Ecopetrol PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ecopetrol Bundle

Navigate the complex external forces shaping Ecopetrol's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting this key player in the energy sector. Gain a strategic advantage by leveraging these insights for your own market planning.

Unlock actionable intelligence with our expertly crafted PESTLE analysis of Ecopetrol. Discover how global trends are creating both opportunities and challenges for the company. Download the full report now to make informed decisions and bolster your competitive edge.

Political factors

Ecopetrol's strategic direction is profoundly shaped by its majority ownership by the Colombian government, which held 88.49% of its shares as of 2024. This substantial government stake means national energy policies and political priorities directly influence the company's investment plans and operational targets. Consequently, Ecopetrol's commitment to energy security and the ongoing energy transition, encompassing both hydrocarbon output and renewable energy growth, is intrinsically linked to the government's overarching agenda.

Colombia's government is actively pursuing an energy transition, with a strong focus on boosting renewable energy sources. This political agenda aims to decrease reliance on traditional fossil fuels, a key area for Ecopetrol. The nation has set an ambitious goal of integrating 20% renewable energy capacity by 2030, signaling a significant shift in energy policy.

Ecopetrol, as a state-owned entity, is directly influenced by these national mandates. The company is tasked with aligning its strategies to support this transition, which involves a gradual move away from oil and gas production. This political directive shapes Ecopetrol's investment decisions, encouraging greater allocation towards cleaner energy alternatives while still needing to ensure hydrocarbon output for national energy security.

Ecopetrol's operations are significantly influenced by geopolitical risks, particularly in regions like its border with Venezuela, where instability can disrupt infrastructure and supply chains. For instance, ongoing political tensions in neighboring countries can lead to increased security costs and potential operational interruptions, impacting production targets.

The company's international footprint, extending to the United States, Brazil, and Mexico, means it navigates diverse political landscapes and regulatory environments. In 2024, the energy sector in these regions faced scrutiny over environmental policies and national energy strategies, which could influence Ecopetrol's investment decisions and market access.

Managing these varying political climates is crucial for Ecopetrol's sustained operational continuity and the protection of its substantial investments. This requires agile risk mitigation strategies, including scenario planning for potential political shifts and robust engagement with local governments across its operating territories.

Regulatory and Legal Frameworks

Changes in Colombian regulations, particularly those concerning environmental policies and tax laws, significantly influence Ecopetrol's operational costs and profit margins. For instance, evolving environmental standards can necessitate increased investment in sustainable practices and emissions reduction technologies.

Ecopetrol must navigate a complex web of national and international legal mandates. This includes adherence to financial reporting requirements, such as filing its annual report on Form 20-F with the U.S. Securities and Exchange Commission (SEC), which underscores its commitment to global transparency and regulatory compliance.

- Environmental Regulations: In 2024, Colombia continued to emphasize its climate commitments, potentially leading to stricter emissions standards for the oil and gas sector.

- Tax Law Impact: Changes in corporate tax rates or royalty structures directly affect Ecopetrol's net income, as seen in past fiscal adjustments.

- Industry-Specific Mandates: New regulations on energy transition or hydrocarbon exploration can reshape Ecopetrol's strategic investments and operational focus.

- International Reporting: Ecopetrol's 2024 financial reporting to bodies like the SEC ensures compliance with international accounting standards and disclosure norms.

Government Transfers and Fiscal Contributions

As a state-owned enterprise, Ecopetrol's financial performance directly impacts the Colombian government's revenue streams. In 2024, Ecopetrol made significant shareholder transfers to the nation, totaling COP 42 trillion. This substantial contribution underscores its vital role in national finances.

This close relationship means Ecopetrol's operations and profitability are closely monitored by the government, influencing expectations for dividend payouts and overall financial health. The company's financial results are therefore intrinsically linked to the country's fiscal stability and policy decisions.

- Government Revenue: Ecopetrol is a primary source of income for the Colombian state through taxes and dividends.

- 2024 Contribution: The company transferred COP 42 trillion to the government in shareholder contributions during 2024.

- Fiscal Interdependence: Ecopetrol's financial performance directly affects and is affected by the nation's fiscal health.

- Policy Influence: Governmental expectations regarding profitability and dividend payouts can shape Ecopetrol's strategic decisions.

Ecopetrol's political landscape is heavily influenced by its status as a state-controlled entity, with the Colombian government holding a majority stake. This means national policy shifts, particularly concerning energy and resource management, directly impact Ecopetrol's strategic direction and investment priorities. The government's push for an energy transition, aiming for 20% renewable energy capacity by 2030, directly shapes Ecopetrol's operational focus, balancing hydrocarbon production with renewable energy development.

Geopolitical factors also play a significant role, with Ecopetrol navigating political stability in regions where it operates, such as its presence in the United States and Brazil. Changes in national regulations, including environmental standards and tax laws in these diverse operating territories, can affect operational costs and strategic investment decisions, requiring agile risk management.

The company's financial performance is intrinsically linked to the Colombian government's fiscal health, as evidenced by Ecopetrol's 2024 shareholder transfers totaling COP 42 trillion. This substantial contribution highlights Ecopetrol's vital role as a revenue generator for the state, influencing governmental expectations for profitability and dividend payouts.

| Political Factor | Impact on Ecopetrol | Key Data/Observation (2024/2025) |

| Government Ownership | Direct influence on strategy and policy alignment | Colombian government held 88.49% of Ecopetrol shares in 2024. |

| Energy Transition Policies | Drives investment in renewables alongside hydrocarbons | Colombia aims for 20% renewable energy capacity by 2030. |

| Geopolitical Stability | Affects operational continuity and security costs | Operations in regions with varying political climates (e.g., US, Brazil). |

| Regulatory Changes | Impacts operational costs, profit margins, and investment decisions | Evolving environmental standards and tax laws in operating countries. |

| Fiscal Interdependence | Shapes company's financial performance expectations | COP 42 trillion transferred to government in shareholder contributions (2024). |

What is included in the product

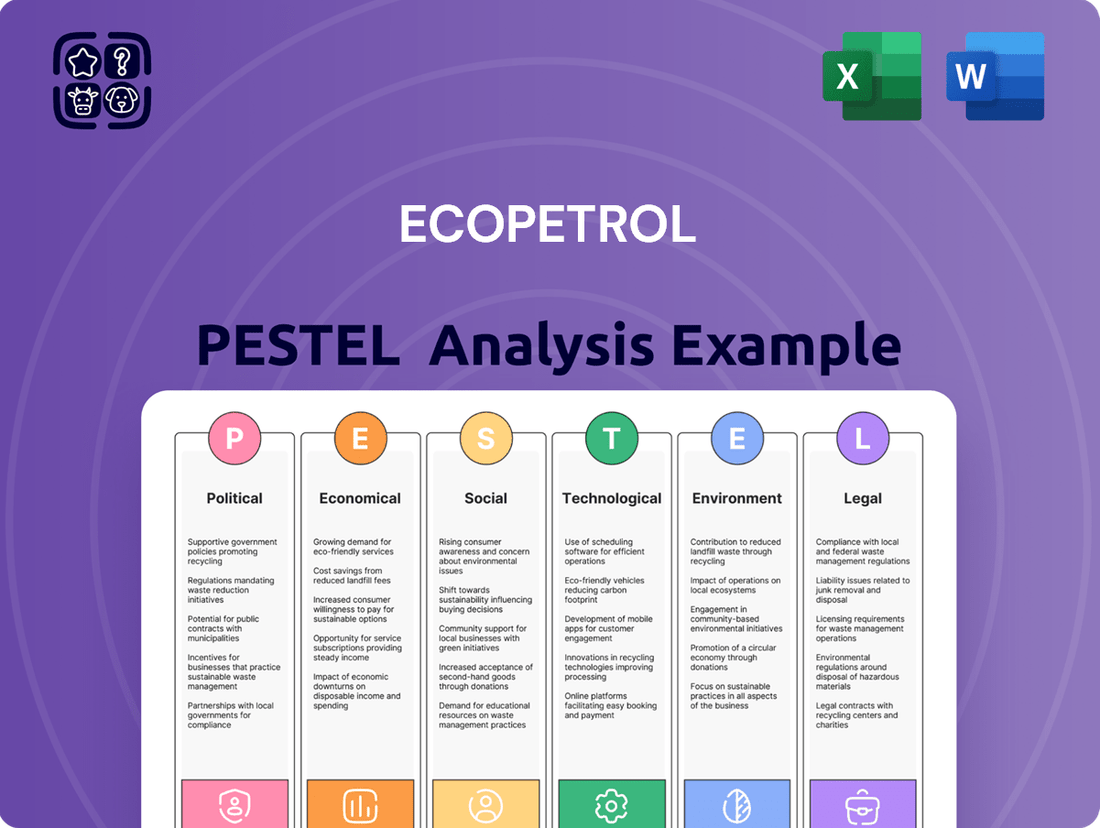

This Ecopetrol PESTLE analysis examines the influence of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the company's operations and strategic direction.

It provides a comprehensive overview of how these forces create both challenges and opportunities, enabling informed decision-making for stakeholders.

A clear, actionable summary of Ecopetrol's PESTLE factors, presented in a digestible format, helps alleviate the pain of navigating complex external influences during strategic planning.

This PESTLE analysis provides a concise, easily shareable overview, relieving the burden of extensive research and facilitating rapid alignment on external risks and opportunities across Ecopetrol's diverse teams.

Economic factors

Ecopetrol's financial health is intrinsically linked to the ebb and flow of global oil and gas prices. These fluctuations directly shape the company's revenue streams and overall profitability. Despite strong financial performance in 2024 and the first quarter of 2025, characterized by healthy EBITDA margins, the company has acknowledged that lower crude prices and inflationary pressures present notable headwinds.

The company's strategic planning reflects this sensitivity. For instance, Ecopetrol's investment blueprint for 2025 is predicated on an assumed Brent crude price of US$73 per barrel. This figure underscores how crucial price stability is for the execution of its growth initiatives and financial projections.

Ecopetrol is actively investing in its energy transition, allocating a substantial portion of its capital to renewable energy and lower-carbon initiatives. For 2025, the company plans to direct roughly 24% of its investment budget, estimated at 6.5 trillion pesos (approximately USD 6.5-7.5 billion), towards these transition projects. This strategic move includes investments in areas like renewable energy generation, hydrogen production, and transmission infrastructure.

This significant financial commitment underscores Ecopetrol's strategy to diversify its revenue streams and mitigate risks associated with the fluctuating prices of traditional fossil fuels. By expanding into renewable energy and other cleaner solutions, Ecopetrol aims to build a more resilient and sustainable business model for the future.

Ecopetrol has made significant strides in operational efficiency, realizing COP 5.3 trillion in optimizations in 2024. These gains were driven by comprehensive programs targeting EBITDA, CAPEX, and working capital management.

Looking ahead, Ecopetrol is committed to further enhancing key performance indicators. The company aims to reduce lifting costs, total refining costs, and the cost per barrel transported to ensure sustained competitive returns in the evolving energy market.

Debt Profile and Financial Stability

Ecopetrol's financial health is bolstered by a robust debt profile, with its gross debt to EBITDA ratio standing at a manageable 2.2x as of 2024. This ratio indicates the company's ability to service its debt obligations effectively within the energy sector.

The company demonstrates proactive debt management through strategic refinancing. Ecopetrol consistently explores capital markets and diverse credit avenues to optimize its debt maturity structure and secure favorable financing terms. This approach ensures financial flexibility and stability.

- Gross Debt/EBITDA Ratio (2024): 2.2x, indicating strong debt servicing capability.

- Debt Management Strategy: Active refinancing through capital markets and credit alternatives.

- Financial Stability: Commitment to managing debt maturities enhances overall financial resilience.

Market Demand and Domestic Supply Commitments

Ecopetrol's role as Colombia's energy backbone is undeniable, producing over 60% of the nation's hydrocarbons and underpinning its energy security. This significant domestic supply commitment, aimed at meeting 65% of Colombia's energy needs, directly influences market demand and Ecopetrol's operational focus. Maintaining consistent production is paramount, impacting not only national energy independence but also Ecopetrol's competitive standing in the market.

The company's ability to meet this substantial domestic demand is a key economic driver. For instance, in 2023, Ecopetrol reported hydrocarbon production of approximately 730,000 barrels of oil equivalent per day (boepd). This output directly addresses the country's energy requirements, highlighting the direct correlation between Ecopetrol's supply capabilities and the national economic landscape.

- Production Capacity: Ecopetrol's daily production of around 730,000 boepd in 2023 is central to meeting domestic energy demand.

- Market Share: The company's contribution of over 60% to Colombia's hydrocarbon output solidifies its dominant market position.

- Energy Security: Meeting 65% of national energy requirements underscores Ecopetrol's critical role in Colombia's energy independence.

- Economic Impact: Stable supply from Ecopetrol directly influences national energy prices and economic stability.

Ecopetrol's financial performance remains closely tied to global energy prices, with 2024 and early 2025 showing strong results despite acknowledged pressures from lower crude prices and inflation. The company's 2025 investment plan, for example, is built on an assumed Brent crude price of US$73 per barrel, highlighting the critical role of price stability for its growth objectives.

The company is strategically investing in its energy transition, with approximately 24% of its 2025 capital expenditure, estimated between USD 6.5-7.5 billion, earmarked for renewable energy, hydrogen, and transmission infrastructure. This substantial commitment aims to diversify revenue and build a more resilient business model.

Ecopetrol demonstrated significant operational efficiency in 2024, achieving COP 5.3 trillion in optimizations through focused management of EBITDA, CAPEX, and working capital. The company plans further enhancements, targeting reduced lifting and refining costs, and lower transportation costs per barrel to maintain competitive returns.

The company's financial stability is supported by a strong debt profile, with a gross debt to EBITDA ratio of 2.2x in 2024, coupled with active debt management through refinancing. This proactive approach ensures financial flexibility and resilience.

| Metric | Value (2024/2025) | Significance |

|---|---|---|

| Assumed Brent Crude Price for 2025 Investments | US$73 per barrel | Key assumption for financial projections and growth initiatives. |

| Energy Transition Investment (2025) | ~24% of CAPEX | Focus on renewables, hydrogen, and transmission infrastructure. |

| Operational Optimizations (2024) | COP 5.3 trillion | Driven by EBITDA, CAPEX, and working capital management. |

| Gross Debt/EBITDA Ratio (2024) | 2.2x | Indicates strong debt servicing capability and financial health. |

Same Document Delivered

Ecopetrol PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ecopetrol delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Ecopetrol's strategic landscape.

Sociological factors

Ecopetrol prioritizes its role in community well-being, channeling substantial funds into projects supporting education, healthcare, and local economic growth in its operational areas. This commitment underscores the company's dedication to fostering strong community ties and contributing to regional prosperity.

In 2024, Ecopetrol's investment in social responsibility reached COP 180 billion. This significant allocation demonstrates a tangible commitment to improving the quality of life and creating sustainable development opportunities for the communities where it operates.

Colombia's Just Energy Transition Roadmap, released in 2023, prioritizes social equity and job creation in renewables as the nation moves away from fossil fuels. This plan aims to ensure that the economic benefits of the transition are shared broadly, with a focus on supporting communities and workers impacted by the shift.

Ecopetrol, as a key player in Colombia's energy sector and a significant employer, faces the challenge of managing the social implications of this transition. The company is expected to invest in retraining its existing workforce for roles in renewable energy projects, such as solar and wind farms, and to foster new employment opportunities within these burgeoning sectors to maintain social stability and economic well-being.

Ecopetrol places a high value on stakeholder relations and transparency, regularly releasing reports detailing its social and environmental performance, including its approach to climate change. In 2023, the company published its Integrated Annual Report, showcasing its progress on sustainability goals and its commitment to open communication. This dedication to clear information sharing and alignment with global sustainability benchmarks is vital for fostering trust among investors, local communities, and the broader public, underpinning its social license to operate.

Indigenous Community Relations

Ecopetrol operates in regions with significant indigenous populations, requiring careful management of its relationships with these communities. This involves addressing concerns about land rights, resource extraction, and environmental stewardship, which are crucial for maintaining its social license to operate.

The Colombian government’s framework, which designates indigenous authorities as environmental regulators, mandates Ecopetrol to engage in proactive and respectful dialogue. This ensures that development projects align with community expectations and adhere to conservation principles, fostering collaborative approaches to resource management.

- Land Use Agreements: Ecopetrol actively seeks agreements with indigenous communities regarding land use for its operations, aiming for mutual benefit and minimal disruption.

- Environmental Impact Mitigation: The company implements specific strategies to mitigate the environmental footprint of its activities in areas inhabited by indigenous peoples, often in consultation with community leaders.

- Consultation Processes: Formal consultation processes are undertaken to inform and gather consent from indigenous communities regarding projects that may affect their territories and traditional ways of life.

- Sustainable Resource Management: Ecopetrol collaborates with indigenous groups on initiatives that promote the sustainable use and conservation of natural resources within their ancestral lands.

Public Perception and Brand Reputation

Ecopetrol's public image is increasingly influenced by its environmental and social performance, with a growing emphasis on sustainability. The company's strategic shift towards renewable energy, evidenced by investments in solar and wind projects, alongside its social responsibility initiatives, directly shapes its brand reputation and public acceptance. For instance, in 2024, Ecopetrol announced plans to invest approximately $500 million in non-conventional energy sources by 2028, signaling a commitment to cleaner operations.

Negative perceptions stemming from environmental incidents, such as oil spills, or unresolved social conflicts can significantly impact Ecopetrol's operations and market standing. A notable example from 2023 involved community protests in the Caño Limón region, which temporarily disrupted production. Such events can lead to increased regulatory scrutiny and affect investor confidence. In 2024, Ecopetrol reported a 15% decrease in oil spills compared to the previous year, a metric closely watched by the public and stakeholders.

Ecopetrol's brand reputation is also built on its community engagement and contributions to local development. The company's social programs, which focus on education, health, and economic empowerment in the regions where it operates, are crucial for maintaining a positive public perception. In 2024, Ecopetrol's social investment reached over $100 million, supporting over 500 community projects across Colombia.

The company actively communicates its sustainability efforts and social impact through various channels to manage public perception. These efforts are vital for securing social license to operate and for attracting talent and investment in an era where corporate responsibility is paramount. Ecopetrol's 2024 sustainability report highlighted a 20% reduction in greenhouse gas emissions intensity from its operations.

Societal expectations for corporate responsibility are evolving, pushing Ecopetrol to integrate sustainability and community well-being into its core strategy. The company's significant social investments, such as the COP 180 billion allocated in 2024 to community projects, reflect this growing emphasis on social equity and local development.

Ecopetrol's commitment to indigenous communities is crucial for its social license to operate, requiring careful navigation of land rights and environmental stewardship. Proactive engagement and adherence to government frameworks that empower indigenous authorities as environmental regulators are key to maintaining positive relationships.

Public perception of Ecopetrol is increasingly tied to its environmental and social performance, with a strong focus on sustainability. Initiatives like the planned $500 million investment in non-conventional energy sources by 2028 and a reported 15% decrease in oil spills in 2024 are vital for enhancing its brand reputation.

Technological factors

Ecopetrol is making significant strides in adopting renewable energy technologies as a core component of its energy transition. The company is actively investing in solar and wind power, aiming to integrate these cleaner sources into its operational mix. This strategic shift is crucial for its long-term sustainability and competitive positioning.

By the close of 2025, Ecopetrol has set an ambitious target of incorporating 900 MW of renewable power generation into its portfolio. Looking further ahead, the company plans to expand this capacity to 2.2 GW by 2030. Projects like the operational La Cira Infantas solar park are tangible examples of this commitment, demonstrating real progress in diversifying its energy sources.

Ecopetrol is making significant technological strides in hydrogen production, aiming to produce 1 million tonnes annually by 2040 through a USD 2.5 billion investment. This ambitious plan includes a diverse hydrogen mix: 40% green, 30% blue, and 30% white.

A concrete step in this strategy is the planned construction of a green hydrogen plant at the Cartagena Refinery, slated for completion by 2026. This facility will feature a 5-MW electrolyzer, underscoring Ecopetrol's commitment to advancing its hydrogen capabilities.

Ecopetrol is actively investing in Carbon Capture, Utilization, and Storage (CCUS) technologies, with pilot projects underway to mitigate emissions from its refining and upstream activities. This strategic focus on CCUS is vital for the company's transition towards decarbonizing its core hydrocarbon operations and achieving its ambitious emissions reduction goals.

In 2024, Ecopetrol announced plans to further develop its CCUS capabilities, aiming to capture significant volumes of CO2. For instance, the company is evaluating the potential to capture up to 2 million tonnes of CO2 per year from its Cartagena refinery by 2030, a move that would represent a substantial step in its environmental strategy.

Digital Transformation and Operational Optimization

Ecopetrol is actively embracing digital transformation to streamline its operations. A key objective is to achieve a significant reduction in operational costs, targeting 24% of its 2025 budget through the implementation of digital solutions.

This strategic push involves optimizing field development, a process enhanced by collaborations with artificial intelligence solution providers. Furthermore, the company is focused on improving its broader business processes to boost overall efficiency and productivity.

- Digital Transformation Initiatives: Ecopetrol is investing in digital technologies to enhance operational efficiency.

- Cost Reduction Target: Aims to cut operational costs by 24% of its 2025 budget via digital strategies.

- AI-Driven Optimization: Partnering with AI firms to optimize field development and resource allocation.

- Process Improvement: Focusing on enhancing overall business processes for greater productivity.

Exploration and Production Technologies

Ecopetrol is actively investing in cutting-edge technologies to optimize its hydrocarbon operations, even as it diversifies into renewables. This dual approach aims to bolster profitability in its core business and support energy security. Key initiatives include enhanced oil recovery (EOR) techniques and the drilling of new wells in strategically important basins. For instance, Ecopetrol has been exploring advanced EOR methods like chemical injection and thermal recovery to maximize output from mature fields. These technological advancements are crucial for maintaining production levels and ensuring a stable energy supply.

The company's commitment to technological innovation in exploration and production is evident in its ongoing projects. Ecopetrol is focusing on drilling new development and exploration wells in areas identified as having high potential. This strategy is supported by investments in seismic imaging and reservoir characterization technologies, which allow for more precise identification of commercially viable reserves. These efforts are designed to extend the life of existing fields and discover new hydrocarbon resources, thereby reinforcing Ecopetrol's position in the energy market.

In 2024, Ecopetrol allocated significant capital to these technological upgrades. Specific investments are directed towards digitalizing exploration processes and implementing advanced drilling techniques that reduce costs and environmental impact. The company reported that its exploration and production segment saw substantial investment, with a focus on projects that leverage new technologies to improve efficiency and recovery rates. This proactive technological adoption is vital for navigating the complexities of the evolving energy landscape.

Ecopetrol's technological roadmap for exploration and production includes:

- Advancements in Enhanced Oil Recovery (EOR) methods to boost production from existing reservoirs.

- Investment in seismic data acquisition and processing for more accurate exploration targeting.

- Adoption of digital technologies and automation in drilling operations for improved efficiency and safety.

- Focus on developing and deploying technologies that minimize the environmental footprint of hydrocarbon extraction.

Ecopetrol is significantly investing in digital transformation, aiming to achieve a 24% reduction in operational costs by 2025 through digital solutions. This includes leveraging artificial intelligence for field development optimization and enhancing overall business processes for greater productivity.

The company is also advancing its capabilities in hydrogen production, targeting 1 million tonnes annually by 2040 with a substantial USD 2.5 billion investment, aiming for a diverse hydrogen mix. Furthermore, Ecopetrol is actively developing Carbon Capture, Utilization, and Storage (CCUS) technologies, with plans to capture up to 2 million tonnes of CO2 per year from its Cartagena refinery by 2030.

In parallel, Ecopetrol is enhancing its hydrocarbon operations through advanced technologies like enhanced oil recovery (EOR) and digitalizing exploration processes. These efforts are supported by significant capital allocation in 2024 towards projects that improve efficiency and recovery rates, ensuring continued energy supply and profitability.

| Technology Area | Key Initiatives | Targets/Data |

|---|---|---|

| Renewable Energy | Solar and Wind Power Integration | 900 MW by end of 2025; 2.2 GW by 2030 |

| Hydrogen Production | Green, Blue, and White Hydrogen | 1 million tonnes annually by 2040 (USD 2.5 billion investment) |

| CCUS | CO2 Capture from Refining | Up to 2 million tonnes/year from Cartagena refinery by 2030 |

| Digital Transformation | Operational Cost Reduction | 24% of 2025 budget |

| Exploration & Production | Enhanced Oil Recovery (EOR) | Focus on chemical and thermal recovery methods |

Legal factors

Ecopetrol navigates a stringent regulatory landscape, encompassing both Colombian national laws and international standards. This includes environmental mandates, financial disclosure requirements, and corporate governance protocols. For instance, in 2023, Ecopetrol reported total revenues of approximately COP 110 trillion (around USD 28 billion), reflecting its significant operational scale and the associated compliance burdens.

The company's commitment to transparency is evident in its regular filings with regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC). Its annual report on Form 20-F for the fiscal year ended December 31, 2023, details its adherence to U.S. accounting standards and SEC regulations, underscoring its global operational reach and accountability.

Ecopetrol's operations are heavily influenced by environmental licensing and permitting regulations in Colombia. The company must navigate a complex legal framework to obtain and maintain these approvals for all its activities, from exploration to production and refining, especially for new projects and expansions. Failure to comply can lead to significant fines and operational disruptions.

Recent developments in Colombia's energy policy are noteworthy. The Ministry of Mines and Energy has been working to streamline environmental licensing processes, particularly for renewable energy projects. This initiative, aimed at accelerating the energy transition, could provide Ecopetrol with a smoother path for its investments in green energy, such as solar and wind power, as it diversifies its portfolio beyond traditional hydrocarbons.

Colombia's legal landscape is actively shaping its energy transition, with new legislation offering tax breaks for renewable energy and energy efficiency initiatives. These incentives are crucial for encouraging investment in cleaner energy sources.

Ecopetrol's strategic pivot towards less carbon-intensive operations is directly influenced by these evolving laws. The government's commitment to diversifying the national energy mix through supportive legal frameworks provides a favorable environment for Ecopetrol's green investments.

Labor Laws and Employment Regulations

Ecopetrol, a major employer with over 19,000 individuals on its payroll, operates under strict adherence to Colombia's comprehensive labor laws and employment regulations. Navigating these legal frameworks is paramount for the company's operational integrity and reputation.

As Ecopetrol actively pursues its energy transition strategy, managing workforce dynamics becomes a significant legal and operational challenge. This includes addressing potential workforce adjustments, implementing robust retraining programs, and ensuring all labor practices align with current and evolving legal requirements, particularly concerning employee rights and fair treatment during periods of change.

- Compliance Burden: Ecopetrol must continuously monitor and adapt to Colombia's labor code, which governs everything from hiring and compensation to termination and benefits, impacting its operational costs and human resource strategies.

- Energy Transition Impact: The shift towards cleaner energy sources necessitates careful legal planning for potential redundancies or the creation of new roles, requiring compliance with laws on worker retraining and severance.

- Employee Relations: Maintaining positive employee relations is legally mandated, requiring Ecopetrol to uphold collective bargaining agreements and ensure safe working conditions, as stipulated by national labor legislation.

- Regulatory Scrutiny: Government bodies like the Ministry of Labor actively oversee corporate compliance, meaning Ecopetrol faces potential penalties for non-adherence to employment laws, underscoring the importance of proactive legal management.

Contractual Obligations and Joint Ventures

Ecopetrol's operations are heavily influenced by contractual obligations, particularly in its joint ventures for exploration and production. These agreements are subject to complex legal frameworks that necessitate thorough due diligence to manage associated risks effectively. For instance, the acquisition of a 51.4% stake in ISA, a significant move into energy transmission, underscores the importance of navigating these intricate legal landscapes for successful partnerships and operational compliance.

The legal environment surrounding Ecopetrol's contractual engagements, especially joint ventures and acquisitions, demands strict adherence to regulations. These legal stipulations are critical for mitigating potential disputes and ensuring the integrity of partnerships. The company's strategic growth, exemplified by its substantial investment in ISA, hinges on its ability to manage these legal complexities, ensuring long-term viability and operational success.

Key contractual aspects for Ecopetrol include:

- Joint Venture Agreements: Governing exploration and production activities, these contracts define partner responsibilities and profit-sharing.

- Acquisition Contracts: Such as the ISA deal, these involve detailed legal due diligence and regulatory approvals.

- Regulatory Compliance: Ensuring all contractual terms align with national and international energy sector laws.

- Dispute Resolution Clauses: Outlining procedures for resolving potential disagreements within contractual partnerships.

Ecopetrol operates under a robust legal framework, demanding strict adherence to environmental, labor, and contractual laws in Colombia and internationally. The company's 2023 revenues, around USD 28 billion, highlight the scale of compliance required across its operations. Recent Colombian energy policies, including streamlined environmental licensing for renewables and tax incentives for green energy, are shaping Ecopetrol's strategic diversification towards less carbon-intensive activities.

Environmental factors

Ecopetrol is actively pursuing climate change mitigation, targeting a 35% reduction in greenhouse gas emissions by 2030. This ambitious goal is supported by a specific objective to cut CO2 equivalent emissions by around 300,000 tons by 2025.

These efforts are integral to Ecopetrol's comprehensive sustainability initiative, known as the 'SosTECnibilidad®' program. This program underscores the company's dedication to aligning its operations with Colombia's national climate change objectives.

Ecopetrol is actively shifting towards a more sustainable energy landscape by substantially growing its renewable energy segment. The company aims to reach 900 MW of renewable power generation capacity by 2025 and further expand this to 2.2 GW by 2030.

These investments span across solar, wind, and emerging hydrogen projects, demonstrating a commitment to diversifying its energy sources. This strategic move not only supports a cleaner energy mix but also significantly mitigates Ecopetrol's overall environmental footprint.

Ecopetrol's commitment to biodiversity is evident through its SosTECnibilidad® program, which actively supports ecosystem services in its operational areas. This initiative includes significant investments in sustainable territory projects, aiming to reduce the environmental impact of its oil and gas operations.

In 2023, Ecopetrol reported investing over COP 22 billion in biodiversity and ecosystem services projects, a substantial increase from previous years. These efforts focus on reforestation, wildlife protection, and water resource management, directly contributing to the ecological health of regions where it operates.

Water Management and Security

Water management is a critical environmental consideration for Ecopetrol, especially within its extensive refining and production activities. The company actively monitors and reports on its water stewardship, focusing on optimizing consumption and minimizing the impact of its operations on water resources.

Ecopetrol's commitment to water security is reflected in its sustainability reporting, which outlines specific initiatives and performance indicators. For instance, in 2023, the company reported a reduction in freshwater withdrawal intensity by 7% compared to its 2019 baseline, demonstrating progress in efficient water use.

Efforts to reduce water contamination are also a priority, with investments in advanced wastewater treatment technologies. These measures aim to ensure that discharged water meets or exceeds regulatory standards, safeguarding local ecosystems and communities.

- Water Use Optimization: Ecopetrol aims to reduce its reliance on freshwater sources by increasing water recycling and reuse in its operations.

- Wastewater Treatment: The company invests in advanced technologies to treat wastewater, ensuring compliance with environmental regulations and protecting water quality.

- Water Scarcity Mitigation: In regions facing water stress, Ecopetrol implements specific strategies to manage water resources responsibly and contribute to local water security.

- 2023 Performance: Ecopetrol reported a 7% reduction in freshwater withdrawal intensity against its 2019 baseline, highlighting progress in water efficiency.

Environmental Reporting and Transparency

Ecopetrol places a strong emphasis on environmental reporting and transparency, regularly issuing detailed annual reports on its Environmental, Social, and Governance (ESG) management. These reports, including the 2024 periodic year-end report, offer comprehensive insights into the company's climate initiatives, environmental practices, and key performance indicators, aligning with international sustainability benchmarks.

This commitment to disclosure ensures stakeholders have a clear understanding of Ecopetrol's environmental footprint and its strategies for sustainable operations. The company's proactive approach to reporting reflects a dedication to accountability and building trust within the global investment community.

- Annual ESG Reports: Ecopetrol publishes comprehensive annual reports detailing its environmental, social, and governance performance.

- Climate Issue Focus: These reports specifically address climate-related matters, providing data on emissions and mitigation efforts.

- Transparency and Standards: The company adheres to global sustainability standards, ensuring transparency in its environmental management.

- 2024 Reporting: The 2024 periodic year-end report offers specific data on Ecopetrol's environmental policies and indicators.

Ecopetrol is making significant strides in reducing its environmental impact, targeting a 35% greenhouse gas emission reduction by 2030 and aiming to cut CO2 equivalent emissions by approximately 300,000 tons by 2025. The company is also aggressively expanding its renewable energy portfolio, with a goal of 900 MW of renewable capacity by 2025 and 2.2 GW by 2030, encompassing solar, wind, and hydrogen projects.

Biodiversity and water management are also key focus areas. In 2023, Ecopetrol invested over COP 22 billion in biodiversity projects and achieved a 7% reduction in freshwater withdrawal intensity compared to its 2019 baseline. Transparency in environmental performance is maintained through comprehensive annual ESG reports, including the 2024 periodic year-end report, which detail climate initiatives and environmental practices.

| Environmental Focus | Target/Metric | Year | Status/Achievement |

|---|---|---|---|

| Greenhouse Gas Emission Reduction | 35% reduction | 2030 | Targeted |

| CO2 Equivalent Emission Cut | ~300,000 tons | 2025 | Targeted |

| Renewable Energy Capacity | 900 MW | 2025 | Targeted |

| Renewable Energy Capacity | 2.2 GW | 2030 | Targeted |

| Biodiversity & Ecosystem Services Investment | COP 22 billion+ | 2023 | Achieved |

| Freshwater Withdrawal Intensity | 7% reduction | 2023 (vs 2019 baseline) | Achieved |

PESTLE Analysis Data Sources

Our Ecopetrol PESTLE Analysis is grounded in data from official Colombian government agencies, international financial institutions, and leading energy industry publications. We incorporate economic indicators, environmental regulations, technological advancements, and socio-political trends from these credible sources.