Endo International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endo International Bundle

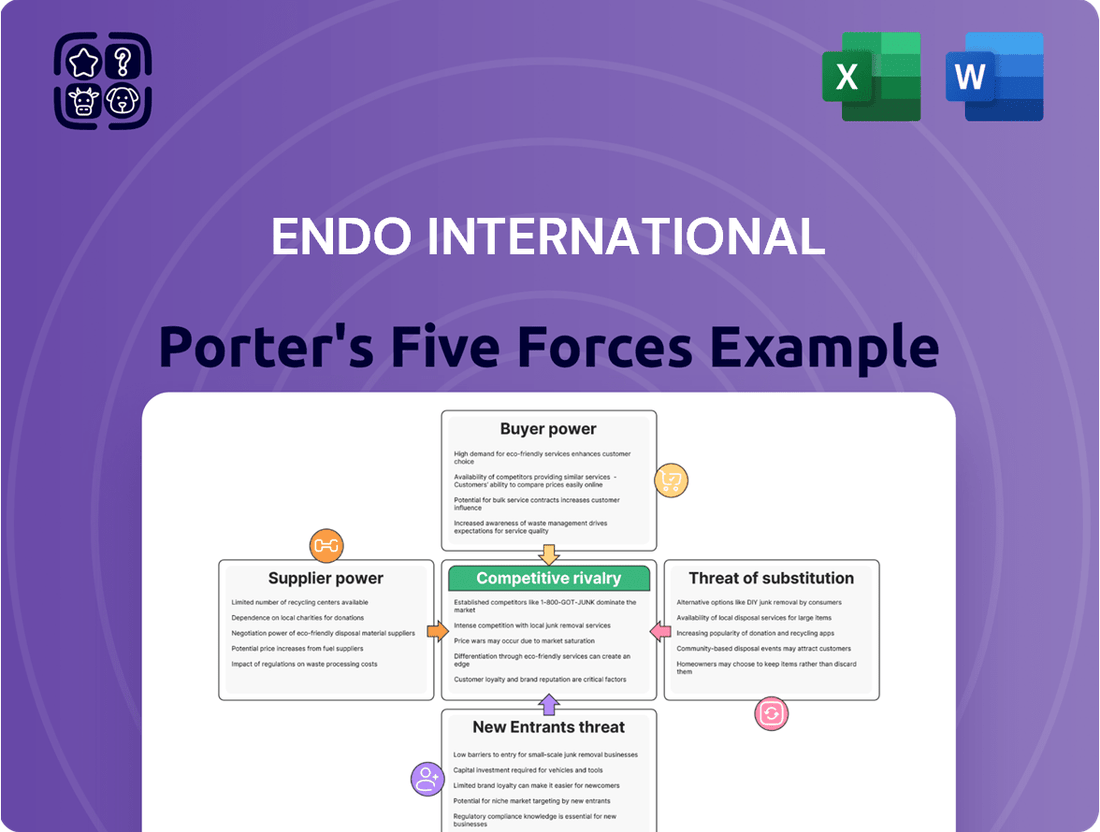

Endo International faces a complex competitive landscape, with significant pressures from rivals, powerful buyers, and the ever-present threat of substitutes. Understanding the dynamics of supplier bargaining power is also crucial to navigating its market. This brief snapshot only scratches the surface of these critical factors.

Unlock the full Porter's Five Forces Analysis to explore Endo International’s competitive dynamics, market pressures, and strategic advantages in detail. Discover how each force impacts their profitability and long-term viability, providing you with the crucial context needed for informed decision-making.

Suppliers Bargaining Power

The pharmaceutical industry, which includes companies like Endo International, often faces concentrated supplier power due to reliance on a few specialized sources for essential raw materials like Active Pharmaceutical Ingredients (APIs). This limited supplier base, with many API manufacturers historically concentrated in regions such as China and India, grants these suppliers significant leverage. For instance, in 2024, the global API market was dominated by a handful of large producers, making it challenging for pharmaceutical firms to switch suppliers without incurring substantial costs and potential production delays.

Switching suppliers in the pharmaceutical industry is a complex and expensive undertaking. It involves navigating stringent regulatory approvals, rigorous quality control validations, and the potential for significant production disruptions. These hurdles create substantial switching costs for companies like Endo International.

For instance, the process of qualifying a new supplier for active pharmaceutical ingredients (APIs) can take years and cost millions of dollars, including extensive testing and documentation to meet FDA standards. This lengthy validation period makes it difficult and costly for pharmaceutical firms to change suppliers, thereby strengthening the bargaining power of their current providers.

This reliance on established relationships and the sheer effort required to change vendors means that existing suppliers often hold considerable leverage. They can command higher prices or more favorable terms because Endo International faces significant financial and operational risks if they attempt to switch.

Suppliers controlling proprietary technologies and patents for essential pharmaceutical ingredients or manufacturing processes wield significant bargaining power. This intellectual property acts as a barrier to entry for other suppliers, limiting Endo International's options for sourcing critical inputs. For instance, if a key active pharmaceutical ingredient (API) is protected by a patent held by a single supplier, Endo would be compelled to negotiate terms with that supplier, potentially leading to higher costs or unfavorable supply agreements.

Impact of Global Supply Chain Challenges

Global supply chain disruptions, fueled by geopolitical events and climate-related issues, continue to bolster supplier leverage within the pharmaceutical sector. These persistent challenges can drive up ingredient costs and limit the availability of critical materials, directly impacting companies like Endo International.

For instance, in 2024, the pharmaceutical industry experienced significant price volatility for active pharmaceutical ingredients (APIs) and excipients due to these ongoing disruptions. This environment grants suppliers more power to dictate terms and pricing.

- Increased Costs: Raw material prices, particularly for specialized chemicals and packaging, saw an average increase of 8-12% in 2024 compared to 2023, squeezing manufacturer margins.

- Limited Availability: Lead times for certain critical components extended by up to 30% in late 2024, forcing manufacturers to hold larger inventories or seek alternative, potentially more expensive, suppliers.

- Geopolitical Impact: Tensions in key manufacturing regions led to a 15% reduction in the supply of certain APIs, creating shortages and price hikes.

- Supplier Consolidation: In specific niches, the number of qualified suppliers has decreased, further concentrating bargaining power among a few entities.

Regulatory Requirements for Quality and Safety

The pharmaceutical industry, including companies like Endo International, operates under intensely strict regulatory frameworks concerning product quality and safety. This means suppliers must meet demanding specifications for raw materials and manufacturing processes.

Meeting these rigorous standards often limits the number of viable suppliers capable of serving the pharmaceutical sector. Consequently, those suppliers who are qualified and compliant gain significant bargaining power due to the essential nature of their role in ensuring regulatory adherence for drug manufacturers.

- Supplier Qualification: Pharmaceutical companies must rigorously vet suppliers to ensure they meet Good Manufacturing Practices (GMP) and other regulatory requirements.

- Impact on Cost: Suppliers who can consistently meet these high standards can often command premium pricing, as the cost of compliance is passed on.

- Supply Chain Reliability: The need for uninterrupted supply of compliant materials grants leverage to established, trusted suppliers.

- Barriers to Entry: The extensive investment required for regulatory compliance creates high barriers to entry for new suppliers, further concentrating power among existing ones.

The bargaining power of suppliers for companies like Endo International is substantial, largely due to the specialized nature of pharmaceutical inputs and the stringent regulatory environment. This concentration of power allows suppliers to influence pricing and terms, impacting Endo's operational costs and strategic flexibility.

Suppliers of Active Pharmaceutical Ingredients (APIs) and specialized excipients often hold significant leverage because of limited qualified sources and high switching costs for manufacturers. For instance, in 2024, the global API market saw price increases averaging 8-12% for specialized chemicals, directly affecting drug production expenses.

This power is amplified by proprietary technologies and patents, creating barriers to entry and limiting alternative sourcing options for pharmaceutical firms. The need for regulatory compliance, such as Good Manufacturing Practices (GMP), further narrows the supplier pool, empowering those who meet these demanding standards.

| Supplier Characteristic | Impact on Pharmaceutical Firms (e.g., Endo International) | 2024 Data/Observation |

|---|---|---|

| Supplier Concentration (e.g., API Manufacturers) | Limited choice, higher prices, potential supply disruptions | Dominance by a few large global producers; lead times for critical components extended by up to 30% |

| Switching Costs (Regulatory, Quality Validation) | High financial and time investment to change suppliers | Years and millions of dollars for new API supplier qualification; extensive testing and documentation required |

| Proprietary Technology/Patents | Forced negotiation with single source for key ingredients | Patented APIs can lead to premium pricing and unfavorable supply agreements |

| Regulatory Compliance (GMP) | Limits qualified suppliers, increases supplier leverage | Suppliers meeting high standards can command premium pricing; high barriers to entry for new suppliers |

What is included in the product

This analysis of Endo International dissects the competitive forces shaping its pharmaceutical and medical device markets, covering threats from new entrants, substitutes, buyer and supplier power, and existing rivalries.

Quickly assess competitive pressures with an intuitive, visual representation of Endo International's market landscape.

Customers Bargaining Power

Major buyers like government health agencies, large hospital systems, and major pharmacy chains wield considerable influence. In 2024, these consolidated entities often represent a significant portion of a pharmaceutical company's revenue. Their substantial purchasing power enables them to negotiate aggressively for lower drug prices and more advantageous contract terms, directly impacting profitability.

Customers, particularly individual patients and large healthcare systems, exhibit significant price sensitivity, especially when it comes to generic pharmaceuticals. This heightened awareness of cost drives a robust demand for more affordable drug options.

This price sensitivity directly translates into increased pressure on pharmaceutical manufacturers like Endo International to reduce their pricing. For instance, in 2024, the average price of a prescription drug in the U.S. continued to be a major concern for consumers and payers alike, with many seeking lower-cost alternatives.

The demand for affordability impacts profitability by forcing companies to compete on price, often squeezing profit margins. This is particularly true in markets where multiple generic versions of a drug are available, creating a highly competitive landscape.

Healthcare systems, such as hospital networks and insurance providers, wield considerable bargaining power due to their large purchasing volumes. Their ability to negotiate bulk discounts and favorable payment terms directly influences the revenue and profitability of drug suppliers.

The pharmaceutical market's increasing embrace of generics and biosimilars significantly boosts customer bargaining power, especially for Endo International. With numerous generic manufacturers actively producing alternatives for off-patent drugs, patients and healthcare providers have a wider array of choices, often at considerably lower price points. This availability directly pressures Endo to compete on price, as customers can readily switch to more affordable options, particularly when branded drug patents expire.

Influence of Healthcare Providers and Formularies

Healthcare providers and formulary committees wield significant influence over drug selection, directly impacting the bargaining power of customers. Their choices, driven by cost-effectiveness and clinical outcomes, can steer demand, especially when considering the vastness of the U.S. pharmaceutical market. For instance, in 2024, many insurance plans continue to prioritize generics and biosimil alternatives, putting pressure on branded drug manufacturers.

These committees, acting as gatekeepers for patient access, can limit or exclude certain medications from their preferred drug lists. This power is amplified by the sheer volume of patients managed by these organizations.

- Formulary Restrictions: Managed care organizations often implement tiered formularies, placing higher co-pays or requiring prior authorization for non-preferred drugs, effectively discouraging their use.

- Evidence-Based Medicine: Decisions are increasingly based on comparative effectiveness research, favoring drugs with proven superior outcomes at a given price point.

- Generic and Biosimilar Uptake: The continued strong uptake of generics and biosimil alternatives in 2024 directly reduces the market share and pricing power of originator drugs.

- Cost-Containment Initiatives: Hospitals and health systems are aggressively pursuing cost-containment strategies, making them more sensitive to drug pricing and more likely to negotiate favorable terms or switch to lower-cost alternatives.

Information Asymmetry and Patient Awareness

While patients might not grasp every detail of complex biopharmaceuticals, the growing accessibility of information about drug prices and alternative treatments is bolstering their collective bargaining power. This increased transparency allows patients to make more informed decisions, putting pressure on manufacturers.

Health insurance providers significantly contribute to this dynamic. By negotiating prices on behalf of a large patient pool, insurers wield considerable leverage. In 2024, U.S. health insurers continued to focus on cost containment, with many implementing stricter formularies and value-based purchasing agreements for high-cost drugs, directly impacting pharmaceutical pricing power.

- Increased online resources and patient advocacy groups empower individuals with knowledge about drug efficacy and cost-effectiveness.

- Health insurance companies negotiate bulk discounts, acting as a powerful collective buyer for prescription medications.

- The rise of price transparency tools and comparison websites enables patients to identify more affordable treatment options.

- Government initiatives aimed at drug price negotiation, such as those explored in 2024, further amplify buyer power.

Customers, especially large purchasers like government health programs and major pharmacy chains, hold significant sway over drug pricing. Their substantial buying volumes in 2024 allowed them to negotiate aggressively for lower prices and better contract terms, directly impacting Endo's revenue and profit margins.

The increasing demand for affordable medications, driven by price-sensitive patients and healthcare systems, forces pharmaceutical companies to compete on price. This is especially true for generics, where multiple manufacturers offer alternatives, as seen with the continued strong uptake of generics in 2024.

Health insurance providers, acting as collective buyers, also exert considerable influence by negotiating bulk discounts and implementing cost-containment strategies like stricter formularies. This trend intensified in 2024 as insurers focused on managing high drug costs.

| Customer Type | Bargaining Power Factor | Impact on Endo International |

|---|---|---|

| Government Health Agencies | Large purchasing volume, price negotiation mandates | Downward pressure on drug prices, reduced profit margins |

| Hospital Systems | Bulk purchasing, formulary control | Demand for discounts, potential for preferred supplier agreements |

| Pharmacy Chains | Significant market share, negotiation leverage | Pressure on wholesale acquisition costs, competitive pricing strategies |

| Individual Patients | Price sensitivity, access to generic alternatives | Increased demand for lower-cost options, switching from branded drugs |

Same Document Delivered

Endo International Porter's Five Forces Analysis

This preview showcases the complete Endo International Porter's Five Forces analysis, detailing the competitive landscape and strategic implications for the pharmaceutical industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally written file, ready for your immediate use.

Rivalry Among Competitors

Endo International navigates a landscape crowded with rivals in both its branded and generic pharmaceutical divisions. The generic sector, especially, is a battlefield with numerous global and local companies vying for market share, often leading to aggressive price wars.

In 2024, the pharmaceutical industry continues to see a proliferation of generic drug manufacturers. For instance, the market for widely prescribed generics, such as those for pain management or cardiovascular health, often features dozens of approved suppliers, driving down prices significantly.

This intense competition directly impacts Endo's pricing power and profitability. The sheer volume of generic alternatives available means that even slight price reductions by competitors can lead to substantial revenue erosion for Endo's generic portfolio.

The branded segment, while offering higher margins, also faces considerable rivalry from both established pharmaceutical giants and emerging biotechs. New product launches and patent expirations constantly shift the competitive dynamics, requiring continuous innovation and marketing investment from Endo.

The pharmaceutical industry, including companies like Endo International, is particularly vulnerable to patent expirations, often referred to as 'patent cliffs.' When patents on highly successful, branded drugs expire, the market opens up dramatically to generic manufacturers. This influx of lower-cost alternatives can lead to a rapid and substantial decline in revenue for the original drug developer. For instance, the expiration of patents for major drugs has historically caused sales to plummet by 80-90% within a short period.

This dynamic significantly escalates competitive rivalry. Companies that previously enjoyed market exclusivity for their blockbuster products now face intense price competition from multiple generic producers. The battle for market share in these now genericized segments becomes fierce, as companies leverage manufacturing efficiency and distribution networks to capture a portion of the remaining demand. This pressure forces innovation and strategic pricing adjustments to maintain any competitive edge.

Competition in the branded pharmaceutical sector, a key area for Endo's growth, hinges on continuous innovation and demonstrating clear clinical advantages. Companies like Endo invest heavily in research and development to bring novel treatments to market or enhance existing ones. This focus on differentiation is crucial for securing market exclusivity and justifying premium pricing for their products, such as XIAFLEX.

Endo's strategy for growth in the branded segment, particularly with products like XIAFLEX, relies on its ability to innovate and offer unique therapeutic benefits. The pharmaceutical industry's competitive landscape is characterized by a race to develop groundbreaking therapies that address unmet medical needs. Success often translates into extended patent protection and the ability to charge higher prices, making product differentiation a cornerstone of competitive strategy.

In 2023, pharmaceutical R&D spending reached significant figures, with major players investing billions to fuel their innovation pipelines. For instance, companies focused on specialty areas often see intense rivalry, where a new drug's efficacy and safety profile can dramatically alter market share. Endo’s focus on products like XIAFLEX, which targets specific indications, places it directly in this highly competitive arena where innovation is paramount.

Regulatory Landscape and Approval Timelines

The pharmaceutical industry, including companies like Endo International, faces rigorous regulatory scrutiny. The U.S. Food and Drug Administration (FDA) approval process, for instance, can take years and involve multiple phases of clinical trials, creating a significant barrier for new entrants seeking to challenge established players. In 2024, the FDA continued to emphasize data integrity and patient safety, potentially leading to extended review times for complex submissions.

Navigating these lengthy approval timelines is crucial for competitive advantage. Companies that can efficiently manage the regulatory pathway and secure approvals for innovative therapies can gain a substantial lead over competitors. This process directly influences the pace of new product introductions and the ability of firms to differentiate themselves in the market.

- Regulatory Hurdles: Complex and lengthy FDA approval processes act as a substantial barrier to entry for new pharmaceutical products.

- Competitive Shaping: These regulatory timelines directly influence the competitive dynamics by shaping market entry and the speed at which new therapies become available.

- Advantage Creation: Companies adept at managing regulatory pathways can establish a competitive advantage through faster market access for their innovations.

- 2024 Focus: The FDA’s continued emphasis on data integrity and patient safety in 2024 suggests that approval timelines might remain extended for certain product categories.

Strategic Focus Post-Bankruptcy

Following its emergence from Chapter 11 bankruptcy in late 2022, Endo International plc has sharpened its strategic focus. A key priority is revitalizing its Branded Pharmaceuticals segment, which includes pain management and orthopedics products. This strategic shift directly impacts its competitive rivalry within these therapeutic areas.

Endo is also concentrating on reviving its Sterile Injectables segment. This involves addressing operational challenges and aiming to regain market share against established players. The company's renewed emphasis on these core areas means its competitive interactions will be intensified within these specific markets.

- Branded Pharmaceuticals Growth: Endo aims to increase market share in its branded drug portfolio, facing off against large pharmaceutical companies with extensive R&D and marketing budgets.

- Sterile Injectables Revitalization: The company is working to re-establish its presence in the sterile injectables market, a sector characterized by high regulatory hurdles and competition from specialized manufacturers.

- Post-Bankruptcy Strategy: Endo's strategic decisions are now heavily influenced by its need to demonstrate financial stability and operational efficiency to regain trust and compete effectively.

Endo International operates in highly competitive pharmaceutical markets, particularly in generics where numerous players drive down prices. In 2024, the generic drug landscape remains crowded, with intense competition leading to significant pricing pressure on established companies like Endo. This rivalry impacts profitability as price wars are common, especially for high-volume medications.

The branded segment also sees fierce competition, with Endo facing off against larger pharmaceutical companies and emerging biotechs. Innovation and effective marketing are crucial differentiators, as seen with products like XIAFLEX, in a market where patent expirations can rapidly erode revenue. For example, the average revenue loss for a blockbuster drug after patent expiry can exceed 80%.

Endo's strategic focus on revitalizing its Branded Pharmaceuticals and Sterile Injectables segments in 2024 means it will be directly contending with established players in these specific therapeutic areas. The company’s post-bankruptcy strategy necessitates demonstrating operational efficiency to compete effectively in these challenging markets.

| Market Segment | Competitive Intensity | Endo's Position |

|---|---|---|

| Generic Pharmaceuticals | Very High | Facing significant price pressure from numerous competitors. |

| Branded Pharmaceuticals (e.g., XIAFLEX) | High | Requires continuous innovation and differentiation against large pharma and biotechs. |

| Sterile Injectables | High | Aiming to regain market share amidst established, specialized manufacturers. |

SSubstitutes Threaten

The availability of generic drugs presents a substantial threat to pharmaceutical companies like Endo International. Once a brand-name drug's patent expires, generic versions, which are chemically identical, can enter the market at much lower price points. This directly erodes the market share and revenue streams of the original innovator.

For instance, the U.S. generic drug market reached an estimated $130 billion in 2023, highlighting the massive scale of this substitution effect. Companies that rely heavily on a few blockbuster drugs face significant pressure as generics capture a large portion of the market. This forces them to innovate constantly or face declining profitability.

The increasing emergence of biosimilars poses a significant threat of substitution for Endo International's biologic products. Biosimilars, which are highly similar to approved biologic medicines, offer a growing challenge to complex branded biologics by providing more affordable alternatives.

As of late 2023 and into 2024, the regulatory landscape has continued to facilitate the approval and market entry of these products. For instance, the U.S. Food and Drug Administration (FDA) has approved numerous biosimilar applications, expanding patient access and driving down costs in therapeutic areas where biologics are prevalent.

This influx of biosimilar competition directly pressures the pricing power and market share of original biologic manufacturers like Endo. Patients and healthcare systems, increasingly cost-conscious, are likely to opt for these lower-priced biosimilar options where clinically appropriate, thereby diverting demand from Endo's branded biologics.

Patients increasingly explore alternative therapies like natural medicines and lifestyle changes as substitutes for traditional pharmaceuticals, broadening the competitive landscape for companies like Endo International. This trend impacts demand for conventional treatments, especially for chronic conditions managed by Endo’s products. For instance, the global market for dietary supplements, a key area of alternative medicine, was projected to reach $230.7 billion in 2023 and is expected to grow significantly, indicating a substantial shift in consumer preference towards natural alternatives.

Advancements in Medical Devices and Procedures

Innovations in medical devices and surgical techniques present a significant threat of substitution for pharmaceutical products. For instance, advancements in orthopedic implants or minimally invasive urological procedures can directly reduce the demand for pain management medications or other related drugs. This trend is particularly pronounced in fields where physical interventions offer a comparable or superior outcome to drug-based therapies.

The market for medical devices saw substantial growth, with global revenues estimated to reach over $600 billion in 2024. This expansion fuels the development of new technologies that can directly compete with or even replace the need for certain pharmaceuticals. For example, advancements in regenerative medicine and bio-engineered tissues are beginning to offer alternatives to drug treatments for conditions like osteoarthritis.

- Orthopedics: New joint replacement technologies and arthroscopic surgical techniques can lessen reliance on pain relievers and anti-inflammatory drugs.

- Urology: Innovations like advanced laser lithotripsy for kidney stones or minimally invasive prostate surgeries reduce the need for post-operative medications.

- Cardiology: Stent technology and angioplasty procedures offer alternatives to long-term medication for certain heart conditions.

- Diabetes Management: Continuous glucose monitoring systems and insulin pumps are increasingly seen as complements or, in some cases, alternatives to oral medications for managing blood sugar.

'Super Generics' and Differentiated Formulations

The emergence of 'super generics,' or advanced generic formulations, presents a significant threat of substitution for pharmaceutical companies like Endo International. These products often boast improved patient convenience, such as extended-release mechanisms, or enhanced efficacy and safety compared to traditional generics. For instance, a super generic might offer a once-daily dosing option where a standard generic requires multiple doses, directly appealing to patient adherence and potentially capturing market share from both branded and older generic products.

These differentiated generics can carve out their own market niche by offering tangible benefits that go beyond simple price competition. For example, a super generic might incorporate a novel delivery system or a combination therapy that addresses unmet patient needs more effectively than existing options. This strategic differentiation allows them to command a premium price over basic generics while still being more accessible than the original branded drug, thus acting as a potent substitute across various therapeutic areas.

Consider the landscape of pain management drugs, where Endo has historically had a presence. The introduction of extended-release formulations of existing opioid analgesics, often classified as super generics, directly competes with immediate-release generics and even some branded products. These advanced formulations can reduce the frequency of dosing, improve patient compliance, and potentially offer a more stable therapeutic effect, making them an attractive alternative for both patients and prescribers seeking improved treatment profiles.

- Super generics offer enhanced patient convenience, such as reduced dosing frequency.

- These formulations can boast improved efficacy or safety profiles over standard generics.

- They pose a threat by capturing market share from both branded and traditional generic drugs.

- The pharmaceutical market saw significant growth in differentiated generics, with some estimates suggesting this segment could capture a substantial portion of the overall generic market by the mid-2020s.

The threat of substitutes for Endo International is multifaceted, encompassing generic drugs, biosimilars, alternative therapies, and medical innovations. The U.S. generic drug market alone was valued at approximately $130 billion in 2023, underscoring the significant impact of lower-cost alternatives on branded pharmaceuticals. Advances in medical devices, with global revenues projected to exceed $600 billion in 2024, also present direct competition by offering non-pharmacological solutions for various conditions.

The rise of biosimilars, supported by increasing FDA approvals, directly challenges Endo's biologic products by providing cost-effective alternatives. Furthermore, growing consumer interest in natural medicines and lifestyle changes, reflected in the dietary supplement market's projected $230.7 billion valuation in 2023, indicates a shift in patient preferences away from traditional drug therapies.

| Substitute Category | Key Characteristics | Impact on Endo | Market Data Point (Approx.) |

|---|---|---|---|

| Generic Drugs | Chemically identical, lower price | Erodes market share and revenue | U.S. Generic Market: $130 billion (2023) |

| Biosimilars | Highly similar to biologics, lower price | Pressures pricing and market share of biologics | Increasing FDA approvals for biosimilars |

| Alternative Therapies (e.g., Supplements) | Natural, lifestyle-focused | Shifts patient preference away from pharmaceuticals | Global Dietary Supplement Market: $230.7 billion (2023 projection) |

| Medical Devices & Innovations | Physical interventions, new technologies | Reduces demand for related drugs | Global Medical Device Market: Over $600 billion (2024 projection) |

Entrants Threaten

The pharmaceutical sector, including companies like Endo International, demands massive upfront capital for research and development, rigorous clinical testing, and the construction of advanced manufacturing plants. This significant financial hurdle makes it extremely difficult for new players to enter the market and compete effectively.

For instance, developing a new drug can cost upwards of $2.6 billion, with many of these investments failing to yield a marketable product. Endo International itself has invested heavily in its specialized manufacturing capabilities, creating a high barrier to entry for those without similar resources.

Stringent regulatory requirements and lengthy approval processes act as a formidable barrier to entry in the pharmaceutical sector. New companies must meticulously navigate complex clinical trial phases and secure approvals from bodies like the U.S. Food and Drug Administration (FDA), a process that can take many years and incur substantial costs. For example, the average time from discovery to market for a new drug in the U.S. has been estimated to be around 10 years, with development costs often exceeding $2 billion.

Endo International's existing patents, like those for its Opioid Analgesics and Urology products, act as significant barriers to entry. For instance, the patent for its extended-release oxycodone formulation, originally set to expire around 2027, protected its market share for years. Developing generic alternatives or entirely new compounds to circumvent such intellectual property requires substantial investment in research and development, often running into hundreds of millions of dollars, and carries a high probability of failure, deterring many potential new competitors.

Need for Specialized Expertise and Talent

The pharmaceutical industry, including companies like Endo International, requires deep specialized knowledge. This includes scientific, medical, and regulatory expertise, which are crucial for research and development, manufacturing, and bringing products to market. New entrants face a steep learning curve and significant investment in acquiring this essential know-how.

Recruiting and retaining top talent in these specialized fields is a major hurdle. For instance, the demand for skilled biopharmaceutical researchers and regulatory affairs specialists often outstrips supply, driving up compensation costs. In 2024, the competition for experienced talent in areas like gene therapy and advanced drug delivery systems remained intense, impacting the operational costs for emerging players.

- High Demand for Specialized Skills: The pharmaceutical sector needs experts in areas such as organic chemistry, pharmacology, clinical trials management, and FDA/EMA regulatory affairs.

- Talent Acquisition Costs: Companies often spend substantial amounts on headhunting and competitive salary packages to attract and retain individuals with these critical skill sets.

- R&D and Manufacturing Expertise: New entrants must build teams capable of complex scientific research and adhering to stringent Good Manufacturing Practices (GMP), which requires specialized training and experience.

- Regulatory Compliance: Navigating the complex and evolving regulatory landscape necessitates experienced professionals who understand drug approval pathways and post-market surveillance requirements.

Established Distribution Channels and Brand Loyalty

Endo International's position is bolstered by deep-seated relationships within the healthcare ecosystem. Established pharmaceutical firms leverage extensive networks with physicians, hospitals, pharmacies, and wholesale distributors, often built over decades. This allows for efficient product placement and promotion, a significant barrier for newcomers attempting to gain market access.

Brand loyalty and trust play a crucial role, particularly for established medications. Patients and prescribers often stick with brands they know and trust, making it difficult for new entrants to displace them. For instance, in 2024, the generics market, where Endo has a significant presence, still sees strong brand preference for certain therapeutic areas, even with lower prices. Building this level of recognition and confidence requires substantial investment in marketing and clinical validation, which can be prohibitive for new players.

Consider these points regarding established distribution channels and brand loyalty:

- Established Networks: Endo benefits from existing contracts and relationships with major pharmaceutical distributors like McKesson, Cardinal Health, and AmerisourceBergen, facilitating broad market reach.

- Brand Recognition: Key Endo brands have achieved significant market recognition, leading to patient and physician preference, a factor that is difficult and costly for new entrants to replicate.

- Switching Costs: Healthcare providers and patients face switching costs, both in terms of time and potential efficacy concerns, when moving from established treatments to new ones, further entrenching Endo's market position.

- Regulatory Familiarity: Decades of navigating complex regulatory landscapes have provided Endo with a deep understanding of approval processes and market access strategies, a knowledge gap new entrants must overcome.

The threat of new entrants for Endo International is considerably low due to several significant barriers. The immense capital required for research, development, and manufacturing, often exceeding billions of dollars, deters many potential competitors. For example, bringing a new drug to market can cost over $2.6 billion. Furthermore, stringent regulatory hurdles, including lengthy FDA approval processes that can take a decade, demand extensive expertise and financial resources that new companies may lack.

Endo's existing patent portfolio also serves as a robust defense; patents for key products can protect market share for years, requiring substantial R&D investment to circumvent. The need for specialized scientific, medical, and regulatory knowledge, coupled with intense competition for top talent in 2024, further elevates the entry barriers. For instance, securing highly skilled biopharmaceutical researchers can involve significant recruitment costs and competitive compensation packages.

Established distribution networks and strong brand loyalty within the healthcare ecosystem present additional challenges. Endo benefits from deep relationships with physicians and pharmacies, and established brands often retain patient and prescriber trust, making it difficult and costly for new entrants to gain market access and displace incumbent products. In 2024, brand preference remained a factor even in the generics market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Endo International is built upon a foundation of publicly available data, including SEC filings, annual reports, and investor presentations. We also incorporate insights from reputable industry research firms and financial news outlets to provide a comprehensive view of the competitive landscape.