Ecopetrol Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ecopetrol Bundle

Unlock the core of Ecopetrol's operational genius with our comprehensive Business Model Canvas. Discover how they connect with key partners, deliver value, and manage their revenue streams in the dynamic energy sector. This detailed analysis is crucial for anyone aiming to understand or replicate success in this industry.

Partnerships

Ecopetrol is forging key partnerships to accelerate its energy transition. A notable collaboration involves an agreement with Statkraft and Enerfin to acquire up to 1,300 megawatts of solar and wind projects in Colombia. This strategic move is central to diversifying its energy sources and expanding renewable capacity.

Further strengthening its renewable portfolio, Ecopetrol finalized the acquisition of Windpeshi, a significant wind energy project, by purchasing 100% of Wind Autogeneración S.A.S. from Enel S.A.S. These alliances are critical for Ecopetrol's objective to bolster its renewable energy generation capabilities and reduce its carbon footprint.

Ecopetrol actively collaborates with key organizations to bolster its sustainability and biodiversity initiatives. Partnerships with entities like The Nature Conservancy (TNC) and the Alexander von Humboldt Institute are crucial for developing the bioeconomy and enhancing biodiversity conservation. These collaborations are designed to provide essential technical data for national bioeconomy strategies and improve biodiversity monitoring using advanced technologies.

A notable agreement exists with the Cataruben Foundation, specifically targeting greenhouse gas emission reductions and promoting biodiversity conservation within the Colombian Orinoco highlands. These strategic alliances underscore Ecopetrol's commitment to integrating environmental stewardship into its core business operations and contributing to national conservation goals.

Ecopetrol actively pursues international upstream collaborations to leverage its extensive oil and gas reserves and tap into significant offshore opportunities. Key partners like Petrobras, Shell, and Oxy are instrumental in these ventures.

These strategic alliances are vital for driving exploration and production, especially within critical basins throughout the Americas. This includes operations in the Permian Basin, the Gulf of Mexico, Brazil, and Mexico, enhancing Ecopetrol's operational reach.

In 2024, Ecopetrol continued to emphasize these partnerships to ensure a stable future energy supply and to optimize the efficient use of its valuable natural resources, underscoring a commitment to global energy security.

Technology and Innovation Partnerships

Ecopetrol is actively forging technology and innovation partnerships to drive operational improvements and explore new avenues for growth. A key example is the January 2025 agreement with UAE-based AIQ, focusing on deploying advanced AI solutions across its operations. This collaboration is designed to boost efficiency and performance through AI-driven insights, including autonomous control for gas-lifted wells and enhanced reservoir visualization.

Further demonstrating its commitment to innovation, Ecopetrol is also engaging with academic institutions. For instance, a partnership with the Technological University of Pereira is underway to investigate the use of native species for climate change mitigation, highlighting Ecopetrol's interest in bioeconomy initiatives.

- AIQ Partnership (January 2025): Focus on AI for operational excellence and energy efficiency.

- Technological University of Pereira Collaboration: Exploration of native species for climate change mitigation via bioeconomy.

- Objective: Enhance operational control, reservoir understanding, and sustainable practices.

Government and Regulatory Bodies

Ecopetrol's role as Colombia's largest company and a state-owned entity necessitates deep collaboration with the Colombian government and various regulatory bodies, including the Financial Superintendence of Colombia. This symbiotic relationship is crucial for navigating the complex energy landscape and ensuring alignment with national objectives. For instance, Ecopetrol's substantial contributions to the Nation, amounting to billions of dollars annually, underscore its importance in funding national development initiatives.

These partnerships are fundamental for Ecopetrol's operational legitimacy and strategic direction. Adherence to national regulations and corporate governance codes is paramount, ensuring transparency and accountability. In 2023, Ecopetrol reported significant transfers to the Nation, reflecting its economic impact and commitment to national progress.

- Government Collaboration: Ecopetrol works closely with the Colombian government on energy policy and national development plans.

- Regulatory Compliance: Partnerships with bodies like the Financial Superintendence ensure adherence to legal and financial frameworks.

- Economic Contribution: Substantial transfers to the Nation highlight Ecopetrol's vital role in Colombia's economy.

- Corporate Governance: Maintaining high standards of corporate governance is a key element of these crucial relationships.

Ecopetrol's key partnerships are crucial for its strategic growth and diversification, particularly in renewable energy and technological advancement.

Collaborations with entities like Statkraft and Enerfin are vital for expanding its solar and wind project portfolio, aiming for significant renewable capacity by 2025.

Furthermore, alliances with organizations such as The Nature Conservancy and academic institutions like the Technological University of Pereira are instrumental in driving bioeconomy initiatives and climate change mitigation efforts.

| Partnership Type | Key Partners | Focus Area | 2024/2025 Impact |

|---|---|---|---|

| Renewable Energy Development | Statkraft, Enerfin, Enel S.A.S. | Solar and Wind Project Acquisition and Development | Acquisition of up to 1,300 MW renewable projects; 100% acquisition of Windpeshi project. |

| Sustainability & Bioeconomy | The Nature Conservancy, Alexander von Humboldt Institute, Cataruben Foundation | Biodiversity Conservation, Bioeconomy Strategy, GHG Emission Reduction | Technical data for national bioeconomy strategies; improved biodiversity monitoring. |

| Technology & Innovation | AIQ, Technological University of Pereira | AI Deployment, Climate Change Mitigation Research | AI-driven operational efficiency; exploration of native species for climate mitigation. |

| Upstream Operations | Petrobras, Shell, Oxy | Offshore Exploration, Critical Basin Operations (Permian, Gulf of Mexico, Brazil, Mexico) | Enhancing operational reach and optimizing natural resource utilization. |

What is included in the product

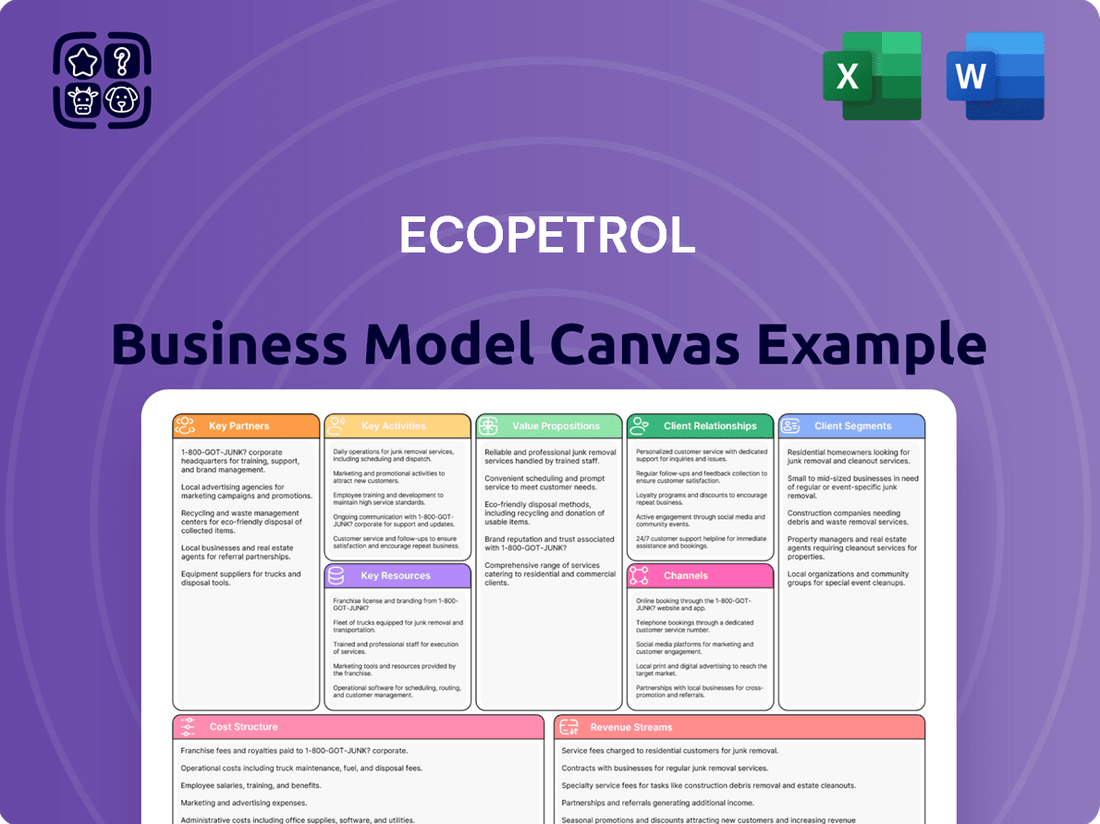

This Ecopetrol Business Model Canvas provides a strategic overview of its operations, detailing customer segments, value propositions, and key activities in the energy sector.

It reflects Ecopetrol's real-world operations and plans, offering insights into its revenue streams and cost structure for informed decision-making.

Ecopetrol's Business Model Canvas provides a clear, one-page snapshot to diagnose and address the complex operational and strategic challenges faced by a major energy company.

It simplifies the intricate web of Ecopetrol's value proposition, customer segments, and revenue streams, offering a visual tool to identify and alleviate pain points in its vast operations.

Activities

Ecopetrol's central business revolves around finding and extracting crude oil and natural gas. For 2025, a substantial 76% of its budget is dedicated to this crucial exploration and production (E&P) segment.

The company targets maintaining daily production between 740,000 and 745,000 barrels of oil equivalent. This output is predominantly sourced from its operations within Colombia, with additional contributions from its international ventures in the United States, Brazil, and Mexico.

To secure future energy supplies, Ecopetrol is actively engaged in drilling new development and exploration wells. This strategic focus on expanding its resource base is fundamental to its long-term operational strategy.

Ecopetrol's key activities heavily involve managing the transportation and logistics of hydrocarbons, essentially running much of Colombia's oil and gas movement infrastructure, including vast pipeline networks.

Significant investments in transport infrastructure are crucial for Ecopetrol to maintain a consistent flow of crude oil and refined products, with targets for 2024 aiming for volumes between 1,130,000 and 1,170,000 barrels per day.

This segment is absolutely vital, acting as the backbone that connects Ecopetrol's production sites to its refining facilities and ultimately to the markets where its products are sold.

Ecopetrol's refining and commercialization activities are centered on its major facilities, Barrancabermeja and Cartagena. These refineries are vital for converting crude oil into a range of refined products and petrochemicals, essential for both domestic consumption and export markets.

Significant capital is allocated to this segment, focusing on maintaining operational efficiency, decreasing reliance on imported refined fuels, and advancing renewable fuel initiatives. For 2024, Ecopetrol anticipates a refinery throughput between 415,000 and 420,000 barrels per day, underscoring its commitment to optimizing production and market supply.

Renewable Energy Development

Ecopetrol's key activities now heavily feature the expansion into renewable energy and lower-carbon solutions, a critical move to support its energy transition objectives. This strategic pivot includes substantial investments in solar, wind, and hydrogen projects across Colombia.

The company is actively pursuing ambitious targets, aiming to achieve 900 MW of renewable power generation capacity by the close of 2025, with a further goal of reaching 2.2 GW by 2030. This expansion is being driven by a dual approach of acquiring established renewable projects and developing new ones from the ground up.

- Renewable Energy Expansion: Ecopetrol is actively developing solar, wind, and hydrogen projects as a core strategic activity.

- Capacity Targets: The company aims for 900 MW of renewable power generation by the end of 2025 and 2.2 GW by 2030.

- Project Development: This involves both acquiring existing renewable energy assets and initiating new developments, like the Windpeshi wind project.

- Hydrogen Initiatives: Ecopetrol is also investing in green hydrogen production, notably a plant planned for the Cartagena Refinery.

Energy Transmission and Infrastructure Management

Ecopetrol, through its subsidiary ISA, actively engages in managing and expanding energy transmission infrastructure. This includes real-time system operations and road concessions, demonstrating a strategic diversification beyond traditional hydrocarbon activities. By 2025, Ecopetrol aims to have around 50,400 kilometers of electric power grid under operation, significantly bolstering its regional energy leadership.

This commitment to electricity transmission is crucial for ensuring a stable energy supply across its operational regions and contributes directly to vital infrastructure development. It underpins the company's broader strategy of becoming a more integrated energy provider.

- Infrastructure Expansion: Targeting 50,400 km of electric power grid in operation by 2025.

- Diversification Strategy: Participation in electricity transmission and road concessions via ISA.

- Regional Leadership: Strengthening Ecopetrol's position in the broader energy sector.

- Stable Energy Supply: Supporting reliable energy delivery beyond fossil fuels.

Ecopetrol's core activities encompass the full hydrocarbon value chain, from exploration and production to refining and commercialization. The company also strategically invests in expanding its renewable energy portfolio and managing vital energy transmission infrastructure.

These key activities are supported by substantial financial commitments. For instance, a significant portion of Ecopetrol's budget is allocated to exploration and production, aiming to maintain robust output levels. Similarly, investments in refining and transport infrastructure are critical for operational efficiency and market access.

The company's diversification into renewables and transmission infrastructure, particularly through its subsidiary ISA, highlights a forward-looking strategy to secure long-term growth and contribute to a broader energy transition.

| Activity | 2024 Target/Focus | 2025 Target/Focus |

|---|---|---|

| Exploration & Production (E&P) | Maintain daily production between 740,000-745,000 boe | 76% of budget dedicated to E&P |

| Transportation & Logistics | Transport volumes between 1,130,000-1,170,000 bpd | Maintain vast pipeline networks |

| Refining & Commercialization | Refinery throughput between 415,000-420,000 bpd | Optimize production and market supply |

| Renewable Energy | Advance renewable fuel initiatives | 900 MW renewable power generation capacity |

| Energy Transmission (ISA) | Expand energy transmission infrastructure | 50,400 km electric power grid in operation |

Full Version Awaits

Business Model Canvas

The Ecopetrol Business Model Canvas preview you're seeing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed Business Model Canvas, ready for your strategic review and application.

Resources

Ecopetrol's most significant key resource is its vast hydrocarbon reserves. These include proven and unproven quantities of crude oil, natural gas, and condensates. These reserves are primarily located within Colombia but also extend to international operations, forming the bedrock of its exploration and production endeavors.

These extensive reserves are the lifeblood of Ecopetrol, supplying the essential raw materials for all its energy products. The company's capacity to consistently discover and replenish these reserves is paramount to its sustained operational capacity and its role in national energy security.

As of year-end 2023, Ecopetrol reported 2,003 million barrels of oil equivalent (MMboe) in proven reserves. This substantial resource base directly fuels its core business and underpins its future growth potential in the energy sector.

Ecopetrol's integrated infrastructure network is a cornerstone of its operations, featuring approximately 1.34 million barrels per day of crude oil pipeline capacity. This extensive system, coupled with major refining facilities like Barrancabermeja and Cartagena, is critical for efficiently handling oil, gas, and refined products.

This robust network facilitates the seamless movement and distribution of Ecopetrol's output, both domestically within Colombia and to global markets. It underpins the company's operational reliability and broad market access, ensuring products reach their destinations effectively.

Ecopetrol's financial capital and robust cash flow are foundational to its business model. The company consistently demonstrates strong financial performance, supported by significant revenues and a healthy equity base. This financial muscle is crucial for funding its ambitious investment plans across both traditional hydrocarbon operations and its growing energy transition ventures.

In the first quarter of 2025, Ecopetrol reported impressive financial results, with revenues reaching COP 31.4 trillion. Crucially, the company generated a positive free cash flow during this period, which bolstered its substantial cash reserves. This financial strength provides the necessary flexibility to pursue strategic growth opportunities and maintain operational stability.

Skilled Human Capital and Technical Expertise

Ecopetrol's strength lies in its substantial workforce of over 19,000 employees, a key resource for its operations. This human capital is diverse, covering critical areas such as exploration, production, refining, and environmental stewardship. Their collective knowledge is fundamental to Ecopetrol's success.

The company actively cultivates innovation through significant investments in science and technology. This focus allows Ecopetrol to develop and implement advanced techniques, like enhanced oil recovery (EOR), and integrate cutting-edge solutions such as artificial intelligence. These advancements are crucial for maintaining operational efficiency and driving strategic growth initiatives.

- Workforce Size: Over 19,000 employees.

- Core Competencies: Exploration, production, refining, engineering, environmental management.

- Innovation Focus: Investment in science, technology, EOR, and AI.

- Strategic Importance: Expertise drives operational efficiency and future development.

Renewable Energy Assets and Technology

Ecopetrol is actively developing a robust portfolio of renewable energy assets, encompassing both acquired wind and solar projects. The company is also strategically planning for green and blue hydrogen production facilities, underscoring its commitment to diversifying its energy sources.

These renewable assets, coupled with the underlying technologies and the growing expertise in renewable energy generation, form the bedrock of Ecopetrol's ambitious energy transition strategy. This focus is essential for navigating the evolving energy landscape and meeting future demand sustainably.

Ecopetrol has set a clear target to achieve 900 MW of renewable power generation capacity by 2025. This milestone signifies a tangible step towards its goal of a cleaner energy future and highlights its dedication to expanding its renewable footprint significantly.

- Portfolio Expansion: Ecopetrol is acquiring and developing wind and solar projects, alongside plans for hydrogen production.

- Strategic Importance: These assets and technologies are vital for Ecopetrol's energy transition and future competitiveness.

- Capacity Target: The company aims to reach 900 MW of renewable power generation by 2025.

Ecopetrol's brand and reputation are critical intangible assets. Its long-standing presence in the energy sector and its role as a national champion in Colombia provide a strong foundation for customer trust and stakeholder engagement. This brand equity supports its market position and its ability to attract investment and talent.

The company's commitment to sustainability and corporate social responsibility further enhances its brand value. Positive public perception and a strong commitment to environmental, social, and governance (ESG) principles are increasingly important in the modern business landscape, influencing investor decisions and consumer loyalty.

| Key Resource | Description | Data/Metric |

|---|---|---|

| Brand & Reputation | Ecopetrol's established name and public perception as a national energy leader. | Long-standing presence, national champion status. |

| Sustainability & ESG | Commitment to environmental, social, and governance principles. | Increasingly important for investor and consumer trust. |

Value Propositions

Ecopetrol is a cornerstone of Colombia's energy landscape, guaranteeing a steady flow of vital products like crude oil, natural gas, and refined fuels. This reliability is paramount for the nation's energy security and the smooth functioning of its economy.

The company's dominance is evident, accounting for over 60% of Colombia's hydrocarbon output. This significant contribution ensures a stable supply of energy resources, underpinning industrial operations and meeting consumer needs across the country.

Furthermore, Ecopetrol plays a crucial role in meeting national demand for natural gas and non-thermal power. This extensive reach provides essential energy stability, supporting a wide array of economic activities and ensuring consistent power for households.

Ecopetrol is actively pursuing leadership in Colombia's energy transition by broadening its offerings to include renewable energy sources and other low-carbon alternatives. The company is making significant investments in solar, wind, and hydrogen initiatives, targeting a reduction of around 300,000 tons in CO2 equivalent emissions by 2025.

Ecopetrol's role as Colombia's largest company translates into a powerful engine for national economic and social progress. In 2023, the company reported significant tax contributions, amounting to approximately 36.7 trillion Colombian pesos, directly bolstering government revenue for public services and infrastructure projects.

Beyond fiscal transfers, Ecopetrol's operational footprint generates substantial employment, directly and indirectly supporting thousands of families. In 2024, the company continued its commitment to regional development, investing in social programs and infrastructure within the communities where it operates, fostering local growth and improving living standards.

Through its SosTECnibilidad® program, Ecopetrol actively pursues sustainable territory initiatives. These efforts focus on environmental conservation and community well-being, demonstrating a commitment to balancing industrial activity with the long-term social and ecological health of Colombia.

Diversified and Integrated Energy Solutions

Ecopetrol is expanding its energy portfolio beyond traditional oil and gas. They are actively developing integrated solutions that include energy transmission and a growing focus on renewable energy sources. This strategic shift aims to create a more resilient and comprehensive energy offering for its customers.

The company's commitment to diversification is evident in its investments. For instance, Ecopetrol's acquisition of ISA shares significantly bolsters its capabilities in power transmission infrastructure. This move allows Ecopetrol to offer a more varied energy mix, integrating different energy sources and delivery mechanisms.

- Diversified Energy Portfolio: Ecopetrol is broadening its scope to include renewable energy alongside its established oil and gas operations.

- Integrated Solutions: The company is developing comprehensive energy offerings that combine transmission and generation.

- Strategic Acquisitions: The acquisition of ISA shares strengthens Ecopetrol's position in the power transmission sector, enhancing its integrated approach.

- Market Resilience: This diversified and integrated strategy is designed to build a more robust and adaptable energy business.

Responsible and Transparent Operations

Ecopetrol champions responsible and transparent operations, underpinned by strong corporate governance. The company regularly publishes detailed reports on its financial, social, and environmental performance, offering stakeholders a clear view of its practices. For instance, Ecopetrol's 2023 Sustainability Report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to 2022, demonstrating a tangible commitment to environmental accountability.

This dedication to transparency is crucial for building and maintaining trust. By proactively sharing information through its year-end and sustainability reports, Ecopetrol ensures accountability to a broad range of stakeholders, including investors, regulatory bodies, and the general public. This open communication fosters confidence in the company’s long-term viability and ethical conduct.

- Robust Corporate Governance: Ecopetrol adheres to stringent corporate governance principles to ensure ethical decision-making and operational integrity.

- Comprehensive Reporting: The company provides regular, detailed reports on financial, social, and environmental performance, including its 2023 Sustainability Report.

- Stakeholder Accountability: Transparency in reporting builds trust and accountability with investors, regulators, and the public.

- Environmental Commitment: Ecopetrol's 2023 data shows a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity, reflecting its dedication to sustainability.

Ecopetrol offers a reliable and extensive supply of essential energy products, including crude oil, natural gas, and refined fuels, vital for Colombia's energy security and economic stability. The company's significant contribution, accounting for over 60% of Colombia's hydrocarbon output, ensures a consistent energy flow for industrial and consumer needs. Ecopetrol is also a key provider of natural gas and non-thermal power, supporting a wide range of economic activities and household energy requirements.

Ecopetrol is actively positioning itself as a leader in Colombia's energy transition by expanding its portfolio to include renewable energy sources and low-carbon alternatives. This strategic diversification is supported by substantial investments in solar, wind, and hydrogen initiatives, with a target to reduce CO2 equivalent emissions by approximately 300,000 tons by 2025. The company's commitment extends to developing integrated energy solutions, incorporating energy transmission and a growing emphasis on renewables, as demonstrated by its acquisition of ISA shares to bolster power transmission infrastructure.

Ecopetrol serves as a major driver of Colombia's economic and social progress, evidenced by its substantial tax contributions. In 2023, these contributions amounted to approximately 36.7 trillion Colombian pesos, directly funding public services and infrastructure. Beyond fiscal impacts, Ecopetrol's operations generate significant employment, supporting thousands of families, and its 2024 community investments in social programs and infrastructure foster regional development and improved living standards.

Ecopetrol champions responsible and transparent operations, adhering to strong corporate governance principles. The company's commitment to transparency is demonstrated through detailed reports on its financial, social, and environmental performance. For example, Ecopetrol's 2023 Sustainability Report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to 2022, underscoring its dedication to environmental accountability and building stakeholder trust.

| Value Proposition | Description | Key Facts/Data |

| Energy Security & Reliability | Guarantees a steady flow of vital energy products for national needs. | Accounts for over 60% of Colombia's hydrocarbon output. Ensures stable supply of natural gas and non-thermal power. |

| Energy Transition Leadership | Broadening offerings to include renewable energy and low-carbon alternatives. | Investing in solar, wind, and hydrogen. Target of 300,000 tons CO2e emission reduction by 2025. |

| Economic & Social Contribution | Drives national economic and social progress through fiscal contributions and employment. | Contributed approx. 36.7 trillion Colombian pesos in taxes in 2023. Supports thousands of families through direct and indirect employment. |

| Transparency & Governance | Upholds responsible and transparent operations with strong corporate governance. | Published 2023 Sustainability Report showing 15% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2022). |

Customer Relationships

Ecopetrol cultivates enduring connections with major industrial clients, power producers, and global collaborators via strategic alliances and supply contracts. These partnerships guarantee consistent demand for Ecopetrol's offerings, promoting shared expansion and operational synergy. For instance, in 2023, Ecopetrol's commitment to long-term supply agreements contributed to a significant portion of its hydrocarbon sales volume, underscoring the stability these relationships provide.

Ecopetrol cultivates open communication with its varied investors, from individuals to large institutions. This engagement is fueled by consistent financial updates, earnings calls, and comprehensive annual reports, ensuring stakeholders are well-informed.

The company prioritizes robust corporate governance and the swift delivery of accurate data, which are cornerstones for building and sustaining investor trust. This dedication is vital for securing the capital needed for its operations and growth initiatives.

In 2023, Ecopetrol reported a net income of approximately USD 3.5 billion, demonstrating its financial performance and commitment to shareholder value. Such transparency reinforces its appeal to a broad spectrum of investors.

Ecopetrol actively engages local communities and stakeholders, emphasizing social and environmental projects in its operational areas. This commitment is exemplified by its SosTECnibilidad® program, which directs investments towards initiatives tackling climate change, fostering sustainable territories, and protecting biodiversity. These efforts are designed to spur regional growth and address community needs.

In 2024, Ecopetrol continued to strengthen its social license to operate through these engagement strategies. For instance, the company reported significant progress in its biodiversity conservation efforts, with over 30 projects actively contributing to the preservation of ecosystems in its operating regions. This focus on shared value creation not only builds goodwill but also enhances operational resilience.

Government and Regulatory Compliance

As a state-owned enterprise, Ecopetrol's relationship with the Colombian government and its regulatory agencies is fundamental. This involves strict adherence to national financial regulations and robust corporate governance practices. Ecopetrol regularly submits detailed reports and actively participates in shaping national energy policies, ensuring its strategic direction aligns with Colombia's developmental objectives and the established regulatory landscape.

- Compliance with National Regulations: Ecopetrol operates under the purview of Colombian financial laws and corporate governance standards, including those set by the Superintendencia Financiera de Colombia.

- Strategic Alignment with Government Goals: The company collaborates with the Ministry of Mines and Energy on national energy strategies and resource management.

- Reporting and Transparency: Periodic financial and operational reports are submitted to government bodies, demonstrating transparency and accountability. In 2023, Ecopetrol reported total revenues of COP 110.6 trillion (approximately USD 28 billion), a significant portion of which contributes to national finances.

Customer Support and Service for Commercial Clients

Ecopetrol offers specialized customer support and technical services tailored for its commercial and industrial clientele, ensuring optimal use of its fuel and petrochemical offerings. This involves meticulous management of supply chains and prompt attention to individual client requirements.

The company prioritizes consistent product availability and robust technical guidance to foster enduring B2B partnerships. In 2024, Ecopetrol continued to invest in digital platforms to enhance client interaction and streamline service requests, aiming for faster response times and greater transparency in its service delivery.

- Dedicated Technical Assistance: Providing expert advice on product application and troubleshooting for industrial processes.

- Supply Chain Reliability: Ensuring timely and consistent delivery of fuels and petrochemicals to commercial partners.

- Client-Specific Solutions: Adapting services to meet the unique operational needs of different industries.

- Digital Service Enhancements: Implementing online portals and communication channels for improved customer engagement and issue resolution.

Ecopetrol fosters diverse customer relationships, from major industrial clients and power producers through strategic alliances and supply contracts, ensuring stable demand and operational synergy. For investors, it maintains open communication via financial updates and reports, underpinned by strong corporate governance, as seen in its 2023 net income of approximately USD 3.5 billion. The company also actively engages local communities through social and environmental projects, like its SosTECnibilidad® program, aiming for shared value and operational resilience, with over 30 biodiversity projects active in 2024.

| Relationship Type | Key Engagement Strategy | 2023/2024 Data Point |

|---|---|---|

| Industrial & Commercial Clients | Strategic alliances, supply contracts, specialized technical support, digital service enhancements | Continued investment in digital platforms for client interaction in 2024 |

| Investors (Individual & Institutional) | Consistent financial updates, earnings calls, annual reports, corporate governance | Reported net income of approx. USD 3.5 billion in 2023 |

| Local Communities & Stakeholders | Social and environmental projects, shared value initiatives | Over 30 biodiversity conservation projects active in 2024 |

| Government & Regulatory Agencies | Compliance with national financial regulations, strategic alignment with energy policies, reporting | Total revenues of COP 110.6 trillion (approx. USD 28 billion) in 2023 contributed to national finances |

Channels

Ecopetrol's extensive pipeline and logistics network is a critical channel, enabling the efficient movement of crude oil, natural gas, and refined products. This infrastructure spans Colombia, connecting production sites to refineries and distribution points, as well as facilitating exports. In 2024, Ecopetrol continued to leverage this network, which is fundamental to its operational efficiency and market reach.

Ecopetrol's refineries, notably Barrancabermeja and Cartagena, are crucial channels transforming crude oil into essential refined products. These facilities are central to the company's operations, processing significant volumes of crude to meet market demands.

Through a robust network of distribution terminals, Ecopetrol efficiently supplies a diverse portfolio of fuels, lubricants, and petrochemicals to industrial clients and retail markets. This integrated approach ensures a steady flow of products across various sectors.

In 2024, Ecopetrol's refining segment processed an average of 388,000 barrels of crude oil per day, highlighting the scale of its operations. The company's commitment to maintaining product quality and ensuring availability is directly supported by its ownership and operation of these critical refining and distribution assets.

Ecopetrol's direct sales and commercial agreements are key to its business model, focusing on large industrial clients, power generators, and major energy consumers. This approach allows for customized solutions and direct negotiation, securing stable demand for its substantial product volumes.

These direct relationships are vital for managing the consistent, large-scale supply of energy products. For instance, in 2023, Ecopetrol reported significant sales volumes to these sectors, underscoring the importance of these channels for its revenue stability and market presence.

Digital Platforms and Corporate Website

Ecopetrol utilizes its corporate website and various digital platforms as crucial touchpoints for engaging with investors, the general public, and all stakeholders. These channels are essential for disseminating vital information, fostering transparency, and ensuring broad accessibility to corporate data.

These digital avenues serve as the central repository for critical corporate documents. This includes detailed financial reports, timely press releases, comprehensive sustainability reports, and insightful investor presentations, all readily available to the public. For instance, Ecopetrol's 2023 annual report, accessible online, provides a deep dive into its financial performance and strategic initiatives.

Furthermore, these platforms act as dynamic hubs for corporate governance updates, offering stakeholders a clear view of the company's leadership and decision-making processes. They also provide continuous news flow regarding Ecopetrol's operational activities and its evolving strategic direction within the energy sector.

- Investor Relations Hub: Ecopetrol's website offers a dedicated section for investors, featuring quarterly earnings reports, analyst calls, and stock performance data, ensuring timely information for investment decisions.

- Public Information Dissemination: Press releases, sustainability reports, and corporate social responsibility updates are published on digital platforms, keeping the public informed about Ecopetrol's environmental and social impact.

- Corporate Governance Transparency: Information on the board of directors, executive management, and corporate policies is readily available, promoting good governance practices and stakeholder trust.

- Operational Updates: Digital channels communicate key developments in Ecopetrol's exploration, production, and refining activities, providing insights into its operational footprint and strategic growth areas.

Retail Sales Networks (via partners/distributors)

Ecopetrol leverages extensive retail sales networks, primarily through partnerships with independent distributors and fuel station operators, to commercialize refined products like gasoline and diesel to end-consumers across Colombia. This strategy ensures broad market penetration and accessibility for its fuel offerings.

These partner networks are vital for Ecopetrol's market reach, enabling widespread availability of its products for daily consumption. In 2024, Ecopetrol continued to rely on this model, which accounted for a significant portion of its domestic fuel sales volume, underscoring the importance of its distributor relationships.

- Widespread Distribution: Ecopetrol's retail network, built on partnerships, ensures its refined products reach consumers in diverse geographic locations throughout Colombia.

- Market Reach: This channel is critical for achieving high sales volumes of gasoline and diesel, catering to the daily transportation needs of millions.

- Partner Dependence: The success of this segment relies heavily on the operational efficiency and market presence of its fuel station and distribution partners.

Ecopetrol's extensive pipeline and logistics network is a critical channel, enabling the efficient movement of crude oil, natural gas, and refined products across Colombia and for exports. This infrastructure is fundamental to its operational efficiency and market reach.

Refineries like Barrancabermeja and Cartagena are crucial channels transforming crude oil into essential refined products, processing significant volumes to meet market demands. In 2024, Ecopetrol's refining segment processed an average of 388,000 barrels of crude oil per day.

Direct sales and commercial agreements with large industrial clients and power generators are key to securing stable demand, with significant sales volumes reported in 2023 to these sectors.

Digital platforms, including its corporate website, serve as vital touchpoints for investors and the public, disseminating financial reports, press releases, and sustainability updates, fostering transparency and accessibility.

The retail sales network, primarily through partnerships with independent distributors and fuel station operators, ensures broad market penetration for gasoline and diesel, accounting for a significant portion of domestic fuel sales in 2024.

| Channel Type | Description | 2024/2023 Data Point | Significance |

|---|---|---|---|

| Pipeline & Logistics | Movement of crude oil, gas, and refined products | Continued leverage of infrastructure | Operational efficiency, market reach |

| Refineries | Processing crude oil into refined products | Avg. 388,000 bpd processed (2024) | Meeting market demand, product transformation |

| Direct Sales & Commercial Agreements | Sales to large industrial clients, power generators | Significant 2023 sales volumes | Revenue stability, market presence |

| Digital Platforms (Website, etc.) | Information dissemination to stakeholders | Online availability of 2023 Annual Report | Transparency, investor engagement |

| Retail Sales Network (Partnerships) | Distribution of fuels to end-consumers | Significant domestic fuel sales volume (2024) | Market penetration, accessibility |

Customer Segments

Ecopetrol's customer base spans both its home country and global markets, encompassing demand for its crude oil, natural gas, and refined products. As a significant energy provider in Latin America, the company actively exports a substantial volume of its output.

This broad market reach, serving both domestic needs and international buyers, is crucial for Ecopetrol's revenue diversification. In 2023, Ecopetrol reported total hydrocarbon production of 733 thousand barrels of oil equivalent per day, with a portion of this naturally feeding into its export strategy to cater to international energy markets.

Ecopetrol's industrial and commercial clients form a crucial segment, encompassing entities like manufacturing plants and power generation companies that demand significant energy volumes. These businesses depend on Ecopetrol for a steady and dependable supply of fuels, natural gas, and petrochemical products, which are vital for their ongoing operations.

The company actively provides customized energy solutions designed to precisely match the unique and substantial energy requirements of these large-scale commercial users. In 2023, Ecopetrol reported total sales of approximately 218 million barrels of oil equivalent, with a considerable portion attributed to these industrial and commercial sectors.

As the majority shareholder, the Colombian Government and its state entities represent a cornerstone customer segment for Ecopetrol. Their direct interest lies in the company's financial performance, which translates into substantial tax transfers and royalties. In 2023, Ecopetrol reported total tax contributions of approximately COP 60.1 trillion (around $15 billion USD), underscoring the government's significant stake in its success.

Beyond financial returns, the government relies on Ecopetrol to ensure national energy security and implement energy policies. The company's operations are vital for supplying domestic energy needs, contributing to economic stability and development. This strategic alignment positions the government as a key partner in Ecopetrol's long-term vision and operational directives.

Shareholders and Investors

Ecopetrol's shareholder and investor segment is diverse, encompassing individual retail investors, domestic and international institutional funds, and pension funds. These stakeholders are primarily focused on Ecopetrol's financial health, dividend payouts, and its capacity for long-term value appreciation. For instance, in 2023, Ecopetrol reported a net profit of COP 19.1 trillion (approximately USD 4.8 billion), demonstrating strong financial performance that directly impacts investor confidence.

The company prioritizes clear and consistent communication to satisfy the informational requirements of this crucial segment. This includes detailed financial reports, updates on operational performance, and adherence to robust corporate governance standards. Ecopetrol's commitment to transparency is vital for maintaining and growing investor trust.

- Key Investor Interests: Financial performance, dividend distributions, long-term value creation.

- Investor Base: Individual retail investors, institutional funds (domestic and international), pension funds.

- Company Focus: Transparent reporting, strong corporate governance, consistent communication.

- 2023 Financial Highlight: Net profit of COP 19.1 trillion (approx. USD 4.8 billion).

Local Communities in Operating Areas

Ecopetrol views local communities within its operational zones as a core customer segment, fostering relationships through dedicated social and environmental programs. These communities are directly affected by Ecopetrol's operations, making them key stakeholders and beneficiaries of the company's commitment to sustainable development. For instance, in 2023, Ecopetrol invested significantly in social projects aimed at community well-being and environmental stewardship across its operational regions.

The company's strategy involves direct engagement and investment in sustainable territories, biodiversity conservation, and climate change mitigation efforts. These initiatives are designed to create shared value and ensure that local populations benefit from Ecopetrol's presence. For example, Ecopetrol's sustainability reports highlight specific projects focused on reforestation and water resource management in areas surrounding its oil fields.

- Community Investment: Ecopetrol's social investment in 2023 reached approximately COP 380 billion, supporting initiatives in education, health, and economic development in its operational areas.

- Environmental Programs: The company actively manages environmental impacts through biodiversity conservation projects, with over 10,000 hectares under protection or restoration as of late 2023.

- Social License to Operate: Maintaining positive and collaborative relationships with local communities is paramount for Ecopetrol's continued social license to operate, enabling uninterrupted operations and mutual benefit.

Ecopetrol serves a diverse customer base, including industrial and commercial entities requiring substantial energy volumes for their operations. These clients, such as manufacturing plants and power generators, rely on Ecopetrol for consistent supplies of fuels and natural gas. In 2023, the company's total sales reached approximately 218 million barrels of oil equivalent, with a significant portion catering to these large-scale commercial users.

The Colombian Government, as the majority shareholder, represents a critical customer segment focused on financial returns, energy security, and policy implementation. Ecopetrol's financial contributions, including tax transfers and royalties, are substantial, with total tax contributions in 2023 amounting to approximately COP 60.1 trillion.

Shareholders and investors, comprising both individual and institutional entities, are another key segment. They are primarily interested in Ecopetrol's financial health and value appreciation, as evidenced by the company's 2023 net profit of COP 19.1 trillion.

Local communities are also considered a customer segment, benefiting from Ecopetrol's social and environmental programs. The company's commitment to sustainable development and community well-being is demonstrated through investments in projects focused on education, health, and environmental stewardship.

| Customer Segment | Key Needs/Interests | 2023 Data/Highlights |

| Industrial & Commercial Clients | Reliable energy supply (fuels, natural gas) | Approx. 218 million boe in total sales |

| Colombian Government | Financial returns, energy security, policy implementation | COP 60.1 trillion in tax contributions |

| Shareholders & Investors | Financial performance, dividend payouts, value appreciation | COP 19.1 trillion net profit |

| Local Communities | Social and environmental benefits, sustainable development | COP 380 billion invested in social projects |

Cost Structure

A significant part of Ecopetrol's expenses revolves around exploration and production. This includes the costs associated with drilling new wells, keeping existing oil fields running, and employing methods to get more oil out of the ground. In 2025, the company plans to invest around 17.2 trillion Colombian pesos in these crucial activities, highlighting how much capital is needed to find and extract oil and gas.

Ecopetrol faces substantial costs in running its refineries and its vast transportation system, which heavily relies on pipelines. These expenses are essential for processing crude oil into usable products and getting them to market efficiently. For instance, in 2023, Ecopetrol reported operating expenses of approximately COP 70.8 trillion, a significant portion of which is tied to these refining and transportation activities.

Maintaining the integrity and operational readiness of these critical assets is paramount, driving ongoing investment in infrastructure upkeep. These costs ensure that Ecopetrol can reliably convert raw materials into refined goods and deliver them without interruption, a core function of its business model.

Ecopetrol is significantly investing in its energy transition, earmarking roughly 24% of its 2025 budget, which translates to approximately 6.5 trillion pesos or US$2 billion, for initiatives like renewable energy, hydrogen production, and transmission infrastructure upgrades.

These substantial capital expenditures are vital for Ecopetrol’s strategic shift towards a more diversified energy portfolio and a reduced environmental impact. The company's commitment is evident in its planned acquisitions of new renewable energy assets and the development of green hydrogen production facilities, both requiring considerable financial commitment.

Environmental and Social Program Investments

Ecopetrol dedicates significant financial resources to its environmental and social programs, a key component of its cost structure. These investments are primarily channeled through its SosTECnibilidad® initiatives, which target critical areas like climate change mitigation, sustainable territorial development, and biodiversity preservation.

For 2025, Ecopetrol has earmarked approximately 2.3 trillion pesos for these crucial sustainability efforts. This substantial financial commitment underscores the company's strategic focus on responsible operations and its dedication to achieving ambitious environmental and social targets. These programs are fundamental to maintaining Ecopetrol's social license to operate and ensuring long-term value creation.

- SosTECnibilidad® Projects: Focus on climate change, sustainable territory, and biodiversity.

- 2025 Investment: Approximately 2.3 trillion pesos allocated.

- Strategic Importance: Vital for meeting sustainability targets and ensuring responsible operations.

General, Administrative, and Financial Expenses

Ecopetrol's cost structure includes significant General, Administrative, and Financial Expenses. These encompass operational necessities like employee compensation, the costs associated with maintaining strong corporate governance, and ensuring compliance with regulatory frameworks.

Financial expenses are also a key component, notably the interest paid on the company's outstanding debt. In 2023, Ecopetrol's financial expenses amounted to approximately COP 6.6 trillion, reflecting its leverage. The company actively pursues efficiency targets across its operational management and investment projects. This strategic focus aims to reduce costs and enhance key financial indicators, such as improving its debt-to-equity ratio and increasing profitability.

- Salaries and Corporate Governance: Costs associated with personnel and maintaining governance standards.

- Compliance Expenses: Costs incurred to meet regulatory and legal requirements.

- Financial Expenses: Primarily interest payments on debt, which were around COP 6.6 trillion in 2023.

- Efficiency Targets: Ongoing efforts to reduce operational and administrative costs to improve financial performance.

Ecopetrol's cost structure is heavily influenced by its core operations in exploration, production, refining, and transportation. Significant investments are also directed towards its energy transition initiatives and crucial environmental and social programs. General, administrative, and financial expenses, including debt servicing, form another substantial part of its overall cost base.

| Cost Category | 2025 Planned Investment/2023 Actual | Key Components |

| Exploration & Production | ~COP 17.2 trillion (2025) | Drilling, field maintenance, enhanced recovery |

| Refining & Transportation | ~COP 70.8 trillion (2023 Operating Expenses) | Refinery operations, pipeline maintenance |

| Energy Transition | ~COP 6.5 trillion (2025) / ~US$2 billion (2025) | Renewables, hydrogen, transmission upgrades |

| Environmental & Social Programs (SosTECnibilidad®) | ~COP 2.3 trillion (2025) | Climate mitigation, sustainable development, biodiversity |

| General, Admin & Financial Expenses | ~COP 6.6 trillion (2023 Financial Expenses) | Salaries, governance, compliance, interest on debt |

Revenue Streams

Ecopetrol's core revenue generation hinges on the sale of crude oil and natural gas. These sales are the bedrock of its financial performance, impacting both domestic and international markets. The company's substantial income is directly tied to fluctuations in global commodity prices and its own production output.

The significance of hydrocarbon sales is underscored by Ecopetrol's robust financial performance. For instance, the company reported revenues of COP 31.4 trillion in the first quarter of 2025, a figure predominantly driven by these essential sales activities.

Ecopetrol's core revenue driver involves selling refined products like gasoline, diesel, and jet fuel, alongside various petrochemicals. These essential commodities are distributed to a broad customer base, encompassing industrial sectors and individual consumers. In 2024, Ecopetrol reported substantial sales volumes of these refined products, contributing significantly to its financial performance.

Ecopetrol, through its subsidiary ISA, generates significant revenue by providing energy transmission services across South America. This includes operations in Brazil, Chile, Peru, and Bolivia, showcasing a broad geographical reach.

This segment is a crucial contributor to the Ecopetrol Group's financial health, representing a substantial portion of its total revenues and EBITDA. For instance, ISA's transmission segment consistently delivers stable, regulated income, underscoring its reliability.

Hydrocarbon Transportation Services

Ecopetrol's extensive pipeline network is a significant revenue generator, offering transportation services for crude oil, refined products, and natural gas. This segment of their business thrives on the reliability and broad reach of their logistics infrastructure, enabling them to charge fees for third-party usage.

In 2024, Ecopetrol's transportation segment, primarily driven by its pipeline operations, contributed substantially to its overall financial performance. The company operates a vast network of over 10,000 kilometers of pipelines, a crucial asset for moving hydrocarbons across Colombia and to export terminals.

- Pipeline Network: Ecopetrol manages a comprehensive system of pipelines essential for the transportation of crude oil, refined products, and natural gas.

- Third-Party Access: Revenue is generated by charging fees to other companies for utilizing this robust logistics infrastructure.

- Key Performance Indicator: The reliability and extensive reach of Ecopetrol's transportation systems are critical drivers for this revenue stream.

- 2024 Impact: This segment plays a vital role in Ecopetrol's financial results, underscoring the importance of its logistical capabilities in the energy market.

Future Revenue from Renewable Energy Projects

Ecopetrol's strategic pivot towards renewable energy is reshaping its future revenue landscape. The company anticipates substantial income from the electricity generated and sold by its growing portfolio of solar and wind farms. This expansion includes projects like Windpeshi, which is poised to become a significant contributor to the Ecopetrol Group's energy needs and, subsequently, its financial performance as it ramps up operations.

The diversification into renewables is not just about meeting energy demand; it's a critical move for long-term sustainability and revenue growth. Beyond electricity, Ecopetrol is exploring revenue opportunities in hydrogen production, further broadening its clean energy income streams. This strategic shift is expected to bolster Ecopetrol's financial resilience in an evolving energy market.

- Electricity Sales: Revenue generated from selling power produced by solar and wind installations.

- Hydrogen Production: Future income from the sale of green hydrogen, a key area of development.

- Projected Contributions: Significant revenue expected from projects like Windpeshi once fully operational.

- Diversification Benefits: Enhanced long-term financial stability and new income avenues.

Ecopetrol's income is primarily derived from the sale of crude oil and natural gas, with these commodity sales forming the backbone of its financial results. The company also generates substantial revenue from selling refined products such as gasoline and diesel, alongside various petrochemicals. Furthermore, Ecopetrol leverages its extensive pipeline network to provide transportation services for hydrocarbons, earning fees for third-party usage.

| Revenue Stream | Description | 2024/2025 Data Point |

|---|---|---|

| Hydrocarbon Sales | Sale of crude oil and natural gas | COP 31.4 trillion in Q1 2025 revenues |

| Refined Products & Petrochemicals | Sales of gasoline, diesel, jet fuel, and petrochemicals | Significant sales volumes in 2024 contributing to financial performance |

| Energy Transmission (ISA) | Providing energy transmission services across South America | Consistent, stable, regulated income contributing to EBITDA |

| Pipeline Transportation Services | Fees for utilizing its logistics infrastructure | Over 10,000 km of pipelines used in 2024 operations |

| Renewable Energy | Electricity sales from solar and wind farms | Future revenue growth anticipated from projects like Windpeshi |

Business Model Canvas Data Sources

The Ecopetrol Business Model Canvas is built upon comprehensive financial reports, detailed market intelligence, and extensive operational data. These sources provide the foundational insights for each strategic block.