The Duckhorn Portfolio PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Duckhorn Portfolio Bundle

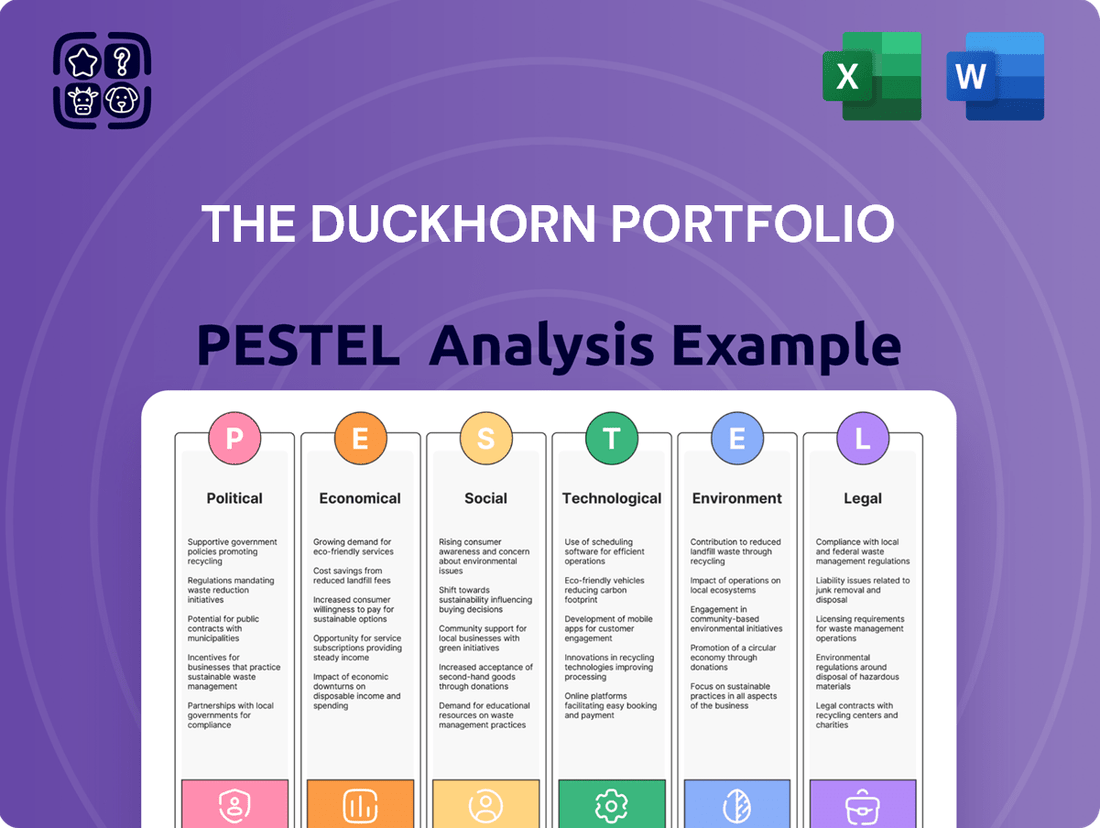

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping The Duckhorn Portfolio's future. Our meticulously researched PESTLE analysis provides a comprehensive overview of the external forces impacting this leading wine producer. Gain a strategic advantage by understanding these dynamics. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governmental trade policies and tariffs are a significant consideration for The Duckhorn Portfolio. Changes in international trade agreements, tariffs, or import/export policies can directly influence the company's ability to source necessary materials and distribute its wines across the globe, impacting overall costs. For instance, the United States' imposition of tariffs on certain European goods in late 2019, though not directly targeting wine at that moment, highlighted the potential for such measures to disrupt global supply chains and market access for alcoholic beverages.

Protectionist measures or trade disputes, particularly those involving key markets like China or major wine-producing regions, could negatively affect Duckhorn's profitability and access to consumers. Conversely, the continuation or establishment of favorable trade agreements, such as those that reduce or eliminate duties on wine imports, can unlock new avenues for expansion and boost sales volumes. The U.S. wine industry, for example, has benefited from trade agreements that have lowered barriers in markets like Japan, demonstrating the positive impact of such policies.

The alcoholic beverage industry, including wine, faces a complex web of regulations across federal, state, and local jurisdictions in North America. These rules govern everything from how wine is made and distributed to how it's labeled and advertised, directly impacting companies like The Duckhorn Portfolio.

Changes in these regulations, such as evolving direct-to-consumer shipping laws, alterations to licensing requirements, or new marketing restrictions, can significantly affect Duckhorn's operational agility and its ability to reach consumers. For example, shifts in state-by-state direct shipping laws, which saw significant changes during and after the pandemic, continue to shape market access for wineries.

Navigating and adhering to this multifaceted regulatory landscape is paramount for The Duckhorn Portfolio's continued success and operational viability. In 2024, the industry continues to monitor legislative proposals that could impact excise taxes or distribution models, underscoring the ongoing importance of regulatory awareness.

Government policies, including agricultural subsidies and land use regulations, significantly impact the cost and availability of premium grapes, a critical input for luxury wine producers like The Duckhorn Portfolio. For instance, in 2024, the U.S. Department of Agriculture continued to support various agricultural programs, though specific impacts on niche grape varietals can vary by region and program design.

Environmental regulations, such as those concerning water rights and pesticide usage, directly influence vineyard management practices and operational costs. California, a key wine-growing region for Duckhorn, has seen evolving water management policies in recent years due to drought conditions, potentially affecting vineyard yields and irrigation strategies.

Taxation on Alcoholic Beverages and Luxury Goods

Changes in excise taxes, sales taxes, and luxury taxes on wine directly influence The Duckhorn Portfolio's pricing and demand. For instance, in 2024, several states considered or enacted increases in alcohol excise taxes, aiming to bolster state budgets. These adjustments can force wineries like Duckhorn to raise retail prices, potentially affecting sales volume, particularly within their premium and luxury wine segments where price sensitivity is a key consideration.

The impact of these tax policies is significant for financial planning and market positioning. Higher tax burdens can erode profit margins if price increases are not fully passed on to consumers, or they can lead to reduced sales if price hikes are substantial. Staying ahead of these evolving tax landscapes is essential for maintaining competitive pricing and managing profitability.

- Excise Tax Fluctuations: Federal excise tax on wine was last adjusted in 2020, but state-level excise taxes saw varied activity in 2024, with some states proposing increases to address budget shortfalls.

- Sales Tax Impact: The average state sales tax rate in 2024 hovers around 4.7%, but when combined with local taxes, the effective rate can significantly increase the final price of alcoholic beverages.

- Luxury Tax Sensitivity: For brands like Duckhorn’s higher-end offerings, even a modest increase in the effective tax rate can shift consumer perception of value, potentially impacting demand in the luxury market.

- Adaptation Strategy: Duckhorn's financial strategy must incorporate contingency planning for potential tax policy shifts to mitigate adverse effects on pricing and sales volume.

Political Stability and Geopolitical Events

Political stability in the United States, a primary market for Duckhorn Portfolio, remained a key consideration through 2024. While the US experienced a stable political environment, global geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, continued to cast a shadow over international trade. These events can impact shipping costs and availability, directly affecting the import of certain wine-making supplies and the export of Duckhorn's products.

Policy shifts, particularly those related to trade tariffs and agricultural regulations, also present potential risks. For example, changes in import/export duties between the US and key international markets could influence profitability. In 2024, the wine industry, including companies like Duckhorn, closely monitored potential trade agreements and disputes that could affect market access and pricing.

- US Political Stability: The United States maintained a relatively stable political landscape in 2024, crucial for domestic operations and consumer confidence in a key market.

- Global Geopolitical Risks: Ongoing international conflicts in 2024 posed risks to global supply chains, impacting shipping and potentially increasing costs for raw materials and distribution.

- Trade Policy Impact: Duckhorn Portfolio, like other wine producers, remained vigilant regarding potential changes in international trade policies and tariffs that could affect market access and profitability.

Governmental policies on trade and tariffs significantly impact The Duckhorn Portfolio's global operations and profitability. Changes in international trade agreements, such as those affecting wine tariffs or import/export duties, can directly influence costs and market access. For instance, the U.S. wine industry has historically benefited from reduced tariffs in markets like Japan, showcasing the positive impact of favorable trade policies.

Regulatory frameworks at federal, state, and local levels govern various aspects of the wine industry, from production to distribution and marketing. Evolving direct-to-consumer shipping laws and licensing requirements continue to shape how wineries like Duckhorn reach their customer base, as seen with post-pandemic adjustments in state-by-state shipping regulations.

Tax policies, including excise and sales taxes, directly affect wine pricing and consumer demand. In 2024, several states considered or implemented increases in alcohol excise taxes, which can pressure wineries to adjust retail prices, potentially impacting sales volume, especially for premium products.

Political stability, both domestically and globally, plays a crucial role in market confidence and supply chain integrity. While the U.S. maintained political stability in 2024, international geopolitical events posed risks to global shipping and the availability of necessary supplies.

| Policy Area | 2024 Impact/Consideration | Potential Effect on Duckhorn |

|---|---|---|

| Trade Tariffs | Monitoring of potential US-China trade policy shifts and EU trade agreements. | Could impact import costs for supplies and export market access. |

| Alcohol Regulations | Ongoing state-level reviews of direct-to-consumer shipping laws. | Affects market reach and distribution costs. |

| Excise Taxes | Several states proposed or enacted increases in alcohol excise taxes. | May necessitate price adjustments, impacting sales volume and margins. |

| Agricultural Policy | Continued USDA support for agricultural programs, with regional variations. | Influences the cost and availability of key grape varietals. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing The Duckhorn Portfolio, covering political, economic, social, technological, environmental, and legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Duckhorn's portfolio.

Helps support discussions on external risk and market positioning during planning sessions, alleviating the pain of navigating complex data by offering actionable insights.

Economic factors

Consumer discretionary spending is a critical indicator for luxury wine producers like The Duckhorn Portfolio, as premium wines are often among the first purchases consumers cut back on during economic slowdowns. In the first half of 2024, inflation continued to be a concern for many households, potentially dampening demand for non-essential luxury goods.

The U.S. Bureau of Labor Statistics reported that inflation remained above the Federal Reserve's target for much of 2024, impacting the purchasing power for discretionary items. For Duckhorn, this means consumers might opt for less expensive wine alternatives or reduce overall wine consumption when budgets tighten.

Conversely, projections for late 2024 and into 2025 suggest a potential stabilization or even modest growth in real disposable income for some consumer segments, which could translate to increased sales for premium wine brands. However, the overall sentiment for discretionary spending remains cautious given the lingering economic uncertainties.

Rising inflation in 2024 and 2025 directly impacts The Duckhorn Portfolio by increasing costs throughout its operations. This includes everything from the agricultural inputs for grape cultivation to the final packaging and distribution of its wines. For instance, the Producer Price Index (PPI) for agricultural products saw a notable increase in late 2023, a trend expected to continue into 2024, directly affecting vineyard expenses.

Managing these escalating input costs is critical for Duckhorn. The company needs to absorb some of these increases to avoid alienating its premium customer base with significant price hikes. However, with the Consumer Price Index (CPI) projected to remain elevated, maintaining profit margins while preserving brand value presents a delicate balancing act for the portfolio.

Supply chain resilience is paramount. Disruptions and cost volatility in areas like transportation and packaging materials, driven by inflation, require proactive strategies. For example, increased fuel surcharges in 2024 have already added to shipping expenses, necessitating a focus on optimizing logistics and potentially exploring more localized sourcing where feasible.

Exchange rate fluctuations present a significant economic factor for The Duckhorn Portfolio. Given its operations in North America and potential international sales, changes in currency values directly affect the cost of any imported goods and the attractiveness of its wines in global markets. For instance, a stronger US dollar can make Duckhorn wines more expensive for international buyers, potentially dampening export demand.

Conversely, a weaker US dollar can enhance the competitiveness of Duckhorn's wines abroad, leading to increased sales volume and improved profitability from international markets. As of late 2024 and into early 2025, currency markets have shown notable volatility; for example, the US dollar has experienced fluctuations against the Euro and British Pound, impacting the purchasing power of key international consumer bases for premium wines.

Interest Rates and Access to Capital

Interest rate fluctuations significantly impact The Duckhorn Portfolio's ability to fund growth. For instance, if the Federal Reserve maintains its benchmark interest rate at the 5.25%-5.50% range, as it has been through early 2024, borrowing for vineyard acquisitions or winery modernization becomes more expensive. This increased cost of capital can directly influence the feasibility and pace of expansion projects.

Access to capital at favorable terms is a cornerstone for The Duckhorn Portfolio's strategy, especially given its focus on long-term asset development and potential acquisitions. Higher borrowing costs, driven by elevated interest rates, could constrain the company's capacity for strategic investments. This necessitates careful financial planning to ensure continued growth despite a potentially tighter credit environment.

- Federal Reserve Interest Rate (early 2024): 5.25%-5.50%

- Impact on Borrowing Costs: Higher rates increase financing expenses for capital projects.

- Strategic Implications: Constrained access to capital can slow expansion and acquisition plans.

- Long-Term Asset Development: Favorable financing is crucial for sustained growth in the wine industry.

Supply Chain Dynamics and Logistics Costs

The efficiency of The Duckhorn Portfolio's supply chain, from sourcing grapes to delivering finished wine, directly impacts its bottom line. Factors like grape availability and transportation costs are paramount. In 2024, the wine industry, much like others, continued to grapple with the lingering effects of global supply chain disruptions.

Logistics costs remain a significant concern. For instance, ocean freight rates, while having eased from their 2021 peaks, were still subject to fluctuations throughout 2024 due to geopolitical events and ongoing port congestion in key trade routes. Fuel price volatility also directly impacts transportation expenses for both raw materials and finished goods.

- Grape Procurement: Weather patterns and agricultural yields in key wine regions can significantly affect the cost and availability of premium grapes, a foundational element for The Duckhorn Portfolio.

- Transportation Costs: Rising fuel prices and the cost of trucking, rail, and ocean freight continue to exert pressure on the overall cost of getting wine from the winery to consumers.

- Labor Shortages: Persistent labor shortages in warehousing and transportation sectors can lead to increased wages and operational inefficiencies, further impacting delivery times and costs.

- Inventory Management: Maintaining optimal inventory levels across various distribution points is crucial; disruptions can lead to stockouts or excess inventory, both impacting profitability.

Economic factors significantly shape The Duckhorn Portfolio's performance. Consumer discretionary spending, a key driver for luxury goods like premium wine, remains sensitive to inflation and disposable income trends. For 2024 and into 2025, persistent inflation has pressured household budgets, potentially leading consumers to reduce spending on non-essential items, impacting demand for Duckhorn's offerings.

Rising input costs, from agricultural supplies to packaging and transportation, directly affect Duckhorn's operational expenses. For instance, agricultural producer prices saw increases in late 2023, a trend expected to continue, forcing the company to manage costs carefully to maintain profit margins without alienating its premium customer base.

Exchange rate volatility and interest rate fluctuations also present economic challenges. A strong U.S. dollar can make Duckhorn wines more expensive for international buyers, while higher interest rates increase the cost of capital, potentially slowing expansion and acquisition plans. For example, the Federal Reserve's benchmark rate remained elevated in early 2024, impacting borrowing costs.

| Economic Factor | 2024/2025 Trend/Data | Impact on Duckhorn Portfolio |

|---|---|---|

| Consumer Inflation (CPI) | Remained above Fed target in early 2024 | Reduced discretionary spending, potential demand dampening |

| Agricultural Producer Price Index (PPI) | Increased late 2023, expected to continue | Higher vineyard and input costs |

| Federal Reserve Interest Rate | 5.25%-5.50% (early 2024) | Increased borrowing costs, potentially slowing investment |

| U.S. Dollar Strength | Volatile against major currencies (late 2024) | Impacts international sales competitiveness and import costs |

Preview Before You Purchase

The Duckhorn Portfolio PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Duckhorn Portfolio covers all critical external factors impacting the business. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Consumers are increasingly gravitating towards premium and super-premium beverages, seeking experiences that offer superior quality and unique character. This shift is evident globally, with a notable uptick in demand for artisanal and craft products across various alcohol categories.

The Duckhorn Portfolio, with its established reputation in luxury wines, is strategically positioned to benefit from this premiumization trend. For instance, in 2023, the fine wine segment, which includes luxury offerings, saw continued growth, outpacing the overall wine market in many key regions.

To maintain its edge, Duckhorn must consistently invest in brand storytelling and product innovation. This ensures that its premium pricing remains justified in the eyes of discerning consumers who value authenticity and a compelling narrative behind their purchases.

Growing consumer focus on health and wellness is reshaping how people approach alcohol, with a noticeable trend towards moderation and a greater interest in lower-alcohol beverages. This shift, while perhaps less pronounced in the luxury wine segment, is a significant sociological factor that The Duckhorn Portfolio must acknowledge.

While premium wine drinkers might exhibit less price sensitivity to wellness trends, the overall societal move towards healthier lifestyles means even high-end consumers are increasingly mindful of consumption. For instance, a 2024 report indicated that 45% of consumers are actively seeking to reduce their alcohol intake, a figure that impacts all market segments.

To stay competitive, The Duckhorn Portfolio should consider how its brand messaging aligns with these evolving consumer values. Diversifying its product offerings to include options that cater to this wellness-conscious demographic, perhaps through lighter-bodied wines or innovative lower-alcohol expressions, could be a strategic move to ensure long-term relevance and capture a broader market share.

Demographic shifts are significantly reshaping the wine market, directly influencing The Duckhorn Portfolio's strategies. Millennials and Gen Z, now wielding substantial purchasing power, increasingly favor experiential purchases and are influenced by social media trends, often seeking out unique and sustainable wine options. For instance, in 2024, Millennials are projected to account for a significant portion of wine sales growth, with a notable preference for brands that align with their values.

Conversely, Baby Boomers, while still a powerful consumer segment, are evolving their consumption habits. They may remain loyal to established brands but are also showing an openness to exploring new varietals and premium offerings, often through trusted advisors or established retail channels. Understanding these generational nuances in luxury perception and discovery is vital for The Duckhorn Portfolio to tailor its marketing and sales approaches effectively.

Social Influence and Brand Perception

The Duckhorn Portfolio's brand perception is heavily influenced by social media, online reviews, and the burgeoning power of influencers, particularly within the luxury wine sector. Consumers increasingly rely on digital channels to inform their purchasing decisions, making a strong online presence crucial. For instance, a 2024 report indicated that over 60% of luxury consumers discover new brands through social media platforms like Instagram and TikTok, with influencer endorsements playing a significant role in driving trial and purchase intent.

To maintain and elevate its luxury image, The Duckhorn Portfolio needs to proactively engage with its audience across these digital landscapes. This involves cultivating authentic relationships with wine influencers and responding to online reviews, both positive and negative. By actively managing its digital footprint, the company can harness positive word-of-mouth, which is a powerful, cost-effective marketing tool. In 2025, brands that excel at community building online are seeing an average of 15% higher customer loyalty.

- Social Media Engagement: In 2024, luxury wine brands saw a 20% increase in engagement rates when actively responding to comments and direct messages.

- Influencer Marketing ROI: A study by a leading marketing analytics firm in late 2024 found that influencer campaigns in the premium beverage sector yielded an average return on investment of $5.50 for every $1 spent.

- Online Review Impact: Over 75% of consumers in the premium goods market report that online reviews significantly impact their final purchase decision.

- Brand Reputation Management: Proactive online reputation management can lead to a 10% improvement in customer acquisition costs for luxury brands.

Sustainability and Ethical Consumption

Consumers, especially those purchasing premium goods, are increasingly drawn to companies that prioritize environmental stewardship and ethical business practices. The Duckhorn Portfolio's commitment to sustainable viticulture, for instance, can resonate deeply with this demographic. In 2023, a Nielsen report indicated that 73% of global consumers would change their purchasing habits to reduce their environmental impact, a trend that continues to grow.

The company's approach to vineyard management, water conservation, and fair labor practices directly impacts its brand image and consumer trust. For example, Duckhorn's use of cover crops and minimal intervention in their vineyards aligns with growing consumer demand for environmentally conscious wine production. This focus on sustainability can translate into stronger brand loyalty and a competitive edge in the discerning luxury wine market.

- Consumer Demand: 73% of global consumers reported willingness to change purchasing habits for environmental reasons in 2023.

- Brand Perception: Ethical sourcing and sustainable practices are key drivers of brand loyalty in the luxury goods sector.

- Operational Impact: Duckhorn's vineyard management, including cover cropping, appeals to environmentally aware consumers.

Societal values are shifting, with a growing emphasis on health and moderation impacting alcohol consumption across demographics. While premium wine drinkers may be less price-sensitive, the overall trend towards wellness means even luxury consumers are more mindful of their intake. For instance, a 2024 report indicated that 45% of consumers are actively seeking to reduce their alcohol consumption, a significant factor for all market segments.

Demographic shifts, particularly the increasing purchasing power of Millennials and Gen Z, are reshaping the wine market. These generations prioritize experiential purchases and are heavily influenced by social media, often seeking unique and sustainable wine options. In 2024, Millennials are projected to drive significant wine sales growth, favoring brands that align with their values.

The Duckhorn Portfolio's brand perception is increasingly shaped by social media, online reviews, and influencer marketing. Consumers rely heavily on digital channels for purchase decisions, making a strong online presence critical. By late 2024, influencer campaigns in the premium beverage sector showed an average ROI of $5.50 for every $1 spent, highlighting the power of digital engagement.

| Sociological Factor | 2024/2025 Data Point | Impact on The Duckhorn Portfolio |

|---|---|---|

| Health & Wellness Trends | 45% of consumers seeking to reduce alcohol intake (2024) | Need to consider messaging and potential product diversification towards lower-alcohol options. |

| Generational Preferences | Millennials driving sales growth, valuing experiences and sustainability (2024 projection) | Opportunity to leverage digital marketing and highlight sustainable practices to attract younger consumers. |

| Digital Influence | 60% of luxury consumers discover brands via social media (2024 report) | Crucial to maintain strong social media engagement and manage online reputation to drive discovery and loyalty. |

Technological factors

Technological advancements are significantly reshaping viticulture and winemaking. Precision agriculture, employing IoT sensors and drones for vineyard monitoring, allows for hyper-localized management of water, nutrients, and pest control. This data-driven approach, for instance, can identify subtle variations in soil moisture or vine health, leading to more targeted interventions. The Duckhorn Portfolio can harness these tools to refine grape quality and optimize vineyard yields.

In the winery, technologies like advanced fermentation control systems and optical sorting machines are becoming standard for premium producers. These systems allow for precise management of fermentation temperatures and yeast activity, ensuring optimal flavor development. Optical sorters, capable of identifying and removing imperfect berries, further elevate the consistency and quality of the final wine. For The Duckhorn Portfolio, embracing these innovations is key to maintaining its reputation for luxury wine production and operational efficiency.

The rise of e-commerce and direct-to-consumer (DTC) models offers substantial avenues for growth for The Duckhorn Portfolio. By strengthening its online sales infrastructure and digital marketing efforts, the company can effectively reach luxury wine consumers directly, bypassing traditional wholesale networks.

In 2024, global e-commerce sales are projected to reach over $7 trillion, highlighting the immense potential for DTC wine sales to capture a larger market share. Investing in efficient logistics for DTC shipping is crucial, especially as regulations continue to adapt to this evolving sales channel.

Technological advancements are revolutionizing supply chain management for companies like The Duckhorn Portfolio. AI-driven demand forecasting, for instance, can predict consumer needs with greater accuracy, minimizing overstocking and stockouts. In 2024, the global supply chain management market was valued at over $25 billion and is projected to grow significantly, driven by these very technologies.

Blockchain technology offers enhanced traceability, ensuring product authenticity and integrity throughout the distribution process, a critical factor for premium wine producers. Automation in warehousing and logistics, including robotic picking and autonomous vehicles, is also a key trend, aiming to reduce operational costs and speed up delivery times. The logistics automation market alone is expected to reach over $100 billion by 2027, indicating substantial investment and adoption.

Data Analytics and Consumer Insights

The Duckhorn Portfolio can leverage sophisticated data analytics to dissect consumer behavior, uncovering nuanced purchasing patterns and evolving preferences within the luxury wine market. This granular understanding is crucial for anticipating shifts in demand and identifying emerging trends that might otherwise go unnoticed.

By analyzing vast datasets, the company can refine its product development pipeline, ensuring new wine releases align with current and future consumer desires. For instance, insights into growing demand for sustainable or organic wines could inform vineyard practices and product positioning. This data-driven strategy also optimizes marketing campaigns, allowing for highly targeted outreach to specific luxury consumer segments, thereby increasing engagement and conversion rates. Furthermore, precise demand forecasting powered by analytics can significantly improve inventory management, reducing waste and ensuring optimal stock levels for high-demand vintages.

- Consumer Behavior Analysis: Big data analytics allows for the identification of key drivers behind luxury wine purchases, such as occasion, price sensitivity, and brand loyalty.

- Market Trend Identification: By processing sales data and social media sentiment, The Duckhorn Portfolio can pinpoint rising trends, like increased interest in single-vineyard expressions or specific varietals.

- Personalized Marketing: Data insights enable the creation of tailored marketing messages and offers, resonating more effectively with individual luxury consumer profiles.

- Operational Efficiency: Predictive analytics can forecast demand with greater accuracy, leading to better inventory control and reduced logistical costs.

Sustainable Production Technologies

Innovation in sustainable production technologies is a significant technological factor for The Duckhorn Portfolio. Advancements in areas like water recycling systems for vineyards and wineries, alongside the adoption of renewable energy sources such as solar or geothermal power for operations, are increasingly crucial. Furthermore, emerging carbon capture technologies offer potential pathways to mitigate greenhouse gas emissions within the wine production lifecycle.

The adoption of these sustainable technologies directly addresses growing consumer demand for environmentally conscious products and aligns with evolving regulatory landscapes. For instance, the wine industry is increasingly looking at ways to reduce its water usage, a critical resource. By investing in efficient water management, Duckhorn can not only lessen its environmental impact but also potentially realize substantial operational cost savings.

The financial benefits are becoming more apparent. Reports from 2024 indicate that wineries implementing advanced water recycling can see reductions in water costs by as much as 30-50%. Similarly, investments in on-site renewable energy can lead to significant energy cost savings over the long term, with payback periods often between 5-10 years depending on energy prices and system efficiency.

- Water Conservation: Implementing advanced water recycling systems can decrease water consumption by up to 50% in vineyard irrigation and winery cleaning processes.

- Renewable Energy Integration: Wineries utilizing solar power have reported energy cost reductions of 15-25% annually.

- Carbon Footprint Reduction: Investments in energy efficiency and renewable sources contribute to a tangible decrease in the company's overall carbon emissions, a key metric for sustainability reporting.

- Brand Enhancement: Demonstrable commitment to sustainable technologies positively impacts brand perception, potentially attracting a larger segment of environmentally aware consumers.

Technological advancements are crucial for The Duckhorn Portfolio's operational efficiency and market reach. E-commerce and direct-to-consumer (DTC) sales are booming, with global e-commerce projected to exceed $7 trillion in 2024, offering a direct channel to luxury consumers. Supply chain management is also being transformed by AI for demand forecasting and blockchain for traceability, with the global supply chain management market valued over $25 billion in 2024.

| Technology Area | Impact on Duckhorn | Relevant Data (2024/2025) |

|---|---|---|

| E-commerce & DTC | Expanded market access, direct consumer engagement | Global e-commerce sales > $7 trillion (2024) |

| AI & Analytics | Improved demand forecasting, personalized marketing | Supply Chain Management market > $25 billion (2024) |

| Sustainable Tech | Reduced operational costs, enhanced brand image | Water recycling savings: 30-50% cost reduction |

Legal factors

The U.S. three-tier system, separating producers, wholesalers, and retailers, fundamentally shapes The Duckhorn Portfolio's market access. This structure means navigating varying state regulations for sales and distribution channels.

Adapting to evolving direct-to-consumer shipping laws and wholesaler agreements is crucial. For instance, in 2024, states continue to refine their DTC shipping regulations, impacting wine brands like Duckhorn. A 2023 report indicated that DTC wine shipping revenue reached $4.7 billion, highlighting its importance.

Protecting its diverse portfolio of esteemed winery brands, such as Duckhorn Vineyards and Kosta Browne, through robust intellectual property rights, including trademarks and copyrights, is paramount for The Duckhorn Portfolio. This legal framework safeguards their unique identities and market value.

Vigilant legal enforcement against counterfeiting and unauthorized brand usage is crucial. In 2024, the global luxury goods market, where Duckhorn operates, saw continued challenges with brand infringement, underscoring the need for proactive legal measures to preserve brand integrity and consumer confidence in their premium wine offerings.

The Duckhorn Portfolio, like all U.S. wineries, must adhere to rigorous federal and state food safety standards. This includes compliance with regulations set forth by the Food and Drug Administration (FDA) and the Alcohol and Tobacco Tax and Trade Bureau (TTB). In 2024, the TTB continues to enforce strict guidelines on wine production, import, and labeling.

Stringent labeling requirements are critical for The Duckhorn Portfolio, covering aspects like alcohol content, potential allergens, and origin. Failure to meet these precise labeling mandates can result in severe consequences, including costly product recalls, significant financial penalties, and substantial damage to the company's hard-earned reputation in the market.

Labor Laws and Employment Regulations

The Duckhorn Portfolio, like any employer, must navigate a complex web of labor laws. These regulations cover everything from minimum wage requirements and workplace safety standards to employee benefits and immigration rules, which are especially critical given the seasonal nature of vineyard work and the need for skilled winery staff. For instance, in 2024, the US federal minimum wage remains at $7.25 per hour, though many states and localities have higher rates, impacting labor costs for vineyard operations.

Changes in these legal frameworks can directly affect operational expenses and the availability of a qualified workforce. A significant labor dispute or an unexpected increase in minimum wage laws could necessitate adjustments to staffing models and compensation strategies. The company's human resources and legal departments must remain vigilant, ensuring full compliance and proactively managing potential labor-related risks.

Key areas of compliance for The Duckhorn Portfolio include:

- Minimum Wage Adherence: Ensuring all employees are paid at least the legally mandated minimum wage, considering federal, state, and local variations.

- Workplace Safety and Conditions: Complying with Occupational Safety and Health Administration (OSHA) standards to provide a safe working environment for all staff.

- Employee Benefits Mandates: Meeting requirements for benefits such as health insurance (under the Affordable Care Act, if applicable) and paid sick leave, which vary by jurisdiction.

- Immigration and Employment Verification: Strictly adhering to immigration laws, including the proper verification of employment eligibility for all workers through the Form I-9 process.

Environmental Compliance and Permitting

The Duckhorn Portfolio's extensive vineyard operations and winemaking processes are governed by a complex web of environmental regulations. These laws address critical areas such as water discharge quality, proper waste disposal, the application of pesticides, and air emissions. Compliance is not just a legal obligation but a cornerstone of their commitment to sustainable viticulture and responsible production.

Navigating these environmental legal factors requires significant investment in permitting and ongoing adherence to evolving standards. For instance, regulations concerning water usage in drought-prone California, where many of Duckhorn's vineyards are located, are constantly being updated. Failure to secure and maintain the correct permits, or to adapt to new environmental mandates, could result in substantial fines and operational disruptions, impacting their ability to produce wine and maintain brand reputation.

Key areas of environmental legal focus for The Duckhorn Portfolio include:

- Water Discharge and Quality: Adherence to regulations set by bodies like the Regional Water Quality Control Boards regarding wastewater from wineries and irrigation runoff from vineyards.

- Waste Management: Compliance with laws governing the disposal of winery byproducts, packaging materials, and vineyard waste.

- Pesticide and Herbicide Use: Following strict guidelines on the types, application methods, and reporting of agricultural chemicals used in vineyard management, with increasing scrutiny on organic and sustainable farming practices.

- Air Quality Standards: Meeting regulations related to emissions from winery operations, such as boilers or generators, and potential impacts from vineyard activities like frost protection.

The Duckhorn Portfolio operates within a complex legal landscape, particularly concerning alcohol sales and distribution, which adheres to the U.S. three-tier system. Evolving state-specific direct-to-consumer (DTC) shipping laws, as seen with ongoing refinements in 2024, directly impact market access and revenue streams, with DTC wine shipping revenue reaching $4.7 billion in 2023. Protecting its brand portfolio through intellectual property rights, including trademarks and copyrights, is vital, especially given ongoing challenges with brand infringement in the premium goods market during 2024.

Compliance with federal and state food safety regulations, enforced by bodies like the FDA and TTB, is non-negotiable, with the TTB maintaining strict guidelines on wine production and labeling in 2024. Stringent labeling requirements, covering alcohol content and potential allergens, carry risks of recalls and penalties for non-compliance. Furthermore, navigating labor laws, including minimum wage (federal $7.25/hour in 2024, though many states exceed this) and workplace safety, is crucial for managing operational costs and workforce availability.

Environmental regulations, covering water discharge, waste management, pesticide use, and air quality, demand significant investment in permitting and adherence to evolving standards, particularly in water-scarce regions like California. Failure to comply with these environmental mandates can lead to substantial fines and operational disruptions.

| Legal Factor | Key Considerations for Duckhorn | 2023/2024 Relevance | Potential Impact |

| Distribution Laws | U.S. Three-Tier System, State DTC Shipping Laws | DTC wine shipping revenue: $4.7 billion (2023); ongoing state law refinements in 2024. | Market access, revenue potential, operational complexity. |

| Intellectual Property | Trademarks, Copyrights, Brand Protection | Continued brand infringement challenges in the luxury goods market (2024). | Brand integrity, market value, consumer trust. |

| Food Safety & Labeling | FDA, TTB Regulations, Accurate Labeling | TTB enforcing strict production and labeling guidelines (2024). | Product recalls, financial penalties, reputational damage. |

| Labor Laws | Minimum Wage, Workplace Safety, Immigration | Federal minimum wage: $7.25/hour (2024); state variations. | Labor costs, workforce availability, operational efficiency. |

| Environmental Regulations | Water Use, Waste Disposal, Pesticides | Evolving water usage regulations in California; increased scrutiny on sustainable practices. | Permitting costs, operational disruptions, sustainability reputation. |

Environmental factors

Climate change poses substantial threats to The Duckhorn Portfolio's operations. Regions crucial for their premium wine production, including California, Oregon, and Washington, are experiencing more frequent droughts, intense heatwaves, and unpredictable frosts. These climatic shifts directly affect grape growing conditions, potentially impacting the quality and quantity of their harvest.

For instance, California, a cornerstone of Duckhorn's vineyards, faced severe drought conditions in recent years, impacting water availability for irrigation. The 2020 and 2021 wildfire seasons also caused significant disruptions, with smoke taint posing a risk to grape quality, leading some wineries to discard entire batches. These environmental factors directly translate to increased operational costs and potential supply chain volatility for luxury wine producers.

Access to sufficient and clean water is critical for The Duckhorn Portfolio's vineyards, particularly in California's drought-prone regions. In 2023, California experienced a slight improvement in snowpack, but long-term drought conditions persist, impacting water availability for agriculture.

The company faces increasing pressure to adopt advanced water management strategies, such as precision irrigation and water recycling systems, to ensure sustainable grape production. Compliance with evolving water rights and conservation regulations is also a key factor in maintaining operational stability and grape quality.

Wildfires in California, a key region for The Duckhorn Portfolio, present a significant environmental risk. In 2023 alone, California experienced over 7,000 wildfires, impacting vast areas. These fires can directly damage vineyards, and more subtly, cause smoke taint in grapes, a phenomenon that can render them unusable for premium wine, potentially costing millions in lost revenue.

Beyond the direct threat to grape quality, the persistent poor air quality resulting from wildfire smoke poses challenges for vineyard workers and winery operations. This can lead to reduced working hours and necessitate costly air filtration systems. For instance, the 2020 wildfire season saw widespread air quality alerts across California, impacting outdoor activities and labor for extended periods, highlighting the need for proactive mitigation plans.

Sustainable Farming Practices and Certifications

Consumers, investors, and regulators are increasingly pushing for environmentally responsible agriculture. This trend directly impacts companies like The Duckhorn Portfolio, highlighting the growing importance of sustainable operations in the wine industry.

The Duckhorn Portfolio's commitment to sustainable, organic, or biodynamic farming, coupled with relevant certifications, can significantly boost its brand image and align with evolving market demands. For instance, the demand for certified organic wine has seen consistent growth, with the global organic wine market projected to reach approximately $20 billion by 2027, indicating a strong consumer preference.

- Consumer Demand: Growing consumer preference for sustainably produced goods, including wine.

- Investor Interest: Increased focus on Environmental, Social, and Governance (ESG) factors by investors.

- Regulatory Pressure: Potential for future regulations favoring or mandating sustainable agricultural practices.

- Brand Enhancement: Certifications like USDA Organic or Biodynamic can differentiate Duckhorn and attract environmentally conscious buyers.

Biodiversity Loss and Ecosystem Health

Biodiversity loss and the health of surrounding ecosystems directly impact The Duckhorn Portfolio's vineyard operations. Healthy ecosystems provide natural pest control, reducing reliance on chemical interventions, and contribute to soil vitality, which is essential for high-quality grape production. For instance, a 2024 report by the World Wildlife Fund highlighted that regions with greater biodiversity often exhibit more resilient agricultural systems, a critical factor for long-term viability in winegrowing.

The Duckhorn Portfolio's commitment to environmental stewardship necessitates careful consideration of its impact on local flora and fauna. Implementing practices that actively promote biodiversity, such as planting native species or maintaining natural buffer zones around vineyards, can enhance ecosystem services. This approach not only supports sustainability but also aligns with growing consumer demand for ethically produced goods, a trend observed to be accelerating through 2025.

- Ecosystem Services: Natural pest predation by beneficial insects and birds, pollination, and soil nutrient cycling are vital for vineyard health.

- Vineyard Viability: Maintaining soil health through biodiversity supports consistent grape yields and quality, crucial for premium wine production.

- Consumer Perception: Demonstrating a commitment to biodiversity can enhance brand reputation and appeal to environmentally conscious consumers.

- Regulatory Landscape: Evolving environmental regulations may increasingly favor or mandate biodiversity-friendly agricultural practices.

Climate change continues to be a significant environmental factor for The Duckhorn Portfolio, with California's ongoing water scarcity and the increasing frequency of wildfires posing direct threats to grape cultivation. The 2023 California wildfire season, while less severe than prior years, still underscored the persistent risks of smoke taint and vineyard damage. These climatic shifts necessitate ongoing investment in water management technologies and risk mitigation strategies to ensure consistent production of high-quality grapes.

The global push for sustainability is increasingly influencing consumer purchasing decisions and investor sentiment, directly impacting the wine industry. Consumers are showing a greater preference for wines produced using environmentally responsible methods, with the organic wine market projected for continued growth through 2025. This trend places a premium on companies like Duckhorn that can demonstrate a commitment to sustainable practices and obtain relevant certifications, thereby enhancing brand value and market appeal.

The health of vineyard ecosystems and surrounding biodiversity plays a crucial role in the long-term viability of The Duckhorn Portfolio's operations. Healthy ecosystems provide natural pest control and improve soil vitality, essential for premium wine production. By implementing biodiversity-friendly practices, Duckhorn can not only enhance its environmental stewardship but also align with growing consumer and regulatory expectations for ethical and sustainable agriculture.

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Duckhorn Portfolio is informed by a comprehensive review of industry-specific publications, market research reports, and financial statements. We also incorporate data from government agencies and regulatory bodies relevant to the wine and spirits industry.