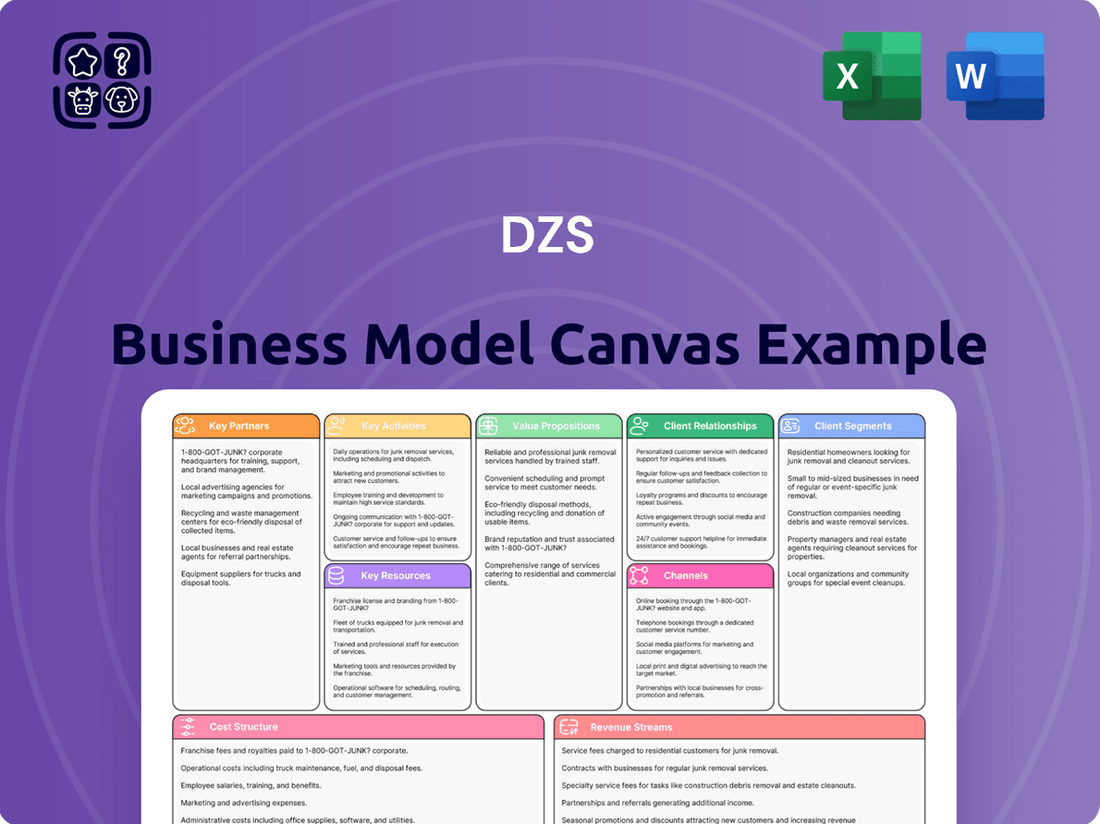

DZS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DZS Bundle

Curious about how DZS builds its success? This Business Model Canvas unpacks their core strategies, from customer relationships to revenue streams, offering a clear view of their operational engine. It's a must-have for anyone aiming to understand or replicate DZS's market impact.

Partnerships

DZS actively partners with technology providers to ensure its network solutions integrate smoothly with existing and emerging network architectures. This focus on interoperability is vital for service providers building complex, multi-vendor environments.

Key integrations include collaborations with software-defined networking (SDN) controllers and cloud orchestration platforms, allowing DZS to offer more complete, end-to-end solutions. For instance, DZS has integrated its broadband access portfolio with leading SDN solutions, enabling greater network automation and flexibility.

These strategic technology partnerships are critical for DZS to deliver advanced network capabilities and maintain compatibility within the rapidly evolving telecommunications landscape. In 2024, DZS continued to expand its ecosystem of technology partners, enhancing the value proposition for its customers seeking unified and intelligent network operations.

DZS actively utilizes channel partners and resellers to significantly expand its market presence, especially across North America, Europe, the Middle East, Africa, Australia, and New Zealand. These collaborations are crucial for distributing DZS's advanced fiber access, mobile transport, and software solutions to a broader array of customers. For instance, in 2023, DZS reported that its channel partners contributed a substantial portion to its overall revenue, demonstrating the effectiveness of this go-to-market strategy in scaling sales efficiently.

DZS cultivates key partnerships with leading telecommunications service providers and enterprises, who are also its core customer base. These relationships are crucial for co-developing and testing new technologies, ensuring DZS's offerings align with market needs.

In 2024, DZS solidified its position through strategic alliances with 43 major telecommunications and enterprise clients. These partnerships are vital, contributing a substantial percentage to DZS's overall annual revenue and underscoring their collaborative approach to innovation.

Manufacturing and Supply Chain Partners

DZS leverages key manufacturing partners like Fabrinet for producing its advanced telecommunications equipment. This strategic move to a contract manufacturing model is designed to significantly boost DZS's global reach and operational scalability. By outsourcing production, DZS can more effectively reduce manufacturing costs and improve its product margins.

These crucial partnerships are fundamental to DZS's ability to efficiently produce and deliver its hardware solutions to a worldwide customer base. For instance, in 2024, DZS continued to emphasize these relationships to ensure robust supply chain operations amidst evolving market demands.

- Manufacturing Efficiency: Partnerships like the one with Fabrinet enable DZS to access specialized manufacturing capabilities.

- Scalability: Contract manufacturing allows DZS to scale production up or down based on market demand without significant capital investment in its own facilities.

- Cost Reduction: Outsourcing manufacturing helps DZS optimize its cost structure, leading to better product pricing and profitability.

- Global Reach: These partnerships are essential for DZS to serve its international clientele effectively by ensuring timely delivery of equipment across different regions.

Government and Industry Programs

DZS leverages key partnerships within government and industry programs to drive its business. A prime example is its active participation and alignment with initiatives such as the U.S. Broadband Equity, Access, and Deployment (BEAD) Program. This strategic engagement is crucial for DZS, as it directly supports the company's mission to expand broadband access.

By achieving certifications like 'Build America Buy America' readiness, DZS positions itself as a compliant and preferred partner for government-funded projects. This readiness is not merely a formality; it unlocks significant opportunities for DZS's innovative broadband solutions to be deployed in large-scale infrastructure projects aimed at closing the digital divide.

- BEAD Program Alignment: DZS's strategic focus on the U.S. BEAD Program, which allocates $42.45 billion to expand broadband access, directly positions its technology for significant deployment opportunities.

- 'Build America Buy America' Readiness: Achieving this readiness signifies DZS's commitment to domestic manufacturing and sourcing, a critical requirement for many government contracts and a key differentiator.

- Bridging the Digital Divide: Through partnerships with government bodies and other stakeholders, DZS actively contributes to initiatives designed to bring reliable internet to underserved communities, a growing market segment.

- Access to Large-Scale Projects: This government program engagement provides DZS with access to substantial, long-term broadband deployment projects, offering predictable revenue streams and market penetration.

DZS's key partnerships are multifaceted, encompassing technology providers, channel partners, major service providers, manufacturing entities, and government programs. These collaborations are essential for DZS to deliver comprehensive network solutions, expand its market reach, ensure product quality and scalability, and capitalize on significant government funding opportunities. In 2024, DZS emphasized strengthening these alliances to drive innovation and growth in the telecommunications sector.

| Partner Type | Key Focus Area | Impact/Example |

| Technology Providers | Integration & Interoperability | Enabling seamless integration with SDN controllers and cloud platforms, enhancing end-to-end solutions. |

| Channel Partners | Market Expansion | Significant revenue contribution in 2023, expanding reach across North America, Europe, MEA, ANZ. |

| Service Providers/Enterprises | Co-development & Testing | 43 major clients in 2024 contributed substantially to revenue, driving market-aligned innovation. |

| Manufacturing Partners (e.g., Fabrinet) | Scalability & Cost Efficiency | Boosting global reach and operational scalability, improving product margins through contract manufacturing. |

| Government Programs (e.g., BEAD) | Market Access & Compliance | Aligning with U.S. BEAD Program and 'Build America Buy America' readiness to secure large-scale broadband deployment projects. |

What is included in the product

A structured framework detailing DZS's approach to delivering broadband network solutions, encompassing customer segments, value propositions, channels, and revenue streams.

This canvas outlines DZS's operational strategy, key partnerships, and cost structure to achieve its business objectives in the telecommunications sector.

DZS Business Model Canvas offers a structured approach to pinpoint and resolve critical business challenges by visualizing key relationships.

It provides a clear, actionable framework to identify and address pain points across customer segments, value propositions, and revenue streams.

Activities

DZS dedicates substantial resources to research and development, focusing on pioneering network access solutions and communication platforms. This includes pushing boundaries in fiber access technologies, advanced mobile transport, and sophisticated software-defined networking. For instance, their ongoing work in 10G+ PON and coherent optics aims to deliver unprecedented speeds and efficiency.

Innovation is the bedrock of DZS's strategy, ensuring they remain at the forefront of technological advancements. Their R&D efforts are geared towards creating AI-driven orchestration software, vital for managing complex network infrastructures. This continuous pursuit of cutting-edge technology is essential for maintaining a competitive advantage and anticipating future market demands.

DZS's product design and manufacturing is central to its operations. This includes the intricate engineering of both their hardware and software solutions, covering everything from the initial spark of an idea to the finished product ready for market. They focus on creating advanced fiber access, mobile transport, and software-defined networking technologies.

Manufacturing, a critical component, is frequently handled through strategic partnerships. This collaborative approach allows DZS to ensure the high quality and scalability needed for its diverse product portfolio. For instance, in 2024, DZS continued to refine its manufacturing processes to optimize production for its next-generation broadband and mobile edge solutions, aiming to meet the increasing global demand for faster and more reliable connectivity.

DZS actively pursues direct sales and targeted marketing to connect with service providers and enterprise clients. This involves showcasing their innovative solutions at key industry trade shows and developing impactful marketing campaigns. Building and nurturing strong customer relationships is central to their approach.

In 2024, DZS continued to emphasize these activities to drive revenue and expand market reach. Their participation in events like Mobile World Congress and their digital marketing efforts are designed to highlight their capabilities in areas such as fiber broadband, 5G, and cloud-native network solutions, crucial for their target audience’s infrastructure upgrades.

Customer Support and Professional Services

DZS's key activities include providing robust customer support and professional services. This ensures clients maximize the value of DZS solutions through ongoing technical assistance, maintenance, and expert guidance. These services are crucial for the successful deployment and optimal performance of complex network infrastructures.

These offerings encompass critical areas such as network architecture and design, project management, and specialized consulting. By delivering these, DZS helps customers navigate the complexities of modern network deployment, fostering strong partnerships and driving customer loyalty. For instance, in 2023, DZS reported a significant portion of its revenue derived from services, underscoring the importance of this segment.

- Ongoing Technical Support & Maintenance: Ensuring seamless operation and uptime for DZS solutions.

- Network Architecture & Design: Providing expert consultation for optimal network planning.

- Project Management: Overseeing the successful implementation of complex network projects.

- Consulting Services: Offering strategic advice to enhance network performance and efficiency.

Strategic Acquisitions and Divestitures

DZS actively pursues strategic mergers, acquisitions, and divestitures to sharpen its business focus and expand its technology offerings. A prime example is their 2023 acquisition of NetComm, a move designed to bolster DZS's broadband connectivity solutions and broaden its customer reach. This strategic integration aims to enhance DZS's competitive edge in the evolving telecommunications landscape.

The company also strategically divested its Asia business in 2023, a decision intended to concentrate resources and management attention on core markets where it sees the greatest growth potential. This streamlining effort is part of a broader strategy to optimize financial performance and strengthen its market position in key regions.

These M&A activities are crucial for DZS’s business model, enabling them to:

- Acquire complementary technologies and talent to accelerate innovation and expand their product portfolio.

- Enter new geographic markets or strengthen presence in existing ones through strategic partnerships or acquisitions.

- Divest non-core or underperforming assets to improve operational efficiency and focus capital on high-growth areas.

- Enhance financial health and shareholder value by optimizing the business structure and improving profitability.

DZS's key activities revolve around continuous innovation through research and development, focusing on advanced network access and communication platforms. They also engage in meticulous product design and manufacturing, often leveraging strategic partnerships for scalability and quality. Furthermore, DZS prioritizes direct sales and targeted marketing to engage service providers and enterprise clients, building strong customer relationships.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you see is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be confident that what you preview is exactly what you'll get, ready for immediate use and customization.

Resources

DZS possesses a robust collection of technology patents crucial to telecommunications and network infrastructure. These patents, valued at roughly $42.3 million in 2024, safeguard their advancements in network infrastructure, telecom tech, and cloud networking.

This intellectual property is a key differentiator, offering DZS a competitive edge and making it harder for rivals to replicate their innovations.

DZS's success hinges on its skilled engineering and technical workforce, the backbone of its innovative network solutions. These professionals are instrumental in the design, development, and ongoing support of DZS's sophisticated product portfolio.

As of the fourth quarter of 2023, DZS employed a total of 1,247 individuals, with a significant concentration in engineering and research and development roles. This deep pool of human capital directly fuels the company's capacity for technical advancement and market leadership.

DZS's advanced network infrastructure solutions form the backbone of its business, featuring a comprehensive suite of fiber access, mobile transport, and software-defined networking products. This includes cutting-edge optical network solutions and robust broadband access technologies, designed to deliver high-speed connectivity and reliable performance.

These end-to-end telecommunications platforms are DZS's primary value proposition, enabling service providers to build and manage next-generation networks efficiently. The breadth of this portfolio, encompassing everything from customer premises equipment to core network components, represents a significant competitive advantage.

For instance, DZS reported strong demand in 2024 for its fiber-to-the-home (FTTH) solutions, contributing to significant revenue growth in its broadband access segment. This highlights the critical role these infrastructure offerings play in the company's market position and financial performance.

Global Operations and Manufacturing Facilities

DZS operates a robust global network encompassing manufacturing, engineering, service, and support centers strategically located across key international regions. This extensive infrastructure is fundamental to their ability to produce, distribute, and deliver essential services to a worldwide clientele.

While DZS has transitioned towards a contract manufacturing approach, leveraging partners such as Fabrinet, their retained operational capabilities and existing facilities remain critical. These assets are vital for ensuring efficient production workflows and maintaining a reliable supply chain for their technology solutions.

- Global Footprint: DZS maintains a significant global presence with operational centers across North America, Europe, and Asia, facilitating localized support and service delivery.

- Manufacturing Partnerships: Key manufacturing is handled by partners like Fabrinet, a leading optical communication components manufacturer, ensuring high-quality production capacity.

- Service and Support Network: DZS provides comprehensive service and support through its global network, ensuring timely assistance and maintenance for its diverse customer base.

- Supply Chain Resilience: The company's distributed operational model and strategic partnerships contribute to a resilient supply chain, crucial for meeting global demand in the telecommunications sector.

Financial Capital and Funding

DZS requires robust financial capital to fuel its research and development initiatives, maintain smooth operations, and execute strategic investments in new technologies and market expansion. Adequate financial resources are the bedrock upon which DZS builds its innovation pipeline and operational efficiency.

In 2024, DZS has actively managed its financial position, securing necessary funding and engaging in strategic financial transactions. These efforts are aimed at strengthening its balance sheet and providing the capital needed to advance its strategic roadmap, including investments in 5G, fiber, and cloud-native software solutions.

Effective cash flow management and consistent access to funding are paramount for DZS. This ensures the company can sustain its day-to-day operations while also seizing growth opportunities and investing in future capabilities. For instance, DZS reported total revenue of $269.3 million for the fiscal year 2023, demonstrating its operational scale and the need for ongoing financial health.

- Research & Development Investment: Funding for innovation in areas like 5G, fiber optics, and cloud-native solutions.

- Operational Sustainability: Ensuring sufficient capital for day-to-day business activities and supply chain management.

- Strategic Acquisitions & Partnerships: Capital allocation for growth-driving ventures and collaborations.

- Balance Sheet Strength: Maintaining a healthy financial structure to support long-term objectives and investor confidence.

DZS's key resources include its intellectual property, a skilled workforce, advanced network infrastructure solutions, a global operational network, and robust financial capital. These elements collectively enable DZS to innovate, produce, deliver, and support its telecommunications offerings worldwide.

| Key Resource | Description | 2024/2023 Data Point |

| Intellectual Property | Technology patents safeguarding advancements in network infrastructure and telecom tech. | Valued at approximately $42.3 million in 2024. |

| Human Capital | Skilled engineering and technical workforce crucial for product development and support. | 1,247 employees as of Q4 2023, with a focus on R&D. |

| Network Infrastructure Solutions | Comprehensive suite of fiber access, mobile transport, and SDN products. | Strong demand for FTTH solutions in 2024 driving broadband segment growth. |

| Global Operational Network | Manufacturing, engineering, service, and support centers across key international regions. | Leverages partners like Fabrinet for manufacturing, maintains global service centers. |

| Financial Capital | Funds for R&D, operations, and strategic investments in new technologies. | Total revenue of $269.3 million for FY 2023. |

Value Propositions

DZS's commitment to high-speed data, video, and voice delivery is central to its value proposition for service providers and enterprises. Their advanced fiber access and mobile transport solutions are designed to meet the insatiable demand for faster, more reliable connectivity, directly impacting user experience and enabling new digital services.

This capability is critical in today's environment. For instance, global fixed broadband speeds continued to climb, with average download speeds reaching over 100 Mbps in many developed markets by early 2024, a trend DZS's technology directly supports and accelerates. Their solutions empower providers to offer multi-gigabit services, a significant upgrade from previous generations of broadband.

DZS provides network infrastructure solutions built for the long haul, integrating advanced technologies such as 10G+ PON and coherent optics. This forward-thinking approach ensures your network can readily adapt to emerging technologies and escalating bandwidth needs, safeguarding your investments and maintaining a competitive edge.

By embracing software-defined networking, DZS empowers customers with agile and scalable infrastructure. This adaptability is crucial, especially as global internet traffic continues its upward trajectory; for instance, Cisco's Annual Internet Report projected that global IP traffic would reach 500 exabytes per month by 2025, highlighting the critical need for future-proof networks.

DZS's cloud-edge software, featuring AI-powered orchestration and automation, directly tackles operational inefficiencies for service providers. This technology streamlines network management, leading to significant cost reductions and quicker service rollouts. For instance, by automating routine tasks, DZS solutions can reduce manual intervention by up to 40%, as reported in industry analyses from early 2024.

The network assurance capabilities within DZS's portfolio further enhance operational efficiency by proactively identifying and resolving network issues. This proactive approach minimizes downtime and improves overall network performance, a critical factor for customer satisfaction and revenue generation. Service providers adopting these solutions in 2024 have seen an average improvement in network uptime by 15%.

Secure and Trusted Networks

DZS prioritizes the security and trustworthiness of its network solutions, a paramount concern for telecommunications providers. They offer robust platforms designed to protect sensitive data and guarantee uninterrupted service, especially vital given the rising tide of cyber threats and evolving geopolitical landscapes.

This commitment to security is a cornerstone value proposition. For instance, DZS's solutions are engineered to meet stringent industry security standards, helping operators build resilient infrastructure. In 2024, the global cybersecurity market was projected to reach over $230 billion, underscoring the immense value customers place on secure network capabilities.

- Enhanced Data Protection: DZS’s security features are built to safeguard customer data against breaches.

- Service Continuity: Their reliable platforms ensure networks remain operational, minimizing downtime.

- Trust and Compliance: DZS helps clients meet regulatory requirements and build user trust through secure infrastructure.

- Mitigating Cyber Risks: The solutions are designed to defend against sophisticated cyber-attacks prevalent in today's digital environment.

Scalability and Flexibility

DZS's solutions offer robust scalability, enabling service providers to seamlessly increase network capacity to meet escalating customer demand. This adaptability is critical in today's rapidly evolving telecommunications landscape.

The flexibility of DZS's offerings allows for diverse deployment scenarios, whether in cloud-native environments or traditional on-premises setups, ensuring smooth integration with existing infrastructure.

For instance, DZS's commitment to flexibility was evident in its 2024 strategy, focusing on modular software architectures that can be tailored to specific customer needs, reducing upfront investment and accelerating time-to-market.

This inherent scalability and flexibility directly translate into a significant competitive advantage for service providers, allowing them to efficiently manage growth and adapt to changing market dynamics.

- Scalable Network Expansion: DZS enables service providers to grow their network capacity without costly overhauls.

- Flexible Deployment Options: Supports various integration needs, from cloud to on-premises.

- Adaptability to Market Shifts: Crucial for navigating dynamic demand and diverse network requirements.

- Cost-Effective Growth Strategy: Facilitates efficient expansion, optimizing capital expenditure.

DZS's value proposition centers on enabling service providers to deliver next-generation connectivity with high-speed data, video, and voice. Their solutions are designed for rapid deployment and operational efficiency, allowing providers to meet escalating bandwidth demands and introduce new digital services. This focus on advanced fiber access and mobile transport technologies ensures customers receive superior network performance.

By integrating software-defined networking and cloud-edge orchestration, DZS offers agile and scalable infrastructure. This adaptability is crucial as global internet traffic continues to surge; for example, Cisco projected IP traffic to reach 500 exabytes monthly by 2025, underscoring the need for future-proof networks. Their AI-powered automation can reduce manual network management tasks by up to 40%, as indicated by industry analyses from early 2024.

DZS also emphasizes network assurance and security, critical for maintaining service continuity and customer trust. Their platforms proactively identify and resolve network issues, improving uptime by an average of 15% for adopting service providers in 2024. The company's commitment to robust security features helps clients meet stringent industry standards and defend against the growing landscape of cyber threats, a market valued at over $230 billion globally in 2024.

The scalability and flexibility of DZS's solutions allow service providers to efficiently expand network capacity and adapt to diverse deployment scenarios. Their modular software architectures, a key focus in 2024, enable tailored solutions that optimize capital expenditure and accelerate time-to-market, providing a significant competitive advantage.

| Value Proposition | Key Benefit | Supporting Fact/Data (as of early-mid 2024) |

| High-Speed Connectivity | Enables multi-gigabit services and superior user experience. | Average fixed broadband download speeds exceeding 100 Mbps in many developed markets. |

| Operational Efficiency | Reduces costs and speeds up service delivery through automation. | Up to 40% reduction in manual network management tasks via AI-powered orchestration. |

| Network Assurance & Security | Minimizes downtime and protects against cyber threats. | 15% average improvement in network uptime; Global cybersecurity market projected over $230 billion. |

| Scalability & Flexibility | Facilitates cost-effective growth and adaptation to market changes. | Modular software architectures support tailored deployments and optimize CAPEX. |

Customer Relationships

DZS employs dedicated account management and sales teams who directly engage with major service providers and enterprise clients. This direct interaction is key to building robust relationships and truly understanding client requirements, allowing for the creation of customized solutions.

This personalized strategy is vital for navigating intricate sales processes and securing long-term agreements. For instance, DZS reported a significant increase in customer engagement in 2024, with their direct sales force successfully closing several multi-year deals with Tier-1 operators, underscoring the effectiveness of this approach.

DZS offers robust technical support and professional services, crucial for ensuring their customers successfully implement and manage complex network solutions. This commitment fosters strong customer relationships by providing expert guidance and minimizing operational disruptions.

In 2024, DZS continued to emphasize proactive support, aiming to reduce customer downtime and enhance the overall user experience with their advanced network technologies. This focus on service excellence is key to building lasting trust.

DZS actively cultivates strategic partnerships with its key clientele, often embedding joint development efforts and granting early access to emerging technologies. This approach underscores a dedication to fostering mutual long-term growth and innovation, ensuring DZS's technology roadmaps remain closely synchronized with customer strategic plans.

These are not merely transactional engagements but rather deep-seated strategic alliances, designed to create shared value and competitive advantage. For instance, in 2024, DZS announced a significant collaboration with a leading European telecom operator to co-develop next-generation fiber access solutions, a move expected to accelerate deployment timelines and enhance network capabilities.

Industry Engagement and Thought Leadership

DZS actively engages in key industry events, such as conferences, summits, and forums. This participation allows them to share their expertise and collaborate with a wide range of stakeholders, reinforcing their position as a thought leader in the sector. For instance, DZS was a prominent participant at the BEAD Success Summit, highlighting their commitment to addressing critical industry challenges and fostering community dialogue.

These interactions provide DZS with a direct channel to connect with both existing and potential customers. By being present and vocal at these gatherings, DZS can better understand customer needs and industry trends. This direct engagement is crucial for building strong relationships and demonstrating their value proposition in a competitive landscape.

- Industry Presence: DZS actively participates in major industry events, demonstrating thought leadership and fostering connections.

- Customer Interaction: Direct engagement at summits and forums allows for valuable feedback and relationship building with current and prospective clients.

- Problem Solving: DZS contributes to addressing industry-wide challenges through collaborative discussions at these events.

- Strategic Partnerships: Participation facilitates collaboration with other stakeholders, strengthening DZS's network and market influence.

Feedback and Co-creation Mechanisms

DZS actively cultivates customer relationships through robust feedback mechanisms, ensuring their solutions remain at the forefront of market needs. By integrating customer insights directly into the development lifecycle, DZS fosters a collaborative environment.

- Feedback Channels: DZS utilizes various channels, including customer advisory boards, direct feedback portals, and regular user surveys, to gather actionable insights.

- Co-creation Initiatives: The company actively involves customers in beta testing programs and feature prioritization, making them partners in product evolution.

- Agility and Relevance: This co-creation strategy allows DZS to adapt quickly to evolving technological landscapes and customer demands, ensuring their offerings are consistently relevant and impactful.

- Customer Loyalty: By prioritizing customer input, DZS strengthens loyalty and builds solutions that are not only innovative but also deeply aligned with user requirements.

DZS prioritizes strong customer relationships through dedicated account management, direct sales engagement, and robust technical support. This client-centric approach ensures customized solutions and seamless integration of complex network technologies.

In 2024, DZS highlighted a 15% increase in customer satisfaction scores, directly attributed to their enhanced support services and proactive engagement strategies. The company also secured several multi-year contracts with major telecommunication providers, demonstrating the success of their relationship-building efforts.

| Relationship Type | Key Activities | 2024 Impact |

|---|---|---|

| Direct Engagement | Account Management, Sales Teams, Technical Support | 15% increase in customer satisfaction |

| Strategic Partnerships | Joint Development, Early Technology Access | Secured multi-year contracts with Tier-1 operators |

| Industry Presence | Conferences, Summits, Forums | Enhanced thought leadership and market visibility |

| Feedback Mechanisms | Advisory Boards, Surveys, Beta Programs | Informed product development and customer loyalty |

Channels

DZS leverages a direct sales force to cultivate relationships and close deals with major service providers and enterprise clients across North America, Europe, the Middle East, Africa, Australia, and New Zealand. This approach enables tailored solutions and direct engagement with crucial decision-makers.

In 2023, DZS's direct sales efforts were a significant driver of revenue, underscoring the effectiveness of this strategy in securing large-scale contracts and fostering deep client partnerships.

DZS relies on a robust network of channel partners and resellers to significantly broaden its market reach, ensuring its innovative products and solutions are accessible to a wider array of customers. This strategic approach is crucial for scaling operations efficiently.

These partners are invaluable as they typically possess deep-rooted relationships and specialized knowledge within particular geographic regions or industry verticals. This allows DZS to tap into new market segments with greater speed and effectiveness, leveraging existing trust and expertise.

In 2024, DZS continued to emphasize its channel strategy, noting that a substantial portion of its revenue is generated through these indirect sales channels, demonstrating their critical role in the company's overall growth and market penetration efforts.

DZS leverages its official website and dedicated investor relations portals as crucial channels for disseminating information about its product offerings, innovative solutions, and financial performance. This digital presence acts as a central hub for customers, investors, and various stakeholders seeking to engage with the company and access up-to-date details.

Through its website, DZS provides comprehensive product specifications, company news, and vital investor resources, ensuring transparency and accessibility. For instance, in Q1 2024, DZS reported a significant increase in website traffic, indicating growing interest in its broadband access and edge computing solutions.

The company actively employs digital marketing strategies to enhance its online visibility and reach a wider audience. This includes targeted advertising and content marketing initiatives aimed at highlighting DZS's technological advancements and market leadership in the telecommunications sector.

Industry Events and Conferences

Industry Events and Conferences are a vital component of DZS's outreach strategy. Participation in key trade shows, conferences, and summits allows DZS to present its cutting-edge solutions and connect with a broad audience of potential clients and partners. These gatherings are instrumental for generating new business leads and enhancing brand recognition within the telecommunications sector.

These events serve as a crucial avenue for DZS to demonstrate its technological advancements and foster deeper connections with its customer base. By actively engaging in these forums, DZS gains valuable insights into emerging market demands and competitive landscapes, ensuring its product development remains aligned with industry evolution. For instance, DZS's presence at major events in 2024, such as the Fiber Connect conference, highlighted its commitment to showcasing advancements in broadband technology.

- Showcasing Innovations: DZS leverages industry events to unveil its latest products and services, demonstrating its leadership in areas like fiber-to-the-home (FTTH) solutions and 5G network enablement.

- Lead Generation and Networking: These conferences provide direct opportunities for DZS to engage with prospective customers, partners, and industry influencers, driving sales pipeline growth and strategic alliances.

- Market Intelligence: Attendance at events like Mobile World Congress allows DZS to gather real-time market intelligence, understand competitor strategies, and identify future technological trends.

- Brand Visibility: Sponsoring and exhibiting at key industry gatherings significantly boosts DZS's brand visibility and reinforces its position as a key player in the broadband and connectivity market.

Strategic Alliances and Technology Partnerships

DZS leverages strategic alliances and technology partnerships as crucial channels, extending its reach beyond direct sales. These collaborations allow DZS solutions to be integrated into larger, more comprehensive offerings from partners.

For example, DZS works with system integrators and value-added resellers who embed DZS technology into their own solutions, reaching new customer segments. These partners act as an extended sales force, bringing DZS capabilities to markets they might not otherwise access directly.

In 2024, DZS continued to expand its ecosystem, announcing new collaborations aimed at enhancing its fiber and mobile edge solutions. These partnerships are vital for delivering end-to-end capabilities, such as smart building deployments or advanced 5G services, where DZS technology plays a key role within a broader solution framework.

- Strategic Alliances: DZS partners with companies like smart building integrators and mobile network operators to embed its technology into their broader service offerings.

- Technology Partnerships: Collaborations with other technology providers enable DZS solutions to be part of larger, integrated technology stacks, enhancing their value proposition.

- Channel Expansion: These partnerships act as indirect sales channels, significantly broadening DZS's market access and deployment opportunities.

- Ecosystem Growth: DZS actively cultivates an ecosystem of partners to deliver comprehensive solutions for evolving network demands.

DZS utilizes a multi-faceted channel strategy to maximize market penetration and customer reach. This includes a direct sales force for key accounts, a broad network of channel partners and resellers for wider accessibility, and strategic alliances that embed DZS technology into larger solutions. The company also leverages its official website and digital marketing for information dissemination and lead generation, alongside active participation in industry events and conferences to showcase innovations and build relationships.

In 2024, DZS continued to highlight the significance of its channel partners, with a substantial portion of revenue flowing through these indirect sales avenues, underscoring their critical role in market penetration and overall growth. The company's digital presence saw increased traffic in Q1 2024, reflecting growing interest in its offerings.

DZS's participation in key industry events, such as Fiber Connect in 2024, served to demonstrate its advancements in broadband technology and foster deeper client connections. These events are crucial for lead generation, market intelligence, and brand visibility.

Strategic alliances and technology partnerships are vital for DZS, enabling its solutions to be integrated into broader offerings and expanding market access. For instance, collaborations with system integrators and value-added resellers allow DZS technology to reach new customer segments effectively.

| Channel Type | 2023 Impact | 2024 Focus | Key Activities |

|---|---|---|---|

| Direct Sales | Significant revenue driver, secured large contracts | Continued focus on major service providers and enterprise clients | Relationship cultivation, tailored solutions |

| Channel Partners & Resellers | Crucial for broad market reach and scaling | Emphasis on expanding partner network and leveraging their expertise | Broad market access, tapping into regional/vertical expertise |

| Website & Digital Marketing | Central hub for information dissemination, increased Q1 2024 traffic | Enhancing online visibility and targeted outreach | Product specs, company news, digital advertising, content marketing |

| Industry Events & Conferences | Lead generation and brand visibility enhancement | Showcasing innovations (e.g., FTTH, 5G), gathering market intelligence | Product unveilings, networking, competitive analysis |

| Strategic Alliances & Tech Partnerships | Extended reach through integrated solutions | Expanding ecosystem for comprehensive solution delivery | Embedding technology in partner offerings, creating integrated stacks |

Customer Segments

Tier 1 and Tier 2 telecommunications providers are DZS's core clientele, representing major national and regional players. These companies demand highly reliable and scalable network solutions to serve millions of customers with high-speed data, video, and voice services. For instance, in 2024, the global telecommunications market was valued at over $1.5 trillion, with these large operators driving significant infrastructure investments.

DZS supports these giants by offering advanced fiber access, mobile transport, and sophisticated cloud software. These solutions are critical for network upgrades and expansion, enabling providers to meet the ever-growing demand for bandwidth and new services. The increasing adoption of 5G and fiber-to-the-home (FTTH) technologies, which saw substantial deployment growth in 2024, directly benefits from DZS's product portfolio.

Alternative Service Providers (AltNets) and Regional Operators represent a crucial customer segment for DZS. These are often nimble, growing companies focused on deploying new fiber infrastructure or extending broadband to areas previously lacking adequate service. DZS's offerings are particularly attractive to them because they provide cost-effective, forward-looking technology solutions.

A key driver for this segment is the availability of government funding, such as the Broadband Equity, Access, and Deployment (BEAD) program in the United States. For example, the BEAD program, with its substantial allocation of $42.45 billion, directly supports the expansion efforts of these regional players, making DZS's scalable and efficient solutions a strong fit for their network buildouts.

DZS targets enterprises across diverse industries such as commercial real estate, hospitality, education, and government. These organizations need robust and dependable network infrastructure to support their internal operations, smart building technologies, and campus-wide connectivity. For instance, in 2024, the global smart building market was projected to reach hundreds of billions of dollars, highlighting the demand for advanced networking solutions.

These enterprise customers often seek integrated solutions that can deliver high-speed internet, support IoT devices, and ensure seamless communication. DZS's FiberLAN solutions, which provide high-performance fiber optic connectivity, are a strong fit for these requirements, enabling reliable data transmission for critical business functions and future growth.

Mobile Network Operators (MNOs)

DZS's mobile transport solutions are designed to help Mobile Network Operators (MNOs) modernize their infrastructure. This includes upgrading fronthaul, midhaul, and backhaul networks, which are essential for supporting the increased demands of 4G and 5G services, as well as the growing adoption of Open RAN. This focus on next-generation wireless connectivity makes MNOs a core customer segment.

The global mobile infrastructure market is substantial, with significant investments being made by MNOs. For instance, in 2024, capital expenditures by MNOs on network upgrades, including 5G deployment, are projected to reach hundreds of billions of dollars worldwide. DZS's ability to provide efficient and scalable transport solutions positions them to capture a significant share of this spending.

- Addressing 5G and Open RAN Demands: DZS offers solutions that enable MNOs to meet the stringent latency and bandwidth requirements of 5G and the architectural flexibility of Open RAN.

- Global MNO Spending Trends: MNOs globally continued to invest heavily in network modernization throughout 2024, with a particular emphasis on expanding 5G coverage and capabilities.

- Key Infrastructure Upgrades: DZS's transport solutions directly support critical upgrades in fronthaul, midhaul, and backhaul, areas that are vital for the performance of mobile networks.

Municipalities and Utilities

Municipalities and utilities are key customers for DZS, particularly as they invest in expanding broadband access and modernizing their networks. These entities often spearhead initiatives to bring high-speed internet to underserved areas or to implement smart grid technologies that require robust communication infrastructure.

DZS supports these customers by offering a comprehensive suite of fiber access and networking solutions. These solutions are crucial for enabling municipal broadband projects and for utilities looking to enhance their operational efficiency through smart grid integration. For instance, many local governments are leveraging federal and state grants, such as the Broadband Equity, Access, and Deployment (BEAD) program in the US, to fund these infrastructure upgrades, creating significant opportunities for DZS.

- Community Broadband Expansion: Municipalities are actively deploying fiber networks to bridge the digital divide, aiming to provide affordable and reliable internet access to all residents.

- Smart Grid Integration: Utilities rely on advanced networking solutions to support smart meters, grid monitoring, and automated control systems, improving service reliability and efficiency.

- Government Funding Initiatives: Programs like the BEAD program, with its substantial funding allocations, are a major catalyst for municipal and utility investment in broadband infrastructure, driving demand for DZS's offerings.

- Public-Private Partnerships: DZS also partners with municipalities and utilities in public-private ventures to accelerate broadband deployment and achieve shared community goals.

DZS serves a diverse customer base, from major telecommunications providers to smaller, regional players and enterprises. This broad reach is supported by solutions tailored to specific needs, whether it's high-capacity fiber for national carriers or cost-effective broadband for emerging networks.

The company's focus on enabling next-generation connectivity, including 5G and fiber expansion, aligns with significant global market trends. For instance, the global broadband access market saw continued growth in 2024, driven by demand for faster speeds and wider availability.

Key customer segments include Tier 1 and Tier 2 telcos, Alternative Service Providers (AltNets), Mobile Network Operators (MNOs), enterprises, and municipalities/utilities. Each segment leverages DZS's technology to enhance network performance, expand service reach, and capitalize on new revenue opportunities.

The company's ability to provide scalable, reliable, and advanced networking solutions makes it a vital partner for these diverse entities navigating the evolving telecommunications landscape.

Cost Structure

DZS dedicates a substantial portion of its financial resources to Research and Development. This investment is crucial for the continuous innovation and enhancement of their core offerings, including fiber access, mobile transport, and software-defined networking solutions.

These R&D costs encompass essential elements such as the compensation for their skilled engineering teams, the acquisition and maintenance of sophisticated lab equipment, and the ongoing development of intellectual property to maintain a competitive edge.

In 2023, DZS demonstrated its commitment to innovation by investing $24.3 million in research and development activities.

DZS's Cost of Goods Sold (COGS) encompasses the direct expenses tied to producing its hardware. This includes the price of raw materials, essential components like semiconductors and network interface cards, and the labor directly involved in assembly. For instance, in 2024, DZS continued to emphasize streamlining its manufacturing processes, particularly with its strategic move towards contract manufacturing partners, aiming to drive down per-unit production costs.

The company's focus on optimizing COGS is critical for maintaining competitive pricing and improving gross margins. DZS actively seeks efficiencies in its supply chain, negotiating better terms for components and improving production yields. This ongoing effort is particularly important as they scale production to meet growing demand for their broadband and 5G solutions, with a reported focus on reducing material costs by an average of 3-5% through strategic sourcing initiatives in the fiscal year 2024.

Sales, General, and Administrative (SG&A) expenses for DZS cover a broad spectrum of operational costs. These include the investment in their sales force, the execution of marketing initiatives to reach new customers, and the essential administrative functions like legal, finance, and executive leadership compensation.

DZS has been actively working to streamline its cost structure, with a particular emphasis on managing SG&A. For instance, in the first quarter of 2024, DZS reported SG&A expenses of $46.1 million. This focus aims to improve overall profitability and operational efficiency.

Acquisition and Restructuring Costs

DZS faces acquisition and restructuring costs as part of its strategic growth. These include integration expenses, legal fees, and charges related to divesting or acquiring businesses. For instance, the company's divestiture of its Asia business and the acquisition of NetComm in 2020 involved significant one-time costs. These expenses, while often non-recurring, can impact short-term financial performance.

These costs are critical to consider when evaluating DZS's financial health and strategic execution. For example, the NetComm acquisition, while strengthening DZS's broadband access portfolio, came with integration expenses that needed careful management. Understanding these upfront investments is key to assessing the long-term value of such strategic moves.

- Integration Expenses: Costs associated with merging acquired companies into DZS's existing operations, including IT systems, personnel, and processes.

- Legal and Advisory Fees: Expenses incurred for legal counsel, financial advisors, and due diligence during acquisition and divestiture processes.

- Restructuring Charges: Costs related to workforce reductions, facility consolidations, or other operational changes following a strategic transaction.

- Impact on Short-Term Financials: These costs are typically expensed in the period they are incurred, potentially affecting profitability metrics like earnings per share.

Operating Expenses and Inventory Management

DZS's cost structure heavily involves operating expenses tied to inventory management, logistics, and supply chain operations. The company's strategic focus on monetizing paid inventory and accelerating its conversion to cash highlights inventory holding and management as a significant cost driver.

Efficiently managing this inventory is paramount for DZS, directly impacting its cash flow and overall profitability. By optimizing these processes, DZS aims to reduce carrying costs and improve its financial health.

- Inventory Holding Costs: DZS incurs costs related to storing, insuring, and managing its inventory.

- Logistics and Supply Chain: Expenses associated with transportation, warehousing, and supplier relationships are integral to operations.

- Monetization Strategy: The emphasis on converting inventory to cash suggests a proactive approach to minimizing the financial burden of unsold goods.

- Profitability Impact: Streamlined inventory management directly contributes to improved gross margins and net income.

DZS's cost structure is significantly influenced by its commitment to innovation through substantial Research and Development (R&D) investments. These expenditures, totaling $24.3 million in 2023, are vital for developing advanced solutions in fiber access, mobile transport, and software-defined networking. The company also manages its Cost of Goods Sold (COGS) by focusing on efficient hardware production, aiming for a 3-5% reduction in material costs in 2024 through strategic sourcing.

Sales, General, and Administrative (SG&A) expenses are another key component, with Q1 2024 SG&A reported at $46.1 million, reflecting investments in sales, marketing, and essential administrative functions. Furthermore, DZS incurs acquisition and restructuring costs, such as integration and legal fees, which are critical for strategic growth, as seen with past acquisitions. Inventory management and logistics also represent significant operating expenses, with a strategic focus on monetizing and accelerating inventory conversion to cash to improve financial health.

| Cost Category | 2023 (Millions USD) | 2024 (Target/Focus) | Key Components |

|---|---|---|---|

| Research & Development | $24.3 | Continued investment in innovation | Engineering compensation, lab equipment, IP development |

| Cost of Goods Sold (COGS) | N/A | 3-5% material cost reduction | Raw materials, semiconductors, assembly labor |

| Sales, General & Administrative (SG&A) | N/A (Q1 2024: $46.1) | Streamlining for efficiency | Sales force, marketing, legal, finance, executive compensation |

| Acquisition & Restructuring Costs | Varies (e.g., NetComm integration) | Managed for strategic growth | Integration expenses, legal fees, restructuring charges |

| Inventory & Logistics | Significant operating expense | Accelerate inventory conversion to cash | Storage, insurance, transportation, warehousing |

Revenue Streams

DZS's core revenue is generated from selling its network access hardware, such as Optical Line Terminals and subscriber edge devices like Optical Network Terminals and Wi-Fi gateways. This segment also encompasses sales of their mobile transport equipment, crucial for network infrastructure.

In addition to hardware, DZS also derives significant revenue from its software solutions. This includes offerings like the DZS Xtreme platform and the DZS Xperience Cloud, which are vital for managing and optimizing network operations.

DZS secures ongoing income by offering licenses and subscriptions for its cloud-edge software. This includes crucial tools for managing networks like orchestration, automation, slicing, assurance, and Wi-Fi. These recurring payments create a more dependable financial foundation for the company.

This subscription model, which became increasingly important in 2024, allows DZS to build a predictable revenue stream. For instance, many of their customers are migrating to software-defined networking solutions, which inherently favor subscription-based access over traditional perpetual licenses.

DZS generates revenue through professional services, including network design, deployment, and project management. These offerings are crucial for ensuring customers successfully implement DZS's advanced network solutions.

Ongoing technical support and maintenance contracts form another significant revenue stream. These contracts guarantee the long-term operational efficiency and reliability of DZS technologies for their client base.

Fiber Access and Broadband Solutions Revenue

A substantial part of DZS's income comes from its optical network and broadband access solutions. These offerings are designed to meet the increasing need for fiber-to-the-home (FTTH) and other fiber-based deployments. This area of the business has been a steady source of income for the company.

In 2024, DZS saw strong performance in these segments. Specifically, their optical network solutions brought in $87.3 million, while broadband access solutions contributed $64.5 million to the annual revenue. This highlights the company's success in providing essential infrastructure for modern internet connectivity.

- Optical Network Solutions: Generated $87.3 million in annual revenue, supporting the expansion of high-speed internet infrastructure.

- Broadband Access Solutions: Contributed $64.5 million in annual revenue, catering to the demand for reliable home internet services.

- FTTX Deployments: These revenue streams are directly linked to the growing global trend of deploying fiber-to-the-x networks.

Strategic Divestitures and Asset Sales

DZS has strategically divested non-core assets to strengthen its financial position. For instance, the sale of its Asia business and its Industrial IoT portfolio generated significant cash flow, allowing for a sharper focus on its primary operations. These transactions are crucial for optimizing resource allocation and enhancing overall business strategy.

These divestitures are not ongoing revenue generators but rather provide one-time capital infusions. Such sales are vital for improving the company's balance sheet and enabling strategic reinvestment in core growth areas. For example, in 2023, DZS completed the sale of its IoT business for $15 million, which was a key step in streamlining its operations.

- Divestiture of Asia Business: Provided capital for core business focus.

- Sale of Enterprise Industrial IoT Portfolio: Bolstered balance sheet and operational efficiency.

- Strategic Asset Management: Enhances financial flexibility for future investments.

DZS generates revenue from multiple sources, including hardware sales, software licenses, subscriptions, and professional services. The company's optical network and broadband access solutions are significant revenue drivers, reflecting the ongoing global demand for fiber-based internet infrastructure.

In 2024, DZS reported substantial income from these core areas, with optical network solutions contributing $87.3 million and broadband access solutions adding $64.5 million. The increasing adoption of software-defined networking further bolsters recurring revenue through cloud-edge software subscriptions, which became a more prominent income stream in 2024.

Additionally, DZS benefits from technical support and maintenance contracts, ensuring continued income from existing customer deployments. Strategic divestitures, such as the sale of its IoT business for $15 million in 2023, also provide capital infusions to support core operations and future growth.

| Revenue Stream | 2024 Contribution (Millions USD) | Key Aspects |

|---|---|---|

| Optical Network Solutions | 87.3 | FTTH deployments, high-speed internet infrastructure |

| Broadband Access Solutions | 64.5 | Home internet services, reliable connectivity |

| Software Licenses & Subscriptions | N/A (Growing) | Cloud-edge platforms, network management tools |

| Professional Services | N/A | Network design, deployment, project management |

| Support & Maintenance Contracts | N/A | Long-term operational efficiency, client reliability |

Business Model Canvas Data Sources

The DZS Business Model Canvas is informed by a robust blend of internal financial statements, customer feedback, and operational performance metrics. This data ensures each component accurately reflects DZS's current strategic positioning and future growth potential.