Enerplus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerplus Bundle

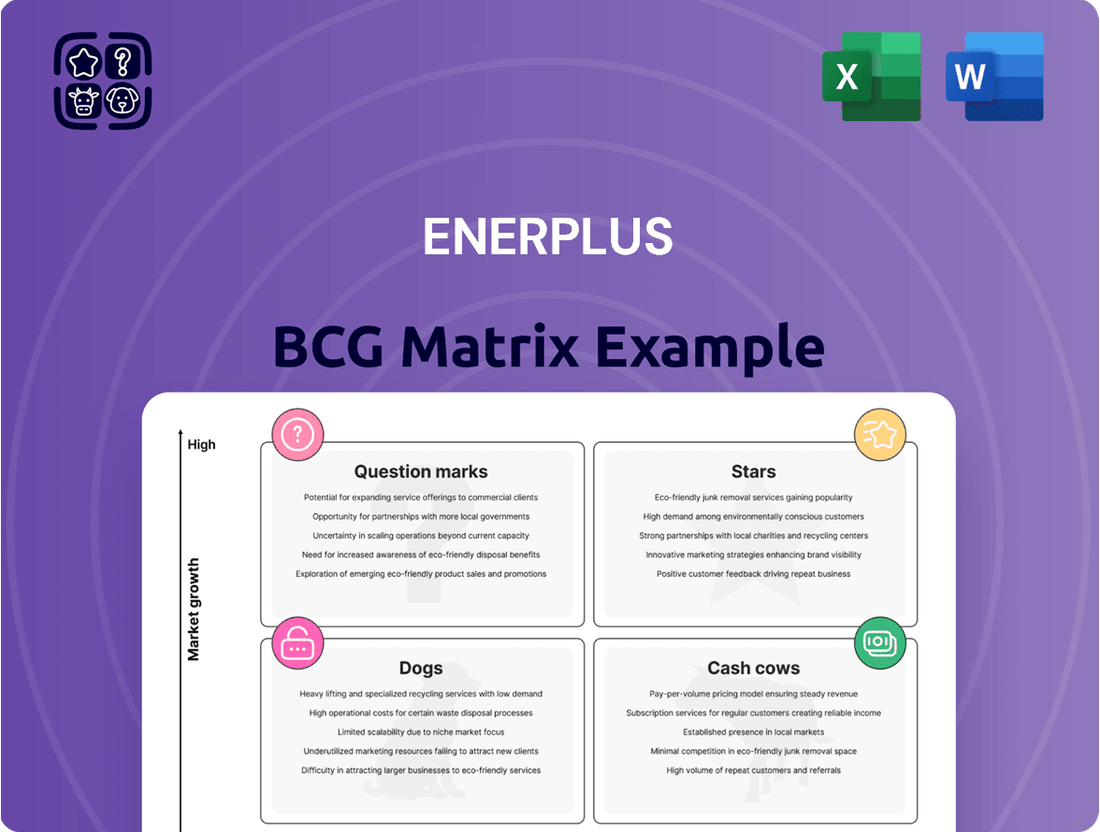

Discover the strategic positioning of Enerplus's portfolio with our insightful BCG Matrix preview. See how their products stack up as Stars, Cash Cows, Dogs, or Question Marks in the current market landscape.

To truly harness this information and drive impactful decisions, unlock the full BCG Matrix report. It provides a comprehensive breakdown, data-backed recommendations, and a clear roadmap for optimizing your investments and product strategies.

Don't miss out on the complete picture; purchase the full Enerplus BCG Matrix today for unparalleled strategic clarity and actionable insights.

Stars

Enerplus's Williston Basin liquids production, primarily from the Bakken formation, has been a cornerstone of its growth strategy. These assets showcase robust operational performance, contributing a substantial portion to the company's overall output.

The high productivity of wells in this region positions them as a key strategic asset for the combined entity. In 2024, Enerplus reported strong production figures from the Williston Basin, with liquids averaging approximately 110,000 barrels of oil equivalent per day (boepd), highlighting their importance.

Anticipated sequential growth in liquids production from these core areas further solidifies their standing as a high-growth market segment. This continued expansion is expected to drive value and support the company's future development plans.

Enerplus's strategic Williston Basin inventory was a cornerstone of its market strength, featuring a deep, low-cost drilling pipeline that secured a significant market share in its operational areas.

This robust inventory served as a predictable engine for future growth and profitability, making it an attractive asset for strategic alliances, such as the one with Chord Energy.

Following the merger, the combined entity now commands a leading position in the Williston Basin, leveraging this extensive resource base.

The merger with Chord Energy is projected to unlock substantial capital efficiency gains for Enerplus, bolstering shareholder returns. This strategic combination positions their integrated Williston Basin assets for rapid expansion and market dominance, solidifying their 'Star' classification.

Strong Production Performance

Enerplus demonstrated exceptional production capabilities, consistently achieving or surpassing its output forecasts, especially in its liquids segment. This consistent delivery, particularly in a high-growth market, strongly aligns with the characteristics of a 'Star' in the BCG Matrix.

The company's 2024 projections reinforced this trend, anticipating sustained robust performance in its liquids production. This forward-looking data suggests continued market strength and operational efficiency.

- Consistent Liquids Production: Enerplus exceeded production guidance for liquids in periods leading up to its merger.

- Market Strength: This performance in a growing market segment is a key indicator of a 'Star' business unit.

- 2024 Outlook: The company's 2024 outlook indicated continued strong liquids production, reinforcing its 'Star' status.

Market Leadership in Key Basins

Enerplus has cultivated market leadership in key basins through a steadfast commitment to disciplined capital allocation, prioritizing assets with superior return potential. Its primary focus on the Williston Basin has cemented its position as a leading operator in this high-growth North American oil and gas region.

The recent merger with Chord Energy significantly amplifies this leadership. This strategic combination creates a more substantial and dominant entity within the Williston Basin, enhancing its operational scale and market influence.

- Williston Basin Dominance: Enerplus's strategic focus on the Williston Basin, a prolific oil and gas producing area, has established it as a key player.

- Merger Impact: The merger with Chord Energy, completed in May 2024, created a larger, more integrated operator, enhancing its competitive standing in the region.

- Production Scale: Post-merger, the combined entity is projected to achieve significant production levels, further solidifying its market leadership. For instance, in the first quarter of 2024, prior to the full integration, Enerplus reported average production of approximately 121,000 barrels of oil equivalent per day (boepd).

Enerplus's Williston Basin operations, particularly its liquids production, firmly place it in the 'Star' category of the BCG Matrix. This classification is driven by its high market share in a high-growth market, characterized by consistent production growth and strong operational performance.

The company's strategic focus on the Williston Basin, a region known for its prolific oil and gas resources, has allowed it to build significant market leadership. This is further amplified by the merger with Chord Energy, which, completed in May 2024, created a more substantial and dominant entity in the area, enhancing its competitive standing and operational scale.

Enerplus's 2024 performance, with liquids production averaging around 110,000 boepd from the Williston Basin, underscores its robust capabilities. The projected sequential growth in these core areas, coupled with a deep, low-cost drilling inventory, solidifies its position as a predictable engine for future profitability and value creation.

| Metric | Value (2024) | Significance for 'Star' Classification |

|---|---|---|

| Williston Basin Liquids Production | ~110,000 boepd | Indicates high output in a key growth area. |

| Market Position | Leading operator in Williston Basin | High market share in a high-growth market. |

| Growth Outlook | Anticipated sequential production growth | Confirms its position in a growing market. |

| Operational Performance | Exceeded production guidance | Demonstrates efficiency and market responsiveness. |

What is included in the product

Strategic allocation of resources for Enerplus's oil and gas assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear visual representation of Enerplus's portfolio, simplifying strategic decision-making by highlighting growth opportunities and resource allocation needs.

Cash Cows

Enerplus demonstrated robust free cash flow generation, a key indicator for its Cash Cows. In 2023, the company's free cash flow significantly outpaced its capital expenditures, a trend that continued into the first quarter of 2024. This consistent surplus cash highlights the stability and profitability of its mature assets.

This strong performance, even when facing market volatility, underscores the efficiency of Enerplus's established production assets. The ability to generate more cash than is needed for operations and investments allows the company to comfortably fund its activities and provide returns to its investors.

Enerplus's business model centered on disciplined capital investment, focusing on generating long-term value and consistent free cash flow from its established assets. This strategy aligns with a 'Cash Cow' profile by reducing reliance on extensive new investments, a hallmark of businesses with high market share and low growth potential.

This focus on optimizing existing operations and returning capital to shareholders, rather than aggressive expansion, is a key characteristic of a mature, cash-generating business. For instance, in 2024, Enerplus reported strong free cash flow generation, allowing for significant shareholder returns through dividends and buybacks, underscoring its cash cow status.

Enerplus's shareholder returns program highlights its strong financial performance, demonstrating a mature and profitable asset base. This commitment to returning capital is evident in its consistent distribution of profits through dividends and share repurchases.

In early 2024, Enerplus announced an 8% increase to its quarterly dividend, underscoring its ability to generate surplus cash flow. This consistent capital return strategy signals confidence in the company's ongoing operational success and its capacity to reward investors.

Established Bakken Production

Enerplus's established Bakken production represents a classic Cash Cow in the BCG matrix. This mature asset base offers stable, predictable cash flow without the need for substantial new capital investment. The wells are largely de-risked and have already recouped their initial drilling and completion costs, making them highly efficient profit generators.

- Stable Production: The Bakken assets consistently deliver a reliable output, contributing significantly to Enerplus's overall revenue.

- Low Reinvestment Needs: Mature wells require less capital for maintenance and optimization compared to exploration or development projects.

- Strong Cash Flow Generation: These assets are prime contributors to free cash flow, supporting dividends, debt reduction, or other strategic initiatives.

Operational Efficiency and Cost Management

Enerplus's operational efficiency and cost management are key drivers of its Cash Cow status. The company has consistently focused on optimizing production costs in its established oil and gas assets. This allows for robust profit margins, even when commodity prices fluctuate.

In 2024, Enerplus reported strong free cash flow generation, a direct result of its disciplined approach to cost control. For instance, their focus on efficient extraction techniques and managing operational expenditures has kept their lifting costs competitive. This efficiency translates directly into sustained profitability from their mature assets, reinforcing their Cash Cow position.

- Effective Cost Management: Enerplus's commitment to controlling production expenses in its core areas is a significant factor in its high profit margins.

- Sustained Profitability: This operational efficiency ensures consistent cash generation from its established assets, even in a mature market.

- Competitive Lifting Costs: In 2024, Enerplus maintained competitive lifting costs, a testament to their ongoing efforts in operational optimization.

- Cash Generation: The company's ability to generate substantial free cash flow underscores the strength of its Cash Cow business segments.

Enerplus's core Bakken assets are firmly established as Cash Cows within the BCG framework. These mature, low-decline assets consistently generate substantial free cash flow, requiring minimal new investment to maintain production levels. This stability allows Enerplus to fund other strategic initiatives and return capital to shareholders.

The company's financial performance in 2023 and early 2024 exemplifies this Cash Cow status. Enerplus reported strong free cash flow generation, with 2023 free cash flow significantly exceeding capital expenditures. This trend continued into Q1 2024, demonstrating the reliable cash-generating capability of its established operations.

Enerplus's disciplined capital allocation strategy, prioritizing shareholder returns through dividends and buybacks, further solidifies its Cash Cow position. For example, an 8% increase in their quarterly dividend in early 2024 reflects confidence in sustained cash flow from these mature assets.

The efficiency of these assets is evident in their competitive lifting costs, a key factor in maintaining profitability. This operational excellence ensures that the Bakken assets remain a consistent and significant contributor to Enerplus's overall financial strength.

| Metric | 2023 (Approx.) | Q1 2024 (Approx.) | Significance for Cash Cow |

|---|---|---|---|

| Free Cash Flow | Exceeded CapEx | Strong Generation | Indicates surplus cash after operations and investment |

| Capital Expenditures | Lower than FCF | Managed | Low reinvestment needs for mature assets |

| Dividend Growth | Consistent | 8% increase (early 2024) | Direct return of excess cash to shareholders |

| Lifting Costs | Competitive | Maintained | Ensures profitability and strong margins |

Full Transparency, Always

Enerplus BCG Matrix

The Enerplus BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present; you’ll get the complete, analysis-ready report for immediate strategic application. The preview accurately represents the final deliverable, ensuring transparency and providing you with a professional tool for evaluating Enerplus's business portfolio. You can trust that the purchased file will be exactly as shown, ready for integration into your business planning and decision-making processes.

Dogs

Enerplus's legacy non-operated natural gas assets in the Marcellus Basin are classified as Dogs in the BCG Matrix. These assets faced production curtailments in Q1 2024, largely due to persistent low natural gas prices and a deliberate reduction in capital investment.

The diminished strategic focus and limited growth prospects for these Marcellus assets, with natural gas prices hovering around $2.00 per MMBtu for much of early 2024, firmly place them in the Dog category. This classification suggests they are unlikely to generate significant future returns or contribute meaningfully to Enerplus's overall growth strategy.

The non-strategic portfolio segment, represented by Enerplus's non-operated Marcellus gas assets, aligns with the characteristics of a 'Dog' in the BCG matrix. Chord Energy's decision to market these assets signals they are not viewed as a core part of the combined entity's future, indicating a low market share and limited growth prospects.

Enerplus's Marcellus assets demonstrate a significant vulnerability to commodity price swings, particularly for natural gas. Production levels experienced curtailments directly tied to price fluctuations, underscoring the assets' sensitivity and potential for unprofitability when natural gas prices are low. For instance, in 2023, the average realized price for natural gas for Enerplus was $2.30 per Mcf, a figure that can easily dip below production costs in a volatile market.

This inherent dependency on volatile market conditions, coupled with limited apparent growth potential, positions the Marcellus assets as a less desirable component within the Enerplus portfolio, aligning with the characteristics of a 'Dog' in the BCG matrix. The company's focus often shifts to higher-margin oil assets, further diminishing the strategic appeal of these gas-heavy operations when prices are unfavorable.

Limited Capital Investment

Enerplus's Marcellus operations represent a "Dogs" category within the BCG Matrix, characterized by limited capital investment. This strategic reduction in spending, particularly evident in 2024, signals a deliberate shift away from this asset class. The company's focus has pivoted towards higher-return liquids-focused plays, leaving the Marcellus with minimal development prioritization.

This lack of investment directly translates to a low-growth outlook for Enerplus's natural gas segment in the Marcellus. For instance, capital expenditures allocated to the Marcellus have seen a significant decrease year-over-year, reflecting this strategic re-evaluation. This approach is typical for "Dogs" in the BCG framework, where resources are minimized to preserve cash flow rather than drive expansion.

- Reduced Capital Allocation: Enerplus has significantly scaled back its capital investment in the Marcellus shale play.

- Strategic De-emphasis: The company is prioritizing investments in liquids-rich areas, signaling a lower strategic importance for its natural gas assets.

- Low Growth Outlook: The limited capital deployment indicates a subdued growth forecast for this segment of Enerplus's operations.

- Cash Preservation Focus: The strategy aligns with managing mature or underperforming assets to generate stable cash flow without substantial reinvestment.

Potential for Divestiture

The active marketing of Enerplus's non-operated Marcellus assets by the newly combined entity, Chord Energy, strongly indicates a divestiture strategy. This move allows Chord Energy to streamline its portfolio and focus resources on higher-growth opportunities.

This divestiture aligns with a typical strategy for companies looking to optimize their asset base. By shedding non-core or less productive assets, companies can unlock capital for reinvestment in areas with greater potential.

- Divestiture Strategy: Chord Energy's sale of non-operated Marcellus assets signals a move to exit this specific basin.

- Capital Allocation: Proceeds from the sale are likely to be redeployed into core operational areas or growth initiatives.

- Portfolio Optimization: This action demonstrates a commitment to enhancing overall portfolio efficiency and returns.

Enerplus's non-operated Marcellus natural gas assets are firmly categorized as Dogs within the BCG Matrix due to their low market share and limited growth prospects. These assets experienced production curtailments in early 2024, a direct consequence of persistently low natural gas prices, which averaged around $2.00 per MMBtu during that period.

The strategic decision by Chord Energy, following its combination with Enerplus, to market these Marcellus assets underscores their non-core status. This move signals a deliberate effort to streamline the portfolio and reallocate capital towards more promising, liquids-focused ventures. The company's reduced capital investment in this segment, evident in 2024, further solidifies its classification as a Dog, highlighting a focus on cash preservation rather than expansion.

Enerplus's Marcellus operations, characterized by a significant reduction in capital allocation and a low growth outlook, represent a classic "Dog" in the BCG Matrix. For instance, capital expenditures for these assets saw a notable year-over-year decrease, reflecting a strategic pivot away from this segment. This approach is typical for underperforming assets where the goal is to generate stable cash flow without substantial reinvestment.

The divestiture strategy for these non-operated Marcellus assets by Chord Energy aims to optimize the company's portfolio and redeploy capital into higher-growth areas. This action is consistent with managing mature or less productive assets to enhance overall portfolio efficiency and returns.

| Asset Segment | BCG Category | Key Characteristics | 2024 Outlook | Strategic Implication |

| Enerplus Marcellus (Non-Operated Gas) | Dog | Low market share, low growth, price sensitive | Production curtailments, reduced capex | Divestiture, portfolio optimization |

| Natural Gas Price (Early 2024 Avg) | N/A | Approx. $2.00/MMBtu | N/A | Impacts profitability of Dog assets |

| Enerplus Avg Realized Gas Price (2023) | N/A | $2.30/Mcf | N/A | Highlights vulnerability to price dips |

Question Marks

Early-stage exploration initiatives represent Enerplus's ventures into new or underexplored acreage. These areas, such as potential shale plays in regions like the Montney or Duvernay formations, are not yet proven for commercial viability. They currently hold a low market share within the company's overall production profile.

These initiatives require significant capital investment to assess their true potential, often involving extensive seismic surveys and initial drilling programs. For instance, in 2024, Enerplus continued its focus on delineating new acreage, with capital allocation for exploration and evaluation activities being a key component of its overall spending plan.

Emerging Environmental Technologies are Enerplus's Question Marks. These are investments in cutting-edge tech to meet aggressive climate goals, like slashing greenhouse gas and methane emissions even further than current improvements allow. For instance, Enerplus is exploring carbon capture technologies and advanced methane leak detection systems, areas where significant research and development are ongoing.

Enerplus's commitment to increasing the inclusion rate of produced water in North Dakota well completions represents a strategic move towards more sustainable operations. This initiative, while environmentally responsible, doesn't offer immediate, quantifiable market share gains or direct financial returns, aligning it with the characteristics of a Question Mark in the BCG matrix.

In 2024, North Dakota's oil production saw an average of approximately 1.1 million barrels per day. The successful implementation of advanced water management systems, like increased produced water recycling, could reduce reliance on freshwater sources and lower disposal costs, indirectly impacting profitability.

Undeveloped Resource Plays

Undeveloped resource plays represent Enerplus's potential future growth engines, akin to question marks in the BCG matrix. These are opportunities where the company has secured acreage or rights but has not yet commenced significant production. Transitioning these plays from their nascent stage to becoming Stars requires substantial capital investment and successful operational execution to capture market share and achieve high growth.

For instance, if Enerplus held undeveloped acreage in a promising shale play in 2024, it would fall into this category. The company would need to invest heavily in exploration, drilling, and infrastructure to unlock the resource's potential. Success here means moving from a low market share and potentially low growth to a high market share and high growth scenario.

- Undeveloped Acreage: Enerplus's strategic landholdings in areas like the Bakken or Marcellus that are not yet in active production represent these question mark assets.

- Capital Intensity: Bringing these plays online typically demands significant upfront capital expenditure for drilling, completions, and midstream development.

- Risk and Reward: The success of these undeveloped plays is contingent on geological success, efficient operations, and favorable commodity prices, offering high potential returns if successful.

- Transition to Stars: A successful development program could transform these question marks into Stars, driving substantial production growth and cash flow for Enerplus.

Diversification into Non-Core Energy Ventures

Diversifying into non-core energy ventures, such as renewable energy exploration or investments in energy transition technologies, would position these activities as Question Marks for Enerplus within a BCG Matrix framework. These emerging sectors represent high-growth potential markets, but Enerplus would likely enter with a minimal existing market share.

Significant capital investment would be necessary to establish a competitive presence and capture market share in these new energy domains. For instance, if Enerplus were to invest in a pilot project for carbon capture utilization and storage (CCUS) in 2024, it would fall into this category, requiring substantial upfront funding with uncertain immediate returns.

- High Growth Potential: Markets like hydrogen production or advanced battery storage are experiencing rapid expansion globally.

- Low Market Share: Enerplus's current involvement in these areas would be nascent, meaning a small footprint compared to established players.

- Capital Intensive: Developing new energy technologies often demands considerable investment in research, development, and infrastructure.

- Strategic Uncertainty: The long-term viability and competitive landscape of these non-core ventures carry inherent risks, necessitating careful evaluation and management.

Enerplus's Question Marks are its investments in areas with high growth potential but low current market share, requiring significant capital and offering uncertain returns. These include early-stage exploration plays, emerging environmental technologies, and undeveloped resource opportunities. The company's success hinges on effectively developing these assets to transition them into future Stars.

In 2024, Enerplus continued to evaluate its undeveloped acreage, particularly in promising shale formations, which represent key Question Marks. These ventures demand substantial capital for exploration and delineation, with the aim of establishing significant production and market share. The company's strategic focus on sustainable operations, such as increasing produced water inclusion in North Dakota, also aligns with this category, offering environmental benefits but not immediate financial gains.

The transition of these Question Marks into Stars is a core objective, requiring strategic investment and operational excellence. For example, if Enerplus were to successfully develop a new, high-potential play in 2024, it would move from a low market share to a high market share position, driving future growth.

| Category | Description | Capital Needs | Market Share | Growth Potential |

|---|---|---|---|---|

| Undeveloped Acreage | Secured land rights not yet in production | High | Low | High |

| Environmental Tech | Investments in emission reduction tech | High | Low | High |

| Emerging Ventures | Diversification into new energy sectors | High | Low | High |

BCG Matrix Data Sources

Our Enerplus BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.