Ecopetrol Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ecopetrol Bundle

Curious about Ecopetrol's strategic positioning? This glimpse into their BCG Matrix highlights key areas, but to truly grasp their market dynamics and future potential, you need the full picture.

Unlock the complete Ecopetrol BCG Matrix to precisely identify their Stars, Cash Cows, Dogs, and Question Marks, empowering you with actionable insights for smart investment and resource allocation.

Don't miss out on the detailed quadrant analysis and strategic recommendations that will guide your decisions. Purchase the full report now for a comprehensive roadmap to Ecopetrol's competitive landscape.

Stars

Ecopetrol's hydrocarbon exploration and production in Colombia is a definite star in its BCG matrix. This core business is a powerhouse, consistently delivering strong results and holding a leading position in the nation's energy landscape.

The company hit a significant milestone in 2024, reaching a record production of 746,000 barrels of oil equivalent per day (kboed), the highest figure seen in nine years. Looking ahead, Ecopetrol is projecting a production range of 740,000 to 745,000 boed for 2025, demonstrating sustained operational strength.

This segment is the engine for substantial cash flow generation for Ecopetrol. Its dominant market share within Colombia underscores its strategic importance and its role as a key driver of the company's overall financial performance.

Ecopetrol's midstream operations, focused on transportation, represent a strong performer within its business portfolio. In 2024, the company achieved impressive results, transporting 1,119,000 barrels per day, exceeding its set targets.

Looking ahead, Ecopetrol anticipates further growth in its midstream segment, projecting transported volumes between 1,130,000 and 1,170,000 barrels per day for 2025. This consistent expansion highlights the efficiency and reliability of its extensive transportation infrastructure, a key driver of the company's overall financial success.

Ecopetrol's refining segment, centered around the Barrancabermeja and Cartagena facilities, represents a significant star in its business portfolio. These refineries are vital for processing crude oil into valuable refined products, contributing substantially to the company's revenue and market position. Their consistent performance underscores their importance as revenue generators.

In 2023, these key refineries processed a combined 420,000 barrels per day (bpd), demonstrating robust operational capacity. For 2025, Ecopetrol has set an ambitious target of 415,000-420,000 bpd for consolidated load. This focus on maintaining high throughput ensures a steady supply of clean fuels, thereby reducing reliance on imported products and bolstering national energy security.

The operational availability of the Barrancabermeja and Cartagena refineries is a critical factor in their star status. By prioritizing efficiency and the production of high-quality fuels, Ecopetrol is able to achieve and maintain strong profit margins. This strategic emphasis on operational excellence directly translates into enhanced financial performance for the company.

ISA (Interconexión Eléctrica S.A. E.S.P.)

Ecopetrol's controlling stake in ISA (Interconexión Eléctrica S.A. E.S.P.), a leading energy transmission company, positions ISA as a significant Star in the BCG Matrix. ISA's robust contribution to the Ecopetrol Group's EBITDA underscores its strong performance and market position.

ISA is set for continued expansion, with substantial planned investments focused on enhancing the electrical transmission network across various regions. This strategic diversification into electricity transmission not only offers stable, predictable returns but also solidifies Ecopetrol's regional leadership in the energy sector.

- ISA's EBITDA Contribution: In 2023, ISA contributed significantly to Ecopetrol's consolidated results, with its transmission segment demonstrating strong operational efficiency.

- Investment in Growth: Ecopetrol has allocated substantial capital for ISA's expansion projects, aiming to bolster its transmission capacity and reach, with significant project pipelines announced for 2024-2028.

- Regional Leadership: ISA's extensive network across Latin America, including Colombia, Brazil, Chile, Peru, and Central America, reinforces its status as a key player in regional energy infrastructure.

- Diversification Benefits: The electricity transmission business provides a stable revenue stream, complementing Ecopetrol's oil and gas operations and reducing overall business volatility.

Permian Basin Operations (USA)

Ecopetrol's Permian Basin operations in the United States are a significant growth area, positioning it as a star in the BCG matrix. The company is actively investing in this region, with plans to drill a portion of its development wells in the US during 2025.

These investments are crucial for increasing production volumes and bolstering Ecopetrol's reserve replacement ratio. The Permian Basin represents a high-potential market, contributing substantially to the company's overall asset portfolio and future growth prospects.

- Permian Basin Investment: Ecopetrol continues to allocate capital to the Permian Basin, recognizing its strategic importance.

- 2025 Development Wells: A portion of Ecopetrol's planned development wells in 2025 are slated for the US, highlighting the focus on this region.

- Production Growth: Operations in the Permian Basin are a key driver for increasing Ecopetrol's overall production volumes.

- Reserve Replacement: The Permian Basin contributes positively to Ecopetrol's reserve replacement ratio, indicating a healthy and expanding resource base.

Ecopetrol's hydrocarbon exploration and production, along with its midstream and refining segments, are clearly classified as Stars in its BCG Matrix. These core businesses consistently deliver strong financial results and hold leading market positions. The company's significant investments in ISA and its growing presence in the Permian Basin further solidify these segments as key drivers of growth and profitability.

The company's hydrocarbon segment achieved a 2024 production of 746 kboed, with projections for 2025 between 740-745 kboed. Midstream operations transported 1,119,000 barrels per day in 2024, targeting 1,130,000-1,170,000 barrels per day for 2025. Refining processed 420,000 bpd in 2023, with a 2025 target of 415,000-420,000 bpd consolidated load.

| Business Segment | BCG Category | 2024 Performance Highlight | 2025 Outlook Highlight | Strategic Importance |

| Hydrocarbon E&P | Star | Record production of 746 kboed | Projected 740-745 kboed | Core revenue and cash flow driver |

| Midstream Operations | Star | Transported 1,119,000 bpd | Targeting 1,130,000-1,170,000 bpd | Efficient infrastructure, supports E&P |

| Refining | Star | Processed 420,000 bpd (2023) | Targeting 415,000-420,000 bpd | Value-added products, energy security |

| ISA (Transmission) | Star | Significant EBITDA contribution | Ongoing network expansion | Diversification, stable returns |

| Permian Basin (US) | Star | Active investment, development wells planned | Continued focus on production growth | High-potential market, reserve replacement |

What is included in the product

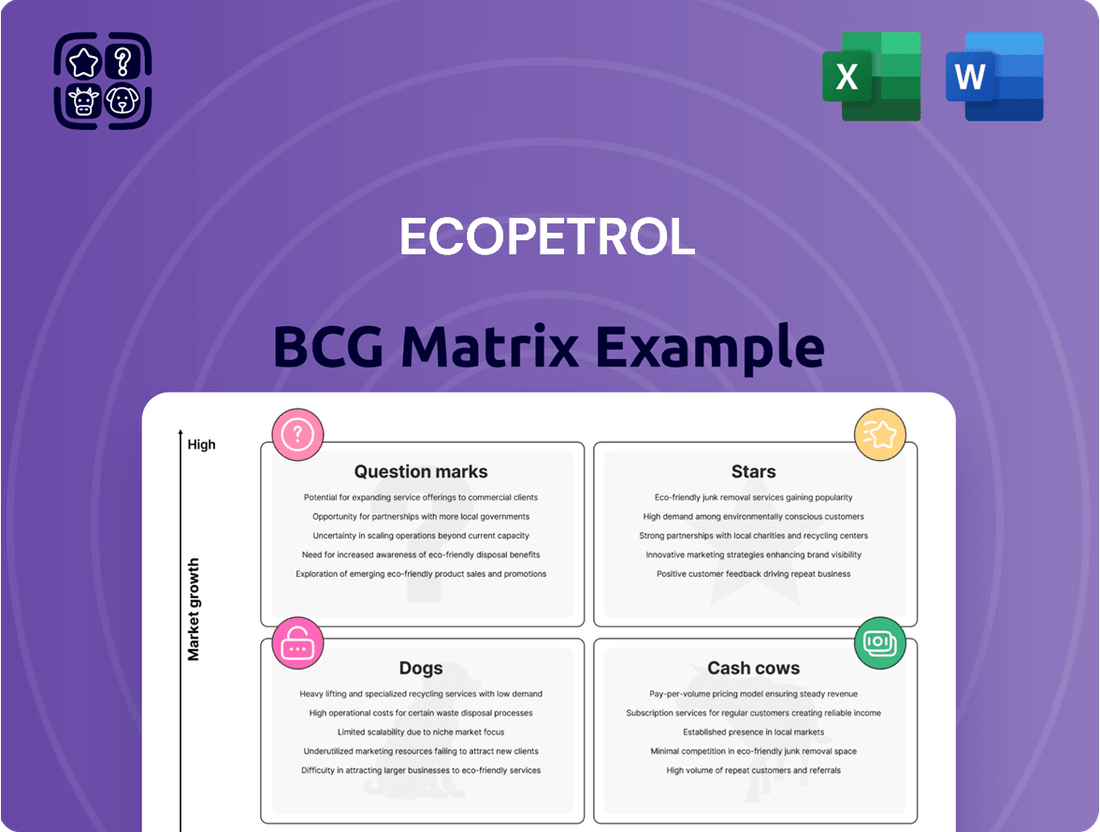

This BCG Matrix analysis for Ecopetrol identifies strategic opportunities and challenges within its diverse portfolio, guiding investment decisions.

A clear Ecopetrol BCG Matrix visualizes strategic options, easing the pain of complex portfolio decisions.

Cash Cows

Ecopetrol's mature oil fields in Colombia, including Caño Sur, Rubiales, Castilla, Chichimene, Akacias, Apiay-Suria, and La Cira-Infantas, represent significant cash cows. These established assets continue to be highly productive, contributing substantially to the company's revenue stream. Their consistent cash generation, even with limited new investment, underscores their importance in Ecopetrol's portfolio.

Ecopetrol's traditional gas production in the Piedemonte Llanero region serves as a reliable cash cow. This mature segment, while not experiencing rapid expansion, consistently contributes to the company's financial stability by supplying essential natural gas to the Colombian market.

In 2024, Ecopetrol continued to focus on optimizing existing infrastructure in Piedemonte Llanero, ensuring efficient delivery of this vital resource. The stable, albeit lower, growth rate of this segment is characteristic of a mature business, providing predictable cash flows that can be reinvested in other areas of the company's portfolio.

Ecopetrol's existing pipeline infrastructure, primarily operated by subsidiaries such as Cenit Transporte y Logística and Oleoducto Central S.A., functions as a significant cash cow. This extensive network is a mature asset, demanding consistent capital for upkeep and operational efficiency rather than aggressive expansion.

These pipelines generate reliable revenue streams through transportation fees, contributing steadily to Ecopetrol's financial performance. For instance, in 2023, Ecopetrol reported that its transportation segment, heavily reliant on this infrastructure, played a crucial role in its overall profitability.

Petrochemicals and Industrial Products

Ecopetrol's petrochemicals and industrial products segment functions as a robust cash cow within its BCG matrix. The consistent production and sale of these refined products, such as polymers and solvents, generate dependable income for the company. These offerings cater to mature industries with relatively stable demand patterns, solidifying their role as reliable revenue generators.

The company's strategic focus on optimizing its refining operations directly bolsters the profitability of this segment. For instance, in 2023, Ecopetrol reported significant contributions from its downstream operations, which include petrochemicals, underscoring their importance to overall financial health. This stability allows Ecopetrol to allocate capital effectively across its diverse business units.

- Stable Revenue: Petrochemicals and industrial products provide a predictable income stream due to established market demand.

- Refinery Optimization: Ecopetrol's efficient refinery operations enhance the profitability of this cash cow segment.

- Market Predictability: Products like polymers and solvents serve mature markets with consistent consumption, ensuring reliable cash flow.

Fuel Price Stabilization Fund (FEPC) Collection

The sustained decrease in accounts receivable from the Fuel Price Stabilization Fund (FEPC) signifies a reliable cash inflow for Ecopetrol. This collection mechanism, while not a traditional product, ensures the company recoups revenue from its fuel sales, acting as a consistent financial contributor.

In 2023, Ecopetrol reported a significant reduction in its FEPC receivables, contributing positively to its cash flow. This trend is expected to continue into 2024, bolstering the company's liquidity.

- FEPC Collections: Ecopetrol's FEPC collections are a crucial component of its financial stability, ensuring timely recovery of fuel sale revenues.

- Reduced Receivables: A declining balance in FEPC accounts receivable indicates efficient cash conversion and improved working capital management for Ecopetrol.

- Steady Cash Flow: The FEPC acts as a dependable source of cash, supporting Ecopetrol's operational and investment needs.

Ecopetrol's mature oil fields, such as Castilla and Apiay-Suria, are prime examples of cash cows, consistently generating substantial revenue with minimal new investment. Similarly, its traditional gas production in Piedemonte Llanero provides a stable, predictable cash flow, crucial for overall financial health. These established assets, along with the extensive pipeline network operated by subsidiaries like Cenit, form the backbone of Ecopetrol's reliable income streams.

The petrochemicals and industrial products segment also functions as a strong cash cow, benefiting from optimized refining operations and stable market demand for products like polymers. Furthermore, the efficient collection of receivables from the Fuel Price Stabilization Fund (FEPC) ensures a steady inflow of cash, enhancing the company's liquidity.

| Segment | Role in BCG Matrix | Key Characteristics | 2023 Contribution (Illustrative) |

|---|---|---|---|

| Mature Oil Fields (e.g., Castilla, Apiay-Suria) | Cash Cow | High production, low investment needs, stable revenue | Significant portion of total hydrocarbon production |

| Piedemonte Llanero Gas Production | Cash Cow | Mature, reliable supply, stable cash flow | Consistent contributor to natural gas revenue |

| Pipeline Infrastructure (Cenit) | Cash Cow | Extensive network, revenue from transportation fees | Key driver of transportation segment profitability |

| Petrochemicals & Industrial Products | Cash Cow | Optimized refining, stable market demand | Substantial contribution from downstream operations |

| FEPC Collections | Cash Cow (Financial Mechanism) | Efficient recovery of fuel sale revenues, improved liquidity | Positive impact on cash flow due to reduced receivables |

Full Transparency, Always

Ecopetrol BCG Matrix

The Ecopetrol BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic analysis ready for your immediate use. You are essentially getting a direct download of the finished product, designed for clear strategic decision-making and impactful presentations. This preview accurately represents the comprehensive Ecopetrol BCG Matrix report, ensuring you know exactly what you're investing in for your business planning and competitive insights.

Dogs

Non-core, underperforming assets, often termed 'dogs' in the BCG matrix, represent business units or assets with a low market share in a low-growth industry. For Ecopetrol, these could historically include older, less productive oil fields or refining segments that require significant capital for maintenance but generate minimal returns. As of early 2024, while Ecopetrol has been actively divesting non-core assets, identifying specific 'dogs' requires a deep dive into their portfolio, but the principle remains that such assets drain resources without contributing significantly to growth or profitability.

Assets that Ecopetrol has recently divested or is actively planning to divest would be considered Dogs in the BCG Matrix. These are typically low-growth, low-market share ventures that the company has decided to exit to optimize its portfolio. For instance, Ecopetrol completed the sale of its stake in Oleoducto Bicentenario de Colombia in 2023, a move aimed at streamlining its asset base.

Certain mature, declining gas fields within Ecopetrol's portfolio, such as Cupiagua, Cusiana, Guajira, and Gibraltar, are facing natural production declines and increasing water intrusion. These fields, despite ongoing operational efforts to mitigate these challenges, are exhibiting characteristics of question marks if their output significantly diminishes with limited prospects for substantial recovery. In 2024, these fields represent a segment of Ecopetrol's assets where continued investment may yield diminishing returns, potentially classifying them as question marks if their long-term growth prospects remain low and operational complexities escalate.

Legacy Exploration Projects with Limited Success

Ecopetrol's portfolio includes legacy exploration projects that have unfortunately not yielded commercially viable discoveries. These ventures, often put on hold due to challenging geological conditions or shifting economic landscapes, represent a drain on resources without providing commensurate returns. Their future growth potential is considered minimal, positioning them as 'dogs' within the BCG matrix framework.

While recent Ecopetrol reports do not explicitly name specific legacy projects as 'dogs,' the general characterization applies to exploration efforts that have failed to deliver profitable outcomes. These projects highlight the inherent risks in the oil and gas industry, where significant upfront investment can be lost if exploration targets prove unfruitful.

- Resource Consumption: These projects tie up capital and operational capacity that could otherwise be allocated to more promising ventures.

- Low Growth Potential: Due to past performance and current assessments, their prospects for future significant revenue generation are limited.

- Risk Mitigation: Identifying and managing these 'dog' assets is crucial for Ecopetrol to optimize its overall portfolio and strategic focus.

Inefficient or Outdated Operational Units

Inefficient or Outdated Operational Units can be considered Dogs in Ecopetrol's BCG Matrix. These are operational units or older facilities that have become inefficient, require disproportionately high maintenance, and contribute minimally to overall production or revenue. For instance, older refineries with lower processing capacities or legacy oil fields with declining production rates might fall into this category.

Ecopetrol's focus on efficiency programs aims to address such areas, preventing them from becoming significant cash traps. In 2024, Ecopetrol continued its strategy of optimizing its asset portfolio, which includes divesting or decommissioning non-core or underperforming assets. This proactive approach ensures that capital is not tied up in units that offer little return.

- Identifying underperforming assets: Ecopetrol regularly assesses its operational units for efficiency and profitability.

- High maintenance costs: Older facilities often incur higher operational and maintenance expenses compared to newer, more technologically advanced ones.

- Low contribution to revenue: Units with declining production or low output capacity generate minimal revenue, dragging down overall financial performance.

- Strategic divestment: The company may choose to sell or close down these units to reallocate resources to more promising ventures.

Dogs in Ecopetrol's portfolio are assets with low market share in low-growth sectors, often representing older, less productive operations or divested ventures. These units consume resources without significant return, necessitating strategic management to optimize the company's overall performance. Identifying and addressing these 'dogs' is key to freeing up capital for more promising investments.

Ecopetrol's ongoing portfolio optimization includes divesting non-core or underperforming assets, a strategy that directly addresses 'dog' categories. For instance, the sale of its stake in Oleoducto Bicentenario de Colombia in 2023 exemplifies this approach, aiming to streamline operations and focus on higher-potential ventures.

Legacy exploration projects that did not result in commercially viable discoveries are prime examples of 'dogs.' These ventures, characterized by minimal future growth potential and past resource drains, highlight the inherent risks in the industry and the importance of strategic portfolio pruning.

Inefficient or outdated operational units, such as older refineries with lower capacities or legacy fields with declining production, also fall into the 'dog' category. Ecopetrol's focus on efficiency programs and potential divestment of such units in 2024 aims to prevent them from becoming significant cash traps.

Question Marks

Ecopetrol's offshore gas exploration in the Caribbean, specifically the Sirius (Gua-Off-0 block) and Papayuela projects, represent key Stars in its BCG Matrix. These ventures hold considerable growth potential, underscored by the Sirius-2 discovery alone confirming approximately 170 billion cubic meters of gas reserves.

Despite the promising reserves, these offshore projects demand substantial capital outlay and extended development timelines. For instance, Papayuela is projected to take 5-7 years to reach full production, creating a degree of uncertainty regarding their future market share and immediate cash flow generation.

Ecopetrol's foray into green and blue hydrogen production is a strategic pivot, positioning these initiatives as significant Question Marks within its business portfolio. The planned green hydrogen plant at the Cartagena Refinery, slated for operation by 2026, signifies a substantial investment in a burgeoning sector.

The company's target of producing 1 million tonnes of hydrogen annually by 2040, coupled with projected substantial EBITDA contributions, highlights the high-growth potential. However, the inherent risks associated with this nascent market, including elevated upfront capital expenditures and unpredictable customer adoption, classify these ventures as Question Marks requiring careful management and market development.

Ecopetrol's ventures into new unconventional renewable energy projects, beyond established solar farms, represent significant growth potential. The company's ambitious 7.5 GW pipeline, which includes the recent acquisition of the Windpeshi project, signals a strategic push into emerging renewable sectors. These projects are positioned in dynamic, high-growth markets.

The success of these new ventures, such as Windpeshi, is intrinsically linked to several critical factors. Substantial capital investment is a prerequisite, alongside strong market acceptance and continuous technological innovation. Furthermore, a supportive regulatory environment will be crucial for these initiatives to capture considerable market share and establish a strong competitive foothold.

Carbon Capture, Utilization, and Storage (CCUS) Initiatives

Ecopetrol's investments in lower-carbon solutions, which implicitly include CCUS technologies as part of its decarbonization efforts, can be seen as Question Marks within the BCG Matrix.

These are high-growth potential areas aligned with the energy transition but are still in early stages of development and deployment, with their market impact and profitability yet to be fully established. Ecopetrol is actively exploring and investing in these nascent technologies as part of its broader strategy to reduce its carbon footprint.

- Ecopetrol's 2023 sustainability report highlighted a commitment to investing in new energy and decarbonization projects, with CCUS being a key focus area.

- While specific CCUS investment figures for Ecopetrol were not detailed as standalone line items in early 2024, the company's overall lower-carbon portfolio is projected for significant growth.

- The global CCUS market is expected to grow substantially, with projections indicating significant expansion through 2030 and beyond, driven by climate policies and technological advancements.

International Expansion into New Energy Markets

Ecopetrol's strategic moves into new energy markets, beyond its current strongholds, would be classified as Question Marks in the BCG matrix. This classification acknowledges the high growth potential inherent in emerging energy sectors, such as offshore wind or green hydrogen, where Ecopetrol aims to establish a significant regional presence.

These ventures are characterized by substantial investment requirements and considerable uncertainty regarding their future profitability and market acceptance. For instance, Ecopetrol's exploration of opportunities in renewable energy projects, which saw significant investment growth in 2024 across Latin America, fits this profile.

- High Growth Potential: Emerging energy markets offer substantial upside as the global energy transition accelerates.

- Significant Risk and Uncertainty: Market penetration, technological viability, and regulatory landscapes in new energy sectors remain uncertain.

- Strategic Alignment: These expansions align with Ecopetrol's ambition to become a key player in the energy transition.

- Investment Focus: Successful ventures will require substantial capital allocation and careful risk management.

Ecopetrol's ventures into new energy sectors, such as green hydrogen and Carbon Capture, Utilization, and Storage (CCUS), are classified as Question Marks in the BCG Matrix. These represent high-growth opportunities but also carry significant investment requirements and market uncertainties.

The company's strategic focus on decarbonization and diversification into lower-carbon solutions, including CCUS technologies, positions these as nascent areas with considerable potential but unproven market dominance. Ecopetrol's commitment to these areas reflects a forward-looking strategy amidst the global energy transition.

The success of these Question Marks hinges on factors like technological advancement, customer adoption, and supportive regulatory frameworks. Ecopetrol's investment in a green hydrogen plant by 2026 and its broader 7.5 GW renewable energy pipeline underscore the capital-intensive nature of these emerging ventures.

These initiatives, while holding the promise of future market leadership, currently demand substantial capital and face the risk of lower market share compared to established businesses, necessitating careful strategic management and market development.

| Initiative | BCG Category | Growth Potential | Investment & Risk | Key Considerations |

| Green Hydrogen | Question Mark | High (Target 1M tonnes/yr by 2040) | Substantial CAPEX, nascent market, adoption uncertainty | Cartagena plant by 2026, EBITDA potential |

| CCUS Technologies | Question Mark | High (Global market expansion) | Early stage deployment, regulatory dependence | Part of decarbonization strategy, investment in lower-carbon solutions |

| New Unconventional Renewables (e.g., Windpeshi) | Question Mark | High (7.5 GW pipeline) | Significant CAPEX, market acceptance, technological innovation | Dynamic markets, supportive regulatory environment crucial |

BCG Matrix Data Sources

Our Ecopetrol BCG Matrix is constructed from robust data, including Ecopetrol's official financial reports, industry growth projections, and market share analyses from leading energy research firms.