The Duckhorn Portfolio Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Duckhorn Portfolio Bundle

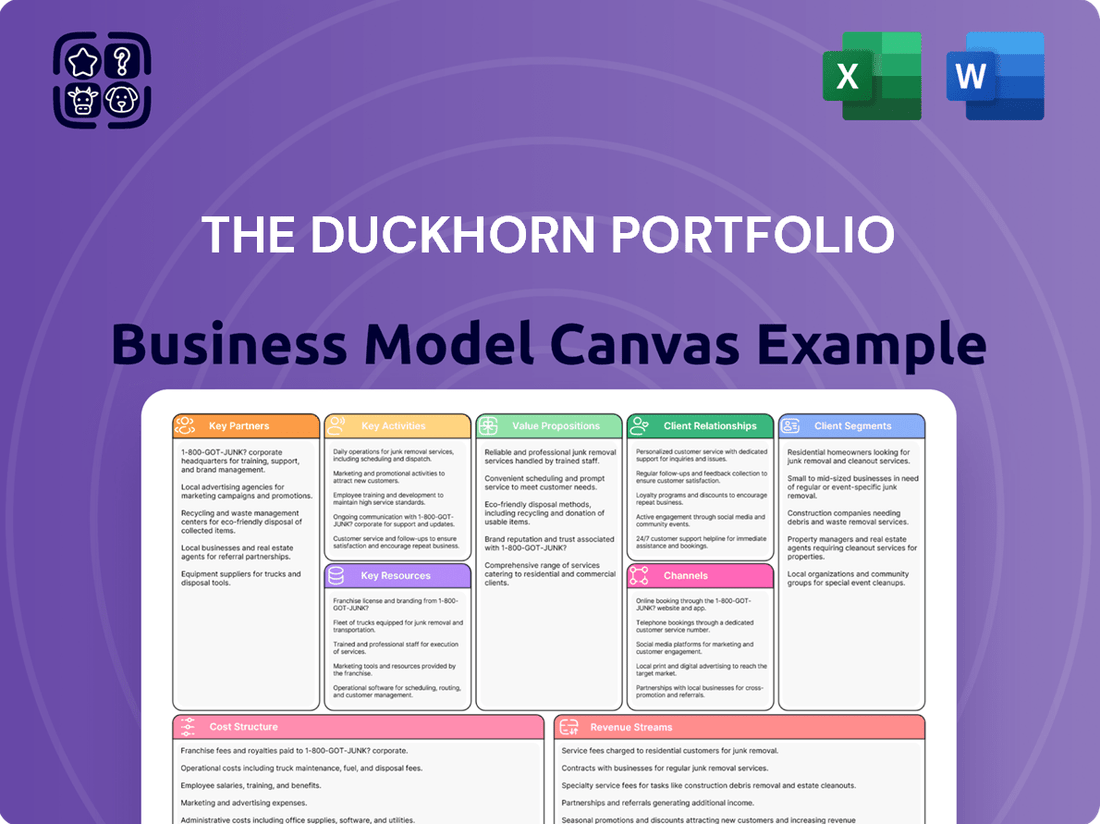

Discover the strategic architecture behind The Duckhorn Portfolio's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Gain actionable insights to fuel your own business growth by downloading the full, professionally crafted canvas today.

Partnerships

The Duckhorn Portfolio cultivates vital relationships with major distributors such as Republic National Distributing Company (RNDC), Breakthru Beverage Group (BBG), and Johnson Brothers. These partnerships are instrumental in achieving nationwide availability, covering all 50 U.S. states and Washington D.C. Their strategic importance lies in ensuring Duckhorn's premium wines reach consumers effectively across both on-premise and off-premise sales channels.

Duckhorn Portfolio has strategically partnered with B2B online marketplaces like Provi. This collaboration is designed to simplify the ordering process for licensed retailers, especially in crucial markets such as California. In 2024, Provi reported significant growth in wine and spirits sales facilitated through its platform, underscoring the value of such digital integrations for expanding market reach.

The Duckhorn Portfolio's success hinges on strong relationships with grape growers and vineyard partners, extending beyond their own estate vineyards. These collaborations are crucial for sourcing premium grapes from renowned regions like Napa Valley, Sonoma County, and Anderson Valley, as well as Oregon and Washington State.

These vital partnerships ensure a consistent supply of high-quality fruit, essential for maintaining the distinct character and regional authenticity of Duckhorn's diverse wine offerings. For instance, in 2024, the company continued to leverage these relationships to secure grapes that reflect the unique terroir of each growing area, a key differentiator in the competitive wine market.

Industry Associations and Event Organizers

Strategic alliances with prominent industry bodies and event organizers are crucial for The Duckhorn Portfolio. A prime example is their three-year partnership with the Academy of Country Music (ACM) Awards, which significantly boosts marketing and brand exposure. This collaboration is designed to introduce the portfolio to new consumer demographics and elevate brand visibility during high-profile events.

These partnerships are integral to The Duckhorn Portfolio's strategy of innovative consumer engagement. By aligning with respected organizations and participating in major events, they gain access to wider audiences and reinforce their brand presence in the market.

- Strategic Marketing Platforms: Partnerships with industry associations and event organizers provide significant marketing and brand exposure opportunities.

- Consumer Demographic Expansion: These alliances enable The Duckhorn Portfolio to connect with new and diverse consumer groups.

- Enhanced Brand Visibility: Association with high-profile events, like the ACM Awards, substantially increases brand recognition.

- Innovative Engagement: This approach is part of a broader strategy to engage consumers through unique and impactful collaborations.

Acquired Entities and Their Networks

The Duckhorn Portfolio’s strategy of acquiring and integrating established wineries is a cornerstone of its business model, effectively leveraging these entities and their existing networks as key partnerships. A prime example is the acquisition of Sonoma-Cutrer in April 2024. This move didn't just add a renowned brand to their portfolio; it brought with it an established distribution system and a loyal customer base, particularly strengthening their presence in the premium Chardonnay market.

These strategic acquisitions function as vital partnerships by:

- Expanding Brand Portfolio: Integrating wineries like Sonoma-Cutrer broadens the company's offerings in sought-after luxury wine segments.

- Enhancing Production Capabilities: Acquired entities often come with specialized vineyards and winemaking facilities, boosting overall production capacity and quality.

- Leveraging Distribution Networks: The existing sales channels and relationships of acquired wineries are immediately integrated, providing wider market access.

- Accessing New Customer Bases: Each acquisition brings a pre-existing customer following, accelerating growth and market penetration.

The Duckhorn Portfolio's key partnerships extend to critical supply chain elements, including packaging suppliers and logistics providers. These relationships are essential for ensuring the consistent quality and timely delivery of their premium wines to market. For example, in 2024, the company continued to work with specialized glass bottle manufacturers to maintain the integrity and aesthetic appeal of their wine bottles, a crucial aspect of their brand presentation.

These operational partnerships are fundamental to maintaining product quality and market responsiveness. Reliable suppliers ensure that the visual and physical aspects of Duckhorn's wines meet the high standards expected by consumers, directly impacting brand perception and customer satisfaction.

The Duckhorn Portfolio also engages with key financial partners, including banks and investment firms, to support its growth strategies and capital needs. These relationships are vital for funding acquisitions, vineyard development, and marketing initiatives. In 2024, the company's financial structure was bolstered by strong relationships with lenders, enabling continued investment in its premium wine brands.

| Partner Type | Examples | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| Distributors | RNDC, Breakthru Beverage Group | Nationwide availability, on/off-premise reach | Ensuring broad market access for all brands |

| Online Marketplaces | Provi | Streamlined B2B ordering, expanded digital reach | Facilitating easier transactions for retailers |

| Grape Growers | Napa Valley, Sonoma County, Oregon | Sourcing premium, terroir-driven fruit | Maintaining consistent quality and regional authenticity |

| Event Organizers | Academy of Country Music (ACM) Awards | Marketing exposure, new consumer demographics | Boosting brand visibility and engagement |

| Acquired Wineries | Sonoma-Cutrer | Brand portfolio expansion, distribution leverage | Strengthening presence in premium segments |

| Packaging Suppliers | Specialized glass manufacturers | Product quality, brand aesthetic | Maintaining premium bottle presentation |

| Financial Institutions | Banks, investment firms | Capital for growth and acquisitions | Supporting strategic investments and expansion |

What is included in the product

A comprehensive, pre-written business model tailored to Duckhorn Portfolio's strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The Duckhorn Portfolio Business Model Canvas streamlines complex wine brand management by offering a clear, one-page snapshot of each winery's core components.

This visual tool alleviates the pain of fragmented information by consolidating key business elements, enabling efficient analysis and strategic decision-making across their diverse portfolio.

Activities

The Duckhorn Portfolio's key activity is the meticulous production of luxury wines. This encompasses everything from tending vines and cultivating grapes to the intricate processes of fermentation, aging, blending, and bottling. Their dedication to crafting exceptional wines from renowned regions like Napa Valley, Sonoma County, and the Willamette Valley is fundamental to their premium brand positioning.

In 2024, The Duckhorn Portfolio continued to emphasize its commitment to quality. Their portfolio includes iconic brands like Duckhorn Vineyards, Kosta Browne, and Goldeneye, each known for distinct expressions of their terroir. This focus on vineyard-specific, appellation-driven winemaking underpins their reputation for consistent excellence and brand integrity in the competitive luxury wine market.

Duckhorn Portfolio actively manages its eleven winery brands, with a keen eye on optimizing performance. Key labels like Duckhorn Vineyards, Decoy, Kosta Browne, and Sonoma-Cutrer are central to this strategy, driving a substantial portion of their net sales.

The company is strategically reallocating resources and consolidating operations, such as tasting rooms, to boost profitability and solidify market leadership. This focused approach ensures investments are channeled into the most promising growth avenues.

Managing and expanding Duckhorn Portfolio's multi-channel sales and distribution is a core activity. This encompasses nurturing wholesale partnerships, driving direct-to-consumer (DTC) sales, and growing international exports.

Key efforts involve continuous negotiation with distributors and meticulous management of complex logistics to ensure products reach consumers efficiently. Optimizing their online sales platforms is also crucial for a seamless customer experience.

For 2024, Duckhorn Portfolio reported strong DTC growth, with their direct-to-consumer channel contributing significantly to overall revenue, highlighting the importance of this direct engagement with customers.

Marketing, Brand Building, and Consumer Engagement

The Duckhorn Portfolio dedicates significant resources to marketing, brand building, and consumer engagement, employing a multi-faceted approach. This involves robust public relations efforts, targeted advertising campaigns across various media, and strategic participation in key industry events to enhance visibility and connect directly with consumers.

Digital content creation plays a crucial role in this strategy, aiming to attract and retain a diverse consumer base, including newer generations. For instance, in 2023, The Duckhorn Portfolio saw continued growth in its digital engagement metrics, with website traffic increasing by 15% and social media engagement up by 20% year-over-year, reflecting successful outreach efforts.

These activities are designed to solidify The Duckhorn Portfolio's esteemed reputation within the luxury wine market, which is experiencing consolidation. By consistently reinforcing brand value and fostering deeper consumer connections, the company aims to drive sustained demand and market share.

- Public Relations: Ongoing media outreach and press coverage to maintain a positive brand image.

- Advertising Campaigns: Targeted digital and traditional advertising to reach key demographics.

- Event Participation: Presence at wine festivals and exclusive events for direct consumer interaction and sampling.

- Digital Content: Creation of engaging online content, including vineyard stories and tasting notes, to build community.

Sustainability and Environmental Stewardship

The Duckhorn Portfolio actively pursues sustainable business practices, integrating responsible grape sourcing, water conservation, and renewable energy investments into its operations. This commitment is guided by their ESG thesis, aiming to reduce environmental impact from vineyard to production.

This dedication to sustainability resonates with a growing segment of consumers who prioritize environmentally conscious brands. For instance, by investing in solar energy at their wineries, they are actively reducing their carbon footprint, a tangible benefit that appeals to this market.

- Responsible Grape Sourcing: Partnering with growers who adhere to sustainable viticultural practices.

- Water Conservation: Implementing advanced irrigation techniques to minimize water usage in vineyards.

- Renewable Energy Investments: Utilizing solar power at key facilities to reduce reliance on fossil fuels.

- ESG Integration: Aligning business strategy with Environmental, Social, and Governance principles.

The Duckhorn Portfolio's key activities are centered on meticulous wine production, brand management, sales and distribution, and marketing. These are supported by a strong commitment to sustainability and ESG principles.

In 2024, the company focused on optimizing its brand portfolio, particularly its core labels like Duckhorn Vineyards and Kosta Browne, to drive profitability. They also continued to expand their direct-to-consumer (DTC) channels, which showed strong growth, and managed wholesale partnerships and international sales.

Marketing efforts in 2024 emphasized digital content creation and consumer engagement to attract new demographics, building on successful digital growth seen in prior years. Sustainability initiatives, including responsible sourcing and renewable energy, remained integral to their operational strategy.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Wine Production | Grape cultivation, fermentation, aging, blending, bottling. | Continued focus on premium quality from Napa Valley, Sonoma County, Willamette Valley. |

| Brand Management | Overseeing eleven winery brands. | Optimizing performance of key labels like Duckhorn Vineyards, Kosta Browne, Sonoma-Cutrer. |

| Sales & Distribution | Wholesale, DTC, and international sales management. | Strong DTC growth reported, highlighting direct customer engagement. |

| Marketing & Engagement | PR, advertising, events, digital content. | Attracting newer generations through engaging online content and community building. |

| Sustainability | ESG integration, responsible sourcing, water conservation, renewable energy. | Reducing carbon footprint through investments like solar energy at wineries. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis of Duckhorn Portfolio's business model. Upon completion of your order, you will gain full access to this complete, ready-to-use document, allowing you to understand and leverage its insights immediately.

Resources

The Duckhorn Portfolio boasts a robust collection of eleven distinct winery brands, a key resource that allows for broad market penetration. Flagship names such as Duckhorn Vineyards, Decoy, Sonoma-Cutrer, and Kosta Browne represent a diverse offering, catering to various consumer tastes and price segments within the luxury wine market.

This extensive portfolio strengthens The Duckhorn Portfolio's market standing by offering a comprehensive range of premium wines. The collective power of these established brands, each with its own loyal following and unique identity, significantly enhances the company's overall reputation and competitive advantage.

The Duckhorn Portfolio commands a significant advantage with over 2,200 acres of vineyards across 38 estate properties. This prime real estate is strategically situated in renowned wine regions like Napa Valley, Sonoma County, Oregon, and Washington State, ensuring access to exceptional fruit.

This substantial owned vineyard acreage is a cornerstone of their business model, granting direct control over grape sourcing and quality. It's a critical factor in consistently producing the high-caliber wines that define their portfolio, directly impacting production costs and brand reputation.

The Duckhorn Portfolio leverages ten state-of-the-art winemaking facilities, crucial for its luxury wine production. These modern sites are outfitted with advanced technology, enabling efficient and high-quality wine creation, aging, and bottling. This infrastructure underpins their commitment to consistent product excellence.

Experienced Management and Winemaking Talent

The Duckhorn Portfolio’s success is significantly underpinned by its seasoned management and winemaking teams. This human capital is a cornerstone, driving both operational excellence and brand prestige. Their collective experience spans viticulture, production, sales, and strategic planning, enabling the company to adeptly navigate the complexities of the wine industry and capitalize on growth opportunities.

This deep reservoir of talent is crucial for maintaining the high quality and distinctive character of Duckhorn’s wines. In 2023, the company highlighted its commitment to nurturing this talent, with a focus on leadership development and retaining key personnel. For instance, their winemaking staff often boasts decades of experience, contributing to the consistent critical acclaim their wines receive year after year.

- Experienced Leadership: A culture-driven management team with proven track records in the wine and consumer goods sectors.

- Winemaking Expertise: A deep bench of talented winemakers and viticulturists responsible for the consistent quality and innovation across their portfolio.

- Operational Acumen: Skilled operational managers who ensure efficient production, supply chain management, and distribution.

- Strategic Vision: Leadership capable of identifying market trends, M&A opportunities, and long-term brand building strategies.

Brand Reputation and Critical Acclaim

The Duckhorn Portfolio leverages its exceptional brand reputation and a history of critical acclaim as a key resource. This prestige, evidenced by numerous industry awards and favorable reviews from leading publications, acts as a powerful differentiator.

This strong reputation translates into a significant competitive advantage, drawing in both discerning consumers and crucial trade partners. For instance, Duckhorn Vineyards consistently receives high scores from critics like Wine Spectator and Robert Parker, reinforcing its premium positioning.

- Brand Prestige: Duckhorn is recognized as a leading Napa Valley producer, with a legacy of quality dating back to its founding in 1976.

- Critical Acclaim: The portfolio regularly garners 90+ point scores from major wine critics, validating its consistent excellence.

- Consumer Trust: This established reputation builds deep consumer trust, allowing for premium pricing and strong demand.

- Trade Partnerships: The brand's standing facilitates strong relationships with distributors and retailers, ensuring broad market access.

The Duckhorn Portfolio's key resources are its extensive winery brand portfolio, significant owned vineyard acreage, state-of-the-art winemaking facilities, experienced leadership and winemaking teams, and strong brand reputation backed by critical acclaim. These elements collectively ensure quality, control, and market presence.

In fiscal year 2023, The Duckhorn Portfolio reported net sales of $367.1 million, showcasing the commercial success driven by these core assets. The company's control over 2,200 acres of vineyards across 38 properties is a testament to its commitment to sourcing high-quality grapes, a critical factor in maintaining brand prestige and consumer trust.

| Key Resource | Description | Impact |

|---|---|---|

| Winery Brand Portfolio | Eleven distinct brands, including Duckhorn Vineyards, Decoy, and Kosta Browne. | Broad market appeal, catering to diverse consumer preferences and price points in the luxury wine segment. |

| Owned Vineyard Acreage | Over 2,200 acres across 38 estate properties in prime regions like Napa Valley and Oregon. | Direct control over grape quality and sourcing, ensuring consistency and supporting premium brand positioning. |

| Winemaking Facilities | Ten state-of-the-art facilities equipped with advanced technology. | Efficient and high-quality wine production, aging, and bottling, crucial for maintaining product excellence. |

| Human Capital | Seasoned management and winemaking teams with extensive industry experience. | Drives operational excellence, innovation, and strategic navigation of the wine market. |

| Brand Reputation & Critical Acclaim | A history of awards and high scores from leading critics. | Builds consumer trust, supports premium pricing, and strengthens trade partnerships. |

Value Propositions

The Duckhorn Portfolio is celebrated for its unwavering dedication to producing luxury wines, consistently offering consumers outstanding flavor profiles and distinct characteristics. This focus on excellence is deeply rooted in their precise vineyard management and sophisticated winemaking processes.

This commitment to superior quality ensures that customers receive a premium wine experience that satisfies their refined palates. For instance, The Duckhorn Vineyards’ 2021 Napa Valley Cabernet Sauvignon, a flagship offering, garnered a 95-point rating from Wine Spectator, underscoring the brand's consistent high standards.

The Duckhorn Portfolio offers a diverse and curated selection of eleven distinct winery brands, each boasting a unique identity and acclaimed wines. This comprehensive range, spanning from accessible luxury to ultra-premium tiers, ensures a curated experience for consumers seeking award-winning options. For instance, in 2023, the portfolio included brands like Duckhorn Vineyards, known for its Merlot, and Kosta Browne, celebrated for its Pinot Noir, catering to a wide spectrum of luxury wine preferences and occasions.

Duckhorn Portfolio's commitment to authenticity and terroir expression is a cornerstone of its value proposition. They primarily source grapes from their own estate vineyards and select growers across prestigious regions like Napa Valley, Sonoma County, and Oregon. This meticulous vineyard selection ensures the wines genuinely reflect the unique characteristics of their origin.

This dedication to regionality and vineyard-specific qualities deeply appeals to consumers who value wines with a distinct sense of place. For instance, in 2024, the demand for wines highlighting provenance continued to grow, with consumers increasingly willing to pay a premium for wines that tell a story of their origin.

Heritage and Established Legacy

The Duckhorn Portfolio's heritage, dating back to 1976, cultivates a deep-seated trust and prestige within the American luxury wine market. This established legacy, built over decades, signifies a consistent commitment to quality and enduring winemaking traditions. For consumers, this history translates into a reliable and respected brand, a key differentiator in a competitive landscape.

This long-standing presence is more than just a timeline; it’s a testament to their ability to adapt and thrive. For instance, in 2023, The Duckhorn Portfolio continued to demonstrate resilience, with net sales reported at $263.9 million, reflecting sustained consumer demand for their established brands.

- Established 1976: Over 48 years of winemaking experience.

- Brand Prestige: Recognized for quality and luxury in the wine industry.

- Consumer Trust: A long history builds confidence and loyalty.

- Enduring Quality: Commitment to traditional winemaking practices.

Commitment to Sustainability and Responsible Practices

The Duckhorn Portfolio actively demonstrates a deep commitment to environmental stewardship, integrating sustainable practices across its vineyards and operational footprint. This dedication is not just a talking point; it's woven into their business model, addressing key concerns for today's environmentally aware consumers.

Their efforts include significant investments in water conservation techniques, the adoption of renewable energy sources to power their facilities, and a steadfast adherence to ethical business practices throughout their supply chain. For example, by 2024, many wineries in regions like Napa Valley, where Duckhorn operates, have implemented advanced irrigation systems that can reduce water usage by up to 30% compared to traditional methods.

This focus on sustainability resonates strongly with a growing segment of consumers who prioritize purchasing from companies that align with their personal values. This commitment adds substantial value to their brand, fostering loyalty and attracting customers who are willing to support environmentally responsible businesses.

- Vineyard Sustainability: Implementing water-saving irrigation and promoting biodiversity.

- Operational Efficiency: Utilizing renewable energy sources and reducing waste.

- Ethical Sourcing: Ensuring fair labor practices and responsible supply chain management.

- Consumer Alignment: Meeting the demand for eco-conscious wine choices.

The Duckhorn Portfolio’s value proposition centers on delivering exceptional luxury wines characterized by distinct flavor profiles and meticulous craftsmanship. This commitment to quality is evident in their vineyard management and winemaking, ensuring a premium experience for discerning consumers. For instance, their 2021 Napa Valley Cabernet Sauvignon received a 95-point rating from Wine Spectator in 2023, a testament to their consistent high standards.

They offer a diverse portfolio of eleven distinct winery brands, catering to a broad range of luxury wine preferences. This curated selection, from accessible luxury to ultra-premium, provides consumers with award-winning options for various occasions. In 2023, brands like Duckhorn Vineyards and Kosta Browne were key contributors, highlighting the breadth of their offerings.

Authenticity and terroir expression are paramount, with grapes sourced primarily from estate vineyards in Napa Valley, Sonoma County, and Oregon. This focus on provenance appeals to consumers who value wines that reflect their origin, a trend that saw continued growth in consumer willingness to pay a premium in 2024.

The Duckhorn Portfolio's heritage, established in 1976, cultivates significant consumer trust and brand prestige. This long-standing legacy signifies a consistent commitment to quality and enduring winemaking traditions, translating into a reliable and respected brand in a competitive market. In 2023, their net sales reached $263.9 million, reflecting sustained consumer demand.

Environmental stewardship is a core value, with sustainable practices integrated across vineyards and operations. Investments in water conservation, renewable energy, and ethical sourcing resonate with environmentally conscious consumers, adding brand value and fostering loyalty. By 2024, many Napa Valley wineries, including Duckhorn, were implementing water-saving irrigation, reducing usage by up to 30%.

| Value Proposition Pillar | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Exceptional Quality & Craftsmanship | Distinct flavor profiles, meticulous winemaking | 2021 Napa Valley Cabernet Sauvignon rated 95 points by Wine Spectator (2023) |

| Diverse & Curated Portfolio | Eleven distinct winery brands, varied tiers | Brands like Duckhorn Vineyards & Kosta Browne prominent in 2023 |

| Authenticity & Terroir Expression | Estate vineyard sourcing, regional specificity | Growing consumer premium for provenance-highlighting wines (2024 trend) |

| Heritage & Brand Prestige | Established 1976, decades of quality | Net sales of $263.9 million (2023) reflect sustained demand |

| Environmental Stewardship | Sustainable practices, water conservation | Napa wineries reducing water usage by up to 30% with advanced irrigation (2024) |

Customer Relationships

The Duckhorn Portfolio prioritizes building direct connections with its customers. This is primarily achieved through their wine clubs and physical tasting rooms, which are crucial for nurturing brand loyalty and encouraging repeat business. In 2023, the company reported that its wine clubs represented a significant portion of its DTC sales, demonstrating the effectiveness of this strategy in driving consistent revenue.

These direct interactions offer a unique opportunity to provide personalized experiences, exclusive promotions, and a more profound connection to Duckhorn's brand narrative and winemaking heritage. While there have been some strategic consolidations of tasting room locations, the overarching commitment to high-value, direct consumer engagement remains a core tenet of their business model.

Duckhorn Portfolio cultivates strong ties with distributors and retailers through dedicated sales support and streamlined ordering, exemplified by their use of the Provi online marketplace. This focused engagement ensures trade partners receive customized help and valuable resources, directly boosting their capacity to market and sell Duckhorn wines effectively.

The Duckhorn Portfolio actively cultivates brand advocacy by transforming consumers into passionate evangelists. This is achieved through targeted marketing initiatives, participation in key industry events, and compelling brand storytelling that highlights the passion behind their winemaking.

By crafting engaging experiences, such as vineyard tours and exclusive tasting events, and effectively communicating the dedication poured into each bottle, The Duckhorn Portfolio builds a strong sense of community. This community engagement is crucial for fostering genuine connections and encouraging loyalty.

This strategy directly fuels word-of-mouth marketing, a powerful and cost-effective driver of growth. In 2024, for example, brands with high customer engagement often see significantly higher repeat purchase rates, demonstrating the tangible financial benefits of fostering a dedicated consumer base.

Educational and Experiential Offerings

Duckhorn Portfolio fosters deep customer connections through educational and experiential initiatives. These offerings go beyond mere sales, creating a richer understanding and appreciation for their luxury wines. By sharing insights into winemaking, vineyard management, and culinary pairings, they transform consumers into engaged enthusiasts.

- Educational Content: Providing online resources and in-person sessions detailing winemaking processes and vineyard practices.

- Experiential Events: Hosting unique wine tasting events and vineyard tours that offer immersive experiences.

- Enrichment of Appreciation: Educating consumers on food pairings and the nuances of their portfolio, enhancing their enjoyment.

- Deepened Engagement: Building loyalty and a stronger connection by offering value beyond the product itself.

Responsive Customer Service

Maintaining a reputation for excellent customer service is paramount for The Duckhorn Portfolio, extending to both discerning end consumers and valued trade partners. This commitment underpins the brand's luxury positioning.

Providing timely support and efficiently addressing inquiries across all touchpoints, from initial order placement to final delivery, ensures a seamless and positive experience. This focus on service quality directly reinforces The Duckhorn Portfolio's luxury brand image.

- Customer Service Excellence: The Duckhorn Portfolio prioritizes a high standard of customer care for both direct consumers and wholesale partners.

- Timely Support: Ensuring prompt responses to inquiries and efficient resolution of issues is key to maintaining customer satisfaction.

- Seamless Experience: The brand aims for a smooth journey for customers at every interaction point, from purchase to receipt of goods.

- Brand Reinforcement: Superior service quality directly supports and strengthens The Duckhorn Portfolio's luxury brand identity.

The Duckhorn Portfolio cultivates deep customer relationships through its wine clubs and tasting rooms, fostering loyalty and repeat business. In 2023, wine clubs were a significant driver of DTC sales, highlighting their effectiveness. These direct channels enable personalized experiences and reinforce the brand's heritage.

The company also strengthens ties with distributors and retailers via dedicated sales support and online platforms like Provi, ensuring effective marketing and sales of their wines.

By creating engaging experiences and sharing their winemaking passion, Duckhorn builds a strong community, driving word-of-mouth marketing. Brands with high customer engagement in 2024 saw notably higher repeat purchase rates.

Educational content, experiential events, and a focus on customer service excellence are central to reinforcing Duckhorn's luxury brand image and deepening consumer appreciation.

| Customer Relationship Strategy | Key Channels/Activities | Impact/Data Point |

|---|---|---|

| Direct Consumer Engagement | Wine Clubs, Tasting Rooms | Significant portion of DTC sales in 2023 |

| Trade Partner Support | Sales Support, Provi Marketplace | Boosts marketing and sales capacity |

| Brand Advocacy & Community | Events, Storytelling | Drives word-of-mouth marketing; higher repeat purchases in 2024 |

| Customer Service Excellence | Timely Support, Issue Resolution | Reinforces luxury brand positioning |

Channels

The Duckhorn Portfolio's primary sales engine is its robust wholesale distribution network. This channel is critical for reaching a vast consumer base through partnerships with major players like Republic National Distributing Company (RNDC) and Breakthru Beverage Group (BBG). These relationships ensure their wines are readily available in thousands of retail locations, restaurants, and bars nationwide.

In 2023, The Duckhorn Portfolio reported net sales of $310.5 million, with the majority of this revenue generated through these wholesale channels. This extensive network is the largest avenue for the company to connect with and serve its end consumers across the United States.

The Duckhorn Portfolio heavily relies on its direct-to-consumer (DTC) sales channels, encompassing online purchases via their websites and exclusive wine club memberships. This direct engagement allows for meticulous control over brand narrative and pricing strategies, simultaneously cultivating deeper connections with their customer base.

In 2023, DTC sales represented a significant 38% of The Duckhorn Portfolio's net sales, underscoring its critical role in the company's revenue generation and brand building efforts.

Winery tasting rooms are crucial for The Duckhorn Portfolio, acting as direct sales channels and key brand immersion points. These physical locations offer consumers an experiential connection to the company's diverse wine portfolio.

The company is strategically consolidating its tasting room footprint, focusing on the most profitable and impactful locations to enhance efficiency and customer engagement. This approach aims to maximize the return on investment from these vital hospitality assets.

In 2023, direct-to-consumer sales, which heavily rely on tasting room experiences, represented a significant portion of The Duckhorn Portfolio's revenue, demonstrating the channel's importance for high-margin sales and brand loyalty.

International Export Markets

The Duckhorn Portfolio actively cultivates its presence in over 50 countries spanning five continents, significantly extending its reach beyond the North American market. This global footprint is crucial for tapping into burgeoning luxury wine markets worldwide and diversifying its revenue base.

International importers recognize The Duckhorn Portfolio as a premier source for high-quality American wines, a perception that underpins its export strategy. This international demand is a key component of their business model, contributing to sales growth and brand recognition on a global scale.

For example, in 2023, The Duckhorn Portfolio reported that its international net sales represented approximately 14.7% of its total net sales, highlighting the growing importance of these markets. This demonstrates a tangible financial impact from their international export efforts.

- Global Reach: Distribution across more than 50 countries on five continents.

- Market Diversification: Tapping into growing global luxury wine markets.

- Importer Appeal: Positioned as an attractive supplier of American wines internationally.

- Revenue Contribution: International net sales accounted for roughly 14.7% of total net sales in 2023.

B2B E-commerce Platforms

Leveraging B2B e-commerce platforms, such as Provi, is becoming a crucial digital avenue for trade partners. For Duckhorn Portfolio, this means enabling licensed retailers to conveniently order wines online, enhancing accessibility within the wholesale segment. This shift modernizes their interactions with trade partners.

In 2024, the B2B e-commerce market for wine and spirits saw significant growth. For instance, platforms like Provi reported a substantial increase in transaction volume, with many suppliers and buyers adopting these digital tools for efficiency. This trend highlights a broader movement towards digitalization in the beverage alcohol industry, making it easier for businesses to connect and transact.

- Digital Channel Growth: B2B e-commerce platforms are increasingly vital for wholesale wine distribution.

- Improved Efficiency: Retailers benefit from the convenience and accessibility of online ordering.

- Market Adoption: In 2024, platforms like Provi saw increased adoption by suppliers and buyers in the beverage alcohol sector.

- Modernized Trade: This digital approach streamlines and modernizes interactions within the wholesale segment.

The Duckhorn Portfolio utilizes a multi-faceted channel strategy to reach its diverse customer base. Wholesale distribution remains a cornerstone, ensuring broad availability through major distributors like RNDC and Breakthru Beverage Group, which in 2023 accounted for the majority of its $310.5 million in net sales. Complementing this is a robust direct-to-consumer (DTC) approach, including online sales and wine clubs, which in 2023 represented a significant 38% of net sales, fostering deeper customer relationships and brand control. Winery tasting rooms serve as crucial experiential hubs for direct sales and brand immersion, with a strategic focus on optimizing these high-margin locations.

The company also maintains a strong international presence, distributing to over 50 countries and deriving approximately 14.7% of its total net sales from international markets in 2023. This global reach taps into luxury wine markets and appeals to international importers. Furthermore, The Duckhorn Portfolio is embracing B2B e-commerce platforms, enhancing convenience for trade partners and streamlining wholesale transactions, a trend that saw significant growth in 2024 across the beverage alcohol industry.

| Channel | Description | 2023 Net Sales Contribution | Key Partners/Features |

|---|---|---|---|

| Wholesale Distribution | Broad availability through national distributors. | Majority of $310.5M net sales | RNDC, Breakthru Beverage Group |

| Direct-to-Consumer (DTC) | Online sales and wine clubs. | 38% of net sales | Brand control, customer loyalty |

| Winery Tasting Rooms | Experiential sales and brand immersion. | Contributes to DTC revenue | Optimized locations, customer engagement |

| International Markets | Distribution in over 50 countries. | 14.7% of total net sales | Global luxury wine markets, importer appeal |

| B2B E-commerce | Online platforms for trade partners. | Growing importance | Convenience for retailers, efficiency |

Customer Segments

Affluent luxury wine consumers are individuals with substantial disposable income who consistently buy wines priced at $15 or more per 750ml bottle. This group values superior quality, the prestige associated with established brands, and distinctive wine-related experiences. For instance, in 2024, the global luxury wine market continued its growth trajectory, with consumers in this segment demonstrating a strong preference for wines from renowned regions and producers.

Discerning wine enthusiasts and collectors represent a core customer segment for The Duckhorn Portfolio. These individuals have a refined palate and a passion for critically acclaimed, often limited-edition wines that showcase a distinct sense of place, or terroir. Their engagement often extends to joining wine clubs and actively seeking to understand the brand's heritage and meticulous winemaking philosophy, valuing exclusivity and in-depth knowledge.

On-premise establishments like fine dining restaurants, luxury hotels, and chic bars represent a crucial customer segment for The Duckhorn Portfolio. These venues are discerning in their wine selections, often featuring premium and luxury wines, making them ideal partners for showcasing Duckhorn's high-quality offerings.

These establishments are pivotal for by-the-glass programs, allowing consumers to experience Duckhorn wines in a sophisticated setting. In 2023, the U.S. fine dining restaurant sector saw continued recovery, with many establishments focusing on curated wine lists to enhance the customer experience, directly benefiting brands like Duckhorn.

The partnership with these on-premise locations significantly boosts brand visibility and drives sales through direct consumer engagement. For instance, a significant portion of premium wine sales in the U.S. still occurs in restaurants and hotels, underscoring the importance of this channel for Duckhorn's revenue and market presence.

Premium Off-Premise Retailers

Premium Off-Premise Retailers are a cornerstone for The Duckhorn Portfolio, encompassing specialized wine shops, high-end grocery stores, and upscale liquor retailers. These outlets are vital for reaching consumers seeking premium and luxury wine selections for home enjoyment or as gifts. In 2024, the fine wine segment, where these retailers operate, continued to show resilience, with sales in premium channels often outperforming the broader beverage alcohol market.

Building and maintaining strong relationships with these key retailers is paramount for The Duckhorn Portfolio's market penetration and brand visibility. These partners are critical for effective merchandising, in-store promotions, and ensuring availability of Duckhorn's diverse portfolio. For instance, data from 2024 indicated that retailers focusing on curated selections often saw higher average transaction values for premium wines.

- Key Retailer Categories: Specialized wine shops, high-end grocery chains, and premium liquor stores.

- Consumer Behavior: Purchases for home consumption and gifting, with a focus on quality and brand reputation.

- Strategic Importance: Essential for market access, brand presence, and driving sales of premium wine offerings.

- Market Trends (2024): Continued demand for curated selections and a focus on provenance in the fine wine retail space.

Emerging Younger Generations (Millennials and Gen Z)

Emerging younger generations, particularly Millennials and Gen Z, represent a significant and growing customer segment for luxury wines. This demographic is increasingly drawn to brands that highlight craftsmanship, single-vineyard sourcing, and a commitment to sustainability. For instance, by 2024, Gen Z consumers are projected to have a spending power exceeding $360 billion, and a notable portion of this is being directed towards premium and experiential goods, including fine wine.

These younger consumers often adopt a 'drink less but better' philosophy, prioritizing quality and unique experiences over quantity. They are highly responsive to digital engagement, seeking authentic brand narratives and transparent sourcing information. Duckhorn Portfolio's focus on vineyard-specific wines and its digital presence, including social media engagement and online storytelling, directly appeals to these preferences.

- Growing Spending Power: Gen Z's projected spending power by 2024 is over $360 billion, with a growing interest in premium goods.

- Preference for Quality: Millennials and Gen Z favor a 'drink less but better' approach, valuing craftsmanship and unique sourcing.

- Digital Engagement: This demographic responds strongly to authentic brand stories and digital marketing efforts.

- Sustainability Focus: Environmental and ethical practices, including sustainable vineyard management, are key purchasing drivers.

The Duckhorn Portfolio targets affluent individuals who appreciate high-quality wines, often priced above $15 per bottle, valuing prestige and unique experiences. Discerning wine enthusiasts and collectors are also key, seeking critically acclaimed, limited-edition wines with a strong sense of terroir and brand heritage.

On-premise establishments, including fine dining restaurants and luxury hotels, are vital for showcasing Duckhorn's premium offerings and driving sales through by-the-glass programs. Premium off-premise retailers, such as specialized wine shops and high-end grocery stores, are crucial for reaching consumers who purchase wine for home enjoyment or as gifts.

Emerging younger consumers, particularly Millennials and Gen Z, are increasingly interested in quality, craftsmanship, and sustainable practices, responding well to authentic brand narratives and digital engagement.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Affluent Consumers | High disposable income, preference for $15+ wines, value prestige. | Continued strong demand for luxury wine experiences. |

| Enthusiasts/Collectors | Refined palate, seek acclaimed and limited editions, value terroir. | High engagement with wine clubs and brand narratives. |

| On-Premise Establishments | Fine dining, luxury hotels, chic bars; focus on premium selections. | Crucial for brand visibility and direct consumer engagement. |

| Premium Off-Premise Retailers | Specialty wine shops, high-end grocers; target home consumption/gifts. | Resilient market segment for fine wine sales. |

| Emerging Generations (Millennials/Gen Z) | Value quality, craftsmanship, sustainability; digitally engaged. | Growing spending power and preference for authentic brand stories. |

Cost Structure

Grape sourcing and vineyard operations represent a substantial portion of The Duckhorn Portfolio's expenses. These costs encompass the meticulous management of their own vineyards, including labor for cultivation, maintenance of specialized equipment, and the purchase of essential agricultural inputs like fertilizers and pest control. For 2024, these operational costs are critical for maintaining the high quality of grapes grown on their estate properties.

Beyond their estate vineyards, The Duckhorn Portfolio also incurs significant costs for acquiring premium grapes from third-party growers. This strategic sourcing ensures access to diverse varietals and appellations, further bolstering the quality and breadth of their wine offerings. These expenditures are foundational to securing the necessary raw materials that define the character and prestige of their portfolio.

Production and winemaking expenses are a significant component, covering everything from grape processing and fermentation to aging in specialized facilities. This includes the costs of labor, utilities, and the maintenance of sophisticated equipment. For instance, in 2023, The Duckhorn Portfolio reported Cost of Goods Sold, which heavily includes these winemaking expenses, at $224.6 million.

These costs also extend to bottling, packaging, and the necessary storage for finished products, all crucial for bringing wine to market. Materials like barrels, bottles, and corks are essential inputs. The company's operational efficiency in managing these costs directly impacts its profitability and ability to scale production.

Duckhorn Portfolio dedicates substantial resources to sales, marketing, and brand building, a necessity for its luxury wine portfolio. These investments span advertising, public relations, digital marketing campaigns, and event sponsorships to cultivate their premium image.

In 2024, the company continued to emphasize these areas. For instance, their marketing and sales expenses, a significant portion of their operational budget, are crucial for driving consumer demand and solidifying market share within the highly competitive premium wine segment.

Distribution and Logistics Expenses

The Duckhorn Portfolio incurs significant costs in distributing its wines, covering everything from getting the product from its wineries to distributors and retailers. This includes the expenses of warehousing the wines and managing the intricate logistics required to reach customers across the United States and in international markets. These distribution and logistics expenses are crucial for ensuring broad market access.

Key components of these costs include freight charges for shipping, fees for storing inventory in warehouses, and the administrative overhead associated with maintaining relationships with a wide network of distributors. In 2023, for example, the wine industry as a whole saw logistics costs increase due to factors like fuel prices and labor shortages, impacting companies like Duckhorn.

- Freight Costs: Expenses related to the transportation of finished goods from production facilities to distribution centers and ultimately to retailers or direct-to-consumer channels.

- Warehousing Fees: Costs associated with storing wine inventory, including rent for warehouse space, utilities, and inventory management systems.

- Distribution Management: Administrative expenses for managing relationships with distributors, brokers, and other intermediaries, including sales support and compliance.

- International Logistics: Additional costs for shipping, customs, tariffs, and compliance for export markets, which can be substantial for global brands.

General and Administrative (G&A) Overheads

General and Administrative (G&A) overheads for a company like The Duckhorn Portfolio encompass essential corporate functions that ensure the business runs smoothly and strategically. These include costs for executive leadership, administrative staff, legal counsel, and the IT infrastructure supporting all operations. For 2024, companies in the wine and spirits industry, similar to Duckhorn, often allocate a significant portion of their G&A to maintaining robust compliance and governance frameworks, especially with increasing emphasis on sustainability reporting.

These expenses are crucial for the overall health and direction of the business, covering everything from accounting and financial management to the IT systems that underpin sales, distribution, and internal communication. For instance, in 2023, the wine industry saw G&A expenses typically range from 5% to 15% of total revenue, depending on the scale and complexity of operations.

- Executive and Administrative Salaries: Compensation for top management and support staff.

- Legal and Compliance Costs: Fees for legal services, regulatory adherence, and sustainability reporting.

- IT Infrastructure: Investment in technology, software, and cybersecurity.

- Accounting and Financial Management: Costs associated with financial record-keeping and reporting.

The Duckhorn Portfolio's cost structure is heavily influenced by its commitment to premium grape sourcing and meticulous winemaking processes. These core operational expenses are foundational to maintaining the high quality and prestige associated with its brands.

Significant investments are also directed towards sales, marketing, and distribution to effectively reach its target consumers and manage its luxury wine portfolio. General and administrative costs support the overall strategic and operational functions of the business.

| Cost Category | Key Components | 2023 Relevance/2024 Focus |

|---|---|---|

| Grape Sourcing & Vineyard Operations | Estate vineyard management, third-party grape acquisition | Critical for quality; continued investment in premium sourcing for 2024. |

| Production & Winemaking | Processing, fermentation, aging, bottling, packaging, barrel costs | Cost of Goods Sold was $224.6 million in 2023, reflecting these substantial expenses. |

| Sales, Marketing & Brand Building | Advertising, PR, digital marketing, events | Continued emphasis in 2024 to drive demand in the premium segment. |

| Distribution & Logistics | Freight, warehousing, distributor management, international shipping | Industry logistics costs saw increases in 2023 due to fuel and labor; critical for market access. |

| General & Administrative (G&A) | Executive salaries, legal, IT, accounting | Typically 5-15% of revenue in the wine industry; focus on compliance and governance in 2024. |

Revenue Streams

Wholesale wine sales form the bedrock of The Duckhorn Portfolio's revenue. This channel involves selling their extensive range of wines to a broad network of distributors throughout the United States.

These distributors act as intermediaries, channeling the wines to various on-premise locations like restaurants and bars, as well as off-premise retailers such as wine shops and supermarkets. This wholesale model is the dominant contributor to both the company's sales volume and overall net sales.

For instance, in the fiscal year 2023, wholesale sales accounted for a significant majority of The Duckhorn Portfolio's net sales, underscoring its critical role in the business model.

Duckhorn Portfolio's direct-to-consumer (DTC) channel is a significant revenue driver, capturing sales directly through its e-commerce websites and exclusive wine clubs. This approach bypasses traditional distribution networks, allowing for potentially higher profit margins on each bottle sold. For instance, in the first quarter of fiscal year 2024, DTC sales represented a substantial portion of their overall revenue, demonstrating the channel's importance in their business model.

The Duckhorn Portfolio generates revenue through international export sales, reaching consumers across five continents. This global reach diversifies their market presence, reducing reliance on any single region and capitalizing on the increasing worldwide appetite for premium American wines.

Sales from Core and Strategic Brands

The Duckhorn Portfolio's revenue is heavily concentrated in its core and strategic brands, which are the primary drivers of its financial performance. These key brands are the engine for growth and represent the vast majority of the company's sales, underscoring a focused approach to market penetration and brand equity.

- Dominant Brands: Duckhorn Vineyards, Decoy, Kosta Browne, and Sonoma-Cutrer form the bedrock of the company's sales, complemented by other significant contributors like Goldeneye, Calera, and Greenwing.

- Revenue Contribution: These strategically important brands collectively account for an impressive 96% of The Duckhorn Portfolio's total net sales, highlighting their critical role in the business model.

- Growth Focus: The company's strategic emphasis on these high-potential brands is designed to maximize revenue generation and capitalize on their established market presence and expansion opportunities.

Revenue Growth from Acquisitions

Strategic acquisitions are a key driver of revenue expansion for The Duckhorn Portfolio. By integrating established luxury wine brands, the company broadens its market reach and increases overall sales volume. For instance, the acquisition of Sonoma-Cutrer Vineyards brought a well-respected brand into the portfolio, immediately contributing to top-line growth and enhancing market share in premium wine segments.

This inorganic growth strategy diversifies the company's product offerings and taps into new consumer bases. Acquisitions allow Duckhorn to enter or strengthen its presence in specific varietals or geographic regions, thereby capturing additional revenue streams. This approach is crucial for maintaining a competitive edge and achieving sustained financial performance in the dynamic wine industry.

- Acquisition Impact: Acquisitions like Sonoma-Cutrer directly add sales volumes and established brand equity.

- Market Share Expansion: These moves increase The Duckhorn Portfolio's overall footprint in the luxury wine market.

- Product Diversification: New brands broaden the company's portfolio, appealing to a wider range of consumers.

- Inorganic Growth: This strategy complements organic growth by providing immediate revenue boosts and market access.

The Duckhorn Portfolio's revenue streams are primarily driven by wholesale wine sales across the United States, direct-to-consumer (DTC) channels including e-commerce and wine clubs, and international export markets. The company also leverages strategic acquisitions to expand its brand portfolio and market reach. Crucially, a significant majority of its revenue, approximately 96%, is generated by its core and strategic brands such as Duckhorn Vineyards, Decoy, Kosta Browne, and Sonoma-Cutrer.

| Revenue Stream | Description | Fiscal Year 2023 Contribution |

| Wholesale Sales | Sales to distributors, who then sell to on-premise and off-premise retailers. | Dominant contributor to net sales. |

| Direct-to-Consumer (DTC) | Sales via e-commerce and wine clubs. | Substantial portion of overall revenue (as of Q1 FY24). |

| International Exports | Sales to consumers across five continents. | Diversifies market presence. |

| Strategic Brands | Revenue generated by core brands like Duckhorn, Decoy, Kosta Browne, Sonoma-Cutrer. | Accounted for 96% of total net sales. |

| Acquisitions | Revenue from newly acquired brands, enhancing sales volume and market share. | Contributes to top-line growth and market presence. |

Business Model Canvas Data Sources

The Duckhorn Portfolio Business Model Canvas is informed by extensive market research, internal financial data, and competitive intelligence. These sources provide a robust foundation for understanding customer needs, market opportunities, and operational efficiencies.