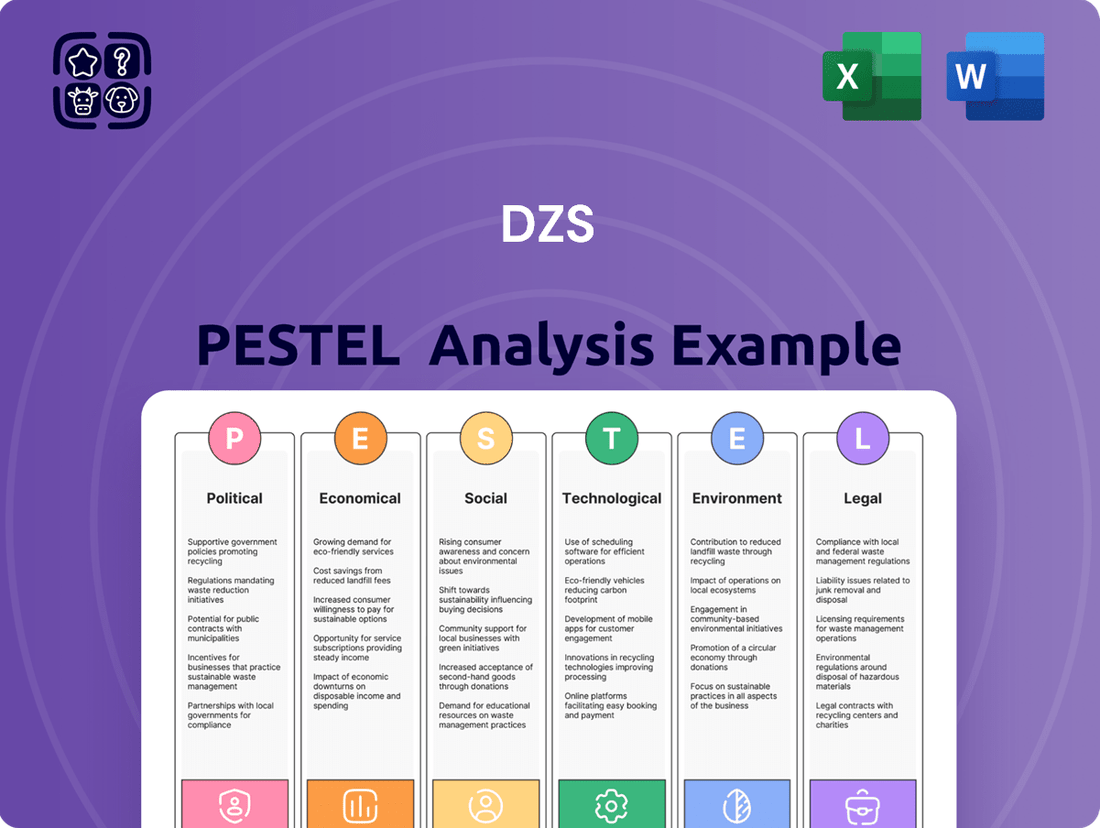

DZS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DZS Bundle

Uncover the hidden forces shaping DZS's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, this report provides critical insights into the external factors influencing the company's success. Equip yourself with the knowledge to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a decisive strategic advantage.

Political factors

Governments worldwide are actively pushing for broader broadband access, with many prioritizing fiber-optic networks. This global push translates directly into increased demand for companies like DZS, which provide the essential fiber access solutions needed to build out these networks. For instance, the United States' Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, is a prime example of how government funding stimulates infrastructure investment, benefiting DZS.

Telecommunications regulatory shifts, including evolving net neutrality stances and spectrum allocation policies, directly shape the investment capacity and strategic direction of DZS's service provider clients. For instance, the ongoing global discussions around 5G spectrum availability and pricing in 2024 and 2025 will influence how much operators can invest in new network technologies that DZS provides.

Mandates for infrastructure sharing or new broadband deployment targets can alter the competitive dynamics, potentially opening new market opportunities or increasing pressure on pricing for DZS. The Federal Communications Commission's (FCC) actions on broadband deployment, such as the recent $42 billion Broadband Equity, Access, and Deployment (BEAD) program, directly impact the spending power of US-based customers.

Trade policies and tariffs significantly impact DZS's operational landscape. For instance, the ongoing trade friction between the US and China, which saw tariffs imposed on various goods in 2023 and continuing into 2024, directly affects the cost of technology components DZS might source, influencing its pricing strategies and competitive edge in global markets.

Geopolitical tensions, such as those impacting semiconductor supply chains in East Asia, can lead to disruptions. These disruptions, coupled with potential trade restrictions or sanctions, necessitate that DZS maintains an agile supply chain and actively pursues market diversification to mitigate risks and ensure consistent market access through 2025.

Geopolitical stability and national security concerns

DZS operates globally, making it susceptible to disruptions from geopolitical instability. Conflicts or trade disputes can impact sales in affected regions, disrupt the flow of goods through its supply chains, and even lead to increased scrutiny of technology providers due to national security concerns. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe and the Middle East continued to create uncertainties for international businesses, potentially affecting DZS's market access and operational stability.

Governments worldwide are prioritizing the security of critical infrastructure and the integrity of their technology supply chains. This trend can significantly influence procurement decisions, with a potential bias towards vendors or technologies perceived as more secure or aligned with national interests. This focus on supply chain resilience, amplified by events in 2023 and continuing into 2024, means DZS must navigate varying national regulations and security requirements.

- Global Exposure: DZS's international footprint means its sales and supply chains are vulnerable to geopolitical events, impacting revenue streams and operational continuity.

- National Security Scrutiny: As a technology provider, DZS faces potential heightened scrutiny from governments concerned about national security, influencing market access and vendor selection.

- Infrastructure Security Focus: Increased government emphasis on securing critical infrastructure and supply chains can lead to preferential treatment for certain vendors or technologies, affecting DZS's competitive landscape.

Cybersecurity policies and infrastructure resilience mandates

Governments worldwide are intensifying their focus on cybersecurity, implementing robust policies and mandates to bolster the resilience of critical national infrastructure, particularly telecommunications networks. This trend is a significant political factor for DZS. For instance, the US National Institute of Standards and Technology (NIST) continues to update its cybersecurity framework, influencing how network equipment providers like DZS design and secure their offerings. These regulations can spur demand for DZS's advanced, secure communication platforms, as operators seek to meet stringent government requirements.

However, these evolving policies also present compliance challenges. DZS must ensure its products and services adhere to increasingly rigorous network security features and protocols mandated by various national governments. Failure to comply could lead to penalties or exclusion from key markets.

- Increased Demand: Government mandates for secure telecom infrastructure directly boost the market for DZS's resilient networking solutions.

- Compliance Burden: DZS faces heightened requirements to embed advanced security features and adhere to diverse international cybersecurity standards.

- Geopolitical Influence: Trade policies and national security concerns can impact DZS's supply chain and market access, as seen in ongoing global discussions around trusted vendor sourcing.

Government initiatives promoting broadband expansion, such as the US BEAD program with its $42.45 billion allocation, directly fuel demand for DZS's fiber access solutions. Regulatory shifts concerning spectrum allocation and net neutrality in 2024-2025 influence telecom operators' investment capacity in new technologies provided by DZS. Trade policies and geopolitical tensions, particularly concerning supply chains and national security, necessitate supply chain agility and market diversification for DZS through 2025.

What is included in the product

This comprehensive DZS PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the business, providing a strategic overview for informed decision-making.

The DZS PESTLE Analysis offers a structured framework that helps organizations proactively identify and address potential external threats and opportunities, thereby reducing the anxiety associated with unforeseen market shifts.

Economic factors

Global economic growth significantly shapes DZS's revenue by influencing the capital expenditure (CapEx) of its core customers, telecommunications providers and enterprises. Strong economic periods typically see increased investment in network upgrades and expansion, directly benefiting DZS. For instance, projections for global GDP growth in 2024 hovered around 3%, signaling potential for robust CapEx.

Conversely, heightened recession risks can cause customers to postpone or reduce their spending on new network equipment and services. Fears of an economic slowdown in late 2024 and early 2025 could lead to tighter budgets for DZS's clients, potentially impacting order volumes and revenue. This makes tracking macroeconomic indicators crucial for DZS's financial planning and sales strategies.

Rising inflation presents a significant challenge for DZS, as it directly impacts operational expenses. For instance, the US annual inflation rate averaged 4.1% in 2023, a notable increase from previous years, meaning DZS likely faced higher costs for essential inputs like semiconductors, network components, and skilled labor throughout 2024. This necessitates careful cost management and strategic pricing adjustments to maintain profitability.

Furthermore, the prevailing interest rate environment, with central banks like the Federal Reserve maintaining higher rates to combat inflation, affects DZS's financial leverage and market demand. If interest rates remain elevated in 2024-2025, DZS's cost of capital for expansion projects could rise, and similarly, its customers, often telecommunications providers, might face increased borrowing costs, potentially delaying or scaling back network infrastructure investments, thus impacting DZS's sales pipeline.

DZS's revenue is closely tied to how much its customers, primarily telecom operators and businesses, are investing in their infrastructure. For instance, the ongoing global push for faster internet speeds means significant capital expenditure on fiber optic networks. In 2024, it's estimated that global telecom CapEx related to broadband expansion will continue to be robust, driven by government initiatives and consumer demand for higher bandwidth.

Similarly, the build-out of 5G networks requires substantial investment in mobile transport and related equipment, directly benefiting DZS's product lines. Reports from late 2024 indicate that major carriers are accelerating their 5G mid-band and mmWave deployments, translating into increased orders for DZS's solutions.

Beyond telecommunications, enterprise digital transformation, including cloud adoption and network modernization, also fuels CapEx. Businesses are upgrading their internal networks to support remote work, data analytics, and IoT devices, creating opportunities for DZS's software-defined networking and enterprise access products throughout 2024 and into 2025.

Currency exchange rate fluctuations

DZS, with its global footprint and international sales, is inherently susceptible to the ups and downs of currency exchange rates. These fluctuations can significantly alter the value of DZS's reported revenues and profits when earnings from foreign markets are translated back into its primary reporting currency, directly impacting its financial performance.

For instance, a stronger US dollar, DZS's reporting currency, could make its products more expensive for international buyers, potentially dampening sales volume. Conversely, a weaker dollar could boost reported revenues from overseas sales, but it also increases the cost of imported components. As of early 2025, major currency pairs like EUR/USD have seen volatility, with the Euro trading around 1.08 against the dollar, a level that can influence DZS's European sales and costs.

To navigate this economic landscape, DZS must employ robust currency risk management strategies. These could include hedging techniques, such as forward contracts or options, to lock in exchange rates for future transactions. Diversifying its sales markets and manufacturing locations can also help to naturally offset some of the currency-related risks.

- Impact on Revenue: A stronger USD can decrease reported revenue from regions with weaker currencies.

- Impact on Costs: A weaker USD can increase the cost of goods sourced from countries with stronger currencies.

- Hedging Strategies: DZS may utilize financial instruments to mitigate currency exposure.

- Market Diversification: Operating in multiple currency zones can provide a natural hedge.

Competition and pricing pressure

The telecommunications equipment sector is intensely competitive, featuring established giants and agile newcomers. This dynamic environment often translates into significant pricing pressure for companies like DZS, potentially squeezing profit margins on their sophisticated network solutions.

To navigate this, DZS must relentlessly focus on innovation and superior performance. For instance, in 2024, the global telecom equipment market was valued at approximately $380 billion, with growth driven by 5G deployments and network upgrades. DZS's ability to offer cost-effective yet high-performing solutions is crucial for securing and expanding its market share amidst this robust competition.

- Intense Market Competition: The telecommunications equipment landscape is crowded with both legacy providers and disruptive startups.

- Pricing Pressure Impact: Fierce competition directly affects DZS's pricing power and subsequent profit margins.

- Differentiation Strategy: Continuous innovation in product performance and cost-efficiency is vital for DZS to maintain its competitive edge.

- Market Dynamics: The ongoing global push for 5G and network modernization amplifies the need for DZS to stay ahead in terms of technology and value proposition.

Economic growth directly influences DZS's customer spending, with global GDP growth around 3% in 2024 suggesting potential for increased network investment. Conversely, recession fears could lead to reduced CapEx from telecom operators and enterprises, impacting DZS's revenue. Elevated inflation, averaging 4.1% in the US in 2023, increases DZS's operational costs, necessitating careful pricing strategies.

High interest rates, maintained by central banks in 2024-2025 to combat inflation, could raise DZS's cost of capital and deter customer investments in network infrastructure. Currency exchange rate volatility, with the EUR/USD around 1.08 in early 2025, also impacts DZS's reported international revenues and costs, requiring robust risk management.

| Economic Factor | Impact on DZS | Data Point/Trend (2024-2025) |

| Global GDP Growth | Influences customer CapEx | Projected ~3% in 2024 |

| Inflation | Increases operational costs | US annual inflation averaged 4.1% in 2023 |

| Interest Rates | Affects cost of capital and customer investment | Central banks maintained higher rates |

| Currency Exchange Rates | Impacts reported international revenue/costs | EUR/USD volatility, around 1.08 in early 2025 |

Same Document Delivered

DZS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This DZS PESTLE Analysis provides a comprehensive overview of the external factors impacting the company. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

The content and structure shown in the preview is the same document you’ll download after payment, offering a clear and actionable framework for understanding DZS's operating environment.

Sociological factors

Societies worldwide are increasingly dependent on fast and dependable internet. This fundamental shift impacts how we work, learn, and entertain ourselves, directly boosting the need for DZS's network access solutions. For instance, in 2024, global internet traffic was projected to reach over 200 zettabytes, highlighting this growing reliance.

The rise of data-hungry applications like 4K video streaming and cloud gaming further fuels this demand. These activities require significant bandwidth, pushing the need for advanced fiber optic and wireless networks. This societal trend is a key driver for DZS's long-term growth prospects.

Societal and governmental efforts to close the digital divide, particularly in rural and underserved urban areas, present a significant growth avenue for DZS. Initiatives focused on equitable high-speed broadband access directly fuel demand for DZS's adaptable fiber and wireless solutions. For instance, the U.S. government's Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, aims to connect millions of unserved and underserved households, creating a substantial market for DZS's technology.

The surge in remote and hybrid work has significantly boosted demand for strong home broadband and secure enterprise networks. This trend directly supports DZS, as companies invest more in residential fiber and enterprise solutions to keep distributed teams connected and productive.

Urbanization and smart city development

The accelerating global shift towards urbanization, with projections indicating that 68% of the world's population will live in urban areas by 2050, fuels a significant demand for robust network infrastructure. This trend directly benefits companies like DZS, whose fiber and mobile transport solutions are crucial for building the backbone of 'smart cities'.

Smart city development, encompassing the integration of technologies like the Internet of Things (IoT), advanced public safety systems, and intelligent transportation networks, hinges on high-speed, reliable, and low-latency connectivity. DZS's portfolio is well-positioned to support these complex, interconnected urban ecosystems.

- Urban Population Growth: The UN estimates that urban areas will house 6.7 billion people by 2050, a substantial increase from 4.4 billion in 2020.

- Smart City Investment: Global spending on smart city solutions is projected to reach $274 billion by 2026, up from $120 billion in 2021, according to IDC.

- IoT Device Proliferation: The number of connected IoT devices in smart cities is expected to grow significantly, requiring scalable network capacity that DZS provides.

Consumer reliance on digital services and IoT adoption

Consumers are deeply embedding digital services into their daily routines, from managing smart home devices to utilizing connected health applications. This trend, coupled with the expanding reach of the Internet of Things (IoT), places immense importance on the robustness and scalability of network infrastructure.

The increasing societal dependence on these digital ecosystems and the sheer volume of interconnected devices directly translate into a sustained and growing demand for the high-performance networks that companies like DZS provide. For instance, by the end of 2024, it's projected that over 30 billion IoT devices will be in use globally, a number expected to climb significantly in 2025.

- Growing IoT Adoption: Global IoT connections are anticipated to reach 39 billion by 2025, up from an estimated 32 billion in 2024, highlighting a significant societal shift towards connected living.

- Digital Service Integration: Consumers are spending an average of 7 hours per day online in 2024, demonstrating a deep reliance on digital services for communication, entertainment, and essential tasks.

- Network Infrastructure Demand: This pervasive digital integration fuels the need for advanced network solutions capable of supporting a massive increase in data traffic and device connectivity.

Societal trends like the increasing reliance on digital services and the growth of the Internet of Things (IoT) directly drive demand for robust network infrastructure. As more people integrate connected devices into their daily lives, the need for high-speed, reliable internet access intensifies, benefiting companies like DZS. For example, global internet traffic was projected to exceed 200 zettabytes in 2024, underscoring this digital dependency.

The push to bridge the digital divide, particularly in underserved areas, presents a significant market opportunity. Government initiatives, such as the US BEAD program with its $42.45 billion allocation, aim to expand broadband access, creating substantial demand for DZS's adaptable network solutions.

The widespread adoption of remote work and the increasing popularity of data-intensive applications like cloud gaming and 4K streaming further amplify the need for advanced network capabilities. These societal shifts directly support DZS's business model by necessitating greater bandwidth and more sophisticated connectivity solutions.

| Societal Trend | Impact on DZS | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Digital Service Integration & IoT Growth | Increased demand for high-performance networks | Global IoT connections projected to reach 39 billion by 2025. Consumers spending ~7 hours daily online in 2024. |

| Bridging the Digital Divide | Market opportunity for broadband expansion solutions | US BEAD program allocating $42.45 billion for broadband deployment. |

| Remote Work & Data-Hungry Applications | Need for enhanced home and enterprise connectivity | Global internet traffic expected to surpass 200 zettabytes in 2024. |

Technological factors

The relentless advancement of fiber optic technologies, moving from GPON to XGS-PON and now towards 25G/50G PON, is a critical technological factor influencing DZS. These upgrades directly enhance the speed and capacity DZS can offer its service provider clients.

DZS's ability to integrate these cutting-edge capabilities, such as the increased throughput offered by XGS-PON, is vital for maintaining its market position. For instance, XGS-PON supports symmetric 10 Gbps speeds, a significant jump from previous generations.

The development of 25G/50G PON promises even greater bandwidth, enabling new services and supporting the burgeoning demand for data-intensive applications. DZS's investment in R&D for these next-generation PON standards will be key to its future success.

The ongoing global deployment of 5G, with an estimated 1.5 billion 5G connections expected by the end of 2024, is a critical technological factor. DZS's mobile transport solutions must be robust enough to handle the increased bandwidth and reduced latency demanded by these networks. This evolution necessitates continuous adaptation of DZS's technology to support the densification and expansion of mobile infrastructure.

Looking ahead, the development of 6G technology presents further opportunities and challenges. While still in its early research phases, 6G promises even greater speeds and connectivity, requiring DZS to invest in future-proofing its platforms. Adapting to these advancements ensures DZS remains competitive in facilitating the seamless transition and growth of mobile communication capabilities.

The telecommunications industry is undergoing a significant transformation driven by the adoption of software-defined networking (SDN) and network function virtualization (NFV). This shift allows for more flexible, automated, and cost-effective network management, moving away from traditional hardware-centric approaches. DZS's strategic alignment with SDN principles is a key factor in its ability to offer customers enhanced network agility and operational efficiency.

By embracing SDN and NFV, DZS is positioning itself to meet the evolving demands of modern network infrastructure. For instance, the global SDN market was valued at approximately $17.4 billion in 2023 and is projected to grow substantially, with estimates suggesting it could reach over $70 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 20%. This growth underscores the industry's commitment to these technologies.

Continued investment and innovation in SDN and NFV capabilities are paramount for DZS to maintain its competitive edge. As service providers increasingly rely on these virtualized and software-driven solutions to deploy new services faster and manage their networks more dynamically, DZS's ability to deliver cutting-edge platforms in this space will be crucial for its future success and market leadership.

Artificial Intelligence (AI) and Machine Learning (ML) integration in networks

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into network operations is a significant technological trend. These technologies are being applied to optimize network performance, automate routine tasks, predict equipment failures, and bolster cybersecurity defenses. For DZS, this presents a dual opportunity: to enhance its own product offerings with AI/ML capabilities and to navigate the competitive landscape where AI-driven solutions are becoming standard.

DZS can capitalize on AI/ML by developing smarter network solutions. This includes platforms that learn from network data to proactively manage traffic, reduce latency, and improve the overall quality of service for end-users. By embedding these advanced analytics, DZS can significantly boost the operational efficiency and service delivery for its customers, thereby strengthening its value proposition.

- Network Optimization: AI/ML algorithms can analyze vast amounts of network data in real-time to dynamically adjust traffic routing and resource allocation, leading to improved throughput and reduced congestion. For instance, by 2025, it's projected that AI in telecommunications will manage over 70% of network traffic, a significant increase from previous years.

- Predictive Maintenance: Machine learning models can identify patterns indicative of potential hardware failures before they occur, enabling proactive maintenance and minimizing service disruptions. This capability is crucial as network infrastructure becomes more complex and distributed.

- Enhanced Security: AI can detect anomalous network behavior that might signal a cyberattack, offering faster and more accurate threat detection than traditional security methods. The global AI in cybersecurity market was valued at approximately $15.1 billion in 2023 and is expected to grow substantially.

Cybersecurity threats and network resilience

The increasing complexity of cyber threats demands constant advancement in network security and resilience. DZS needs to ensure its communication platforms and access solutions are built with strong security measures to defend against cyberattacks and maintain uninterrupted service for essential infrastructure.

Investing in sophisticated security protocols and threat intelligence is crucial. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial impact of security breaches. DZS's commitment to robust security directly impacts its ability to safeguard client data and maintain operational continuity.

- DZS must prioritize advanced encryption standards and multi-factor authentication across its product portfolio.

- Proactive threat hunting and rapid incident response capabilities are essential to mitigate the impact of potential attacks.

- Ensuring compliance with evolving cybersecurity regulations, such as those mandated by NIST or ENISA, is a key technological consideration.

- The company's investment in secure software development lifecycles (SSDLC) directly correlates with its network resilience.

The technological landscape for DZS is shaped by rapid advancements in fiber optic technologies, with a clear progression from GPON to XGS-PON and the emerging 25G/50G PON standards, directly impacting network speed and capacity. Concurrently, the global expansion of 5G networks, expected to reach 1.5 billion connections by the end of 2024, necessitates DZS's mobile transport solutions to handle increased bandwidth and reduced latency, while also preparing for future 6G capabilities.

The industry's shift towards Software-Defined Networking (SDN) and Network Function Virtualization (NFV) offers DZS opportunities for greater network agility and operational efficiency, a trend supported by the projected growth of the SDN market to over $70 billion by 2030. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into network operations is a key trend, with AI anticipated to manage over 70% of network traffic by 2025, driving DZS to develop smarter, AI-enhanced solutions for optimization and predictive maintenance.

Cybersecurity remains a critical technological factor, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, underscoring the need for DZS to implement advanced encryption, multi-factor authentication, and proactive threat mitigation strategies across its product portfolio to ensure network resilience and client data protection.

| Technological Factor | Description | Impact on DZS | Relevant Data/Projections |

| Fiber Optic Advancement | Progression from GPON to XGS-PON and 25G/50G PON | Enhances speed and capacity offerings; requires R&D investment | XGS-PON supports 10 Gbps symmetric speeds. |

| 5G and Future Mobile Networks | Global deployment and development of 5G and 6G | Demands robust mobile transport solutions; necessitates future-proofing | Estimated 1.5 billion 5G connections by end of 2024. |

| SDN/NFV Adoption | Shift to software-driven, virtualized networks | Enables greater network agility and operational efficiency | Global SDN market projected to exceed $70 billion by 2030 (CAGR ~20%). |

| AI/ML Integration | Application of AI/ML in network operations | Opportunity for smarter network solutions; competitive differentiator | AI projected to manage >70% of network traffic by 2025. |

| Cybersecurity | Increasing complexity of cyber threats | Requires robust security measures and threat intelligence | Global cost of cybercrime projected at $10.5 trillion annually by 2025. |

Legal factors

DZS's service provider clients rely on government-issued telecommunications licenses and spectrum allocations, shaping their operational boundaries and investment choices. For instance, the FCC's ongoing efforts to reallocate spectrum, such as the 3.1-3.45 GHz band, directly impact which frequencies providers can utilize for 5G and future broadband deployments, influencing their need for DZS's network infrastructure solutions.

Shifts in these regulatory landscapes, like evolving licensing mandates or the introduction of new spectrum auctions, can significantly sway customer demand for DZS's equipment and services. The success of recent spectrum auctions, such as the AWS-3 auction in 2015 which generated over $44 billion, highlights the substantial financial implications of spectrum availability for carriers and, by extension, their technology partners like DZS.

The increasing global adoption of data privacy and protection laws, like Europe's GDPR and California's CCPA, significantly influences how DZS's clientele manage user data across their networks. These regulations mandate careful handling of personal information, affecting data processing, storage, and security protocols.

DZS's network platforms and software must be designed to enable customer compliance with these evolving legal frameworks. This includes features that support data minimization, consent management, and robust security measures to safeguard sensitive user information, thereby assisting customers in meeting their legal responsibilities.

Protecting DZS's proprietary technologies through patents, trademarks, and trade secrets is paramount for sustaining its competitive edge in the dynamic telecommunications industry. This legal framework safeguards their innovative solutions from unauthorized use and imitation.

Legal disputes concerning intellectual property infringement can significantly affect DZS's financial health and market standing. The company's active involvement in such cases, whether as a claimant or respondent, underscores the critical need for diligent IP portfolio management.

Antitrust and competition laws

DZS operates within a telecommunications and networking sector where antitrust and competition laws are rigorously enforced to ensure a level playing field. These regulations are crucial for preventing market dominance and fostering innovation. For instance, in 2024, regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and the European Commission, continued to scrutinize large technology mergers, impacting potential consolidation within the industry.

Any strategic moves by DZS, such as mergers, acquisitions, or even specific pricing and partnership strategies, must navigate these complex legal frameworks. Failure to comply can result in significant fines and operational restrictions, directly influencing DZS's ability to grow and compete. The ongoing enforcement of these laws means DZS must remain vigilant about its market conduct and that of its rivals.

- Regulatory Scrutiny: Antitrust authorities actively monitor market concentration in the telecommunications equipment sector.

- Merger & Acquisition Compliance: DZS must ensure all M&A activities adhere to competition law guidelines.

- Impact on Strategy: Legal constraints can shape DZS's market entry, product bundling, and partnership decisions.

- Global Enforcement Trends: Increased focus on digital markets by regulators in 2024-2025 necessitates proactive compliance.

Product safety and compliance standards

DZS's network access solutions and communications platforms are subject to a complex web of international and national product safety, electromagnetic compatibility (EMC), and environmental compliance standards. Failure to meet these stringent requirements, such as those set by the FCC in the United States or CE marking in Europe, can result in significant penalties. Non-compliance can lead to costly product recalls, substantial fines, and even outright restrictions on market access, all of which can severely damage DZS's reputation and financial performance. This necessitates ongoing investment in robust product design, rigorous testing, and proactive certification processes to ensure continued market eligibility.

Key compliance areas for DZS include:

- Product Safety: Adherence to standards like IEC 60950-1 (or its successor IEC 62368-1) for electrical safety.

- Electromagnetic Compatibility (EMC): Meeting regulations such as FCC Part 15 in the US and EN 55032 in Europe to prevent interference.

- Environmental Compliance: Compliance with directives like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) is crucial for global market access.

- Telecommunications Standards: Ensuring products meet specific national telecommunications authority requirements for network interoperability and safety.

DZS's clients depend on government-issued licenses and spectrum allocations, which directly influence their infrastructure investment decisions. For instance, the FCC's ongoing spectrum reallocation efforts, such as the 3.1-3.45 GHz band, impact the frequencies carriers can use for 5G and future broadband, affecting their demand for DZS's solutions.

The increasing global adoption of data privacy laws like GDPR and CCPA mandates how DZS's clients manage user data, requiring DZS platforms to support compliance through data minimization and robust security measures.

Antitrust and competition laws are critical in the telecommunications sector, with regulators worldwide scrutinizing mergers and acquisitions. DZS must navigate these complex legal frameworks for all strategic moves, as non-compliance can lead to significant fines and operational restrictions.

DZS's products must meet stringent international safety, EMC, and environmental standards. Failure to comply with regulations like FCC Part 15 or RoHS can result in costly recalls, fines, and market access restrictions, underscoring the need for rigorous testing and certification.

Environmental factors

The energy consumption of network infrastructure is a significant environmental concern, with global data centers and telecommunications networks accounting for a substantial portion of electricity usage. As environmental regulations tighten and customers demand greater sustainability, DZS is focused on developing energy-efficient solutions. For instance, advancements in 5G deployment, while enabling new services, also increase power demands; therefore, DZS's commitment to energy-saving technologies in its broadband and mobile edge solutions is crucial for reducing operational expenditures for service providers and contributing to a lower carbon footprint.

Increasing global regulations on electronic waste (e-waste) are compelling companies like DZS to adopt circular economy principles. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive mandates collection and recycling targets, with a goal to recover valuable materials and prevent hazardous substances from entering landfills. By 2025, the EU aims for a 65% collection rate of WEEE.

DZS must therefore integrate product lifecycle management, focusing on design for disassembly, repairability, and the use of recycled content. This proactive approach not only ensures compliance with evolving Extended Producer Responsibility (EPR) laws, which hold manufacturers accountable for their products' end-of-life management, but also presents opportunities for cost savings and brand differentiation in a market increasingly valuing sustainability.

Societal and regulatory pressure regarding climate change is increasingly shaping business practices. For DZS, this translates into potential requirements for reducing greenhouse gas emissions from its manufacturing and operational footprint. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, could indirectly impact supply chains and manufacturing costs for companies operating globally.

Furthermore, the escalating frequency and intensity of extreme weather events, a direct consequence of climate change, necessitate greater resilience in network infrastructure. This trend is expected to boost demand for DZS's robust and sustainable solutions designed to withstand such environmental challenges, ensuring reliable connectivity even in adverse conditions.

Supply chain environmental sustainability

DZS faces growing pressure to ensure its supply chain is environmentally sustainable. This includes making sure materials are sourced responsibly, labor practices are ethical, and the carbon footprint from shipping is minimized. For instance, the tech industry, which DZS operates within, is increasingly focused on reducing e-waste and improving energy efficiency in manufacturing processes. Many companies are setting ambitious targets; for example, some aim for 100% renewable energy in their operations by 2030.

To meet these expectations and comply with evolving regulations, DZS needs to collaborate closely with its suppliers. This partnership is crucial for enforcing environmental standards and fostering sustainable practices across the entire value chain. Stakeholders, including investors and customers, are demanding greater transparency and action on environmental, social, and governance (ESG) issues. In 2023, global ESG investments were projected to reach over $3.9 trillion, highlighting the significant financial influence of sustainability initiatives.

- Responsible Sourcing: Ensuring raw materials are acquired ethically and with minimal environmental impact.

- Carbon Emission Reduction: Implementing strategies to lower greenhouse gas emissions from logistics and manufacturing.

- Supplier Compliance: Working with suppliers to adhere to environmental regulations and sustainability benchmarks.

- Stakeholder Expectations: Aligning supply chain practices with the growing demands for corporate environmental responsibility from investors and consumers.

Corporate Social Responsibility (CSR) and ESG reporting

Investor and public demand for Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting significantly shapes DZS's operational strategies and market perception. For instance, in 2024, a significant majority of institutional investors globally indicated that ESG factors are material to their investment decisions, with many actively seeking companies with robust ESG disclosures.

DZS's commitment to environmental stewardship, extending beyond regulatory requirements, can bolster its brand image and attract top talent. This focus also appeals to a growing segment of socially responsible investors, as evidenced by the substantial growth in ESG-focused investment funds, which saw trillions of dollars in assets under management by early 2025.

Demonstrating strong ESG performance can translate into tangible business benefits:

- Enhanced Brand Reputation: Companies with strong CSR initiatives often enjoy higher public trust and brand loyalty.

- Improved Talent Acquisition and Retention: Employees, particularly younger generations, increasingly prefer to work for organizations with clear social and environmental values.

- Access to Capital: Socially responsible investors are more likely to allocate capital to companies with strong ESG credentials, potentially lowering the cost of capital for DZS.

- Risk Mitigation: Proactive management of environmental and social risks can prevent costly regulatory fines and reputational damage.

The increasing global focus on sustainability and climate change directly impacts DZS, driving demand for energy-efficient network solutions. As regulators push for reduced carbon footprints, DZS's innovations in 5G and edge computing are critical for lowering operational costs for service providers and minimizing environmental impact. The growing pressure to manage e-waste, underscored by initiatives like the EU's WEEE Directive aiming for higher collection rates by 2025, necessitates DZS's adoption of circular economy principles for product lifecycle management.

Societal and regulatory pressures regarding climate change are compelling DZS to reduce its operational and supply chain emissions, with mechanisms like the EU's CBAM potentially influencing manufacturing costs. Furthermore, the escalating frequency of extreme weather events, a consequence of climate change, is expected to increase demand for DZS's resilient network infrastructure solutions.

Investor and public demand for Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting significantly shapes DZS's operational strategies and market perception. In 2024, a significant majority of institutional investors globally indicated that ESG factors are material to their investment decisions, with many actively seeking companies with robust ESG disclosures.

Demonstrating strong ESG performance can translate into tangible business benefits, including enhanced brand reputation, improved talent acquisition, better access to capital from socially responsible investors, and crucial risk mitigation against regulatory fines and reputational damage.

| Environmental Factor | Impact on DZS | Key Developments/Data (2024-2025) |

| Energy Consumption & Efficiency | Demand for energy-efficient network solutions; pressure to reduce operational carbon footprint. | Global data centers and telecom networks account for substantial electricity usage. DZS's focus on energy-saving technologies in broadband and mobile edge solutions is critical. |

| Electronic Waste (E-waste) | Need for circular economy principles; compliance with e-waste regulations. | EU's WEEE Directive aims for 65% collection rate by 2025. DZS must integrate product lifecycle management, focusing on repairability and recycled content. |

| Climate Change & Extreme Weather | Potential impact on supply chain costs (e.g., CBAM); increased demand for resilient infrastructure. | EU's CBAM implemented Oct 2023. Escalating extreme weather events necessitate robust, sustainable network solutions. |

| Supply Chain Sustainability | Pressure for responsible sourcing, carbon emission reduction in logistics, and supplier compliance. | Tech industry focus on reducing e-waste and energy efficiency. Some companies target 100% renewable energy by 2030. Global ESG investments projected over $3.9 trillion in 2023. |

| ESG Reporting & Investor Demand | Enhanced brand reputation, talent acquisition, access to capital, and risk mitigation. | Majority of institutional investors consider ESG factors material in 2024. Trillions in assets under management in ESG funds by early 2025. |

PESTLE Analysis Data Sources

Our DZS PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry-specific reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the telecommunications sector.