Driven Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Driven Brands Bundle

Driven Brands' robust franchise model and diversified brand portfolio are significant strengths, offering resilience and broad market appeal. However, understanding potential threats from market saturation and evolving consumer preferences is crucial for sustained growth.

Want the full story behind Driven Brands' competitive advantages, potential challenges, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Driven Brands commands a dominant presence in the North American automotive services sector, boasting a comprehensive portfolio that spans vehicle maintenance, paint and collision repair, and car wash operations. This broad diversification across critical aftermarket services creates a robust business model, offering resilience against economic downturns as many of these services are considered essential.

As of early 2024, Driven Brands operates an extensive network of roughly 5,000 locations across the United States and extends its reach into 13 other countries. This vast footprint allows the company to service tens of millions of vehicles each year, solidifying its market leadership.

Driven Brands' primary strength lies in its robust franchise model, a key driver for its rapid growth and efficient use of capital. This structure allows the company to expand its reach across various brands like Meineke Car Care Centers and Maaco Collision Repair and Auto Painting without bearing the full financial burden of company-owned locations.

The company effectively supports its franchisees by providing essential operational tools, comprehensive marketing strategies, and streamlined supply chain management. This support system is crucial for maintaining brand consistency and ensuring franchisee success, which in turn fuels further expansion. For instance, as of early 2024, Driven Brands operates over 4,000 locations across its portfolio of brands.

The established brand recognition inherent in the franchise system is a significant advantage. Customers often seek out these familiar brands for their perceived reliability and quality of service, creating a consistent demand that benefits all franchisees. This brand equity is a powerful asset, attracting both new customers and potential franchisees to the Driven Brands network.

Driven Brands exhibits remarkable strength in its consistent growth across crucial segments. The Take 5 Oil Change brand, for instance, has achieved an impressive streak of 19 consecutive quarters of same-store sales growth, extending through the first quarter of 2025. This sustained performance underscores the enduring demand for their efficient, quick-service automotive solutions.

Strategic Focus on Debt Reduction and Portfolio Management

Driven Brands demonstrates a strong strategic focus on optimizing its financial structure through aggressive debt reduction. The divestiture of its U.S. car wash business in April 2025, for instance, generated significant proceeds earmarked for debt repayment, underscoring a commitment to deleveraging. This proactive approach is designed to bolster financial health and create greater operational flexibility.

This strategic pruning of the portfolio allows Driven Brands to concentrate on its core, higher-margin franchise segments. By shedding non-core assets, the company aims to channel resources more effectively into areas with greater growth potential and stronger cash flow generation. This sharpened focus is a key strength in navigating the competitive franchise landscape.

- Portfolio Optimization: Divestiture of U.S. car wash business in April 2025.

- Debt Reduction Focus: Proceeds from divestiture used primarily to pay down debt.

- Enhanced Financial Flexibility: Strategic moves aim to improve the company's balance sheet.

- Core Business Concentration: Increased focus on higher-margin, cash-generating franchise businesses.

Resilience of Non-Discretionary Services

The core of Driven Brands' business is built on essential automotive services that people need regardless of the economic climate. This resilience is a significant strength, ensuring a steady flow of customers and revenue even when discretionary spending tightens.

Vehicle owners consistently prioritize maintenance and repairs to keep their cars running, especially as the average age of vehicles on U.S. roads continues to climb. For instance, the average age of light vehicles in operation in the U.S. reached a record 12.5 years in 2023, a trend expected to continue, driving demand for services like oil changes, tire rotations, and brake repairs.

- Essential Services: Driven Brands offers services like oil changes, tire sales, and repairs, which are non-discretionary for vehicle owners.

- Aging Vehicle Fleet: The increasing average age of vehicles on the road (12.5 years in the U.S. as of 2023) directly translates to higher demand for maintenance and repair services.

- Stable Revenue Streams: This inherent demand provides Driven Brands with predictable and stable revenue, reducing vulnerability to economic fluctuations.

Driven Brands' franchise model is a significant strength, enabling rapid expansion and efficient capital deployment across its diverse brands. This model, supported by robust franchisee resources and strong brand recognition, fosters consistent growth and customer loyalty. For example, the Take 5 Oil Change brand has demonstrated impressive, sustained same-store sales growth for 19 consecutive quarters through Q1 2025.

The company's strategic focus on deleveraging, exemplified by the April 2025 divestiture of its U.S. car wash business to reduce debt, enhances financial flexibility and allows for concentration on core, high-margin segments. This operational streamlining, combined with the essential nature of its automotive services, provides resilience against economic downturns, further bolstered by the increasing average age of vehicles on U.S. roads, which reached 12.5 years in 2023.

What is included in the product

Delivers a strategic overview of Driven Brands’s internal and external business factors, highlighting its strong brand portfolio and franchise model while acknowledging potential integration challenges and market competition.

Highlights key competitive advantages and potential threats for strategic advantage.

Weaknesses

Driven Brands experienced a net loss in fiscal year 2024, a challenging but improved outcome compared to the previous year. This indicates ongoing efforts to achieve profitability.

The company's substantial debt load is a key concern, with a stated goal to reduce net leverage by the end of 2026. This high leverage can constrain their ability to fund new initiatives and makes them vulnerable to rising interest rates.

While Driven Brands boasts strong performance in some areas, like its Take 5 Oil Change segment, other parts of its business are facing headwinds. For instance, its Franchise Brands, which encompass well-known names like Meineke and Maaco, have seen a dip in same-store sales. This mixed performance across its diverse portfolio suggests that not all of Driven Brands' segments are contributing equally to its overall success, highlighting potential inconsistencies within its franchise network.

Driven Brands experienced a notable increase in Selling, General, and Administrative (SG&A) expenses during the first quarter of 2025. These costs grew at a faster pace than the company's revenue, a trend that could put pressure on overall profitability if not addressed. This escalation in operating expenses might indicate either growing overhead investments or emerging operational inefficiencies that require careful management to ensure they translate into future growth.

Competition in a Fragmented Market

Driven Brands operates within the automotive aftermarket, a sector characterized by significant fragmentation. This means there are a vast number of independent repair shops and other large competing chains, creating a highly competitive environment. For instance, the independent repair shop segment often accounts for a substantial portion of the aftermarket service volume, potentially offering price advantages that pressure larger players.

The competitive pressures extend beyond independent shops. Franchisees of Driven Brands also face competition from dealership service departments, which can leverage manufacturer loyalty programs, and from emerging online platforms that facilitate booking and price comparisons. This multi-faceted competition can indeed put pressure on pricing strategies and the ability to capture and maintain market share for Driven Brands' network.

- Fragmented Market: The automotive aftermarket is highly fragmented with numerous independent repair shops, creating intense competition.

- Price Competition: Independent mechanics often compete on price, potentially undercutting larger chains.

- Dealership and Online Threats: Dealership service departments and online booking platforms also present significant competitive challenges.

- Market Share Pressure: This competitive landscape can limit pricing flexibility and impact market share for Driven Brands' franchisees.

Reliance on Franchisee Performance

Driven Brands' reliance on its franchisees presents a significant weakness. The company's overall financial health and growth trajectory are directly linked to the operational success and profitability of these independent business owners. For instance, in 2023, Driven Brands operated over 5,000 locations, meaning the performance of thousands of individual businesses dictates system-wide results.

Macroeconomic headwinds pose a substantial risk to this model. Rising labor costs, inflation impacting consumer spending, and evolving consumer preferences for services like car washes can squeeze franchisee margins. This can, in turn, limit their ability to invest in upgrades or expand, directly impacting Driven Brands' scalability and overall profitability.

- Franchisee Financial Health: The company's revenue streams, often derived from royalties and fees, are directly dependent on the financial success of its franchisees.

- Impact of Economic Downturns: Recessions or periods of high inflation can disproportionately affect franchisees, leading to reduced royalty payments and slower expansion.

- Brand Consistency Challenges: Maintaining consistent brand standards and customer experience across a large, diverse franchisee base can be difficult and impact overall brand perception.

Driven Brands' substantial debt load remains a significant concern, with a stated objective to reduce net leverage by the end of 2026. This high leverage limits financial flexibility for new investments and increases vulnerability to interest rate fluctuations.

The company faces a fragmented market with intense competition from independent repair shops, dealerships, and online platforms, which can pressure pricing and market share. For example, the independent segment often offers competitive pricing, impacting larger players.

Reliance on franchisees presents a weakness, as the company's success is tied to the profitability of thousands of independent business owners. Economic downturns like rising labor costs and inflation can squeeze franchisee margins, impacting royalty payments and expansion plans.

Mixed performance across its diverse portfolio, with some segments like Franchise Brands experiencing same-store sales dips, indicates potential inconsistencies. This suggests that not all of Driven Brands' segments are equally contributing to overall growth, highlighting operational challenges within its franchise network.

Preview the Actual Deliverable

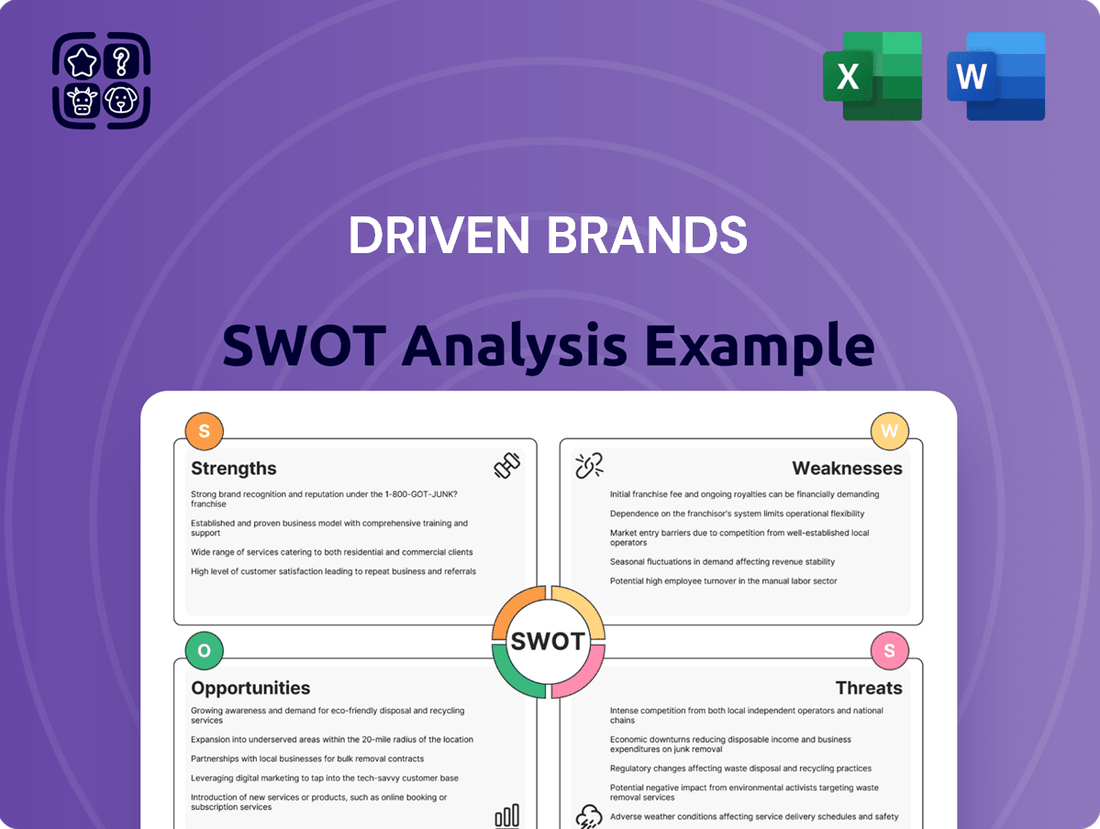

Driven Brands SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Driven Brands' strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, offering actionable insights into Driven Brands' Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The automotive aftermarket is a booming sector, with global revenues expected to hit $799.1 billion by 2025, and further growth anticipated. This expansion is fueled by a rising number of vehicles on the road and older cars requiring more maintenance. Driven Brands is well-positioned to capitalize on this trend by offering a wide range of services across its brands.

The accelerating shift towards electric and hybrid vehicles (EVs/HEVs) opens significant new avenues for automotive service providers. As of early 2024, EV sales continue to surge, with projections indicating they will represent a substantial portion of new vehicle registrations by 2025. This trend directly translates into a growing need for specialized maintenance, diagnostics, and repair services that cater specifically to EV powertrains and battery systems, creating a ripe opportunity for companies like Driven Brands to expand their service offerings.

The automotive service sector is ripe for innovation. Driven Brands can capitalize on the integration of artificial intelligence (AI) for predictive maintenance, anticipating vehicle issues before they become major problems. This technology, coupled with connected car data, allows for proactive service scheduling, minimizing customer inconvenience and maximizing shop utilization. For instance, AI-powered diagnostics can pinpoint potential failures with remarkable accuracy, reducing diagnostic time and improving first-time fix rates.

Furthermore, advanced diagnostic tools are transforming how vehicles are serviced. These tools provide deeper insights into complex systems, enabling technicians to perform more efficient and effective repairs. By embracing these technological advancements, Driven Brands can significantly enhance operational efficiency, reduce vehicle downtime for customers, and deliver a more personalized and satisfying service experience, ultimately strengthening its competitive position in the market.

Strategic Acquisitions and International Growth

Driven Brands has a robust history of strategic acquisitions, a key driver for its expansion. The company consistently targets net store growth, aiming to open new locations each year to broaden its reach. This approach not only expands its footprint but also solidifies its market position through consolidation.

International expansion presents a significant opportunity for Driven Brands, especially in markets where its brands are not yet established. This inorganic growth strategy can unlock new revenue streams and enhance system-wide sales by penetrating previously untapped customer bases. For instance, in 2024, Driven Brands continued its aggressive expansion, with plans to add hundreds of new locations across its portfolio, including international markets.

- Strategic Acquisitions: Driven Brands has a proven track record of acquiring complementary businesses to expand its service offerings and market share.

- Net Store Growth: The company is committed to increasing its store count annually, a strategy that has seen significant success in recent years.

- International Expansion: Entering new geographic markets offers substantial potential for revenue growth and brand diversification.

- Market Consolidation: Through its growth strategies, Driven Brands aims to further solidify its leadership in the automotive aftermarket services sector.

Focus on Customer Convenience and Digitalization

The automotive service industry is seeing a significant move towards convenience, with customers increasingly valuing services like mobile mechanics and user-friendly digital platforms for booking and tracking repairs. Driven Brands is well-positioned to capitalize on this trend by further integrating digitalization into its operations. This focus can enhance customer interaction, improve operational efficiency, and provide more adaptable vehicle maintenance options, meeting the demands of today's busy consumers.

By investing in digital tools, Driven Brands can streamline the entire customer journey, from initial service request to final payment. For instance, a robust mobile app or online portal can allow customers to easily schedule appointments, receive real-time updates on their vehicle's status, and even authorize repairs remotely. This not only boosts customer satisfaction but also reduces administrative overhead for the company. Data from 2024 indicates a strong preference among consumers for digital channels, with over 70% of automotive service appointments being booked online or via mobile apps.

- Enhanced Customer Experience: Digital platforms offer transparency and ease of use, improving customer loyalty.

- Operational Efficiency: Streamlined booking and communication reduce administrative burdens and potential errors.

- Market Adaptability: Meeting consumer demand for digital solutions ensures Driven Brands remains competitive.

- Data-Driven Insights: Digital interactions provide valuable data for service optimization and personalized offerings.

Driven Brands can leverage the growing automotive aftermarket, projected to reach nearly $800 billion by 2025, by expanding its service offerings. The increasing prevalence of electric and hybrid vehicles presents a significant opportunity for specialized maintenance and repair services, a trend that saw continued acceleration in early 2024. Furthermore, the company can capitalize on technological advancements like AI for predictive maintenance and advanced diagnostics to enhance efficiency and customer satisfaction.

Threats

Economic downturns, marked by rising inflation and interest rates, pose a significant threat by potentially curbing consumer discretionary spending. This directly impacts demand for services like auto repair and maintenance, which, while somewhat resilient, can see reduced customer frequency during tighter economic periods. For instance, a sustained period of high inflation, as seen in 2023 with CPI figures averaging around 4.1% year-over-year, can force consumers to defer non-essential vehicle upkeep.

The automotive repair sector, including companies like Driven Brands, is grappling with a significant shortage of skilled technicians. This scarcity directly translates to escalating labor costs as companies compete for qualified personnel. For instance, in 2024, the average hourly wage for automotive technicians continued its upward trend, driven by this demand. This rising cost of labor impacts profitability and can necessitate price adjustments for services.

This talent gap not only inflates operational expenses but also poses a risk to service quality and efficiency. Longer wait times for appointments and repairs can frustrate customers, potentially impacting customer retention and brand reputation. Driven Brands, like its competitors, must therefore prioritize substantial investments in robust training programs and offer highly competitive compensation packages to attract and retain the necessary skilled workforce.

The automotive industry is experiencing unprecedented technological shifts, with advanced driver-assistance systems (ADAS), software-defined vehicles, and autonomous driving becoming mainstream. This rapid evolution necessitates substantial, continuous investment in specialized technician training, cutting-edge diagnostic equipment, and advanced repair tools for companies like Driven Brands. For instance, the global ADAS market was valued at approximately $31.4 billion in 2023 and is projected to grow significantly, highlighting the increasing complexity of vehicle maintenance.

Failure to adapt and invest in these new technologies risks making current service capabilities outdated and uncompetitive. This technological acceleration demands a proactive approach to skill development and equipment upgrades to ensure service centers can effectively handle the sophisticated systems found in modern vehicles, potentially impacting customer retention and revenue streams.

Intensified Competition from New Entrants and Business Models

The automotive aftermarket is seeing a surge of new entrants employing innovative business models, like mobile mechanic services and direct-to-consumer online platforms. This presents a significant threat to established players like Driven Brands, as these agile, tech-savvy competitors can offer unparalleled convenience and potentially lower costs, directly challenging traditional service providers and dealerships.

For instance, the rise of mobile repair services, which bypass the need for physical storefronts, allows for lower overhead and greater flexibility in customer service. In 2024, the global automotive aftermarket was valued at over $450 billion, with a significant portion of growth attributed to these disruptive digital-first and service-on-demand models.

- Mobile Mechanic Market Growth: The mobile mechanic sector is projected to grow at a CAGR of over 7% through 2028, indicating a substantial shift in consumer preference for convenient, at-home or at-work automotive repairs.

- Online Platforms' Market Share: Online automotive parts and service marketplaces are capturing increasing market share, with some reporting year-over-year revenue growth exceeding 20% as consumers embrace digital purchasing and booking.

- Disruption of Traditional Models: These new entrants often leverage data analytics and streamlined operations to offer competitive pricing and faster service, potentially eroding the market share of brick-and-mortar businesses that may have higher operating costs.

Supply Chain Disruptions and Cost Fluctuations

Driven Brands faces significant threats from ongoing supply chain disruptions within the automotive parts sector. Shortages and delays in obtaining critical components, coupled with volatile pricing for raw materials, directly impact service operations and inventory management. For instance, the automotive industry experienced widespread parts shortages in 2023 and early 2024, with some manufacturers reporting delays of several months for essential electronic components, which can trickle down to aftermarket service providers like those under Driven Brands.

These external pressures can lead to increased operating costs, squeezing profit margins as the company absorbs higher material and logistics expenses. Furthermore, the inability to secure necessary parts efficiently can hinder Driven Brands' capacity to meet customer demand promptly, potentially affecting customer satisfaction and revenue generation. The projected growth in automotive repair and maintenance services for 2024, estimated to be around 3-5%, could be hampered by these supply-side challenges.

- Component Shortages: Persistent availability issues for key automotive parts, particularly electronics and specialized materials, continue to plague the industry.

- Price Volatility: Fluctuations in the cost of raw materials like steel, aluminum, and plastics directly affect the pricing of replacement parts.

- Logistical Bottlenecks: Port congestion and transportation delays, while showing some improvement from peak 2022 levels, still pose risks to timely inventory replenishment.

- Impact on Profitability: Increased operational expenses due to supply chain issues can erode profit margins if not effectively passed on to consumers or mitigated through strategic sourcing.

Intensifying competition from independent repair shops and dealerships poses a threat as they may offer more aggressive pricing or specialized services. Additionally, the increasing complexity of vehicles, requiring advanced diagnostic tools and technician training, can create a barrier to entry for less-equipped competitors, but also demands significant ongoing investment from established players like Driven Brands to remain competitive.

Regulatory changes, such as evolving emissions standards or new vehicle safety mandates, could necessitate costly upgrades to equipment and processes for Driven Brands' service centers. For example, stricter emissions testing protocols implemented in various regions in 2024 have required shops to invest in updated diagnostic hardware and software to maintain compliance.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Relevance |

|---|---|---|---|

| Economic Conditions | Consumer Spending Reduction | Decreased demand for non-essential services | Inflationary pressures persist, impacting discretionary income. |

| Labor Market | Skilled Technician Shortage | Increased labor costs, service delays | Demand for technicians remains high, driving wage growth. |

| Technological Advancements | Rapid EV/ADAS Adoption | Need for new equipment and training | Increasing complexity of vehicle systems requires continuous investment. |

| Competition | New Entrants & Digital Platforms | Loss of market share, pricing pressure | Mobile and online services gain traction, challenging traditional models. |

| Supply Chain | Parts Shortages & Volatility | Higher operating costs, service interruptions | Component availability remains a concern, affecting repair times. |

SWOT Analysis Data Sources

This Driven Brands SWOT analysis is built on a foundation of credible data, including publicly available financial reports, comprehensive market research, and expert industry commentary to ensure a well-rounded and accurate assessment.