Endo International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endo International Bundle

Navigate the complex external forces shaping Endo International's future with our comprehensive PESTLE analysis. From evolving political landscapes and economic uncertainties to technological advancements, social shifts, and environmental regulations, this report provides critical insights. Understanding these dynamics is crucial for strategic planning and risk mitigation. Download the full PESTLE analysis now to gain a competitive edge and make informed decisions.

Political factors

Governmental healthcare policies profoundly shape the pharmaceutical landscape, directly impacting companies like Endo International. For instance, the Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices for certain high-cost medications, began its implementation in 2024, with initial negotiation rounds announced in late 2023 for drugs to be priced in 2026. This legislation introduces significant pricing pressure, potentially reducing revenue for drugs selected for negotiation. Furthermore, shifts in reimbursement policies by payers, including Medicare and private insurers, can alter market access and profitability for both branded and generic pharmaceuticals. In 2024, continued emphasis on value-based care models and outcomes-based pricing may further influence how pharmaceutical products are evaluated and reimbursed.

Endo International's financial trajectory has been significantly impacted by the opioid crisis, culminating in a Chapter 11 restructuring in August 2022. This restructuring was largely driven by the need to address substantial liabilities stemming from opioid litigation, including an estimated $450 million in opioid settlement payments as part of its reorganization plan.

The ongoing oversight of these settlement funds by various states and governmental bodies, along with potential future regulatory actions concerning opioid manufacturers, creates a persistent cloud of uncertainty. Companies like Endo must navigate strict reporting requirements and adhere to evolving standards aimed at curbing the opioid epidemic, influencing operational costs and strategic planning for pain management portfolios.

International trade relations and tariffs are crucial for Endo International, a company with a global footprint. Fluctuations in trade agreements and the imposition of tariffs can directly impact the cost of raw materials, manufacturing expenses, and the final price of pharmaceutical products. For instance, a shift in trade policy between the United States and countries where Endo sources active pharmaceutical ingredients (APIs) could lead to increased import duties, raising overall operational costs.

Changes in tariffs can also affect market accessibility. If Endo faces higher tariffs on its finished products in key international markets, it could reduce sales volume and profitability. In 2024, ongoing trade tensions, particularly between major economic blocs, continue to create uncertainty, requiring companies like Endo to build resilience into their supply chains and adapt market entry strategies to mitigate these risks.

Regulatory Agency Influence and Approval Processes

Endo International's reliance on regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) means that political shifts can significantly impact its product pipeline and market access. These agencies oversee the rigorous approval processes for new drugs, and their operational pace is often influenced by governmental priorities.

Changes in political administrations can lead to altered regulatory philosophies, potentially affecting how quickly or stringently new pharmaceutical products are evaluated. For instance, a government focused on accelerating access to innovative treatments might fast-track certain drug approvals, while another might increase scrutiny on drug safety and efficacy, leading to longer review periods. This directly influences Endo's revenue generation and strategic planning, as demonstrated by the lengthy and complex approval pathways for many specialty pharmaceuticals.

In 2023, the FDA continued to grapple with backlog issues, though efforts were made to streamline certain review processes. For example, the Prescription Drug User Fee Act (PDUFA) reauthorizations in 2022 aimed to improve FDA efficiency, but the impact on specific company timelines, like Endo's, can vary. The EMA, similarly, faces evolving political landscapes within the European Union that can shape its regulatory agenda.

- FDA approval timelines: While the FDA aims for efficiency, the median review time for New Molecular Entities (NMEs) can still extend beyond 10 months, impacting market entry for new Endo products.

- EMA regulatory focus: The EMA's priorities, such as those related to manufacturing quality and post-market surveillance, can introduce additional compliance hurdles for companies like Endo.

- Political influence on drug pricing: Government policies on drug pricing and reimbursement, often driven by political considerations, directly affect Endo's profitability and market competitiveness.

Government Support for R&D and Innovation

Government support for research and development is a significant driver for companies like Endo International. In 2024, the U.S. government continued to allocate substantial funds towards biomedical research, with agencies like the National Institutes of Health (NIH) playing a crucial role. For instance, the NIH budget for fiscal year 2024 was proposed at over $48 billion, much of which supports early-stage research that can lead to breakthroughs in various therapeutic areas.

Tax incentives also play a vital role in encouraging innovation. The U.S. government offers tax credits for qualified research and development expenses, which can lower a company's tax burden and free up capital for further investment in new drug discovery and development. This financial support is critical for the long-term viability of product pipelines, especially in complex fields like specialty pharmaceuticals.

- Government Funding: Continued federal investment in areas like neuroscience and oncology through NIH grants provides a foundation for pharmaceutical innovation.

- Tax Incentives: R&D tax credits available to companies like Endo International reduce the cost of innovation, making it more feasible to pursue novel treatments.

- Strategic Investments: Political focus on advanced therapies, such as mRNA technology and gene editing, can create a more supportive regulatory and financial environment for companies operating in these spaces.

- Favorable Conditions: Government policies aimed at accelerating drug approval processes for unmet medical needs can also positively impact a company's ability to bring new products to market efficiently.

Political factors significantly influence Endo International's operating environment, particularly through healthcare policy and regulatory frameworks. The Inflation Reduction Act of 2022, impacting drug pricing negotiations for Medicare starting in 2024, directly affects revenue streams for affected medications.

Furthermore, ongoing opioid litigation and settlements, including Endo's Chapter 11 restructuring in August 2022 and estimated $450 million in opioid settlement payments, highlight the profound political and legal ramifications of the opioid crisis, demanding continuous compliance and strategic adaptation.

Government oversight of these settlements and potential future regulations on opioid manufacturers add persistent uncertainty and operational costs for Endo, impacting its pain management portfolio strategies.

Changes in international trade relations and tariffs also pose risks, affecting raw material costs, manufacturing expenses, and market access for Endo's global operations, with ongoing trade tensions in 2024 requiring supply chain resilience.

| Political Factor | Impact on Endo International | Data/Context (2023-2024) |

| Healthcare Policy (e.g., Inflation Reduction Act) | Potential reduction in drug pricing and revenue for negotiated drugs. | Medicare drug price negotiations began in 2023 for drugs to be priced in 2026, impacting a segment of the market. |

| Opioid Litigation & Settlements | Significant financial liabilities and ongoing compliance burdens. | Endo's Chapter 11 filing in August 2022 was linked to substantial opioid liabilities, including ~$450 million in settlement payments. |

| Regulatory Approval Processes (FDA, EMA) | Influences market entry timelines and product pipeline success. | FDA median review time for New Molecular Entities (NMEs) can exceed 10 months; EMA focuses on manufacturing quality and post-market surveillance. |

| Government R&D Support & Tax Incentives | Supports innovation and reduces R&D costs. | U.S. NIH budget proposed over $48 billion for FY2024; R&D tax credits lower innovation costs for companies. |

What is included in the product

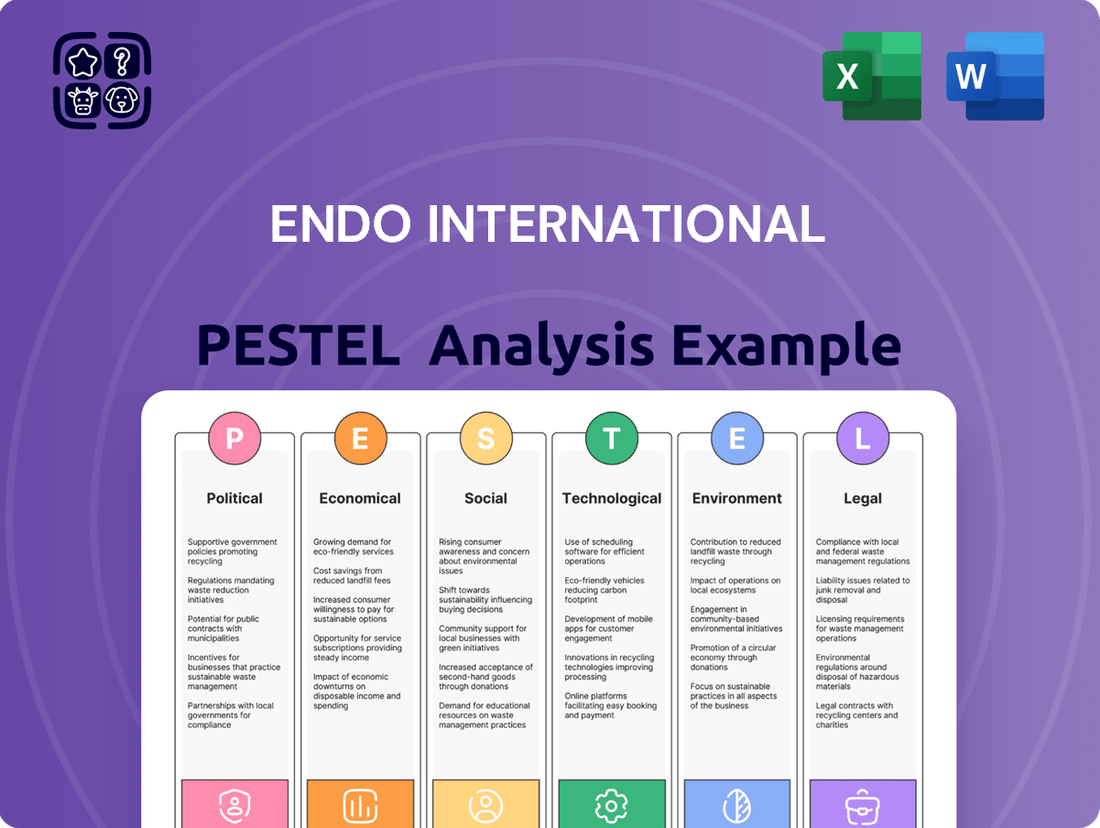

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Endo International, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for the pharmaceutical and healthcare sectors.

A PESTLE analysis for Endo International offers a structured approach to identifying and mitigating external challenges, acting as a crucial pain point reliever by proactively addressing market shifts and regulatory changes.

Economic factors

The global economic landscape, marked by persistent inflation and fluctuating interest rates as seen in 2024, directly impacts healthcare expenditures. For instance, the US inflation rate hovered around 3.4% in early 2024, influencing consumer purchasing power and the cost of healthcare services.

Economic slowdowns, a recurring concern in various regions through 2024, often translate to reduced spending on non-essential medical treatments. This puts pressure on pharmaceutical companies like Endo International to manage costs and demonstrate value, affecting demand for both innovative and generic medications.

Governments and private insurers, facing budget constraints during economic contractions, tend to implement stricter cost-control measures on pharmaceuticals. This can involve increased scrutiny of drug pricing and a greater emphasis on cost-effective alternatives, a trend anticipated to continue through 2025.

The purchasing power of consumers, directly tied to economic stability and employment rates, plays a crucial role in the demand for pharmaceuticals. In 2024, for example, regions experiencing higher unemployment saw a noticeable dip in out-of-pocket spending on healthcare, including prescription drugs.

The pharmaceutical market's generic and branded generic segments are seeing robust expansion. This growth is fueled by major drug patent expirations, creating openings for lower-cost alternatives. For instance, the U.S. market for generics reached an estimated $130 billion in 2023, highlighting the significant value shift towards these products.

This dynamic presents a dual challenge and opportunity for companies like Endo International. While patent expiries offer avenues for generic product development and sales, they simultaneously intensify competition for existing branded medications. Endo's strategic positioning, which includes a portfolio of both branded and generic offerings, requires careful management to capitalize on these market shifts.

The increasing global demand for cost-effective healthcare solutions further propels the generic market. As healthcare systems worldwide face budget constraints, the appeal of affordable generics becomes even stronger. This trend is projected to continue, with the global generics market expected to reach over $300 billion by 2028, according to some industry forecasts.

Healthcare systems globally are grappling with significant budget limitations, directly impacting pharmaceutical companies. This translates into intense pressure on drug pricing and reimbursement negotiations with entities like national health services, private insurers, and pharmacy benefit managers. For instance, in 2024, many European countries continued to implement stricter cost-effectiveness analyses for new drug approvals, potentially delaying or limiting market access for products like those from Endo International.

The ability of pharmaceutical firms to secure advantageous reimbursement terms is absolutely paramount for the commercial viability of their products. Endo International, like its peers, must navigate these complex pricing landscapes. In 2023, for example, the US Medicare Prescription Drug Price Negotiation Program began its first round of negotiations, targeting a select group of high-cost drugs, a trend that could expand to more products in the coming years, influencing future revenue streams.

Research and Development Investment Returns

The pharmaceutical sector, including companies like Endo International, faces substantial economic pressures due to the high cost and extended timelines inherent in research and development. For example, the average cost to develop a new drug can exceed $2 billion, with development typically taking 10-15 years. This makes the return on investment (ROI) a paramount consideration for sustained profitability.

Companies must carefully manage these significant upfront investments against the inherent uncertainty of successful drug discovery and subsequent market approval and uptake. Strategic R&D portfolio management and streamlined development processes are crucial for navigating these challenges and ensuring long-term financial health.

- High R&D Expenditure: The pharmaceutical industry regularly sees R&D spending as a major operational cost. For instance, in 2023, major pharmaceutical companies continued to allocate significant portions of their revenue to R&D, often between 15-25%.

- Long Development Cycles: The path from initial research to a marketable drug can span over a decade, increasing financial risk.

- ROI Uncertainty: A substantial percentage of R&D projects fail to reach the market, meaning the ROI on many initiatives is zero.

- Market Acceptance Risk: Even successful drug development doesn't guarantee commercial success; factors like pricing, competition, and regulatory hurdles heavily influence market acceptance and thus, returns.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Endo International, given its global footprint in the pharmaceutical sector. For instance, if the U.S. dollar strengthens considerably against other major currencies where Endo operates and sells its products, its reported revenues in dollars from those foreign markets would decrease. Conversely, a weaker dollar could make imported raw materials or components, often sourced internationally, more expensive, thereby increasing Endo's cost of goods sold.

Managing these currency risks is not just a matter of financial prudence but is critical for maintaining profitability and operational stability. In 2024, the pharmaceutical industry, like many others, continued to monitor the volatility of key currency pairs such as the USD/EUR and USD/JPY. For example, a 10% adverse movement in exchange rates could have a material impact on a company's net income, depending on the proportion of its revenues and costs denominated in foreign currencies.

Endo's strategy to mitigate these impacts likely includes hedging mechanisms, such as forward contracts or options, to lock in exchange rates for future transactions. The effectiveness of these strategies directly influences the predictability of its financial performance.

- Revenue Impact: A stronger USD in 2024 would have reduced the dollar value of sales made in markets like Europe or Japan.

- Cost of Goods Sold: Conversely, a weaker USD would have increased the cost of imported active pharmaceutical ingredients (APIs) or manufacturing equipment.

- Profitability: Net profit margins can be squeezed or boosted by currency movements depending on the company's exposure.

- Hedging Strategies: Implementing financial instruments to offset potential losses from adverse currency fluctuations is a key risk management tool.

Persistent inflation and interest rate hikes throughout 2024 directly affected healthcare spending, impacting demand for pharmaceuticals. Economic slowdowns in various regions in 2024 also led to reduced spending on non-essential medical treatments, pressuring companies like Endo to manage costs. Governments and insurers, facing budget constraints, implemented stricter cost controls on drugs, a trend expected to continue into 2025.

What You See Is What You Get

Endo International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Endo International delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy. Understand the critical external influences shaping Endo's future landscape.

Sociological factors

Public perception of pharmaceutical companies significantly influences their operations, with high drug prices and past litigation, notably the opioid crisis, eroding trust. A 2024 Gallup poll indicated that only 30% of Americans have a positive view of the pharmaceutical industry, a figure that has remained stagnant for several years.

This diminished public trust can translate into reduced patient adherence to prescribed medications and a weaker brand loyalty, directly impacting sales. For companies like Endo International, which faced significant legal challenges related to opioid sales, rebuilding this trust is paramount for future market access and patient engagement.

Negative sentiment often triggers heightened regulatory scrutiny and can hinder the adoption of new products, creating substantial headwinds for market penetration and revenue growth. Companies are increasingly investing in corporate social responsibility initiatives and transparent communication to counteract these perceptions.

In 2024, pharmaceutical companies collectively spent an estimated $5.7 billion on lobbying and public relations efforts aimed at shaping public opinion and influencing policy, highlighting the critical importance of managing public perception in the current climate.

The world's population is getting older, with the United Nations projecting that by 2050, one in six people globally will be 65 years or older. This demographic trend, coupled with a significant rise in chronic diseases like diabetes and heart disease, directly fuels demand for pharmaceutical solutions. For companies like Endo International, this means a steady and growing market for treatments addressing age-related ailments and long-term health management.

This increasing prevalence of chronic conditions, which often require ongoing medication, presents a substantial opportunity. For instance, the global market for diabetes drugs alone was valued at over $90 billion in 2023 and is expected to grow. Endo International must strategically align its product development and marketing efforts to capitalize on these expanding segments, ensuring its offerings meet the complex needs of an aging and chronically ill patient population.

Consumers are increasingly health-conscious, actively seeking information about their well-being and treatment options. This trend, amplified by readily available online medical resources, empowers patients to become more assertive in their healthcare journeys. For instance, by mid-2024, surveys indicated that over 70% of adults regularly research health conditions and treatments online before consulting a doctor.

This heightened patient engagement translates into a demand for greater transparency from pharmaceutical companies regarding medication efficacy, potential side effects, and cost-effectiveness. Companies like Endo International must adapt by providing clear, accessible data and engaging directly with patient communities to build trust and meet evolving expectations.

The push for affordable alternatives also influences market dynamics. As patients become more financially aware, they actively seek out generic or biosimilar options, impacting the market share of branded pharmaceuticals. By the end of 2024, the global generic drugs market was projected to reach over $370 billion, demonstrating this significant shift.

Lifestyle Changes and Disease Patterns

Shifting global lifestyles, from evolving dietary habits and reduced physical activity to increased environmental exposures, are directly impacting disease prevalence. This trend fuels demand for treatments targeting conditions like cardiovascular disease, diabetes, and certain cancers. For instance, the World Health Organization reported in 2023 that noncommunicable diseases (NCDs) account for 74% of all deaths globally, with lifestyle factors being a major contributor. This rise in lifestyle-related diseases presents significant market opportunities for pharmaceutical companies like Endo International.

Adapting research and development strategies to address these emerging health challenges is paramount. Companies that can innovate and offer effective therapies for these conditions are poised for growth. The market for diabetes care alone was projected to reach over $600 billion by 2027, highlighting the economic implications of these lifestyle-driven health shifts.

- Changing Diets: Increased consumption of processed foods and sugary beverages contributes to obesity and metabolic disorders.

- Sedentary Lifestyles: Reduced physical activity is linked to higher rates of heart disease, type 2 diabetes, and certain cancers.

- Environmental Factors: Pollution and exposure to chemicals can exacerbate respiratory and dermatological conditions.

- Aging Populations: As global life expectancy increases, so does the incidence of age-related chronic diseases, creating sustained demand for treatments.

Access to Healthcare and Affordability Demands

Societal pressure for accessible and affordable healthcare is intensifying worldwide, especially in developing markets. This trend directly impacts pharmaceutical companies like Endo International, as governments face increasing demands to regulate drug prices and encourage generic alternatives. For instance, in 2023, the U.S. Inflation Reduction Act began implementing measures to allow Medicare to negotiate prescription drug prices, a significant shift driven by affordability concerns.

Pharmaceutical firms are now expected to actively participate in addressing these healthcare access challenges. This includes not only providing essential medications but also investing in initiatives that broaden patient reach and lower out-of-pocket costs. Endo International, like its peers, must navigate this evolving landscape, balancing innovation with the growing societal mandate for cost-effective treatments. The global pharmaceutical market, valued at over $1.5 trillion in 2024, is under scrutiny to demonstrate its commitment to equitable access.

Key areas influenced by these demands include:

- Drug Pricing Regulations: Governments are implementing stricter controls on prescription drug costs, impacting revenue streams.

- Generic Drug Promotion: Policies favoring generic medications increase competition and pressure on branded products.

- Corporate Social Responsibility: Pharmaceutical companies are increasingly judged on their contributions to public health and affordability initiatives.

- Market Access Strategies: Companies must adapt their strategies to ensure their products are accessible to a wider patient population.

Societal shifts, including an aging global population and the rise of chronic diseases, are creating sustained demand for pharmaceutical solutions. By 2050, the UN projects one in six people will be over 65, fueling the need for treatments for age-related conditions. The global diabetes drug market, exceeding $90 billion in 2023, exemplifies this growth opportunity.

Growing health consciousness among consumers, with over 70% researching health topics online by mid-2024, necessitates greater transparency from companies regarding drug efficacy and cost. This also drives demand for more affordable alternatives, with the generic drug market projected to surpass $370 billion by the end of 2024.

Increased societal pressure for affordable healthcare, highlighted by the US Inflation Reduction Act's drug price negotiation measures in 2023, is leading to stricter regulations on drug pricing globally. Pharmaceutical firms must now focus on corporate social responsibility and market access strategies to ensure wider patient reach and cost-effectiveness.

| Sociological Factor | Impact on Endo International | Relevant Data (2023-2025) |

| Aging Population & Chronic Diseases | Increased demand for treatments addressing age-related and long-term health issues. | UN: 1 in 6 globally to be 65+ by 2050. Global diabetes drug market >$90B (2023). |

| Health Consciousness & Transparency Demands | Need for clear communication on drug efficacy, side effects, and cost; preference for accessible information. | >70% of adults research health online before doctor visits (mid-2024). |

| Affordability & Access Pressure | Regulatory pressure on drug pricing, favoring generics, and emphasis on corporate social responsibility for access. | US Inflation Reduction Act (2023) allows Medicare drug price negotiation. Global generic drug market projected >$370B (end of 2024). |

Technological factors

Technological leaps in genomics, proteomics, and bioinformatics are fundamentally reshaping how drugs are discovered and developed. These sophisticated tools allow for the rapid pinpointing of disease targets and streamline the process of refining potential drug compounds. For instance, the increasing availability of genomic data, with human genome sequencing costs dropping dramatically since the early 2000s, fuels these advancements.

This technological acceleration directly translates to more efficient lead optimization and the burgeoning field of personalized medicine, where treatments are tailored to individual genetic profiles. Companies like Endo International, by embracing these innovations, can significantly enhance their R&D pipelines. The global bioinformatics market alone was valued at approximately $13.2 billion in 2023 and is projected to grow substantially, underscoring the economic importance of these technological factors.

Artificial intelligence (AI) and machine learning (ML) are significantly reshaping the pharmaceutical landscape, impacting everything from drug discovery to patient interaction. By 2024, many pharma companies are leveraging AI to analyze vast datasets, aiming to identify potential drug candidates and predict their efficacy much faster than traditional methods. This technology is key to optimizing clinical trial design and patient selection, a process that historically consumed significant resources. For instance, AI-powered platforms are being developed to identify optimal patient cohorts for rare disease trials, potentially reducing trial timelines and costs.

The increasing embrace of digital health, encompassing remote monitoring and telemedicine, is fundamentally reshaping patient care and how medications are delivered. For instance, by 2025, the global digital health market is projected to reach over $660 billion, indicating a significant shift towards tech-enabled healthcare. This trend allows pharmaceutical companies like Endo International to foster deeper patient engagement, track adherence more effectively, and gather valuable real-world evidence.

Leveraging these digital tools opens up new pathways for innovation in both product development and service offerings. Companies can explore personalized treatment approaches based on data from wearable devices and remote monitoring, enhancing patient outcomes. This integration also provides opportunities to develop novel digital therapeutics and support services alongside traditional pharmaceuticals, creating a more holistic patient experience.

Manufacturing Process Innovations (e.g., 3D Printing)

Technological advancements in pharmaceutical manufacturing are reshaping how companies like Endo International operate. Innovations such as 3D printing for personalized dosages and continuous manufacturing processes present significant opportunities. These technologies can lead to more efficient production, lower costs, and ultimately, better product quality for patients.

Adopting these cutting-edge manufacturing techniques can also bolster Endo's supply chain. Increased resilience and quicker responses to fluctuating market demands are direct benefits. For instance, the global 3D printing market in healthcare was projected to reach $2.7 billion in 2023 and is expected to grow substantially, indicating a strong trend toward adopting these advanced methods.

- Increased Efficiency: Continuous manufacturing can reduce production cycle times significantly compared to traditional batch processes.

- Cost Reduction: Automation and optimized material usage in 3D printing can lower manufacturing expenses.

- Personalized Medicine: 3D printing allows for the creation of patient-specific drug dosages and delivery systems.

- Supply Chain Agility: On-demand manufacturing capabilities enhance responsiveness to market needs and reduce inventory risks.

Data Security and Cybersecurity Risks

As Endo International, like many in the pharmaceutical sector, deepens its reliance on digital platforms and extensive data management, the threat landscape for cybersecurity significantly expands. Protecting sensitive patient information, proprietary research, and critical operational infrastructure from malicious actors is an ongoing challenge. The financial implications of a data breach can be severe, encompassing regulatory fines, reputational damage, and the cost of remediation. For instance, the healthcare industry, a close parallel, has seen cyberattacks surge, with reports in late 2023 and early 2024 indicating a substantial increase in ransomware incidents targeting healthcare providers, leading to data exfiltration and service disruptions.

Endo International must prioritize robust data security and cybersecurity measures to maintain patient trust and ensure compliance with evolving data protection regulations, such as HIPAA and GDPR. Investments in advanced threat detection, employee training, and secure network architecture are essential. The company's ability to safeguard its intellectual property, including vital drug formulations and clinical trial data, directly impacts its competitive advantage and future revenue streams. Failure to do so can result in significant financial losses and operational paralysis.

The increasing sophistication of cyber threats necessitates continuous adaptation and investment in cybersecurity. This includes:

- Implementing multi-factor authentication across all systems.

- Conducting regular vulnerability assessments and penetration testing.

- Developing and practicing comprehensive incident response plans.

- Ensuring secure cloud storage and data encryption protocols.

Technological advancements are revolutionizing drug discovery and patient care for companies like Endo International. Innovations in AI and digital health are streamlining R&D and enhancing patient engagement. For example, the global bioinformatics market reached $13.2 billion in 2023, highlighting the economic impact of these technological shifts.

The integration of AI in drug discovery is accelerating candidate identification and clinical trial optimization. By 2024, many pharma firms are using AI to analyze extensive data, speeding up the process significantly. This also extends to digital health, with the global market projected to exceed $660 billion by 2025, reflecting a move towards tech-enabled healthcare solutions.

Manufacturing technologies like 3D printing and continuous manufacturing offer greater efficiency and customization. The healthcare 3D printing market, valued at $2.7 billion in 2023, is expected to grow, indicating adoption of these advanced methods that can lower costs and improve product quality.

Legal factors

Intellectual property rights, particularly patents, are crucial for pharmaceutical companies like Endo International to recoup substantial research and development costs. These patents grant exclusivity, allowing companies to charge premium prices for their innovative drugs.

However, the expiration of these patents opens the door for generic manufacturers, leading to intense price competition and a significant decline in revenue for the original branded products. For instance, Endo has faced patent cliffs for key products, necessitating a proactive strategy.

Managing a robust patent portfolio and consistently developing new pipeline drugs are essential survival strategies in this environment. This involves not only defending existing patents but also securing new ones for future revenue streams.

The landscape is dynamic, with ongoing legal challenges and regulatory reviews impacting patent validity and market exclusivity. Navigating these legal complexities is paramount for maintaining market share and profitability.

Pharmaceutical companies like Endo International are heavily regulated. Bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set strict rules for everything from how drugs are developed and made to how they're advertised and monitored after they hit the market.

Failing to follow these rules can lead to serious trouble. This includes hefty fines, costly product recalls, and significant damage to a company's reputation, impacting consumer trust and market standing. For instance, in 2023, the FDA issued numerous warning letters to pharmaceutical companies for various compliance issues, highlighting the ongoing scrutiny.

Staying on top of these ever-changing regulations is crucial for companies to even get their products approved and sold. Endo International, like its peers, must constantly adapt its processes and ensure ongoing compliance to maintain market access and its operational integrity.

The pharmaceutical sector, including companies like Endo International, is constantly exposed to product liability claims stemming from alleged drug defects or harmful side effects. These lawsuits can lead to substantial financial penalties and damage a company's public image.

Endo International itself has faced significant legal challenges, particularly related to its role in the opioid crisis. By 2023, the company had reached numerous settlements, with some estimates placing its total liability in the billions of dollars, underscoring the severe financial repercussions of such litigation.

Effectively managing these risks requires proactive legal defense, comprehensive safety testing, and transparent communication regarding potential adverse events. Companies must invest in strong compliance programs and engage in rigorous internal reviews to mitigate these ongoing legal threats.

Antitrust Laws and Market Competition Regulations

Antitrust laws are a significant legal factor for Endo International, as they aim to foster a competitive pharmaceutical market by preventing monopolistic behavior, especially concerning the introduction of generic drugs. Regulators closely examine mergers, acquisitions, and pricing strategies, which can directly impact Endo's growth and its slice of the market.

Endo must navigate a complex web of antitrust regulations to ensure its business practices are compliant. For instance, in 2023, the Federal Trade Commission (FTC) continued its focus on pharmaceutical competition, investigating practices that may delay generic entry. Failure to comply can lead to substantial fines and operational restrictions.

Key areas of antitrust scrutiny that affect pharmaceutical companies like Endo include:

- Merger and Acquisition Review: Regulatory bodies assess deals to prevent undue market concentration.

- Pricing Practices: Investigations into whether pricing strategies stifle competition or exploit market dominance.

- Patent Litigation and Settlements: Scrutiny of agreements that might delay generic alternatives from entering the market.

- Market Exclusivity and Bundling: Ensuring that these strategies do not create anti-competitive barriers.

Data Privacy Regulations (e.g., GDPR, HIPAA)

Endo International, like all pharmaceutical firms, must navigate a complex web of data privacy regulations. Strict laws such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States dictate how patient health information can be collected, stored, and utilized. Failure to comply can result in significant financial penalties and damage to reputation, as evidenced by the multi-million dollar fines levied against companies for data breaches under these frameworks.

These legal mandates directly influence Endo's operations across several key areas. For instance, the design and execution of clinical trials require meticulous adherence to privacy protocols to protect participant data. Marketing strategies must be carefully crafted to ensure they respect patient privacy rights, and patient support programs need robust safeguards to prevent unauthorized data access. The increasing focus on data security and patient consent, particularly in the wake of evolving cyber threats, adds another layer of complexity and compliance burden for companies like Endo.

- GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- HIPAA violations can result in penalties ranging from $100 to $50,000 per violation, with annual caps.

- Compliance costs for data privacy can represent a significant operational expense for pharmaceutical companies.

- Patient trust is heavily reliant on a company's demonstrated commitment to data privacy and security.

Endo International's legal landscape is heavily shaped by patent expirations, leading to generic competition and revenue erosion, a challenge faced by the company as it seeks to maintain market exclusivity for its products. The company must also contend with stringent regulations from bodies like the FDA, where non-compliance can result in severe financial penalties and reputational damage, as seen with widespread warning letters issued in 2023.

Environmental factors

Pharmaceutical manufacturing, by its nature, involves chemicals and produces waste, making strict adherence to environmental regulations paramount for companies like Endo International. These regulations cover everything from air emissions and water discharge to the proper disposal of hazardous materials. Failure to comply can result in substantial fines and damage to a company's reputation.

The increasing stringency of environmental laws directly impacts operational costs. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to emphasize reductions in greenhouse gas emissions from industrial sources, potentially requiring significant capital outlays for new pollution control technologies or process modifications in manufacturing plants. Similarly, evolving waste disposal mandates, particularly for pharmaceutical byproducts, necessitate advanced treatment solutions, adding to overheads.

Endo International, like its peers, must invest in sustainable practices to meet these evolving standards. This includes not only compliance but also proactive measures to minimize environmental impact, such as optimizing water usage and exploring greener chemical alternatives. Maintaining a strong social license to operate, built on environmental responsibility, is crucial for long-term business viability and investor confidence, especially as consumers and regulators alike demand greater accountability.

Endo International faces growing pressure to ensure its supply chain is both environmentally sound and ethically managed. This means actively working to reduce the carbon footprint associated with transporting raw materials and finished products, a significant challenge for global pharmaceutical operations.

Companies like Endo are increasingly being asked to demonstrate transparency in their sourcing, ensuring that suppliers adhere to strict environmental standards and ethical labor practices. For example, as of early 2024, many pharmaceutical firms are setting targets to reduce Scope 3 emissions, which include supply chain activities, by 2030.

This focus on sustainability extends to waste reduction throughout the manufacturing and distribution processes. The industry is exploring innovative packaging solutions and more efficient logistics to minimize environmental impact.

Climate change poses significant long-term risks to Endo International's operations. Extreme weather events, such as floods or hurricanes, could disrupt manufacturing facilities and vital supply chains, hindering the production and timely distribution of essential medicines. For instance, the increasing frequency of severe weather events globally, as reported by NOAA, highlights the potential for such disruptions.

Furthermore, shifts in disease patterns driven by climate change can directly influence demand for Endo's therapeutic offerings. As temperatures and environmental conditions change, the prevalence of certain illnesses may rise, altering the market for specific treatments. Companies like Endo must proactively assess and implement strategies to mitigate these evolving environmental risks to ensure business continuity and adapt to changing healthcare needs.

Waste Management and Product Lifecycle Impact

Endo International, like other pharmaceutical giants, faces increasing scrutiny regarding its waste management and the environmental footprint of its products throughout their lifecycle. This pressure stems from regulatory bodies, consumers, and investors alike, pushing for more sustainable practices in manufacturing, packaging, and end-of-life disposal. The company is expected to invest in and implement strategies to minimize pharmaceutical waste generation, a significant concern given the volume of production. Furthermore, developing and adopting eco-friendly packaging solutions, moving away from traditional plastics, is becoming a critical aspect of corporate environmental responsibility.

The focus on sustainable product design is also gaining momentum. This involves considering the environmental impact from the initial stages of drug development and manufacturing, aiming to reduce resource consumption and pollution. For instance, the pharmaceutical industry, in general, is exploring biodegradable materials for packaging and more efficient manufacturing processes that yield less hazardous waste. By 2025, many companies are setting targets to reduce their packaging waste by a certain percentage, demonstrating a tangible commitment to this environmental factor.

- Reduced Packaging Waste Targets: Many pharmaceutical companies are aiming to reduce their packaging waste by 15-20% by 2025 compared to 2020 levels.

- Eco-Friendly Packaging Initiatives: Investment in research and development for biodegradable and recyclable packaging materials is a growing trend.

- Pharmaceutical Waste Reduction: Efforts are underway to optimize manufacturing processes to minimize the generation of chemical and active pharmaceutical ingredient (API) waste.

- Safe Disposal Programs: The industry is increasingly supporting and promoting safe drug take-back programs to prevent improper disposal of medications into the environment.

Corporate Social Responsibility and Green Initiatives

Growing consumer, investor, and regulatory pressure is pushing pharmaceutical companies like Endo International to prioritize corporate social responsibility (CSR) and adopt green initiatives. This trend is particularly strong in 2024 and 2025, with stakeholders increasingly scrutinizing environmental impact. Endo, like its peers, faces demands to set ambitious sustainability targets and invest in eco-friendly practices.

The pharmaceutical sector is responding by focusing on reducing its carbon footprint and improving waste management. This includes exploring renewable energy sources for manufacturing facilities and supply chain operations. For instance, many leading pharma companies are setting targets to achieve net-zero emissions by 2040 or earlier, with interim goals for 2025 and 2030. Endo's engagement in these areas will be crucial for its long-term viability and stakeholder perception.

Demonstrating a robust commitment to environmental stewardship can significantly enhance brand reputation and attract a wider base of environmentally conscious investors and consumers. Companies that actively report on their environmental performance, such as through sustainability reports detailing greenhouse gas emissions reductions and water conservation efforts, tend to gain a competitive edge. This focus on green initiatives is not just about compliance but also about building trust and long-term value.

- Sustainability Targets: Pharmaceutical companies are increasingly setting specific, measurable, achievable, relevant, and time-bound (SMART) sustainability goals.

- Renewable Energy Investment: A growing number of firms are investing in solar, wind, and other renewable energy sources to power their operations, aiming for significant percentages of their energy mix by 2025.

- Environmental Reporting: Transparency in reporting environmental performance, including Scope 1, 2, and 3 emissions, is becoming standard practice.

- Brand Reputation: Companies with strong ESG (Environmental, Social, and Governance) profiles often see improved brand loyalty and investor confidence.

Environmental regulations significantly influence pharmaceutical operations, dictating waste management and emissions control. For example, the US EPA's continued focus on greenhouse gas reductions in 2024 necessitates investments in cleaner technologies, directly impacting production costs for companies like Endo. Furthermore, evolving waste disposal mandates for pharmaceutical byproducts require advanced treatment solutions, adding to operational overheads.

Endo International must proactively invest in sustainable practices to meet these growing environmental standards. This includes minimizing its carbon footprint across the supply chain, with many pharma firms setting Scope 3 emission reduction targets of 15-20% by 2030. The company is also expected to develop and adopt eco-friendly packaging, aiming to reduce packaging waste by up to 20% by 2025.

Climate change presents substantial long-term operational risks, including potential disruptions to manufacturing and supply chains from extreme weather events. Shifts in disease patterns due to climate change could also alter demand for Endo's products, requiring strategic adaptation to evolving healthcare needs and ensuring business continuity.

| Environmental Factor | Impact on Endo International | Key Data/Trends (2024-2025) |

|---|---|---|

| Regulatory Compliance | Increased operational costs due to stricter emission and waste disposal standards. | Continued emphasis on greenhouse gas reduction by EPA; evolving pharmaceutical waste mandates. |

| Supply Chain Sustainability | Pressure to reduce carbon footprint and ensure ethical sourcing. | Many pharma companies targeting 15-20% Scope 3 emission reduction by 2030; focus on transparent sourcing. |

| Waste Management & Packaging | Need for investment in waste reduction and eco-friendly packaging solutions. | Aim for up to 20% packaging waste reduction by 2025; R&D in biodegradable and recyclable materials. |

| Climate Change Risks | Potential disruptions from extreme weather; shifts in product demand due to changing disease patterns. | Increasing frequency of severe weather events globally; need for proactive risk mitigation strategies. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Endo International is grounded in comprehensive data from governmental health and regulatory bodies, leading economic forecasting firms, and reputable industry publications. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental landscape impacting the pharmaceutical sector.