Endo International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endo International Bundle

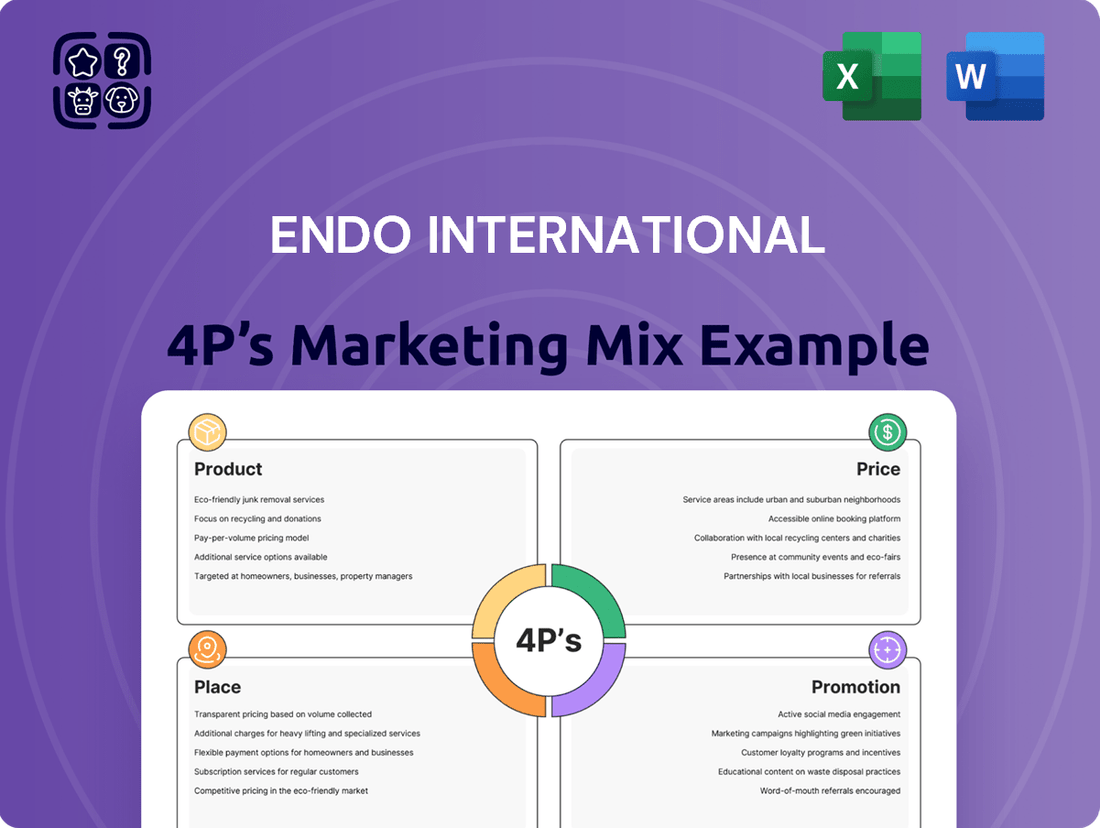

Endo International's marketing mix is a complex interplay of specialized pharmaceuticals and medical devices. Their product strategy focuses on niche therapeutic areas, while pricing reflects the value and innovation of their offerings. Understanding their distribution channels and promotional activities is key to grasping their market impact.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Endo International's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the pharmaceutical sector.

Product

Endo, Inc.'s branded pharmaceutical portfolio is anchored by XIAFLEX®, a critical product that generated record revenues in 2024. This medication provides a non-surgical approach for patients suffering from conditions like Peyronie's disease and Dupuytren's contracture, highlighting its therapeutic value and market demand.

The company is actively engaged in expanding the market presence for its branded offerings. This strategy aims to foster long-term growth and ensure that patients can readily access these important treatments, reinforcing Endo's commitment to patient care and market penetration.

Endo International's diverse generic offerings are a cornerstone of its business, primarily reaching the U.S. market through wholesalers. This broad portfolio includes many cost-effective alternatives to branded drugs, serving a wide range of patient needs.

A key contributor to Endo's revenue stream is its Lidocaine patch 5%. In 2024, this single product represented a significant portion of the company's consolidated revenues, highlighting the importance of its generic segment.

While the generic pharmaceutical market is highly competitive, Endo maintains its presence by focusing on providing affordable medication options. This strategy allows them to cater to a substantial patient base seeking value.

Endo International's sterile injectables, primarily serving U.S. hospitals, represent a significant portion of their business with roughly 40 products currently available. These offerings are designed to simplify hospital operations by providing pre-prepared, FDA-approved medications, thereby reducing the burden on healthcare professionals. The recent introduction of ADRENALIN® ready-to-use premixed bags exemplifies their dedication to growing this essential product category.

Active Pipeline and Development

Endo International is actively cultivating its product pipeline, especially in sterile injectables. They are targeting new FDA submissions and product launches for 2025, aiming for sustained growth. This proactive approach is designed to introduce novel therapies and unique product options.

The company's strategic investment in its development pipeline is a key component of its long-term vision. By focusing on sterile injectables, Endo is positioning itself to capitalize on a growing market segment. This ensures a consistent flow of innovative treatments that can address unmet medical needs and drive future revenue streams.

Furthermore, Endo's pipeline extends to exploring new applications for its existing branded products. This strategy leverages current assets by identifying and pursuing new indications, potentially expanding market reach and enhancing the value of established therapies.

Key aspects of Endo's Active Pipeline and Development include:

- Focus on Sterile Injectables: Strategic development in this high-growth area.

- 2025 FDA Submissions & Launches: Targeting new product introductions in the upcoming year.

- Pipeline Expansion: Commitment to a steady stream of new therapies.

- New Indications for Existing Products: Maximizing value from current branded assets.

Therapeutic Area Specialization

Endo International's product strategy centers on deep specialization within key therapeutic areas. This focus includes urology, orthopedics, and medical aesthetics, alongside a commitment to inflammatory diseases and autoimmune disorders. This targeted approach enables Endo to craft precise solutions for distinct patient groups, capitalizing on its accumulated knowledge to meet significant unmet medical needs.

The company's deliberate expansion in these crucial sectors has been significantly amplified by strategic acquisitions. For instance, in late 2023 and early 2024, Endo continued to assess opportunities that align with its core therapeutic strengths, aiming to enrich its product offerings and solidify its market position in these specialized fields. This strategy is designed to foster innovation and deliver greater value to patients and healthcare providers.

Endo's commitment to therapeutic area specialization is a cornerstone of its marketing mix, influencing product development and market penetration. By concentrating resources and expertise, the company aims to become a leader in its chosen niches. This is supported by ongoing research and development efforts, with a notable focus on expanding its pain management portfolio within the orthopedic space, an area that saw significant market growth in 2024.

The company's portfolio is a testament to this specialization:

- Urology: Focus on treatments for conditions like overactive bladder and prostate cancer.

- Orthopedics: Emphasis on pain management solutions, particularly post-operative care, a segment projected to grow by 5-7% annually through 2025.

- Medical Aesthetics: Development of products for cosmetic and reconstructive procedures.

- Inflammatory & Autoimmune Diseases: Targeted therapies for conditions such as rheumatoid arthritis and Crohn's disease.

Endo International's product strategy centers on specialized therapeutic areas like urology and orthopedics, aiming to address unmet medical needs. The company's branded portfolio includes XIAFLEX®, which achieved record revenues in 2024, and a strong generic segment, highlighted by the significant contribution of its Lidocaine patch 5% to overall revenue. Endo is also expanding its sterile injectables business, with approximately 40 products serving U.S. hospitals and new FDA submissions planned for 2025.

| Product Category | Key Products/Focus Areas | 2024/2025 Data Points |

|---|---|---|

| Branded Pharmaceuticals | XIAFLEX® | Record revenues in 2024; treats Peyronie's disease and Dupuytren's contracture. |

| Generic Pharmaceuticals | Lidocaine patch 5% | Significant contributor to consolidated revenues in 2024; focus on affordable alternatives. |

| Sterile Injectables | ADRENALIN® premixed bags | 40+ products for U.S. hospitals; new FDA submissions and launches targeted for 2025. |

What is included in the product

This analysis provides a comprehensive overview of Endo International's marketing strategies, examining its Product portfolio, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It offers insights into how Endo International positions itself within the competitive pharmaceutical landscape, detailing its product offerings, pricing structures, market access, and promotional campaigns.

Streamlines the understanding of Endo International's marketing strategy by presenting its 4Ps as solutions to market access and patient pain points.

Offers a clear, concise view of how Endo's Product, Price, Place, and Promotion strategies address key challenges in the pharmaceutical landscape.

Place

Endo International leverages an extensive wholesale distribution network to ensure its generic pharmaceuticals reach a wide array of patients. This network is a cornerstone of their strategy, facilitating the broad availability of their cost-effective medications. In 2024, Endo reported significant revenue driven by the efficient movement of these products through established channels, reaching countless pharmacies nationwide.

Endo International’s sterile injectables reach over 95% of U.S. hospitals directly. This extensive network ensures critical medicines are readily available. The company’s direct engagement fosters tailored supply solutions and efficient logistics, directly supporting healthcare providers in managing patient care needs.

By partnering directly with these healthcare systems, Endo integrates its products smoothly into existing clinical workflows. This approach emphasizes collaboration to optimize the delivery and administration of essential treatments.

Endo International is strategically divesting its International Pharmaceuticals business, with the deal anticipated to finalize around mid-2025. This significant shift is designed to sharpen Endo's strategic focus and reallocate resources primarily to its core U.S. pharmaceutical operations. The company projects this will allow for a more concentrated approach to key domestic markets, enhancing its competitive position within the United States.

Importance of Supply Chain Resilience

For Endo International, the importance of a resilient supply chain within its marketing mix is paramount, especially considering the critical nature of its pharmaceutical products like sterile injectables. Many of these essential medications are produced domestically in the U.S., underscoring the need for a robust and dependable manufacturing and distribution network. Endo’s commitment to operational excellence directly impacts its ability to consistently supply the market.

Ensuring the continuous availability of its products and effectively managing any potential supply disruptions are key to meeting patient demand and maintaining market access. This focus is not just about production; it’s about ensuring that patients who rely on Endo’s medications can access them without interruption. A strong supply chain underpins Endo's market presence and its reputation for reliability.

In 2024, the pharmaceutical industry, including companies like Endo, continued to navigate complex global supply chain challenges. Factors such as geopolitical instability, raw material shortages, and logistical bottlenecks have amplified the need for proactive supply chain management. Endo’s strategy to concentrate sterile injectable manufacturing in the U.S. aims to mitigate some of these risks, offering greater control and potentially reducing lead times.

- Domestic Manufacturing Focus: Endo’s emphasis on U.S.-based manufacturing for sterile injectables aims to enhance supply chain visibility and control.

- Patient Access Imperative: Continuous product availability is critical for patient health outcomes and adherence to treatment plans.

- Operational Excellence: A resilient supply chain is a cornerstone of Endo’s strategy to maintain consistent market presence and meet demand.

- Risk Mitigation: Proactive management of supply chain disruptions is essential in the face of ongoing global logistical and material challenges.

Digital and Online Presence for Information

Endo International leverages its digital and online presence as a crucial component of its marketing mix, specifically within the 'Place' element, focusing on information accessibility. While direct product transactions occur via traditional healthcare channels, the company's official website and dedicated investor relations portal serve as primary digital 'places' for stakeholder engagement. These platforms are vital for disseminating key corporate information.

These digital channels provide readily available access to critical data, including financial results, comprehensive product portfolios, and up-to-date corporate announcements. For instance, as of early 2024, Endo's investor relations site typically features quarterly earnings reports, SEC filings, and presentations, offering transparency to shareholders. This digital infrastructure acts as an essential touchpoint for a wide audience, from potential investors and financial analysts to healthcare professionals seeking product details and the general public interested in corporate developments.

- Website as Information Hub: Endo's official website (endo.com) functions as a central repository for company news, product information, and corporate social responsibility initiatives.

- Investor Relations Portal: A dedicated section on their website provides investors with access to financial statements, annual reports, and webcast information, facilitating informed decision-making.

- Digital Accessibility: The online presence ensures that information is accessible 24/7 to a global audience, overcoming geographical limitations inherent in physical distribution.

- Stakeholder Communication: These platforms are critical for maintaining communication with investors, healthcare providers, and the public, building trust and transparency.

Endo International's distribution strategy for its generic pharmaceuticals relies heavily on a broad wholesale network, ensuring widespread availability across the U.S. In 2024, this efficient network was instrumental in driving significant revenue, making their cost-effective medications accessible to numerous pharmacies.

Their sterile injectables boast an impressive reach, supplying over 95% of U.S. hospitals directly. This direct engagement allows for customized supply solutions and streamlined logistics, directly supporting healthcare providers in managing patient needs and ensuring critical medicines are always on hand.

The company's strategic divestment of its International Pharmaceuticals business, expected to conclude around mid-2025, signals a sharpened focus on its core U.S. operations. This move is anticipated to bolster its competitive standing within the domestic market.

Endo's commitment to domestic manufacturing for sterile injectables, a strategy bolstered by supply chain challenges in 2024, aims to enhance control and reduce lead times, prioritizing patient access and operational excellence.

Same Document Delivered

Endo International 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive Endo International 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This means you know precisely what you're getting—a complete and ready-to-use analysis for your strategic planning. There are no hidden surprises or altered versions; the file is as is. This ensures you can immediately leverage the insights within for your business decisions.

Promotion

Endo International strategically utilizes targeted advertising and promotional campaigns to boost awareness and demand for both its branded and generic pharmaceutical offerings. These initiatives are crucial for educating healthcare providers and patients on the unique advantages and efficacy of their treatments.

For instance, in 2023, Endo reported that its sales of branded products accounted for approximately $1.4 billion of its total revenue, highlighting the importance of marketing efforts for these higher-margin items. The success of these campaigns directly influences product adoption and market share growth.

Endo International's promotion strategy for its specialty and sterile injectable products centers on robust engagement with healthcare professionals. This includes physicians, surgeons, and pharmacists who are key decision-makers in product adoption and patient care. The company focuses on delivering comprehensive product information and supporting data, ensuring professionals understand appropriate usage and clinical benefits.

A significant portion of this promotional effort involves participation in medical conferences and the publication of clinical trial results in peer-reviewed journals. These channels are crucial for building credibility and fostering professional acceptance. For instance, in 2023, Endo likely invested millions in medical education and conference sponsorships to highlight its portfolio, which includes products for pain management and urology.

Direct interaction through medical science liaisons and sales representatives plays a vital role in this engagement. These teams provide in-depth product knowledge, address clinical queries, and support the scientific exchange necessary for informed prescribing. This personal touch is essential for building relationships and ensuring that Endo's offerings are considered for patient treatment plans.

Endo International's Public Relations and Investor Communications strategy is vital, particularly following its Chapter 11 restructuring in 2024 and the subsequent planned merger. The company utilizes press releases and investor calls to clearly articulate its strategic path and financial health, aiming to rebuild confidence among stakeholders. This proactive communication is essential for demonstrating a clear vision for future growth and value.

Transparency in financial reporting is a cornerstone of Endo's approach, fostering trust and solidifying investor confidence. By openly sharing performance metrics and strategic updates, the company seeks to assure its investors of its commitment to a stable and prosperous future, especially in light of significant operational changes.

Patient-Centric Information and Support

Endo International's patient-centric information and support efforts, particularly for branded products like XIAFLEX®, focus on educating patients about non-surgical treatment alternatives for specific medical conditions. This strategy aims to empower individuals to make informed decisions, thereby driving demand for their life-enhancing therapies.

By providing accessible information and support, Endo International helps patients manage their health and improve their quality of life. This commitment to patient well-being is a key component of their marketing strategy, fostering trust and loyalty.

- Patient Education: Initiatives for products like XIAFLEX® highlight non-surgical treatment options.

- Quality of Life Focus: The company aims to support patients in living their best lives.

- Informed Choices: Providing access to information helps drive demand through consumer understanding.

- Therapeutic Access: Support is offered for life-enhancing therapies.

Strategic Realignment and Synergies

Endo International's recent emergence from Chapter 11 bankruptcy proceedings in October 2023, following a restructuring plan, serves as a key element in its strategic realignment. This move is being framed as a significant step towards a more robust financial footing and operational efficiency. The company is actively promoting this transition as a catalyst for future growth and enhanced market positioning.

The planned merger with Mallinckrodt plc, announced in early 2024, is central to Endo's narrative of creating a stronger, more diversified pharmaceutical entity. This combination aims to leverage overlapping strengths and expand market reach, promising significant operational synergies and a broader product portfolio. Endo's communications highlight this as a strategic imperative to navigate the evolving pharmaceutical landscape.

This strategic repositioning is designed to attract renewed investment and foster confidence in Endo's long-term viability. By emphasizing the benefits of complementary portfolios and the pursuit of operational efficiencies, the company seeks to build a compelling case for its future prospects. The narrative is carefully crafted to signal a new era for Endo, focused on innovation and sustainable growth.

- Strategic Realignment: Emergence from Chapter 11 in October 2023, aiming for financial stability.

- Planned Merger: Proposed combination with Mallinckrodt plc to create a diversified leader.

- Synergistic Benefits: Emphasis on leveraging complementary portfolios and operational efficiencies.

- Future Outlook: Positioning the 'new' Endo for enhanced growth and investment attraction.

Endo International's promotion strategy leverages targeted education for healthcare providers and patients, emphasizing product benefits for both branded and generic lines. For instance, in 2023, branded products contributed approximately $1.4 billion to their revenue, underscoring the impact of these promotional efforts.

The company engages healthcare professionals through conferences and clinical publications, aiming to build credibility for its sterile injectables and specialty products. In 2023, significant investment in medical education supported this outreach.

Direct engagement via medical science liaisons and sales representatives provides in-depth product knowledge, crucial for driving adoption. Post-Chapter 11 emergence in October 2023 and the planned 2024 merger with Mallinckrodt are key promotional narratives, focusing on financial stability and future growth.

| Marketing Element | Key Initiatives | 2023 Impact/Focus |

|---|---|---|

| Advertising & Awareness | Targeted campaigns for branded and generic pharmaceuticals | $1.4 billion revenue from branded products |

| Professional Engagement | Medical conferences, peer-reviewed publications, MSLs | Investment in medical education and sponsorships |

| Patient Education | Information on non-surgical treatments (e.g., XIAFLEX®) | Empowering informed patient decisions |

| Corporate Communications | Post-Chapter 11 restructuring, planned merger with Mallinckrodt | Building confidence for future growth and investment |

Price

Endo International's generic segment navigates a fiercely competitive pricing arena. For instance, dexlansoprazole delayed-release capsules, a key product, experience substantial price pressure due to numerous market entrants. This necessitates a delicate balancing act for Endo, aiming to set prices that are attractive enough to capture market share against rivals, while simultaneously safeguarding profit margins in a market where cost is a primary driver for purchasers.

Endo International employs value-based pricing for its branded specialty products like XIAFLEX®, reflecting the unique benefits and non-surgical advantages it offers for specific medical conditions. This strategy is designed to capture the premium value perceived by patients and healthcare providers.

The company's focus on optimizing net selling prices is demonstrated by the revenue growth of XIAFLEX®, which has been bolstered by both increased sales volume and favorable pricing adjustments. For instance, XIAFLEX® net sales in 2023 reached $342 million, a notable increase from $316 million in 2022, underscoring the effectiveness of its value-based approach.

Endo International's pricing strategy is heavily shaped by the dynamic landscape of healthcare reforms and reimbursement policies. Government regulations, tax structures, and evolving reimbursement models directly dictate the prices across its diverse product portfolio, influencing what patients and healthcare systems ultimately pay.

The pharmaceutical sector, including companies like Endo, faces intricate negotiations with payers and must adapt to ongoing healthcare reforms. These external forces are critical determinants of market access and, consequently, revenue generation for the company's offerings.

For instance, the Inflation Reduction Act of 2022, which began impacting Medicare drug prices in 2023, represents a significant policy shift. While Endo's specific products might not be immediately subject to the initial price negotiation phases, the broader legislative intent signals increasing governmental scrutiny on drug pricing, potentially affecting future reimbursement rates and market dynamics for a wide range of pharmaceuticals.

Furthermore, shifts in payer coverage and preferred drug lists, often driven by cost-containment efforts, can indirectly influence Endo's pricing power. Successfully navigating these complex, often opaque, reimbursement pathways is paramount for maintaining competitive pricing and ensuring broad patient access to essential medications.

Strategic Financial Restructuring and Debt Management

Endo International's strategic financial restructuring, completed with its emergence from Chapter 11 bankruptcy in April 2024, has fundamentally altered its debt management and, consequently, its pricing power. The company emerged with substantially reduced debt. For instance, the new capital structure includes new credit facilities, allowing for more agile operations. This deleveraging directly impacts its capacity for competitive pricing and future investment initiatives.

The post-restructuring financial landscape provides Endo with a stronger balance sheet, enabling more strategic financial decisions. This improved financial flexibility is a key component of its marketing mix, influencing how it can position its products in the market. The company's ability to secure new credit facilities and notes post-bankruptcy underscores a renewed confidence in its operational viability.

- Reduced Indebtedness: Endo emerged from Chapter 11 with significantly less debt, enhancing its financial flexibility.

- New Capital Structure: The company operates with new credit facilities and notes, bolstering its balance sheet.

- Pricing Influence: The financial restructuring directly affects Endo's ability to price its products competitively.

- Investment Capacity: A stronger financial position allows for more strategic investment in growth and product development.

Pricing Considerations in Mergers and Acquisitions

The proposed merger between Endo International and Mallinckrodt plc is set to significantly alter pricing considerations within Endo's marketing mix. The combined entity anticipates leveraging complementary product portfolios to create new pricing strategies. For instance, by integrating products that address similar or adjacent therapeutic areas, they could offer bundled solutions or tiered pricing models, potentially increasing market penetration and revenue.

Future pricing will likely be shaped by the consolidated market position and the combined entity's enhanced bargaining power with payers and distributors. Endo's historical pricing for key products like Xiaflex, which generated approximately $280 million in revenue in 2023, will now be evaluated alongside Mallinckrodt's offerings, such as its specialty generics and branded products. This integration aims to optimize pricing across a more diversified range of pharmaceuticals.

The strategic goal is to achieve cost synergies and maximize overall revenue and profitability. This could translate into more competitive pricing for certain products to gain market share or premium pricing for differentiated, high-value therapies. The success of these pricing strategies will hinge on effective integration and a clear understanding of the combined entity's competitive landscape.

Key pricing considerations post-merger could include:

- Portfolio Optimization: Evaluating and adjusting prices for overlapping or complementary products to avoid internal cannibalization and maximize overall revenue.

- Market Access and Reimbursement: Negotiating with payers for better reimbursement rates for the combined product portfolio, leveraging increased scale.

- Competitive Benchmarking: Analyzing competitor pricing for similar therapeutic offerings in the newly integrated market segments.

- Value-Based Pricing: Potentially implementing value-based pricing models for innovative therapies, demonstrating improved patient outcomes to justify higher price points.

Endo International's pricing strategy is a dual approach, balancing competitive pricing for generics with value-based pricing for specialty brands. The company must navigate significant price pressures in the generic market due to intense competition, as seen with dexlansoprazole. Conversely, products like XIAFLEX® command premium pricing, reflecting their unique therapeutic benefits and contributing to notable revenue growth, with net sales reaching $342 million in 2023.

The company's financial restructuring, completing Chapter 11 in April 2024, has significantly bolstered its pricing flexibility. Emerging with substantially reduced debt and new credit facilities, Endo is better positioned to make strategic pricing decisions. This improved financial footing is crucial for negotiating with payers and adapting to healthcare reforms that directly influence market access and revenue.

The proposed merger with Mallinckrodt plc introduces further pricing dynamics, aiming for portfolio optimization and enhanced bargaining power with payers. This integration will likely lead to new pricing strategies, potentially including bundled solutions or tiered pricing, to maximize revenue and profitability across a broader pharmaceutical range.

4P's Marketing Mix Analysis Data Sources

Our Endo International 4P's Marketing Mix Analysis is grounded in comprehensive research, utilizing SEC filings, annual reports, investor presentations, and press releases to understand product portfolio, pricing strategies, distribution channels, and promotional activities. We also incorporate data from industry reports and competitor analyses to ensure a holistic view of their market presence.