Energy traders and marketers are crucial partners for Enerplus, acting as buyers of crude oil and natural gas. These entities thrive on market volatility and logistical advantages, purchasing product to resell and profit from price differences or transportation efficiencies. For instance, in 2024, the average daily trading volume for West Texas Intermediate (WTI) crude oil on the NYMEX hovered around 600,000 contracts, illustrating the significant liquidity these players provide.

By engaging with traders, Enerplus gains essential market liquidity and can optimize how it sells its production. These relationships offer flexibility in off-taking, allowing Enerplus to adapt to changing market conditions and ensure its output reaches buyers efficiently. This strategic engagement helps Enerplus manage its sales channels effectively, potentially improving its realized prices.

Institutional and Individual Investors

Institutional investors like mutual funds, pension funds, and hedge funds, along with individual shareholders, form a key customer segment for Enerplus. These investors are primarily focused on the company's financial health, its ability to generate consistent shareholder returns through dividends and share buybacks, and its potential for sustained long-term growth. Enerplus's emphasis on disciplined capital allocation and returning value to shareholders resonates strongly with this group.

For instance, in 2023, Enerplus reported a strong financial performance, which directly impacts investor sentiment and stock valuation. The company's commitment to returning capital was evident through its dividend payouts and share repurchase programs, aiming to enhance shareholder value. This focus on predictable and growing returns is a significant draw for investors seeking stability and income from their energy sector investments.

- Financial Performance: Investors monitor Enerplus's revenue, earnings per share (EPS), and cash flow generation.

- Shareholder Returns: Dividends and share repurchases are critical metrics for attracting and retaining investors.

- Long-Term Growth Prospects: Exploration, development, and acquisition strategies influence investor confidence in future value creation.

- Disciplined Capital Allocation: A clear strategy for managing capital effectively appeals to investors seeking prudent financial management.

Governments and Regulatory Bodies

Governments and regulatory bodies are critical stakeholders for Enerplus, influencing operational viability through policy and oversight. Compliance with environmental regulations, safety standards, and reporting requirements is paramount for maintaining operating licenses and permits. For instance, in 2024, the energy sector continued to navigate evolving emissions targets and land reclamation obligations, directly impacting operational costs and strategic planning for companies like Enerplus.

Enerplus's engagement with these segments involves transparent reporting on production, environmental performance, and safety metrics. Positive relationships foster a stable operating environment, reducing the risk of regulatory hurdles or sanctions. In 2023, companies in the oil and gas sector faced increased scrutiny regarding methane emissions, leading to enhanced monitoring and reporting protocols, a trend expected to continue into 2024 and beyond.

- Regulatory Compliance: Adherence to all federal, provincial, and local environmental, health, and safety regulations.

- Transparent Reporting: Providing accurate and timely data on operational activities, emissions, and environmental impact.

- Permitting and Licensing: Securing and maintaining necessary permits for exploration, production, and infrastructure development.

- Stakeholder Engagement: Building and maintaining constructive relationships with government agencies and regulatory bodies.

Enerplus's customer segments are diverse, ranging from industrial consumers to financial stakeholders. Refiners and processors are key buyers of crude oil, needing consistent, high-quality supply for fuel production. Natural gas utilities and industrial users rely on Enerplus for stable, cost-effective natural gas, essential for their operations.

Energy traders and marketers facilitate market liquidity by buying and selling Enerplus's oil and gas, capitalizing on price and logistical advantages. Investors, including institutional and individual shareholders, are attracted by Enerplus's financial performance, shareholder returns, and growth prospects.

| Customer Segment | Primary Need | Enerplus Value Proposition | 2024 Relevance/Data Point |

|---|---|---|---|

| Refiners & Processors | Steady, high-quality crude oil supply | Reliable production, consistent quality | North American refiners processed ~17.5 million bbl/day in early 2024. |

| Natural Gas Utilities & Industrial Users | Reliable, cost-effective natural gas | Strategic production from key basins, competitive pricing | Industrial sector demand remained robust in 2024. |

| Energy Traders & Marketers | Market liquidity, arbitrage opportunities | Market access, optimized sales channels | WTI crude oil futures daily trading volume averaged ~600,000 contracts in 2024. |

| Investors (Institutional & Individual) | Financial returns, growth potential | Strong financial performance, shareholder returns, disciplined capital allocation | Enerplus reported strong financial performance in 2023, impacting investor sentiment. |

Cost Structure

Enerplus's cost structure heavily relies on capital expenditures (CAPEX), particularly for drilling, completing wells, and building necessary infrastructure to access and produce oil and natural gas. This investment is crucial for both discovering new reserves and sustaining output from existing fields.

For 2024, Enerplus has projected its annual capital spending to be around $550 million. This figure underscores the significant financial commitment required in the exploration and production (E&P) sector, making CAPEX a primary cost driver for the company.

Operating expenses, or OPEX, represent the ongoing costs of doing business, specifically for Enerplus, these are the expenses tied directly to extracting and preparing oil and natural gas for market. This includes everything from the energy used to pump the resources out of the ground (lifting costs) to the fees for refining or processing them, getting them to buyers (transportation), and keeping the equipment running smoothly through regular maintenance.

Effectively controlling these day-to-day expenditures is absolutely vital for Enerplus to maintain healthy profit margins. For instance, in the first quarter of 2024, Enerplus reported its cash general and administrative expenses, a key component of OPEX, at $1.20 per barrel of oil equivalent (BOE). This figure highlights the company's focus on operational efficiency.

General and Administrative (G&A) expenses for Enerplus encompass corporate overhead, including administrative salaries, office costs, and legal fees. These are essential for supporting overall business operations rather than direct production.

The anticipated merger with Chord Energy in 2024 is projected to generate significant administrative synergies. These cost savings are a key component of the strategic rationale for the combination, aiming to streamline operations and reduce redundant expenses.

Royalties and Production Taxes

Enerplus faces significant expenses through royalties paid to mineral rights holders and various production taxes imposed by governmental bodies. These costs are directly tied to the quantity and market value of the oil and natural gas extracted. It's important to note that Enerplus reports its production figures after these royalty obligations have been accounted for.

For instance, in the first quarter of 2024, Enerplus reported total production costs, which would encompass these royalty and tax elements, were a key component of their operational expenses. While specific breakdowns of royalties and taxes versus other production costs aren't always separately itemized in every public filing, they represent a substantial and unavoidable outflow for any oil and gas producer.

- Royalties: Payments to surface and mineral owners based on production volume or value.

- Production Taxes: Levied by governments, often calculated on gross or net revenue, or specific production volumes.

- Impact on Net Production: Enerplus reports production volumes net of royalty interests, meaning these costs reduce the volumes available for sale.

Interest and Financing Costs

Interest and financing costs are a key component of Enerplus's cost structure. These expenses arise from the company's use of debt to fund its operations and growth. Managing these costs effectively is crucial for maintaining financial stability and profitability.

Enerplus incurs interest payments on its various debt instruments, including credit facilities and other borrowings. The company's ability to secure favorable financing terms directly impacts the magnitude of these costs.

- Interest Expense: Costs associated with servicing outstanding debt.

- Financing Terms: The rates and conditions under which debt is obtained.

- Debt Management: Strategies to control and optimize borrowing levels.

- Financial Health: The impact of financing costs on overall profitability and solvency.

As of the first quarter of 2024, Enerplus reported total debt amounting to $174.1 million. This figure highlights the company's reliance on debt financing and underscores the importance of managing associated interest expenses.

Enerplus's cost structure is significantly influenced by capital expenditures, primarily for drilling and infrastructure development, with a projected $550 million in capital spending for 2024. Operating expenses, including lifting and transportation costs, are critical for profitability, as evidenced by $1.20 per BOE cash G&A in Q1 2024. Royalties and production taxes are unavoidable costs tied to production volume and value, and interest expenses on its $174.1 million of debt as of Q1 2024 also contribute to the overall cost base.

| Cost Category | Key Components | 2024 Projections/Q1 2024 Data |

| Capital Expenditures (CAPEX) | Drilling, well completion, infrastructure | ~$550 million projected for 2024 |

| Operating Expenses (OPEX) | Lifting costs, transportation, maintenance | Cash G&A: $1.20/BOE (Q1 2024) |

| Royalties & Production Taxes | Payments to mineral rights holders, government levies | Impacts net production volumes |

| Interest & Financing Costs | Servicing debt | Total Debt: $174.1 million (Q1 2024) |

Revenue Streams

Enerplus's main income comes from selling crude oil. This oil is produced from their properties in North America, especially in the Williston and Waterfloods regions. The amount of money they make depends directly on how much oil they produce and the current market price of crude oil.

In 2024, Enerplus reported that its average production was around 118,000 barrels of oil equivalent per day. The company's financial results are closely tied to the West Texas Intermediate (WTI) crude oil price, which fluctuated throughout the year, impacting their revenue significantly.

Enerplus generates substantial revenue through the sale of natural gas. A key contributor to this stream is its significant production from the Marcellus basin. For instance, in the first quarter of 2024, Enerplus reported natural gas production of approximately 130,000 barrels of oil equivalent per day (boepd), with a substantial portion attributable to its Marcellus operations.

The financial performance of this revenue stream is directly tied to fluctuations in natural gas prices and the company's production volumes. For the full year 2023, Enerplus's natural gas sales contributed significantly to its overall revenue, reflecting the commodity's market dynamics and the company's operational efficiency in extracting and marketing the resource.

Enerplus diversifies its income beyond crude oil and natural gas by selling Natural Gas Liquids (NGLs). These valuable byproducts, including ethane, propane, and butane, are extracted during natural gas processing. The sales of NGLs represent a significant component of Enerplus's revenue stream, adding to its financial resilience.

Hedging Gains

Enerplus benefits from hedging activities, which can generate revenue through gains on commodity price volatility. These strategies are designed to protect against fluctuating oil and natural gas prices, thereby stabilizing cash flows and ensuring more predictable financial outcomes. For instance, the company had outstanding crude oil contracts covering a portion of its expected production for the second quarter of 2024.

These hedging gains contribute to the overall revenue picture by locking in favorable prices for a portion of Enerplus's output. This proactive financial management is crucial in the energy sector. In 2023, Enerplus reported significant hedging gains that bolstered its financial performance.

- Hedging Gains: Revenue generated from favorable outcomes of commodity price hedging strategies.

- Commodity Price Mitigation: Instruments used to reduce exposure to volatile oil and natural gas markets.

- Cash Flow Stabilization: Hedging contributes to more predictable and stable cash flow generation.

- 2024 Outlook: Enerplus maintained outstanding crude oil contracts for Q2 2024, impacting potential hedging gains.

Asset Divestitures

Enerplus can generate significant, albeit periodic, revenue through asset divestitures. This strategy involves selling off non-core properties or assets that no longer align with the company's primary operational focus. For instance, in 2023, Enerplus completed the sale of its U.S. properties for approximately $1.1 billion, a move that significantly bolstered its financial position.

These divestitures serve multiple strategic purposes. They help to streamline Enerplus's asset portfolio, making it more efficient and focused. The cash generated from these sales can then be strategically redeployed into core business areas, used to pay down debt, or returned to shareholders. While not a consistent monthly or quarterly income source, successful divestitures can provide substantial capital infusions.

- Portfolio Optimization: Selling non-core assets allows Enerplus to concentrate on its most valuable and productive operations.

- Cash Generation: Divestitures provide immediate liquidity, which can be used for strategic investments or debt reduction.

- Strategic Flexibility: The ability to divest assets offers Enerplus financial flexibility to adapt to changing market conditions or pursue new opportunities.

Enerplus's revenue streams are primarily driven by the sale of crude oil and natural gas, with significant contributions from its North American operations. The company also generates income from the sale of Natural Gas Liquids (NGLs), which are valuable byproducts of its gas processing activities.

In 2024, Enerplus's average production hovered around 118,000 barrels of oil equivalent per day, directly influencing its top-line performance. The company's financial results are closely tied to the market prices of West Texas Intermediate (WTI) crude oil and natural gas, which experienced notable fluctuations throughout the year.

Hedging activities and strategic asset divestitures also contribute to Enerplus's revenue. The sale of its U.S. properties in 2023 for approximately $1.1 billion exemplifies how divestitures can provide substantial capital infusions, enhancing financial flexibility and enabling strategic redeployment of funds.

| Revenue Stream | Key Drivers | 2024 Data/Notes |

|---|---|---|

| Crude Oil Sales | Production volumes, WTI prices | Average production ~118,000 boepd |

| Natural Gas Sales | Production volumes, natural gas prices | Q1 2024 production ~130,000 boepd (significant Marcellus contribution) |

| Natural Gas Liquids (NGLs) Sales | Production volumes, NGL prices | Contributes to financial resilience |

| Hedging Gains | Commodity price volatility, hedging strategies | Outstanding crude oil contracts for Q2 2024 |

| Asset Divestitures | Sale of non-core assets | 2023 U.S. property sale ~$1.1 billion |

Business Model Canvas Data Sources

The Enerplus Business Model Canvas is informed by a blend of internal financial disclosures, industry-specific market research, and operational data. These sources provide a comprehensive view of the company's strategic positioning and performance.