DZS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DZS Bundle

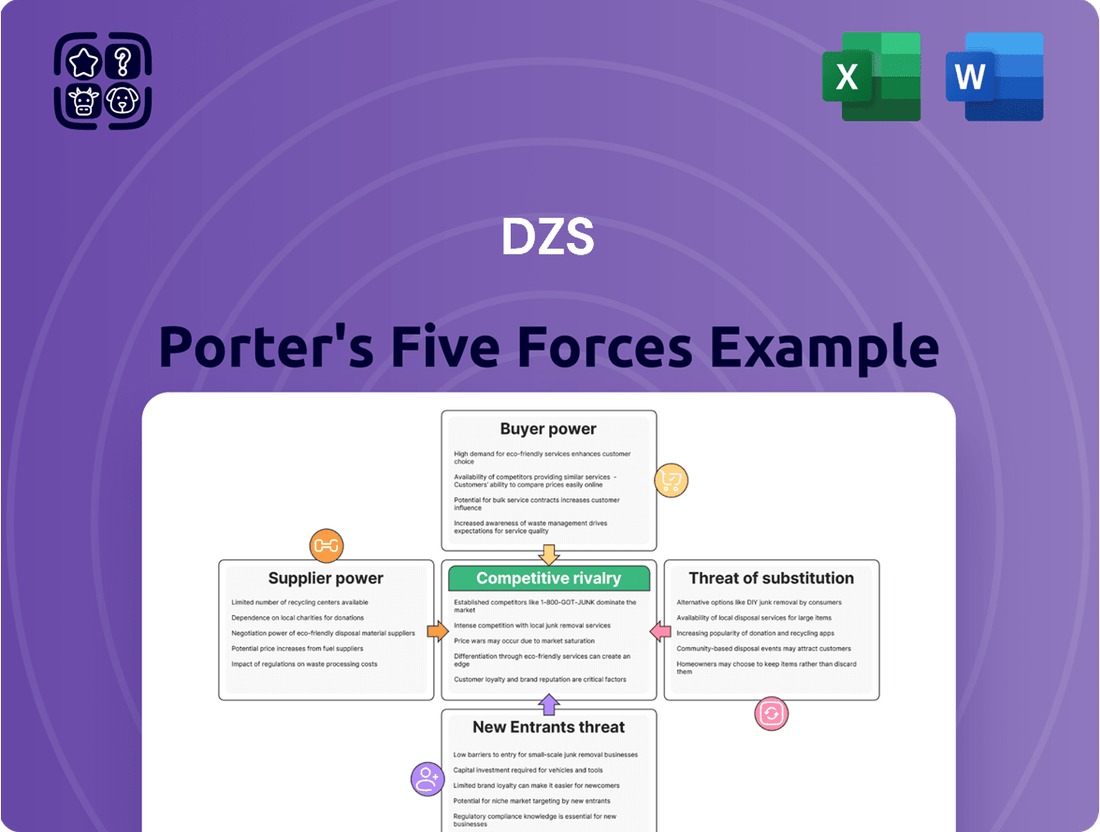

Understanding the competitive landscape for DZS is crucial, and Porter's Five Forces analysis provides a powerful framework. This initial look highlights key pressures, but the true depth of DZS's market dynamics lies within the complete report. Unlock the full Porter's Five Forces Analysis to explore DZS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

DZS depends on a limited number of suppliers for crucial components and raw materials needed for its network access solutions and communications platforms. When the supplier base is concentrated, these few dominant players gain significant leverage, which can translate into increased costs for DZS as they dictate terms.

The global telecom equipment sector features major companies such as Huawei, Ericsson, Nokia, Cisco, and ZTE. The presence of these large entities means they hold considerable sway over the supply chain, impacting DZS's ability to negotiate favorable pricing and terms for essential inputs.

The cost and complexity for DZS to switch between suppliers for specialized networking components can be substantial. This involves not only financial outlays for new equipment and re-tooling but also significant time spent on re-certifying products to meet industry standards and renegotiating intricate supply contracts. For instance, integrating a new supplier for critical optical transceivers might necessitate extensive testing and validation to ensure compatibility and performance within DZS's existing infrastructure.

These high switching costs inherently grant existing suppliers greater bargaining power. They can leverage DZS's investment in their products and processes to negotiate more favorable pricing and terms, knowing that a change would be disruptive and costly for DZS. This dynamic can impact DZS's cost of goods sold and overall profitability if suppliers are able to command premium prices.

The uniqueness of a supplier's offerings significantly impacts their bargaining power. If suppliers provide highly specialized or proprietary components that are crucial for DZS's advanced fiber access, mobile transport, or software-defined networking solutions, and these components are hard to replicate, their leverage increases.

DZS's position as one of only five U.S. telecom electronics equipment manufacturers certified for the BEAD program highlights its reliance on certain specialized inputs. This certification implies that the components DZS uses for these critical infrastructure projects may be unique or have limited alternative sources, thereby strengthening supplier bargaining power.

Threat of Forward Integration by Suppliers

Suppliers might threaten DZS by moving into DZS's own business, becoming direct competitors. This forward integration is a strategic option for suppliers who have strong technical know-how or significant sway in the market. For instance, a supplier of network components could start offering their own integrated network access solutions or platforms directly to service providers and enterprises, bypassing DZS.

This strategy is particularly prevalent in sectors where suppliers hold substantial intellectual property or have established strong relationships with DZS’s customer base. By offering end-to-end solutions, these suppliers could capture a larger share of the value chain, potentially reducing DZS's market position and profitability. For example, in the telecommunications equipment sector, a component manufacturer with advanced software capabilities could develop and market its own branded network management systems.

- Forward Integration Threat: Suppliers can become direct competitors by offering integrated network access solutions or platforms.

- Strategic Rationale: This move is common for suppliers with significant technological expertise or market influence.

- Impact on DZS: DZS could face increased competition, reduced market share, and pressure on pricing and margins.

- Industry Example: A component supplier in the telecom sector might launch its own network management software, directly challenging DZS.

Importance of DZS to Suppliers

The bargaining power of suppliers to DZS is influenced by how critical DZS is as a customer to them. If DZS accounts for a substantial percentage of a supplier's overall sales, that supplier may be more inclined to offer competitive pricing and favorable contract terms to retain DZS's business. For instance, if a key component supplier derives over 15% of its annual revenue from DZS, DZS's importance in that relationship is clear.

Conversely, if DZS represents only a minor portion of a supplier's revenue, perhaps less than 2%, the supplier's leverage increases. In such scenarios, suppliers are less dependent on DZS and may have more flexibility to dictate terms, potentially leading to higher costs or less favorable supply agreements for DZS. This dynamic directly impacts DZS's cost of goods sold and overall profitability.

- Customer Significance: DZS's revenue contribution to its suppliers is a key determinant of supplier bargaining power.

- Supplier Dependence: High dependence of a supplier on DZS can lead to more favorable terms for DZS.

- Revenue Thresholds: Suppliers earning over 15% of revenue from DZS likely offer more negotiation flexibility.

- Minor Customer Status: If DZS is less than 2% of a supplier's revenue, the supplier's power is significantly enhanced.

The bargaining power of suppliers to DZS is significant due to the concentrated nature of the telecom equipment sector, where a few large players like Huawei, Ericsson, and Nokia hold considerable sway. DZS faces high switching costs for specialized components, which strengthens suppliers' leverage to dictate terms and pricing. Furthermore, suppliers can pose a threat of forward integration, potentially becoming direct competitors by offering their own solutions.

DZS's reliance on specific, potentially unique components, such as those certified for the BEAD program, further amplifies supplier power. The extent to which DZS represents a significant portion of a supplier's revenue also plays a crucial role; if DZS is a minor customer (e.g., less than 2% of revenue), suppliers have less incentive to offer favorable terms.

| Factor | Impact on DZS | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Limited choice, potential price increases | High |

| Switching Costs | Costly and time-consuming to change suppliers | High |

| Component Uniqueness | Difficulty finding alternatives for specialized parts | High |

| Forward Integration Threat | Risk of direct competition from suppliers | Moderate to High |

| DZS's Customer Importance | Low revenue contribution to supplier means less negotiation power for DZS | High |

What is included in the product

This analysis unpacks the competitive forces impacting DZS, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its market.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Simplify complex market analysis into actionable insights, reducing the stress of strategic planning.

Customers Bargaining Power

DZS's customer base is largely comprised of service providers and enterprises. The concentration of these customers is a key factor in their bargaining power. If a few major telecommunications companies or large enterprises represent a substantial portion of DZS's revenue, they can leverage this position to negotiate more favorable terms.

The broadband industry has seen ongoing consolidation, which can further amplify the bargaining power of remaining large players. For instance, in 2023, several significant mergers and acquisitions were reported within the telecommunications sector, potentially leading to fewer, but larger, customers for DZS.

Switching costs for DZS's customers are a significant factor in their bargaining power. These costs encompass not only the price of new hardware and software but also the extensive training required for staff to operate new systems. For instance, a telecommunications provider migrating from DZS's optical network solutions to a competitor's might face millions in capital expenditure and months of operational disruption.

Service providers and enterprises in the telecom sector frequently operate with slim profit margins, making them acutely aware of infrastructure costs. This inherent price sensitivity directly empowers customers, compelling DZS to maintain competitive pricing structures.

For instance, the ongoing push for 5G deployment, while driving demand, also intensifies the need for cost-effective network solutions. Companies are actively seeking ways to reduce capital expenditure and operational expenses, directly impacting their willingness to negotiate pricing on equipment and services.

Customer Information and Transparency

Customers of DZS, particularly large telecommunications companies, possess significant bargaining power due to increased market transparency. Access to detailed pricing, product specifications, and competitor analyses empowers these buyers to negotiate more favorable terms. For instance, the availability of industry reports detailing average selling prices for similar broadband access equipment allows customers to benchmark DZS's offers and push for competitive pricing.

The telecom equipment sector, while complex, benefits from various market research firms and industry publications that shed light on product performance and cost structures. This readily available information enables customers to make informed decisions and exert pressure on suppliers like DZS to offer better value. In 2024, the ongoing drive for cost optimization within the telecom industry further amplifies this customer leverage.

- Informed Negotiation: Customers can leverage market data to negotiate pricing and contract terms with DZS.

- Transparency in Pricing: The availability of industry benchmarks for telecom equipment allows customers to compare DZS’s offerings.

- Competitive Landscape Awareness: Customers are aware of alternative solutions, increasing their ability to demand better deals.

- Cost Optimization Drive: The industry-wide focus on reducing capital expenditure in 2024 enhances customer bargaining power.

Threat of Backward Integration by Customers

Large service providers and enterprises possess the potential to develop their own network access solutions or communications platforms internally. This move would lessen their dependence on external suppliers like DZS, effectively increasing their bargaining power. For instance, a major telecom operator might invest in building its own fiber optic deployment technology or developing proprietary software for network management, thereby reducing the need to purchase these services from third parties.

The threat of backward integration is a significant factor in customer bargaining power. However, undertaking such an endeavor typically demands substantial capital investment and a high level of technical expertise. While a large enterprise might have the resources, the complexity and ongoing maintenance costs can be prohibitive. For example, developing and managing advanced optical networking hardware requires specialized engineering talent and significant R&D expenditure, which may not always be economically viable compared to sourcing from a specialized vendor.

- Customer Threat: Large customers can develop their own solutions, reducing reliance on vendors.

- Investment Barrier: Backward integration requires significant capital and technical expertise.

- Example: Telecoms could build own fiber tech or network management software.

- Cost-Benefit: The economic viability of in-house development versus outsourcing is a key consideration.

DZS's customers, primarily large service providers and enterprises, wield significant bargaining power. This stems from their substantial purchase volumes, the high cost for DZS to acquire new customers, and the customers' increasing access to market information. For instance, in 2024, the ongoing consolidation in the telecom sector means fewer, larger customers, amplifying their negotiation leverage.

The sensitivity to price among these customers is high, as they often operate on tight margins and are focused on cost optimization, especially with initiatives like 5G deployment. This pressure forces DZS to remain competitive. Furthermore, the threat of customers developing in-house solutions, while costly, remains a latent power that influences negotiations.

| Customer Attribute | Impact on Bargaining Power | 2024 Context/Example |

|---|---|---|

| Customer Concentration | High | Telecom sector consolidation leads to fewer, larger buyers. |

| Switching Costs (for Customer) | Low to Moderate | While high, customers may absorb costs for better long-term pricing. |

| Price Sensitivity | High | Focus on CapEx reduction for 5G deployment drives price negotiations. |

| Market Transparency | High | Availability of industry pricing benchmarks empowers informed negotiation. |

| Threat of Backward Integration | Moderate | Large players may explore in-house development, though costly. |

Same Document Delivered

DZS Porter's Five Forces Analysis

This preview showcases the complete DZS Porter's Five Forces Analysis, offering an in-depth examination of competitive pressures within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

The telecom equipment market is quite crowded, featuring many global companies and a few that really stand out. Think of giants like Huawei, Nokia, Ericsson, ZTE, Cisco, and Ciena; they are major players on the world stage.

DZS itself faces a vast competitive landscape, with over 1,500 active competitors. This high number indicates a dynamic market where differentiation and strategic positioning are crucial for success.

The telecom equipment and software-defined networking (SDN) markets are experiencing robust growth, which directly fuels competitive rivalry. The SDN market, in particular, is projected for exponential expansion, with forecasts suggesting it could reach over $100 billion by 2027, according to various market research reports. This rapid ascent attracts new entrants and encourages existing players to innovate aggressively, intensifying the battle for market share and technological leadership.

The degree to which DZS can differentiate its fiber access, mobile transport, and software-defined networking solutions directly influences the intensity of competitive rivalry. When DZS offers unique features or superior performance, it lessens the need to compete solely on price.

Products like DZS's BABA certified equipment, specifically designed to meet the requirements of the U.S. Broadband Equity, Access, and Deployment (BEAD) program, represent a significant point of differentiation. This specialization allows DZS to capture market share by addressing specific regulatory and technological needs, thereby reducing direct head-to-head price competition with less specialized offerings.

Exit Barriers

High exit barriers in the telecom equipment sector, including substantial investments in specialized manufacturing facilities and R&D, can trap companies in the market even when profitability declines. For instance, companies like Nokia and Ericsson have significant capital tied up in their infrastructure. This often forces them to continue competing aggressively, potentially leading to price wars or increased spending on sales and marketing to retain market share, as exiting would mean forfeiting these sunk costs.

These elevated exit barriers directly fuel competitive rivalry. When companies cannot easily leave the market, they are more likely to engage in intense competition to survive and gain an advantage. This can manifest as aggressive pricing strategies or a focus on innovation to differentiate themselves, especially when demand softens.

Consider the financial implications: companies with high exit barriers may face prolonged periods of lower returns. For example, if a major player in the telecom infrastructure market decides to exit, the remaining competitors might see a temporary relief from price pressure. However, the underlying issue of high fixed costs and specialized assets means that even then, competitive intensity can remain high as firms fight for a larger share of a potentially shrinking market.

The impact of these barriers is evident in industry dynamics:

- Specialized Assets: Telecom equipment manufacturers often possess highly specialized machinery and intellectual property that have limited alternative uses, making divestment difficult and costly.

- Long-Term Contracts: Many companies operate under multi-year service and supply agreements, obligating them to remain in the market to fulfill these commitments.

- High Capital Investment: The continuous need for substantial capital expenditure in R&D and manufacturing capacity creates a significant financial hurdle for potential entrants and a deterrent for exiting firms.

- Brand Reputation and Relationships: Established relationships with major telecom operators are crucial and difficult to replicate, making it challenging for exiting firms to recoup value and for new entrants to gain traction.

Strategic Stakes

The telecommunications sector is critical for global connectivity and the ongoing digital transformation, placing significant strategic importance on companies like DZS and its competitors. This high-stakes environment often fuels aggressive competitive tactics. For instance, in 2024, major players continued to heavily invest in research and development, with companies like Nokia and Ericsson reporting substantial R&D expenditures aimed at advancing 5G and future 6G technologies. Strategic partnerships also remain a key differentiator, as seen with various collaborations announced in 2024 to expand network reach and develop new service offerings.

These high strategic stakes translate into intense rivalry, pushing companies to innovate rapidly and secure market share. The pursuit of leadership in areas like fiber-to-the-home (FTTH) and private 5G networks is particularly fierce. DZS, for example, has been actively expanding its portfolio of broadband access solutions, facing direct competition from established vendors and emerging technology providers. The race to deploy next-generation network infrastructure means that any perceived advantage gained through R&D or market positioning can have a profound impact on long-term profitability and survival.

- High R&D Investment: Competitors in the telecom infrastructure space, including DZS's rivals, allocated billions in 2024 to R&D, focusing on areas like advanced optical networking and software-defined networking (SDN).

- Strategic Partnerships: Numerous joint ventures and alliances were formed in 2024 to accelerate the deployment of 5G networks and explore new revenue streams in areas such as edge computing.

- Market Share Competition: Companies are aggressively vying for contracts with major telecommunication operators worldwide, recognizing that securing these deals is crucial for sustained growth and market leadership.

The competitive rivalry within the telecom equipment market is exceptionally fierce, driven by a crowded field of global players like Huawei, Nokia, and Ericsson, alongside numerous smaller entities. DZS itself contends with over 1,500 active competitors, underscoring the market's dynamic nature and the constant need for differentiation. This intense competition is further fueled by significant growth in sectors like SDN, projected to exceed $100 billion by 2027, attracting aggressive innovation and strategic maneuvering for market share.

Companies like DZS must leverage unique offerings, such as BEAD program-certified equipment, to mitigate price-based competition. High exit barriers, including substantial investments in specialized manufacturing and R&D, compel firms to remain competitive even during downturns, potentially leading to price wars. The strategic importance of telecommunications infrastructure also intensifies rivalry, with major players like Nokia and Ericsson continuing substantial R&D investments in 2024 to maintain technological leadership in 5G and beyond.

| Key Competitor | 2023 Revenue (approx. USD billions) | Key Focus Areas |

|---|---|---|

| Nokia | 23.0 | 5G, Cloud, Network Infrastructure |

| Ericsson | 24.0 | 5G, Enterprise Solutions, Cloud |

| Huawei | 95.0 (global) | 5G, Enterprise, Consumer Devices |

| Cisco | 57.0 | Networking Hardware, Software, Security |

| Ciena | 4.0 | Optical Networking, SDN |

SSubstitutes Threaten

The primary threat of substitutes for DZS's fiber access solutions comes from alternative connectivity technologies. While fiber is often considered the gold standard for speed and reliability, technologies like fixed wireless access (FWA) and satellite broadband are increasingly viable options, especially in areas where deploying fiber is cost-prohibitive. For instance, in 2024, the global FWA market is projected to reach over $100 billion, indicating significant adoption.

These alternatives, such as Starlink from SpaceX, offer competitive speeds and can be deployed much faster than traditional fiber networks. This presents a challenge for DZS as customers, particularly in rural or less densely populated regions, may opt for these quicker-to-deploy solutions, thereby limiting the market penetration of fiber-to-the-home services. The ongoing advancements in 5G FWA technology further intensify this competitive pressure.

The attractiveness of substitutes hinges on their performance relative to their price. If alternative technologies can deliver comparable speeds and reliability at a lower cost, customers might choose them, even if fiber offers better long-term advantages.

Fixed Wireless Access (FWA) has experienced substantial growth, presenting a viable substitute. For instance, by the end of 2023, FWA subscriber numbers were projected to reach over 100 million globally, demonstrating a significant market penetration.

This trend suggests that for certain customer segments, the immediate cost savings and ease of deployment of FWA can outweigh the perceived long-term benefits of fiber optics, especially if the performance gap narrows.

Customer propensity to substitute for DZS's solutions is a key consideration. Factors such as how easy it is to adopt a new technology, the perceived advantages it offers, and the current infrastructure in place all play a significant role in a customer's willingness to switch. For instance, while initiatives like the U.S. Broadband Equity, Access, and Deployment (BEAD) program are designed to boost fiber optic network expansion, some consumers may remain satisfied with their current broadband services or alternative technologies, limiting the immediate pressure for them to upgrade.

Evolution of Wireless Technologies

Advances in wireless technologies, like the ongoing 5G rollout and the development of 6G, present a significant threat of substitutes for DZS's wired solutions. These wireless advancements promise enhanced speeds and capacities, potentially reducing the reliance on extensive fiber optic infrastructure for certain applications. The global 5G infrastructure market was valued at approximately $60 billion in 2023 and is projected to grow substantially, illustrating the increasing adoption of wireless alternatives.

The increasing capabilities of wireless networks mean that in some instances, they can effectively compete with or even replace the need for wired connections. This is particularly true for mobile broadband and certain enterprise connectivity needs. For example, fixed wireless access (FWA) using 5G is becoming a viable alternative to traditional broadband in many regions, directly impacting the demand for last-mile fiber deployments.

- 5G Deployment Impact: The widespread deployment of 5G networks is a primary driver in the telecom equipment market, offering high-speed data services that can substitute for wired broadband in many consumer and business use cases.

- Wireless Capacity Growth: Continued advancements in wireless spectrum efficiency and antenna technologies are increasing the data-carrying capacity of wireless networks, making them more competitive with wired options.

- Fixed Wireless Access (FWA) Expansion: FWA services, powered by 5G, are gaining traction as a direct substitute for fiber-to-the-home (FTTH) in areas where fiber deployment is cost-prohibitive or time-consuming.

- Future 6G Potential: Emerging research and development in 6G technologies suggest even greater wireless speeds and lower latency, which could further intensify the threat of substitutes in the coming years.

Cloud-Native Solutions and Virtualization

The rise of cloud-native solutions and network virtualization presents a significant threat of substitutes for traditional hardware providers like DZS. As businesses increasingly embrace Software-Defined Wide Area Networking (SD-WAN) and other cloud-based network functions, they can bypass the need for specialized, proprietary hardware. This shift allows for greater agility and scalability, directly impacting the demand for DZS's hardware-centric offerings.

For instance, the global SD-WAN market was valued at approximately $4.5 billion in 2023 and is projected to grow substantially, indicating a clear move towards software-defined networking. This trend means that customers can achieve network flexibility and cost efficiencies through software, potentially reducing their reliance on physical network equipment.

The advantages of these substitutes are compelling:

- Flexibility and Agility: Cloud-native solutions allow for rapid deployment and modification of network services without the constraints of physical hardware upgrades.

- Scalability: Virtualized network functions can be scaled up or down on demand, matching resource allocation to actual needs, a significant advantage over fixed hardware capacity.

- Cost Efficiency: While initial cloud migration can have costs, the long-term operational expenses and the ability to avoid large capital expenditures on hardware can make substitutes more attractive.

- Reduced Vendor Lock-in: Software-defined approaches often promote open standards, lessening dependence on a single hardware vendor.

The threat of substitutes for DZS's offerings is significant, primarily stemming from advancements in wireless technologies and the rise of cloud-native solutions. Fixed Wireless Access (FWA), particularly 5G-enabled, is rapidly maturing, providing a competitive alternative to fiber, especially in areas where fiber deployment is challenging. For instance, the global FWA market was projected to exceed $100 billion in 2024, highlighting its growing adoption.

Furthermore, the increasing prevalence of Software-Defined Wide Area Networking (SD-WAN) and network virtualization allows businesses to achieve agility and scalability through software, reducing their reliance on traditional hardware. The SD-WAN market alone was valued at approximately $4.5 billion in 2023, indicating a strong shift towards these substitute solutions.

These substitutes offer compelling advantages such as flexibility, scalability, and potential cost efficiencies, directly challenging the market position of hardware-centric providers like DZS. The continuous evolution of wireless capabilities, including future 6G potential, further intensifies this competitive landscape.

| Threat Type | Key Substitute | 2023/2024 Market Data | Key Advantage | Impact on DZS |

| Technological | Fixed Wireless Access (FWA) | FWA Market > $100 Billion (2024 Projection) | Faster deployment, lower initial cost | Reduces demand for fiber deployment |

| Technological | 5G/6G Wireless | 5G Infrastructure Market ~$60 Billion (2023) | High speed, low latency, mobility | Can replace wired connectivity needs |

| Architectural | Cloud-Native/SD-WAN | SD-WAN Market ~$4.5 Billion (2023) | Agility, scalability, flexibility | Decreases reliance on physical hardware |

Entrants Threaten

Launching a business in the network access solutions and communications platforms sector demands significant upfront capital. Companies need to invest heavily in research and development to innovate, build and maintain manufacturing facilities, and establish robust network infrastructure. For instance, major telecom equipment providers often spend billions annually on R&D alone, a figure that can be prohibitive for newcomers.

Established players in the telecommunications infrastructure sector, such as DZS, often leverage significant economies of scale. This allows them to spread high fixed costs across a larger production volume, leading to lower per-unit costs in manufacturing, R&D, and distribution. For instance, DZS's extensive global supply chain and manufacturing footprint enable them to negotiate better terms with suppliers and optimize logistics, a feat difficult for newcomers to replicate quickly.

New entrants face a substantial barrier due to these existing economies of scale. They would need to invest heavily to build comparable production capacity and distribution networks, making it challenging to match the cost efficiencies of incumbents like DZS. This cost disadvantage can severely impact their ability to compete on price, a critical factor in the telecommunications market where margins can be tight.

DZS's robust portfolio of existing patents, coupled with its proprietary technologies and deep expertise in critical areas like fiber access, mobile transport, and software-defined networking, presents a significant hurdle for potential new entrants. Building comparable solutions would demand substantial time and financial investment, making it a challenging proposition for newcomers to match DZS's capabilities. This technological moat is further strengthened by DZS's achievement of BABA certification for its U.S. manufactured equipment, underscoring its commitment to quality and compliance, which can be a difficult standard for new companies to attain quickly.

Access to Distribution Channels

New entrants into DZS's market would struggle to secure access to critical distribution channels. Established players, including DZS, have cultivated deep, long-standing relationships with major service providers and enterprise clients. These existing partnerships represent significant barriers, as newcomers would find it exceptionally difficult to penetrate these established sales networks and gain market traction.

The difficulty in accessing these channels is further compounded by the incumbents' established sales forces and logistical infrastructure. For instance, in the telecommunications equipment sector, where DZS operates, securing contracts with major carriers often requires years of proven reliability and integrated supply chains. A new entrant would need substantial investment and time to replicate this level of access and trust, making it a formidable hurdle.

Consider the landscape of broadband deployment. As of early 2024, major telecommunications companies continue to consolidate their vendor relationships. For a new entrant to displace an incumbent supplier like DZS, they would not only need superior technology but also the ability to seamlessly integrate into the existing operational frameworks of these large service providers, a feat that is both capital-intensive and time-consuming.

- Established Partnerships: DZS benefits from long-term contracts with key telecommunications operators and enterprise clients, making it hard for new companies to gain initial market access.

- Sales Channel Control: Existing players have developed robust and efficient sales channels, including direct sales teams and channel partners, which are difficult and costly for new entrants to replicate.

- Customer Loyalty and Integration: Major customers often prefer working with established vendors due to existing integration, support, and proven track records, creating a loyalty barrier for newcomers.

- Investment in Market Penetration: Overcoming these distribution channel barriers requires significant upfront investment in sales infrastructure, marketing, and building customer trust, which can deter potential new entrants.

Government Policy and Regulations

Government policy and regulations significantly shape the threat of new entrants. For instance, the 'Build America, Buy America' provisions within the U.S. Broadband Equity, Access, and Deployment (BEAD) program, which began allocating funds in 2024, create substantial hurdles for foreign or less established companies. These rules mandate the use of domestic materials and manufactured goods, directly benefiting incumbent domestic suppliers like DZS.

Navigating these complex and often costly compliance requirements presents a formidable challenge for potential new market participants. The sheer effort and investment needed to meet specific domestic content thresholds can deter smaller or newer firms from entering the market, thereby reducing the overall threat.

- BEAD Program Impact: The U.S. BEAD program, with its 2024 funding, emphasizes domestic sourcing, favoring established players.

- Compliance Costs: New entrants face significant financial and operational burdens to comply with Buy America provisions.

- Barrier to Entry: These regulations effectively act as a barrier, protecting incumbent domestic manufacturers from new competition.

The threat of new entrants in the network access solutions and communications platforms sector is considerably low due to substantial capital requirements for R&D, manufacturing, and infrastructure. Established players like DZS benefit from massive economies of scale, making it difficult for newcomers to match cost efficiencies. Furthermore, DZS's strong patent portfolio, proprietary technologies, and successful integration with major service providers create significant technological and customer loyalty barriers. Government regulations, such as the U.S. BEAD program's domestic sourcing requirements, further bolster incumbents by creating compliance hurdles for new participants.

| Barrier Type | Description | Impact on New Entrants | Example (DZS) |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and infrastructure. | Deters new entrants due to prohibitive initial costs. | Billions spent annually on R&D by major telecom equipment providers. |

| Economies of Scale | Spreading high fixed costs over larger production volumes leads to lower per-unit costs. | New entrants struggle to compete on price against established cost structures. | DZS's global supply chain and manufacturing footprint. |

| Technology & Patents | Proprietary technologies and extensive patent portfolios. | Requires significant investment and time for newcomers to develop comparable solutions. | DZS's expertise in fiber access, mobile transport, and SDN; BABA certification. |

| Distribution Channels | Established relationships with service providers and enterprise clients. | Difficult for new entrants to penetrate existing sales networks and gain market access. | Long-standing partnerships with major telecommunications operators. |

| Government Regulations | Policies like 'Build America, Buy America' (BEAD program). | Creates compliance costs and favors domestic incumbents. | BEAD program mandates domestic materials, benefiting companies like DZS. |

Porter's Five Forces Analysis Data Sources

Our DZS Porter's Five Forces analysis is built upon a foundation of robust data, incorporating financial statements, industry-specific market research reports, and publicly available company disclosures. This multi-faceted approach ensures a comprehensive understanding of competitive dynamics.