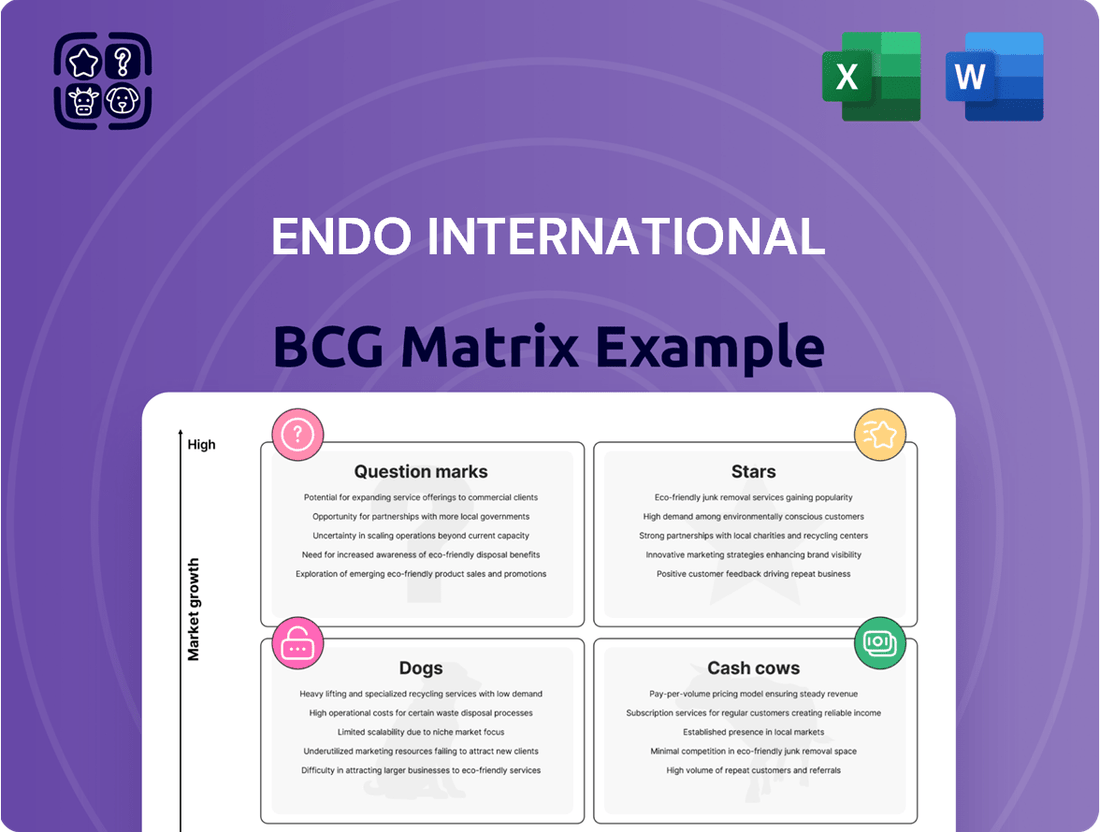

Endo International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endo International Bundle

Curious about Endo International's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Understand which products are driving growth and which might be holding the company back.

But this is just the surface. Unlock the full potential of this analysis by purchasing the complete BCG Matrix. You'll gain detailed quadrant placements, data-driven insights, and actionable strategies to optimize Endo International's market position.

Don't miss out on the complete picture. Invest in the full report to receive a comprehensive breakdown, including specific recommendations for resource allocation and future product development. Equip yourself with the knowledge to make informed strategic decisions.

This isn't just about understanding the past; it's about shaping the future. The full BCG Matrix report for Endo International provides a clear roadmap for navigating market dynamics and achieving sustainable growth. Purchase today and gain a competitive edge.

Stars

XIAFLEX®, a cornerstone of Endo International's portfolio, represents a significant star in the BCG matrix. This branded franchise, covering indications like Dupuytren's Contracture and Peyronie's Disease, is a primary revenue engine for the company.

In 2024, XIAFLEX® posted record revenues of $516 million, a testament to its strong market penetration and sustained demand. This impressive financial performance highlights its position as a leading product within its respective therapeutic areas.

Looking ahead to 2025, the expectation of continued high-single-digit revenue growth reinforces XIAFLEX®'s status as a star. Its robust growth trajectory in a market with enduring patient needs solidifies its role as a key asset for Endo International.

ADRENALIN® Ready-to-Use Premixed Bags, launched in late 2024, are positioned as a potential star product for Endo International. This represents a significant innovation as the first and only FDA-approved premixed epinephrine IV bags prepared by the manufacturer. Endo is investing heavily in expanding customer adoption and increasing supply, signaling strong expectations for market penetration and growth. This strategic move addresses a critical need for convenience and safety in critical care settings.

Endo International is strategically expanding XIAFLEX®'s reach by pursuing new indications, notably Hammer Toe, Urethral Stricture, and Arthrofibrosis of the Knee (AFK). These developments are crucial for its BCG Matrix positioning, targeting substantial growth in underserved or expanding medical areas.

The potential market penetration in these therapeutic areas is significant. For instance, the global arthrofibrosis of the knee market alone was projected to reach billions by 2030, presenting a prime opportunity for XIAFLEX® to capture a considerable share. Similarly, the markets for hammer toe correction and urethral stricture treatment offer substantial patient populations seeking less invasive solutions.

These pipeline investments are designed to cultivate XIAFLEX® into a future star performer for Endo. By successfully launching these new indications, the company aims to diversify revenue streams and solidify XIAFLEX®'s position as a versatile therapeutic agent, thereby driving long-term value.

Select Newly Launched Sterile Injectable Products

Endo International, as part of its strategic portfolio expansion, introduced three new sterile injectable products in the latter half of 2024, building on the momentum of ADRENALIN® RTU. This move is particularly significant as these launches are supported by enhanced manufacturing capabilities, positioning them within a rapidly expanding market segment. The company anticipates launching an additional three sterile injectable products in 2025, further solidifying its presence in this growth area.

These newly launched sterile injectable products, while in their early stages of market penetration, are designed to capitalize on evolving healthcare needs and technological advancements in sterile manufacturing. The focus on products leveraging improved manufacturing processes suggests a commitment to quality and efficiency, which are critical factors in the pharmaceutical industry. Their novelty in the market, coupled with Endo's strategic allocation of resources, points towards a high potential for future growth and market share capture.

- New Product Launches: Endo introduced 3 sterile injectable products in late 2024, with 3 more planned for 2025.

- Market Position: These products leverage improved manufacturing capabilities and are entering a growing market segment.

- Growth Potential: Despite initial market share development, the novelty and strategic focus indicate high growth prospects.

Strategic Growth Initiatives from Mallinckrodt Merger

The planned merger between Endo International and Mallinckrodt plc, slated for completion in the latter half of 2025, is designed to forge a diversified pharmaceutical entity with augmented operational capacities. This strategic union intends to capitalize on the synergy between their existing product lines and actively explore new business development avenues, with a particular focus on the rare and orphan disease sector. The integration of future products in these specialized therapeutic areas is anticipated to position them as potential stars within the BCG matrix.

This merger is projected to unlock significant growth potential, with analysts forecasting a combined revenue exceeding $7 billion in the initial years post-completion. The strategic rationale centers on creating a more robust market presence and achieving economies of scale. Key growth initiatives will likely include:

- Expansion into rare and orphan disease markets: Targeting unmet medical needs with specialized therapies.

- Leveraging complementary product portfolios: Cross-selling and up-selling opportunities across a broader patient base.

- Pursuing strategic business development: Acquiring or licensing promising late-stage assets.

- Driving operational efficiencies: Streamlining R&D, manufacturing, and commercial operations.

XIAFLEX® continues its strong performance as a star product for Endo International, achieving $516 million in revenues in 2024. With anticipated high-single-digit growth projected for 2025, its market leadership in existing indications and the pursuit of new therapeutic areas like Hammer Toe and Arthrofibrosis of the Knee underscore its star status. These expansion efforts are crucial for maintaining its growth trajectory and solidifying its value within Endo's portfolio.

| Product | BCG Category | 2024 Revenue (Millions USD) | Projected 2025 Growth | Key Developments |

| XIAFLEX® | Star | 516 | High-single-digit | New indications pursued (Hammer Toe, AFK, Urethral Stricture) |

| ADRENALIN® RTU Bags | Question Mark/Star Potential | N/A (Launched late 2024) | High (Expected) | First FDA-approved premixed epinephrine IV bags by manufacturer |

| New Sterile Injectables (3 launched late 2024) | Question Mark/Star Potential | N/A (Early Market Penetration) | High (Anticipated) | Leverage enhanced manufacturing capabilities, 3 more planned for 2025 |

What is included in the product

Strategic assessment of Endo's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

Guides decisions on investment, holding, or divesting specific business units based on market growth and share.

A clear visualization of Endo's business units, clarifying strategic focus and resource allocation.

Cash Cows

VASOSTRICT® stands as a prime example of a cash cow for Endo International, primarily within its Sterile Injectables division. Its consistent generation of revenue underscores its role as a reliable source of cash flow for the company.

Despite facing some competition, VASOSTRICT® remains a foundational product for Endo. In 2024, the Sterile Injectables segment, where VASOSTRICT® plays a key part, was a significant contributor to Endo's overall financial performance.

The product's enduring market position and steady, mature demand allow it to generate substantial cash without the need for heavy marketing expenditure. This mature demand is a hallmark of a successful cash cow, allowing for a strong return on past investments.

The Lidocaine Patch 5% (Generic) stands as a classic cash cow for Endo International. Its consistent performance and rising revenues, a testament to its stable position within a mature market, highlight its reliable contribution to the company's financial health.

Endo's commitment to ensuring a steady supply of this generic product, even when facing intense competition in the broader generics sector, solidifies its status as a dependable cash generator. This reliability is crucial for funding other ventures within Endo's portfolio.

In 2024, the global transdermal drug delivery systems market, which includes lidocaine patches, was valued at approximately $6.5 billion and is projected to grow steadily. This robust market environment directly supports the sustained revenue generation from Endo's generic lidocaine patch.

SUPPRELIN® LA, a specialty branded product within Endo International's portfolio, plays a role in the company's branded pharmaceuticals revenue. While facing some volume challenges, it continues to be a cash-generating asset due to its established presence in a niche market and its loyal customer base.

As a mature product, SUPPRELIN® LA represents a stable contributor to Endo's overall profitability, demonstrating its value even amidst market shifts. Its consistent cash flow generation supports the company's financial stability.

Established Branded Pharmaceutical Products

Beyond its prominent product XIAFLEX®, Endo International manages a collection of established branded pharmaceutical offerings. These products operate within mature therapeutic categories, and while their growth may not be explosive, they command substantial market presence.

These mature products are instrumental in generating consistent and predictable revenue streams for Endo. They contribute positively to the company's adjusted gross margin, underscoring their role as dependable cash cows within the BCG Matrix.

- Stable Revenue Generation: These products offer a reliable income source, crucial for funding other business initiatives.

- Mature Market Dominance: They hold significant market share in their respective, well-established therapeutic areas.

- Contribution to Gross Margin: These established brands bolster Endo's overall adjusted gross margin.

- Funding Growth: The cash generated supports investment in newer, higher-growth potential products or research.

Certain Stable Generic Pharmaceutical Products

Within Endo International's generic pharmaceuticals division, certain stable, mature generic products function as cash cows. These products, despite the intense competition inherent in the generic market, have carved out a consistent niche, generating predictable revenue streams.

These mature generics, often found in high-volume, lower-margin categories, are crucial for providing foundational cash flow to support Endo's broader operational needs and investments. Their stability is a key characteristic, distinguishing them from more volatile product lines.

- Market Presence: These products benefit from established market recognition and a loyal customer base, ensuring consistent demand.

- Profitability: While margins may be lower due to competition, the sheer volume of sales translates into substantial and reliable profits.

- Cash Flow Generation: They are vital for fueling other areas of Endo's business, including research and development for new products or acquisitions.

- Endo's 2024 Performance: While specific product-level data for 2024 is proprietary, Endo's overall generic segment has historically been a significant contributor to its revenue, with mature products forming the backbone of this contribution. For instance, in fiscal year 2023, Endo reported total revenue of approximately $2.5 billion, with its generics segment playing a substantial role in that figure.

Endo International's cash cows are products like VASOSTRICT®, the Lidocaine Patch 5% (Generic), and other established branded pharmaceuticals. These items generate consistent revenue due to their strong market positions in mature segments. Their reliable cash flow is essential for funding research and development or other strategic investments.

| Product/Category | Division | BCG Matrix Role | Key Characteristics | 2024 Relevance |

|---|---|---|---|---|

| VASOSTRICT® | Sterile Injectables | Cash Cow | Consistent revenue, mature demand, low marketing needs | Significant contributor to Sterile Injectables segment performance |

| Lidocaine Patch 5% (Generic) | Generics | Cash Cow | Stable performance, rising revenues, strong market position | Benefits from a growing global transdermal market (approx. $6.5B in 2024) |

| Established Branded Pharmaceuticals | Branded Pharmaceuticals | Cash Cow | Mature therapeutic categories, substantial market presence, predictable revenue | Contribute positively to adjusted gross margin |

| Mature Generic Products | Generics | Cash Cow | Consistent niche, predictable revenue, high volume | Formed a backbone of the generics segment's contribution to Endo's ~$2.5B revenue in FY23 |

Full Transparency, Always

Endo International BCG Matrix

The BCG Matrix report for Endo International that you are previewing is the exact, complete document you will receive upon purchase. This comprehensive analysis is fully formatted and ready for immediate strategic application, offering deep insights into Endo's product portfolio without any watermarks or demo content.

Dogs

Dexlansoprazole delayed-release capsules (generic) exemplifies a Dog within Endo International's BCG Matrix. Facing intense competition, this product saw its revenues tumble significantly throughout 2024. By early 2025, market share continued to erode, with reports indicating a negative growth trajectory.

This downward trend suggests dexlansoprazole generic is consuming resources without generating sufficient returns. Its diminishing appeal and declining sales performance position it as a liability, demanding careful consideration for divestment or restructuring to mitigate further losses for Endo International.

Varenicline tablets, now available generically, are positioned as a Dog in Endo International's BCG Matrix. Similar to other products facing market saturation, its revenue has seen significant declines. This decline is largely attributed to the fierce competition within the pharmaceutical market, a common challenge for established generic medications.

With a low market share and operating in a low-growth segment, generic varenicline likely contributes minimally to Endo's overall profitability. The market dynamics for smoking cessation aids have evolved, with new entrants and alternative therapies impacting the demand for older treatments.

The financial performance of generic varenicline reflects these market realities. While specific 2024 revenue figures for this particular generic line are not publicly detailed by Endo, the broader trend for established generics in competitive therapeutic areas indicates pressure on pricing and volume. Companies often re-evaluate such products, considering their strategic fit and potential for future returns.

Given its characteristics, generic varenicline tablets are a strong candidate for divestiture or discontinuation. This strategic move would allow Endo to reallocate resources towards products with higher growth potential and market share, thereby optimizing its portfolio for greater overall efficiency and profitability.

NASCOBAL® Nasal Spray, under Endo International's portfolio, likely represented a Cash Cow or possibly a Dog in the BCG Matrix. Its discontinuation due to low sales volumes directly indicates a lack of market demand and growth potential. This strategic move aligns with the principle of divesting from products that are not contributing significantly to revenue or market share, freeing up resources for more promising ventures.

International Pharmaceuticals Business

Endo International's International Pharmaceuticals business, including its Canadian subsidiary Paladin Pharma Inc., is slated for divestiture by mid-2025. This strategic move suggests the segment was not a primary driver of future growth for Endo, positioning it as a potential 'Dog' in the BCG Matrix. Companies often divest non-core assets that exhibit low market share and limited growth potential to focus resources on more promising ventures.

The decision to sell this segment, which was part of Endo's broader restructuring efforts, highlights a strategic shift away from these specific international markets. While specific revenue figures for the International Pharmaceuticals business prior to the divestiture announcement are not readily available, the action itself implies it was underperforming relative to Endo's other divisions.

Key factors indicating its 'Dog' status include:

- Low Market Share: The business likely held a minor position in the competitive international pharmaceutical landscape.

- Limited Growth Prospects: Anticipated slow or stagnant growth rates were a contributing factor to the divestiture decision.

- Non-Core Asset: Endo's strategic focus shifted to areas deemed more central to its long-term profitability and market position.

- Divestiture Strategy: The sale is a clear indicator that the business did not align with Endo's future strategic objectives.

Opana® ER

Opana ER, once a significant product for Endo International, serves as a stark example of a product that transitioned into a 'dog' within the BCG matrix, primarily due to severe litigation and market withdrawal. Although sales halted in 2017, the product's legacy includes substantial legal liabilities that contributed to Endo's bankruptcy proceedings.

The company faced intense scrutiny and ultimately agreed to significant settlements related to Opana ER. This culminated in the cessation of its marketing and sales efforts, underscoring its extremely negative long-term impact and complete loss of viable market presence.

Key points regarding Opana ER's classification as a 'dog' include:

- Cessation of Sales: Opana ER's sales officially stopped in 2017, marking the end of its market participation.

- Litigation Liabilities: The product was associated with immense litigation, creating significant financial burdens for Endo International.

- Bankruptcy Impact: These liabilities were a contributing factor to Endo's bankruptcy proceedings, illustrating the severe consequences of problematic products.

- No Market Presence: Post-2017, Opana ER had no viable market presence, a defining characteristic of a 'dog' in strategic analysis.

Endo International's portfolio includes several products that fit the 'Dog' quadrant of the BCG Matrix. These are typically characterized by low market share in low-growth markets, meaning they generate minimal profits and often consume resources without significant returns. Examples like generic dexlansoprazole and varenicline highlight the challenges of established generics facing intense competition and market saturation.

The strategic divestiture of its International Pharmaceuticals business, including Paladin Pharma Inc., by mid-2025 further illustrates Endo's approach to managing 'Dog' assets. This move signals a deliberate effort to shed underperforming segments that lack growth potential and a strong market position, allowing the company to redirect capital and focus towards more promising areas.

Products like Opana ER, which faced market withdrawal due to severe litigation and associated liabilities, also exemplify 'Dogs' due to their complete loss of market presence and significant negative financial impact. These instances underscore the importance of continuous portfolio evaluation and strategic decision-making to optimize resource allocation and long-term profitability.

Question Marks

Endo International's sterile injectables pipeline is a key focus for growth, with an ambitious target of seven new FDA submissions slated for 2025. Three of these submissions were successfully completed in the first quarter of 2025, signaling strong progress.

These products are strategically positioned in high-growth therapeutic areas, reflecting a forward-looking approach to market demand. However, their current market share is minimal, as many are either pre-launch or have only recently undergone submission processes.

Achieving market penetration and success for these novel sterile injectables will necessitate substantial investment, covering development, regulatory affairs, and early-stage commercialization efforts. This commitment is crucial for realizing their high-growth potential.

Endo International is gearing up to launch three new sterile injectable products in 2025. This strategic move targets a market that, while competitive, shows significant growth potential, with the global sterile injectables market projected to reach over $700 billion by 2030. These new offerings are currently in the 'question marks' phase of the BCG matrix, meaning they require substantial investment for development and market entry without a guaranteed return.

The success of these 2025 launches will depend heavily on Endo's ability to execute robust marketing strategies, drive rapid customer adoption, and quickly capture market share. Given that these products are cash consumers during their introductory period, establishing a strong market presence early is crucial for their transition out of the question mark category and towards future profitability.

Following a hypothetical merger with Mallinckrodt, the newly combined Endo International might strategically target emerging, high-growth therapeutic areas. These would be areas where their combined R&D capabilities and existing pipelines offer synergistic advantages, potentially including rare diseases or advanced gene therapies. For example, if Endo has a strong presence in pain management and Mallinckrodt in autoimmune disorders, they could jointly invest in novel treatments for inflammatory conditions with unmet needs.

Such new ventures would initially represent question marks on the BCG matrix. They demand significant capital for research, clinical trials, and market penetration, leading to low initial market share. By 2024, the biopharmaceutical industry saw substantial investment in oncology and neurology, with companies like Pfizer investing billions in acquired assets within these domains, illustrating the capital-intensive nature of entering new therapeutic frontiers.

Early-Stage Business Development Opportunities

Endo International's strategy involves exploring early-stage business development opportunities for its branded platform. These ventures represent potential high-growth markets but are characterized by unproven market share and significant investment needs for development and commercialization, making them high-risk, high-reward propositions.

These early-stage opportunities are akin to 'Question Marks' in the BCG matrix, requiring careful evaluation. For instance, in 2024, the pharmaceutical industry saw significant investment in R&D for novel therapies, with companies like Moderna and BioNTech continuing to invest heavily in their mRNA platforms. Endo's pursuit of similar early-stage ventures would place them in a similar strategic position, needing to decide whether to invest further to grow market share or divest if prospects dim.

- Strategic Focus: Targeting nascent markets with high future growth potential.

- Risk Profile: Ventures carry substantial risk due to unproven market traction and development costs.

- Investment Needs: Require significant capital infusion for research, development, and market entry.

- Potential Returns: Offer the possibility of substantial long-term rewards if successful in capturing market share.

Investment in R&D for Sterile Injectables Manufacturing Network

Endo International is strategically increasing its investment in Research and Development (R&D) to bolster its sterile injectables product pipeline and enhance its manufacturing capabilities. This focus on innovation is vital for the company's long-term growth trajectory, aiming to introduce new and improved sterile injectable products to the market.

These R&D expenditures are currently a drain on cash flow, as is typical for question mark products or business units. The success and eventual profitability of these investments hinge on several factors, including the effectiveness of the developed products, regulatory approvals, and their acceptance by healthcare providers and patients.

- Pipeline Development: Endo's sterile injectables pipeline includes potential new treatments for various medical conditions, with ongoing clinical trials and formulation development.

- Manufacturing Network Expansion: Investments are directed towards upgrading and expanding manufacturing facilities to meet higher quality standards and increased production demands for sterile injectables.

- Market Adoption Risk: The commercial success of new sterile injectables faces inherent risks associated with market competition, pricing pressures, and physician prescribing habits.

- Financial Outlay: For instance, in 2023, Endo reported R&D expenses of approximately $275 million, a significant portion of which is allocated to its sterile injectables segment, reflecting the substantial upfront capital required for this area.

Endo International's sterile injectables represent significant 'question marks' within the BCG matrix. These are products with low market share but operating in high-growth markets, demanding substantial investment for development and market penetration.

The company is targeting seven new FDA submissions for sterile injectables by 2025, with three already completed in Q1 2025. This aggressive pipeline development highlights the high-growth potential sought, but also the current lack of established market share.

These new ventures require significant capital for R&D, regulatory processes, and early commercialization. For example, in 2023, Endo's R&D spending was around $275 million, much of which supports this high-potential but cash-consuming segment.

Success hinges on rapid market adoption and effective marketing strategies to transition these 'question marks' into profitable products, mirroring industry trends where companies like Pfizer invested billions in growth areas in 2024.

| BCG Category | Endo International's Sterile Injectables | Market Growth | Market Share | Investment Needs | Potential |

| Question Mark | New sterile injectables pipeline (e.g., 7 FDA submissions by 2025) | High (Global sterile injectables market projected >$700B by 2030) | Low (Pre-launch or recently submitted) | High (R&D, regulatory, commercialization; $275M R&D in 2023) | High (If successful, can become Stars) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial disclosures, industry reports, and sales performance metrics to accurately assess product portfolio positions.