Enerplus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerplus Bundle

Enerplus operates in an industry characterized by moderate buyer power, as customers have some ability to switch suppliers, but this is tempered by the specialized nature of oil and gas products. The threat of new entrants is generally low due to high capital requirements and regulatory hurdles, offering Enerplus a degree of protection. However, the bargaining power of suppliers can be significant, particularly for specialized equipment and services, impacting Enerplus's cost structure.

The complete report reveals the real forces shaping Enerplus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oilfield services sector experienced a significant upswing, marking its strongest performance in 34 years during 2023 and extending into early 2024. This robust demand for their specialized equipment and skilled labor suggests a heightened bargaining power for these suppliers.

The bargaining power of suppliers in the drilling services sector for Enerplus is significantly weakened by declining day rates. In 2024, U.S. composite day rates for drilling services saw an 11-month consecutive decline, a clear indicator of reduced demand relative to available capacity.

This trend is further underscored by falling rig utilization rates, which suggest an oversupply within the drilling services market. When there are more rigs available than needed, suppliers have less leverage to dictate terms and prices, directly impacting their bargaining power.

The oil and gas sector, including companies like Enerplus, grapples with persistent labor shortages, especially for highly specialized roles such as geoscientists and experienced engineers crucial for complex infrastructure development. This scarcity of talent significantly enhances the bargaining power of these skilled workers, allowing them to command higher wages and better benefits.

Proprietary Technology and Equipment

When suppliers possess proprietary technology and specialized equipment essential for exploration and extraction, their bargaining power significantly increases. This uniqueness makes companies like Enerplus dependent on their offerings, allowing these suppliers to dictate terms and potentially charge higher prices. For instance, in 2024, the demand for advanced seismic imaging technology, often held by a few specialized firms, remained robust, contributing to higher equipment leasing costs for exploration companies.

This reliance on unique intellectual property and specialized machinery creates a barrier for Enerplus to switch suppliers easily. The critical nature of these technologies in unlocking reserves means that disruptions or unfavorable pricing from these suppliers can directly impact Enerplus's operational efficiency and profitability. The cost of developing or acquiring comparable in-house technology can be prohibitively high, reinforcing the suppliers' strong position.

- Proprietary Technology: Suppliers with exclusive patents or advanced technological know-how in areas like enhanced oil recovery (EOR) techniques can charge a premium.

- Specialized Equipment: The need for highly specific drilling or processing equipment, available from a limited number of manufacturers, grants those suppliers leverage.

- Intellectual Property: Unique software for reservoir simulation or data analytics, developed and controlled by a few entities, strengthens their negotiating position.

- Critical Nature: The inability of Enerplus to perform essential operations without these proprietary technologies makes them vulnerable to supplier-driven price increases.

Dependency on Critical Inputs and Switching Costs

Enerplus's dependence on specialized inputs, such as drilling equipment, completion fluids, and seismic data services, grants significant leverage to its suppliers. The complexity and proprietary nature of some of these critical materials and services can make it difficult and costly for Enerplus to switch to alternative providers. This reliance on a limited pool of specialized suppliers, coupled with the substantial costs associated with changing vendors, directly enhances the bargaining power of these suppliers in price negotiations and contract terms.

The high switching costs for Enerplus are particularly evident in areas like specialized drilling technology and geological surveying. For instance, adopting new drilling techniques or seismic analysis software often requires significant investment in new equipment, extensive training for personnel, and potential integration challenges with existing systems. These barriers to switching mean that suppliers who offer unique or highly specialized solutions can command premium pricing and dictate more favorable terms, impacting Enerplus's operational costs and profitability.

- Dependency on Specialized Inputs: Enerplus requires specialized materials like high-spec drill bits and advanced completion fluids, crucial for efficient oil and gas extraction.

- High Switching Costs: The expense and time involved in qualifying new suppliers for specialized equipment or services, including retraining and system integration, create substantial switching barriers.

- Supplier Concentration: In certain niche segments of the oilfield services market, a limited number of suppliers may dominate, further increasing their bargaining power.

- Impact on Enerplus: These factors allow suppliers to potentially charge higher prices or impose less favorable contract terms, directly affecting Enerplus's cost structure and competitive position.

The bargaining power of suppliers for Enerplus is influenced by the concentration within specific oilfield service segments. In 2024, the market for hydraulic fracturing services, for example, saw consolidation, with a few major players dominating. This concentration means Enerplus has fewer options for these critical services, giving the dominant suppliers more leverage in pricing and contract negotiations.

The demand for specialized equipment and proprietary technologies remains a key driver of supplier power. For instance, advanced directional drilling equipment and sophisticated reservoir simulation software, often patented and controlled by a limited number of firms, command higher prices. Enerplus’s reliance on these specialized inputs, as seen in 2024’s continued investment in enhanced oil recovery techniques, directly strengthens the hand of these technology-holding suppliers.

Enerplus faces significant switching costs when dealing with specialized suppliers, particularly for essential components like high-performance drill bits or unique completion fluids. The expense of qualifying new vendors, including rigorous testing and potential operational downtime, reinforces the existing suppliers' positions. These costs, estimated to be substantial in the complex upstream sector, allow suppliers to maintain pricing power.

| Supplier Characteristic | Impact on Enerplus | Supporting Data/Trend (2024) |

|---|---|---|

| Supplier Concentration | Increased leverage for dominant firms | Consolidation in hydraulic fracturing services market |

| Proprietary Technology/Specialization | Higher prices for critical inputs | Robust demand for advanced seismic imaging and EOR technologies |

| High Switching Costs | Reduced flexibility, entrenched supplier relationships | Significant investment required for new technology adoption and vendor qualification |

What is included in the product

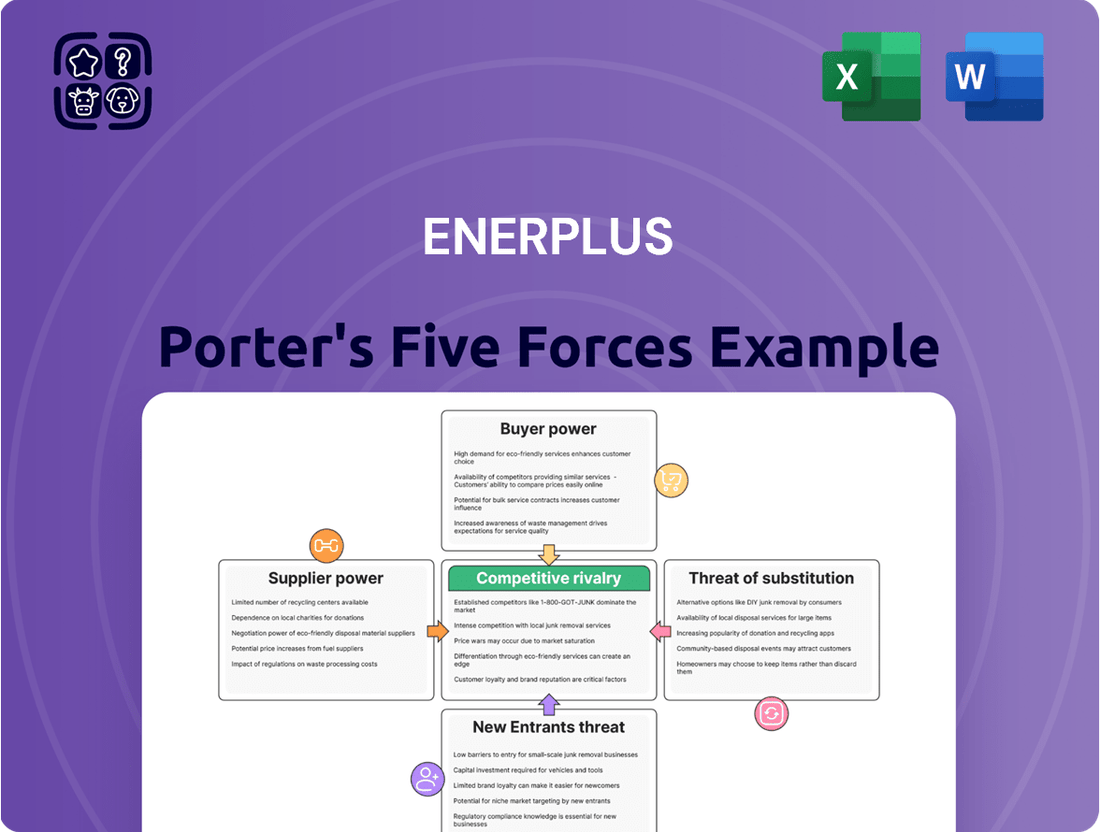

This Porter's Five Forces analysis provides a comprehensive overview of the competitive landscape for Enerplus, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on the company's operations and profitability.

Instantly visualize the competitive landscape and identify key threats with a dynamic Porter's Five Forces analysis for Enerplus.

Customers Bargaining Power

Customers' bargaining power is significantly amplified by commodity price volatility, particularly in the energy sector. For example, the average Henry Hub natural gas price experienced a notable decline, reaching historic lows in 2024. This downward price pressure inherently shifts leverage towards buyers, allowing them to negotiate more favorable terms and potentially secure lower input costs.

While 2025 anticipates robust growth in road transportation fuel demand, the long-term outlook for traditional fuels suggests a more modest expansion. Projections indicate only a 1% increase in demand between 2024 and 2034. This subdued growth rate could potentially temper the bargaining power of fuel producers when dealing with large-scale buyers.

Consolidation among downstream buyers, particularly in the refining and marketing sectors, presents a significant shift. As fewer, larger entities emerge, their increased purchasing volumes translate directly into amplified bargaining power over upstream producers like Enerplus. This trend means these consolidated buyers can negotiate more favorable terms due to their substantial market influence.

Availability of Diverse Energy Portfolios

Enerplus faces significant customer bargaining power due to the availability of diverse energy portfolios among its larger clients. These customers, often major industrial users or energy traders, can leverage their ability to switch between different energy sources or even invest in alternative fuels, putting downward pressure on Enerplus's crude oil and natural gas prices. For instance, a large manufacturing company with integrated renewable energy capabilities might reduce its reliance on purchased natural gas, thereby diminishing its need to negotiate favorable terms with suppliers like Enerplus.

The increasing focus on sustainability and energy transition amplifies this trend. Customers actively seeking to reduce their carbon footprint or hedge against volatile fossil fuel prices are more inclined to diversify their energy procurement strategies. This diversification can include direct investments in renewable energy projects or long-term contracts with renewable fuel providers, directly impacting the demand and pricing power Enerplus holds for its conventional energy products.

- Customer Diversification: Large industrial consumers and energy trading firms often possess diversified energy portfolios, allowing them to shift demand away from specific suppliers.

- Renewable Fuel Investments: Customers investing in renewable fuels or alternative energy sources reduce their dependence on traditional oil and gas, increasing their bargaining power.

- Price Sensitivity: The ability to switch energy sources makes these customers highly sensitive to price fluctuations, enabling them to negotiate more favorable terms.

- Market Influence: Major energy consumers can collectively influence market prices by altering their purchasing patterns based on the availability and cost of diverse energy options.

Global Demand Shifts and Regional Disparities

Shifts in global energy demand, coupled with significant regional disparities, directly impact Enerplus's customer bargaining power. For instance, in regions experiencing robust supply and potentially slower demand growth, buyers can leverage this situation to negotiate better pricing and more favorable contract terms. This dynamic is evident in 2024 data showing varied energy consumption trends across continents, with some areas seeing increased demand while others exhibit stabilization or slight declines.

These regional differences create opportunities for customers to exert greater influence. Buyers in markets with oversupply or where demand is softening can more effectively push for concessions. This can translate into lower prices per barrel or more flexible delivery schedules, directly affecting Enerplus's revenue and profit margins.

- Regional Demand Variations: In 2024, North America's energy demand showed resilience, while certain European nations focused on transitioning to renewables, potentially softening demand for traditional oil and gas.

- Supply Dynamics: Ample oil and gas supply in key producing regions in 2024 provided buyers with more options, increasing their leverage against suppliers like Enerplus.

- Contract Negotiation Power: Customers in regions with abundant supply and moderate demand growth in 2024 were better positioned to negotiate favorable pricing and terms.

The bargaining power of Enerplus's customers is substantial, driven by factors like commodity price volatility and the increasing ease of switching energy sources. For instance, the average Henry Hub natural gas price saw a significant drop in 2024, empowering buyers. Furthermore, the trend of downstream buyer consolidation means fewer, larger entities can negotiate better terms due to their increased purchasing volumes.

Customers' ability to diversify their energy portfolios and invest in renewables directly challenges Enerplus's pricing power. This strategic shift, amplified by sustainability goals, allows buyers to reduce reliance on traditional fuels and secure more favorable contracts. In 2024, regional energy demand variations also played a role, with some markets offering buyers more leverage due to ample supply and softer demand growth.

| Factor | Impact on Bargaining Power | Supporting Data/Trend (2024 Focus) |

|---|---|---|

| Commodity Price Volatility | Increases buyer power | Henry Hub natural gas prices reached historic lows in 2024. |

| Downstream Consolidation | Increases buyer power | Fewer, larger downstream entities can negotiate from a position of greater volume. |

| Customer Diversification & Renewables | Increases buyer power | Customers investing in renewables reduce dependence on traditional energy suppliers. |

| Regional Demand/Supply Imbalances | Increases buyer power in certain markets | Varied energy consumption trends across continents in 2024 provided buyers with more options. |

What You See Is What You Get

Enerplus Porter's Five Forces Analysis

This preview showcases the complete Enerplus Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the energy sector.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into Enerplus's strategic positioning.

You're looking at the actual document, which meticulously breaks down each force to illuminate the industry's profit potential and Enerplus's competitive landscape.

Rivalry Among Competitors

The global oil and gas sector is characterized by considerable concentration, with a few major entities holding substantial market sway. This concentration naturally fuels intense rivalry as these established companies vie fiercely for market share and operational advantages.

For instance, in 2024, the top five publicly traded oil and gas companies, by revenue, included giants like Saudi Aramco, ExxonMobil, and Shell. These companies, with their vast resources and integrated operations, set a high bar for competition, making it challenging for smaller or newer entrants to gain significant traction.

The energy sector, particularly for companies like Enerplus, has seen substantial consolidation. In 2023, the value of oil and gas mergers and acquisitions reached an estimated $250 billion globally, with further significant activity continuing into 2024. This trend intensifies competitive rivalry as fewer, larger players emerge, each vying for greater market share and operational efficiencies.

Declining day rates and rig utilization in 2024 underscore a highly competitive landscape for Enerplus. This pressure stems from an oversupply of drilling services coupled with softened demand, forcing producers to vie aggressively for available capacity and focus on cost optimization. For instance, some industry reports indicated rig utilization rates dipping below 70% in certain North American basins during early 2024, a significant drop that directly impacts service provider pricing power.

Focus on Capital Discipline and Production Efficiency

Enerplus, like many in its sector, has increasingly focused on capital discipline and production efficiency. This strategy is crucial for maintaining financial health and investor confidence, especially in a volatile market. Companies are pushing for lower operating costs and more streamlined production processes.

This drive for efficiency is evident in the industry's performance metrics. For instance, in the first quarter of 2024, many North American oil and gas producers reported significant improvements in their finding and development (F&D) costs, often falling below $10 per barrel of oil equivalent (BOE). This cost reduction directly translates to higher profitability and a stronger competitive position.

- Capital Discipline: Companies are limiting capital expenditures to internally generated cash flows, ensuring sustainable operations rather than aggressive expansion.

- Production Efficiency: Focus on optimizing well performance, reducing downtime, and leveraging technology to lower per-barrel production costs.

- Cost Reduction: Efforts to decrease operating expenses, including general and administrative costs and lifting costs, are paramount.

- Investor Returns: Prioritizing shareholder returns through dividends and buybacks, which is often linked to disciplined capital allocation and efficient operations.

Commodity Price Pressures and Market Volatility

The competitive rivalry within the energy sector, particularly for companies like Enerplus, is intensified by the inherent volatility of commodity prices. Crude oil and natural gas prices are notoriously unpredictable, directly impacting profitability and strategic planning.

The year 2024 has seen historically low natural gas prices, presenting a significant challenge. For instance, the Henry Hub natural gas spot price averaged around $1.80 per million British thermal units (MMBtu) in early 2024, a stark contrast to previous years. This environment forces companies to constantly adjust their operations and hedging strategies to maintain a competitive edge and ensure profitability amidst fluctuating market conditions.

- Price Volatility: Crude oil and natural gas prices are subject to rapid and significant swings due to geopolitical events, supply and demand imbalances, and economic conditions.

- 2024 Natural Gas Market: The sustained low prices for natural gas in 2024 create margin compression and necessitate cost-efficiency measures.

- Strategic Adaptation: Companies must be agile, adapting production levels, exploration plans, and financial strategies to navigate these price uncertainties.

- Competitive Pressure: Intense competition means that companies unable to manage costs effectively or adapt to price shifts risk losing market share and profitability.

Enerplus operates in a highly competitive oil and gas market, where established players and a growing number of smaller entities constantly vie for resources and market share. The industry's consolidation trend, with significant M&A activity continuing through 2024, means larger, more efficient companies are emerging, intensifying rivalry.

This fierce competition is further exacerbated by fluctuating commodity prices, particularly the historically low natural gas prices observed in early 2024, with Henry Hub averaging around $1.80 per MMBtu. Companies like Enerplus must maintain strict capital discipline and focus on production efficiency, as evidenced by industry-wide improvements in finding and development costs falling below $10 per BOE in Q1 2024, to remain competitive.

The pressure is also evident in service sector metrics, with rig utilization rates in some North American basins dipping below 70% in early 2024, forcing producers to negotiate aggressively on costs.

| Metric | 2023 (Est.) | Early 2024 (Est.) | Impact on Rivalry |

| Global Oil & Gas M&A Value | $250 Billion | Significant Activity | Industry Consolidation, Fewer, Larger Competitors |

| Henry Hub Natural Gas Price | Varies | ~$1.80/MMBtu | Margin Compression, Increased Cost Focus |

| North American Rig Utilization | Varies | <70% (some basins) | Lower Service Costs, Increased Negotiation Power for Producers |

| Finding & Development Costs (North America) | Varies | <$10/BOE (Q1) | Improved Profitability, Stronger Competitive Position |

SSubstitutes Threaten

The accelerating global energy transition, driven by climate change concerns, significantly increases the threat of substitutes for traditional fossil fuels. Demand for clean energy solutions is surging, with renewable energy sources like solar and wind power experiencing substantial growth. For instance, global renewable energy capacity additions reached a record high in 2023, exceeding 500 gigawatts, a nearly 50% increase from 2022, according to the International Energy Agency (IEA).

This shift directly impacts companies reliant on fossil fuel extraction, as cleaner alternatives become more competitive and widely adopted. Governments worldwide are implementing policies and incentives to promote renewable energy, further accelerating this substitution trend. The International Energy Agency projects that renewables will account for over 90% of global electricity capacity expansion in the coming years, underscoring the long-term threat to fossil fuel demand.

The threat of substitutes for oil is intensifying, particularly as multiple forecasting agencies project global oil demand to peak between 2025 and 2032. This anticipated decline in demand, driven by factors like electric vehicle adoption and renewable energy growth, signals a potential structural shift away from crude oil. For instance, the International Energy Agency (IEA) has noted that policies aimed at energy efficiency and emissions reduction are already impacting consumption patterns.

This trend suggests that industries heavily reliant on oil, including transportation and petrochemicals, will face increasing pressure to transition to alternative energy sources and materials. The growing availability and improving economics of renewables and electric vehicles present viable substitutes that could erode oil's market share significantly in the coming years.

The increasing competitiveness of renewable energy sources, especially solar and wind, presents a significant substitution threat to natural gas in power generation. Projections indicate that renewables are set to meet all electricity demand growth through 2025, directly impacting the market share of traditional energy sources like natural gas.

Natural Gas as a Substitute for Oil Products

Natural gas is increasingly stepping in as a substitute for oil products across several key industries. This shift is particularly evident in power generation, where gas offers a cleaner burning alternative, and in road transport, with growing adoption of natural gas vehicles.

Government policies and evolving market conditions are further bolstering natural gas's role as a substitute within the broader fossil fuel market. For instance, in 2024, many regions continued to implement or strengthen incentives for cleaner energy sources, directly benefiting natural gas adoption over oil.

The impact on companies like Enerplus is significant, as the availability and price competitiveness of natural gas can directly influence demand for their oil products. This dynamic creates a constant need for strategic evaluation of market positioning and product diversification.

Here's a look at the trend:

- Power Generation Shift: In 2024, natural gas accounted for approximately 40% of the U.S. electricity generation, a figure that has steadily grown as coal plants retire and renewables integrate, often with gas as a reliable backup.

- Transportation Adoption: While still a smaller segment, the number of natural gas-powered heavy-duty trucks on the road saw a notable increase in 2024, driven by lower operating costs and emissions regulations.

- Price Sensitivity: The price spread between crude oil and natural gas is a critical factor. When natural gas prices are significantly lower, the incentive to switch from oil-based fuels intensifies.

- Policy Support: Environmental regulations and carbon pricing mechanisms enacted or considered in 2024 in major economies often favor natural gas over oil, reinforcing its position as a viable substitute.

Government Policies and Investment in Alternative Energies

Government policies play a significant role in shaping the competitive landscape for energy companies like Enerplus. For instance, incentives such as tax credits for renewable energy projects, like those seen in the Inflation Reduction Act of 2022 in the United States, can significantly accelerate the adoption of alternative energy sources. This directly increases the threat of substitutes by making them more economically viable and attractive to consumers and investors.

However, the landscape is dynamic. Political shifts can introduce headwinds for these alternatives. For example, changes in government administrations or policy priorities can lead to the reduction or elimination of subsidies and tax credits, thereby slowing the growth of substitute energy sources. This policy uncertainty can impact long-term investment decisions in both traditional and alternative energy sectors.

The threat of substitutes is amplified by government mandates and targets for renewable energy adoption. Many countries have set ambitious goals for reducing carbon emissions and increasing the share of renewables in their energy mix. For example, the European Union aims for at least 42.5% renewable energy by 2030. Such policies create a direct push towards alternatives, potentially diminishing demand for traditional fossil fuels that Enerplus produces.

- Policy Impact: Government incentives like tax credits for solar and wind power can make substitutes more competitive.

- Regulatory Environment: Evolving environmental regulations and carbon pricing mechanisms can further favor alternative energy sources.

- Investment Trends: In 2023, global investment in clean energy reached an estimated $1.7 trillion, a significant increase that highlights the growing traction of substitutes.

- Political Risk: Changes in government policy can either accelerate or decelerate the adoption of substitute energy technologies.

The threat of substitutes for Enerplus's oil and gas products is substantial and growing, primarily driven by the global energy transition and increasing competitiveness of renewable alternatives. Government policies and technological advancements are accelerating the adoption of cleaner energy sources, directly impacting demand for fossil fuels.

Renewable energy sources like solar and wind are becoming increasingly cost-competitive, presenting a direct substitute for natural gas in power generation. By 2024, renewables were on track to meet all projected electricity demand growth in many regions, eating into natural gas's market share.

| Substitute Type | Key Drivers | Impact on Oil & Gas | 2024 Trend Example |

|---|---|---|---|

| Renewable Electricity (Solar, Wind) | Falling costs, government incentives, climate goals | Reduces demand for natural gas in power generation | Global renewable capacity additions continued strong growth, exceeding 500 GW in 2023, with similar trends in 2024. |

| Electric Vehicles (EVs) | Improving battery technology, government mandates, lower operating costs | Decreases demand for gasoline and diesel in transportation | EV sales continued to climb in 2024, with projections indicating they could represent over 20% of new car sales in major markets. |

| Natural Gas (as substitute for oil) | Price differentials, cleaner burning profile, policy support | Shifts demand away from oil products in some industrial and transportation sectors | Natural gas maintained its position as a key substitute for oil in power generation and heavy-duty transport, supported by favorable price spreads and emissions regulations. |

Entrants Threaten

The oil and gas industry, including companies like Enerplus, presents an extremely high threat of new entrants due to the colossal capital required. Establishing operations from exploration and drilling to refining and distribution necessitates billions of dollars. For instance, a single offshore oil platform can cost upwards of $1 billion, and developing a new oil field can easily run into tens of billions.

The energy sector, particularly for companies like Enerplus, is heavily burdened by extensive regulatory and environmental hurdles. New entrants must contend with a complex, costly, and time-consuming process of obtaining permits and approvals from various government bodies. For instance, in 2024, the average time to secure drilling permits in some key North American basins could extend over several months, adding significant upfront investment and uncertainty.

Established entities like Enerplus, now part of Chord Energy, hold substantial control over proven oil and gas reserves and existing infrastructure. This deep integration makes it exceptionally challenging for newcomers to gain access to competitive assets, thereby posing a significant barrier to entry.

Proprietary Technology and Expertise

The oil and gas industry, including companies like Enerplus, is characterized by significant reliance on proprietary technology and specialized expertise. Developing or acquiring the necessary geological understanding, advanced drilling techniques, and efficient extraction methods requires substantial investment, acting as a considerable barrier for potential new entrants. For instance, the cost of seismic imaging and reservoir modeling alone can run into millions of dollars, a hurdle many smaller entities cannot easily overcome.

This technological moat is further reinforced by the need for highly skilled personnel. Expertise in areas like directional drilling, hydraulic fracturing, and production optimization is not easily replicated. Companies that have invested decades in building these capabilities and cultivating specialized teams possess a distinct advantage. In 2024, the demand for experienced petroleum engineers and geoscientists remained high, with specialized roles commanding significant compensation, underscoring the value of this human capital.

- High Capital Expenditure: Significant upfront investment is required for exploration, drilling, and infrastructure, deterring new players.

- Technological Sophistication: Advanced technologies in seismic analysis, horizontal drilling, and enhanced oil recovery are critical and costly to develop.

- Specialized Human Capital: Access to experienced geologists, reservoir engineers, and drilling specialists is essential and often scarce.

- Intellectual Property: Patents and proprietary knowledge related to extraction and processing methods create a competitive edge.

High Fixed Operating Costs and Scale Advantages

New entrants in the energy sector, particularly those looking to compete with established players like Enerplus, face a significant hurdle in the form of high fixed operating costs. These costs, associated with exploration, drilling, infrastructure development, and regulatory compliance, require substantial upfront capital investment. For instance, the average cost of drilling a new oil well can range from several million dollars to tens of millions, depending on the depth and complexity.

Achieving economies of scale is another critical challenge for potential new entrants. Larger, established companies benefit from spreading their fixed costs over a greater production volume, leading to lower per-unit production costs. This scale advantage allows incumbents to operate more efficiently and competitively on pricing. In 2024, major oil and gas producers often reported production volumes in the hundreds of thousands of barrels of oil equivalent per day, a scale that is difficult for newcomers to match quickly.

These factors combine to create a formidable barrier to entry. A new company would need to secure significant financing to cover initial high costs and then rapidly scale operations to achieve cost competitiveness against established, efficient producers.

- High Upfront Capital: Significant investment is needed for exploration, drilling, and infrastructure.

- Economies of Scale: Incumbents benefit from lower per-unit costs due to larger production volumes.

- Cost Competitiveness: New entrants struggle to match the cost efficiency of established players.

The threat of new entrants for companies like Enerplus (now part of Chord Energy) remains low due to immense capital requirements. New players need billions for exploration, drilling, and infrastructure, with offshore platforms alone costing over $1 billion. Regulatory hurdles are also substantial, with permit acquisition in 2024 potentially taking months and incurring significant costs.

Established players control vital reserves and infrastructure, making asset access difficult for newcomers. Furthermore, proprietary technology and specialized expertise, like advanced seismic imaging costing millions, create significant barriers. The need for experienced petroleum engineers, whose roles commanded high compensation in 2024, further solidifies this advantage.

| Barrier Type | Description | Example/Data Point (2024) |

|---|---|---|

| Capital Requirements | Extremely high upfront investment for exploration and infrastructure. | New offshore platform cost: >$1 billion. |

| Regulatory Hurdles | Complex and time-consuming permit and approval processes. | Drilling permit acquisition: Several months in key basins. |

| Access to Resources | Control of proven reserves and existing infrastructure by incumbents. | Established players hold significant reserve portfolios. |

| Technological Expertise | Need for advanced, costly technologies and specialized skills. | Seismic imaging and reservoir modeling: Millions of dollars. |

Porter's Five Forces Analysis Data Sources

Our Enerplus Porter's Five Forces analysis is built upon a foundation of robust data, including Enerplus's annual reports, SEC filings, and investor presentations. We supplement this with industry-specific market research reports and publications from reputable energy sector analysts.