The Duckhorn Portfolio Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Duckhorn Portfolio Bundle

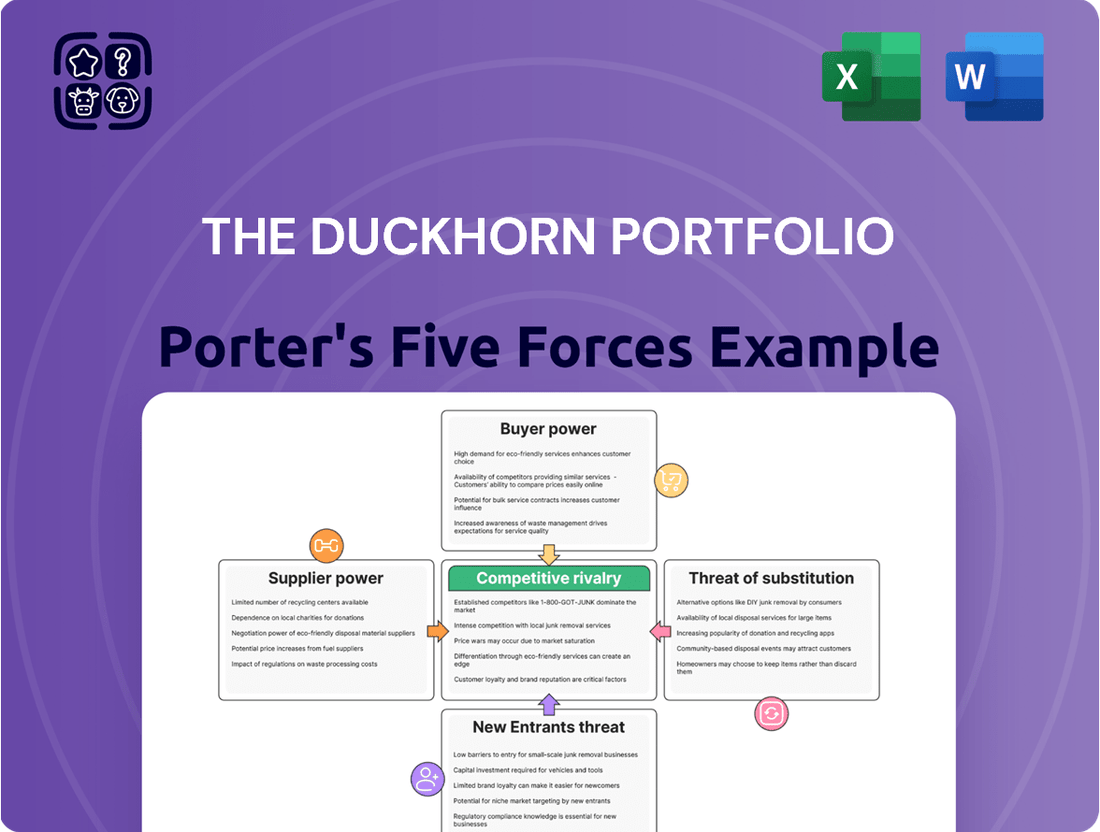

The Duckhorn Portfolio operates in a dynamic wine market, influenced by factors like brand loyalty and distribution channels. Understanding the intensity of rivalry among existing wine producers is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Duckhorn Portfolio’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Duckhorn Portfolio's reliance on a concentrated supplier base, particularly for specialized grape varietals or from niche regions, could grant suppliers significant bargaining power. While Duckhorn operates its own estate vineyards in prime locations like Napa Valley and Sonoma County, it also sources from external growers in these and other key areas, including Oregon and Washington State.

The uniqueness of inputs significantly impacts supplier bargaining power. For luxury wine producers like Duckhorn, the availability of specific, high-quality grapes from renowned appellations is paramount. If these vineyards or particular grape varietals are rare and in high demand, the growers possess considerable leverage, especially for Duckhorn's premium single-vineyard wines.

Duckhorn's reliance on specific grape varietals and vineyard locations, often tied to premium appellations, means that switching suppliers isn't a simple transaction. The process of identifying, vetting, and securing new vineyard sources, especially for established, high-quality grapes, can take years and significant upfront investment. This long lead time and the potential for disruption to their established wine profiles inherently increase the bargaining power of their current grape suppliers.

Threat of Forward Integration by Suppliers

Grape growers, particularly those with significant resources, could potentially enter the wine production and marketing space themselves. This forward integration would transform them from suppliers into direct competitors, potentially impacting Duckhorn's market share and pricing power.

While smaller growers might find this challenging, larger, well-capitalized vineyards could realistically pose this threat. For instance, a major vineyard with established distribution channels might decide to bottle and sell its own premium wines, directly competing with brands like Duckhorn.

This scenario could limit Duckhorn's leverage in negotiating grape prices and supply terms. If key suppliers become competitors, they may prioritize their own brands, potentially reducing the availability or increasing the cost of grapes for Duckhorn.

- Potential for Grower Competition: Large, well-resourced vineyards may engage in forward integration, producing and marketing their own wines.

- Impact on Duckhorn: This could turn suppliers into direct rivals, affecting Duckhorn's market position and ability to set terms.

- Resource Dependency: The feasibility of this threat is tied to the financial and operational capacity of individual grape growers.

Availability of Substitutes for Inputs

The availability of substitutes for inputs significantly impacts a supplier's bargaining power. While premium wine producers like Duckhorn rely on specific high-quality grape varietals, the broader wine market can experience oversupply. For instance, in 2023, California saw a notable grape surplus in several key regions, which naturally put downward pressure on grape prices for growers. This general oversupply scenario weakens the negotiating position of individual grape suppliers, as buyers may have alternative sources or the ability to wait for more favorable pricing.

This dynamic can be observed through:

- Grape Oversupply: Reports from the 2023 harvest indicated a surplus of certain grape varietals in California, impacting grower revenues and their ability to command higher prices.

- Price Sensitivity: For wineries not exclusively tied to ultra-premium, single-vineyard sources, the availability of more affordably priced grapes from oversupplied regions can dilute the bargaining power of exclusive suppliers.

- Market Conditions: Broader economic factors influencing consumer demand for wine can exacerbate or mitigate grape oversupply, directly affecting supplier leverage.

The bargaining power of suppliers for The Duckhorn Portfolio is influenced by the uniqueness and availability of their grape sources. While Duckhorn has estate vineyards, its reliance on external growers, especially for specific high-quality varietals from prime locations like Napa Valley and Sonoma County, grants these suppliers considerable leverage. The difficulty and time required to establish new, quality grape sources further solidify supplier power, as switching can disrupt established wine profiles and require significant investment.

The threat of forward integration by suppliers, where large vineyards might produce their own wines, could turn them into direct competitors, diminishing Duckhorn's negotiating power. Conversely, market conditions like grape oversupply, as seen in California in 2023 with surpluses impacting grower revenues, can weaken individual supplier leverage for those not tied to ultra-premium, exclusive sources.

| Factor | Impact on Duckhorn | Supplier Leverage | Supporting Data (2023/2024 Estimates) |

|---|---|---|---|

| Uniqueness of Grapes/Appellations | High reliance on specific, high-demand varietals | Strong | Premium Napa/Sonoma grapes command significantly higher prices than general Californian grapes. |

| Switching Costs for Duckhorn | Long lead times, investment in new sources, potential disruption | Strong | Securing contracts with top-tier vineyards can involve multi-year commitments. |

| Supplier Forward Integration Threat | Potential for direct competition | Moderate to Strong (for large growers) | Increased direct-to-consumer sales by vineyards are a growing trend. |

| Availability of Substitutes/Oversupply | Weakens leverage for non-exclusive sources | Weak (for general market) | California experienced grape surpluses in 2023, leading to price pressures for some growers. |

What is included in the product

This analysis unpacks the competitive forces impacting The Duckhorn Portfolio, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a comprehensive overview of the wine industry's five forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

The Duckhorn Portfolio's diverse customer base, spanning on-premise, off-premise, and direct-to-consumer (DTC) channels, significantly dilutes the bargaining power of any single customer segment. This multi-channel strategy means no one group holds enough sway to dictate terms.

The direct-to-consumer channel, representing 13.9% of net sales in Fiscal 2024, is particularly important. It not only provides higher gross margins but also fosters direct engagement, further lessening reliance on traditional wholesale channels.

While Duckhorn's portfolio spans luxury wines from $20 to $230, a growing price sensitivity among consumers, fueled by inflation and economic headwinds, is a key factor. This trend is leading some consumers to trade down in less premium wine segments, potentially impacting pricing power even for established brands like Duckhorn.

The luxury wine market is quite crowded, meaning customers have plenty of high-quality options to choose from. This abundance of alternative wine brands directly translates to increased bargaining power for consumers, as they can easily switch to a competitor if they find Duckhorn's offerings less appealing or too expensive. For instance, in 2024, the global premium wine market continued its robust growth, with numerous established and emerging wineries vying for market share.

Customer Information and Transparency

Consumers, particularly in the luxury wine market like that of The Duckhorn Portfolio, are more informed than ever. Online platforms and wine critics provide detailed information on quality, vintages, and pricing, directly impacting purchasing decisions. This heightened transparency significantly boosts customer bargaining power.

The accessibility of information means customers can easily compare The Duckhorn Portfolio's offerings against competitors. They can research vineyard practices, grape varietals, and historical performance of different vintages. This knowledge base allows them to negotiate better prices or seek out alternatives if pricing or perceived value doesn't align with their expectations.

- Informed Consumer Base: 70% of wine consumers in the US research wine online before purchasing, according to a 2024 Wine Industry Network study.

- Price Sensitivity in Luxury: While luxury buyers are less price-sensitive, transparency in quality and rarity still allows for informed comparisons, influencing perceived value.

- Impact of Reviews: Positive or negative reviews from influential wine critics can sway purchasing decisions, giving consumers leverage in demanding quality and fair pricing from producers like The Duckhorn Portfolio.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while low for individual consumers, could be a consideration for large retail chains or restaurant groups. These entities might explore producing private label wines, thereby lessening their dependence on brands like Duckhorn. However, Duckhorn's strong brand equity and proven production capabilities significantly mitigate this risk.

For instance, in 2024, major wine retailers often carry a substantial portfolio of private label wines, which can represent a significant portion of their sales volume. This trend highlights the potential for large buyers to exert pressure. Yet, the capital investment and expertise required to establish a premium wine production facility, comparable to Duckhorn's, remain substantial barriers.

- Customer Integration Threat: Large retail chains and restaurant groups possess the scale to potentially develop their own private label wines, reducing reliance on established brands.

- Brand Equity as a Deterrent: Duckhorn's established brand recognition and reputation for quality make it less susceptible to customers seeking to replace it with private labels.

- Production Barriers: The significant capital and expertise needed to replicate Duckhorn's premium wine production processes act as a strong deterrent to backward integration by customers.

The bargaining power of customers for The Duckhorn Portfolio is moderate, influenced by an informed consumer base and a competitive market. While 70% of US wine consumers research online before buying, according to a 2024 study, the luxury segment shows some resilience to price sensitivity. However, the sheer number of premium wine options available in 2024 means consumers can readily switch if value propositions don't align.

The direct-to-consumer channel, representing 13.9% of Duckhorn's net sales in Fiscal 2024, offers a direct relationship that can mitigate some customer leverage. Still, the threat of large retail chains developing private label wines persists, though substantial barriers to replicating Duckhorn's production expertise remain.

| Factor | Impact on Duckhorn | Supporting Data (2024) |

| Informed Consumers | Increased Bargaining Power | 70% of US wine consumers research online before purchase. |

| Competitive Landscape | Moderate Bargaining Power | Robust growth in the global premium wine market with many competitors. |

| DTC Channel | Reduced Bargaining Power | 13.9% of net sales in Fiscal 2024, fostering direct engagement. |

| Private Label Threat | Low to Moderate Bargaining Power | Large retailers carry private labels; high production barriers for competitors. |

Same Document Delivered

The Duckhorn Portfolio Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for The Duckhorn Portfolio, offering an in-depth examination of competitive forces within the wine industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring full transparency and immediate utility.

Rivalry Among Competitors

The North American luxury wine market is quite crowded, featuring a wide array of competitors. Duckhorn Portfolio navigates this landscape alongside numerous smaller, craft wineries and larger, established multi-brand corporations.

This diversity means Duckhorn faces rivals across different price tiers and wine types, from single-vineyard Pinot Noir specialists to broad-spectrum Cabernet Sauvignon producers.

In 2024, the U.S. wine market alone saw over 10,000 wineries operating, highlighting the sheer volume of potential competitors Duckhorn must consider.

The U.S. wine market is experiencing a slowdown, with projections indicating continued volume declines. This presents a challenging environment for established players like Duckhorn Portfolio.

While the premium and above segment is expected to see growth, the overall market contraction intensifies competition as companies fight for a larger share of a shrinking pie.

For instance, in 2023, U.S. wine volumes saw a slight decrease, putting pressure on brands to differentiate and capture consumer attention.

The Duckhorn Portfolio enjoys significant competitive advantages through its robust brand differentiation and the resulting customer loyalty. Brands like Duckhorn Vineyards and Kosta Browne are not only highly recognized but also consistently receive critical acclaim, bolstering their market position. This strong brand equity allows Duckhorn to stand out in a crowded wine market, fostering repeat business and reducing price sensitivity among consumers.

Exit Barriers

High fixed costs are a major hurdle for wineries looking to exit the market. Think about the significant investments in vineyards, state-of-the-art winemaking facilities, and established distribution networks. These aren't easily shed assets. For instance, a single acre of prime Napa Valley vineyard can cost upwards of $300,000 to $500,000, and building a winery can run into tens of millions of dollars.

These substantial upfront and ongoing expenses mean that even when market conditions are tough, wineries might be compelled to continue operations rather than absorb massive losses from liquidation. This sticky situation can prolong competitive pressure, as underperforming companies remain in the game, potentially driving down prices or increasing promotional activity to maintain market share.

- Vineyard Investment: Costs can range from $300,000 to $500,000+ per acre in premium regions.

- Winery Infrastructure: Building and equipping a winery can easily cost tens of millions of dollars.

- Distribution Networks: Establishing and maintaining these channels involves significant logistical and marketing outlays.

- Operational Continuity: High fixed costs incentivize continued operation, even in downturns, thereby sustaining competitive rivalry.

Acquisition and Consolidation Trends

The fine wine industry, including segments where Duckhorn operates, is seeing a significant uptick in mergers and acquisitions. This consolidation trend is particularly pronounced in the United States, as companies aim to broaden their brand portfolios and market reach.

Duckhorn Portfolio's own strategic moves, such as its acquisition of Sonoma-Cutrer, underscore this active competitive environment. Such actions demonstrate a clear strategy of portfolio expansion through acquiring established brands, thereby intensifying rivalry as players seek to gain or maintain market share.

- M&A Activity: The fine wine market has witnessed a surge in M&A deals, reflecting a broader industry consolidation trend.

- Duckhorn's Strategy: Duckhorn's acquisition of Sonoma-Cutrer exemplifies the competitive drive to expand brand offerings.

- Market Impact: This consolidation intensifies competition as companies seek to build larger, more diversified portfolios.

Competitive rivalry within the North American luxury wine market is intense, fueled by a crowded field of established players and emerging craft wineries. Duckhorn Portfolio faces rivals across various price points and wine styles, with over 10,000 U.S. wineries operating in 2024.

The market slowdown, with U.S. wine volumes declining in 2023, exacerbates this rivalry as companies vie for a larger share of a contracting market, particularly in the premium segment where growth is anticipated.

High fixed costs, such as vineyard investments averaging $300,000-$500,000+ per acre in prime regions and tens of millions for winery infrastructure, create significant barriers to exit, prolonging competitive pressure.

Mergers and acquisitions, like Duckhorn's purchase of Sonoma-Cutrer, are actively reshaping the competitive landscape, as companies consolidate to expand brand portfolios and market reach.

| Key Competitor Factors | Description | Impact on Rivalry |

| Market Saturation | Over 10,000 U.S. wineries in 2024 | High; intensifies competition for market share. |

| Market Trends | Projected U.S. wine volume declines | High; companies fight for shrinking market share. |

| Barriers to Exit | High fixed costs (vineyards, facilities) | Moderate to High; incentivizes continued operation, sustaining rivalry. |

| Industry Consolidation | Increased M&A activity | High; strategic acquisitions intensify competition. |

SSubstitutes Threaten

The most direct substitutes for wine are other alcoholic beverages, including spirits, beer, and ready-to-drink (RTD) cocktails. The spirits sector is experiencing significant growth, with projections indicating it will surpass wine in total beverage alcohol volume share. For instance, in 2023, the global spirits market was valued at approximately $1.3 trillion and is expected to grow further.

The threat of substitutes for alcoholic beverages, like those in The Duckhorn Portfolio, is growing as the non-alcoholic (No/Low) beverage market expands rapidly. Consumers, especially younger demographics like Millennials and Gen Z, are increasingly prioritizing health and wellness, leading them to seek alternatives to traditional alcoholic drinks. This trend encompasses non-alcoholic wines, spirits, and a variety of other innovative beverages designed to mimic the experience of alcohol consumption without the alcohol content.

The Duckhorn Portfolio faces a growing threat from changing consumer preferences, particularly among younger demographics who increasingly favor sustainable and ethically produced wines. This trend, coupled with a broader societal move towards alcohol moderation, encourages consumers to explore a wider array of beverage options beyond traditional wine. For instance, the global non-alcoholic beverage market is projected to reach $1.75 trillion by 2028, indicating a significant shift in consumer spending habits that could impact wine sales.

Water and Other Hydration Options

Water and other non-alcoholic beverages are significant substitutes for wine, particularly when the goal is simply to quench thirst. This is especially true in casual dining or everyday consumption scenarios, where the social or celebratory aspects of wine are less critical. For instance, in 2023, the global non-alcoholic beverage market was valued at over $1.3 trillion, showcasing the sheer scale of alternatives available to consumers.

The availability of a wide array of affordable and accessible hydration options, from bottled water to juices and sodas, directly impacts the demand for wine. Consumers can easily opt for these substitutes if wine prices increase or if its perceived value diminishes. In 2024, the average price of a bottle of wine in the US saw a slight increase, making these alternatives even more appealing for budget-conscious consumers.

- Broad Availability: Non-alcoholic options are ubiquitous, found in nearly every retail and hospitality setting.

- Price Sensitivity: Water and other beverages are often significantly cheaper than wine.

- Health Trends: Growing consumer focus on health and wellness can steer individuals away from alcohol towards water and healthier non-alcoholic choices.

- Occasion-Based Substitution: In many daily situations, the primary need is hydration, not the specific experience a wine provides.

Cannabis and Other Recreational Substances

The growing acceptance and legalization of cannabis present a subtle but significant threat. While not a direct beverage substitute, cannabis offers an alternative recreational experience, potentially diverting discretionary spending away from alcoholic beverages like wine. For instance, in 2024, the U.S. cannabis market was projected to reach over $30 billion, indicating a substantial consumer base seeking alternative forms of relaxation and enjoyment.

This shift in consumer preference means that Duckhorn's wine products may face competition for consumer dollars from a growing legal cannabis market. As more states legalize recreational cannabis, accessibility increases, making it a more viable option for consumers looking for leisure activities or stress relief.

- Cannabis Market Growth: The U.S. legal cannabis market was anticipated to exceed $30 billion in 2024, highlighting a significant alternative for discretionary spending.

- Consumer Preference Shift: Increased legalization and social acceptance of cannabis can lead consumers to choose it over alcohol for recreational purposes.

- Impact on Discretionary Spending: Funds allocated to leisure and recreation might be redirected from wine purchases to cannabis products.

The threat of substitutes for Duckhorn's wines is amplified by the burgeoning non-alcoholic beverage market, driven by health-conscious consumers, particularly Millennials and Gen Z. This trend is evident in the projected growth of the non-alcoholic beverage market, which was expected to reach $1.75 trillion by 2028. Additionally, the expanding legal cannabis market, projected to exceed $30 billion in the U.S. in 2024, offers an alternative recreational experience, potentially diverting discretionary spending away from wine.

| Substitute Category | Key Drivers | Market Size/Growth (Illustrative) | Impact on Wine Demand |

| Non-Alcoholic Beverages | Health & Wellness Trends, Consumer Preference Shift | Global Market projected to reach $1.75 trillion by 2028 | Increasingly strong, especially for casual consumption |

| Other Alcoholic Beverages (Spirits, Beer) | Market Growth, Consumer Taste Evolution | Global Spirits Market valued at ~$1.3 trillion in 2023 | Moderate to strong, depending on category and pricing |

| Cannabis Market | Legalization, Alternative Recreation | U.S. Market projected >$30 billion in 2024 | Emerging threat, impacting discretionary spending |

Entrants Threaten

Establishing a luxury wine brand, similar to The Duckhorn Portfolio, demands significant upfront capital. This includes acquiring prime vineyard land, building state-of-the-art wineries, investing in extensive barrel aging programs, and developing robust distribution channels. For instance, vineyard land in premium wine regions can cost millions per acre, making the initial investment a formidable hurdle.

The sheer scale of these capital requirements acts as a substantial barrier, deterring many potential new entrants from entering the luxury wine market. Without access to considerable funding, it is exceedingly difficult for new players to compete with established brands that have already made these investments and possess decades of operational history and brand recognition.

The Duckhorn Portfolio benefits from strong brand recognition and a long-standing reputation for quality in the luxury wine market, built over decades since its founding in 1976. This deep-rooted trust makes it difficult for new players to gain traction.

New entrants face a considerable challenge in building comparable brand loyalty and trust, as consumers often gravitate towards established names in the premium segment. For instance, in 2024, the top 10 wine brands in the US accounted for a significant portion of market share, highlighting the power of established brands.

For a new entrant looking to break into the wine market, securing access to established distribution channels is a significant hurdle. Building relationships with distributors and retailers takes time and considerable investment, and even then, prime shelf space is often dominated by established brands like Duckhorn. In 2024, the wine industry continued to see consolidation among distributors, making it even harder for newcomers to gain traction.

Regulatory Hurdles

The wine industry faces significant regulatory hurdles that act as a barrier to new entrants. These include stringent rules on production methods, ingredient disclosure, and packaging, which can be costly and time-consuming to comply with. For instance, in the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) oversees much of this regulation, requiring extensive labeling approvals and adherence to specific production standards.

Distribution and sales regulations further complicate market entry. Each state in the U.S. has its own unique set of laws governing how alcohol can be sold and transported, creating a complex patchwork of legal requirements. This fragmentation means new wineries must invest heavily in understanding and navigating these diverse compliance landscapes, potentially limiting their ability to scale quickly or enter multiple markets simultaneously.

In 2024, the ongoing evolution of direct-to-consumer (DTC) shipping laws continues to present challenges. While DTC sales offer a vital channel for wineries, especially smaller ones, the legal framework is still developing and varies widely. For example, while many states permit DTC shipping, the volume limits and tax implications differ, adding another layer of complexity for new businesses aiming to reach consumers directly.

- Production Standards: Compliance with TTB regulations regarding winemaking processes and ingredient usage.

- Labeling Requirements: Adherence to strict federal and state guidelines for wine labels, including alcohol content and origin.

- Distribution Laws: Navigating the three-tier system and state-specific sales and distribution permits.

- Direct-to-Consumer (DTC) Shipping: Managing compliance with varying state laws for shipping wine directly to consumers.

Expertise and Experience

The luxury wine market demands deep expertise in viticulture, enology, and intricate blending techniques. Newcomers face a steep learning curve, as mastering these skills takes years of hands-on experience.

Building a team with the right blend of specialized knowledge and practical experience is a considerable hurdle for potential entrants. The wine industry's talent pool often favors those with established track records, making it challenging for new players to attract top-tier talent without offering significant incentives or demonstrating a clear path to success.

- Specialized Knowledge: Viticulture (grape growing), enology (winemaking science), and blending require years of study and practical application.

- Industry Experience: The wine sector often values proven success and established networks, making it difficult for new entrants to recruit experienced professionals.

- Talent Acquisition: Attracting and retaining skilled winemakers and vineyard managers is a significant cost and challenge for those entering the market.

The threat of new entrants into the luxury wine market, like that occupied by The Duckhorn Portfolio, is significantly mitigated by the immense capital requirements. Acquiring prime vineyard land, building wineries, and establishing distribution networks demand millions, creating a formidable barrier to entry. For instance, vineyard land in Napa Valley, a key region for luxury wines, can easily exceed $1 million per acre, a cost prohibitive for most newcomers. In 2024, the continued high valuations of established vineyard properties reinforce this barrier.

Furthermore, regulatory complexities and the need for specialized expertise act as substantial deterrents. Navigating state-specific alcohol distribution laws and TTB production standards requires significant legal and operational investment. Mastering viticulture and enology, essential for luxury wine production, demands years of experience, making it difficult for new players to attract top talent and achieve consistent quality, a hallmark of brands like Duckhorn.

Brand loyalty and established distribution channels further solidify the position of incumbents. Consumers in the luxury segment often favor trusted, well-known brands, and gaining shelf space with distributors, who are increasingly consolidating, is a major challenge for new entrants. By 2024, the dominance of established brands in premium retail environments remained a clear indicator of this advantage.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Duckhorn Portfolio is built upon a foundation of comprehensive data, including SEC filings, investor relations reports, wine industry trade publications, and market research from firms specializing in the beverage alcohol sector.