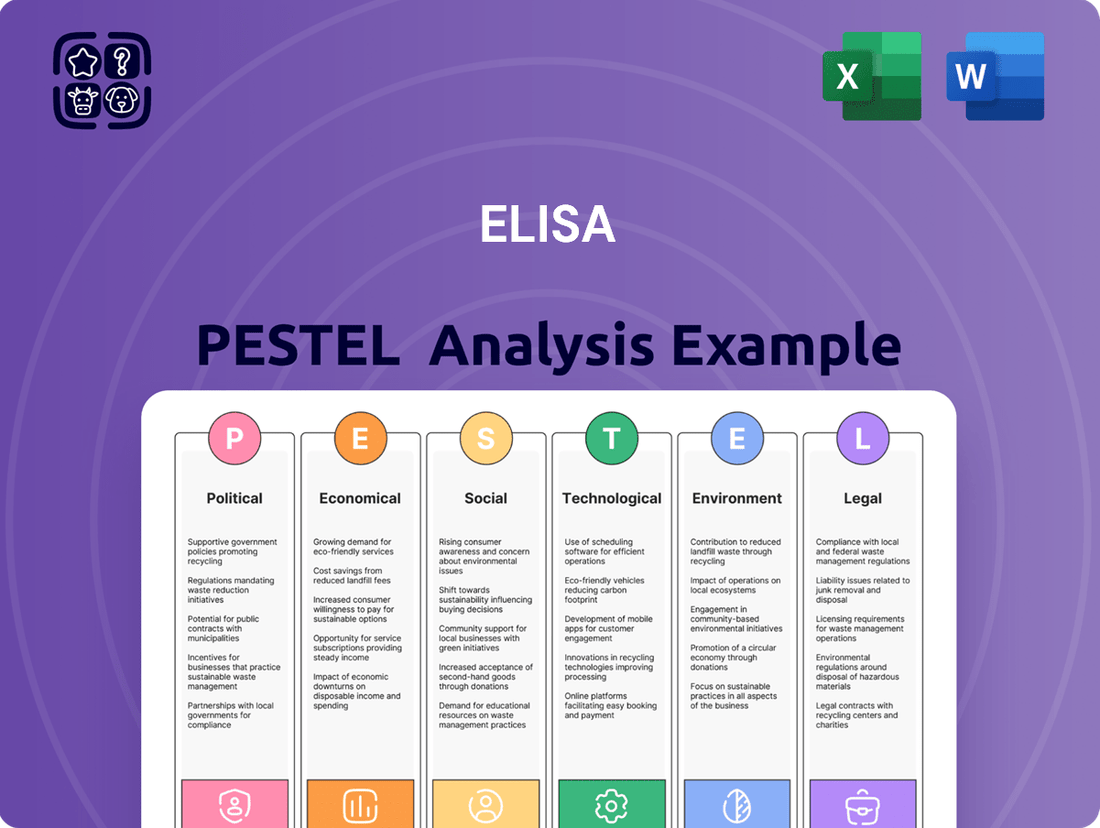

Elisa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elisa Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors impacting Elisa's strategic trajectory. Our PESTLE analysis delivers critical insights into the external forces shaping the telecommunications landscape. Equip yourself with actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full analysis now and gain a decisive competitive advantage.

Political factors

Governments in Finland and Estonia are pushing hard for digitalization, especially in areas like telecommunications. This means more investment in digital infrastructure and a general push for tech innovation, which is great news for companies like Elisa. These efforts create a fertile ground for their services to grow and expand.

For instance, Finland's Digital Infrastructure Strategy is aiming for all homes and businesses to have at least 100 Mbps broadband speeds by 2025. This directly supports Elisa's core business by increasing demand for faster and more reliable internet services.

Telecommunications policy significantly shapes Elisa's operational landscape. Finland, a leader in mobile technology, has proactively allocated spectrum for 5G, with ongoing efforts to develop a 6G roadmap. This regulatory environment influences everything from network expansion to service offerings.

Changes in spectrum allocation, such as the 700 MHz band auction in 2023 which saw significant investment from operators, directly impact Elisa's ability to deploy advanced mobile services. Furthermore, universal service obligations and regulations on infrastructure sharing can affect cost structures and competitive dynamics within the Finnish market.

Data protection and cybersecurity are increasingly important political considerations, especially as Elisa's reliance on digital services grows. New regulations like the EU's Digital Services Act (DSA) and Data Act significantly impact how Elisa manages user data and secures its operations. Finland incorporated the DSA into its national law in February 2024, and the Data Act's provisions are slated for application in September 2025, presenting new compliance requirements.

Geopolitical Stability and Trade Policies

Elisa's operations in Finland and Estonia mean it's influenced by the geopolitical stability of the Baltic Sea region and the wider European Union. While direct impacts of geopolitical shifts might be minimal, changes in international trade policies or regional instability can indirectly affect the economic climate and supply chains, potentially impacting Elisa's operational costs and overall business stability.

For example, the ongoing geopolitical tensions in Eastern Europe, while not directly involving Finland or Estonia in conflict, have led to increased defense spending and a heightened sense of security across the EU. This can translate into shifts in government budgets and potentially affect consumer and business spending patterns, indirectly influencing demand for telecommunications services.

- EU Trade Agreements: Elisa benefits from the EU's common trade policies, facilitating seamless cross-border operations within the single market.

- Baltic Region Stability: The relative peace and cooperation in the Baltic region have historically supported economic growth and investment, crucial for infrastructure development in telecommunications.

- Cybersecurity Threats: Geopolitical factors can exacerbate cybersecurity risks, requiring continuous investment in network security to protect customer data and service continuity.

Government Support for R&D and Innovation

Both the Finnish and Estonian governments are actively championing research and development (R&D) in cutting-edge fields like 6G connectivity, artificial intelligence (AI), and quantum computing. This focus translates into tangible support for Elisa's innovation efforts.

These governmental initiatives, including dedicated funding programs and strategic development plans, cultivate a fertile ground for technological breakthroughs. Elisa can capitalize on this supportive environment to drive its own advancements and enhance its service portfolio.

- Finnish Government R&D Investment: Finland allocated €2.1 billion to R&D in 2023, with a significant portion directed towards digital innovation.

- Estonian Digital Agenda 2030: This strategy prioritizes AI and data-driven innovation, aiming to boost the digital economy by 2030.

- EU Funding for 6G: Elisa, as part of European consortia, benefits from EU funding for 6G research, such as the Hexa-X project which received €9 million in initial funding.

Governmental support for digitalization in Finland and Estonia, including ambitious broadband targets like Finland's 100 Mbps goal by 2025, directly fuels demand for Elisa's services. Proactive spectrum allocation for 5G, with ongoing 6G roadmapping, creates a favorable regulatory environment for network expansion and service innovation.

New data protection regulations, such as the EU's Digital Services Act implemented in Finland in February 2024 and the Data Act effective September 2025, necessitate significant compliance investments from Elisa. Geopolitical stability in the Baltic region and EU trade policies generally support Elisa's cross-border operations, though regional tensions can indirectly impact economic conditions.

Active government investment in R&D, exemplified by Finland's €2.1 billion R&D allocation in 2023 and Estonia's digital agenda prioritizing AI, directly benefits Elisa's innovation pipeline. Elisa also leverages EU funding for advanced research, such as its participation in the €9 million Hexa-X project for 6G development.

What is included in the product

This Elisa PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Elisa PESTLE Analysis offers a clear, summarized version of complex external factors, easing the burden of detailed research and making strategic discussions more efficient.

Economic factors

Elisa's performance is intrinsically linked to the economic vitality of Finland and Estonia. A robust economy typically fuels higher consumer expenditure on telecommunication services, encompassing mobile plans, internet access, and digital entertainment offerings.

Finland's economic outlook for 2025 projects a real GDP growth of 1.0%, signaling a positive trajectory following a period of recession. This anticipated growth suggests a strengthening consumer base more likely to invest in Elisa's diverse service portfolio.

Inflation directly affects Elisa's operational expenses, such as energy and equipment procurement. For instance, in early 2025, many European countries experienced inflation rates ranging from 2% to 5%, impacting utility and supply chain costs for telecommunication companies.

Rising interest rates, a key concern in 2024 and 2025, increase Elisa's cost of borrowing for crucial network infrastructure upgrades. Elisa's Q1 2025 financial results highlighted this, showing an increase in net financial expenses due to higher interest rates and a growing net debt, despite the company's overall strong performance amid a challenging economic climate.

Consumers' disposable income is a key driver for Elisa's service uptake, directly impacting their ability to opt for premium mobile plans or higher-value digital services. As consumers have more discretionary funds, they are more likely to invest in enhanced connectivity and bundled offerings.

The financial health of Elisa's customer base is reflected in its performance metrics. Notably, Elisa reported an increase in its mobile post-paid Average Revenue Per User (ARPU) in Finland during the first quarter of 2025. This upward trend indicates that customers are spending more on average for their mobile services, a positive sign for the company's revenue generation capabilities.

Competition in the Telecommunications Market

Elisa operates in a dynamic telecommunications market, particularly in Finland and Estonia, where competition is a significant factor. Major players like Telia and DNA in Finland, and Tele2 and Telia in Estonia, actively vie for market share. This intense rivalry directly impacts Elisa's pricing strategies and necessitates continuous investment in network upgrades and innovative services to remain competitive.

The competitive pressures can lead to price wars, potentially squeezing profit margins if not managed effectively through differentiation and customer loyalty programs. For instance, in 2023, the Finnish mobile market saw ongoing price competition, particularly in the prepaid and SIM-only segments, which can influence average revenue per user (ARPU) for all operators, including Elisa.

- Market Share Dynamics: Elisa's market share in Finland is substantial, but it faces strong challenges from established competitors, requiring strategic moves to maintain or grow its position.

- Pricing Pressures: Aggressive pricing by rivals can force Elisa to adjust its own pricing, impacting profitability if not offset by cost efficiencies or value-added services.

- Innovation Investment: To counter competitive threats, Elisa must invest heavily in 5G deployment, new digital services, and customer experience enhancements, which adds to operational costs.

- Finnish Market Growth: Despite competition, the Finnish telecom market is expected to see steady growth, driven by increased data consumption and the rollout of new technologies, offering opportunities for Elisa to expand.

Investment in Infrastructure and Technology

Elisa's strategic investment in infrastructure and technology is a cornerstone of its future success. The company's commitment to expanding its 5G coverage and fiber network, alongside significant IT upgrades, directly impacts its ability to offer competitive services and maintain market leadership. These capital expenditures are intrinsically linked to the broader economic climate and the ease with which Elisa can secure necessary funding.

The company's financial performance in early 2025 reflects this focus. Elisa reported a capital expenditure of €72 million in Q1 2025, with a substantial portion allocated to these critical growth areas. This proactive spending demonstrates Elisa's dedication to staying at the forefront of technological advancements in the telecommunications sector.

- 5G Expansion: Continued investment to broaden 5G network reach and enhance data speeds.

- Fiber Network Development: Upgrading and expanding fiber optic infrastructure for improved broadband services.

- IT Investments: Modernizing IT systems to support new services, improve operational efficiency, and enhance customer experience.

- Q1 2025 Capex: €72 million allocated specifically to these infrastructure and technology initiatives.

Economic factors significantly influence Elisa's revenue and operational costs. A healthy economy boosts consumer spending on telecommunications, while inflation and interest rates can increase expenses and borrowing costs. Disposable income directly impacts customer uptake of premium services, as seen in Elisa's Q1 2025 ARPU increase.

| Economic Factor | Impact on Elisa | 2024/2025 Data/Trend |

|---|---|---|

| GDP Growth (Finland) | Drives consumer spending on services | Projected 1.0% real GDP growth in 2025 |

| Inflation | Increases operational expenses (energy, equipment) | 2-5% range in early 2025 for many European countries |

| Interest Rates | Raises cost of borrowing for infrastructure | Increased net financial expenses noted in Elisa's Q1 2025 results |

| Disposable Income | Influences uptake of premium services | Q1 2025 saw increased mobile post-paid ARPU in Finland |

Full Version Awaits

Elisa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Elisa PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights to inform your strategic decisions.

Sociological factors

High digital adoption and literacy in Finland and Estonia directly benefit Elisa by providing a ready and capable customer base. Finland's internet penetration reached 98.2% by January 2025, with a significant portion of its population possessing essential digital skills, indicating a strong market for Elisa's digital offerings.

Consumers are increasingly turning to digital platforms for everything from entertainment to work, a trend that has accelerated significantly. This shift fuels a robust demand for reliable, high-speed internet and mobile services. Elisa is well-positioned to capitalize on this, offering a comprehensive suite of mobile and fixed network subscriptions, broadband connections, and streaming entertainment options that directly address these evolving consumer preferences.

In 2024, the global digital services market is projected to reach over $3.5 trillion, with a substantial portion driven by subscription-based entertainment and communication. Elisa's strategic focus on expanding its 5G network coverage and enhancing its fiber optic infrastructure directly supports this growing consumer reliance on digital connectivity, ensuring they can deliver the seamless online experiences users expect.

Finland's aging population, while digitally adept overall, requires targeted efforts for full inclusion. Projects like OdigO in Lapland demonstrate a commitment to bridging the digital divide for seniors, emphasizing the need for accessible digital services. This trend presents a significant opportunity for Elisa to innovate by developing user-friendly platforms and support systems specifically designed for older demographics, ensuring they can fully benefit from the digital economy.

Urbanization and Smart City Development

Urbanization trends in Finland and Estonia are driving demand for advanced digital services. Elisa is well-positioned to capitalize on this through its ICT, cloud, and IoT offerings, essential for developing smart city infrastructure. For instance, Tallinn's ambitious '15-minute city' concept and ongoing smart city projects across Estonia represent a significant growth area for Elisa's technological solutions.

The expansion of smart city initiatives directly translates into market opportunities for Elisa. These projects require robust connectivity and data management, areas where Elisa excels. The increasing adoption of digital services in urban environments signifies a growing customer base for Elisa's specialized solutions.

- Smart City Investment: Estonia's national smart city strategy, with significant government backing, aims to integrate digital solutions across public services and infrastructure.

- IoT Growth: The Internet of Things market in the Nordics and Baltics is projected to grow substantially, with smart city applications being a key driver. Reports indicate a compound annual growth rate exceeding 20% for IoT solutions in the region through 2025.

- Digital Infrastructure Needs: Urban development necessitates enhanced digital infrastructure, including 5G networks and cloud computing, services that Elisa actively provides and expands.

- Talinn's Digital Agenda: Tallinn has consistently ranked high in digital governance and innovation, fostering an environment conducive to smart city technology adoption and investment.

Workforce Skills and Availability

The availability of skilled professionals, especially in areas like software, artificial intelligence, and cybersecurity, is paramount for Elisa's ongoing innovation and the enhancement of its services. As of early 2024, the demand for these specialized skills continues to outpace supply across the tech sector.

Elisa is strategically addressing this by actively recruiting AI and software experts within Finland and Estonia. This targeted hiring is designed to bolster its digital service capabilities and advance network automation initiatives. For instance, in 2023, Elisa reported a significant increase in its investments in R&D, with a substantial portion allocated to talent acquisition in these critical fields.

- Talent Gap: A persistent shortage of AI and cybersecurity professionals impacts the pace of technological advancement across industries.

- Geographic Focus: Elisa's recruitment efforts in Finland and Estonia reflect the strong tech talent pools in these regions.

- Strategic Investment: Hiring specialized personnel is a direct investment in Elisa's future service development and competitive edge.

Sociological factors significantly shape Elisa's market landscape, particularly concerning digital adoption and evolving consumer behaviors. High digital literacy in Finland and Estonia, with 98.2% internet penetration in Finland by early 2025, creates a fertile ground for Elisa's digital services. The increasing reliance on digital platforms for entertainment and communication fuels demand for robust connectivity, a trend Elisa addresses through its 5G and fiber expansions.

Urbanization trends are also a key sociological driver, pushing demand for smart city solutions. Elisa's ICT, cloud, and IoT offerings are vital for these initiatives, with projects like Tallinn's '15-minute city' concept highlighting growth opportunities. Furthermore, the need to cater to an aging population requires accessible digital services, presenting an avenue for Elisa to develop user-friendly platforms. The availability of skilled tech talent in Finland and Estonia, though facing a global shortage, is crucial for Elisa's innovation, with significant R&D investments directed towards talent acquisition in AI and cybersecurity.

| Sociological Factor | Impact on Elisa | Supporting Data/Trend |

|---|---|---|

| Digital Adoption & Literacy | High demand for digital services, strong customer base | Finland's 98.2% internet penetration (Jan 2025); growing digital skills |

| Consumer Behavior Shift | Increased reliance on digital platforms for entertainment & communication | Global digital services market projected over $3.5 trillion (2024) |

| Urbanization & Smart Cities | Growth opportunities for ICT, cloud, and IoT solutions | Tallinn's smart city initiatives; Nordic IoT market growth >20% CAGR (pre-2025) |

| Demographics (Aging Population) | Need for accessible and user-friendly digital services | Targeted projects for senior digital inclusion (e.g., OdigO) |

| Talent Availability | Crucial for innovation and service enhancement | High demand for AI/cybersecurity professionals; Elisa's R&D investment in talent |

Technological factors

The ongoing rollout and enhancement of 5G networks are fundamental to Elisa's operations, providing significantly faster speeds and reduced latency, which are crucial for delivering advanced mobile and fixed wireless services. This technological shift directly impacts Elisa's ability to support data-intensive applications and new service offerings.

Elisa's strategic move to launch 5.5G (5G Advanced) networks in Q2 2025 underscores its commitment to staying at the forefront of mobile technology, promising even greater capabilities for its customers and a stronger competitive edge.

Furthermore, Finland's ambition to be a leader in the development of future 6G technologies presents a significant long-term technological factor for Elisa. Early engagement and investment in 6G research and development could position Elisa to capitalize on the next generation of wireless innovation, potentially unlocking new revenue streams and service paradigms.

Artificial intelligence and automation are fundamentally reshaping telecommunications, impacting everything from how networks are managed and customers are supported to how cybersecurity threats are handled. Elisa is at the forefront, actively embedding AI into its core operations. This includes a strategic push to hire AI specialists and leverage these advanced technologies to boost operational efficiency and pioneer innovative new services for its customer base.

The widespread embrace of cloud computing by both corporations and government bodies, coupled with the escalating risk of cyber threats, is a significant driver for Elisa's IT services. This trend directly fuels the demand for their cloud solutions and advanced cybersecurity capabilities, positioning Elisa to capitalize on these critical business needs.

Elisa's financial performance in Q1 2025 reflects this dynamic, with notable growth reported in their international software services. This expansion includes a strong contribution from their cloud solutions, underscoring the market's increasing reliance on these offerings and Elisa's successful market penetration.

IoT (Internet of Things) Growth

The relentless expansion of Internet of Things (IoT) devices and their applications is fueling a significant demand for robust connectivity and sophisticated data management solutions. This trend presents a clear avenue for Elisa to broaden its Machine-to-Machine (M2M) and IoT subscription base, alongside its associated service offerings.

Elisa's strategic focus on these growth areas is evident in its financial performance. For instance, in the second quarter of 2025, the company reported a notable increase in its mobile post-paid subscriptions, which crucially includes its M2M and IoT connections.

- IoT Connectivity Demand: The increasing number of connected devices globally necessitates enhanced network infrastructure and data processing capabilities, a core area for Elisa's business.

- M2M & IoT Subscription Growth: Elisa's mobile post-paid segment, encompassing M2M and IoT, experienced growth in Q2 2025, indicating successful market penetration and service adoption.

- Data Management Opportunities: The vast amounts of data generated by IoT devices create opportunities for Elisa to offer value-added data analytics and management services, further diversifying its revenue streams.

Fiber Optic Network Expansion

Elisa is heavily invested in expanding its fiber optic network across Finland, recognizing its critical role in meeting escalating data demands. This expansion is crucial for delivering high-speed fixed broadband to both residential and business customers.

The company is actively accelerating fiber network construction, already introducing 10 Gbit/s speeds in various locations. This strategic move positions Elisa to capitalize on the growing need for robust and fast internet connectivity.

- Fiber Network Growth: Elisa's commitment to fiber expansion is a key technological driver, directly impacting service quality and market competitiveness.

- Speed Advancements: The rollout of 10 Gbit/s speeds signifies Elisa's proactive approach to future-proofing its infrastructure and offering cutting-edge services.

- Market Reach: By expanding to new geographical areas, Elisa broadens its customer base and strengthens its presence in the Finnish telecommunications market.

Elisa's technological strategy is deeply intertwined with advancements in mobile and fixed network infrastructure. The ongoing rollout of 5G and the strategic launch of 5.5G (5G Advanced) in Q2 2025 highlight a commitment to superior speed and reduced latency, essential for data-intensive services. Furthermore, Elisa's proactive engagement with 6G research positions it to lead in future wireless innovation.

AI and automation are being integrated across Elisa's operations, from network management to customer service and cybersecurity, with a focus on hiring AI specialists to enhance efficiency and develop new services. The company's IT services, particularly cloud solutions and cybersecurity, are experiencing strong demand, evidenced by growth in its international software services in Q1 2025, with cloud offerings being a significant contributor.

The burgeoning Internet of Things (IoT) ecosystem fuels Elisa's expansion in M2M and IoT subscriptions, as seen in the Q2 2025 mobile post-paid segment growth. Concurrently, Elisa's accelerated fiber optic network expansion, including the deployment of 10 Gbit/s speeds, addresses the escalating demand for high-speed fixed broadband, strengthening its market position.

Legal factors

Elisa operates under Finland's Act on Electronic Communication Services and similar legislation in Estonia, necessitating licenses for spectrum allocation and service provision. These regulatory frameworks dictate operational standards and market access.

Recent amendments in Finland, effective from January 1, 2025, focus on enhancing broadband penetration and bolstering network security. These changes could influence Elisa's investment strategies in infrastructure and cybersecurity measures.

As an EU-based telecommunications provider, Elisa is directly impacted by evolving EU regulations. The General Data Protection Regulation (GDPR) mandates strict data privacy controls, affecting how Elisa collects, processes, and stores customer information. Non-compliance can lead to substantial fines, as seen with various companies facing penalties in the hundreds of millions of euros for GDPR breaches.

The Digital Services Act (DSA) introduces new obligations for online platforms regarding content moderation and transparency, which could influence Elisa's digital service offerings and partnerships. Furthermore, the Data Act, set to fully apply from September 2025, will govern access to and use of data generated by connected devices, impacting Elisa's IoT services and data monetization strategies.

Consumer protection laws significantly shape how telecommunication companies like Elisa operate, dictating everything from service terms and contract lengths to how disputes are handled. These regulations are designed to ensure fair practices and transparency for customers.

Recent legislative shifts, such as those seen in Finland, directly impact business models. For instance, a reduction in the maximum contract duration for mobile subscriptions from 24 months to 12 months, implemented in 2023, forces providers to adapt their customer acquisition and retention strategies, potentially affecting revenue predictability.

Competition Law and Antitrust Regulations

Competition authorities in Finland actively monitor the telecommunications market to prevent monopolies and ensure fair competition, directly impacting Elisa's strategic decisions. These regulations can significantly influence Elisa's merger and acquisition activities, pricing strategies, and overall market behavior, ensuring a level playing field for all players.

Finland's national digital infrastructure strategy, updated in 2024, specifically aims to enhance competition within the telecommunications sector by promoting infrastructure sharing and encouraging new market entrants. This strategic focus means Elisa must continuously adapt its business model to remain competitive and compliant.

- Regulatory Oversight: Finnish competition authorities scrutinize market concentration, potentially limiting Elisa's ability to acquire competitors or engage in certain pricing practices.

- Merger & Acquisition Impact: Antitrust reviews can delay or block M&A deals, affecting Elisa's growth and market positioning strategies.

- Pricing and Market Behavior: Regulations aim to prevent anti-competitive pricing, influencing how Elisa structures its service offerings and promotions to consumers.

- Digital Infrastructure Goals: Finland's push for enhanced competition in digital infrastructure may lead to new regulatory requirements or opportunities for Elisa to collaborate or compete with new entities.

Cybersecurity and Critical Infrastructure Regulations

Elisa, as a key player in Finland's telecommunications sector, operates within a stringent regulatory environment focused on cybersecurity and the resilience of critical infrastructure. This means Elisa must adhere to evolving legal frameworks designed to protect essential services from digital threats.

The recently implemented NIS 2 Directive, transposed into Finnish law via a new cybersecurity act, significantly elevates these obligations. For Elisa, this translates to more rigorous security measures and mandatory incident reporting protocols for its essential services.

- Stricter Security Requirements: Elisa must implement advanced technical and organizational measures to manage cybersecurity risks and prevent disruptions to its network operations.

- Enhanced Incident Reporting: The directive mandates timely and comprehensive reporting of significant cybersecurity incidents to national authorities, increasing transparency and accountability.

- Supply Chain Security: Elisa is also expected to ensure the cybersecurity of its own supply chain, addressing vulnerabilities in third-party services and components.

- Supervisory Powers: National authorities are granted increased powers to supervise compliance and impose penalties for non-adherence, underscoring the importance of robust cybersecurity practices.

Legal factors significantly shape Elisa's operations, from spectrum licensing under Finland's Act on Electronic Communication Services to compliance with EU regulations like GDPR and the forthcoming Data Act. These laws mandate strict data privacy, content moderation, and data access protocols, impacting service offerings and revenue streams. Recent Finnish legislation, such as the reduction of maximum mobile contract durations to 12 months in 2023, forces strategic adjustments in customer retention and revenue predictability.

Finland's competition authorities actively monitor the telecommunications market, influencing Elisa's merger and acquisition strategies and pricing. The national digital infrastructure strategy, updated in 2024, promotes infrastructure sharing and new entrants, compelling Elisa to adapt its business model for sustained competitiveness.

Cybersecurity is a critical legal concern, with Elisa bound by the NIS 2 Directive, transposed into Finnish law. This requires robust security measures, incident reporting, and supply chain security, with enhanced supervisory powers for authorities to ensure compliance.

| Regulatory Area | Key Legislation/Directive | Impact on Elisa | Example Data/Trend |

|---|---|---|---|

| Spectrum Licensing & Service Provision | Finland's Act on Electronic Communication Services | Requires licenses for operations; dictates service standards. | Continued investment in 5G spectrum auctions. |

| Data Privacy | EU General Data Protection Regulation (GDPR) | Mandates strict data handling, collection, and storage; non-compliance incurs significant fines. | Fines for GDPR breaches can reach millions of euros. |

| Digital Services & Data Access | EU Digital Services Act (DSA), EU Data Act (applies Sept 2025) | Governs content moderation, transparency, and access to data from connected devices. | Impacts IoT service development and data monetization. |

| Consumer Protection | Finnish Consumer Protection Laws | Dictates contract terms, dispute resolution, and fair practices. | Maximum mobile contract duration reduced to 12 months (2023). |

| Competition Law | Finnish Competition Authority oversight | Scrutinizes M&A, pricing, and market behavior to ensure fair competition. | Potential delays or blocks on M&A deals impacting market consolidation. |

| Cybersecurity | NIS 2 Directive (transposed into Finnish law) | Elevates security obligations for critical infrastructure, including incident reporting and supply chain security. | Increased investment in cybersecurity infrastructure and protocols. |

Environmental factors

Elisa is aggressively pursuing climate change mitigation, setting a net-zero emissions goal for 2040. This commitment extends to reducing absolute Scope 1, 2, and 3 greenhouse gas emissions, underscoring a deep integration of environmental sustainability into its core business strategy.

The energy consumption of network infrastructure is a critical environmental factor for telecommunications companies like Elisa. As networks become more complex and data traffic grows, managing this energy use is paramount.

Elisa has made significant strides in improving the energy efficiency of its mobile network, achieving a remarkable 71% improvement. This focus on efficiency directly addresses the environmental impact of powering these essential services.

Elisa is focusing on responsible waste management, especially for electronic waste generated by their network infrastructure and customer devices. This commitment extends to adopting circular economy principles to improve material efficiency and promote services that reuse and recycle products.

In 2023, Elisa reported a significant reduction in waste, with 80% of their operational waste being recycled or recovered. They also aim to increase the lifespan of customer devices through repair and refurbishment programs, contributing to a more sustainable approach to electronics.

Environmental Reporting and Compliance

Elisa is proactive in its environmental commitments, aligning with key regulations like the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy Regulation. These frameworks guide the company's approach to transparently disclosing its environmental impact and ensuring sustainable practices.

The company demonstrates this commitment through its annual Sustainability Statement, a comprehensive report detailing its environmental performance. This statement undergoes third-party assurance, adding a layer of credibility and external validation to Elisa's reported data.

For instance, in their 2023 Sustainability Statement, Elisa reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline. They also highlighted investments in renewable energy sources, with 95% of their electricity consumption sourced from renewables in 2023.

- CSRD and EU Taxonomy Compliance: Elisa actively integrates reporting requirements from these significant EU environmental regulations.

- Annual Sustainability Statement: A core element of their environmental reporting, providing detailed performance metrics.

- Third-Party Assurance: Enhances the credibility and reliability of their published environmental data.

- Emission Reduction Targets: Elisa has set ambitious targets, aiming for a 50% reduction in Scope 1 and 2 emissions by 2025 (vs. 2020 baseline).

Sustainable Business Practices and Green Transition

Elisa is actively contributing to the green transition by offering services like energy storage solutions, which directly support the shift towards more sustainable energy consumption. This focus on environmental responsibility is a key aspect of their business model.

The company's dedication to sustainability is reflected in its strong Environmental, Social, and Governance (ESG) ratings. For instance, Elisa has consistently been recognized among the top performers in sustainability rankings, highlighting their commitment to eco-friendly operations and corporate citizenship.

In 2024, Elisa's investments in renewable energy infrastructure and smart grid technologies are projected to further reduce their carbon footprint. Their efforts are aligned with broader European Union goals for a greener economy, with Elisa aiming to achieve carbon neutrality in its own operations by 2030.

- Elisa's Energy Storage Solutions: Facilitating the integration of renewable energy sources by providing reliable energy storage.

- ESG Recognition: Consistently high ESG ratings from major assessment agencies, underscoring their commitment to environmental stewardship.

- Carbon Footprint Reduction: Ongoing investments in green technologies and operational efficiencies to minimize environmental impact.

- Green Transition Contribution: Actively supporting the societal shift towards sustainable practices through their service offerings and corporate strategy.

Elisa's environmental strategy is deeply embedded in its operations, with a clear net-zero emissions goal for 2040, covering Scope 1, 2, and 3. The company is actively reducing its energy consumption, achieving a 71% improvement in mobile network energy efficiency. Furthermore, Elisa prioritizes responsible waste management, recycling 80% of operational waste in 2023 and focusing on extending device lifespans through repair and refurbishment.

| Environmental Metric | 2023 Performance | Target/Context |

|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 15% (vs. 2020 baseline) | Target: 50% reduction by 2025 (vs. 2020 baseline) |

| Renewable Electricity Usage | 95% | Commitment to 100% renewable energy |

| Operational Waste Recycling/Recovery | 80% | Focus on circular economy principles |

| Net-Zero Emissions Goal | 2040 | Includes Scope 1, 2, and 3 emissions |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using data from reputable sources like the World Bank, International Monetary Fund, and leading industry analysis firms. This ensures that each factor, from political stability to technological advancements, is informed by current and authoritative global information.