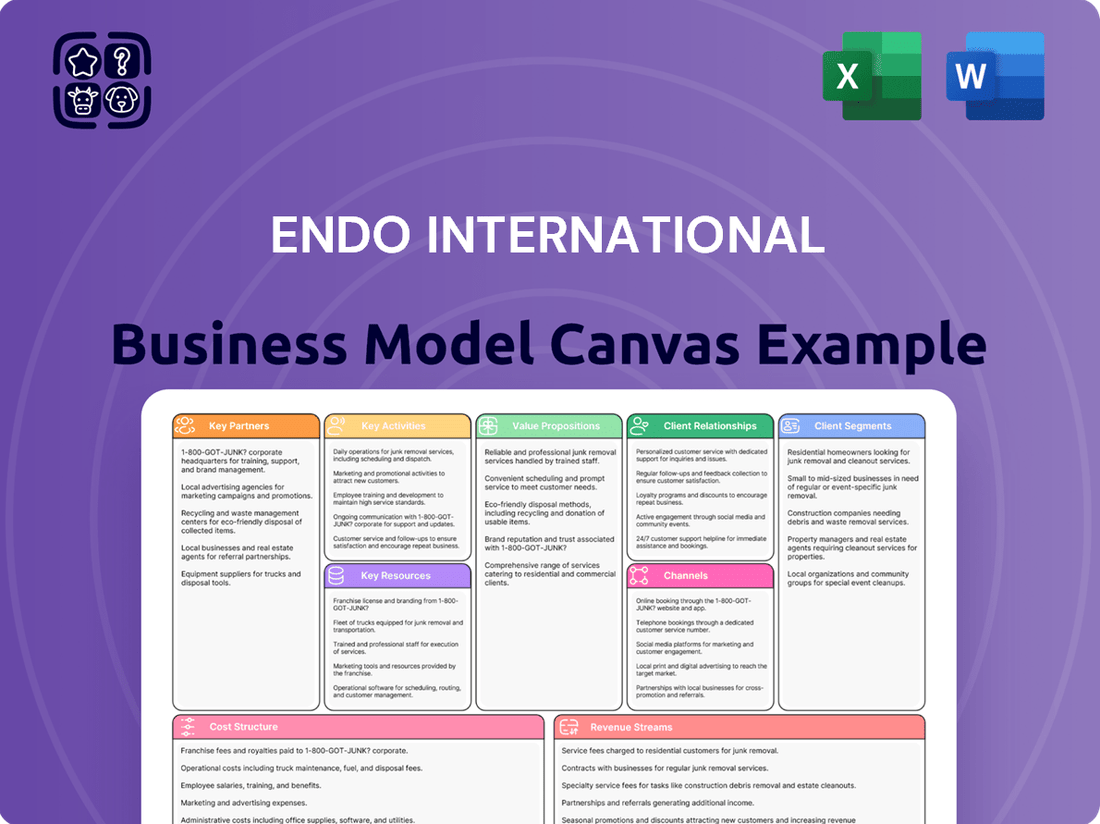

Endo International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endo International Bundle

Unlock the full strategic blueprint behind Endo International's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Endo International’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Endo International operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Endo International’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Endo International. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Endo, Inc. actively pursues strategic alliances to enhance its product development efforts, focusing on key areas such as sterile injectables. These collaborations are crucial for accelerating the innovation process.

By partnering with external entities, Endo aims to expedite the journey of novel therapies from development to market availability. This approach is vital for staying competitive in the pharmaceutical landscape.

These strategic alliances are designed to broaden Endo's product portfolio and, more importantly, to address critical unmet needs within patient populations. For example, in 2024, the company continued to explore partnerships in specialized therapeutic areas.

The company's strategy involves leveraging these external relationships to gain access to cutting-edge technologies and expertise, ultimately strengthening its pipeline and market position.

Endo International relies on Contract Manufacturing Organizations (CMOs) to produce its wide range of branded and generic pharmaceuticals. This partnership is essential for scaling production effectively and managing manufacturing capacity.

These CMO relationships are vital for optimizing Endo's supply chain and ensuring a consistent, high-quality supply of medications to patients. For example, in 2023, the pharmaceutical contract manufacturing market was valued at approximately $150 billion globally, highlighting the scale of these critical partnerships.

Endo International plc heavily relies on a sophisticated network of wholesale distributors, such as McKesson, AmerisourceBergen, and Cardinal Health, to ensure its pharmaceutical products reach a vast array of healthcare settings, including retail pharmacies, hospitals, and clinics throughout the United States. These distributors are critical for managing inventory, logistics, and the complex supply chain inherent in the pharmaceutical industry.

Group Purchasing Organizations (GPOs) represent another vital partnership for Endo. By contracting with GPOs, which represent a significant portion of the U.S. hospital and healthcare system market, Endo gains streamlined access and preferred status for its offerings. For instance, by mid-2024, GPOs collectively managed purchasing for an estimated 95% of U.S. hospitals, highlighting their immense influence on market penetration.

These strategic alliances with wholesale distributors and GPOs are foundational to Endo's business model, enabling efficient product delivery and maximizing market reach. Without these partnerships, Endo would face substantial challenges in getting its diverse portfolio of branded and generic pharmaceuticals to the patients who need them.

Healthcare Provider Networks and Institutions

Endo International's business model heavily relies on cultivating robust collaborations with a diverse array of healthcare providers. These include major hospital systems, outpatient clinics, and specialized medical networks. Such partnerships are fundamental for effectively bringing products to market, particularly its portfolio of sterile injectable drugs.

These strategic alliances allow Endo direct access to the healthcare professionals who are the ultimate users of its therapies. This direct engagement is key to driving the adoption and consistent utilization of its life-enhancing treatments. By fostering strong ties within these established healthcare networks, Endo not only supports its product's commercial success but also contributes to improved patient care pathways.

For instance, in 2024, the company continued to emphasize its focus on specialty injectables, a segment where strong provider relationships are paramount. Endo's success in this area is directly tied to its ability to integrate its products into existing treatment protocols within these partner institutions.

- Hospital Systems: Collaborating with major hospital chains to ensure widespread availability of Endo's injectable products.

- Specialty Clinics: Partnering with clinics focusing on specific therapeutic areas where Endo's drugs offer significant patient benefits.

- Ambulatory Surgery Centers: Engaging with ASCs to facilitate outpatient administration of its injectable therapies.

- Integrated Delivery Networks: Working with IDNs to streamline the adoption and reimbursement processes for its products.

Academic and Research Collaborations

Endo International actively partners with academic institutions and research centers to push the boundaries of scientific discovery and identify promising new therapeutic avenues. These collaborations are crucial for early-stage research, fueling the drug discovery pipeline and developing novel treatment strategies. For example, in 2024, Endo continued its engagement with leading universities on research grants focused on pain management and opioid addiction alternatives, aiming to leverage cutting-edge academic insights.

Such academic alliances are foundational to Endo's long-term innovation strategy, ensuring the company remains competitive and at the vanguard of pharmaceutical advancements. These partnerships provide access to specialized expertise and state-of-the-art facilities, accelerating the translation of basic science into clinical applications. By investing in these relationships, Endo aims to foster a sustainable pipeline of innovative healthcare solutions.

- Academic Research Focus: Collaborations concentrate on novel therapeutic targets and early-stage scientific exploration.

- Innovation Pipeline: Partnerships drive drug discovery and the development of new treatment modalities.

- Strategic Importance: Academic ties are essential for maintaining a competitive edge and long-term pharmaceutical innovation.

- 2024 Engagement: Continued university partnerships in pain management and addiction research were a key focus.

Endo International's Key Partnerships are multifaceted, encompassing collaborations with contract manufacturers for production, wholesale distributors for market reach, and Group Purchasing Organizations (GPOs) for access to healthcare systems. These relationships are critical for efficient supply chain management and broad product availability.

The company also fosters vital ties with hospital systems, specialty clinics, and ambulatory surgery centers to integrate its sterile injectables into patient care. These provider partnerships are paramount for driving product adoption and ensuring therapeutic efficacy.

Furthermore, Endo actively engages with academic institutions and research centers to propel early-stage drug discovery and innovation, particularly in areas like pain management. These scientific collaborations are essential for building a robust and competitive future pipeline.

| Partner Type | Key Role | Example/Impact | 2024 Focus Area |

| Contract Manufacturing Organizations (CMOs) | Production of branded and generic pharmaceuticals | Essential for scaling production and managing capacity. The global CMO market reached ~$150 billion in 2023. | Ensuring consistent, high-quality supply. |

| Wholesale Distributors (e.g., McKesson, AmerisourceBergen) | Logistics and delivery to pharmacies, hospitals, clinics | Critical for managing inventory and complex supply chains across the US. | Maximizing market reach. |

| Group Purchasing Organizations (GPOs) | Streamlined access and preferred status in healthcare systems | GPOs managed purchasing for ~95% of US hospitals by mid-2024, impacting market penetration. | Facilitating product adoption. |

| Healthcare Providers (Hospitals, Clinics, ASCs) | Product integration into treatment protocols, direct user engagement | Crucial for sterile injectables and driving consistent utilization. | Specialty injectables and patient care pathways. |

| Academic Institutions & Research Centers | Early-stage research, drug discovery, novel therapeutic avenues | Fueling the innovation pipeline and developing new treatment strategies. | Pain management and opioid addiction alternatives. |

What is included in the product

A comprehensive overview of Endo International's business model, detailing its key customer segments, channels, and value propositions. This canvas reflects the company's strategic approach to pharmaceutical product development and commercialization.

The Endo International Business Model Canvas acts as a pain point reliver by providing a structured, visual framework that simplifies complex strategic planning, enabling clearer problem identification and solution development.

Activities

Endo International's key activities heavily rely on robust Research and Development. This involves a continuous effort to create innovative branded pharmaceuticals and to produce high-quality generic alternatives. A significant focus is also placed on expanding the approved uses, or indications, for their existing treatments, such as their therapy for Dupuytren's contracture, XIAFLEX®.

This R&D pipeline encompasses every stage of drug development, from initial preclinical research and laboratory testing to rigorous clinical trials in humans. Formulation development, ensuring the drug is delivered effectively and safely, is also a critical component of these activities, all aimed at bringing new and improved therapeutic solutions to patients.

In 2023, Endo reported spending $386 million on research and development. This substantial investment underscores the company's commitment to innovation and its strategy to drive sustainable growth by addressing unmet medical needs and staying competitive in the pharmaceutical landscape.

Endo International's core activity involves the meticulous manufacturing of its diverse pharmaceutical products, encompassing branded drugs, generics, and sterile injectables. This process is underpinned by an unwavering commitment to rigorous quality assurance protocols. For instance, in 2024, the company continued to invest in advanced manufacturing technologies to ensure product integrity and patient safety, a critical factor given the pharmaceutical sector's highly regulated nature.

The emphasis on stringent quality control and adherence to regulatory standards, such as those set by the FDA, is paramount. This dedication is not merely about compliance but is fundamental to guaranteeing the safety, efficacy, and consistent availability of Endo's medications. Maintaining these high manufacturing standards builds essential patient trust and reinforces the company's reputation within the healthcare ecosystem.

Endo International's key activities revolve around the robust commercialization of its pharmaceutical products. This is primarily achieved through a dedicated sales force that engages directly with healthcare professionals. These teams are crucial for educating doctors and other prescribers about the benefits and appropriate uses of Endo's medications.

Marketing campaigns and promotional efforts are strategically deployed to build brand awareness and drive product adoption. These initiatives often focus on highlighting clinical data and differentiating Endo's offerings in competitive therapeutic areas. For instance, in 2024, significant marketing spend likely supported the promotion of their pain management and urology portfolios.

Market access strategies are another critical component, ensuring that Endo's products are available and affordable for patients. This involves navigating payer relationships and demonstrating the value proposition of their treatments. Success in these areas directly translates to revenue generation and market share growth.

Regulatory Affairs and Compliance

Endo International's key activities heavily involve navigating the intricate web of regulatory affairs and compliance. This includes managing all necessary submissions to the U.S. Food and Drug Administration (FDA) for product approvals, ensuring every stage from manufacturing to marketing and distribution adheres to stringent guidelines. Maintaining ongoing compliance is paramount for market access and the company's operational integrity.

This critical function directly impacts Endo's ability to bring and keep products on the market. For instance, in 2024, pharmaceutical companies globally continued to face intense scrutiny, with the FDA issuing numerous guidance documents and enforcement actions related to manufacturing quality and drug safety. Endo's proactive engagement with these evolving standards is a core operational necessity.

- FDA Submissions: Managing the lifecycle of product approvals, from initial applications to post-market changes.

- Ongoing Compliance: Ensuring adherence to current Good Manufacturing Practices (cGMP), labeling requirements, and promotional guidelines.

- Regulatory Monitoring: Keeping abreast of evolving regulations and policy changes that could affect product development, manufacturing, or sales.

- Risk Management: Implementing systems to identify, assess, and mitigate regulatory risks across all business operations.

Supply Chain Management and Distribution

Endo International Plc's supply chain management and distribution are crucial for delivering its pharmaceutical products effectively. This involves carefully orchestrating the flow of goods from sourcing raw materials to the final delivery to patients, ensuring timely access to essential medications. In 2024, the company continued to focus on optimizing these processes to mitigate potential disruptions.

Key activities include sophisticated inventory management to balance stock levels and prevent shortages, alongside robust logistics operations to ensure efficient transportation. Endo also relies on strategic partnerships with various distributors to broaden its reach and ensure product availability across different markets. This integrated approach aims to maintain a consistent supply, even amidst evolving market demands.

- Logistics Optimization: Continuously improving transportation networks and delivery routes to reduce transit times and costs.

- Inventory Control: Implementing advanced forecasting and tracking systems to manage stock levels efficiently and minimize waste.

- Distribution Partnerships: Collaborating with a network of reliable distributors to ensure broad market access and patient reach.

- Risk Mitigation: Developing contingency plans to address potential supply chain disruptions, ensuring product availability.

Endo International's key activities encompass the strategic commercialization of its pharmaceutical portfolio, primarily through an engaged sales force and targeted marketing campaigns. These efforts aim to educate healthcare providers and drive product adoption, with significant focus in 2024 on areas like pain management and urology.

Furthermore, ensuring market access by managing payer relationships and demonstrating product value is a critical activity for revenue generation and market share growth. This multi-faceted approach ensures Endo's treatments reach the patients who need them.

Endo's operations are fundamentally driven by rigorous Research and Development, investing $386 million in 2023 to innovate branded pharmaceuticals and develop high-quality generics, alongside expanding indications for existing treatments like XIAFLEX®.

The meticulous manufacturing of its diverse product lines, including sterile injectables, is a cornerstone, supported by significant 2024 investments in advanced technologies and strict adherence to quality assurance protocols to ensure patient safety and product integrity.

Navigating complex regulatory affairs and compliance, including all FDA submissions and adherence to evolving standards like cGMP, is a vital activity for market access and operational integrity, especially given increased scrutiny in 2024.

Efficient supply chain management and distribution are crucial, with a 2024 focus on optimizing logistics, inventory control, and distribution partnerships to ensure timely and consistent access to medications for patients.

| Key Activity | Description | 2023 Data Point | 2024 Focus Area | Impact |

| Research & Development | Developing new branded and generic drugs. | $386 million spent on R&D. | Expanding indications for existing treatments. | Drives innovation and future revenue. |

| Manufacturing | Producing pharmaceuticals with high quality standards. | N/A | Investing in advanced manufacturing technologies. | Ensures product safety, efficacy, and patient trust. |

| Commercialization | Sales force engagement and marketing campaigns. | N/A | Promoting pain management and urology portfolios. | Drives revenue and market share. |

| Regulatory Affairs | Ensuring compliance with FDA and other regulations. | N/A | Adapting to evolving global regulatory landscapes. | Maintains market access and operational integrity. |

| Supply Chain & Distribution | Managing the flow of goods from production to patient. | N/A | Optimizing logistics and inventory management. | Ensures timely product availability and patient access. |

Full Version Awaits

Business Model Canvas

The Endo International Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, allowing you to immediately begin strategizing and refining your business operations.

Resources

Endo International's intellectual property, especially patents for branded drugs like XIAFLEX®, is a cornerstone of its business. In 2023, XIAFLEX® generated $244 million in net sales, highlighting the financial impact of its patent protection.

The company's strength also lies in its diverse product portfolio, encompassing both branded and generic pharmaceuticals. This breadth across various therapeutic areas, including pain management and sterile injectables, offers a degree of resilience and multiple revenue streams.

This combination of strong IP and a wide product range gives Endo a significant competitive edge. It allows the company to secure market share for its key products while also serving a broader patient population with its generic offerings.

Endo International plc operates its own manufacturing facilities, which are absolutely crucial for producing its diverse portfolio of pharmaceutical products, with a particular emphasis on sterile injectable drugs. These sites are outfitted with sophisticated technology and are maintained to meet rigorous quality control standards, ensuring the safety and efficacy of their medications.

These production capabilities are vital for Endo to guarantee a consistent supply of its products to patients and healthcare providers. In 2023, the company continued to leverage these facilities to meet market demand, highlighting their importance in the value chain.

Endo International's business model heavily relies on its scientific, medical, and commercial talent. This human capital is crucial for driving innovation in research and development, ensuring adherence to stringent regulatory standards, and effectively executing sales and marketing initiatives. Their collective expertise is the bedrock upon which Endo builds its product pipeline and maintains market competitiveness.

In 2024, Endo continued to leverage its teams to navigate the complex pharmaceutical landscape. The company's R&D efforts, powered by its scientific talent, focus on developing therapies for pain management and other areas. The medical affairs teams, comprised of experienced professionals, are essential for educating healthcare providers and ensuring the safe and effective use of Endo's products.

The commercial talent at Endo is responsible for bringing these products to market and driving revenue. This includes sales representatives, marketing specialists, and market access professionals who work to establish strong relationships with payers and providers. Their ability to communicate the value proposition of Endo's treatments directly impacts market penetration and financial performance.

Financial Capital and Strengthened Balance Sheet

Endo, Inc. emerged from Chapter 11 bankruptcy in April 2024, fundamentally reshaping its financial landscape. This restructuring significantly reduced its debt, leading to a strengthened balance sheet.

The company's improved financial position provides enhanced flexibility. This allows Endo to strategically invest in key areas like growth initiatives and the development of its product pipeline.

- Reduced Debt Burden: Post-restructuring, Endo has a substantially lower debt load, improving its financial stability.

- Strengthened Balance Sheet: The company's balance sheet is now healthier, reflecting its deleveraged status.

- Increased Financial Flexibility: This allows for more capital allocation towards strategic investments and operational improvements.

- Investment in Growth: Endo can now allocate resources to pursue new market opportunities and enhance its existing business segments.

Established Distribution and Sales Networks

Endo International plc leverages its established distribution and sales networks as a cornerstone of its business model. These networks include a robust system of distributors, wholesalers, and a dedicated direct sales force. This infrastructure is vital for ensuring Endo's pharmaceutical products reach healthcare providers and patients efficiently, facilitating broad market penetration for its therapies.

The extensive reach of these channels is a critical asset, enabling widespread access to Endo's diverse portfolio of treatments. In 2024, the pharmaceutical distribution landscape continued to be dominated by major players, with companies like McKesson, AmerisourceBergen, and Cardinal Health handling a significant portion of drug distribution in the United States. Endo's ability to partner effectively with these entities, alongside managing its own direct sales force, is paramount to its commercial success.

- Distributor Partnerships: Endo relies on key distribution partners to manage the logistics and warehousing of its products, ensuring timely delivery to pharmacies and hospitals.

- Wholesaler Relationships: Strong ties with pharmaceutical wholesalers allow for broad reach across various healthcare settings, from large hospital systems to smaller clinics.

- Direct Sales Force: A dedicated sales team engages directly with physicians and other healthcare professionals, promoting product awareness and adoption.

- Market Access: The breadth and depth of these established networks are crucial for achieving widespread market access and ensuring patients can obtain necessary medications.

Endo International's key resources extend beyond patents and products to its skilled workforce and robust infrastructure. The company's scientific, medical, and commercial teams are vital for innovation, regulatory compliance, and market penetration. In 2024, these teams were instrumental in navigating the pharmaceutical market, with R&D focusing on pain management therapies and commercial teams driving product adoption.

The company's manufacturing facilities, particularly for sterile injectables, are critical for ensuring a consistent supply of high-quality medications. These sites adhere to strict quality control standards, underscoring their importance in Endo's value chain. Its extensive distribution and sales networks, including partnerships with major distributors and a direct sales force, are essential for broad market access and efficient product delivery.

Value Propositions

Endo International plc is dedicated to offering a portfolio of high-quality branded and generic pharmaceutical products. These therapies are designed to meet significant patient needs across key therapeutic areas. For instance, Endo's focus on urology and orthopedics aims to improve daily living for many. In 2024, the company continued to emphasize these core areas, ensuring access to reliable treatments.

Endo International addresses unmet medical needs through its differentiated branded products, like XIAFLEX. This innovative therapy offers a non-surgical treatment for conditions such as Dupuytren's contracture and Peyronie's disease, areas where treatment options have historically been limited. The company's focus on developing specialized treatments provides significant value to both patients seeking alternatives to surgery and healthcare providers looking for effective solutions.

Endo International plc is committed to providing a dependable supply of essential sterile injectable medications, a crucial offering for hospitals and healthcare providers. Their extensive portfolio covers vital areas such as critical care and maternal health, ensuring that healthcare systems have access to the medicines they need, when they need them. This focus on reliability is paramount for patient care.

The company's dedication to consistent supply is underscored by innovations like the ADRENALIN® ready-to-use bags. This product simplifies administration for healthcare professionals, further reinforcing Endo's value proposition of dependable access to critical medications. By reducing preparation steps, these advancements contribute to more efficient patient treatment.

In 2023, the pharmaceutical industry continued to grapple with supply chain challenges, making Endo's commitment to reliable delivery even more significant. For instance, the shortage of certain injectable drugs in the US during 2023 highlighted the critical importance of manufacturers like Endo maintaining robust production and distribution networks to meet ongoing demand for essential hospital-based treatments.

Offering Cost-Effective Generic Alternatives

Endo International's generic pharmaceuticals segment offers a crucial value proposition by providing cost-effective alternatives to branded medications. This directly addresses the growing need for healthcare cost containment, making essential treatments more accessible to a wider patient population. These generic options deliver the same efficacy and safety standards as their brand-name counterparts but at a significantly reduced price point.

This focus on affordability yields substantial benefits for both payers, such as insurance companies and government programs, and end-users, the patients themselves. By lowering the overall cost of prescription drugs, Endo's generics play a vital role in expanding access to necessary therapies, particularly for those facing financial constraints. The company's commitment to this segment demonstrates a clear strategy to capture market share by meeting a fundamental demand for economical healthcare solutions.

- Affordable Healthcare: Endo's generics provide a lower-cost option, aiding in the reduction of overall healthcare expenditures.

- Patient Access: By offering cheaper alternatives, more patients can afford and access vital medications.

- Equivalent Quality: These generic products are proven to be as effective and safe as their branded equivalents.

- Market Competitiveness: The cost-effectiveness of generics allows Endo to compete effectively in a price-sensitive market.

Strategic Transformation and Future Growth Potential

Following its Chapter 11 restructuring, Endo International is actively pursuing strategic initiatives to drive future growth. A key element is the planned merger with Mallinckrodt, which aims to create a more robust entity with enhanced market positioning. This move signals a commitment to sustained value creation for stakeholders by focusing on core therapeutic areas and expanding its product pipeline.

Endo’s strategy emphasizes resilience and adaptability in a dynamic market. The company is prioritizing investment in its core growth assets, seeking to maximize their potential. Furthermore, a significant focus is being placed on expanding its research and development pipeline to introduce innovative solutions and capture new market opportunities.

- Post-Restructuring Focus: Endo is emerging from bankruptcy with a clear strategy to build sustained growth and shareholder value.

- Strategic Merger: The proposed merger with Mallinckrodt is a critical step in this transformation, aiming for enhanced market presence and operational efficiencies.

- Pipeline Expansion: A key value proposition lies in Endo's commitment to developing and expanding its product pipeline, driving future revenue streams.

- Stakeholder Confidence: The company's demonstrated resilience and forward-looking approach are designed to instill confidence in investors and partners.

Endo International offers a dual value proposition: providing essential, high-quality branded pharmaceuticals for unmet needs, such as XIAFLEX for specific conditions, and delivering cost-effective generic alternatives that enhance patient access and reduce healthcare costs. This dual approach allows Endo to serve diverse patient and payer needs effectively.

The company's commitment to reliable sterile injectable supply is a critical value driver for hospitals, ensuring availability of vital medications in areas like critical care. Innovations like ADRENALIN® ready-to-use bags further streamline healthcare delivery, underscoring Endo's role as a dependable partner in patient treatment, especially highlighted by industry-wide supply chain issues in 2023.

Post-Chapter 11, Endo is strategically focused on growth, notably through its planned merger with Mallinckrodt, aiming for greater market strength. Investments in its core assets and a focus on expanding its R&D pipeline are key to future revenue and market positioning.

| Value Proposition | Description | Key Impact |

|---|---|---|

| Branded Pharmaceuticals | Differentiated therapies for unmet medical needs (e.g., XIAFLEX). | Improved patient outcomes, alternative treatment options. |

| Generic Pharmaceuticals | Cost-effective alternatives to branded drugs. | Increased patient access, reduced healthcare spending. |

| Sterile Injectables Supply | Reliable delivery of essential hospital medications. | Ensured patient care continuity, support for critical treatments. |

| Post-Restructuring Strategy | Focus on growth via mergers and R&D pipeline expansion. | Enhanced market competitiveness, future innovation. |

Customer Relationships

Endo International fosters dedicated relationships with healthcare professionals through its sales force and Medical Science Liaisons (MSLs). These teams directly engage physicians and specialists, providing essential education on Endo’s products and addressing complex medical questions. This direct interaction is vital for driving product adoption and ensuring ongoing physician support, a cornerstone of their customer relationship strategy.

Endo International cultivates crucial partnerships with pharmaceutical wholesalers and distributors, essential for its market reach. These relationships are actively managed by dedicated account teams, ensuring seamless integration into Endo's supply chain. This strategic approach prioritizes efficient order processing and robust logistics.

The core of these partnerships lies in guaranteeing timely product delivery and maintaining competitive pricing structures. For instance, in 2024, Endo continued to refine its distribution networks, aiming to optimize inventory levels across major wholesale channels like McKesson, Cardinal Health, and AmerisourceBergen, which collectively handle a significant portion of U.S. pharmaceutical distribution.

These operational collaborations are the bedrock of Endo's business model, enabling its products to consistently reach pharmacies and healthcare providers nationwide. The emphasis on smooth logistics and reliable supply underscores the importance of these wholesale and distributor relationships for sustained market presence and revenue generation.

Endo International, for specific branded medications, provides patient support programs designed to help individuals access their treatments, stay on track with their prescribed regimens, and gain a better understanding of their conditions. These initiatives are crucial for improving how well patients do with their therapy and making their overall journey better. For instance, in 2023, Endo reported significant investment in patient assistance, with programs helping thousands of patients navigate insurance complexities and co-pay burdens.

Online Resources and Professional Education

Endo International leverages digital channels to foster strong customer relationships within the healthcare sector. Their online resources provide an accessible hub for healthcare professionals, delivering crucial product information, up-to-date scientific data, and continuing education materials. This digital infrastructure is key to supporting the ongoing professional development of their user base.

These online platforms serve as vital conduits for communication and support, ensuring that healthcare providers remain informed and empowered. By offering readily available, high-quality educational content, Endo cultivates loyalty and facilitates a deeper understanding of their product offerings and their clinical applications.

- Digital Engagement: Endo offers online portals featuring product details, scientific research, and educational modules for healthcare providers.

- Professional Development: These digital resources are designed to support the continuous learning and skill enhancement of medical professionals.

- Information Accessibility: The platforms ensure that relevant and timely information is easily accessible, streamlining access to critical data.

- Ongoing Support: Digital channels facilitate consistent communication and assistance, reinforcing Endo's commitment to its customer base.

Strategic Account Management for Healthcare Systems

For major healthcare systems and hospital networks, Endo International leverages strategic account management to cultivate robust relationships. This involves deeply understanding their unique requirements and delivering customized solutions, especially for their sterile injectables portfolio.

This dedicated approach is designed to foster enduring partnerships, ensuring Endo provides comprehensive and responsive service delivery that aligns with the evolving needs of these critical clients.

- Deep Relationship Building: Endo's strategic account managers focus on creating strong, collaborative ties with key decision-makers within large healthcare organizations.

- Needs Assessment: A core function involves thoroughly analyzing the specific operational and therapeutic needs of each healthcare system.

- Tailored Solutions: Based on these assessments, Endo develops and presents bespoke product and service packages, particularly emphasizing their sterile injectables.

- Long-Term Partnerships: The ultimate goal is to transition from a transactional vendor relationship to a strategic, long-term alliance, ensuring mutual growth and sustained value.

Endo International's customer relationships are multifaceted, extending from direct engagement with healthcare professionals to strategic alliances with distribution partners and patient support initiatives. In 2024, the company continued to emphasize its direct sales force and Medical Science Liaisons to educate physicians, while also reinforcing its digital platforms to provide accessible product information and educational resources.

Channels

Endo International primarily leverages a robust network of independent wholesale distributors as its main channel. These distributors are crucial for getting both branded and generic medications to a wide array of customers, including pharmacies, hospitals, and various healthcare clinics throughout the United States. This extensive distribution network is fundamental for achieving broad market penetration and ensuring product availability.

Endo International relies heavily on its direct sales force to connect with healthcare providers, including physicians and specialists like urologists and orthopedists. This team is crucial for educating medical professionals about Endo's branded specialty products, fostering understanding and driving adoption.

The direct engagement allows for personal relationships to be cultivated, which in turn influences prescribing habits. This personal touch is key for promoting complex or novel treatments within their portfolio.

In 2024, pharmaceutical companies like Endo often invest significantly in their sales forces, recognizing their direct impact on market share. For instance, a substantial portion of a pharmaceutical company's operating budget is typically allocated to sales and marketing, reflecting the importance of direct physician outreach.

Hospitals and Integrated Delivery Networks (IDNs) are crucial channels for Endo International's sterile injectable products, particularly for critical care medications. Sales often involve direct engagement with these healthcare systems or through carefully negotiated distribution agreements. For instance, in 2024, the hospital sector continued to be a primary driver for injectable pharmaceuticals due to its high volume of patient care.

Endo International strategically focuses on direct relationships with hospitals and IDNs to navigate their complex procurement processes. Securing formulary approvals, which means getting their products listed on the hospital's approved medication list, is paramount for ensuring consistent product availability and sales. This direct approach allows for better understanding of institutional needs and facilitates timely supply chain management.

Retail and Specialty Pharmacies

Endo International's products are distributed to patients primarily through a network of retail and specialty pharmacies. These pharmacies act as the final point of access, dispensing medications prescribed by doctors. For instance, in 2024, the U.S. retail pharmacy market was valued at an estimated $430 billion, highlighting the significant reach of this channel.

Maintaining strong relationships with both large chain pharmacies and independent drugstores is vital. Specialty pharmacies play an equally important role, particularly for complex or high-cost medications, requiring specialized handling and patient support services. Endo’s strategy focuses on ensuring consistent product availability and appropriate inventory levels at these diverse points of sale to facilitate patient access to their treatments.

- Retail Pharmacies: Chain and independent pharmacies are key partners for dispensing Endo's broad range of pharmaceutical products to the general patient population.

- Specialty Pharmacies: These pharmacies are critical for medications requiring specific storage, administration, or patient support, enhancing treatment adherence for complex conditions.

- Product Availability: Ensuring that pharmacies have adequate stock of Endo's medications is paramount for patient access and physician trust.

- Patient Access: The effectiveness of this channel directly impacts how easily patients can obtain and begin their prescribed treatments.

Digital Platforms and Professional Portals

Endo International leverages its corporate website and specialized professional portals as crucial channels for communicating with a broad audience. These digital platforms are instrumental in disseminating vital information regarding its pharmaceutical products, offering transparent investor relations updates, and providing valuable educational content to healthcare professionals and patients alike. For example, in 2024, their investor relations section likely featured quarterly earnings reports and SEC filings, accessible to a global financial community.

While these digital avenues may not directly facilitate every product sale, they are fundamental for building brand awareness, fostering trust, and enabling informed decision-making among key stakeholders. They serve as the primary touchpoint for disseminating scientific data, clinical trial results, and corporate news, ensuring that the company’s message reaches its intended recipients effectively. These portals are essential for managing the company's reputation and providing ongoing support and information.

Key functions of these digital platforms include:

- Product Information Dissemination: Providing detailed information on Endo's diverse product portfolio, including indications, dosage, and safety profiles.

- Investor Relations: Offering access to financial reports, press releases, and shareholder meeting information to the investment community.

- Educational Content: Sharing resources, webinars, and publications aimed at healthcare providers to support informed prescribing practices.

- Corporate Communications: Broadcasting company news, sustainability initiatives, and corporate social responsibility efforts.

Endo International's channels are diverse, encompassing wholesale distributors for broad reach, direct sales forces engaging healthcare professionals, and hospitals/IDNs for specialized products. Retail and specialty pharmacies serve as the final patient access points, supported by digital platforms for information dissemination and investor relations. In 2024, the pharmaceutical industry's reliance on direct physician engagement and robust supply chains remained critical, with the U.S. retail pharmacy market alone valued at approximately $430 billion.

Customer Segments

Healthcare professionals, particularly physicians and surgeons in fields like orthopedics and urology, represent a crucial customer segment for Endo International. These specialists are the primary prescribers and administrators of Endo's branded and generic pharmaceutical products, directly influencing patient access and treatment outcomes.

Their specialized knowledge and direct patient interaction make their adoption and preference for Endo's offerings paramount to the success of its product portfolio. For instance, in 2024, Endo continued to focus on its pain management and orthopedics segments, areas heavily reliant on the trust and expertise of specialized physicians.

Hospitals, clinics, and large integrated healthcare systems represent a core customer segment for Endo International. These institutions are particularly interested in Endo's sterile injectable products and other offerings geared towards institutional use. Their primary drivers for purchasing are cost-effectiveness, ensuring a consistent and reliable supply chain, and maintaining high standards of patient care. In 2024, the global hospital market was valued at approximately $1.3 trillion, with a significant portion attributed to pharmaceutical and medical supply procurement.

Pharmaceutical wholesalers and Pharmacy Benefit Managers (PBMs) are crucial partners for Endo International, acting as gatekeepers within the complex drug distribution and access system. Wholesalers, such as McKesson, Cardinal Health, and AmerisourceBergen, buy Endo's products in bulk and manage their physical delivery to pharmacies and hospitals. In 2024, these three major wholesalers continued to dominate the U.S. pharmaceutical distribution market, processing billions of dollars in drug sales annually, which directly impacts Endo's sales volume and reach.

PBMs, like Express Scripts (Cigna), CVS Caremark, and Optum Rx, play an equally vital role by negotiating drug prices and managing prescription formularies on behalf of insurers and employers. Their decisions significantly influence which of Endo's medications are covered and at what cost to patients. For instance, PBMs' formulary placement can determine whether Endo's brands gain preferred status, impacting prescription volumes and market share. The consolidation within the PBM sector in recent years means fewer, larger entities hold substantial power in these negotiations.

Patients (Indirect Beneficiaries)

While Endo International doesn't directly engage with patients for sales, they are the ultimate recipients and beneficiaries of the company's pharmaceutical products. Endo focuses its development and marketing efforts on addressing critical patient needs across several key therapeutic areas, aiming to improve their quality of life and health outcomes.

The company's mission is deeply rooted in enhancing patient outcomes and ensuring access to vital therapies. For instance, in 2024, Endo continued its focus on pain management and urology, areas where patient access and effective treatment are paramount. Their commitment is reflected in ongoing research and development aimed at creating better treatment options.

- Therapeutic Focus: Endo primarily serves patients dealing with pain management, urological conditions, and other specific health challenges.

- Indirect Engagement: Patients benefit from Endo's innovations through prescriptions from healthcare providers, making them the end-users of the company's solutions.

- Outcome-Oriented Mission: The ultimate success of Endo's business is measured by the positive impact its medications have on patient health and well-being.

- Access to Therapies: Ensuring that patients can access and afford necessary treatments remains a critical consideration for the company's market strategy.

Government Health Programs and Payers

Government health programs and payers, encompassing entities like Medicare, Medicaid, and numerous private insurance companies, are critical customers for pharmaceutical companies. These organizations determine which drugs are covered and at what cost, directly influencing patient access and overall sales. In 2024, for instance, Medicare Part D covered a vast number of prescriptions, highlighting the immense market share controlled by such programs. Their formulary decisions, often influenced by clinical efficacy and cost-effectiveness, are paramount for a drug's market penetration and commercial success. Therefore, cultivating and maintaining strong, collaborative relationships with these payers is not just beneficial, but essential for long-term market viability and revenue generation.

Key aspects of this customer segment include:

- Reimbursement Influence: Payers dictate the financial terms of drug acquisition, impacting affordability and adoption.

- Formulary Placement: Inclusion on preferred drug lists directly translates to higher prescription volumes.

- Market Access Negotiations: Success hinges on demonstrating value and negotiating favorable reimbursement agreements.

- Regulatory Compliance: Adherence to payer-specific guidelines and reporting requirements is mandatory.

Endo International's customer segments are diverse, ranging from direct prescribers to the ultimate beneficiaries of their therapies. Understanding these distinct groups is key to their market strategy.

Healthcare professionals, including physicians and surgeons in specialties like orthopedics and urology, are primary influencers and prescribers. Hospitals and integrated healthcare systems are significant purchasers, especially for sterile injectables, driven by cost-effectiveness and supply chain reliability. In 2024, the global hospital market was valued at approximately $1.3 trillion, underscoring the importance of this segment.

Pharmaceutical wholesalers and Pharmacy Benefit Managers (PBMs) are critical intermediaries. Wholesalers ensure product distribution, while PBMs manage formularies and pricing, heavily influencing market access. Major PBMs like CVS Caremark and Optum Rx wield considerable power in drug access negotiations.

Government health programs and private payers, such as Medicare and major insurance companies, are essential customers. Their formulary decisions and reimbursement rates, exemplified by Medicare Part D's extensive coverage in 2024, directly impact sales volumes and market penetration. Endo must demonstrate clinical value and cost-effectiveness to secure favorable terms.

| Customer Segment | Role in Endo's Business Model | Key Drivers | 2024 Relevance |

| Healthcare Professionals (Physicians, Surgeons) | Prescribers and administrators of therapies | Clinical efficacy, patient outcomes, product familiarity | Crucial for adoption in pain management and urology |

| Hospitals and Healthcare Systems | Bulk purchasers of institutional products | Cost-effectiveness, supply chain reliability, patient care standards | Significant buyers of sterile injectables |

| Pharmaceutical Wholesalers | Distributors of products to healthcare providers | Volume purchasing, efficient logistics | Dominant in U.S. pharmaceutical distribution |

| Pharmacy Benefit Managers (PBMs) | Negotiators of drug pricing and formulary placement | Cost control, formulary effectiveness, patient access | Gatekeepers influencing prescription volumes |

| Government Health Programs & Private Payers | Determiners of drug coverage and reimbursement | Clinical value, cost-effectiveness, regulatory compliance | Shape market access and revenue through formulary decisions |

Cost Structure

Endo International dedicates a substantial portion of its financial resources to Research and Development (R&D). These expenses encompass the crucial stages of drug discovery, rigorous preclinical testing, and extensive clinical trials, along with the complex process of regulatory submissions. For instance, in 2023, Endo reported approximately $274 million in R&D expenses, highlighting the significant investment required in this area.

These investments are fundamental to Endo's strategy of developing innovative new pharmaceutical products and enhancing its existing portfolio. The company's commitment to R&D is a primary catalyst for its long-term growth trajectory, aiming to bring new treatments to market and address unmet medical needs.

Manufacturing and production costs for Endo International are significant, encompassing everything from the procurement of raw materials and skilled labor to the overhead required to run its specialized facilities. These expenses are fundamental to the company's operations, directly influencing the profitability of its diverse product lines. For instance, in 2023, the company continued to navigate the complexities of its supply chain and production efficiency, a key factor for any pharmaceutical manufacturer.

The pharmaceutical industry demands rigorous quality control, adding another layer of substantial cost to the manufacturing process. Ensuring compliance with stringent regulatory standards, such as those set by the FDA, requires significant investment in testing, validation, and adherence protocols. This focus on quality is non-negotiable and directly impacts the final cost of goods sold, as well as the company's reputation and market access.

Efficiency in these manufacturing operations is paramount for Endo International to maintain healthy gross margins. Streamlining production processes, optimizing resource allocation, and managing inventory effectively are critical levers for profitability. As of the first quarter of 2024, the company's focus on operational improvements aimed at reducing these costs while maintaining high product quality remained a core strategic objective.

Sales, Marketing, and Administrative (SG&A) expenses are a significant component of Endo International's cost structure, encompassing all activities related to bringing products to market and running the business. These costs include sales force compensation, which can be substantial given the pharmaceutical industry's reliance on direct sales teams, as well as advertising and promotional activities designed to build brand awareness and drive prescription volume. In 2023, Endo International reported SG&A expenses of approximately $850 million, reflecting the ongoing investment in commercialization efforts.

These expenditures are critical for Endo's strategy to achieve market penetration and maintain product demand. For instance, the company's investment in marketing campaigns for its pain management and generics portfolios directly impacts sales volumes. Efficient management of these SG&A costs is therefore paramount to achieving operational leverage, allowing the company to translate revenue growth into profitability.

Regulatory and Legal Compliance Costs

Endo International navigates a pharmaceutical landscape demanding substantial investment in regulatory and legal compliance. These expenses are critical for maintaining operations within stringent industry standards and addressing historical legal challenges.

In 2024, these costs remain a significant factor, reflecting the ongoing need for adherence to FDA regulations and other global health authorities. Past litigation, particularly concerning opioid settlements, has necessitated substantial financial provisions.

The company's 2022 Chapter 11 restructuring was designed to alleviate many of these legacy liabilities. However, ongoing legal and compliance efforts are still a substantial part of the cost structure.

- Regulatory Adherence: Costs associated with meeting FDA, EMA, and other global health authority requirements for drug development, manufacturing, and marketing.

- Legal Defense and Settlements: Expenses related to ongoing litigation, including product liability claims and past agreements, such as the significant opioid settlement.

- Compliance Monitoring: Investments in systems and personnel to ensure continuous adherence to evolving legal and regulatory frameworks.

- Restructuring Impact: While the 2022 restructuring aimed to resolve many prior legal issues, ongoing costs for managing remaining liabilities and compliance are still incurred.

Interest Expense and Debt Servicing

Following its emergence from Chapter 11 bankruptcy in October 2022, Endo International plc operates with a restructured capital base. While debt levels have been significantly reduced, interest expenses remain a material component of its cost structure. For instance, in the first quarter of 2024, Endo reported approximately $110 million in interest expense. This highlights the ongoing financial commitment associated with its remaining debt obligations.

Effective management of this debt is paramount for Endo's financial stability and its ability to invest in future growth. The company's strategic focus includes optimizing its debt servicing capabilities to ensure long-term viability. This involves careful consideration of refinancing options and maintaining a disciplined approach to borrowing.

- Reduced Debt Load: Post-bankruptcy, Endo's debt burden has been substantially lowered, impacting its overall cost of capital.

- Significant Interest Payments: Despite reductions, interest expense continues to be a notable ongoing cost for the company, as seen in Q1 2024 figures.

- Crucial Debt Management: Efficiently handling debt servicing is vital for Endo's financial health, impacting its capacity for operational investment and strategic initiatives.

Endo International's cost structure is significantly influenced by its operational expenditures, including manufacturing, sales, marketing, and administrative functions. These are critical for product delivery and market presence.

Research and Development (R&D) remains a substantial investment, crucial for pipeline expansion and product innovation. In 2023, R&D expenses were approximately $274 million, underscoring the commitment to new treatments.

Manufacturing costs are also a key component, encompassing raw materials, labor, and adherence to stringent quality control standards. The company's focus on operational efficiency in 2024 aims to mitigate these costs while maintaining quality.

Sales, Marketing, and Administrative (SG&A) expenses were around $850 million in 2023, reflecting significant spending on commercialization efforts to drive product demand and market penetration.

| Cost Category | 2023 ($ Millions) | Q1 2024 ($ Millions) | Key Drivers |

|---|---|---|---|

| Research & Development | 274 | N/A | Drug discovery, clinical trials, regulatory submissions |

| Manufacturing & Production | N/A | N/A | Raw materials, labor, quality control, overhead |

| Sales, Marketing & Administrative (SG&A) | 850 | N/A | Sales force, advertising, promotional activities |

| Interest Expense | N/A | 110 | Debt servicing post-restructuring |

| Legal & Compliance | N/A | N/A | Regulatory adherence, litigation, settlements |

Revenue Streams

Endo International's primary revenue source is the sale of its branded pharmaceutical products. A significant contributor to this is XIAFLEX®, a treatment for specific medical conditions. These branded drugs typically achieve higher price points due to their proprietary formulations, patent protection, and targeted therapeutic uses.

In 2023, Endo reported total net sales of approximately $2.6 billion. The company's strategy is heavily weighted towards expanding sales within its branded pharmaceutical segment, aiming for continued growth in this area. This focus on branded products is crucial for maintaining profitability and market position.

Revenue streams for generic pharmaceutical product sales at Endo International are built on the volume sales of a broad range of off-patent medications. These products are crucial for market access to essential medicines and form a stable revenue base, though they are inherently more price-sensitive due to intense competition.

In 2024, the generics market remains highly competitive, with numerous players vying for market share. Endo’s strategy in this segment focuses on maintaining a diverse portfolio to cater to various therapeutic areas, aiming for consistent, albeit lower-margin, revenue generation.

Sales of sterile injectable products, encompassing critical care and other hospital-based medicines, form a significant revenue stream for Endo International. In 2024, the company's strategic focus is on revitalizing growth within this segment, driven by the introduction of new products and efforts to broaden customer adoption. These offerings are indispensable within institutional healthcare settings, contributing substantially to patient treatment protocols.

New Product Launches and Pipeline Advancements

Endo International anticipates significant future revenue growth driven by its robust new product launches and advancements within its development pipeline. The company's strategic investments in research and development are specifically targeted at bringing innovative therapies to market, thereby cultivating new revenue streams. This focus includes the expansion of its sterile injectables portfolio and securing new indications for its existing branded products.

The company's strategy for future revenue generation heavily relies on the successful introduction of new pharmaceuticals. These upcoming products are expected to address unmet medical needs and capture market share, directly contributing to top-line growth. For instance, in 2024, Endo continued to focus on expanding its sterile injectables offerings, a segment known for its consistent demand and potential for recurring revenue.

- Pipeline Advancements: Future revenue growth hinges on bringing new products from the R&D pipeline to market.

- Sterile Injectables: Expansion of this segment is a key driver for new revenue opportunities.

- New Indications: Obtaining new uses for existing branded products will create additional revenue streams.

- R&D Investment: Ongoing investment fuels the innovation necessary for these future revenue sources.

Licensing and Royalty Agreements

Endo International PLC, in its ongoing business operations, has historically leveraged licensing and royalty agreements as a method to generate revenue. This involves allowing other companies to utilize Endo's intellectual property, such as patents or proprietary technologies, in exchange for upfront fees or ongoing royalty payments based on sales. While typically a less significant revenue contributor compared to direct product sales, these agreements offer a valuable diversification of income streams.

The divestiture of Endo's International Pharmaceuticals business in 2022, for instance, included an upfront cash payment and provisions for potential future milestone payments tied to the performance of the divested assets. These types of arrangements are common in the pharmaceutical industry, allowing companies to monetize their innovations without bearing the full cost and risk of global commercialization for every product.

Key aspects of Endo's licensing and royalty revenue streams can be summarized as follows:

- Intellectual Property Monetization: Licensing agreements allow Endo to earn revenue from its patents and technologies by granting rights to third parties.

- Royalty Income: Royalties are earned when partners commercialize products that incorporate Endo's licensed intellectual property, with payments typically calculated as a percentage of sales.

- Diversified Revenue: These agreements provide an additional, often recurring, revenue source that is not directly tied to Endo's own sales force or marketing efforts.

- Strategic Partnerships: Licensing can facilitate market penetration in regions or therapeutic areas where Endo may not have a direct commercial presence, generating income while minimizing operational risk.

Endo International's revenue is primarily generated through branded pharmaceuticals, with XIAFLEX® being a key product. The company also generates revenue from generic drug sales and sterile injectables. In 2023, total net sales reached approximately $2.6 billion, with a strategic emphasis on growing the branded segment.

The generics segment, while competitive in 2024, provides a stable revenue base through a diverse portfolio of off-patent medications. Endo's sterile injectables are crucial for hospital settings, and the company is focusing on new product introductions and broader adoption in 2024 to revitalize growth in this area.

Future revenue growth is anticipated from new product launches and pipeline advancements, with significant investment in R&D to bring innovative therapies to market. Licensing and royalty agreements also contribute by monetizing intellectual property through partnerships, offering a diversified income stream.

| Revenue Stream | 2023 Net Sales (Approx.) | 2024 Strategic Focus |

|---|---|---|

| Branded Pharmaceuticals | Significant portion of $2.6B total | Growth of XIAFLEX® and new branded products |

| Generic Pharmaceuticals | Core revenue base | Maintaining diverse portfolio, market access |

| Sterile Injectables | Key contributor | New product introductions, broader customer adoption |

| Licensing & Royalties | Diversified income | Monetizing intellectual property, strategic partnerships |

Business Model Canvas Data Sources

The Endo International Business Model Canvas is informed by a blend of internal financial data, public market research on the pharmaceutical sector, and competitive intelligence gathered from industry reports. This triangulation ensures a robust and data-driven strategic overview.