DZS Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DZS Bundle

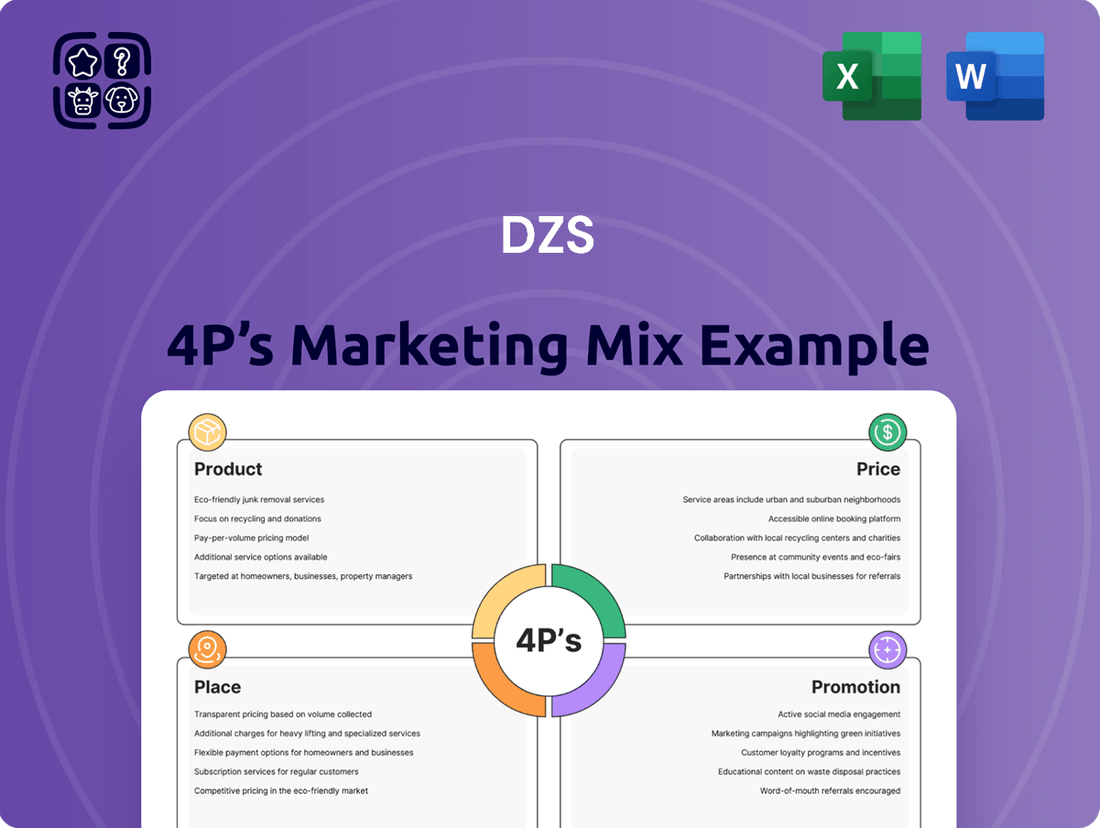

Uncover the strategic brilliance behind DZS's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We delve deep into their product innovation, pricing strategies, distribution channels, and promotional campaigns, revealing the intricate web that drives their success.

This ready-to-use report provides actionable insights, real-world examples, and structured thinking, saving you hours of research. It's the perfect tool for business professionals, students, and consultants seeking to understand and replicate effective marketing strategies.

Gain instant access to a professionally written, editable analysis that breaks down each P with clarity. Elevate your understanding of DZS's market positioning and communication mix, and apply these powerful lessons to your own business planning or client presentations.

Product

DZS, now integrated with Zhone Technologies, provides advanced fiber access systems like the DZS Velocity OLT. These systems are crucial for delivering high-speed, multi-gigabit services, supporting diverse FTTx deployments for both homes and businesses.

The Velocity OLT is engineered for future scalability, allowing seamless upgrades to 50/100-gigabit capacities, ensuring long-term network viability. This focus on forward compatibility is key for service providers aiming to meet escalating bandwidth demands.

In 2024, the demand for high-speed broadband continues to surge, with fiber optic deployments accelerating globally to support 5G backhaul, IoT, and enhanced residential experiences. DZS's solutions are positioned to capitalize on this trend, offering a competitive edge in the rapidly evolving telecommunications infrastructure market.

DZS's mobile transport solutions, particularly its advanced optical transport platforms like the Saber series, are pivotal for the expansion of 4G and 5G networks. These solutions are designed to deliver the low-latency, high-performance connectivity essential for front and midhaul transport, enabling seamless mobile communication.

The DZS Saber 4400 ROADM platform exemplifies this, offering cost-effective deployment at the network edge, even in challenging remote cabinet locations. This focus on efficient edge deployment is crucial as carriers push 5G infrastructure further out to serve more users.

By providing these critical mobile transport capabilities, DZS supports the increasing demand for bandwidth and the rollout of new mobile services. This strategic product offering positions DZS to capitalize on the ongoing global 5G buildout, which saw significant investment in 2024 and is projected to continue growing through 2025.

DZS's software-defined networking (SDN) and cloud software, integrated from Zhone Technologies, are central to their product strategy. The DZS Xtreme platform, for instance, offers multi-domain cloud-based automation, crucial for streamlining the rollout of services like 4G core and 5G SDN/NFV. This simplifies complex network management for operators.

The DZS Xperience Cloud further enhances their software offerings by providing award-winning Wi-Fi experience management and service assurance. This focus on user experience and network reliability is a key differentiator in the competitive telecommunications software market, aiming to improve customer satisfaction and operational efficiency.

Connected Home and Fiber Extension

DZS's Connected Home and Fiber Extension offerings, bolstered by the NetComm acquisition, provide a comprehensive suite of solutions. This includes advanced Wi-Fi 6/6E/7 devices and residential gateways, addressing the growing demand for robust in-home connectivity. The market for Wi-Fi 7 devices is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2027, indicating strong consumer uptake.

Furthermore, DZS's fiber extension technologies, such as Distribution Point Units (DPUs), are crucial for upgrading existing infrastructure, particularly in multi-dwelling units (MDUs). This allows for the delivery of high-speed fiber-like services without complete rewiring, a critical factor as fiber deployment continues to expand globally. The global DPU market is expected to reach billions in the coming years, driven by the need for faster broadband in dense urban environments.

- Enhanced In-Home Connectivity: DZS now offers cutting-edge Wi-Fi 6/6E/7 units and residential gateways, meeting the increasing need for reliable and fast wireless internet within homes.

- Efficient Fiber Upgrades: Fiber extension solutions, including DPUs, enable service providers to deliver high-speed fiber services over existing copper infrastructure, particularly beneficial for MDUs.

- Market Growth: The connected home and fiber extension markets are experiencing robust growth, driven by consumer demand for faster speeds and service provider efforts to expand broadband reach.

- Strategic Acquisition: The acquisition of NetComm significantly broadens DZS's product portfolio in these critical areas, strengthening its competitive position.

Fixed Wireless Access (FWA) and Industrial IoT

DZS's product strategy now prominently features Fixed Wireless Access (FWA) for both 4G/5G and the higher-speed 5G millimeter wave spectrum, addressing a broad range of connectivity demands. This expansion allows DZS to offer more versatile solutions to customers seeking alternatives or complements to traditional wired broadband. The company is strategically focusing on its core strengths in broadband networking, connectivity systems, and cloud edge software, leveraging the NetComm acquisition to enhance its IoT capabilities within this framework.

While DZS divested its enterprise IoT portfolio, the integration of NetComm has brought valuable IoT functionalities into its core business. This allows DZS to provide integrated solutions that combine robust broadband connectivity with essential IoT management and deployment features. For instance, DZS's FWA solutions can serve as the backbone for industrial IoT deployments, enabling reliable data transmission from sensors and devices in various sectors. The global FWA market is projected to grow significantly, with analysts forecasting it to reach over $100 billion by 2028, driven by demand for faster, more flexible internet access.

- Expanded FWA Portfolio: DZS offers both 4G/5G and 5G millimeter wave FWA solutions.

- Strategic Focus: Emphasis remains on core broadband networking, connectivity systems, and cloud edge software.

- IoT Integration: NetComm acquisition bolsters IoT capabilities within the core product offering.

- Market Growth: The FWA market is experiencing substantial growth, indicating strong demand for these solutions.

DZS's product suite is designed to address the evolving needs of high-speed connectivity, from the core network to the end-user device. Their advanced fiber access systems, like the Velocity OLT, are crucial for delivering multi-gigabit services, supporting future-proof scalability to 50/100-gigabit capacities. This positions DZS to capitalize on the accelerating global fiber optic deployments seen throughout 2024 and projected into 2025.

Furthermore, DZS's mobile transport solutions, exemplified by the Saber series, are vital for 4G and 5G network expansion, offering low-latency, high-performance connectivity essential for mobile communication. The company also provides comprehensive Connected Home and Fiber Extension solutions, including Wi-Fi 7 devices and DPUs, which facilitate high-speed services over existing infrastructure. This strategic product diversification, enhanced by acquisitions like NetComm, allows DZS to capture growth in both wired and wireless broadband markets.

| Product Category | Key Solutions | Target Market | 2024/2025 Relevance |

|---|---|---|---|

| Fiber Access | DZS Velocity OLT | FTTx deployments (residential & business) | Enables multi-gigabit services, future-proofed for 50/100Gbps upgrades. |

| Mobile Transport | DZS Saber Series (e.g., Saber 4400 ROADM) | 4G/5G network expansion | Provides low-latency, high-performance front/midhaul transport. |

| Connected Home & Fiber Extension | Wi-Fi 6/6E/7 devices, DPUs | Residential broadband, MDU upgrades | Enhances in-home connectivity and delivers fiber-like speeds over existing infrastructure. |

| Fixed Wireless Access (FWA) | 4G/5G and 5G mmWave FWA | Broadband alternatives/complements | Addresses diverse connectivity demands, leveraging IoT capabilities. |

What is included in the product

This DZS 4P's Marketing Mix Analysis provides a comprehensive, professionally written deep dive into the company's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

Ideal for managers and marketers, this document offers a complete breakdown of DZS's marketing positioning, making it easy to repurpose for reports or presentations.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of information overload.

Provides a clear, concise framework for understanding and optimizing product, price, place, and promotion, alleviating the stress of scattered marketing efforts.

Place

DZS's foundational market is global service providers and telecommunications operators. The newly formed Zhone entity, built on DZS's strengths, continues this legacy, reaching customers in over 120 countries.

The company maintains a strategic emphasis on key regions such as North America, Europe, the Middle East, Africa (EMEA), Australia, and New Zealand (ANZ). This extensive geographical footprint allows DZS to tap into varied regulatory environments and economic conditions, fostering broad market penetration.

DZS's go-to-market strategy heavily relies on a dual approach: direct sales to major service providers and a comprehensive partner ecosystem. This allows them to address the complex needs of large clients while leveraging specialized expertise for broader market penetration.

The company's past successes, such as its work with NCTC in the US and RFC in Israel, highlight the effectiveness of strategic partnerships in expanding reach and offering tailored local support. These collaborations are vital for integrating solutions and ensuring customer success.

Looking ahead to 2024 and 2025, DZS is focused on revitalizing and expanding its channel partnerships. This initiative is key to fulfilling its existing backlog, estimated to be in the hundreds of millions of dollars, and to driving significant revenue growth.

DZS strategically leverages its global network of manufacturing, engineering, service, and support centers to efficiently deliver advanced technologies. This worldwide presence ensures they can meet customer needs with world-class solutions.

With its headquarters now in Plano, Texas, DZS has solidified a robust North American operational base. This is particularly crucial for capitalizing on significant opportunities such as the U.S. BEAD program, which aims to expand broadband access across the nation.

Optimized for Network Edge Deployments

DZS solutions are engineered for seamless integration at the network edge, covering central offices, hub sites, outdoor cabinets, and customer premises. This versatility ensures efficient deployment across diverse network architectures.

The focus on flexible and compact optical transport modules, along with easily installable customer premise equipment (CPE), significantly reduces deployment time and costs. For instance, DZS's commitment to rapid deployment contributed to a 20% faster service activation for a major European operator in early 2024.

- Versatile Edge Placement: From central offices to customer premises, DZS technology fits where you need it.

- Cost-Effective Installation: Compact modules and CPE minimize labor and logistics expenses.

- Rapid Service Activation: Streamlined deployment leads to quicker revenue generation for service providers.

Targeting Government Broadband Initiatives

DZS is strategically positioning itself to capitalize on government-backed broadband expansion efforts worldwide. A key focus is the United States' Broadband Equity, Access, and Deployment (BEAD) Program, which allocates significant funding to bridge the digital divide. This initiative, part of the Infrastructure Investment and Jobs Act, aims to provide affordable, reliable broadband to all Americans, with a substantial portion of the $42.45 billion allocated for deployment.

The company's commitment to domestic manufacturing is a crucial element of its 'place' strategy. DZS’s U.S.-manufactured components have secured Build America Buy America (BABA) certification. This compliance is vital for projects funded by federal initiatives, ensuring DZS solutions are well-suited for deployment in rural and underserved regions targeted by these government programs.

- BEAD Program Funding: Over $42 billion allocated to expand broadband access in the U.S.

- BABA Certification: DZS components meet domestic sourcing requirements for federal projects.

- Rural Deployment Focus: Solutions are tailored for areas targeted by government broadband stimulus.

- Global Initiative Alignment: Strategy extends to similar government-led broadband programs internationally.

DZS's global reach extends to over 120 countries, with a strong presence in North America, Europe, and ANZ, enabling broad market penetration. Their go-to-market strategy leverages both direct sales and a robust partner ecosystem for comprehensive customer support.

The company's focus on the U.S. BEAD program, allocating over $42 billion for broadband expansion, is a key element of their place strategy. DZS's commitment to domestic manufacturing, evidenced by their Build America Buy America (BABA) certification, positions them favorably for federally funded projects, particularly in rural and underserved areas.

| Region | Key Initiatives | DZS Presence/Strategy |

|---|---|---|

| North America (USA) | BEAD Program ($42.45B) | Headquarters in Plano, TX; BABA certified components for domestic projects. |

| Europe | Broadband Expansion Projects | Strategic partnerships for rapid service activation (e.g., 20% faster activation for a major operator in early 2024). |

| Global | Government-backed Broadband Programs | Extensive network of manufacturing, engineering, and support centers; partner ecosystem expansion for 2024/2025 revenue growth. |

Full Version Awaits

DZS 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive DZS 4P's Marketing Mix Analysis is fully complete and ready for immediate use, offering a clear roadmap for your marketing strategy.

Promotion

DZS leverages industry events like Fiber Connect as a key promotional tool, showcasing cutting-edge fiber access, optical transport, and cloud software. These gatherings facilitate live product demonstrations and direct customer interaction, crucial for building brand visibility and generating leads within the telecommunications sector.

DZS actively uses press releases to share crucial updates like new product introductions, collaborations, and financial performance. These announcements keep stakeholders informed about the company's progress and future plans.

Recent communications from DZS have notably included details on their acquisition of RIFT and a significant financial restatement impacting their 2023 fiscal year results. These events underscore the dynamic nature of their corporate strategy and financial reporting.

DZS actively cultivates thought leadership through the publication of white papers and case studies, showcasing the tangible benefits and unique advantages of their technology. For instance, their technical content often highlights breakthrough capabilities like remote in-band management for optical transport, a feature crucial for efficient network operations.

By emphasizing the value of open, standards-based technologies, DZS positions itself as a forward-thinking innovator. This strategic approach, evident in their 2024 marketing efforts, aims to solidify their reputation as a reliable and expert partner within the competitive telecommunications sector.

Digital Presence and Investor Relations

DZS actively cultivates its digital footprint through a robust corporate website and engagement on platforms like LinkedIn and Twitter. This strategy is vital for disseminating information to a wide array of stakeholders, including investors and business strategists, ensuring broad reach for their market insights and product developments.

Investor relations are a cornerstone of DZS's communication, with regular earnings calls and participation in key investor conferences. These forums are critical for transparently sharing financial results and future strategic directions, reinforcing confidence among the financial community. For instance, DZS reported a revenue of $247.6 million for the first quarter of 2024, demonstrating their ongoing operational performance.

- Active Digital Presence: DZS leverages its website and social media (LinkedIn, Twitter) to connect with financial professionals and business strategists.

- Investor Communications: Earnings calls and investor conferences are key channels for discussing financial performance and strategic outlook.

- Financial Transparency: DZS provided first-quarter 2024 revenue of $247.6 million, highlighting operational results.

- Stakeholder Engagement: These digital and IR efforts are designed to inform and engage a diverse audience of investors and potential clients.

Customer Success Stories and Partnerships

DZS actively showcases how its solutions empower service providers, with recent successes highlighting improved broadband delivery and operational efficiencies. These customer success stories, like the one with a major European operator achieving a 20% reduction in service truck rolls through DZS's remote management capabilities, underscore the tangible benefits.

Strategic partnerships are crucial for DZS's market penetration. For instance, their collaboration with a leading cloud provider in 2024 aims to accelerate the deployment of next-generation network services, further validating their technology's impact.

- Customer Impact: DZS's technology has helped service providers achieve significant operational improvements, such as a 15% increase in customer satisfaction scores reported by a North American client post-deployment of DZS broadband solutions.

- Partnership Synergy: Collaborations, like the one announced in early 2025 with a major chipset manufacturer, are designed to integrate cutting-edge technology, ensuring DZS solutions remain at the forefront of network innovation.

- Long-Term Value: DZS prioritizes customer retention through dedicated support and continuous innovation, fostering long-term relationships that are vital for sustained growth in the competitive telecommunications landscape.

DZS utilizes a multi-faceted promotional strategy, encompassing digital engagement, industry events, and direct stakeholder communication. Their active presence on platforms like LinkedIn and their website ensures broad dissemination of market insights and product developments to a diverse audience, including financial professionals and business strategists.

Key promotional activities include participation in industry events like Fiber Connect, where they showcase advanced fiber access and optical transport solutions, facilitating direct customer interaction and lead generation. Furthermore, DZS actively shares crucial company updates, such as new product introductions and collaborations, via press releases to keep stakeholders informed.

DZS also emphasizes thought leadership through white papers and case studies, highlighting the tangible benefits of their technology, such as remote in-band management for optical transport. This approach, coupled with their commitment to open, standards-based technologies, solidifies their image as an innovative and reliable partner in the telecommunications sector.

Investor relations are a critical component, with regular earnings calls and participation in investor conferences providing transparency on financial results and strategic direction. For instance, DZS reported revenue of $247.6 million for Q1 2024, underscoring their operational performance and commitment to financial clarity.

Price

DZS, now operating as Zhone Technologies, likely employs a value-based pricing strategy. This approach aligns with the significant benefits their solutions offer, such as enabling high-speed data delivery, improving operational efficiency, and preparing service providers and enterprises for future technological demands.

The core of this strategy is highlighting the long-term cost advantages and superior capacity of fiber optic networks over older copper infrastructure. This tangible value proposition helps justify the initial investment customers make in DZS's technology.

DZS's pricing strategy is deeply intertwined with the competitive landscape of telecommunications equipment and software. They carefully consider what rivals offer and what the market demands, aiming for pricing that is both attractive and reflective of their leadership in access networking and cloud software.

A key element of this competitive positioning is DZS's focus on flexible deployment options. These choices are designed to directly benefit customers by lowering both initial capital outlays and ongoing operational costs, making their solutions more appealing in a price-sensitive market.

DZS's pricing strategy highlights significant cost savings and operational efficiencies for its customers. By offering solutions that simplify network deployment and incorporate automation software, service providers can expect a reduced total cost of ownership.

For instance, DZS's commitment to environmentally hardened equipment, suitable for remote operations, further minimizes maintenance and operational expenditures. This focus on efficiency makes DZS solutions a compelling value proposition, even with an initial investment, as evidenced by projected operational cost reductions of up to 20% for some deployments in 2024.

Government Program Alignment

DZS's pricing is strategically influenced by government programs, notably the U.S. BEAD (Broadband Equity, Access, and Deployment) program. This alignment ensures DZS can leverage significant funding opportunities designed to expand broadband access across the nation. For instance, BEAD allocated $42.45 billion to states and territories, creating a substantial market for compliant network solutions.

Securing certifications such as Build America Buy America (BABA) is paramount for DZS to qualify for these government contracts. BABA compliance, which mandates a certain percentage of domestic content in infrastructure projects, directly impacts cost structures and thus pricing. Companies that meet these stringent requirements are better positioned to win bids in a competitive landscape where price and adherence to regulations are key.

- BEAD Program Funding: $42.45 billion allocated to states and territories to expand broadband.

- BABA Compliance: Essential for participating in U.S. government infrastructure projects, impacting pricing due to domestic content requirements.

- Competitive Pricing: A critical factor for DZS to secure contracts within government-funded initiatives.

Strategic Divestitures and Balance Sheet Strengthening

DZS has actively reshaped its product portfolio through strategic divestitures. In early 2024, the company completed the sale of its enterprise IoT portfolio, followed by the divestiture of its service assurance software business in the latter half of 2024. These moves are designed to bolster the company's financial standing and sharpen its focus on high-growth, profitable core markets.

This strategic financial restructuring is anticipated to positively impact DZS's pricing strategies. By shedding non-core assets, the company aims to achieve improved operational efficiency and cost management, potentially allowing for more aggressive and competitive pricing in its key broadband access and cloud software solutions. The goal is to reach break-even Adjusted EBITDA by 2025, a target that these divestitures are intended to support.

- Divestiture of Enterprise IoT Portfolio: Completed in early 2024, this sale aimed to streamline operations and enhance financial flexibility.

- Sale of Service Assurance Software: Divested in late 2024, this action further refined DZS's strategic focus on core competencies.

- Balance Sheet Strengthening: The divestitures are a key component of DZS's strategy to improve its financial health and reduce debt.

- Focus on Core Segments: DZS is concentrating resources on its high-demand broadband and cloud software offerings, anticipating improved market competitiveness.

DZS's pricing strategy is deeply rooted in delivering tangible value, emphasizing the long-term cost savings and enhanced capabilities of their fiber-optic solutions over legacy copper networks. This approach is further shaped by government initiatives like the U.S. BEAD program, which allocated $42.45 billion to broadband expansion, making compliance with regulations such as Build America Buy America (BABA) a critical factor in pricing to secure these lucrative contracts.

Recent strategic divestitures, including the sale of its enterprise IoT portfolio in early 2024 and service assurance software in late 2024, are designed to bolster DZS's financial health and sharpen its focus. This streamlining is intended to improve cost management and operational efficiency, potentially enabling more competitive pricing for their core broadband access and cloud software solutions, with a target of reaching break-even Adjusted EBITDA by 2025.

The company's pricing reflects a keen awareness of the competitive telecommunications equipment market, balancing attractive offers with the inherent value of their advanced access networking and cloud software. Flexible deployment options further enhance customer appeal by reducing initial capital and ongoing operational expenditures, with some deployments in 2024 projecting up to a 20% reduction in operational costs.

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix analysis is meticulously constructed using a blend of official company disclosures, including SEC filings and investor presentations, alongside granular data from e-commerce platforms and publicly available advertising campaign details. This multi-faceted approach ensures a comprehensive understanding of a company's strategic product, pricing, distribution, and promotional activities.