Ecopetrol Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ecopetrol Bundle

Discover how Ecopetrol leverages its product portfolio, pricing strategies, extensive distribution network, and impactful promotional campaigns to maintain its market leadership. This analysis delves into the core elements of their marketing mix, offering a clear picture of their operational strengths.

Save valuable time and gain strategic clarity with our comprehensive 4Ps Marketing Mix Analysis for Ecopetrol. This ready-to-use report provides actionable insights, detailed examples, and a structured framework perfect for business professionals, students, and consultants.

Unlock the secrets behind Ecopetrol's marketing success. Our full analysis breaks down each of the 4Ps with expert research and real-world data, empowering you to understand their strategy and apply similar principles to your own business.

Product

Ecopetrol's core product centers on the exploration, production, and sale of crude oil and natural gas. For 2025, the company is prioritizing profitable production, dedicating substantial investment to these established hydrocarbon ventures. This includes drilling new wells in Colombia and the U.S. to bolster its reserve base.

Ecopetrol's refining and petrochemical segment transforms crude oil into essential products like gasoline, diesel, and jet fuel. They also produce vital petrochemicals such as polypropylene resins, a key component in many manufacturing processes. This segment is a cornerstone of their operations, directly supplying energy and materials to the market.

The Barrancabermeja and Cartagena refineries are central to Ecopetrol's refining capacity. Significant investments are being made to boost their efficiency, environmental performance, and the quality of the fuels they produce. For instance, in 2024, Ecopetrol announced a $1.2 billion investment in the Barrancabermeja refinery to upgrade its processing units and reduce emissions, aiming for a 25% increase in the production of higher-quality fuels by 2026.

Ecopetrol's commitment extends beyond crude oil to the crucial distribution of natural gas and LPG, essential for Colombia's domestic energy needs. The company is actively bolstering its gas supply through strategic investments in exploration and development projects, particularly targeting the Piedemonte Llanero and offshore Caribbean areas. This focus aims to ensure a robust and reliable energy future for the nation.

Renewable Energy Solutions

Ecopetrol is actively pursuing renewable energy solutions as a cornerstone of its energy transition. This involves significant expansion into lower-carbon alternatives, encompassing unconventional renewable energy sources and energy efficiency initiatives. The company is committed to boosting its renewable generation capacity substantially by 2025 and 2030.

Key investments are being channeled into solar, wind, and green hydrogen projects. A prime example of this strategic push is the development of a new green hydrogen plant at the Cartagena Refinery, signaling a concrete step towards decarbonization and a diversified energy portfolio.

- Capacity Growth: Ecopetrol targets a significant increase in renewable energy generation capacity by 2025 and 2030.

- Project Focus: Investments are concentrated in solar, wind, and green hydrogen technologies.

- Strategic Initiatives: Development of a green hydrogen plant at the Cartagena Refinery exemplifies commitment to new energy solutions.

- Low-Carbon Expansion: Ecopetrol's strategy includes broadening its portfolio with unconventional renewable energy and energy efficiency projects.

Electric Power Transmission and Road Concessions

Ecopetrol, through its subsidiary ISA, offers electric power transmission and road concessions, significantly broadening its market presence beyond traditional oil and gas. This diversification strategy leverages ISA's established leadership in energy transmission across Latin America.

ISA's commitment to expanding its electric power grid is a key aspect of this product offering. For instance, as of early 2024, ISA was actively involved in numerous projects across several Latin American countries, aiming to enhance energy security and facilitate the integration of renewable energy sources. This expansion directly contributes to the region's critical energy infrastructure development.

- ISA's robust energy transmission network spans over 50,000 kilometers of high-voltage lines across Latin America as of late 2023.

- The company is investing billions in new transmission projects, with a focus on connecting renewable energy generation sites to the grid.

- Road concessions represent another facet, with ISA managing key transportation infrastructure that supports economic activity and connectivity in the regions it operates.

- This dual offering in energy transmission and road infrastructure diversifies Ecopetrol's revenue streams and reduces its reliance on fossil fuel markets.

Ecopetrol's product portfolio is a dynamic mix of traditional energy sources and expanding renewable ventures. Their core business remains the exploration, production, and sale of crude oil and natural gas, with significant 2025 investments in drilling new wells to bolster reserves.

The company refines crude oil into essential fuels like gasoline and diesel, alongside petrochemicals such as polypropylene. This segment is critical, with major upgrades planned for their Barrancabermeja and Cartagena refineries to enhance efficiency and environmental performance.

Beyond hydrocarbons, Ecopetrol is actively developing its renewable energy capacity, focusing on solar, wind, and green hydrogen projects. A key initiative is the new green hydrogen plant at the Cartagena Refinery, underscoring their commitment to a lower-carbon future.

Through its subsidiary ISA, Ecopetrol also offers electric power transmission and road concessions, diversifying its revenue streams and contributing to vital infrastructure development across Latin America.

| Product Segment | Key Activities | 2024/2025 Focus/Data |

|---|---|---|

| Hydrocarbons | Exploration, Production, Sale of Crude Oil & Natural Gas | Prioritizing profitable production; new well drilling in Colombia & U.S. |

| Refining & Petrochemicals | Processing Crude Oil into Fuels & Petrochemicals | Upgrades at Barrancabermeja ($1.2B investment in 2024) & Cartagena refineries; aiming for 25% higher-quality fuel production by 2026. |

| Renewable Energy | Solar, Wind, Green Hydrogen, Energy Efficiency | Substantial capacity growth targets for 2025 & 2030; green hydrogen plant at Cartagena Refinery. |

| Infrastructure (ISA) | Electric Power Transmission, Road Concessions | ISA operates over 50,000 km of high-voltage lines (late 2023); investing in grid expansion to connect renewables. |

What is included in the product

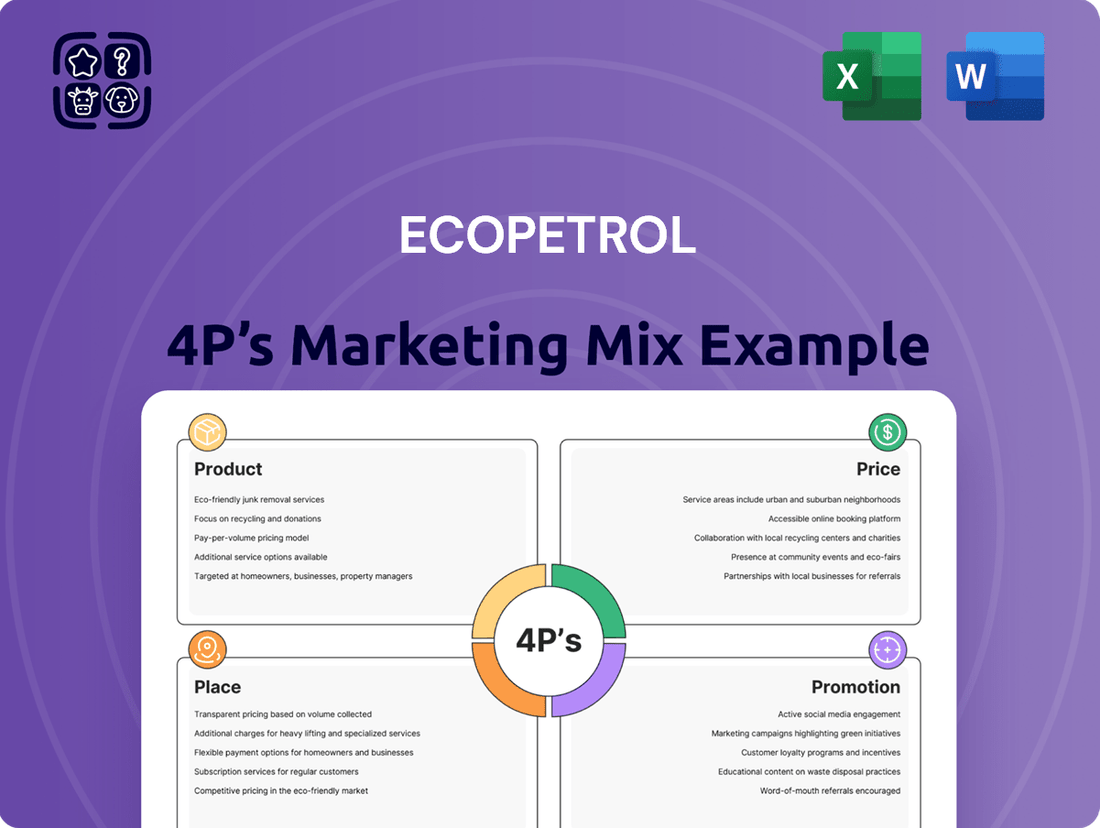

This analysis provides a comprehensive breakdown of Ecopetrol's marketing strategies across Product, Price, Place, and Promotion, offering insights into their market positioning and operational approach.

This Ecopetrol 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, concise overview of their strategies, enabling quick identification of areas for improvement and alignment across teams.

Place

Ecopetrol boasts an extensive pipeline and logistics network within Colombia, featuring thousands of kilometers of crude oil and multi-purpose pipelines. This infrastructure is crucial for transporting crude oil, refined products, and biofuels from production sites to refineries, distribution centers, and export terminals. In 2023, Ecopetrol's transportation segment moved approximately 1.1 million barrels of oil equivalent per day, highlighting the scale and importance of its logistics operations in ensuring efficient delivery across the nation.

Ecopetrol's reach extends significantly across both domestic and international arenas. Within Colombia, the company is a dominant force, accounting for over 60% of the nation's hydrocarbon production and holding leadership roles in the petrochemical and gas distribution sectors, catering to a wide array of clients.

Internationally, Ecopetrol actively engages in exploration and production within key American basins, including the United States, Brazil, and Mexico. Furthermore, through its subsidiary ISA, Ecopetrol has established a robust presence in power transmission, operating across multiple Latin American countries, underscoring its broad regional footprint.

Ecopetrol's refineries, notably Barrancabermeja and Cartagena, are more than just production sites; they are vital distribution nerve centers. These strategically located facilities ensure the efficient flow of gasoline, diesel, and other refined products directly to markets across Colombia. In 2024, Ecopetrol's refining segment played a crucial role in meeting domestic demand, processing approximately 340,000 barrels of crude oil per day across its facilities, thereby reducing reliance on imported fuels.

Direct Sales and Commercial Subsidiaries

Ecopetrol employs direct sales for its bulk products, primarily serving large industrial customers and fellow energy firms. This approach ensures efficient delivery and tailored solutions for significant volume transactions.

The company's commercial arm, Ecopetrol US Trading based in Houston, is crucial for international operations. It actively seeks and manages opportunities in the global crude oil and refined product markets, enhancing Ecopetrol's reach and profitability.

In 2023, Ecopetrol's commercial and marketing segment reported significant revenue contributions, with international sales through subsidiaries like Ecopetrol US Trading being a key driver.

- Direct Sales Focus: Ecopetrol targets industrial clients and energy sector peers for bulk product distribution.

- International Reach: Ecopetrol US Trading in Houston manages global crude oil and product sales.

- Market Capitalization: The Houston subsidiary actively capitalizes on international market dynamics.

Digital Platforms and Innovation

Ecopetrol is actively embracing digital platforms and innovation, viewing them as crucial extensions of its traditional 'place' strategy. This digital transformation is not just about online presence but about fundamentally improving how the company operates, which in turn affects product delivery and efficiency.

The company's commitment to digital solutions is evident in its significant investments. For instance, Ecopetrol has been a leader in adopting technologies like artificial intelligence and advanced data analytics. These tools are being deployed to refine operational management, from exploration and production to refining and distribution. The goal is to create a more agile and responsive supply chain, ensuring products reach markets more effectively.

Ecopetrol’s digital initiatives are geared towards optimization and efficiency gains. By leveraging data, they aim to predict maintenance needs, optimize energy consumption in their facilities, and improve the logistics of transporting crude oil and refined products. This focus on innovation is designed to enhance overall accessibility and reduce operational friction, indirectly benefiting customers and stakeholders by ensuring a more reliable supply.

- Digital Transformation Investment: Ecopetrol has allocated substantial resources towards digital initiatives, aiming to modernize its infrastructure and operational processes.

- AI and Data Analytics Deployment: The company is actively integrating AI and data analytics to enhance decision-making, optimize production, and streamline supply chain management.

- Operational Efficiency Gains: These digital advancements are projected to yield significant improvements in operational efficiency, potentially leading to cost reductions and faster product delivery.

- Innovation in Logistics: Ecopetrol is exploring innovative digital solutions to optimize its transportation and distribution networks, improving the accessibility of its products.

Ecopetrol's physical infrastructure, including its extensive pipeline network and strategically located refineries in Barrancabermeja and Cartagena, forms the backbone of its 'Place' strategy. These assets ensure the efficient movement of crude oil and refined products across Colombia and to international markets. The company's logistical capabilities are substantial, moving approximately 1.1 million barrels of oil equivalent per day in 2023.

The company's distribution network is robust, with refineries acting as key hubs for gasoline and diesel, serving the Colombian market. Ecopetrol's reach also extends internationally through its subsidiary Ecopetrol US Trading, facilitating global sales and market access. In 2024, Ecopetrol's refining capacity was essential in meeting domestic demand, processing around 340,000 barrels of crude oil daily.

Digitalization is a key component of Ecopetrol's evolving 'Place' strategy, enhancing operational efficiency and product accessibility. Investments in AI and data analytics are optimizing logistics and supply chain management, aiming for more agile product delivery. This digital transformation supports Ecopetrol's goal of improving market responsiveness and overall operational effectiveness.

| Infrastructure Component | Key Function | 2023/2024 Data Point |

|---|---|---|

| Pipeline Network | Crude oil, refined products, and biofuel transport | 1.1 million barrels of oil equivalent per day transported (2023) |

| Refineries (Barrancabermeja, Cartagena) | Processing and distribution of refined products | ~340,000 barrels of crude oil processed daily (2024) |

| International Operations | Global sales and market management | Ecopetrol US Trading subsidiary active in Houston |

Same Document Delivered

Ecopetrol 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Ecopetrol 4P's Marketing Mix Analysis is ready for immediate download, offering a complete and actionable strategy.

Promotion

Ecopetrol prioritizes robust investor relations and financial reporting to foster trust and transparency. The company actively engages with the financial community through detailed investor presentations, timely quarterly results announcements, and comprehensive sustainability reports. This consistent communication provides crucial financial and operational updates, catering to the diverse needs of individual investors, financial professionals, and business strategists.

In 2024, Ecopetrol reported strong financial performance, with net income reaching approximately COP 15.2 trillion (USD 3.9 billion) for the first nine months, demonstrating operational efficiency and strategic execution. Their commitment to sustainability is further underscored by detailed reporting on ESG metrics, aligning with investor expectations for responsible business practices and long-term value creation.

Ecopetrol showcases its dedication to sustainability and ESG principles through its annual Integrated Management and Sustainability Reports. These reports detail advancements in climate action, community engagement, and corporate governance, resonating with investors prioritizing responsible business practices.

Ecopetrol actively engages with the media through press releases and official statements to disseminate critical company updates, strategic advancements, and financial results. This proactive approach guarantees widespread public understanding of its operations, particularly its commitment to energy transition initiatives and its vital role in bolstering national energy security.

In 2023, Ecopetrol reported a net income of approximately COP 19.1 trillion (USD 4.8 billion), showcasing its robust financial health and capacity to fund strategic communications. The company's media engagement highlights its progress in areas like renewable energy projects, aiming to inform stakeholders about its evolving business model.

Corporate Communications and Brand Positioning

Ecopetrol's corporate communications are centered on its 'Energy that Transforms' strategy, highlighting its evolution into an integrated energy group dedicated to sustainability. This messaging emphasizes the company's significant investments and progress in diversifying its portfolio towards renewable energy sources and lower-carbon solutions.

The brand positioning reinforces Ecopetrol as a forward-thinking energy conglomerate, actively shaping a more sustainable future for the sector. This strategic communication aims to build trust and demonstrate commitment to stakeholders regarding its energy transition journey.

- Renewable Energy Growth: Ecopetrol's renewable energy portfolio saw substantial expansion, with significant project developments in solar and wind power. For instance, by early 2024, the company had advanced several key renewable projects, aiming to contribute a substantial portion of its energy generation from non-conventional sources.

- Low-Carbon Investments: The company allocated considerable capital towards initiatives focused on reducing its carbon footprint, including investments in hydrogen technology and carbon capture. Ecopetrol's 2024-2025 investment plan earmarked billions of dollars for these transition-related projects.

- Stakeholder Engagement: Ecopetrol actively communicates its sustainability efforts and strategic vision through various channels, including annual reports, investor briefings, and public relations campaigns, aiming to align its brand with global environmental, social, and governance (ESG) expectations.

Stakeholder Engagement and Community Initiatives

Ecopetrol actively cultivates relationships with a broad spectrum of stakeholders, encompassing its workforce, supply chain partners, and the local communities where it operates. These interactions are frequently highlighted in its sustainability reporting, underscoring a dedication to fostering positive connections and contributing to regional social progress.

The company's commitment to community development is evident through various initiatives. For instance, in 2023, Ecopetrol invested over COP 200 billion in social projects, focusing on education, health, and environmental conservation. This investment directly impacts thousands of individuals across its operational areas.

Key stakeholder engagement activities include:

- Community Dialogues: Regular meetings with local leaders and residents to address concerns and identify collaborative opportunities.

- Supplier Development Programs: Initiatives aimed at strengthening local supplier capabilities and promoting sustainable procurement practices.

- Employee Volunteerism: Encouraging employees to participate in community service and social impact projects.

- Educational Scholarships: Providing opportunities for students in operational areas to pursue higher education, fostering future talent and community growth.

Ecopetrol's promotion strategy centers on communicating its transformation into an integrated energy company focused on sustainability. This involves highlighting its investments in renewable energy, such as solar and wind projects, and its commitment to low-carbon solutions like hydrogen. The company actively engages with investors and the public through detailed reports and media outreach to showcase its progress and future vision.

For instance, Ecopetrol's 2024-2025 investment plans include billions of dollars for energy transition initiatives. By early 2024, the company had advanced several key renewable projects, aiming for a significant contribution from non-conventional sources. This proactive communication strategy aims to build confidence and align its brand with global ESG expectations.

| Initiative | Focus | 2023/2024 Data/Target |

|---|---|---|

| Renewable Energy Expansion | Solar and Wind Power Projects | Advancements in multiple projects by early 2024 |

| Low-Carbon Investments | Hydrogen Technology, Carbon Capture | Billions allocated in 2024-2025 investment plan |

| Brand Messaging | Energy Transition, Sustainability | Communicated via Integrated Management and Sustainability Reports |

Price

Ecopetrol's hydrocarbon pricing is intrinsically linked to global benchmarks, with Brent crude serving as a primary reference point. This market-driven approach means that changes in international oil and gas prices directly translate into fluctuations in the company's revenue streams.

For instance, during 2024, Ecopetrol's financial performance will continue to be sensitive to the volatility observed in crude oil markets. A sustained increase in Brent crude prices, which averaged around $83 per barrel in early 2024, would bolster Ecopetrol's profitability, while a downturn could necessitate revisions to its projected earnings and capital expenditure plans.

Ecopetrol's refined product pricing in Colombia is significantly influenced by government regulations and the Fuel Stabilization Fund (FEPC). This fund acts as a buffer, absorbing fluctuations in international crude oil prices to maintain more stable domestic fuel costs for consumers.

The FEPC's operations directly impact Ecopetrol's revenue, as it can lead to adjustments in the effective price the company receives for its refined products, especially during periods of high global price volatility. For instance, in early 2024, the FEPC played a role in managing the pass-through of international price movements to the domestic market.

Ecopetrol's pricing strategy is geared towards delivering robust shareholder returns, underpinned by a steadfast commitment to operational efficiency. This focus on cost management is crucial for maintaining competitive pricing in the dynamic energy market.

The company actively sets ambitious targets for key performance indicators such as lifting costs, total refining costs, and transportation costs per barrel. For instance, Ecopetrol aimed to reduce its lifting costs by approximately 5-7% in 2024, a move that directly enhances its profitability and pricing flexibility.

Investment Budget Allocation and Capital Discipline

Ecopetrol's substantial investment budget, with a significant portion directed towards exploration and production, underscores its dedication to sustaining output, a key factor impacting market supply and, consequently, pricing dynamics. For instance, in 2023, Ecopetrol reported capital expenditures of approximately COP 29.4 trillion (around USD 7.4 billion at the average 2023 exchange rate), with a large part of this allocated to upstream activities. This strategic allocation directly influences the company's ability to meet demand and manage its market presence.

The company's commitment to capital discipline is paramount, ensuring that investments are geared towards profitable growth and the creation of sustainable value. This rigorous approach means that investment returns are a critical consideration in their pricing strategies, aiming to balance market competitiveness with the need for financial health.

- Exploration & Production Focus: Ecopetrol's capital allocation prioritizes upstream activities to maintain and grow hydrocarbon reserves and production volumes.

- Capital Discipline: The company employs strict financial oversight to ensure investments yield attractive returns and contribute to long-term value.

- Pricing Influence: Investment decisions and capital discipline indirectly affect pricing by influencing supply levels and the company's cost structure.

- 2023 Capex: Approximately COP 29.4 trillion was invested, with a substantial portion dedicated to enhancing production capacity and resource discovery.

Long-Term Assumptions and Strategic Planning

Ecopetrol's long-term strategic planning, notably its 'Energy that Transforms' initiative, is deeply intertwined with its assumptions regarding future oil and gas prices. These crucial price forecasts directly influence its capital allocation, guiding investments in both established hydrocarbon projects and emerging renewable energy sectors. This forward-looking approach shapes Ecopetrol's long-term pricing outlook and its strategy for diversifying its energy portfolio.

For instance, Ecopetrol's 2024-2028 strategic plan anticipates Brent crude oil prices to average around $70-$80 per barrel, a key factor in its investment decisions. The company is actively increasing its investment in low-carbon energy sources, aiming for 30% of its investments to be directed towards these areas by 2025. This strategic shift reflects a proactive approach to the evolving energy landscape and a commitment to sustainable growth.

- Price Assumptions: Ecopetrol's long-term outlook relies on price assumptions for Brent crude, projected between $70-$80 per barrel for 2024-2028.

- Investment Diversification: The 'Energy that Transforms' strategy targets a significant shift in investment towards new energy ventures.

- Low-Carbon Focus: Ecopetrol aims to allocate 30% of its investments to low-carbon energy sources by 2025.

- Strategic Alignment: Future price assumptions are critical for aligning investment decisions with the company's long-term vision and portfolio diversification goals.

Ecopetrol's pricing for its core hydrocarbon products is directly tied to international benchmarks like Brent crude, meaning global price swings heavily influence its revenue. For refined products within Colombia, pricing is managed through mechanisms like the Fuel Stabilization Fund (FEPC), which aims to smooth out international price volatility for domestic consumers.

The company's commitment to operational efficiency, targeting cost reductions like a 5-7% decrease in lifting costs for 2024, directly supports its pricing competitiveness. Furthermore, Ecopetrol's substantial capital investments, such as the approximately COP 29.4 trillion (around USD 7.4 billion) spent in 2023, primarily on exploration and production, are strategic moves to secure future supply and influence market dynamics.

Looking ahead, Ecopetrol's long-term strategy, including its 'Energy that Transforms' initiative, relies on price forecasts, anticipating Brent crude to average between $70-$80 per barrel from 2024-2028. This outlook guides its increasing investments in low-carbon energy, with a target of 30% of investments by 2025, balancing traditional energy market pricing with a diversified future.

| Metric | 2023 Value | 2024 Target/Outlook | Impact on Pricing |

|---|---|---|---|

| Brent Crude Average (Est.) | ~$82/barrel | ~$83/barrel | Directly influences hydrocarbon revenue |

| Lifting Costs | N/A (Focus on reduction) | Target 5-7% reduction | Enhances profitability and pricing flexibility |

| Capital Expenditure (2023) | COP 29.4 trillion (~USD 7.4 billion) | N/A (Ongoing investment) | Supports production levels and cost structure |

| Low-Carbon Investment Target | N/A (Growing focus) | 30% by 2025 | Diversifies revenue streams, long-term pricing strategy |

4P's Marketing Mix Analysis Data Sources

Our Ecopetrol 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, investor relations materials, and industry-specific market intelligence. We leverage annual reports, press releases, and publicly available financial statements to understand Ecopetrol's strategic product offerings, pricing structures, distribution networks, and promotional activities.