The Duckhorn Portfolio SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Duckhorn Portfolio Bundle

The Duckhorn Portfolio boasts a strong brand reputation and a loyal customer base, but faces intense competition and potential economic headwinds. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the premium wine market.

Want the full story behind The Duckhorn Portfolio's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Duckhorn Portfolio boasts a robust collection of prestigious luxury wine brands, encompassing names like Duckhorn Vineyards, Decoy, Goldeneye, Paraduxx, Migration, Canvasback, Calera, and the highly sought-after Kosta Browne. This diversified stable of brands is a significant asset, catering to discerning consumers and commanding premium pricing.

The strategic acquisition of Sonoma-Cutrer further solidifies The Duckhorn Portfolio's market position, reinforcing its status as a top-tier supplier of wines priced at $15 and above within the U.S. off-premise retail sector. This expansion enhances their reach and appeal to a broad segment of the luxury wine market.

The Duckhorn Portfolio's strategic focus on the high-growth luxury wine segment, defined by bottles priced at $15 or more, is a significant strength. This niche has demonstrated consistent expansion, providing a fertile ground for the company's offerings.

The company's performance within this segment has been particularly robust, outperforming overall industry growth. This outperformance, evident in recent years, has been a key driver of Duckhorn's own expansion and market penetration.

The Duckhorn Portfolio has significantly bolstered its market presence through strategic distribution enhancements. Recent agreements with Republic National Distributing Company (RNDC) and Breakthru Beverage Group (BBG) are key to this expansion. These deepened partnerships are designed to amplify brand visibility and market penetration across a wider array of U.S. states, ensuring more robust access to consumers.

Strategic Acquisitions and Operational Excellence

Duckhorn's strategic acquisition approach has been a significant strength, exemplified by the integration of Sonoma-Cutrer in fiscal 2024. This move not only broadened their portfolio with premium Chardonnay but also doubled their estate vineyard holdings, a key asset in the wine industry.

This strategic expansion, coupled with a focus on operational efficiency and cost control, has directly translated into robust financial results. The company reported a substantial increase in adjusted EBITDA, underscoring the financial benefits derived from these well-executed acquisitions and disciplined management.

- Acquisition Success: Sonoma-Cutrer acquisition in FY24 expanded luxury Chardonnay offerings and estate vineyard acreage.

- Operational Efficiency: Effective cost management practices bolster profitability.

- Financial Performance: Acquisitions and operational excellence have driven a significant increase in adjusted EBITDA.

- Asset Growth: Doubling estate vineyard acres provides greater control over supply and quality.

Critical Acclaim and Brand Equity

The Duckhorn Portfolio consistently garners exceptional reviews and accolades from leading wine critics and publications, bolstering its esteemed brand equity. For instance, in 2023, Wine Spectator awarded Duckhorn Vineyards’ 2020 Napa Valley Merlot a score of 93 points, highlighting the brand’s enduring quality. This critical validation directly translates into robust brand loyalty and deep consumer engagement across its diverse wine offerings.

This high level of critical acclaim significantly reinforces the credibility and perceived value of the entire Duckhorn Portfolio. Such consistent recognition not only attracts new consumers but also solidifies the trust and preference of existing patrons, a crucial advantage in the competitive wine market.

- Consistent High Scores: Duckhorn wines regularly achieve scores of 90+ points from major critics.

- Prestigious Awards: The portfolio has received numerous awards, including Wine Enthusiast's American Winery of the Year in 2021.

- Brand Strength: Critical success translates directly into powerful brand recognition and consumer trust.

- Portfolio Credibility: Acclaim for individual brands elevates the perception of the entire Duckhorn collection.

The Duckhorn Portfolio's strength lies in its diversified portfolio of luxury wine brands, with a particular focus on the high-growth segment of wines priced at $15 and above. This strategic positioning, coupled with successful acquisitions like Sonoma-Cutrer in fiscal year 2024, has significantly expanded its market reach and asset base, including a doubling of estate vineyard acreage.

The company demonstrates strong operational efficiency and cost control, which has directly contributed to robust financial performance, including a notable increase in adjusted EBITDA. Furthermore, strategic distribution enhancements through partnerships with Republic National Distributing Company (RNDC) and Breakthru Beverage Group (BBG) are amplifying brand visibility and market penetration across the U.S.

Exceptional critical acclaim from leading wine publications, such as Wine Spectator's 93-point rating for Duckhorn Vineyards’ 2020 Napa Valley Merlot in 2023, reinforces brand equity and consumer trust. This consistent validation, alongside awards like Wine Enthusiast's American Winery of the Year in 2021, solidifies the portfolio's credibility and appeal.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Brand Diversification | A portfolio of highly regarded luxury wine brands. | Includes Duckhorn Vineyards, Decoy, Kosta Browne, and others. |

| Luxury Market Focus | Strategic concentration on the high-growth luxury wine segment ($15+). | Outperforming overall industry growth in this segment. |

| Acquisition Strategy | Successful integration of premium brands and assets. | Sonoma-Cutrer acquisition (FY24) doubled estate vineyard holdings. |

| Distribution Network | Enhanced market access through key distribution partnerships. | Agreements with RNDC and Breakthru Beverage Group. |

| Critical Acclaim | Consistent high scores and awards from respected wine critics. | Wine Spectator 93 points for Duckhorn Merlot (2023); Wine Enthusiast American Winery of the Year (2021). |

What is included in the product

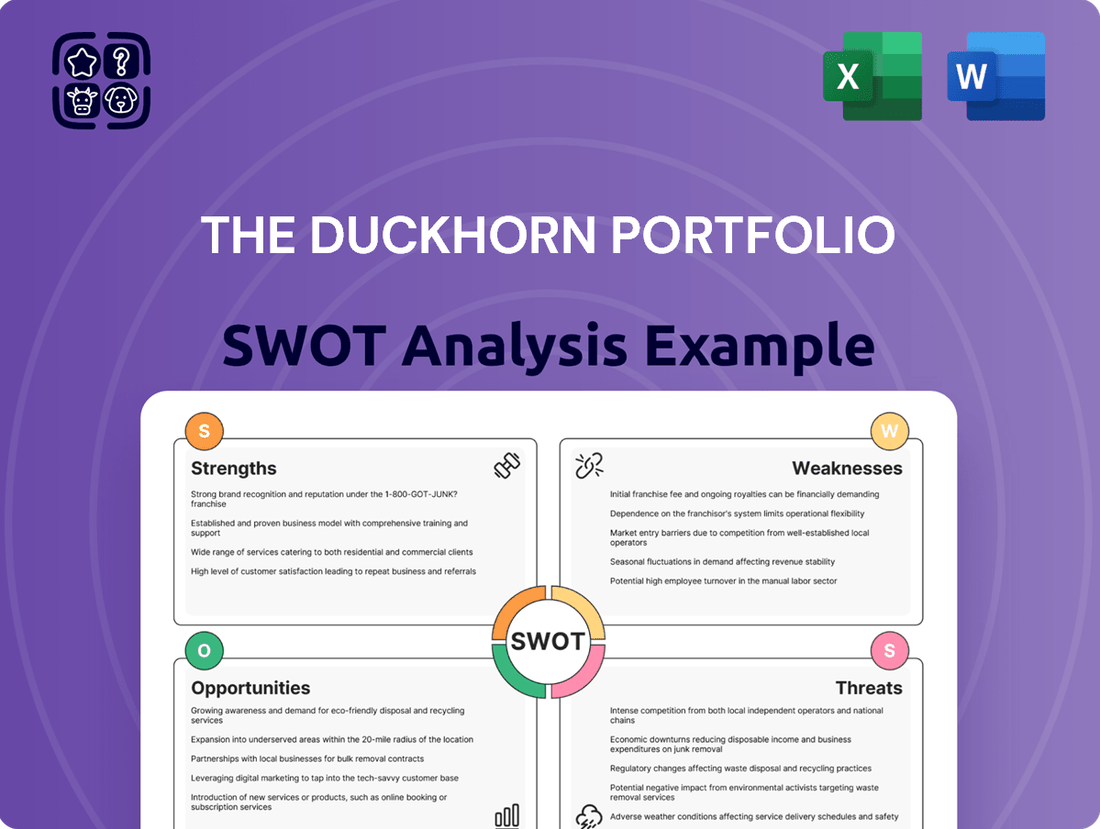

Delivers a strategic overview of The Duckhorn Portfolio’s internal and external business factors, highlighting key strengths and potential threats.

Offers a clear, actionable roadmap by pinpointing Duckhorn's strategic advantages and areas for improvement, alleviating the pain of uncertain decision-making.

Weaknesses

While Duckhorn's focus on the luxury wine segment is a key strength, it also represents a significant weakness. This segment is particularly vulnerable to economic downturns and fluctuations in consumer confidence. For instance, during periods of economic uncertainty, high-income consumers may reduce discretionary spending on premium goods like luxury wines, directly impacting Duckhorn's sales volumes and revenue.

The Duckhorn Portfolio experienced a notable dip in net income during its fiscal first quarter of 2025, even as net sales saw an uptick. This divergence suggests that while the company is successfully driving top-line growth, it's facing challenges in translating those sales into bottom-line profit.

This situation points to potential headwinds such as rising cost of goods sold, increased operating expenses, or other efficiency issues that are eating into margins. For instance, if the cost of grapes or production expenses climbed significantly in late 2024 or early 2025, it could directly impact profitability despite higher sales volumes.

The Duckhorn Portfolio's net sales experienced a temporary dip due to one-time inventory transfers. This occurred when outgoing distributors moved unsold inventory to new distributors in specific states, a necessary step in operational transitions. For instance, in fiscal year 2023, the company reported net sales of $280.5 million, and while this was an increase from the prior year, such transfers can create short-term fluctuations in reported sales figures.

Rationalization of Brands and Tasting Rooms

The Duckhorn Portfolio's decision to strategically reallocate investment away from brands like Canvasback, Migration, Paraduxx, and Postmark, alongside tasting room closures, presents a notable weakness. This move, aimed at portfolio optimization, could inadvertently diminish the visibility and market presence of these specific brands. While the company aims for efficiency, the reduction in physical tasting rooms might also impact direct consumer engagement and brand experience for some segments of their customer base.

This rationalization, while financially driven, carries the risk of alienating loyal customers of the divested brands or those who frequented the closed tasting rooms. For instance, the company's 2023 annual report indicated a focus on streamlining operations, suggesting that these closures were part of a broader cost-efficiency drive. The impact on brand equity for the discontinued labels needs careful management to prevent negative spillover effects.

- Reduced Brand Visibility: Divesting or de-emphasizing certain brands can lead to a loss of market share and brand recognition in specific consumer segments.

- Impact on Consumer Engagement: Tasting room closures can limit direct customer interaction and experiential marketing opportunities, potentially affecting brand loyalty.

- Potential for Negative Brand Perception: While strategic, the closure of tasting rooms and brand rationalization might be perceived negatively by consumers who valued those specific offerings.

- Operational Transition Challenges: Managing the transition of resources and customer relationships away from these brands and locations requires careful execution to minimize disruption.

Vulnerability to Climate Change Impacts

Duckhorn Portfolio, as a producer heavily reliant on viticulture, faces significant vulnerability to climate change. Shifts in temperature and precipitation patterns directly impact grape quality, ripening cycles, and ultimately, harvest yields. For instance, extreme weather events like droughts or unseasonal frosts can devastate crops, leading to reduced production and increased costs.

The wine industry is increasingly aware of these risks, with many producers investing in sustainable farming practices. However, the long-term efficacy of these measures against severe or prolonged climate shifts remains a concern. The 2023 harvest in Napa Valley, for example, saw challenges due to heat spikes and water scarcity, impacting the quality and quantity of certain varietals, a trend that could persist or worsen in the coming years.

- Grape Quality: Climate change can alter the balance of sugars, acids, and tannins in grapes, affecting the final wine profile.

- Yield Variability: Extreme weather events can cause significant fluctuations in harvest volumes year-over-year.

- Operational Costs: Adapting to changing climate conditions, such as investing in new irrigation systems or frost protection, can increase operational expenses.

- Reputational Risk: Inconsistent quality or supply due to climate impacts could affect consumer perception and brand loyalty.

The company's reliance on the luxury wine segment makes it susceptible to economic downturns, as consumers may cut back on discretionary spending. For example, a significant recession could lead to reduced demand for premium wines, directly impacting Duckhorn's revenue. The recent fiscal first quarter of 2025 saw net income decline despite increased net sales, indicating challenges in cost management or margin pressures that could worsen during economic hardship.

Strategic brand rationalization and tasting room closures, while intended to streamline operations, can diminish brand visibility and direct consumer engagement. This move risks alienating loyal customers of de-emphasized brands like Migration and Paraduxx, potentially impacting brand equity. The closure of tasting rooms, a key touchpoint for many wine consumers, could also reduce opportunities for experiential marketing and fostering brand loyalty.

Duckhorn Portfolio's dependence on viticulture exposes it to the significant risks of climate change, which can impact grape quality and yield. Extreme weather events, such as those experienced in Napa Valley in 2023 with heat spikes and water scarcity, can lead to reduced production and increased operational costs. These climate-related challenges can create year-over-year variability in supply and potentially affect consumer perception if wine quality is inconsistent.

Preview Before You Purchase

The Duckhorn Portfolio SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Duckhorn Portfolio's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic decision-making.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Duckhorn Portfolio's market position and future growth potential.

Opportunities

Consumers, especially younger demographics like millennials, are increasingly seeking out premium and sustainably produced wines, adopting a mindset of enjoying higher quality beverages less frequently. This shift perfectly complements Duckhorn's established reputation for producing luxury wines and offers a clear avenue to deepen its commitment to environmentally conscious practices.

The burgeoning e-commerce landscape offers a prime avenue for luxury wine purveyors like Duckhorn to expand their reach, providing consumers with unparalleled convenience and access to a broader selection. This digital shift is particularly advantageous for premium brands that can translate their curated experience online.

Duckhorn's strategic foresight in bolstering its direct-to-consumer (DTC) operations is a significant tailwind. This investment not only enhances gross margins, as seen in the favorable impact on profitability, but also provides a direct channel for cultivating deeper customer relationships and gathering valuable market insights.

By further capitalizing on its established DTC infrastructure, Duckhorn can unlock substantial growth opportunities. This includes personalized marketing campaigns, exclusive online offerings, and virtual tasting experiences, all designed to drive engagement and solidify brand loyalty in an increasingly digital marketplace.

Duckhorn Portfolio can strategically acquire brands that complement its existing luxury wine portfolio, potentially entering new high-growth segments or expanding its geographic reach. The successful integration of Sonoma-Cutrer, acquired in 2021 for $419.5 million, showcases their capability in leveraging acquisitions to enhance market presence and product offerings.

Leveraging Brand Equity for Cross-Selling

Duckhorn's robust portfolio of highly regarded luxury wine brands presents significant avenues for cross-selling. By strategically highlighting the unique appeal and shared heritage of its various labels, the company can deepen relationships with its existing customer base.

This approach aims to capture a larger share of consumer spending within the premium wine segment. For instance, a customer who enjoys Duckhorn Vineyards' Napa Valley Cabernet Sauvignon might be enticed to explore the distinct offerings from Kosta Browne's Pinot Noir or Calera's Chardonnay. This cross-promotion is key to expanding customer lifetime value.

The company's strong brand equity, built over years of producing critically acclaimed wines, acts as a powerful catalyst for these cross-selling initiatives. This allows for more effective marketing campaigns that can introduce consumers to the breadth of Duckhorn's premium wine portfolio.

- Cross-selling potential: Leveraging the diverse appeal of brands like Duckhorn Vineyards, Kosta Browne, and Calera to introduce customers to new varietals and regions.

- Increased wallet share: Encouraging existing customers to purchase from multiple brands within the Duckhorn portfolio, thereby increasing average transaction value.

- Customer acquisition: Utilizing the reputation of one successful brand to attract new consumers to explore the wider Duckhorn family of wines.

- Brand synergy: Creating integrated marketing efforts that showcase the collective quality and prestige of the entire Duckhorn portfolio.

Emerging Market Growth in Luxury Wine

While some mature luxury markets are experiencing a slight cooling, emerging economies present a significant opportunity for growth in the luxury wine sector. Regions such as Brazil, the Middle East, and South Korea are demonstrating increasing consumer spending power and a growing appetite for premium goods, including fine wines. For The Duckhorn Portfolio, this translates into a chance to tap into new customer bases and diversify revenue streams.

Expanding strategic marketing and distribution efforts into these burgeoning markets could unlock substantial new revenue. For instance, the global luxury goods market was projected to grow between 7% and 9% in 2024, with emerging markets often outpacing developed ones. This indicates a fertile ground for high-end wine producers like Duckhorn.

- Brazil's affluent segment is showing increased interest in imported premium wines.

- The Middle East's luxury market continues its upward trajectory, with a growing appreciation for fine beverages.

- South Korea's younger, affluent consumers are increasingly exploring and investing in premium wine experiences.

- Targeted digital marketing and partnerships with local luxury retailers can drive brand awareness and sales in these regions.

Capitalizing on the growing demand for premium and sustainably sourced wines, particularly among younger consumers, aligns perfectly with Duckhorn's brand identity. This trend presents a significant opportunity to further emphasize and expand environmentally conscious production methods, resonating with a key demographic.

The expansion of e-commerce channels offers a direct pathway to reach a wider consumer base, providing convenience and access to Duckhorn's luxury portfolio. This digital shift is crucial for premium brands to translate their curated experiences online and drive sales.

Strategic acquisitions, like the 2021 purchase of Sonoma-Cutrer for $419.5 million, demonstrate Duckhorn's proven ability to integrate complementary brands and enhance market presence. This approach can unlock new high-growth segments and geographic reach.

Leveraging its strong brand equity, Duckhorn can effectively cross-sell across its diverse portfolio, encouraging existing customers to explore additional labels. This strategy aims to increase customer lifetime value and capture a larger share of the premium wine market.

| Opportunity Area | Description | 2024/2025 Focus |

|---|---|---|

| Emerging Markets Growth | Increasing consumer spending power and appetite for premium goods in regions like Brazil, the Middle East, and South Korea. | Targeted digital marketing and local retail partnerships to build brand awareness and drive sales. |

| E-commerce Expansion | Providing consumers with convenient access to luxury wines and a broader selection. | Enhancing online platforms for a seamless customer experience and direct sales. |

| DTC Enhancement | Strengthening direct-to-consumer channels for personalized marketing and customer engagement. | Developing virtual tasting experiences and exclusive online offerings to foster loyalty. |

| Strategic Acquisitions | Acquiring brands that complement the existing luxury portfolio and expand market reach. | Identifying and integrating brands in high-growth segments or new geographic territories. |

Threats

The luxury wine sector, including brands like Duckhorn, faces headwinds from global economic uncertainty. Inflationary pressures and potential recessions in key markets could lead high-net-worth individuals to reduce discretionary spending, directly impacting demand for premium wines. For instance, a slowdown in consumer confidence, as indicated by a dip in global consumer sentiment indices in late 2024, could translate to fewer purchases of high-priced bottles.

This cautious consumer behavior is a significant threat, as luxury goods are often the first to be cut back during economic downturns. A projected deceleration in global GDP growth for 2025, coupled with rising interest rates, further exacerbates this risk by tightening household budgets even for affluent consumers.

Proposals for increased duties on European goods, coupled with broader geopolitical tensions, pose a significant threat to revenue streams for major luxury players, including those in the wine sector. For instance, ongoing trade discussions between the US and EU could see retaliatory tariffs impacting imported wines, potentially raising costs for consumers and squeezing profit margins for companies like Duckhorn Portfolio. Such trade barriers can disrupt established supply chains and necessitate costly adjustments.

The luxury wine market is a crowded space, with established global brands and ambitious new wineries constantly entering the fray. This intense competition means The Duckhorn Portfolio must constantly innovate and invest heavily in marketing to stand out. For instance, in 2023, the global premium wine market was valued at over $30 billion, and this segment is expected to grow, but competition is fierce.

Shifting Consumer Preferences and Generational Shifts

The wine industry, including premium segments like those offered by Duckhorn, must contend with evolving consumer tastes. A notable trend is the rise of the anti-alcohol movement, which directly impacts demand for all alcoholic beverages. This shift necessitates a proactive approach to engage consumers who may be reducing or abstaining from alcohol consumption.

Younger generations, particularly Gen Z and Millennials, exhibit different consumption patterns than older cohorts. Data from 2023 indicates that while these demographics are open to exploring new beverages, their commitment to traditional wine consumption may be less pronounced. For instance, a 2023 NielsenIQ report highlighted that younger legal drinking age consumers are increasingly opting for ready-to-drink (RTD) cocktails and hard seltzers over wine.

Adapting to appeal to these new demographics is crucial for long-term growth. This involves understanding their preferences, which often lean towards convenience, lower alcohol content, and unique flavor profiles. The industry needs to innovate in product development and marketing to resonate with these evolving consumer priorities.

- Growing Anti-Alcohol Sentiment: Increasing consumer focus on health and wellness contributes to a segment of the population reducing or eliminating alcohol intake.

- Generational Shift in Preferences: Younger consumers (Gen Z, Millennials) show a declining affinity for traditional wine consumption compared to Baby Boomers and Gen X.

- Competition from Alternative Beverages: The rise of RTDs, craft beers, and spirits presents significant competition for wine, particularly among younger demographics.

- Need for Product Innovation: Wine brands must adapt by offering lighter options, new flavor profiles, and more convenient formats to attract and retain younger consumers.

Supply Chain Challenges and Raw Material Costs

Persistent supply chain disruptions, particularly in logistics and packaging, continue to pose a threat to The Duckhorn Portfolio. These challenges can lead to delays in bringing products to market and increased operational costs. For instance, the wine industry experienced significant increases in shipping costs in 2023 and early 2024, impacting overall profitability.

Volatile grape harvests, influenced by climate change and weather patterns, directly affect the availability and cost of key raw materials. Unfavorable growing conditions in 2024, such as unexpected frosts or droughts in prime wine regions, could significantly drive up grape prices. This volatility directly impacts The Duckhorn Portfolio's ability to secure consistent, high-quality fruit, potentially squeezing gross profit margins and affecting production volumes.

- Supply Chain Costs: Global shipping rates saw a notable surge in late 2023 and early 2024, with container spot rates increasing by over 100% on some key routes.

- Grape Harvest Variability: The 2023 Napa Valley harvest, for example, was impacted by early season heat spikes, affecting yields for certain varietals.

- Input Cost Increases: Beyond grapes, the cost of glass bottles, corks, and labeling materials also saw increases of 5-10% in the 2023-2024 period.

- Operational Efficiency: Delays in receiving essential supplies can disrupt production schedules, leading to underutilization of winery capacity and reduced operational efficiency.

The Duckhorn Portfolio faces significant threats from global economic instability, with inflation and potential recessions impacting discretionary spending by high-net-worth individuals. For instance, a projected slowdown in global GDP growth for 2025, coupled with rising interest rates, tightens budgets even for affluent consumers.

Intensifying competition from established global brands and new entrants in the premium wine market necessitates continuous innovation and marketing investment. The global premium wine market, valued at over $30 billion in 2023, is growing but highly competitive.

Evolving consumer preferences, particularly the rise of the anti-alcohol movement and the shift towards RTDs and seltzers among younger demographics, pose a challenge. Data from 2023 indicates younger consumers are less committed to traditional wine consumption.

Supply chain disruptions, including logistics and packaging, along with volatile grape harvests due to climate change, increase operational costs and affect raw material availability. Shipping costs saw significant increases in late 2023 and early 2024, and input costs for bottles and corks rose 5-10%.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including The Duckhorn Portfolio's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded strategic view.