DZS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DZS Bundle

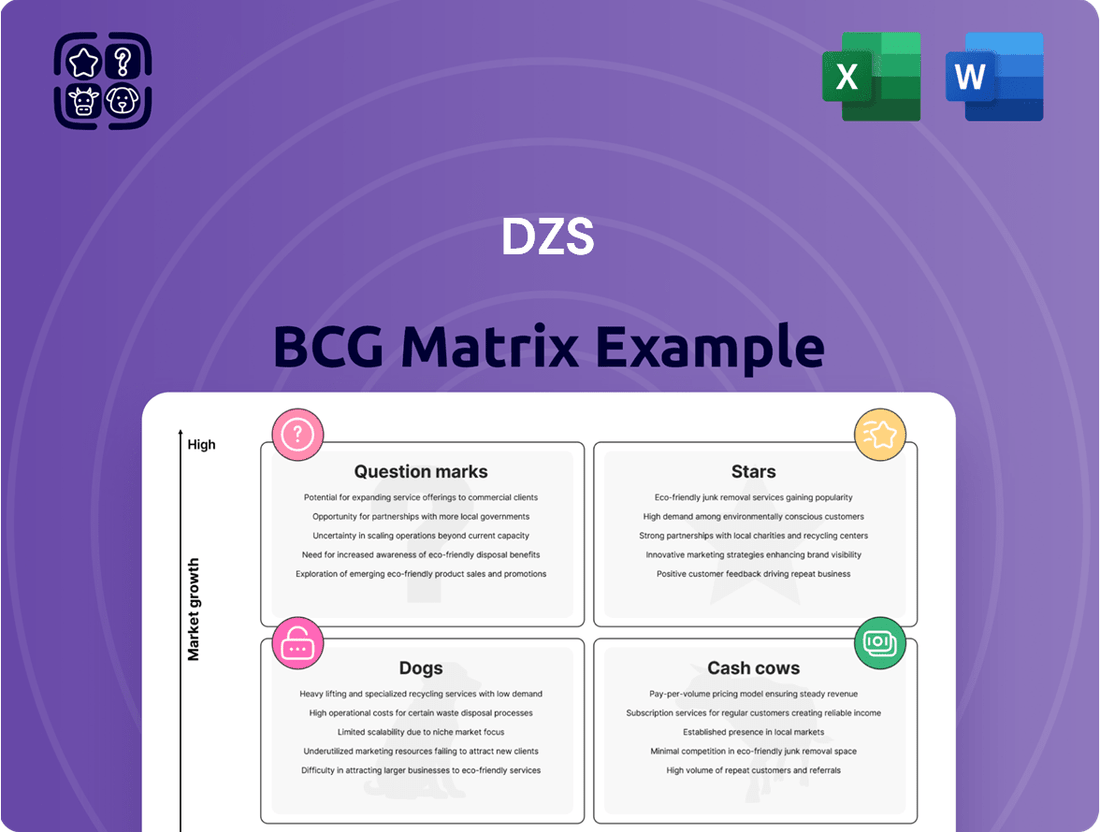

Curious about DZS's strategic positioning? This glimpse into their BCG Matrix highlights their current market standing, but the real power lies in the full analysis. Understand which of their offerings are Stars, Cash Cows, Dogs, or Question Marks to make informed decisions.

Unlock the complete DZS BCG Matrix to gain a comprehensive understanding of their product portfolio's performance and potential. This detailed report provides the actionable insights you need to optimize resource allocation and drive future growth.

Don't settle for a partial view. Purchase the full DZS BCG Matrix for a complete quadrant breakdown, strategic recommendations, and a clear roadmap to capitalize on opportunities and mitigate risks.

Stars

DZS's Fiber Access Solutions, particularly its Velocity portfolio, are poised for significant growth, likely positioning them as a star in the BCG matrix. The global optical fiber connectivity market is expanding rapidly, with projections indicating continued strong performance through 2025. This surge is fueled by the escalating demand for faster internet speeds and the ongoing build-out of 5G infrastructure worldwide.

The Fiber to the Home (FTTH) segment is a key driver of this expansion. DZS has recently announced securing new multi-year FTTX networking contracts, underscoring their strong market presence. Their Velocity access edge OLT portfolio is particularly well-suited to capitalize on this trend, especially with anticipated government broadband stimulus programs expected to significantly boost deployment activity in 2024 and 2025.

DZS's AI-driven cloud software, specifically DZS Xtreme and DZS Xperience Cloud, are positioned as stars within the BCG matrix. These solutions are at the forefront of the rapidly expanding Software Defined Networking (SDN) market, a sector projected to reach $150 billion by 2027, fueled by global digitalization trends and the rollout of 5G networks.

The strong performance of DZS Xtreme, evidenced by its 'Excellent' industry review scores, highlights its competitive edge. This success is directly linked to the increasing demand for automated and intelligent network management, a key driver in the cloud software space.

DZS's acquisition of NetComm's Fixed Wireless Access (FWA) solutions positions these offerings as potential stars. The global FWA market is experiencing robust growth, projected to reach $100 billion by 2028, with significant expansion in key markets like India and the United States, fueled by the persistent demand for high-speed broadband.

The integration of NetComm's FWA portfolio into DZS's offerings is already demonstrating positive cross-selling synergies. DZS anticipates a notable uplift in sales and improved inventory turnover during late 2024 and into 2025, particularly benefiting from the momentum generated by government-backed broadband expansion initiatives.

Optical Transport Solutions (Saber Portfolio)

DZS's optical transport solutions, exemplified by the DZS Saber 4400 ROADM module, are a shining example of a star product within their portfolio. These solutions are indispensable for facilitating high-speed data transmission, a capability that has garnered significant industry acclaim. Their importance is underscored by the 'Excellent' ratings received in the 2024 Lightwave Innovation Review, a testament to their cutting-edge performance and reliability.

The market for these advanced optical fiber connectivity solutions is experiencing robust growth, fueled by the ongoing expansion of 5G networks and a pervasive increase in demand for bandwidth. DZS's offerings are strategically positioned to capitalize on this trend, playing a crucial role in enabling the infrastructure necessary for next-generation communication services.

- Key Growth Drivers: Continued 5G deployment and escalating data consumption are major catalysts for the optical transport market.

- Industry Recognition: DZS Saber solutions received 'Excellent' scores in the 2024 Lightwave Innovation Review.

- Product Highlight: The DZS Saber 4400 ROADM module is a key component of their star optical transport offerings.

- Market Position: These solutions are vital for high-speed data transmission and are integral to the growing optical fiber connectivity sector.

Solutions for BEAD Program Certified Projects

DZS's achievement of Build America Buy America (BABA) manufacturing readiness certification for the U.S. Broadband Equity, Access, and Deployment (BEAD) Program firmly places its compliant solutions in the 'Star' category within the DZS BCG Matrix. This certification is critical, as it validates DZS as one of only five U.S. telecom electronics equipment manufacturers meeting these stringent requirements.

This distinction provides DZS with a substantial competitive edge in securing a significant portion of the substantial federal funding earmarked for U.S. broadband expansion. The BEAD program, with its multi-billion dollar allocation, represents a massive opportunity for companies like DZS that can deliver BABA-compliant equipment.

- BEAD Program Funding: The BEAD program has allocated $42.45 billion to states and territories for broadband deployment.

- DZS Market Position: DZS is among a select group of five U.S.-based manufacturers certified for BABA compliance, enhancing its appeal to BEAD-funded projects.

- Competitive Advantage: Compliance with BABA requirements is a key differentiator, directly impacting DZS's ability to win contracts for federally funded network buildouts.

DZS's Fiber Access Solutions, particularly its Velocity portfolio, are poised for significant growth, likely positioning them as a star in the BCG matrix. The global optical fiber connectivity market is expanding rapidly, with projections indicating continued strong performance through 2025. This surge is fueled by the escalating demand for faster internet speeds and the ongoing build-out of 5G infrastructure worldwide.

The Fiber to the Home (FTTH) segment is a key driver of this expansion. DZS has recently announced securing new multi-year FTTX networking contracts, underscoring their strong market presence. Their Velocity access edge OLT portfolio is particularly well-suited to capitalize on this trend, especially with anticipated government broadband stimulus programs expected to significantly boost deployment activity in 2024 and 2025.

DZS's AI-driven cloud software, specifically DZS Xtreme and DZS Xperience Cloud, are positioned as stars within the BCG matrix. These solutions are at the forefront of the rapidly expanding Software Defined Networking (SDN) market, a sector projected to reach $150 billion by 2027, fueled by global digitalization trends and the rollout of 5G networks. The strong performance of DZS Xtreme, evidenced by its 'Excellent' industry review scores, highlights its competitive edge.

DZS's acquisition of NetComm's Fixed Wireless Access (FWA) solutions positions these offerings as potential stars. The global FWA market is experiencing robust growth, projected to reach $100 billion by 2028, with significant expansion in key markets like India and the United States, fueled by the persistent demand for high-speed broadband. DZS anticipates a notable uplift in sales during late 2024 and into 2025 from this portfolio.

DZS's optical transport solutions, exemplified by the DZS Saber 4400 ROADM module, are a shining example of a star product within their portfolio. These solutions are indispensable for facilitating high-speed data transmission, a capability that has garnered significant industry acclaim. Their importance is underscored by the 'Excellent' ratings received in the 2024 Lightwave Innovation Review, a testament to their cutting-edge performance and reliability.

DZS's achievement of Build America Buy America (BABA) manufacturing readiness certification for the U.S. Broadband Equity, Access, and Deployment (BEAD) Program firmly places its compliant solutions in the 'Star' category within the DZS BCG Matrix. This certification is critical, as it validates DZS as one of only five U.S. telecom electronics equipment manufacturers meeting these stringent requirements, providing a substantial competitive edge in securing federal funding.

| DZS Product Category | BCG Matrix Classification | Key Growth Drivers | Market Opportunity (2024-2025) | Supporting Data/Recognition |

|---|---|---|---|---|

| Fiber Access Solutions (Velocity Portfolio) | Star | 5G deployment, FTTH expansion, government broadband stimulus | Global optical fiber connectivity market projected for strong growth through 2025 | Secured multi-year FTTX contracts, anticipated boost from 2024/2025 stimulus programs |

| AI-driven Cloud Software (Xtreme, Xperience) | Star | Digitalization, 5G rollout, demand for automated network management | SDN market projected to reach $150 billion by 2027 | DZS Xtreme received 'Excellent' industry review scores |

| Fixed Wireless Access (FWA) Solutions (NetComm Acquisition) | Star | Demand for high-speed broadband, expansion in India and US | Global FWA market projected to reach $100 billion by 2028 | Anticipated sales uplift and improved inventory turnover in late 2024/2025 |

| Optical Transport Solutions (Saber 4400 ROADM) | Star | 5G network expansion, increasing bandwidth demand | Robust growth in optical fiber connectivity solutions | Received 'Excellent' ratings in the 2024 Lightwave Innovation Review |

| BABA Compliant Solutions (BEAD Program) | Star | U.S. broadband expansion initiatives, federal funding requirements | BEAD program allocated $42.45 billion to states and territories | One of five U.S. manufacturers certified for BABA compliance |

What is included in the product

The DZS BCG Matrix offers a strategic framework to evaluate DZS's product portfolio by categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

Provides a clear, visual representation of DZS's portfolio, simplifying complex strategic decisions.

Cash Cows

DZS's legacy fiber access systems, while not experiencing high growth, are likely cash cows. These mature products benefit from a substantial existing customer base, ensuring steady revenue streams from maintenance, support, and incremental upgrades. Their established market presence, even in slower-growing segments, provides a reliable source of cash flow for the company.

DZS's core network access solutions, such as their broadband gateways and fiber-to-the-home (FTTH) equipment, represent significant cash cows. These offerings have a deep-rooted presence with existing service provider clients, indicating a strong and stable market position. In 2024, the demand for reliable broadband infrastructure continued to be robust as service providers upgraded their networks to meet escalating data consumption needs.

These mature products benefit from DZS's established relationships and high market share within the service provider segment. This allows them to generate consistent revenue streams with relatively lower investment requirements for marketing and development. The company can effectively leverage these established offerings to fund growth in newer, more dynamic market segments.

The ongoing maintenance and support services for DZS's established, widely deployed products are a prime example of a cash cow. These services benefit from high profit margins and a predictable, recurring revenue stream stemming from long-term support contracts. For instance, DZS reported that its Services segment revenue was $106.2 million in the first quarter of 2024, demonstrating the substantial and consistent income generated from these offerings.

Subscriber Edge Solutions (DZS Helix ONTs and Smart Gateways)

DZS Helix ONTs and Smart Gateways are positioned as cash cows within DZS's portfolio, particularly in mature fiber-to-the-x (FTTx) markets. These devices are fundamental for delivering high-speed internet services, and as fiber penetration increases in established regions, the demand for these essential components becomes more predictable and consistent.

This steady demand translates into reliable revenue streams for DZS, requiring less investment in market development or aggressive expansion. The focus shifts from capturing new market share to efficiently serving existing, high-density fiber footprints. For instance, in 2024, DZS reported continued strong performance in its Broadband Connectivity Solutions segment, which includes these gateway and ONT products, indicating their sustained revenue-generating capability.

- Steady Revenue: DZS Helix products provide a consistent revenue base due to their essential role in established fiber networks.

- Mature Markets: Their cash cow status is reinforced by the increasing maturity of fiber deployments in many developed regions.

- Reduced Investment: Less need for aggressive marketing or R&D compared to growth-stage products, allowing for higher profit margins.

- Market Penetration: While not primary growth drivers, they benefit from ongoing upgrades and replacements within existing fiber infrastructure.

FiberLAN Business Gateways

DZS FiberLAN Business Gateways, deployed in environments such as hotels and other enterprise locations, represent a potential cash cow for DZS. These solutions offer dependable, high-speed internet access, a critical need for businesses.

The ongoing requirement for strong network infrastructure means businesses will consistently need replacements, upgrades, and related services for these gateways, creating a stable revenue stream in a mature market. For instance, in 2024, DZS reported continued strong demand for its enterprise solutions, contributing significantly to its overall revenue stability.

- Stable Demand: Businesses require consistent, high-performance connectivity, ensuring a predictable need for FiberLAN gateways.

- Recurring Revenue: Replacement cycles, upgrades, and service contracts generate ongoing income for DZS.

- Market Position: In the enterprise networking sector, DZS FiberLAN gateways are established solutions, benefiting from brand recognition and proven performance.

- Revenue Contribution: These solutions are a key component of DZS's enterprise segment, which saw a notable percentage increase in revenue in early 2024, underscoring their cash cow status.

DZS's established fiber access systems and broadband gateways are prime examples of cash cows. These mature products, benefiting from a substantial existing customer base and deep-rooted presence with service providers, generate steady revenue streams from maintenance, support, and incremental upgrades. In 2024, the continued robust demand for reliable broadband infrastructure supported these offerings, with DZS reporting strong performance in its Broadband Connectivity Solutions segment.

| Product Category | BCG Status | Key Characteristics | 2024 Data Point |

| Legacy Fiber Access Systems | Cash Cow | Mature, substantial customer base, steady revenue from support and upgrades. | Services segment revenue was $106.2 million in Q1 2024. |

| Broadband Gateways & FTTH Equipment | Cash Cow | Deep-rooted presence with service providers, stable market position, essential for network upgrades. | Strong performance in Broadband Connectivity Solutions segment in 2024. |

| FiberLAN Business Gateways | Cash Cow | Dependable high-speed internet for enterprises, consistent need for replacements and upgrades. | Notable percentage increase in enterprise segment revenue in early 2024. |

Preview = Final Product

DZS BCG Matrix

The DZS BCG Matrix document you are currently previewing is the identical, fully prepared report you will receive immediately after completing your purchase. This means no hidden watermarks, no placeholder text, and no altered content—just the complete, professionally designed strategic tool ready for your immediate business analysis and decision-making.

Dogs

DZS's divestiture of its Asia business operations in early 2024 clearly places this segment within the 'Dog' category of the BCG Matrix. This business unit struggled with low profit margins and a geographically scattered footprint, which inherently drove up operational expenses and management complexity.

The strategic decision to sell these operations was driven by the need to boost overall gross margins and redirect DZS's resources towards more promising, high-growth markets. This move signals that the Asia business was underperforming, consuming valuable capital that could be better utilized elsewhere.

Certain legacy copper access solutions, if still part of DZS's portfolio, would likely fall into the Dogs quadrant of the BCG matrix. This is due to the market's decisive shift away from copper towards fiber and 5G technologies.

These older copper-based products face dwindling demand and consequently hold a low market share in a rapidly evolving telecommunications landscape. In 2024, the global broadband market continued its strong migration to fiber, with fiber-to-the-home (FTTH) connections projected to reach over 1.2 billion by the end of the year, further marginalizing copper's relevance.

Consequently, these legacy copper solutions are typically cash-neutral or cash-consuming, making them prime candidates for divestiture or a strategic decision to minimize further investment. DZS, like many in the industry, focuses its resources on high-growth areas like fiber and next-generation wireless solutions.

Products acquired from past mergers, such as those from RIFT.io or ASSIA, that haven't achieved significant market traction or are no longer relevant to current market needs fall into the Dogs category. These products often become cash traps, consuming resources without delivering substantial returns, possibly due to poor integration or a mismatch with market demands.

High Inventory Products with Slow Sales

DZS's high inventory products with slow sales fall into the 'Dogs' category of the BCG Matrix. The company has stated efforts to monetize $75 million of paid inventory, suggesting a significant portion of their stock is not generating rapid sales. This situation often arises from products facing weak market demand or operating in segments where DZS holds a low market share, essentially immobilizing capital and incurring ongoing storage and management expenses without proportional revenue generation.

These 'Dogs' represent a drag on DZS's financial performance. The $75 million figure specifically highlights the capital tied up in these underperforming assets as of their latest disclosures. This inventory requires management attention and resources that could otherwise be directed towards more promising growth areas.

The implications for DZS are clear:

- Capital Impairment: The $75 million in paid inventory represents capital that is not being effectively utilized for growth or profit.

- Carrying Costs: Holding slow-moving inventory incurs costs such as warehousing, insurance, and potential obsolescence, further eroding profitability.

- Strategic Review Needed: DZS likely needs to strategically assess these 'Dog' products, considering options like liquidation, significant price reductions, or even discontinuation to free up resources and improve overall financial health.

Products with Limited Synergy Post-Acquisition

Some acquired product lines, like the Wi-Fi management software from ASSIA, have shown limited synergy with DZS's primary ONT business. These offerings might struggle to gain widespread adoption or generate substantial revenue, either on their own or alongside other DZS products.

If these products continue to consume resources without making significant contributions to market share or profitability, they could be categorized as Dogs in the DZS BCG Matrix. For instance, in early 2024, DZS reported that while overall revenue grew, certain acquired software segments were still in the integration and growth phase, indicating potential challenges in immediate synergistic returns.

- Limited Synergies: Acquired software, such as ASSIA's Wi-Fi management, faced integration hurdles with DZS's core hardware.

- Struggling Adoption: These products may not achieve broad market acceptance or generate sufficient independent revenue.

- Resource Drain: Continued underperformance could classify them as Dogs, consuming capital without significant returns.

- Financial Impact: In Q1 2024, DZS reported a net loss of $12.3 million, partly due to ongoing integration costs and investments in newer product lines, highlighting the financial pressure from less synergistic acquisitions.

DZS's divestiture of its Asia business operations in early 2024 clearly places this segment within the 'Dog' category of the BCG Matrix, struggling with low profit margins and high operational expenses. This strategic move to sell these underperforming operations was aimed at boosting overall gross margins and redirecting resources to more promising, high-growth markets.

Legacy copper access solutions, if retained, would also likely be Dogs due to the market's strong shift towards fiber and 5G technologies, leading to dwindling demand and low market share. In 2024, the global broadband market's migration to fiber, with FTTH connections projected to exceed 1.2 billion, further marginalizes copper's relevance.

Products from past mergers, like those from RIFT.io or ASSIA, that haven't gained significant traction or are no longer market-relevant also fall into the Dogs category, often becoming cash traps. DZS's high inventory of slow-selling products, with $75 million in paid inventory needing monetization as of their latest disclosures, further exemplifies this, tying up capital and incurring carrying costs.

These 'Dog' assets represent a significant drag on DZS's financial performance, with the $75 million in inventory alone highlighting capital that is not being effectively utilized for growth or profit. Holding this slow-moving inventory incurs warehousing, insurance, and potential obsolescence costs, further eroding profitability, necessitating strategic review for liquidation or price reductions.

Question Marks

While NetComm's Fixed Wireless Access (FWA) technology is positioned as a potential star within DZS's portfolio, other acquired NetComm assets, like specific Fiber Extension and Industrial IoT solutions, may currently reside in the question mark quadrant. These products operate in expanding markets, but DZS faces the challenge of nurturing their nascent market share, which necessitates considerable investment to elevate them to a dominant position.

The success of these newly integrated NetComm offerings hinges critically on DZS's strategic execution in terms of integration and go-to-market strategies. For instance, in the growing Industrial IoT sector, where global market size was projected to reach over $200 billion in 2024, DZS must demonstrate a clear path to capturing significant share for these acquired assets.

DZS's emerging AI-influenced broadband solutions are positioned as Question Marks in the BCG matrix. These innovative offerings, while tapping into the burgeoning AI in networking market which is projected for substantial growth, are still in their early stages of market penetration. For instance, the global AI in networking market was valued at approximately $3.5 billion in 2023 and is expected to grow at a CAGR of over 20% through 2030, presenting a significant opportunity.

New 5G mobile transport solutions focusing on advanced architectures like network slicing and edge computing could represent a question mark for DZS. While the 5G market is experiencing robust growth, DZS's current market share in these highly specialized and emerging segments might be limited.

To establish leadership in these innovative areas, DZS would likely need to make significant investments in research and development. This strategic focus is crucial as the 5G landscape continues to evolve rapidly, demanding solutions that can support dynamic network configurations and specialized edge applications.

Products Targeting New Geographic Markets Post-Divestiture

Following its divestiture of the Asia business, DZS is strategically concentrating its efforts on the Americas, EMEA, and ANZ regions. These are existing markets, but the introduction of new products or intensified efforts to penetrate less-developed sub-regions within them could position these offerings as potential stars. This strategy requires substantial investment to gain traction in already competitive environments.

DZS’s focus on these established markets post-divestiture means new product introductions will likely face entrenched competitors. For example, in the Americas, the broadband access market is highly competitive, with major players like Cisco and Nokia holding significant market share. DZS's success will hinge on differentiating its new products and executing aggressive go-to-market strategies to capture market share.

- Targeting Established Markets: DZS's post-divestiture strategy centers on the Americas, EMEA, and ANZ, requiring focused product introductions and market penetration.

- Competitive Landscape: These regions are competitive, demanding significant investment for DZS to capture market share with new offerings.

- Potential for Growth: New product introductions or aggressive expansion into under-served sub-regions within these established markets could elevate offerings to ‘star’ status.

- Investment Needs: Success in these competitive arenas necessitates substantial capital allocation for product development, marketing, and sales initiatives.

Advanced Cloud-Controlled Software for New Use Cases

DZS is strategically shifting towards cloud-controlled software, indicating a strong focus on developing and launching new software capabilities designed for emerging applications within the broadband sector. This move aligns with the broader market trend favoring cloud-based solutions, which are experiencing significant growth.

The company's ambition to increase its cloud-controlled software footprint suggests a commitment to innovation, potentially introducing advanced platforms that address novel use cases. However, these advanced software offerings, despite operating in a burgeoning cloud market, will likely be categorized as question marks until they gain substantial market traction and prove their distinct competitive edge. For instance, the global cloud computing market was valued at approximately $948.9 billion in 2023 and is projected to reach $2,022.5 billion by 2030, growing at a CAGR of 11.5%.

- Focus on Cloud-Native Development: DZS is investing in software architectures that leverage cloud capabilities for enhanced flexibility and scalability.

- Addressing Emerging Broadband Needs: New software features are being developed to support evolving demands in areas like IoT, 5G integration, and enhanced subscriber experiences.

- Market Validation Required: The success of these advanced software solutions hinges on their ability to capture significant market share and demonstrate clear differentiation in a competitive landscape.

Question Marks represent products or services in new or developing markets where DZS has limited market share. These offerings require significant investment to grow and potentially become Stars. For example, DZS's emerging AI-influenced broadband solutions, while tapping into a rapidly growing market, are still in their early stages of market penetration. The global AI in networking market was valued at approximately $3.5 billion in 2023 and is expected to grow substantially, presenting a clear opportunity for these DZS offerings to mature.

Similarly, new 5G mobile transport solutions, focusing on advanced architectures, could be considered Question Marks. While the 5G market is expanding, DZS's current share in these specialized segments might be modest, necessitating R&D investment to build leadership. DZS's acquired NetComm assets, such as specific Fiber Extension and Industrial IoT solutions, also fall into this category, operating in growing markets but requiring nurturing to gain significant market share. For instance, the Industrial IoT market was projected to exceed $200 billion in 2024, highlighting the potential for DZS to capture a piece of this expanding pie.

| DZS Offering Category | Market Characteristic | DZS Market Position | Investment Need | Potential Outcome |

|---|---|---|---|---|

| AI-Influenced Broadband | High Growth, Emerging | Low Market Share | High R&D and Market Penetration | Star or Dog |

| 5G Mobile Transport (Advanced Architectures) | High Growth, Evolving | Limited Share in Niche Segments | Significant R&D and Strategic Partnerships | Star or Dog |

| Acquired NetComm Assets (Fiber Extension, Industrial IoT) | Growing Market | Nascent Market Share | Integration, Marketing, and Sales Investment | Star or Dog |

BCG Matrix Data Sources

Our DZS BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitive landscape analysis, to provide strategic insights.