Ecopetrol Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ecopetrol Bundle

Ecopetrol operates within a dynamic energy landscape, facing significant pressures from powerful buyers and intense rivalry among established players. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for navigating this complex market. The full analysis reveals the real forces shaping Ecopetrol’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ecopetrol's reliance on specialized equipment and technology for its extensive operations, from exploration to refining, places significant power in the hands of its suppliers. These suppliers provide proprietary, high-cost solutions like advanced drilling rigs and complex refinery components, often with few viable alternatives available in the market.

For instance, the global market for highly specialized oil and gas exploration technology is dominated by a few key players. In 2024, companies like Schlumberger and Halliburton continue to be critical providers of seismic imaging and advanced drilling services, commanding substantial pricing power due to their unique technological capabilities and substantial R&D investments.

The oil and gas sector, including Ecopetrol, relies heavily on specialized skills. Engineers, geologists, and technicians with expertise in upstream exploration and downstream refining are in high demand. This scarcity of talent means these skilled labor groups can exert significant influence.

Ecopetrol's ability to execute complex projects and maintain operational efficiency is directly tied to its access to this specialized workforce. For instance, in 2024, the demand for experienced petroleum engineers remained robust, with many companies competing for a limited pool of qualified professionals.

The bargaining power of these skilled labor suppliers is amplified by the critical nature of their roles. Disruptions due to labor shortages or demands can lead to significant project delays and increased operational costs for Ecopetrol, underscoring the importance of retaining and attracting top talent.

Ecopetrol's reliance on critical raw materials and chemicals for its refining and operational activities means suppliers can wield considerable power. If these essential inputs are in short supply, dominated by a limited number of providers, or subject to unpredictable international pricing, Ecopetrol's costs can be significantly impacted. This is especially true for specialized catalysts and additives crucial for producing high-quality fuels.

Infrastructure and Logistics Providers

Ecopetrol, while possessing extensive internal logistics capabilities in Colombia, still engages third-party infrastructure and logistics providers for specialized needs, particularly in remote regions. The concentration of a few providers capable of managing Ecopetrol's large-scale and complex logistical demands grants these suppliers significant bargaining power. This reliance can lead to higher costs or less favorable terms for Ecopetrol.

In 2024, the transportation sector in Colombia, which includes logistics providers, faced ongoing challenges related to infrastructure development and operational efficiency. For instance, the maintenance and expansion of pipelines and road networks, crucial for Ecopetrol's operations, often depend on specialized engineering and construction firms. These firms, due to their technical expertise and limited competition for large projects, can command higher prices.

- Limited Competition: The specialized nature of oil and gas logistics, including the transport of crude oil, refined products, and specialized equipment, restricts the number of capable third-party providers.

- High Switching Costs: Ecopetrol may incur substantial costs and operational disruptions if it were to switch its primary logistics partners, reinforcing the existing suppliers' leverage.

- Critical Infrastructure Dependence: Reliance on third-party providers for essential infrastructure like port facilities, specialized storage, or unique transportation modes (e.g., specific types of barges or railcars) further amplifies their bargaining power.

Environmental and Regulatory Service Providers

Ecopetrol's reliance on specialized environmental and regulatory service providers grants these suppliers significant bargaining power. With the global push for enhanced ESG performance and stringent environmental regulations, companies like Ecopetrol must engage experts in areas such as emissions monitoring, waste disposal, and compliance reporting. This necessity, coupled with the specialized knowledge these providers possess, allows them to command higher prices and dictate terms.

The complexity of environmental laws, both domestic and international, means that few firms can offer the required expertise. This scarcity of specialized skills strengthens the position of these service providers. For instance, in 2024, the global environmental consulting market was valued at approximately $40 billion, with a projected compound annual growth rate of over 5%, indicating strong demand and a potentially concentrated supplier base for critical services.

- Niche Expertise: Environmental and regulatory service providers possess specialized knowledge crucial for Ecopetrol's compliance.

- Regulatory Demands: Increasing environmental regulations and ESG reporting requirements heighten dependence on these suppliers.

- Market Concentration: A limited number of highly qualified providers can lead to concentrated supplier power.

- Cost Implications: The specialized nature of these services can translate into higher costs for Ecopetrol.

Ecopetrol faces significant bargaining power from suppliers of specialized equipment and proprietary technology, as these are often high-cost, critical components with few alternatives. This is particularly evident in areas like advanced drilling and refinery components, where a limited number of global players dominate. In 2024, companies such as Schlumberger and Halliburton continued to hold substantial pricing power due to their unique technological offerings and significant R&D investments, impacting Ecopetrol's operational costs.

The scarcity of highly skilled labor, including petroleum engineers and specialized technicians, also grants these professionals considerable bargaining power. Ecopetrol’s operational efficiency hinges on access to this talent, and in 2024, the demand for experienced petroleum engineers remained strong, leading to competitive recruitment and potential wage inflation.

Suppliers of critical raw materials, specialized catalysts, and essential chemicals can exert influence, especially when supply is limited or subject to volatile international pricing. Furthermore, third-party logistics providers managing Ecopetrol's complex supply chain, particularly in remote areas, possess leverage due to the concentration of capable firms and high switching costs. In 2024, the transportation sector in Colombia, which includes these specialized logistics firms, continued to grapple with infrastructure challenges, allowing key providers to command higher prices for essential services.

| Supplier Category | Key Factors Influencing Bargaining Power | 2024 Market Context |

| Specialized Technology & Equipment | Proprietary nature, high R&D, limited alternatives | Dominated by few global players (e.g., Schlumberger, Halliburton) |

| Skilled Labor (Engineers, Technicians) | Scarcity of expertise, critical role in operations | Robust demand for petroleum engineers, competitive recruitment |

| Critical Raw Materials & Chemicals | Limited supply, volatile pricing, essential for refining | Impacted by global commodity markets and specialized additive availability |

| Logistics & Transportation | Concentration of providers, high switching costs, infrastructure dependence | Challenges in Colombian infrastructure impacting specialized transport firms |

What is included in the product

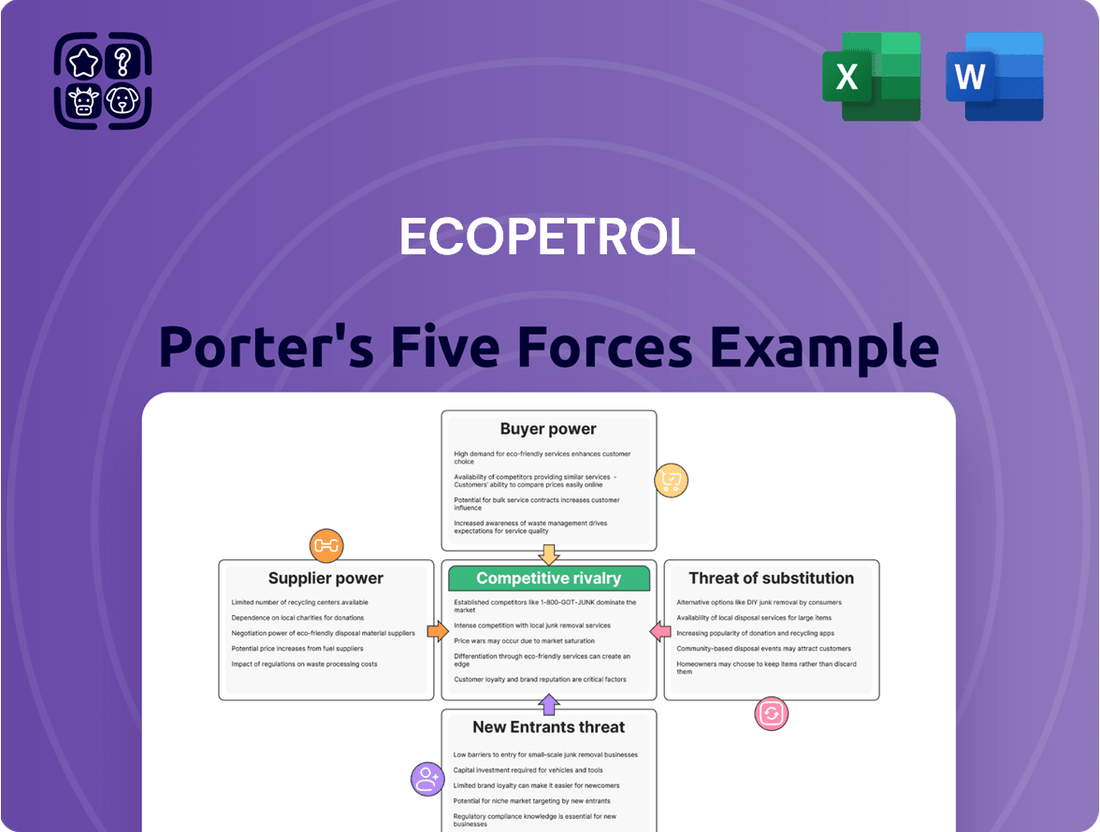

This analysis uncovers the competitive landscape for Ecopetrol by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the oil and gas industry.

Understand Ecopetrol's competitive landscape at a glance, identifying key threats and opportunities to inform strategic adjustments.

Customers Bargaining Power

Ecopetrol's commanding presence in Colombia, controlling over 60% of the nation's hydrocarbon production, transportation, logistics, and refining, significantly curtails the bargaining power of its domestic customers. This near-monopoly on essential energy resources means that for many Colombian consumers and businesses, Ecopetrol is the primary, if not sole, viable supplier, limiting their ability to negotiate better terms or seek alternative sources, especially for critical fuels and petrochemicals.

Ecopetrol's customer base is quite varied, encompassing industrial clients, individual households, and the entire transportation industry. This broad reach means that no single customer segment holds significant sway over Ecopetrol's pricing or contract conditions.

The different demand sensitivities across these customer groups further dilute any individual customer's bargaining power. For instance, while industrial users might have more leverage due to larger purchase volumes, residential consumers often face more inelastic demand for essential fuel products.

This customer diversification contributes to more stable demand for Ecopetrol's offerings, as fluctuations in one segment are often offset by stability or growth in others. In 2024, Ecopetrol reported serving millions of residential customers across Colombia, alongside substantial industrial contracts that underscore this diversification.

As a state-owned entity, Ecopetrol's customer pricing and supply dynamics are heavily influenced by governmental directives and regulations. For instance, the Fuel Price Stabilization Fund (FEPC) in Colombia has historically played a role in capping domestic fuel prices.

This government intervention, while benefiting consumers by moderating price volatility, effectively channels customer power through the state. The government, as a major stakeholder, mediates the direct bargaining power of individual customers, making its policies a primary determinant of pricing and supply conditions.

High Switching Costs for Industrial Customers

For large industrial clients, switching away from Ecopetrol's offerings, such as specialized refined fuels or natural gas, often necessitates substantial investments in new equipment, facility modifications, or intricate supply chain adjustments. These significant switching costs diminish their inclination and capacity to readily shift to competing providers, thereby reinforcing Ecopetrol's market leverage.

These high switching costs act as a substantial barrier, making it economically unviable for many industrial customers to change suppliers frequently. For instance, a refinery that has integrated Ecopetrol's specific crude oil grades into its processing units would face considerable expense and downtime to reconfigure its operations for a different supplier's product. This operational inertia directly benefits Ecopetrol by securing a more stable customer base.

- High Capital Investment: Industrial customers might need to invest millions in new processing units or storage facilities to accommodate alternative energy sources or refined products.

- Operational Disruptions: The transition period can lead to significant production downtime, impacting output and revenue for the customer.

- Logistical Reconfiguration: Establishing new transportation routes and contracts for different suppliers can be complex and costly.

Essential Nature of Products

Ecopetrol's customers, particularly those reliant on oil, gas, and refined products, face a situation where the essential nature of these commodities significantly influences their bargaining power. These products are the lifeblood of Colombia's economy, powering everything from transportation to industry and electricity generation.

The demand for these fundamental energy sources tends to be inelastic, especially in the short to medium term. This inelasticity means that even if prices rise, consumers and businesses still need these products, limiting their ability to demand lower prices or better terms. For example, in 2023, Colombia's energy sector remained heavily dependent on fossil fuels, with oil and gas accounting for a substantial portion of the country's export revenue.

- Essential Products: Oil, gas, and refined products are critical for Colombia's transportation, industrial, and power generation sectors.

- Inelastic Demand: The fundamental need for these energy sources results in relatively inelastic demand, particularly in the short to medium term.

- Limited Customer Leverage: This inelasticity restricts customers' ability to dictate terms, even as the global push for energy transition gains momentum.

Ecopetrol's dominant market position in Colombia, coupled with high customer switching costs and the essential nature of its products, significantly limits the bargaining power of its customers. Government regulations also play a role, channeling customer influence through state policies rather than direct negotiation.

In 2024, Ecopetrol's extensive customer base, serving millions of residential and industrial users, further diluted individual customer leverage. The inelastic demand for core energy products means customers have limited ability to negotiate lower prices, even with the ongoing global energy transition.

| Factor | Ecopetrol's Position | Customer Bargaining Power |

|---|---|---|

| Market Dominance | Controls over 60% of Colombia's hydrocarbon production. | Low |

| Switching Costs | High for industrial clients needing new equipment/logistics. | Low |

| Product Essentiality | Oil, gas, and refined products are critical for the economy. | Low |

| Demand Elasticity | Inelastic demand for essential energy sources. | Low |

| Government Influence | Pricing and supply influenced by state directives (e.g., FEPC). | Low (channeled through government) |

Preview the Actual Deliverable

Ecopetrol Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Ecopetrol's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the oil and gas industry. This comprehensive breakdown provides actionable insights into Ecopetrol's strategic positioning.

Rivalry Among Competitors

Ecopetrol stands as a dominant force in Colombia's energy sector, controlling over 60% of the nation's hydrocarbon output. This substantial market share, coupled with its integrated operations spanning exploration, refining, and distribution, significantly curtails direct competition within the domestic market.

Ecopetrol, while a dominant force in Colombia, encounters significant competition from international oil companies (IOCs) and other major energy players in its global ventures. These rivals compete for market share and crucial resources like capital and advanced technology, particularly in regions such as the US Permian Basin, the Gulf of Mexico, and Brazil.

Key international competitors vying with Ecopetrol include established giants like Canadian Natural Resources, ENI, Suncor Energy, Woodside Energy Group, Oxy, Petrobras, and Chevron. For instance, in 2023, Chevron reported a net income of $21.4 billion, highlighting the substantial financial muscle these global competitors possess, which can be leveraged to outbid Ecopetrol for prime assets or technological advancements.

Ecopetrol's move into renewable energy and low-carbon solutions pits it against established renewable developers and agile new entrants. In 2024, Colombia's renewable energy sector is seeing significant growth, with projects like wind farms in La Guajira attracting substantial investment, intensifying rivalry.

The competitive landscape is further shaped by shared challenges in obtaining permits and securing grid connections, impacting all companies, including Ecopetrol. For instance, delays in grid infrastructure upgrades in 2024 have been a common hurdle for new renewable energy projects across the country, affecting the pace of market entry and expansion for all participants.

Price Volatility and Global Market Dynamics

The oil and gas sector experiences substantial global crude oil price swings, a factor that can heighten competitive rivalry. Companies often battle for market share and profitability, especially when navigating fluctuating price environments. Ecopetrol's financial planning for 2025, which anticipates an average Brent crude price of $73 per barrel, underscores its vulnerability to these global market shifts.

This price volatility directly impacts Ecopetrol's competitive stance. When prices are high, profitability increases, potentially allowing for greater investment in exploration and production, which can strengthen its market position. Conversely, during periods of low prices, the company faces pressure to manage costs and maintain production levels, intensifying competition as firms seek to optimize their operations and secure revenue streams.

- Global Crude Oil Price Volatility: The oil and gas industry is inherently exposed to significant price fluctuations driven by geopolitical events, supply and demand imbalances, and economic growth.

- Ecopetrol's 2025 Brent Price Assumption: The company's financial plan for 2025 is based on an average Brent crude oil price of $73 per barrel, indicating a direct link between its financial performance and global oil market conditions.

- Impact on Competition: Price volatility can intensify competitive rivalry as companies adjust strategies to maintain profitability and market share, potentially leading to price wars or increased focus on operational efficiency.

Governmental Influence and Strategic Mandate

As a state-controlled entity, Ecopetrol's competitive landscape is significantly shaped by governmental influence. Colombia's national energy security objectives and its commitment to an energy transition roadmap directly impact Ecopetrol's strategic direction, often steering its decisions away from purely profit-driven motives common in private sector competitors.

Ecopetrol's mandate frequently involves prioritizing domestic energy supply and contributing to Colombia's economic growth. For instance, in 2023, the Colombian government continued to emphasize the importance of maintaining stable fuel prices for citizens, a factor that can influence Ecopetrol's pricing strategies and investment priorities, potentially impacting its short-term profitability compared to less regulated entities.

- Governmental Mandate: Ecopetrol's operations are guided by national policies, including energy security and transition goals.

- Strategic Differentiation: This governmental oversight creates a competitive approach distinct from purely commercial oil and gas companies.

- Domestic Focus: The company's role extends to ensuring national energy supply and fostering economic development, which can supersede profit maximization.

- 2024 Context: In 2024, Ecopetrol's strategic planning continues to align with Colombia's long-term energy diversification efforts, potentially involving investments in renewable energy sources alongside its traditional hydrocarbon operations.

Ecopetrol faces intense rivalry from both domestic and international players in the energy sector. While its substantial market share in Colombia offers some insulation, global ventures bring it into direct competition with financially robust international oil companies. These giants, like Chevron which reported $21.4 billion in net income in 2023, possess significant capital and technological advantages.

The push into renewables further intensifies competition, with Ecopetrol competing against established developers and agile new entrants in a growing Colombian market. Shared challenges in securing permits and grid connections, evident in 2024 renewable project delays, affect all participants, including Ecopetrol.

Global crude oil price volatility, with Ecopetrol's 2025 Brent price assumption at $73 per barrel, directly impacts competitive dynamics, forcing companies to prioritize efficiency and market share. As a state-controlled entity, Ecopetrol's strategy is also influenced by national energy security and transition goals, differentiating its competitive approach from purely profit-driven private firms.

| Competitor Type | Key Players | 2023 Net Income (USD billions) | Key Competitive Factors |

|---|---|---|---|

| International Oil Companies (IOCs) | Chevron | 21.4 | Capital, Technology, Asset Acquisition |

| IOCs | Petrobras | N/A (Financials vary) | Market Share, Resource Access |

| Renewable Energy Developers | Various (e.g., project developers in La Guajira) | N/A (Sector specific) | Innovation, Project Execution, Grid Access |

SSubstitutes Threaten

The intensifying global commitment to decarbonization and combating climate change presents a substantial threat from substitute energy sources for traditional fossil fuels. This transition is accelerating the adoption of renewables like solar and wind, alongside emerging technologies such as green hydrogen.

Ecopetrol is proactively addressing this threat by strategically allocating a significant portion of its resources. For instance, the company has earmarked 24% of its 2025 budget for energy transition initiatives, demonstrating a clear commitment to diversifying its portfolio beyond oil and gas.

These investments are directed towards areas such as renewable energy generation, the development of hydrogen as a clean fuel, and enhancing energy efficiency across its operations. This strategic pivot is crucial for Ecopetrol to remain competitive and relevant in a rapidly evolving energy landscape.

The increasing competitiveness and scalability of renewable energy sources like solar and wind power present a significant threat of substitution for traditional fossil fuels. Colombia's ambitious target of 6 GW of renewable capacity by 2026 underscores this shift.

Ecopetrol is actively participating in this transition, aiming for 900 MW of renewable capacity by 2025 and a substantial 2.2 GW by 2030. This strategic pivot highlights the growing viability and adoption of alternative energy solutions, directly impacting demand for conventional oil and gas products.

The emergence of green hydrogen presents a significant threat of substitution for Ecopetrol's core business. Green hydrogen, produced using renewable energy, offers a cleaner alternative for industrial processes and transportation fuels, directly competing with traditional fossil fuels.

Ecopetrol itself is investing heavily in this substitute, planning Latin America's largest green hydrogen plant by 2026 and targeting 1 million tonnes annually by 2040. This strategic move highlights the growing importance and potential of green hydrogen as a viable long-term replacement for hydrocarbons.

Electrification of Transportation and Industry

The accelerating shift towards electrification in transportation, exemplified by the growing adoption of electric vehicles (EVs), poses a significant threat of substitution for Ecopetrol. Globally, EV sales have seen remarkable growth, with projections indicating continued expansion. For instance, in 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, signaling a clear trend away from internal combustion engine vehicles that rely on fossil fuels.

This trend directly impacts the demand for gasoline and diesel, Ecopetrol's core products. While Colombia's EV market is still developing, the global momentum suggests a long-term erosion of demand for traditional fuels. Ecopetrol is actively exploring diversification strategies to mitigate this threat, investing in renewable energy sources and other low-carbon alternatives to adapt its business model for a future with reduced reliance on oil and gas.

- Decreasing Demand for Fossil Fuels: The rise of EVs directly substitutes demand for gasoline and diesel.

- Global EV Growth: Over 13 million EVs were sold globally in 2023, indicating a strong market shift.

- Long-Term Threat: Electrification represents a sustained challenge to Ecopetrol's traditional revenue streams.

- Ecopetrol's Mitigation: The company is investing in a diversified energy portfolio to counter this threat.

Natural Gas as a Transition Fuel

Natural gas presents a nuanced threat of substitution for Ecopetrol, even as the company increases its focus on gas production. While Ecopetrol aims to leverage its natural gas assets, gas itself can substitute for more carbon-intensive fuels like coal and fuel oil in sectors such as power generation and industrial processes. This substitution is particularly relevant in the short to medium term as many economies view natural gas as a crucial transition fuel to lower emissions before fully embracing renewables.

Ecopetrol's strategic shift to prioritize natural gas investments directly addresses this evolving energy landscape. By expanding its natural gas portfolio, Ecopetrol is positioning itself to benefit from the demand for cleaner-burning fuels. For instance, in 2023, Ecopetrol announced significant investments in its natural gas business, aiming to bolster domestic supply and potentially export markets, recognizing gas's role in displacing higher-emission alternatives.

- Natural Gas as a Cleaner Alternative: Natural gas offers a lower carbon footprint compared to coal and oil, making it an attractive substitute for power plants and industrial facilities seeking to reduce emissions.

- Ecopetrol's Strategic Alignment: Ecopetrol's increased investment in natural gas production, highlighted by its 2024 development plans, aims to capitalize on this demand for transition fuels.

- Market Dynamics: The global push for decarbonization creates a dual dynamic: while Ecopetrol benefits from producing gas, the gas itself competes with other energy sources, including renewables, in the long run.

The escalating adoption of renewable energy sources like solar and wind power directly challenges Ecopetrol's traditional oil and gas business. Colombia's commitment to expanding renewable capacity, with a target of 6 GW by 2026, signifies a significant market shift. Ecopetrol's own strategic expansion into renewables, aiming for 900 MW by 2025, demonstrates its recognition of this competitive pressure.

The rise of electric vehicles (EVs) poses a substantial threat by directly reducing demand for gasoline and diesel. Global EV sales surpassed 13 million units in 2023, a clear indicator of this trend. Ecopetrol's investments in energy transition initiatives, including a 24% allocation of its 2025 budget to such projects, highlight its efforts to mitigate this substitution risk.

Green hydrogen is emerging as a powerful substitute, offering a cleaner alternative for industrial and transportation sectors. Ecopetrol's ambitious plans, including Latin America's largest green hydrogen plant by 2026, underscore the growing viability and competitive threat of this technology.

| Substitute Energy Source | Ecopetrol's Response/Investment | Key Data Point/Target |

|---|---|---|

| Renewable Energy (Solar & Wind) | Investing in renewable capacity | Target of 900 MW by 2025, 2.2 GW by 2030 |

| Electric Vehicles (EVs) | Diversifying energy portfolio | Global EV sales exceeded 13 million in 2023 |

| Green Hydrogen | Developing green hydrogen production | Latin America's largest plant planned by 2026 |

Entrants Threaten

The energy sector, particularly oil and gas, presents a formidable barrier to entry due to its exceptionally high capital intensity. Establishing operations in exploration, production, and refining requires substantial upfront investment, making it difficult for new players to enter the market and compete with established giants like Ecopetrol.

Ecopetrol's significant financial commitments highlight this barrier. For 2025, the company has projected an investment budget ranging from $5.4 billion to $6.4 billion. A considerable portion of this budget is earmarked for exploration and production (E&P), underscoring the immense financial scale necessary to maintain and expand operations in this capital-intensive industry.

The Colombian energy sector is a tightly regulated landscape, demanding a maze of permits, licenses, and environmental approvals before any new player can even consider entering. This intricate web of regulations, coupled with potentially lengthy bureaucratic processes, acts as a significant deterrent.

For instance, securing the necessary approvals for renewable energy projects can be particularly time-consuming, creating substantial barriers. In 2023, Colombia continued to refine its regulatory framework for energy, with specific attention paid to streamlining processes for renewables, yet the inherent complexity remains a challenge for newcomers.

Beyond governmental red tape, social consultations and robust community engagement are also mandatory, adding another layer of complexity and potential delays. These requirements necessitate significant investment in time and resources, making the threat of new entrants relatively low.

Ecopetrol benefits from a deeply entrenched infrastructure, encompassing extensive pipelines, refineries, and a robust distribution system. Replicating this complex and capital-intensive network would require billions of dollars and years of development, presenting a significant barrier for potential new entrants seeking to compete in the Colombian energy market.

Access to Reserves and Exploration Expertise

New companies looking to enter the oil and gas sector, particularly in areas like Colombia where Ecopetrol operates, face substantial hurdles in gaining access to proven reserves and the critical exploration expertise needed to identify new ones. These ventures demand immense capital for seismic surveys, drilling, and infrastructure development, often running into billions of dollars before any production begins.

Ecopetrol, with its deep roots and decades of operational history within Colombia's promising basins, possesses an inherent advantage. This experience translates into invaluable geological knowledge and established relationships, making it significantly easier for Ecopetrol to secure exploration rights and identify promising sites compared to a newcomer. For instance, in 2023, Ecopetrol reported investing approximately $3.7 billion in its operations, a substantial portion of which is directed towards exploration and production activities, underscoring the scale of investment required.

- High Capital Requirements: Entering the oil and gas exploration market demands billions in upfront investment for exploration, drilling, and infrastructure.

- Geological Expertise: Identifying viable reserves requires specialized geological knowledge and advanced technologies, which new entrants may lack.

- Ecopetrol's Advantage: Ecopetrol benefits from extensive experience in Colombian basins and international operations, providing a significant competitive edge.

- Operational Scale: In 2023, Ecopetrol's capital expenditure reached around $3.7 billion, highlighting the financial commitment necessary for sustained exploration and production.

Government Support and State-Owned Status

As a state-owned entity, Ecopetrol enjoys a unique advantage that significantly deters new entrants. The Colombian government's backing provides implicit and explicit support, often translating into preferential access to crucial resources and a strategic mandate to ensure national energy security. This governmental alignment creates a substantial barrier, as private companies entering the market are unlikely to receive comparable backing or possess the same level of national strategic importance.

This government support can manifest in several ways, making it difficult for new players to compete effectively. For instance, state-owned enterprises may benefit from favorable regulatory treatment, access to subsidized financing, or direct capital injections. In 2023, Ecopetrol reported total assets of approximately COP 225.8 trillion (around USD 57 billion), a scale that is challenging for nascent private competitors to match without significant government backing.

- Government backing provides Ecopetrol with an inherent advantage over private competitors.

- Preferential access to resources, such as exploration blocks or infrastructure, is often granted to state-owned companies.

- Strategic mandate for energy security aligns Ecopetrol's operations with national interests, potentially influencing policy and investment decisions in its favor.

- Uneven playing field is created for new private entrants who lack similar government support and strategic alignment.

The threat of new entrants in the Colombian energy sector, where Ecopetrol operates, is considerably low. This is primarily due to the sector's extreme capital intensity, requiring billions for exploration, production, and infrastructure, a barrier Ecopetrol's 2025 projected investment of $5.4 billion to $6.4 billion clearly illustrates. Furthermore, stringent regulations, mandatory social consultations, and Ecopetrol's established, extensive infrastructure present significant hurdles for newcomers. The company's deep geological expertise and decades of operational history in Colombian basins, evidenced by its 2023 investment of approximately $3.7 billion in E&P, provide an additional layer of defense against potential competitors.

| Barrier Type | Description | Ecopetrol's Position/2023-2025 Data |

|---|---|---|

| Capital Intensity | High upfront investment for exploration, production, and infrastructure. | 2025 projected investment: $5.4-$6.4 billion. 2023 E&P investment: ~$3.7 billion. |

| Regulatory Hurdles | Complex permits, licenses, and environmental approvals; lengthy bureaucratic processes. | Ongoing refinement of regulations, particularly for renewables, yet complexity persists. |

| Infrastructure & Scale | Need to replicate extensive pipelines, refineries, and distribution networks. | Ecopetrol's deeply entrenched infrastructure represents billions in replication costs. |

| Expertise & Reserves | Access to proven reserves and specialized geological knowledge for exploration. | Ecopetrol's decades of experience in Colombian basins provide invaluable geological insights. |

| Government Support | Preferential access to resources and strategic mandate for energy security. | State-owned status provides implicit and explicit governmental backing. 2023 Total Assets: ~USD 57 billion. |

Porter's Five Forces Analysis Data Sources

Our Ecopetrol Porter's Five Forces analysis is built upon a foundation of robust data, including Ecopetrol's annual reports, investor presentations, and filings with regulatory bodies like the SEC. We supplement this with insights from reputable industry research firms and macroeconomic data providers to capture a comprehensive view of the competitive landscape.