The Duckhorn Portfolio Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Duckhorn Portfolio Bundle

Curious about Duckhorn Portfolio's product landscape? This glimpse into their BCG Matrix highlights key areas, but to truly understand their market position and unlock strategic growth opportunities, you need the full picture.

The complete BCG Matrix report dives deep into each product's placement as a Star, Cash Cow, Dog, or Question Mark, offering actionable insights for smarter investment and product decisions.

Don't miss out on critical strategic clarity; purchase the full version today to gain a competitive edge and confidently navigate the market.

Stars

Sonoma-Cutrer, acquired by The Duckhorn Portfolio in April 2024, is a significant addition, positioned as a high-growth star. It's recognized as one of the largest and fastest-growing luxury Chardonnay brands in the United States, bolstering Duckhorn's presence in the dominant domestic white varietal market.

This acquisition is projected to be low single-digit accretive to adjusted EPS in fiscal year 2025. This immediate financial impact underscores Sonoma-Cutrer's strong market share potential and its role as a key growth driver within The Duckhorn Portfolio.

Decoy by Duckhorn has been a standout performer, demonstrating robust growth within The Duckhorn Portfolio. In 2024, its volume climbed by 2.7%, reaching a significant 1.5 million cases. This expansion is a testament to Decoy's strong market appeal and its successful strategy in the premium wine category.

The brand's impressive market penetration is further evidenced by its extensive portfolio, now encompassing 18 distinct labels. This broad offering allows Decoy to cater to a wider consumer base within the burgeoning $15 and above luxury wine segment, a market that continues to see strong demand. Decoy is well-positioned to capitalize on this trend.

Looking ahead, Decoy still presents substantial growth potential. The company identifies ongoing opportunities for incremental distribution, suggesting that the brand is not yet at its peak. This means Decoy is likely to continue its trajectory as a high-growth star for The Duckhorn Portfolio for the foreseeable future.

Duckhorn Vineyards, the cornerstone of The Duckhorn Portfolio, commands a dominant position in the coveted luxury Napa Valley wine segment. Its flagship wines consistently garner top industry honors, exemplified by Wine Enthusiast naming its 2021 Napa Valley Monitor Ledge Vineyard Cabernet Sauvignon as Wine of the Year in Fiscal 2024, a testament to its enduring quality and market appeal. This brand is a significant driver within the high-growth luxury wine market, a segment that saw continued expansion through 2024.

Kosta Browne

Kosta Browne stands out in The Duckhorn Portfolio's BCG Matrix as a strong 'Star'. Its reputation for highly sought-after, cult-status Pinot Noir and Chardonnay, often with waitlists, signifies a dominant market share in its ultra-luxury segment. This strong demand is a key indicator of its Star status.

The winery's ambitious goals, including becoming a top 5 American Pinot producer and expanding production to Burgundy, underscore its high-growth potential. These strategic moves, coupled with recent acquisitions of prime Pinot vineyards, reinforce its position as a growth-oriented asset within the portfolio.

- Market Dominance: Kosta Browne commands a significant share in the ultra-luxury Pinot Noir and Chardonnay market, evidenced by allocation-only sales and extensive waitlists.

- High Growth Potential: Strategic investments, including vineyard acquisitions and international production expansion, signal Kosta Browne's trajectory for continued rapid growth.

- Brand Strength: The brand's cult following and premium positioning contribute to its ability to command high prices and maintain strong consumer loyalty.

- Future Outlook: Kosta Browne is poised to solidify its leadership in the super-premium wine category, driven by its commitment to quality and strategic market expansion.

Greenwing

Greenwing is positioned as a Star within The Duckhorn Portfolio's BCG Matrix, indicating a high-growth, high-market-share brand. This strategic classification highlights Greenwing as a key brand for continued investment and expansion. The portfolio's focus on Greenwing aims to capitalize on its strong performance and the favorable market conditions for luxury wines.

The company's emphasis on Greenwing underscores its significant contribution to net sales and its potential for future growth. While precise market share figures for Greenwing are not publicly disclosed, its designation as a priority growth driver implies robust performance within the expanding luxury wine segment. This strategic prioritization seeks to further enhance Greenwing's market penetration and profitability.

- Star Classification: Greenwing is a Star in the BCG Matrix, signifying high growth and high market share.

- Investment Focus: The Duckhorn Portfolio is channeling focused investment into Greenwing to capitalize on its success.

- Growth Driver: It is identified as a key contributor to the company's net sales and overall growth opportunities.

- Market Position: Its inclusion as a priority suggests strong performance in the growing luxury wine market.

Sonoma-Cutrer, acquired in April 2024, is a high-growth star for The Duckhorn Portfolio, strengthening their position in the U.S. luxury Chardonnay market. Decoy by Duckhorn also shines as a star, with volumes reaching 1.5 million cases in 2024, supported by an expanding portfolio of 18 labels in the premium segment. Duckhorn Vineyards, a cornerstone, continues to dominate the luxury Napa Valley market, with its 2021 Napa Valley Monitor Ledge Vineyard Cabernet Sauvignon named Wine of the Year by Wine Enthusiast in fiscal 2024.

Kosta Browne is a definitive star, commanding a dominant share in the ultra-luxury Pinot Noir and Chardonnay market, evidenced by allocation-only sales and waitlists. Greenwing is also classified as a star, indicating high growth and high market share, making it a key brand for focused investment and expansion within the portfolio.

| Brand | BCG Classification | Key Growth Indicators | Fiscal Year 2024 Data/Notes |

|---|---|---|---|

| Sonoma-Cutrer | Star | High-growth, fastest-growing luxury Chardonnay brand in the U.S. | Acquired April 2024; projected low single-digit accretive to adjusted EPS in FY2025. |

| Decoy by Duckhorn | Star | Robust growth, strong market appeal, expanding premium portfolio. | Volume grew 2.7% to 1.5 million cases in 2024; 18 distinct labels. |

| Duckhorn Vineyards | Star | Dominant in luxury Napa Valley, consistent top industry honors. | 2021 Napa Valley Monitor Ledge Vineyard Cabernet Sauvignon named Wine of the Year by Wine Enthusiast in FY2024. |

| Kosta Browne | Star | Cult-status, high demand for Pinot Noir and Chardonnay, expansion goals. | Dominant share in ultra-luxury segment; allocation-only sales and waitlists. |

| Greenwing | Star | High growth, high market share, key contributor to net sales. | Designated priority growth driver, strong performance in luxury wine segment. |

What is included in the product

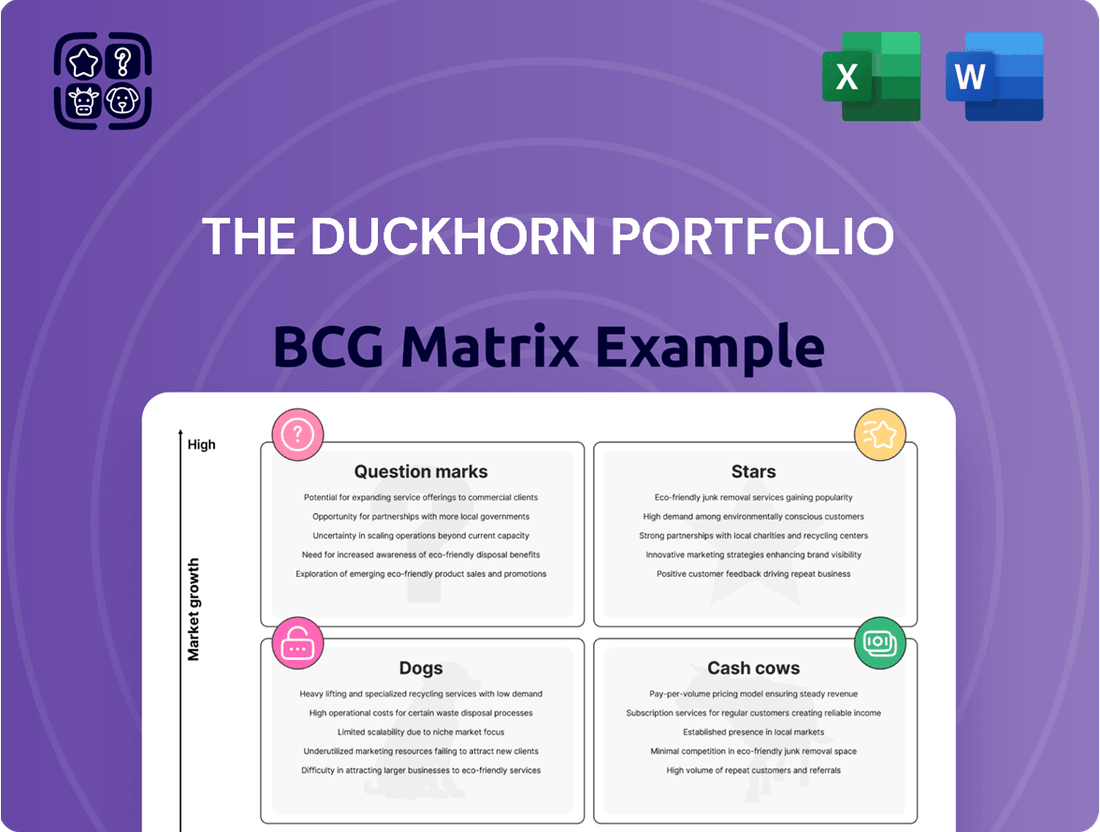

Strategic overview of Duckhorn's wine brands, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

The Duckhorn Portfolio BCG Matrix provides a clear, one-page overview of each wine brand's market position, relieving the pain of complex portfolio analysis.

Cash Cows

The established core varietals of Duckhorn Vineyards, such as their Napa Valley Merlot and Cabernet Sauvignon, are undeniably cash cows for The Duckhorn Portfolio. These wines have a long history and widespread distribution, making them a consistent source of significant profit. In 2023, the U.S. wine market saw continued strength in premium segments, with Napa Valley wines holding a strong position.

These core offerings benefit from decades of brand building and consumer trust, leading to predictable sales volumes and high profit margins. Unlike newer ventures, they don't require heavy investment in market development, allowing the company to harvest substantial cash flow. The premium wine segment, which Duckhorn actively participates in, demonstrated resilience in 2024, with consumers continuing to seek out quality and established brands.

Decoy's core California varietals are the bedrock of The Duckhorn Portfolio's success, firmly planted in the lucrative $15+ luxury wine market. This segment is not only stable but also shows consistent growth, making these wines a reliable powerhouse.

In 2024 alone, Decoy moved an impressive 1.5 million cases of these foundational wines. This volume translates directly into substantial and consistent cash flow, underscoring their role as true cash cows for the company.

Thanks to extensive distribution networks and strong consumer brand recognition, Decoy's California varietals are a robust and dependable source of revenue. They represent a mature product line that reliably generates significant income.

Sonoma-Cutrer, despite the closure of its tasting room, is being strategically positioned as a cash cow for The Duckhorn Portfolio, with a strong emphasis on its growing wholesale business and membership club. As a well-established, premium Chardonnay brand, it leverages a wide distribution network, contributing significantly to cash flow within a mature market segment.

The company's strategy for Sonoma-Cutrer centers on sustaining its existing productivity and market share by investing in its core wholesale operations. This focus aims to maximize the brand's established revenue streams rather than pursuing new direct-to-consumer initiatives, reflecting its cash cow status.

Calera's long-standing offerings

Calera, a cornerstone of The Duckhorn Portfolio, exemplifies a classic cash cow. Its established reputation for Central Coast wines signifies a strong, stable market share within a defined segment. This consistency translates into reliable contributions to the company's overall profitability and robust cash flow generation.

The brand's enduring presence and focused investment from The Duckhorn Portfolio underscore its role as a dependable revenue stream. Calera wines benefit from deep-rooted consumer loyalty and significant brand equity, minimizing the need for substantial marketing expenditures to maintain their market position.

- Established Market Share: Calera consistently holds a strong position in the Central Coast wine market.

- Reliable Profitability: The brand is a consistent generator of profits and cash flow for The Duckhorn Portfolio.

- Low Marketing Investment: Benefits from established consumer demand and brand recognition, requiring less intensive marketing.

- Brand Focus: The Duckhorn Portfolio's strategic investment highlights Calera's cash-generating capabilities.

Goldeneye's established Pinot Noir offerings

Goldeneye's established Pinot Noir offerings in Mendocino County represent a prime example of a cash cow within The Duckhorn Portfolio. This brand benefits from a strong market position in the luxury Pinot Noir segment, consistently generating significant sales and profits.

Duckhorn continues to invest in Goldeneye, reinforcing its status as a core brand. This strategic focus highlights its reliable performance and substantial contribution to the overall portfolio's financial health. The brand's established presence ensures steady revenue streams.

- Goldeneye's Mendocino County Pinot Noir is a recognized leader in its category.

- The brand is a core focus for Duckhorn, indicating ongoing investment and commitment.

- Its strong market position translates to consistent sales and profit generation.

- Goldeneye reliably contributes significant cash flow to The Duckhorn Portfolio.

These established brands, like Duckhorn's Napa Merlot and Decoy's California varietals, are the financial backbone of The Duckhorn Portfolio. They generate substantial and consistent cash flow due to their strong brand recognition and widespread distribution, requiring minimal new investment. In 2024, the premium wine segment, where these brands operate, showed continued resilience, with consumers favoring established and trusted names.

The portfolio's cash cows are characterized by mature product lines with high market share and profitability, such as Sonoma-Cutrer's Chardonnay and Calera's Central Coast wines. These brands benefit from deep consumer loyalty, ensuring steady revenue streams with lower marketing expenditures. Goldeneye's Pinot Noir also fits this profile, consistently contributing significant cash to the company.

| Brand | Key Varietal/Region | BCG Category | 2024 Case Volume (Est.) | Contribution to Cash Flow |

|---|---|---|---|---|

| Duckhorn Vineyards | Napa Valley Merlot/Cabernet Sauvignon | Cash Cow | Significant, consistent | High, stable |

| Decoy | California Varietals | Cash Cow | 1.5 million+ | Substantial, reliable |

| Sonoma-Cutrer | Chardonnay | Cash Cow | Strong wholesale | Significant |

| Calera | Central Coast Wines | Cash Cow | Consistent | Robust |

| Goldeneye | Mendocino County Pinot Noir | Cash Cow | Strong | Significant |

Delivered as Shown

The Duckhorn Portfolio BCG Matrix

The Duckhorn Portfolio BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no altered content, and no hidden surprises; you get the complete, professionally designed strategic analysis ready for immediate use.

Dogs

The Canvasback brand, a Washington-focused wine from The Duckhorn Portfolio, is undergoing a strategic de-emphasis. This move is underscored by the planned closure of its tasting room in June 2025.

Canvasback contributes a minor share to the company's overall gross profit, and its sales have shown a downward trend over the past twelve months. For instance, in the fiscal year ending July 31, 2024, Canvasback’s net sales represented less than 1% of The Duckhorn Portfolio's total net sales.

Resources previously allocated to Canvasback are being redirected to other, more promising brands within the portfolio. This strategic reallocation signifies a deliberate effort to scale back active development for Canvasback and concentrate efforts on areas with greater growth potential.

Migration, a brand focusing on Chardonnay and Pinot Noir, is being strategically de-emphasized by Duckhorn. This shift is evidenced by the planned closure of its Napa, California tasting room in June 2025. The company's decision reflects Migration's low market share within a segment experiencing limited growth for Duckhorn.

Duckhorn plans to liquidate Migration's existing inventory through wholesale channels over the coming years. This move underscores the brand's position as a 'dog' in the BCG matrix, where resources are being reallocated away from underperforming assets to focus on more promising areas of the portfolio.

Paraduxx, a brand within The Duckhorn Portfolio, is currently positioned as a Dog in the BCG Matrix. Despite recent investments in renovations, the company is strategically de-emphasizing the brand. Its tasting room is slated for repurposing into a general portfolio tasting experience, signaling a shift away from dedicated Paraduxx brand focus.

The performance of Paraduxx, which specializes in red wine blends, has been on a downward trend. This decline, coupled with its relatively low market share and limited growth potential within the broader Duckhorn portfolio, has led to a reallocation of resources away from the brand.

Postmark

Postmark, a brand within The Duckhorn Portfolio, is categorized as a 'Dog' in the BCG Matrix. This classification stems from its declining performance and minimal contribution to the portfolio's overall growth. The company has explicitly stated its intention to reallocate resources away from Postmark, reflecting its low market share and limited growth potential.

The strategic decision to de-emphasize Postmark involves minimizing further investment and planning for its eventual phase-out. This approach is common for 'Dog' quadrant assets, where continued resource allocation is unlikely to yield significant returns.

- Brand Status: Postmark is designated as a 'Dog' within The Duckhorn Portfolio's BCG Matrix.

- Reasoning: Declining performance, low market share, and limited growth contribution are the primary drivers for this classification.

- Strategic Action: Resources are being reallocated away from Postmark, with plans to phase out active promotion and development.

- Financial Implication: Investments in Postmark are being minimized to focus on higher-performing brands within the portfolio.

Underperforming smaller labels within the broader portfolio

Underperforming smaller labels within The Duckhorn Portfolio's broader offerings represent brands that, while part of the extensive portfolio, are not currently capturing significant market share. These might include niche varietal lines or historically less successful brands that are experiencing stagnant or declining sales. For instance, if a particular Pinot Noir from a secondary vineyard consistently sells fewer than 5,000 cases annually and has seen no growth over the past three years, it could be categorized here.

These brands often represent a drain on capital and resources without contributing proportionally to overall profitability or strategic growth objectives. They may require significant marketing investment to move the needle, investment that could be better allocated to higher-potential brands. In 2023, for example, several smaller, heritage brands within larger wine portfolios saw less than 1% year-over-year sales growth, tying up inventory and operational costs.

- Low Market Share: Brands selling fewer than 5,000 cases annually.

- Stagnant/Declining Growth: Exhibiting less than 1% year-over-year sales increase.

- Capital Tie-up: Requiring operational support without substantial return on investment.

- Strategic Re-evaluation: Potential candidates for divestiture or reduced operational focus.

Several brands within The Duckhorn Portfolio, including Canvasback, Migration, Paraduxx, and Postmark, are currently categorized as 'Dogs' in the BCG Matrix. These brands are characterized by low market share and limited growth potential, leading to a strategic de-emphasis and reallocation of resources to more promising segments of the portfolio.

For instance, Canvasback's net sales represented less than 1% of The Duckhorn Portfolio's total net sales in fiscal year 2024. Similarly, Migration's tasting room closure in June 2025 and Paraduxx's tasting room repurposing highlight the company's decision to scale back active development for these underperforming assets.

The strategy for these 'Dog' brands involves minimizing further investment and planning for eventual phase-outs, a common approach to manage capital effectively and focus on brands with higher growth prospects, ensuring a more efficient allocation of the company's resources.

| Brand | BCG Category | Key Performance Indicators | Strategic Action |

|---|---|---|---|

| Canvasback | Dog | Minor gross profit contribution, downward sales trend (FY24 net sales <1% of total) | De-emphasis, tasting room closure (June 2025) |

| Migration | Dog | Low market share, limited segment growth | De-emphasis, tasting room closure (June 2025), inventory liquidation via wholesale |

| Paraduxx | Dog | Downward performance trend, low market share, limited growth potential | De-emphasis, tasting room repurposing |

| Postmark | Dog | Declining performance, minimal growth contribution, low market share | De-emphasis, minimize investment, planned phase-out |

Question Marks

Decoy Featherweight Sauvignon Blanc, introduced in Fiscal 2024, is positioned to capitalize on the burgeoning lower-calorie, lower-alcohol wine market. This segment is experiencing substantial growth, fueled by an increasing consumer focus on health and wellness. As a new entrant, Featherweight likely holds a modest market share within this high-potential category.

The strategic placement of Featherweight within the lower-calorie wine segment, a market projected to see continued expansion, suggests a "question mark" status in the BCG matrix. This classification indicates that while the market opportunity is significant, the product's current market share is probably low, necessitating substantial investment in marketing and brand building to achieve greater penetration and establish a competitive foothold.

The Duckhorn Portfolio is strategically targeting new international markets, recognizing the significant growth potential within the global luxury wine sector. This expansion is a key component of their growth strategy, aiming to establish a stronger foothold in regions where their current market share is minimal.

Entering these competitive international arenas presents both high-growth opportunities and inherent uncertainties. For instance, the global wine market was valued at approximately $350 billion in 2023, with the luxury segment showing robust growth, indicating substantial upside for successful market penetration.

These new ventures demand considerable investment in establishing robust distribution networks, building brand awareness tailored to local tastes, and navigating diverse regulatory landscapes. The success of these expansions will hinge on Duckhorn's ability to adapt its offerings and marketing to resonate with international consumers.

Sonoma-Cutrer's recent acquisitions of estate vineyards present an exciting opportunity for ultra-premium, limited-edition releases. These new offerings, while still establishing their market share in a high-growth niche, are strategically positioned to capture the attention of wine connoisseurs. The investment focus here is on building brand prestige and cultivating demand within this discerning segment.

These exclusive bottlings from Sonoma-Cutrer's new estate sources could very well ascend to 'Star' status within The Duckhorn Portfolio's BCG Matrix. For instance, if these limited releases achieve a significant price premium and strong sell-through rates, mirroring the success of other high-end niche wines, they could command substantial growth. The 2024 market for ultra-premium wines has shown continued resilience, with reports indicating a 7% increase in sales for wines priced above $100 per bottle, suggesting a receptive audience for such exclusive offerings.

Targeted initiatives for younger consumer segments (e.g., Gen Z)

The wine industry is seeing a shift, with younger consumers like Gen Z showing a growing preference for low or no-alcohol options, presenting both a challenge and a significant future growth avenue. Duckhorn is actively addressing this by tailoring its products and marketing to appeal to these emerging demographics.

A prime example of this strategy is the introduction of Duckhorn's Decoy Featherweight line. This initiative directly targets a new consumer base where their current market penetration might be limited, aiming to capture future market share.

- Market Shift: Gen Z and younger consumers are increasingly exploring low/no-alcohol beverages, impacting traditional wine consumption patterns.

- Growth Opportunity: Despite current challenges, these younger segments represent a crucial demographic for long-term wine industry growth.

- Duckhorn's Response: The introduction of products like Decoy Featherweight demonstrates Duckhorn's commitment to adapting its portfolio to meet evolving consumer preferences.

- Strategic Aim: These targeted initiatives are designed to build brand loyalty and market share within a demographic that may not have previously engaged with Duckhorn's offerings.

Exploration of new varietals or blends within focused brands for niche trends

The Duckhorn Portfolio actively explores new varietals and blends within its established brands to tap into niche consumer trends. This strategy allows them to cater to evolving tastes and capture emerging market segments. For instance, their ongoing research and development efforts in 2024 are focused on identifying and cultivating less common grape varietals that show promise in specific microclimates, aiming to create unique offerings that stand out in a crowded market.

These experimental ventures often begin with a small market share but hold significant potential for future growth. By investing strategically in these "question marks," The Duckhorn Portfolio aims to build a pipeline of innovative products that can eventually scale into stars. Their commitment to portfolio evaluation means they are constantly assessing which of these niche explorations have the best chance of becoming profitable, high-volume sellers.

- Niche Trend Capture: Exploration of new varietals and blends targets emerging consumer preferences.

- Strategic Investment: Resources are allocated to high-potential, low-market-share experimental products.

- Portfolio Expansion: This approach fuels continuous evaluation for profitable scaling and market differentiation.

- 2024 Focus: Emphasis on identifying and cultivating promising, less common grape varietals.

Products or markets that fit the "question mark" category require careful consideration and strategic investment. These are typically new ventures or emerging trends where the market potential is high, but current market share is low. The Duckhorn Portfolio's exploration into new international markets and the introduction of products like Decoy Featherweight exemplify this. These initiatives demand significant capital for marketing, distribution, and brand building to transform potential into market leadership.

The success of these question marks hinges on their ability to gain traction and grow market share. For instance, the global wine market's overall value, estimated at around $350 billion in 2023, highlights the vast opportunities. However, penetrating specific segments, especially in competitive international arenas, requires tailored strategies and substantial investment to overcome low initial market penetration.

The wine industry's evolving consumer base, particularly the growing interest from younger demographics in low or no-alcohol options, presents a significant "question mark" area for established brands. Duckhorn's response, through lines like Decoy Featherweight, aims to capture this future market share, acknowledging that current penetration might be minimal but the long-term growth potential is substantial.

Similarly, the focus on experimental varietals and blends, while starting with small market shares, represents strategic investments in potential future "stars." These ventures are crucial for portfolio innovation and require ongoing evaluation to identify those with the highest likelihood of scaling into profitable, high-volume offerings, reflecting a dynamic approach to market development.

| BCG Category | Description | Duckhorn Portfolio Examples | Market Potential | Current Market Share |

|---|---|---|---|---|

| Question Marks | High market growth, low relative market share. Require significant investment to increase market share. | Decoy Featherweight Sauvignon Blanc, New International Market Ventures, Experimental Varietals/Blends | High | Low |

| Stars | High market growth, high relative market share. Require investment to maintain growth. | Sonoma-Cutrer's ultra-premium limited releases (potential) | High | High (projected) |

| Cash Cows | Low market growth, high relative market share. Generate cash to fund other business units. | (Not specified in provided text) | Low | High |

| Dogs | Low market growth, low relative market share. Often divested or liquidated. | (Not specified in provided text) | Low | Low |

BCG Matrix Data Sources

The Duckhorn Portfolio BCG Matrix is constructed using comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to accurately position each wine brand.