Enerplus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerplus Bundle

Unlock the critical external factors shaping Enerplus's trajectory with our comprehensive PESTLE analysis. From evolving environmental regulations to shifting economic landscapes, understand the forces that will dictate its future success. Download the full report to gain actionable intelligence and refine your strategic approach.

Political factors

Governmental energy policies, including carbon pricing mechanisms and emissions reduction targets, directly shape Enerplus's operational expenses and investment strategies across North America. For instance, Canada's federal carbon pricing system, which reached $65 per tonne of CO2 in April 2023 and is set to rise to $170 per tonne by 2030, impacts the cost of production for oil and gas companies like Enerplus.

The stability and predictability of these regulations in both the United States and Canada are crucial for Enerplus. Frequent policy changes, such as shifts in environmental permitting or taxation, can introduce significant uncertainty, affecting capital allocation and long-term project viability for the company.

Broader geopolitical events significantly shape global energy markets, indirectly influencing demand and pricing for Enerplus's products. For instance, ongoing conflicts in Eastern Europe and the Middle East have contributed to price volatility, with Brent crude oil prices fluctuating between $75 and $90 per barrel in early 2024, impacting the overall economic environment for energy producers.

Political stability in key energy-producing or consuming regions outside North America directly affects international oil and gas prices and investor sentiment. Instability in nations like Libya or Venezuela can disrupt supply, leading to price spikes, while stable production from major players like Saudi Arabia can temper these effects. This global price influence is crucial for Enerplus, as its North American operations are still subject to international market dynamics.

Enerplus navigates a complex web of regulations across its operating regions, particularly concerning new project approvals and infrastructure development. For instance, in the United States, the permitting process for oil and gas activities can involve multiple federal and state agencies, with timelines often extending beyond initial projections. Delays in obtaining these crucial permits, as seen in some North American shale plays where environmental reviews have become more rigorous, can directly impact project schedules and inflate capital expenditures, potentially hindering Enerplus's strategic growth plans.

Indigenous Relations and Resource Development

The evolving landscape of Indigenous rights, land claims, and consultation requirements in Canada and the United States significantly impacts resource development. For Enerplus, navigating these complexities is crucial for project viability and maintaining a social license to operate.

Successful engagement with Indigenous communities can lead to partnerships that enhance long-term operational stability. For instance, in 2023, the Canadian government continued to emphasize co-development agreements, with several major resource projects in various stages of negotiation or implementation that involve Indigenous participation and benefit sharing.

- Increased Scrutiny: Regulatory bodies and courts are increasingly upholding Indigenous rights, demanding more thorough consultation processes for new projects.

- Partnership Opportunities: Collaborative agreements can provide Indigenous communities with economic benefits and greater control over resource development on their traditional territories.

- Social License: Demonstrating genuine respect and partnership with Indigenous groups is essential for securing and maintaining public acceptance, which is vital for project continuity.

- Risk Mitigation: Proactive and respectful engagement can mitigate potential delays, legal challenges, and reputational damage associated with resource projects.

International Trade Agreements and Tariffs

International trade agreements and tariffs significantly shape the energy market. For Enerplus, existing agreements like the Canada-United States-Mexico Agreement (CUSMA) facilitate relatively seamless trade of oil and gas within North America. However, potential new tariffs or shifts in global trade policies could impact the competitiveness of North American crude oil and natural gas exports, potentially affecting Enerplus's access to international customers and its overall market reach.

The evolving landscape of international trade agreements presents both opportunities and challenges for energy commodity flows. For instance, the European Union's efforts to diversify energy sources away from Russia, as seen in the post-2022 energy crisis, could open avenues for North American LNG exports. Conversely, protectionist measures or retaliatory tariffs imposed by major economies could erect barriers, impacting Enerplus's ability to export and potentially increasing the cost of imported goods or services necessary for its operations.

- CUSMA's Impact: Facilitates significant cross-border energy trade, reducing friction for Enerplus's North American operations.

- Global Trade Volatility: Potential for new tariffs or sanctions could disrupt export markets and affect the price competitiveness of Enerplus's products.

- Diversification Needs: Global energy security concerns may create opportunities for North American producers like Enerplus to supply new markets, but trade policy remains a critical factor.

Governmental energy policies, including carbon pricing mechanisms and emissions reduction targets, directly shape Enerplus's operational expenses and investment strategies across North America. For instance, Canada's federal carbon pricing system, which reached $65 per tonne of CO2 in April 2023 and is set to rise to $170 per tonne by 2030, impacts the cost of production for oil and gas companies like Enerplus.

The stability and predictability of these regulations in both the United States and Canada are crucial for Enerplus. Frequent policy changes, such as shifts in environmental permitting or taxation, can introduce significant uncertainty, affecting capital allocation and long-term project viability for the company.

Broader geopolitical events significantly shape global energy markets, indirectly influencing demand and pricing for Enerplus's products. For instance, ongoing conflicts in Eastern Europe and the Middle East have contributed to price volatility, with Brent crude oil prices fluctuating between $75 and $90 per barrel in early 2024, impacting the overall economic environment for energy producers.

Political stability in key energy-producing or consuming regions outside North America directly affects international oil and gas prices and investor sentiment. Instability in nations like Libya or Venezuela can disrupt supply, leading to price spikes, while stable production from major players like Saudi Arabia can temper these effects. This global price influence is crucial for Enerplus, as its North American operations are still subject to international market dynamics.

Enerplus navigates a complex web of regulations across its operating regions, particularly concerning new project approvals and infrastructure development. For instance, in the United States, the permitting process for oil and gas activities can involve multiple federal and state agencies, with timelines often extending beyond initial projections. Delays in obtaining these crucial permits, as seen in some North American shale plays where environmental reviews have become more rigorous, can directly impact project schedules and inflate capital expenditures, potentially hindering Enerplus's strategic growth plans.

The evolving landscape of Indigenous rights, land claims, and consultation requirements in Canada and the United States significantly impacts resource development. For Enerplus, navigating these complexities is crucial for project viability and maintaining a social license to operate.

Successful engagement with Indigenous communities can lead to partnerships that enhance long-term operational stability. For instance, in 2023, the Canadian government continued to emphasize co-development agreements, with several major resource projects in various stages of negotiation or implementation that involve Indigenous participation and benefit sharing.

- Increased Scrutiny: Regulatory bodies and courts are increasingly upholding Indigenous rights, demanding more thorough consultation processes for new projects.

- Partnership Opportunities: Collaborative agreements can provide Indigenous communities with economic benefits and greater control over resource development on their traditional territories.

- Social License: Demonstrating genuine respect and partnership with Indigenous groups is essential for securing and maintaining public acceptance, which is vital for project continuity.

- Risk Mitigation: Proactive and respectful engagement can mitigate potential delays, legal challenges, and reputational damage associated with resource projects.

International trade agreements and tariffs significantly shape the energy market. For Enerplus, existing agreements like the Canada-United States-Mexico Agreement (CUSMA) facilitate relatively seamless trade of oil and gas within North America. However, potential new tariffs or shifts in global trade policies could impact the competitiveness of North American crude oil and natural gas exports, potentially affecting Enerplus's access to international customers and its overall market reach.

The evolving landscape of international trade agreements presents both opportunities and challenges for energy commodity flows. For instance, the European Union's efforts to diversify energy sources away from Russia, as seen in the post-2022 energy crisis, could open avenues for North American LNG exports. Conversely, protectionist measures or retaliatory tariffs imposed by major economies could erect barriers, impacting Enerplus's ability to export and potentially increasing the cost of imported goods or services necessary for its operations.

- CUSMA's Impact: Facilitates significant cross-border energy trade, reducing friction for Enerplus's North American operations.

- Global Trade Volatility: Potential for new tariffs or sanctions could disrupt export markets and affect the price competitiveness of Enerplus's products.

- Diversification Needs: Global energy security concerns may create opportunities for North American producers like Enerplus to supply new markets, but trade policy remains a critical factor.

What is included in the product

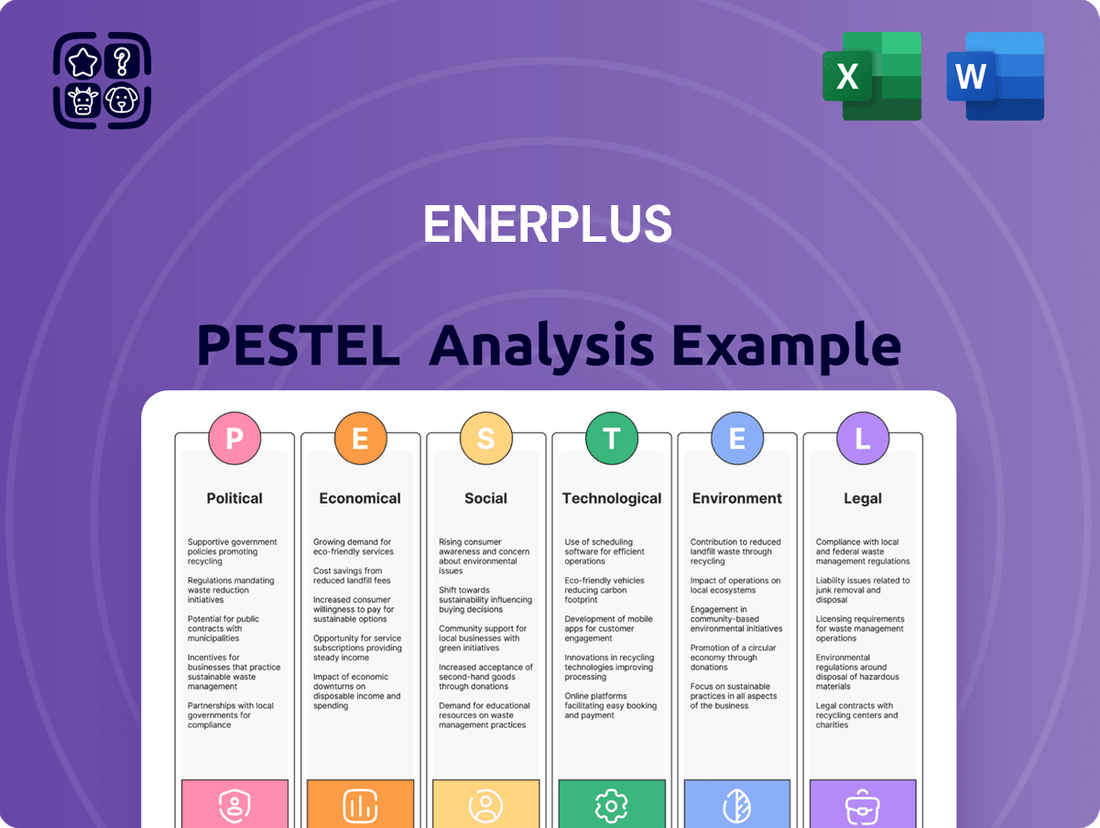

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Enerplus, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions. It aims to equip stakeholders with a clear understanding of market dynamics to inform strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making it easier to communicate complex external factors impacting Enerplus.

Economic factors

Global commodity prices, particularly for crude oil and natural gas, exhibit significant inherent volatility. This directly impacts Enerplus's revenues, profitability, and cash flow generation, as the company's financial performance is closely tied to the fluctuating market prices of these essential energy resources.

Factors such as OPEC+ production decisions, the pace of global economic growth, and ongoing geopolitical tensions are key drivers of these price fluctuations. For instance, in early 2024, oil prices saw considerable swings, with Brent crude trading in a range influenced by supply concerns and demand outlooks, directly affecting Enerplus's realized prices and operational planning.

Inflation significantly impacts Enerplus's operating expenses. Rising costs for labor, essential materials like steel and chemicals, and specialized equipment directly increase the cost of oil and gas extraction and production. For instance, the US Producer Price Index for crude petroleum and natural gas saw a substantial year-over-year increase in late 2023 and early 2024, reflecting these pressures.

These escalating costs can compress Enerplus's profit margins if not effectively managed. To maintain financial health and competitiveness, the company must implement robust cost management strategies. This includes optimizing supply chains, leveraging technology for operational efficiency, and potentially hedging against commodity price volatility to secure more predictable input costs.

Prevailing interest rates directly impact Enerplus's borrowing costs. For instance, if the Bank of Canada's overnight rate, which influences prime lending rates, were to rise, Enerplus's expenses for any new debt taken on for exploration or acquisitions would increase. This tighter capital access can slow down growth initiatives.

Changes in monetary policy, such as interest rate hikes by central banks like the Federal Reserve or Bank of Canada, can significantly alter the investment landscape. Higher rates make debt financing less attractive and can cool overall investor sentiment towards capital-intensive industries like energy, potentially affecting Enerplus's ability to secure funding at favorable terms.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations, particularly between the Canadian Dollar (CAD) and the US Dollar (USD), significantly impact Enerplus's financial performance. Given that commodity prices, like oil and natural gas, are predominantly priced in USD, while a substantial portion of Enerplus's operating costs and asset base are denominated in CAD, movements in the CAD/USD exchange rate directly affect reported revenues and expenses.

For instance, a stronger USD relative to the CAD generally benefits Enerplus by increasing the CAD equivalent of its USD-denominated revenues. Conversely, a weaker USD can reduce the CAD value of those revenues. This dynamic also influences the cost of goods sold and operating expenses incurred in Canada when translated back into USD for reporting purposes, or vice versa.

Enerplus's financial results are sensitive to these shifts. For example, in Q1 2024, the average CAD/USD exchange rate was approximately 1.35. If the USD were to strengthen to 1.40 against the CAD, the CAD value of Enerplus's USD revenue would decrease, potentially impacting profitability if costs remain stable in CAD.

- Impact on Revenue: A stronger USD generally boosts reported revenue in CAD terms for Enerplus, as USD-denominated commodity sales translate into more CAD.

- Impact on Expenses: Conversely, a weaker USD can increase the CAD cost of USD-denominated expenses, or the USD cost of CAD-denominated expenses if reporting in USD.

- Asset Valuation: Fluctuations can also affect the reported CAD value of US-based assets and vice versa, influencing the company's balance sheet.

- 2024/2025 Outlook: Analysts project continued volatility in the CAD/USD exchange rate throughout 2024 and into 2025, necessitating careful hedging strategies and financial management by Enerplus.

Economic Growth and Energy Demand

Global and regional economic growth directly correlates with energy demand. When economies expand, industrial activity and consumer spending increase, leading to higher consumption of crude oil and natural gas, Enerplus's core products.

Conversely, economic slowdowns, particularly in major consuming nations like China and India, can significantly dampen energy consumption. For instance, a projected 2.5% global GDP growth in 2024, compared to 3.1% in 2023, suggests a moderating pace that could temper energy demand growth. This directly impacts Enerplus's sales volumes and pricing power.

- Economic Growth Impact: A 1% increase in global GDP growth typically translates to a roughly 0.5% to 1% increase in oil demand.

- Key Market Influence: China's economic growth rate is a critical driver; a slowdown there can reduce global oil demand by hundreds of thousands of barrels per day.

- Natural Gas Outlook: Industrial sector expansion and residential heating needs, both tied to economic activity, are key determinants for natural gas demand.

- Long-Term Projections: Forecasts for 2025 suggest continued, albeit potentially slower, economic expansion, which would support sustained, but not necessarily accelerated, demand for Enerplus's energy products.

Global commodity prices, particularly for crude oil and natural gas, exhibit significant inherent volatility. This directly impacts Enerplus's revenues, profitability, and cash flow generation, as the company's financial performance is closely tied to the fluctuating market prices of these essential energy resources.

Factors such as OPEC+ production decisions, the pace of global economic growth, and ongoing geopolitical tensions are key drivers of these price fluctuations. For instance, in early 2024, oil prices saw considerable swings, with Brent crude trading in a range influenced by supply concerns and demand outlooks, directly affecting Enerplus's realized prices and operational planning.

Inflation significantly impacts Enerplus's operating expenses. Rising costs for labor, essential materials like steel and chemicals, and specialized equipment directly increase the cost of oil and gas extraction and production. For instance, the US Producer Price Index for crude petroleum and natural gas saw a substantial year-over-year increase in late 2023 and early 2024, reflecting these pressures.

These escalating costs can compress Enerplus's profit margins if not effectively managed. To maintain financial health and competitiveness, the company must implement robust cost management strategies. This includes optimizing supply chains, leveraging technology for operational efficiency, and potentially hedging against commodity price volatility to secure more predictable input costs.

Prevailing interest rates directly impact Enerplus's borrowing costs. For instance, if the Bank of Canada's overnight rate, which influences prime lending rates, were to rise, Enerplus's expenses for any new debt taken on for exploration or acquisitions would increase. This tighter capital access can slow down growth initiatives.

Changes in monetary policy, such as interest rate hikes by central banks like the Federal Reserve or Bank of Canada, can significantly alter the investment landscape. Higher rates make debt financing less attractive and can cool overall investor sentiment towards capital-intensive industries like energy, potentially affecting Enerplus's ability to secure funding at favorable terms.

Currency exchange rate fluctuations, particularly between the Canadian Dollar (CAD) and the US Dollar (USD), significantly impact Enerplus's financial performance. Given that commodity prices, like oil and natural gas, are predominantly priced in USD, while a substantial portion of Enerplus's operating costs and asset base are denominated in CAD, movements in the CAD/USD exchange rate directly affect reported revenues and expenses.

For instance, a stronger USD relative to the CAD generally benefits Enerplus by increasing the CAD equivalent of its USD-denominated revenues. Conversely, a weaker USD can reduce the CAD value of those revenues. This dynamic also influences the cost of goods sold and operating expenses incurred in Canada when translated back into USD for reporting purposes, or vice versa.

Enerplus's financial results are sensitive to these shifts. For example, in Q1 2024, the average CAD/USD exchange rate was approximately 1.35. If the USD were to strengthen to 1.40 against the CAD, the CAD value of Enerplus's USD revenue would decrease, potentially impacting profitability if costs remain stable in CAD.

- Impact on Revenue: A stronger USD generally boosts reported revenue in CAD terms for Enerplus, as USD-denominated commodity sales translate into more CAD.

- Impact on Expenses: Conversely, a weaker USD can increase the CAD cost of USD-denominated expenses, or the USD cost of CAD-denominated expenses if reporting in USD.

- Asset Valuation: Fluctuations can also affect the reported CAD value of US-based assets and vice versa, influencing the company's balance sheet.

- 2024/2025 Outlook: Analysts project continued volatility in the CAD/USD exchange rate throughout 2024 and into 2025, necessitating careful hedging strategies and financial management by Enerplus.

Global and regional economic growth directly correlates with energy demand. When economies expand, industrial activity and consumer spending increase, leading to higher consumption of crude oil and natural gas, Enerplus's core products.

Conversely, economic slowdowns, particularly in major consuming nations like China and India, can significantly dampen energy consumption. For instance, a projected 2.5% global GDP growth in 2024, compared to 3.1% in 2023, suggests a moderating pace that could temper energy demand growth. This directly impacts Enerplus's sales volumes and pricing power.

- Economic Growth Impact: A 1% increase in global GDP growth typically translates to a roughly 0.5% to 1% increase in oil demand.

- Key Market Influence: China's economic growth rate is a critical driver; a slowdown there can reduce global oil demand by hundreds of thousands of barrels per day.

- Natural Gas Outlook: Industrial sector expansion and residential heating needs, both tied to economic activity, are key determinants for natural gas demand.

- Long-Term Projections: Forecasts for 2025 suggest continued, albeit potentially slower, economic expansion, which would support sustained, but not necessarily accelerated, demand for Enerplus's energy products.

Enerplus's financial performance is heavily influenced by global economic trends and energy demand. Slower economic growth, as observed with a projected 2.5% global GDP growth in 2024, can lead to reduced energy consumption, directly impacting Enerplus's sales volumes and pricing power. Conversely, robust economic expansion typically fuels higher demand for oil and natural gas.

Inflationary pressures, exemplified by rising producer prices for crude petroleum and natural gas in late 2023 and early 2024, increase Enerplus's operating expenses. This necessitates effective cost management strategies to maintain profit margins amidst escalating costs for labor and materials.

Interest rate policies by central banks like the Federal Reserve and Bank of Canada directly affect Enerplus's borrowing costs and access to capital. Higher rates make debt financing more expensive, potentially slowing growth initiatives and impacting investor sentiment towards capital-intensive sectors.

Currency exchange rate volatility, particularly the CAD/USD rate, significantly impacts Enerplus's reported revenues and expenses, as commodity prices are typically USD-denominated. Analysts anticipate continued exchange rate fluctuations throughout 2024 and 2025, requiring diligent financial management.

| Economic Factor | Impact on Enerplus | Key Data/Outlook (2024/2025) |

|---|---|---|

| Global Economic Growth | Drives energy demand; slower growth dampens consumption. | Projected 2.5% global GDP growth in 2024 (down from 3.1% in 2023). |

| Inflation | Increases operating expenses (labor, materials). | US PPI for crude petroleum and natural gas showed year-over-year increases in late 2023/early 2024. |

| Interest Rates | Affects borrowing costs and capital access. | Central bank policies influence borrowing attractiveness for capital-intensive industries. |

| Currency Exchange Rates (CAD/USD) | Impacts reported revenue and expenses due to USD commodity pricing. | Average CAD/USD rate ~1.35 in Q1 2024; continued volatility expected through 2025. |

Full Version Awaits

Enerplus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Enerplus PESTLE analysis provides an in-depth look at the political, economic, social, technological, legal, and environmental factors impacting the company.

Sociological factors

Public perception of fossil fuels is a significant sociological factor impacting companies like Enerplus. Growing awareness and concern about climate change are leading to increased demand for sustainable energy solutions. Surveys in 2024 indicate a strong majority of the public in North America support a transition to renewable energy sources, which directly affects the social license for oil and gas operations.

This evolving sentiment influences investor sentiment, often favoring companies with robust environmental, social, and governance (ESG) strategies. Regulatory pressure is also mounting, driven by public demand for stricter environmental controls and a faster shift away from fossil fuels. For Enerplus, this means navigating a landscape where public discourse on sustainability can directly translate into policy changes and affect the availability of capital.

Enerplus faces a dynamic North American labor market for skilled oil and gas professionals. The industry's cyclical nature can lead to periods of both high demand and potential layoffs, impacting talent acquisition and retention. Demographic shifts, such as an aging workforce and the retirement of experienced engineers, also present challenges in finding qualified replacements.

Attracting and retaining top talent requires more than just competitive salaries. Enerplus must focus on offering robust training programs to upskill existing employees and attract new entrants. A positive and safe work environment, coupled with clear career progression paths, is crucial for keeping valuable employees engaged, especially as the industry navigates evolving environmental regulations and technological advancements.

Enerplus's operations are significantly influenced by community engagement and the critical need for a social license to operate. Strong relationships with local communities are paramount for project approval and sustained operations, as demonstrated by the increasing scrutiny on energy projects. For instance, in 2024, the energy sector globally faced heightened public awareness regarding environmental and social impacts, leading to more rigorous community consultation processes. Effective engagement, which involves transparent communication, addressing local concerns about land use and environmental stewardship, and contributing to regional economies through job creation and local procurement, directly mitigates operational risks and builds essential goodwill.

ESG Investor Scrutiny and Shareholder Activism

Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, especially within the energy industry. This trend means companies like Enerplus face greater scrutiny regarding their sustainability practices. For instance, by the end of 2024, a significant portion of global assets under management are expected to be influenced by ESG considerations, pushing companies to demonstrate genuine commitment beyond mere compliance.

Shareholder activism, fueled by ESG concerns, can directly impact Enerplus's strategic decisions and its standing with stakeholders. When ESG ratings are unfavorable, it can hinder access to capital as many funds now have mandates to invest only in sustainable businesses. This pressure encourages companies to align their operations and reporting with evolving investor expectations for responsible resource development.

- Growing ESG Investment: Global ESG assets were projected to exceed $50 trillion by 2025, indicating a powerful market force.

- Activist Investor Influence: In 2023, ESG-focused shareholder proposals saw increased support, signaling a shift in corporate governance priorities.

- Reputational Impact: A strong ESG profile can enhance brand image and attract talent, while poor performance can lead to divestment campaigns.

Energy Consumption Trends

Societal shifts are significantly reshaping how we use energy. Growing environmental awareness and a desire for sustainability are driving consumers towards cleaner alternatives, impacting demand for traditional fossil fuels. For Enerplus, this means a potential decrease in long-term demand for its core oil and gas products unless it strategically diversizes.

Technological progress, especially in renewable energy and energy efficiency, further accelerates this transition. For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 50% increase from 2022, according to the International Energy Agency (IEA). This surge in renewables directly challenges the market share of fossil fuels.

Policy initiatives worldwide are also reinforcing the move to cleaner energy. Governments are implementing carbon pricing, subsidies for renewables, and stricter emissions standards. For example, many nations are setting ambitious targets for renewable energy integration into their grids, aiming for substantial percentages by 2030 and beyond, which will undoubtedly influence Enerplus's operational landscape and require adaptive strategies.

- Consumer Behavior: Increasing demand for sustainable products and services, including lower-carbon energy options.

- Technological Advancements: Rapid growth in renewable energy technologies (solar, wind) and energy storage solutions.

- Policy Initiatives: Government mandates and incentives promoting decarbonization and renewable energy adoption.

- Market Impact: Potential long-term decline in demand for conventional oil and gas, necessitating strategic shifts for companies like Enerplus.

Societal expectations around corporate responsibility are increasingly focused on environmental stewardship and ethical labor practices. Enerplus must navigate public sentiment that favors companies demonstrating strong ESG commitments, as evidenced by the projected growth of ESG investments, which were anticipated to surpass $50 trillion globally by 2025.

The demand for skilled labor in the energy sector is also a critical sociological factor, with demographic shifts like an aging workforce presenting challenges for talent acquisition and retention. Companies like Enerplus need to invest in training and development to attract and keep qualified professionals amidst evolving industry demands.

Community relations are paramount for maintaining a social license to operate, requiring transparent communication and engagement with local stakeholders. The energy sector globally experienced heightened public scrutiny in 2024 regarding environmental and social impacts, reinforcing the need for robust community consultation processes.

| Sociological Factor | Impact on Enerplus | Supporting Data/Trend |

|---|---|---|

| Public Perception of Fossil Fuels | Decreasing social license, potential for reduced demand | Majority support for renewable energy transition (2024 surveys) |

| Labor Market Dynamics | Challenges in talent acquisition and retention due to aging workforce and industry cycles | Need for robust training and positive work environment to attract talent |

| Community Engagement | Essential for operational approval and sustained activities | Heightened scrutiny on energy projects and environmental impacts (2024) |

| ESG Investor Sentiment | Influence on capital access and strategic decisions | Projected ESG assets > $50 trillion by 2025; increased support for ESG shareholder proposals (2023) |

Technological factors

Enerplus benefits significantly from advancements in drilling and completion technologies. Innovations like extended-reach horizontal drilling and multi-stage hydraulic fracturing are key to unlocking the potential of unconventional resource plays. These techniques allow for greater wellbore reach and more efficient reservoir stimulation, directly boosting recovery rates and improving the cost-effectiveness of operations.

These technological leaps enable Enerplus to maximize resource extraction from existing assets. For instance, the company's focus on the Bakken and Marcellus shale plays relies heavily on these sophisticated methods to access previously uneconomical reserves. The ability to drill longer horizontal sections and fracture more stages per well means more oil and gas can be produced from a single pad, reducing the overall footprint and capital expenditure per barrel.

In 2024, the industry continued to see improvements in drilling efficiency, with average lateral lengths in key plays increasing. This trend directly translates to higher production volumes per well for companies like Enerplus. Furthermore, ongoing refinements in proppant technology and water management for hydraulic fracturing are leading to more sustainable and cost-effective completions, further enhancing the economic viability of unconventional resource development.

Enerplus is increasingly leveraging digitalization and automation to streamline its operations. The company is exploring the integration of artificial intelligence and advanced data analytics to optimize field operations, predict equipment failures, and enhance supply chain efficiency. For instance, in 2024, the energy sector saw significant investment in AI-driven predictive maintenance, aiming to reduce unplanned downtime by up to 30%.

The adoption of technologies like the Internet of Things (IoT) allows for real-time monitoring of assets, providing crucial data for improving operational efficiency and safety. This can lead to a reduction in costly downtime and a more proactive approach to maintenance. By 2025, it's projected that IoT devices in industrial settings will generate over 1.5 zettabytes of data annually, underscoring the potential for data-driven optimization.

The development of Carbon Capture, Utilization, and Storage (CCUS) technologies is accelerating, offering a pathway to significantly reduce greenhouse gas emissions from oil and gas operations. For instance, by the end of 2023, global CCUS capacity reached approximately 45 million tonnes per annum (Mtpa), with numerous projects in development aiming to add substantial capacity by 2030.

Enerplus could explore investments in CCUS to meet evolving environmental, social, and governance (ESG) standards and to potentially unlock new revenue streams through carbon credits or the sale of captured CO2 for utilization. This strategic alignment is crucial as governments worldwide, including Canada and the United States, continue to implement stricter climate regulations and offer incentives for CCUS deployment.

Emissions Reduction Technologies

Emerging technologies for reducing methane emissions and flaring are significantly reshaping the oil and gas sector. Innovations like advanced leak detection and repair (LDAR) systems, using drones and infrared cameras, are becoming more sophisticated and cost-effective. For instance, by mid-2024, many operators are investing in continuous monitoring solutions that can identify fugitive emissions in real-time, a marked improvement over traditional periodic surveys.

Enerplus can capitalize on these technological advancements to bolster its environmental performance. Implementing these cutting-edge solutions can lead to substantial reductions in greenhouse gas emissions, helping the company meet increasingly stringent regulatory requirements, such as those anticipated under potential carbon pricing mechanisms or methane intensity targets. This proactive adoption also directly enhances Enerplus's Environmental, Social, and Governance (ESG) standing, making it more attractive to investors prioritizing sustainability.

The financial benefits are also becoming clearer. Companies adopting these technologies often see operational efficiencies and reduced product loss due to leaks. For example, studies in 2024 suggest that effective methane management can recover valuable gas that would otherwise be vented or flared, potentially offsetting the investment in new technologies. Furthermore, a strong ESG profile, driven by emission reduction efforts, can lead to a lower cost of capital and improved access to funding for projects.

- Advanced LDAR: Drones equipped with optical gas imaging (OGI) cameras offer enhanced detection of methane leaks, improving accuracy and coverage over traditional methods.

- Vapor Recovery Units (VRUs): These systems capture volatile organic compounds (VOCs) and methane from tanks and equipment, converting them into saleable products or fuel.

- Flaring Reduction Technologies: Innovations like reduced-emission completions (RECs) and advanced flare gas recovery systems minimize the environmental impact of routine flaring.

- Carbon Capture, Utilization, and Storage (CCUS): While a larger-scale solution, CCUS technologies are being explored to capture CO2 and other emissions directly from production facilities.

Renewable Energy Integration and Competitiveness

Technological advancements are rapidly making renewable energy sources more efficient and affordable. For instance, the global average cost of electricity from solar photovoltaics (PV) fell by approximately 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA). This trend directly challenges the long-term demand for traditional fossil fuels. Enerplus needs to closely track these cost reductions and efficiency gains in solar, wind, and battery storage technologies.

The increasing competitiveness of renewables necessitates strategic adaptation for companies like Enerplus. By 2024, renewable energy sources are projected to account for a significant portion of new power generation capacity globally. Enerplus could explore strategic partnerships or investments in renewable energy projects to diversify its portfolio and hedge against potential declines in fossil fuel demand. Monitoring policy shifts and technological breakthroughs will be crucial for maintaining a competitive edge in the evolving energy landscape.

- Decreasing Costs: Solar PV costs have seen dramatic reductions, making renewables increasingly competitive with fossil fuels.

- Efficiency Gains: Ongoing technological improvements in solar panels, wind turbines, and energy storage are enhancing the viability of renewables.

- Market Share Growth: Renewables are capturing an increasing share of new energy capacity additions worldwide.

- Strategic Response: Enerplus must monitor these trends and consider diversification into renewable energy or related technologies to adapt.

Technological advancements continue to drive efficiency in oil and gas extraction, with innovations like extended-reach horizontal drilling and multi-stage hydraulic fracturing enabling Enerplus to access more reserves cost-effectively. By mid-2024, the energy sector saw significant investment in AI-driven predictive maintenance, aiming to reduce unplanned downtime by up to 30%, a trend Enerplus can leverage for operational optimization.

The company is also benefiting from digitalization and IoT, allowing for real-time asset monitoring and data-driven improvements. Furthermore, the accelerating development of Carbon Capture, Utilization, and Storage (CCUS) technologies presents opportunities for Enerplus to reduce emissions and potentially create new revenue streams, especially as global CCUS capacity is projected to grow substantially by 2030.

Emerging methane emission reduction technologies, such as advanced leak detection and repair (LDAR) systems, are becoming more sophisticated and cost-effective, with many operators investing in continuous monitoring solutions by mid-2024. These advancements allow Enerplus to improve its environmental performance and ESG standing.

The increasing efficiency and affordability of renewable energy sources, with solar PV costs falling significantly between 2010 and 2022, represent a long-term challenge to fossil fuel demand, necessitating strategic adaptation and potential diversification for Enerplus.

Legal factors

Enerplus operates within a stringent environmental regulatory landscape, requiring adherence to laws governing air emissions, water discharge, waste management, and land reclamation across its operational areas. Navigating these complex rules, which vary by jurisdiction, is crucial for maintaining its license to operate and avoiding significant penalties.

The company faces increasing scrutiny on its environmental footprint, with permitting requirements becoming more rigorous. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize methane emission reductions, a key area for oil and gas producers like Enerplus, with potential fines for non-compliance reaching substantial figures for significant violations.

Potential liabilities for non-compliance are considerable, encompassing fines, operational shutdowns, and reputational damage. In 2025, the trend of increased enforcement and stricter environmental standards is expected to continue, necessitating ongoing investment in compliance technologies and robust environmental management systems for Enerplus.

The oil and gas sector operates under rigorous health and safety regulations, such as those enforced by OSHA in the United States, requiring meticulous adherence to safe operating procedures and robust worker protection measures.

Enerplus must continually invest in compliance, including safety training and equipment upgrades, to maintain a secure workplace and minimize the likelihood of operational incidents, a critical factor for sustained operations and investor confidence.

Enerplus navigates a complex web of taxation and royalty regimes across its operating regions, primarily Canada and the United States. Changes in federal and provincial corporate income tax rates, like the recent adjustments in Canada, directly affect net profitability. Furthermore, royalty rates on production, which vary significantly by jurisdiction, such as those in North Dakota versus Alberta, can materially alter project economics and investment decisions.

Indigenous Rights and Consultation Laws

Enerplus operates under legal frameworks in both Canada and the United States that mandate consultation and accommodation with Indigenous communities regarding project development. In Canada, this stems from Section 35 of the Constitution Act, 1982, and evolving common law principles, requiring meaningful engagement and consideration of potential impacts on Aboriginal and treaty rights. Failure to meet these obligations can lead to significant project delays, legal injunctions, and reputational damage.

In the United States, the National Environmental Policy Act (NEPA) and the National Historic Preservation Act (NHPA) often necessitate consultation with federally recognized tribes concerning projects on or affecting federal lands or resources. Enerplus must navigate varying state-specific regulations and tribal consultation protocols. For instance, in 2024, the U.S. Department of the Interior continues to emphasize tribal consultation as a cornerstone of federal environmental review processes, impacting energy project approvals.

- Canadian Duty to Consult: Enerplus must engage Indigenous groups whose rights may be impacted by its operations, ensuring consultation is informed and addresses potential adverse effects.

- U.S. Tribal Consultation: Compliance with federal laws like NEPA and NHPA requires consultation with federally recognized tribes, particularly for projects involving federal permits or lands.

- Legal Risks: Non-compliance can result in litigation, project stoppages, and significant financial penalties, as seen in past energy project disputes across North America.

- Accommodation Requirements: Beyond consultation, legal obligations may extend to accommodating Indigenous rights, potentially involving benefit-sharing agreements or mitigation measures.

Corporate Governance and Disclosure Requirements

Enerplus, as a publicly traded entity, operates under stringent legal frameworks governing corporate governance and disclosure. These include adherence to securities regulations like those enforced by the U.S. Securities and Exchange Commission (SEC) and Canadian provincial securities regulators. Compliance ensures transparency in financial reporting and operational conduct, vital for maintaining investor trust.

Key legal obligations for Enerplus involve regular filings of financial statements, such as annual reports (10-K in the U.S.) and quarterly reports (10-Q), detailing financial performance and material business developments. For fiscal year 2023, Enerplus reported total revenues of approximately $2.2 billion CAD, underscoring the scale of information that must be accurately disclosed.

- Adherence to SEC and Canadian Securities Administrators regulations is paramount.

- Timely and accurate filing of financial reports, including annual and quarterly statements, is legally mandated.

- Emphasis on transparency and ethical conduct is crucial for upholding investor confidence and market integrity.

- Compliance with disclosure requirements ensures that all material information affecting the company's value is made public.

Enerplus's operations are significantly shaped by legal and regulatory frameworks, particularly concerning environmental protection and worker safety. The company must navigate evolving regulations on emissions, waste management, and land reclamation, with strict enforcement and potential for substantial fines for non-compliance, as seen with EPA methane reduction initiatives in 2024.

Taxation and royalty regimes across Canada and the United States directly impact Enerplus's profitability. Changes in corporate tax rates and varying royalty rates by jurisdiction, such as those in North Dakota versus Alberta, materially affect project economics and investment decisions.

Consultation and accommodation with Indigenous communities are legal imperatives, stemming from constitutional rights and evolving common law. Failure to engage meaningfully can lead to project delays and legal challenges, with U.S. tribal consultation under NEPA and NHPA remaining a key focus in 2024.

As a publicly traded entity, Enerplus is bound by stringent corporate governance and disclosure laws enforced by bodies like the SEC. Accurate and timely financial reporting, such as the $2.2 billion CAD in total revenues reported for fiscal year 2023, is critical for maintaining investor trust and market integrity.

Environmental factors

Governments worldwide are intensifying pressure on the oil and gas industry to curb greenhouse gas emissions, with many setting ambitious net-zero targets. This trend directly impacts companies like Enerplus, as stricter climate policies are increasingly implemented.

These policies can manifest as carbon taxes, cap-and-trade systems, or direct mandates for emissions reduction, all of which could increase operational costs or necessitate significant capital investment for Enerplus to comply. For instance, Canada, where Enerplus operates, has a federal carbon pricing system that is set to increase over the coming years, directly affecting the cost of emissions.

Enerplus faces significant environmental scrutiny regarding water management in its hydraulic fracturing activities. Regulations around water acquisition, usage, and disposal are stringent, particularly in regions like the US where fracking is prevalent. Companies must navigate complex permitting processes and adhere to strict discharge standards to minimize potential contamination of groundwater and surface water sources.

Sustainable water management is crucial for Enerplus's operational continuity and environmental stewardship. This includes investing in advanced water recycling technologies, which can significantly reduce the demand for fresh water. For instance, in 2023, the oil and gas industry in North America saw increased adoption of water reuse, with some operators achieving over 90% water recycling rates in their fracking operations, a trend Enerplus is likely following to manage costs and environmental impact.

Enerplus's operations, like those of other oil and gas companies, carry potential environmental impacts on local ecosystems and wildlife habitats. Exploration and production activities can affect land use, leading to habitat fragmentation and disruption of natural processes. For instance, seismic surveys and well pad construction require land clearing, which can alter drainage patterns and impact vegetation.

Enerplus is committed to minimizing its ecological footprint through various biodiversity protection and land stewardship initiatives. The company aims to restore disturbed areas and implement practices that support native species. In 2023, Enerplus reported investing in reclamation projects across its operating regions, focusing on returning land to a functional state post-operation.

Waste Management and Remediation

Enerplus operates within a stringent environmental regulatory landscape governing the disposal of drilling waste, produced water, and other operational by-products. Compliance with these regulations, which often mandate specific treatment and disposal methods, is paramount to avoid penalties and maintain operational continuity. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations under the Resource Conservation and Recovery Act (RCRA) for hazardous waste, impacting how oil and gas companies manage certain drilling fluids and sludges.

The company's approach to waste management focuses on minimizing waste generation at the source and employing safe disposal techniques. This includes strategies for recycling or reusing drilling fluids where feasible and treating produced water to meet discharge standards or for beneficial reuse, such as in enhanced oil recovery operations. Enerplus's commitment to site remediation ensures that any historical or current operational impacts are addressed, preventing soil and groundwater contamination and restoring affected areas to meet or exceed environmental standards.

Key aspects of Enerplus's environmental strategy include:

- Waste Reduction Initiatives: Implementing technologies and operational practices to decrease the volume of waste produced, such as optimizing drilling fluid formulations and improving water management.

- Safe Disposal Practices: Adhering to strict protocols for the transportation, treatment, and disposal of all waste streams, utilizing licensed facilities and approved methods.

- Site Remediation Programs: Actively managing and cleaning up sites impacted by past operations, employing advanced techniques to address soil and water contamination and ensure ecological restoration.

- Regulatory Compliance Monitoring: Continuously tracking and adapting to evolving environmental regulations across its operating regions to ensure full adherence and proactive risk management.

Energy Transition and Decarbonization Pressures

The global shift towards energy transition and decarbonization significantly impacts the long-term demand for fossil fuels, including oil and natural gas, which are Enerplus's core products. This trend is accelerating investment in renewable energy sources and energy efficiency technologies. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that renewable energy capacity additions could reach 500 GW in 2024, a substantial increase from previous years.

Enerplus is actively managing these pressures by focusing on reducing its operational emissions intensity. In 2023, the company reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity. This strategic focus on operational efficiency and emissions management is crucial for maintaining its competitive position and ensuring long-term sustainability in an evolving energy landscape.

- Global Decarbonization Efforts: The Paris Agreement and national net-zero targets are driving policy changes that favor cleaner energy.

- Investment Shifts: Significant capital is flowing into renewable energy projects, potentially diverting funds from traditional fossil fuel exploration.

- Enerplus's Response: The company is implementing initiatives to lower its carbon footprint, aiming to align with industry sustainability goals.

- Market Volatility: The energy transition introduces price volatility for fossil fuels as demand patterns shift.

Stricter environmental regulations, including carbon pricing and emissions reduction mandates, are increasing operational costs for Enerplus. The company must also manage stringent rules around water usage and disposal in hydraulic fracturing, with a growing industry trend towards over 90% water recycling rates in North America. Enerplus is also focused on minimizing its ecological footprint through land stewardship and reclamation projects, while adhering to regulations for waste disposal, such as the EPA's RCRA enforcement in 2024.

The global energy transition, marked by substantial investments in renewables, presents a long-term challenge to fossil fuel demand. Enerplus is responding by reducing its operational emissions intensity, with reported reductions in Scope 1 and Scope 2 greenhouse gas emissions intensity in 2023, aligning with broader industry sustainability goals and navigating market volatility.

| Environmental Factor | Impact on Enerplus | Enerplus's Response/Data |

| Climate Change Policies | Increased operational costs due to carbon pricing and emissions mandates. | Canada's federal carbon pricing system is increasing; Enerplus focuses on reducing operational emissions intensity. |

| Water Management | Stringent regulations on water acquisition, usage, and disposal in fracking. | Investing in water recycling technologies; industry trend of over 90% water recycling rates in North America (2023). |

| Ecosystem Impact & Waste Disposal | Potential disruption to habitats and strict rules for waste and produced water disposal. | Commitment to land stewardship and reclamation projects (reported in 2023); adherence to EPA's RCRA for waste management (2024). |

| Energy Transition | Long-term pressure on fossil fuel demand due to renewable energy growth. | Focus on reducing emissions intensity; IEA projected 500 GW renewable capacity additions in 2024. |

PESTLE Analysis Data Sources

Our Enerplus PESTLE analysis is built on a robust foundation of data from official government energy agencies, international financial institutions, and leading industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends impacting the energy sector.