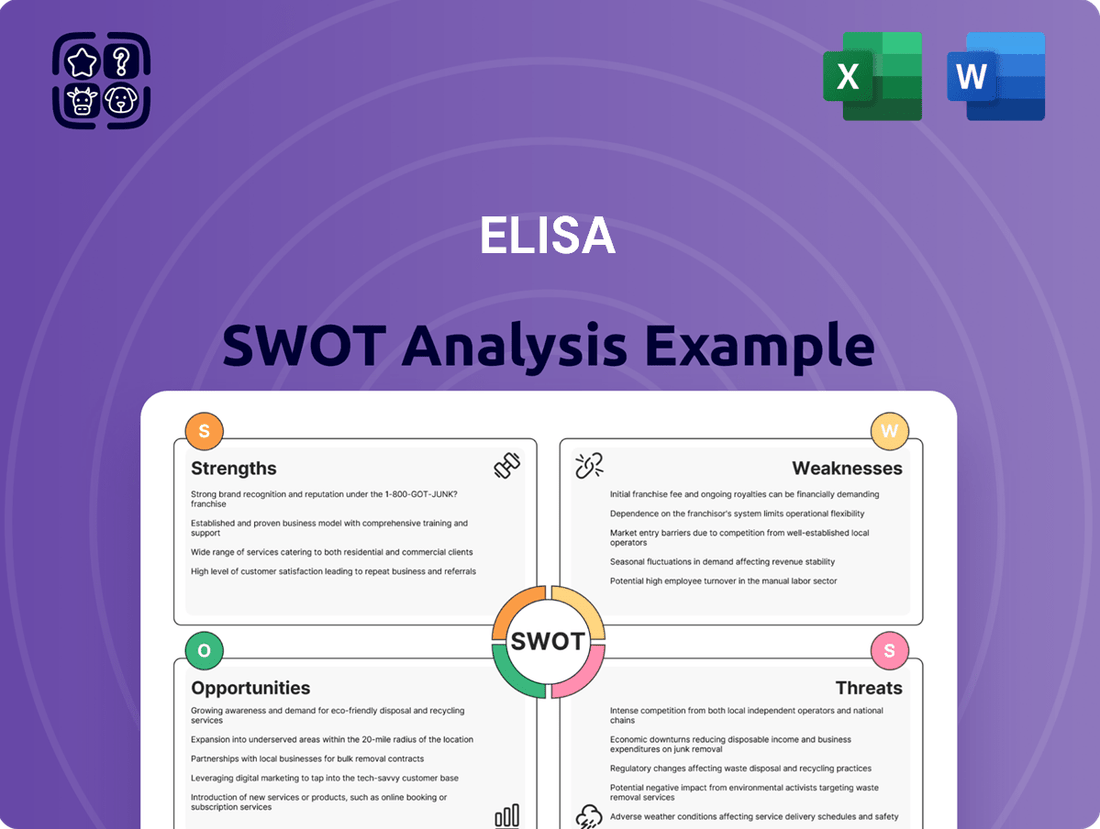

Elisa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elisa Bundle

While the provided highlights offer a glimpse into Elisa's strategic landscape, they only scratch the surface of its true market potential and challenges. To truly understand how Elisa is positioned for future success, you need the complete picture.

Unlock the full story behind Elisa's innovative strengths, potential market threats, and crucial growth opportunities with our comprehensive SWOT analysis. This in-depth report provides actionable insights, financial context, and strategic takeaways, making it indispensable for investors, analysts, and business leaders.

Don't just see the overview; gain the strategic advantage. Purchase the complete Elisa SWOT analysis today to access a professionally written, fully editable report designed to empower your planning, pitches, and research.

Strengths

Elisa commands a leading position in Finland and Estonia's telecommunications sectors, consistently ranking among the top three operators. This robust market share, particularly in Finland where it serves over 2.8 million mobile subscriptions as of Q1 2024, translates into a substantial and loyal customer base.

Elisa has showcased impressive financial strength, with 2024 marking a year of record comparable EBITDA and EBIT. This consistent profitability is a direct result of the company's strategic emphasis on operational efficiency and the steady growth in its mobile service revenue.

Elisa stands out as a leader in advanced network deployment, notably being the first Finnish operator to launch 5G standalone (SA) networks. This pioneering spirit extends to their offering of 5G Advanced (5.5G) services, demonstrating a commitment to cutting-edge technology for both consumers and businesses.

This technological prowess translates into tangible benefits, offering customers high-speed, low-latency connectivity. This superior network performance not only elevates the current customer experience but also lays the groundwork for innovative applications and services that will define the future.

Growing ICT and International Digital Services

Elisa is experiencing robust growth in its Information and Communications Technology (ICT) sector, particularly in areas like cloud solutions, cybersecurity, and AI-driven IT services tailored for businesses. This strategic shift diversifies revenue beyond traditional mobile and fixed-line services, tapping into higher-margin digital offerings.

The company's international digital services, notably through Elisa Industriq, are showing significant expansion. This global reach in digital solutions strengthens Elisa's position as a comprehensive technology partner for enterprises worldwide.

- ICT Expansion: Elisa's enterprise ICT services, including cloud and cybersecurity, are a key growth driver.

- International Reach: Elisa Industriq's success highlights strong performance in global digital services.

- Revenue Diversification: Moving into higher-value digital services reduces reliance on traditional telecom revenue.

Commitment to Sustainability and High Customer Satisfaction

Elisa's dedication to sustainability has garnered significant global acclaim, with the company recognized as one of the world's most sustainable businesses. This strong environmental, social, and governance (ESG) profile is a key strength, appealing to a growing segment of ethically-minded investors.

This commitment is further bolstered by consistently high customer satisfaction ratings. For instance, Elisa has frequently been awarded top marks in independent customer satisfaction surveys within the telecommunications sector in its operating markets. This dual focus on sustainability and customer care not only builds a robust brand reputation but also cultivates deep customer loyalty, a critical asset in a competitive industry.

- Global Sustainability Recognition: Elisa's consistent ranking among the world's most sustainable companies highlights its long-term commitment to ESG principles.

- High Customer Satisfaction: Proven track record of excellent customer service, translating into strong loyalty and positive brand perception.

- Investor Appeal: Alignment with increasing investor demand for responsible business practices, potentially leading to favorable capital access and valuation.

- Competitive Advantage: Differentiates Elisa in the market, attracting customers and talent who prioritize ethical and customer-centric organizations.

Elisa's leading market position in Finland and Estonia, serving over 2.8 million mobile subscriptions in Finland by Q1 2024, provides a substantial and loyal customer base. The company has demonstrated remarkable financial health, achieving record comparable EBITDA and EBIT in 2024 through efficient operations and growing mobile service revenue.

The company's commitment to cutting-edge technology is evident in its pioneering launch of 5G standalone (SA) networks and the introduction of 5G Advanced (5.5G) services, ensuring high-speed, low-latency connectivity for its users and paving the way for future innovations.

Elisa's strategic expansion into the ICT sector, particularly in cloud, cybersecurity, and AI-driven IT services, diversifies its revenue streams into higher-margin digital offerings. This growth is further amplified by its international digital services through Elisa Industriq, strengthening its global presence as a technology partner.

Elisa's strong sustainability credentials, recognized globally, alongside consistently high customer satisfaction ratings, build a powerful brand reputation and foster deep customer loyalty. This dual focus appeals to ethically-minded investors and provides a significant competitive advantage.

| Metric | 2023 (EUR million) | Q1 2024 (EUR million) | Key Strength |

|---|---|---|---|

| Comparable EBITDA | 1,168.0 | 308.5 | Strong operational efficiency and profitability |

| Mobile Subscriptions (Finland) | 2,800,000+ (as of Q1 2024) | 2,800,000+ | Dominant market share and loyal customer base |

| 5G SA Network Launch | Completed | Completed | Technological leadership and network innovation |

What is included in the product

Analyzes Elisa’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic thinking, offering a clear path to identifying and addressing critical business challenges.

Weaknesses

Elisa operates in the highly concentrated telecommunications sectors of Finland and Estonia, facing intense rivalry from a few dominant players. This competitive landscape directly impacts pricing strategies and makes it challenging to expand market share in its core mobile and fixed-line services.

Elisa's reliance on its core markets, Finland and Estonia, presents a challenge. These are mature telecommunications landscapes, meaning most potential customers already subscribe to mobile and broadband services. For instance, Finland's mobile penetration rate hovers around 120%, indicating more SIM cards than people, a common sign of market saturation.

This high penetration limits opportunities for significant subscriber gains through traditional means. Elisa must therefore focus on increasing revenue per user by offering more advanced services, like 5G capabilities or bundled entertainment packages, or by successfully expanding into new geographical territories.

Elisa's performance is inherently tied to the broader economic climate and global political landscape. For instance, the ongoing conflict in Ukraine and its ripple effects have introduced significant economic uncertainty, potentially causing businesses to postpone crucial investment decisions. This can directly affect Elisa's revenue streams and the overall stability of its operations.

Furthermore, shifts in global trade policies or unexpected geopolitical events can disrupt supply chains and increase operational costs. In 2024, for example, persistent inflation in key European markets, where Elisa has a strong presence, has already put pressure on consumer spending and corporate IT budgets, highlighting the tangible impact of these external vulnerabilities.

Fluctuations in Low-Margin Equipment Sales

Elisa has noted a decline in sales of its lower-margin equipment. This trend can put a damper on overall revenue growth, even when its primary services are performing well. For instance, in Q1 2024, while Elisa's service revenue saw a 2.9% increase year-on-year, the company's equipment sales experienced a more significant dip, impacting the total revenue picture.

The unpredictable nature of equipment sales creates challenges for consistent revenue expansion. To offset this, Elisa needs its higher-margin service offerings to perform even more robustly to balance the books. This reliance on service revenue to compensate for equipment sales volatility was evident in the company's 2023 financial results, where service revenues formed the bulk of its overall earnings.

- Decreased Equipment Sales: Elisa has seen a reduction in revenue generated from equipment sales.

- Revenue Growth Headwinds: This decline in a lower-margin segment can hinder overall revenue expansion.

- Service Revenue Reliance: The company must rely more heavily on its core, higher-margin services to compensate for equipment sales fluctuations.

- Q1 2024 Impact: While service revenue grew, equipment sales decline created a drag on total revenue in early 2024.

Mobile Post-Paid Churn Rate Concerns

Despite efforts to boost mobile post-paid Average Revenue Per User (ARPU), Elisa has experienced a concerning uptick in its mobile post-paid churn rate within Finland. This trend suggests a greater proportion of customers are switching providers, which can directly impact revenue stability and market share.

A rising churn rate necessitates more aggressive marketing and customer retention strategies. These can include discounted pricing, loyalty programs, and enhanced service offerings, all of which add to operational costs and can potentially erode profit margins if not managed effectively. For instance, while ARPU might be growing, if the cost of acquiring and retaining customers outpaces this growth due to churn, overall profitability could suffer.

- Increased Customer Acquisition Costs: Higher churn forces Elisa to spend more on attracting new customers to replace those lost.

- Reduced Customer Lifetime Value: Customers leaving sooner than expected diminish the total revenue generated from each subscriber over their relationship with Elisa.

- Competitive Pressure: Rising churn often signals that competitors are offering more attractive deals or services, putting pressure on Elisa's pricing and product development.

Elisa faces significant challenges due to its concentrated operating markets in Finland and Estonia, which are mature telecommunications landscapes with high mobile penetration rates, around 120% in Finland. This saturation limits organic subscriber growth, forcing Elisa to focus on increasing revenue per user through advanced services or geographical expansion to counteract limited market share gains.

The company's financial performance is also susceptible to macroeconomic and geopolitical instability. For example, persistent inflation in key European markets in 2024 has already impacted consumer spending and corporate IT budgets, directly affecting Elisa's revenue streams and operational stability. This vulnerability underscores the need for robust risk management strategies.

A notable weakness is the observed decline in Elisa's equipment sales, a lower-margin segment. In Q1 2024, this dip in equipment revenue, despite service revenue growth of 2.9% year-on-year, acted as a drag on total revenue. This trend heightens Elisa's reliance on its higher-margin services to maintain overall earnings growth and balance revenue fluctuations.

Furthermore, Elisa is grappling with an increased mobile post-paid churn rate in Finland. This rise in customer attrition necessitates higher spending on customer acquisition and retention, potentially eroding profit margins. For instance, if the cost of acquiring new customers surpasses the revenue generated from them, it directly impacts profitability, even with growing ARPU.

| Weakness | Description | Impact | Supporting Data (2024/2025) |

| Market Saturation | Operating in mature markets with very high mobile penetration. | Limits subscriber growth and market share expansion. | Finland mobile penetration ~120% (indicative of saturation). |

| Economic Sensitivity | Performance tied to broader economic and geopolitical conditions. | Creates revenue uncertainty and can delay investment decisions. | Inflation in European markets impacting consumer/corporate IT budgets (2024). |

| Declining Equipment Sales | Reduction in revenue from lower-margin equipment. | Hinders overall revenue growth and increases reliance on services. | Q1 2024: Equipment sales decline offset service revenue growth. |

| Increased Churn Rate | Higher customer switching in mobile post-paid segment (Finland). | Raises customer acquisition costs and reduces customer lifetime value. | Uptick in mobile post-paid churn rate noted in Finland. |

Full Version Awaits

Elisa SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. This ensures transparency and guarantees you get the complete, professional-quality report you expect.

You are viewing a live preview of the actual ELISA SWOT analysis file. The complete, detailed version becomes available immediately after your purchase.

Opportunities

Elisa's continued expansion of 5G and the emerging 5.5G technology in Finland and Estonia opens up substantial revenue streams. The company can capitalize on this by offering premium services like advanced mobile broadband and fixed wireless access, tapping into the demand for higher speeds and reliability.

Monetizing these advanced networks involves developing and selling specialized solutions tailored for enterprise clients, such as low-latency applications for manufacturing or enhanced connectivity for smart cities. Elisa's investment in network infrastructure directly translates into opportunities for new service creation and market penetration.

Elisa has a significant chance to grow its IT services for businesses, especially in areas like cloud solutions, AI-driven service management, and cybersecurity. This is a big opportunity because more and more companies are going digital and dealing with new cyber threats.

By offering a complete package of IT and security services, Elisa can meet this rising demand. This will help them become a leader in the IT service market. For instance, the global cybersecurity market is projected to reach $366 billion by 2028, showing the vast potential for growth in this sector.

The increasing adoption of Internet of Things (IoT) and Machine-to-Machine (M2M) connections presents a significant opportunity for Elisa. As of Q1 2024, Elisa reported strong growth in its IoT subscriptions, indicating a robust market demand for connected solutions across various industries. This expansion allows Elisa to capitalize on its advanced network capabilities by offering tailored connectivity services and integrated platforms, thereby generating new revenue streams from sectors like manufacturing, logistics, and smart cities.

International Software Services Growth (Elisa Industriq)

Elisa's international software services, operating under the Elisa Industriq brand, are experiencing robust growth, fueled by both organic expansion and strategic acquisitions. This segment is poised for further development, especially within industrial automation and manufacturing software, presenting a substantial opportunity for Elisa to diversify its revenue streams and extend its market presence beyond its core telecommunications services.

The company's focus on these high-growth areas is expected to yield significant returns. For instance, the global industrial automation market size was valued at approximately USD 200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, indicating a strong tailwind for Elisa Industriq's offerings.

Key opportunities within this segment include:

- Expanding market share in industrial IoT solutions: Leveraging Elisa's expertise in connectivity and data management to provide integrated IoT platforms for manufacturing clients.

- Developing specialized software for Industry 4.0: Focusing on areas like predictive maintenance, supply chain optimization, and smart factory management.

- Strategic acquisitions of niche software providers: Identifying and integrating companies with complementary technologies and established customer bases in the industrial software space to accelerate growth and broaden capabilities.

Leveraging AI and Automation for Operational Efficiency and New Services

Elisa can significantly boost its operational efficiency and cut costs by integrating AI and automation across its network operations, customer service, and overall service delivery. This technological adoption is a key opportunity to streamline processes and improve resource allocation.

Beyond internal efficiencies, AI opens doors to entirely new revenue streams and enhanced customer value. For instance, developing AI-powered tools like automated call summaries for business clients offers a tangible benefit, differentiating Elisa in a competitive market.

- AI-driven network optimization: In 2024, telecom companies are increasingly using AI for predictive maintenance and fault detection, aiming to reduce downtime by up to 20%.

- Enhanced customer experience: AI chatbots and virtual assistants are handling over 60% of initial customer inquiries in the sector, freeing up human agents for complex issues.

- New service development: AI-powered analytics and personalized recommendations are becoming a significant differentiator, with early adopters reporting a 10-15% increase in customer engagement.

Elisa's advanced 5G and 5.5G networks offer significant opportunities for premium services like enhanced mobile broadband and fixed wireless access, catering to the growing demand for speed and reliability. The company is well-positioned to leverage its infrastructure investments for new service creation and market penetration, particularly within enterprise solutions.

The expansion of IT services, including cloud, AI, and cybersecurity, presents a substantial growth avenue, especially as businesses increasingly prioritize digital transformation and robust security measures. Elisa's ability to offer integrated IT and security packages addresses this demand, aiming to solidify its leadership in the IT service sector, a market projected for significant expansion.

The burgeoning Internet of Things (IoT) and Machine-to-Machine (M2M) markets provide Elisa with further opportunities. Strong growth in IoT subscriptions, as seen in Q1 2024, highlights the demand for connected solutions across industries, allowing Elisa to offer tailored services and platforms.

Elisa's international software services, particularly within industrial automation, offer diversification and market expansion. The global industrial automation market's projected growth indicates a strong tailwind for these offerings, with opportunities in industrial IoT and Industry 4.0 software development.

AI integration presents a dual opportunity for Elisa: enhancing operational efficiency through network and customer service automation, and creating new revenue streams via AI-powered tools and analytics. This strategic adoption of AI is crucial for competitive differentiation and improved customer engagement.

| Opportunity Area | Key Driver | Market Potential (Illustrative) | Elisa's Advantage |

|---|---|---|---|

| 5G/5.5G Services | Demand for high-speed, low-latency connectivity | Growing enterprise adoption of advanced mobile broadband | Extensive network infrastructure and expertise |

| IT & Cybersecurity Services | Digital transformation and increasing cyber threats | Global cybersecurity market projected to reach $366 billion by 2028 | Integrated IT and security solutions offering |

| IoT/M2M Solutions | Increased adoption of connected devices across industries | Robust growth in IoT subscriptions | Advanced network capabilities for tailored connectivity |

| Industrial Automation Software | Industry 4.0 and smart factory initiatives | Global industrial automation market projected to grow at 8%+ CAGR | Elisa Industriq's specialized software and services |

| AI Integration | Efficiency gains and new service development | AI adoption in telecom expected to reduce downtime by up to 20% | AI-driven network optimization and enhanced customer experience |

Threats

Elisa faces increasing regulatory pressure as the telecommunications and digital services landscape evolves, particularly with new EU legislation such as the Digital Services Act and the upcoming AI Act. These frameworks aim to address issues like online content moderation, data privacy, and the ethical deployment of artificial intelligence.

Compliance with these complex and often changing regulations can lead to substantial costs for Elisa, potentially impacting profitability. For instance, implementing robust data protection measures and ensuring algorithmic transparency as mandated by new AI regulations requires significant investment in technology and personnel.

Furthermore, this heightened scrutiny can limit Elisa's operational flexibility, potentially constraining its ability to innovate or adapt its service offerings and pricing strategies swiftly to market demands. The need to navigate these regulatory hurdles could also slow down the introduction of new digital services or the expansion of existing ones.

Elisa faces the threat of intensified competition in Finland and Estonia, potentially driving down prices for mobile and fixed-line services. This could squeeze profit margins and hinder efforts to increase average revenue per user (ARPU). For instance, in Q1 2024, Elisa reported a slight decrease in its mobile ARPU in Finland, underscoring the existing pricing pressures.

The escalating sophistication of cyber threats, including nation-state sponsored attacks and supply chain vulnerabilities, presents a substantial risk to Elisa. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure that could significantly impact Elisa's financial stability and operational continuity.

Data breaches and potential service disruptions directly threaten Elisa's revenue streams and market position. Such incidents can lead to hefty regulatory fines, as seen with GDPR penalties, and erode customer loyalty, which is a critical asset in the competitive telecommunications sector.

Global Supply Chain Disruptions

Ongoing global supply chain uncertainties present a significant threat to Elisa. Disruptions can affect the availability and cost of crucial network equipment and components, potentially delaying network expansion projects. For instance, the semiconductor shortage that began in 2020 continued to impact various industries into 2024, leading to increased lead times and higher prices for electronic components, which could affect Elisa's infrastructure upgrades.

These supply chain issues can directly translate into increased capital expenditure for Elisa and pose challenges in maintaining consistent service quality for its customers. The ability to procure essential hardware on time and at predictable costs is vital for Elisa's operational efficiency and its ability to roll out new services and technologies, such as 5G expansion and fiber network enhancements.

- Component Shortages: Persistent global shortages of semiconductors and other critical electronic parts can inflate equipment costs and extend delivery times.

- Logistical Bottlenecks: Shipping delays and increased freight costs, exacerbated by geopolitical events and port congestion, can further impact project timelines and budgets.

- Price Volatility: Fluctuations in raw material prices and manufacturing costs due to supply chain pressures can lead to unpredictable operational expenses for Elisa.

Substitution by Over-The-Top (OTT) Services

The increasing availability and popularity of Over-The-Top (OTT) services present a significant threat to Elisa's traditional revenue streams. These platforms, offering everything from messaging to video streaming, directly compete with Elisa's legacy voice and PayTV offerings. For instance, global OTT messaging app usage has surged, with platforms like WhatsApp and Telegram handling billions of messages daily, directly impacting traditional SMS and voice call revenues.

While Elisa has invested in its own entertainment services, the overarching market trend of substitution remains a persistent challenge. The convenience and often lower cost of OTT alternatives continue to draw consumers away from traditional telco bundles. In 2024, the global video streaming market alone was valued in the hundreds of billions of dollars, highlighting the scale of competition Elisa faces in the entertainment space.

This shift means Elisa must continually adapt its strategy to retain customers and find new avenues for growth. The threat isn't just about losing subscribers; it's about the commoditization of core services as consumers opt for more flexible and feature-rich OTT solutions.

- Erosion of Legacy Revenue: OTT services like WhatsApp and Telegram directly substitute traditional voice and SMS, impacting Elisa's older revenue models.

- Competition in Entertainment: While Elisa offers its own streaming, the broader market is dominated by global OTT players, creating intense competition for PayTV and content revenue.

- Consumer Preference Shift: The market trend favors flexible, feature-rich OTT solutions over bundled telco services, posing a continuous challenge to Elisa's traditional offerings.

Elisa faces significant threats from evolving regulatory landscapes, particularly new EU legislation like the Digital Services Act and the upcoming AI Act, which necessitate costly compliance measures and can limit operational flexibility. Intense competition in its core markets, Finland and Estonia, is already pressuring average revenue per user, as seen in a slight Q1 2024 mobile ARPU decrease in Finland. The company is also vulnerable to sophisticated cyber threats, with global data breach costs averaging $4.45 million in 2023, posing risks to revenue and customer loyalty.

SWOT Analysis Data Sources

This Elisa SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market research, and expert industry commentary, ensuring a data-driven and accurate strategic evaluation.