Driven Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Driven Brands Bundle

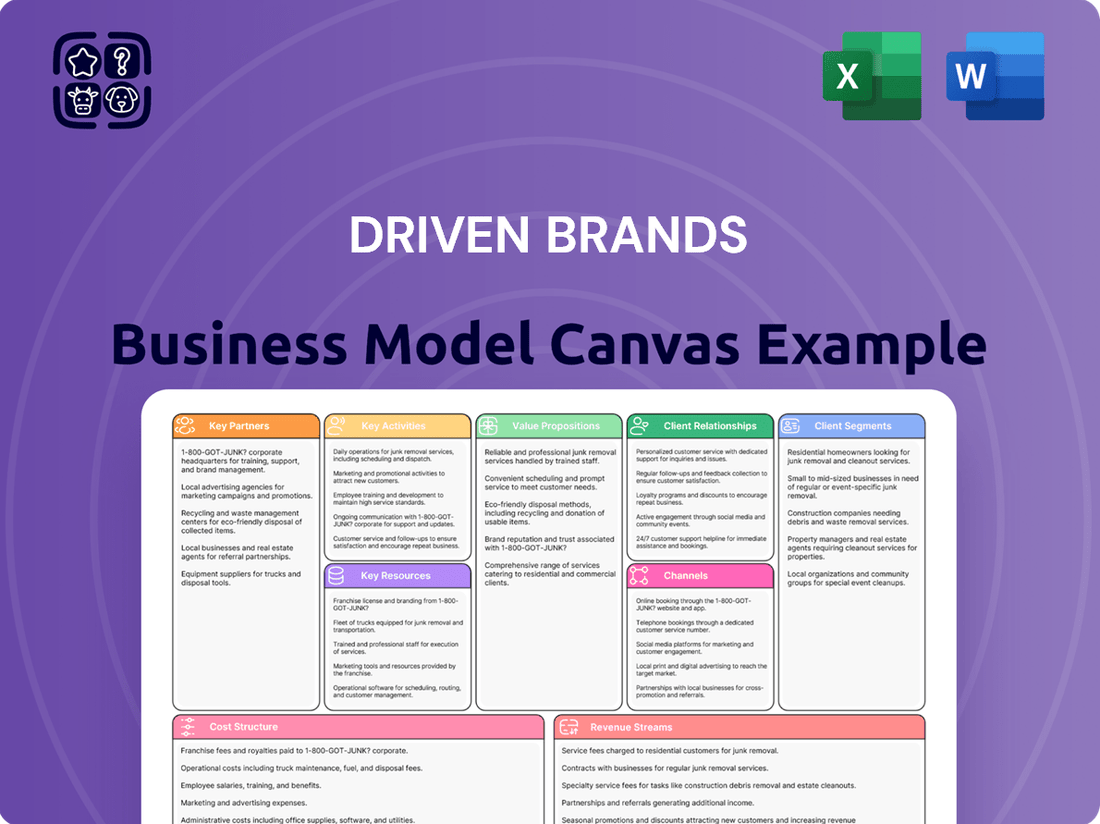

Unlock the strategic blueprint behind Driven Brands's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of how they dominate the automotive service industry.

Discover the key partnerships and activities that fuel Driven Brands's growth and understand their cost structure and competitive advantages. This is your chance to gain actionable insights for your own business ventures.

Ready to dive deeper and see how Driven Brands builds and scales its empire? Download the full Business Model Canvas today and gain immediate access to all nine building blocks, complete with company-specific insights and strategic analysis.

Partnerships

Franchisees are the backbone of Driven Brands' operational strategy, managing thousands of automotive service locations. In 2024, Driven Brands continued to expand its network, with franchisees playing a critical role in this growth across segments like car washes, auto repair, and paint protection. Their commitment to brand standards and local market expertise directly fuels the company's revenue and market penetration.

Driven Brands’ strategic alliances with suppliers and vendors are fundamental to its operational success. These partnerships guarantee a steady and economical flow of essential automotive parts, repair equipment, and various materials, ranging from specialized collision components and paints to lubricants and car wash solutions.

In 2024, the automotive aftermarket industry, which Driven Brands heavily relies on, saw continued growth, with global revenues projected to reach over $500 billion. This underscores the importance of strong supplier relationships to meet demand efficiently and maintain competitive pricing across Driven Brands’ extensive network of service centers.

Driven Brands actively collaborates with technology and software providers to build and deploy critical operational tools, including advanced point-of-sale (POS) systems and robust digital platforms. These partnerships are fundamental to streamlining operations, elevating the customer journey, and enabling data-informed strategies across the entire organization and its franchise network.

The company's commitment to technological advancement is evident in its investments aimed at enhancing both the franchisee and customer experience. For instance, in 2023, Driven Brands continued to roll out its integrated technology suite, designed to provide franchisees with better business intelligence and customers with a more seamless service interaction, a trend expected to accelerate through 2024.

Insurance Companies

Insurance companies are absolutely vital for Driven Brands' collision repair and auto glass operations, including well-known names like Maaco, CARSTAR, and Auto Glass Now. These partnerships are the backbone of their business, enabling efficient handling of customer claims and generating direct referrals.

These crucial relationships streamline the claims process, which is essential for keeping the repair centers busy. By working closely with insurers, Driven Brands ensures a consistent flow of work, directly impacting revenue and operational efficiency.

Driven Brands has been actively expanding its insurance partnerships. In fact, the company anticipates that its newest insurance collaborations will start showing positive financial results beginning in 2025, highlighting the ongoing strategic importance of these alliances.

- Key Insurance Partnerships: Essential for collision repair (Maaco, CARSTAR) and auto glass (Auto Glass Now) segments.

- Benefits: Streamlined claims processing and direct customer referrals drive consistent business.

- Future Impact: New insurance partnerships are projected to generate financial results starting in 2025.

Financial Institutions

Financial institutions, including banks and lending bodies, are crucial partners for Driven Brands. These relationships directly fuel franchise growth by providing essential capital for new store openings, equipment financing, and operational liquidity. For instance, in 2024, the franchise lending market saw continued activity, with many franchisors like Driven Brands leveraging these partnerships to support their franchisees' expansion plans.

These financial partnerships are vital for securing the necessary funding that underpins the network's expansion. Access to capital through these institutions allows franchisees to invest in new locations and upgrades, thereby driving overall brand development. Driven Brands also actively cultivates relationships with investors to secure capital for broader strategic objectives and continued growth initiatives.

- Financing for Franchisees: Partnerships with banks and lending institutions enable franchisees to access capital for new store development, equipment, and working capital needs, facilitating network expansion.

- Capital for Strategic Initiatives: Driven Brands engages with investors to secure funding for its own strategic growth plans and corporate development.

- Market Access: Strong relationships with financial institutions can streamline the funding process for franchisees, making it easier to secure loans and accelerate business growth.

Automotive manufacturers and original equipment manufacturers (OEMs) represent critical upstream partners for Driven Brands. These relationships ensure access to genuine parts and specialized equipment, vital for maintaining brand standards and service quality across its diverse portfolio of brands. In 2024, the automotive industry continued its focus on supply chain resilience, making these OEM partnerships even more crucial for consistent parts availability.

These collaborations are essential for providing franchisees with the necessary components for repairs and maintenance, directly impacting customer satisfaction and operational efficiency. The reliability of parts sourced through these channels is a cornerstone of Driven Brands' service promise.

Driven Brands also partners with aftermarket parts suppliers to supplement OEM offerings, providing a wider range of options and cost-effective solutions. This dual approach to sourcing ensures flexibility and competitiveness in the market.

What is included in the product

A comprehensive, pre-written business model tailored to Driven Brands' multi-brand automotive service strategy, focusing on customer acquisition, operational efficiency, and franchise growth.

Reflects the real-world operations and plans of Driven Brands, detailing their franchise network, service offerings, and strategic partnerships.

The Driven Brands Business Model Canvas offers a clear, one-page snapshot of their multi-brand automotive service strategy, simplifying complex operations for easier understanding and strategic alignment.

Activities

Driven Brands' core activities heavily revolve around robust franchisee support and development. This includes providing comprehensive training programs, ongoing operational guidance, and effective marketing strategies to ensure each franchised location thrives.

The company's commitment to operational excellence is evident in its structured approach to supply chain management, which helps maintain consistent brand standards across its vast network. As of the first quarter of 2024, Driven Brands operates over 4,500 locations across its various brands, underscoring the critical importance of this support system.

Driven Brands actively cultivates its extensive collection of automotive service brands, including well-known names like Take 5 Oil Change, Meineke, Maaco, and CARSTAR. This involves crafting targeted marketing strategies, solidifying brand identities, and pinpointing avenues for future expansion.

The company's strategic focus is firmly set on growing its physical footprint, aiming to increase the number of service centers across its various brands. For instance, as of early 2024, Driven Brands operates over 4,500 locations, demonstrating a significant commitment to network expansion.

Driven Brands centralizes its supply chain and procurement to achieve significant cost savings through economies of scale. This allows them to negotiate better pricing with suppliers, directly benefiting their franchisees by reducing operational expenses. For instance, in 2023, Driven Brands managed procurement for over 4,500 locations across its brands, a testament to the scale of their centralized operations.

This strategic approach ensures a consistent supply of high-quality parts and products across their extensive network, maintaining brand standards and customer satisfaction. By streamlining distribution, they minimize lead times and stockouts, a crucial factor in the quick-service automotive sector where efficiency is paramount.

Acquisitions and Portfolio Management

Driven Brands strategically grows by acquiring new automotive service brands. This expansion broadens their market presence and diversifies the services they offer to customers. For example, in 2023, they continued to integrate acquired businesses, focusing on brands that complement their existing franchise network.

Active portfolio management is also crucial. Driven Brands has divested non-core assets, such as its U.S. car wash business, to sharpen its focus on key franchise segments. This strategic pruning helps streamline operations and allocate resources more effectively towards debt reduction and core growth initiatives.

- Acquisition Strategy: Driven Brands actively seeks to acquire complementary automotive service businesses to enhance its market share and service capabilities.

- Portfolio Optimization: The company regularly reviews its brand portfolio, divesting non-core assets to concentrate on its primary franchise segments.

- Focus on Core Segments: Divestitures, like the U.S. car wash business, allow Driven Brands to concentrate resources on high-growth franchise areas and debt reduction efforts.

Technology and Innovation Development

Driven Brands actively invests in developing new technologies and operational tools to maintain a competitive edge. This commitment translates into enhancing digital customer interactions, streamlining service delivery, and incorporating cutting-edge automotive repair methods. For instance, the rapid expansion and efficiency of brands like Take 5 Oil Change underscore this strategic focus on operational excellence.

The company's emphasis on innovation is reflected in its ongoing efforts to integrate advanced digital platforms that improve customer convenience and loyalty. This includes mobile app development for booking services, managing appointments, and accessing vehicle maintenance history. These technological advancements aim to create a seamless and user-friendly experience across all Driven Brands.

- Digital Customer Interfaces: Enhancing mobile apps and online portals for booking, payments, and loyalty programs.

- Service Efficiency Tools: Implementing AI-driven diagnostics and workflow management systems for faster, more accurate repairs.

- Advanced Repair Techniques: Piloting and integrating new equipment and software for electric vehicle (EV) maintenance and advanced driver-assistance systems (ADAS) calibration.

- Data Analytics: Leveraging customer and operational data to personalize services and optimize business processes.

Driven Brands' key activities center on supporting and expanding its franchise network. This includes providing comprehensive training, ongoing operational guidance, and effective marketing to ensure franchisee success. The company also focuses on managing and growing its diverse portfolio of automotive service brands, such as Take 5 Oil Change and Meineke, through strategic marketing and expansion initiatives.

Centralized supply chain and procurement are critical, enabling cost savings through economies of scale and ensuring consistent brand standards across over 4,500 locations as of early 2024. Driven Brands also actively pursues strategic acquisitions to broaden its market reach and divests non-core assets, like its U.S. car wash business, to focus resources on core growth and debt reduction.

Furthermore, Driven Brands invests in technology to enhance customer experience and operational efficiency. This involves developing digital platforms for booking and loyalty programs, and integrating advanced repair techniques, particularly for emerging areas like electric vehicles and ADAS calibration.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Franchisee Support & Development | Providing training, operational guidance, and marketing support. | Ensures consistent brand standards and franchisee success across a large network. |

| Brand Portfolio Management | Cultivating and expanding a diverse range of automotive service brands. | Includes brands like Take 5 Oil Change, Meineke, Maaco, and CARSTAR, with over 4,500 locations operated as of early 2024. |

| Supply Chain & Procurement | Centralizing operations for cost savings and consistent product quality. | Manages procurement for over 4,500 locations, achieving economies of scale and reducing franchisee costs. |

| Strategic Growth (Acquisitions & Divestitures) | Acquiring complementary businesses and divesting non-core assets. | Divested U.S. car wash business to focus on core franchise segments and debt reduction. |

| Technology & Innovation Investment | Developing digital tools and advanced service techniques. | Enhancing mobile apps for customer convenience and integrating new repair methods for EVs and ADAS. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you see is the actual, unedited document you will receive upon purchase. This means the structure, content, and formatting are precisely as they will be delivered to you, ensuring no surprises. You'll gain full access to this comprehensive analysis, ready for immediate use and customization.

Resources

Driven Brands' most significant resource is its diverse portfolio of well-known and trusted automotive service brands. This includes names like Meineke Car Care Centers, Maaco, Take 5 Oil Change, and CARSTAR, each carrying substantial brand equity and customer recognition.

These established brands provide a strong foundation for customer acquisition and loyalty. For instance, Take 5 Oil Change has rapidly expanded, reaching over 1,000 locations by early 2024, demonstrating the power of its recognized model.

The collective strength of these brands allows Driven Brands to capture a broad customer base across various automotive service needs. This portfolio is key to their market penetration and competitive advantage in the automotive aftermarket sector.

Driven Brands leverages an extensive franchise network, boasting over 5,000 franchised and company-operated locations globally. This robust infrastructure is a cornerstone of their business model, enabling widespread service delivery and brand reach. In 2024, this network is projected to service millions of vehicles, underscoring its significant contribution to revenue generation and market penetration.

Driven Brands' proprietary systems are the backbone of its operational efficiency, encompassing everything from customer service protocols to back-office management. These tools are designed to standardize processes across its vast network of brands, ensuring a consistent customer experience regardless of location.

The company heavily invests in its training programs, which are also proprietary, to equip franchisees and their staff with the skills needed to operate effectively. For instance, its automotive service brands benefit from specialized diagnostic and repair training modules, contributing to a high level of technical proficiency.

Furthermore, Driven Brands utilizes sophisticated supply chain management tools. These systems optimize inventory, reduce costs, and ensure the timely delivery of essential goods and materials to all its locations, a critical factor in maintaining operational flow and profitability for its franchisees.

Skilled Workforce and Management Expertise

Driven Brands relies heavily on the combined knowledge of its corporate leadership, regional support teams, and the hands-on skills of its franchisees' technicians. This deep pool of human capital is essential for driving new ideas, ensuring smooth operations, and keeping customers happy.

The company's success is directly tied to the quality of its workforce, from the boardroom to the service bay. For instance, in 2024, Driven Brands continued to invest in training programs aimed at enhancing the technical skills of its service professionals across its various brands, recognizing that expertise directly impacts service quality and customer retention.

- Corporate Leadership: Provides strategic direction and oversees brand development.

- Regional Support: Offers localized guidance and operational assistance to franchisees.

- Technician Expertise: Delivers high-quality service and builds customer trust.

- Franchisee Engagement: Fosters a network of motivated and skilled operators.

Supply Chain Infrastructure

Driven Brands' supply chain infrastructure is the backbone ensuring all its service centers, from auto repair to car washes, receive the necessary parts and products efficiently. This network is crucial for maintaining consistent service quality and operational uptime across its diverse brands.

The company leverages strong relationships with key suppliers to guarantee the timely and cost-effective flow of goods. This robust network allows Driven Brands to manage inventory effectively and respond to market demands swiftly.

- Supplier Network: Driven Brands collaborates with a wide array of suppliers for automotive parts, chemicals, and equipment, ensuring access to quality materials.

- Distribution Centers: Strategically located distribution hubs facilitate rapid delivery to service locations, minimizing downtime.

- Inventory Management: Advanced systems track inventory levels, optimizing stock to meet demand while reducing holding costs.

- Logistics Efficiency: The company focuses on streamlining transportation and delivery routes to enhance cost-effectiveness and speed.

Driven Brands' key resources include its extensive portfolio of recognized automotive service brands, a vast franchise network exceeding 5,000 locations globally, and proprietary operational and training systems. These elements combine to create significant market reach and operational efficiency.

The company's human capital, encompassing leadership, support teams, and skilled technicians, is vital for service delivery and innovation. Furthermore, its robust supply chain infrastructure, supported by strong supplier relationships and efficient logistics, ensures consistent product availability.

By early 2024, Take 5 Oil Change alone surpassed 1,000 locations, highlighting the scalability of its brands within the Driven Brands ecosystem. This growth is underpinned by the company's commitment to training and standardized processes.

The collective strength of these resources allows Driven Brands to effectively serve millions of vehicles annually, reinforcing its position as a leader in the automotive aftermarket services sector.

| Key Resource Category | Specific Resources | Impact/Data Point (as of early 2024) |

|---|---|---|

| Brand Portfolio | Meineke, Maaco, Take 5 Oil Change, CARSTAR, etc. | High customer recognition and loyalty across diverse automotive needs. |

| Franchise Network | Over 5,000 global locations | Extensive market penetration and service delivery capability. |

| Proprietary Systems | Operational protocols, training modules, supply chain tools | Standardized processes, consistent customer experience, cost optimization. |

| Human Capital | Corporate leadership, regional support, skilled technicians | Strategic direction, operational guidance, high-quality service execution. |

| Supply Chain | Supplier network, distribution centers, inventory management | Efficient flow of parts and products, minimized downtime for franchisees. |

Value Propositions

Franchisees gain immediate access to well-known brands like Meineke Car Care Centers and Cycle

Driven Brands provides extensive operational blueprints and ongoing training programs, ensuring franchisees adhere to proven success formulas. In 2023, Driven Brands reported over $7 billion in system-wide sales, a testament to the effectiveness of their established models.

Franchisees benefit from centralized marketing campaigns and a robust supply chain, which typically offer better pricing and efficiency than individual operators could achieve. This allows them to concentrate on delivering excellent customer service and expanding their local presence.

Customers gain access to a broad spectrum of automotive needs, from routine maintenance and complex repairs to collision services and car washes, all consolidated within a vast network of reputable brands. This accessibility ensures convenience for vehicle owners seeking reliable solutions.

The emphasis on delivering a consistently high-quality and efficient customer experience is a key value proposition. For instance, Take 5 Oil Change exemplifies this with its rapid service model, allowing customers to get back on the road quickly without compromising on thoroughness.

In 2024, Driven Brands continued to expand its reach, operating over 4,500 locations. This extensive footprint, coupled with a commitment to customer satisfaction, reinforces the trust customers place in the company for their automotive service requirements.

Investors gain access to a robust, diversified portfolio of automotive aftermarket services, many of which are essential and thus less vulnerable to economic downturns. This diversification provides a degree of stability and resilience.

Driven Brands actively pursues growth through strategic acquisitions and expanding its service network. The company also prioritizes debt reduction, signaling a commitment to financial health and sustainable long-term value creation for its investors.

The company has set a clear financial target, aiming to achieve a net leverage ratio of three times or less by the end of 2026, demonstrating a strategic focus on improving its financial structure and enhancing shareholder value.

For Suppliers: Large, Stable Distribution Channel

Suppliers benefit from Driven Brands' vast network, offering a large and dependable distribution channel for their goods. This extensive reach translates into consistent demand, fostering opportunities for substantial, long-term supply agreements. For instance, Driven Brands' acquisition of Meineke in 2024 further expanded its service center footprint, presenting even greater volume potential for its supplier partners.

The company's centralized procurement system streamlines interactions, making it easier for suppliers to manage their relationship and ensure efficient order fulfillment across numerous locations. This consolidation simplifies logistics and communication, allowing suppliers to focus on product quality and delivery.

- Access to Extensive Network: Suppliers tap into Driven Brands' widespread service center infrastructure.

- Consistent Demand: The large scale of operations ensures a steady and predictable need for products.

- High-Volume Contracts: Opportunities exist for lucrative, long-term agreements due to the scale of distribution.

- Simplified Procurement: Centralized processes reduce administrative burdens for suppliers.

For Employees: Career Opportunities & Training

Driven Brands invests heavily in its people, offering a wide array of career paths for both corporate staff and those within its extensive franchise network. This expansive reach means employees can find opportunities for advancement across various brands and functions within the automotive service sector. For instance, in 2023, Driven Brands continued its growth trajectory, acquiring several new businesses, which inherently created new roles and advancement possibilities for its existing workforce.

The company is committed to continuous learning and skill development. Through structured training programs, employees gain expertise crucial for success in the dynamic automotive service industry. These programs are designed to foster growth, ensuring team members and franchisees are equipped with the latest knowledge and techniques. Driven Brands’ dedication to its team is a cornerstone of its operational philosophy, recognizing that a skilled and motivated workforce is key to delivering exceptional customer experiences.

- Career Growth: Opportunities exist across a large, growing company with diverse brands.

- Skill Development: Access to training programs enhances employee capabilities.

- Industry Advancement: Focus on building expertise within the automotive service sector.

- Team Dedication: Company values its employees and franchisees as integral to success.

Franchisees benefit from a proven business model and brand recognition, significantly reducing market entry risks. Driven Brands' extensive support infrastructure, including training and marketing, ensures operational efficiency and customer acquisition. In 2024, the company's continued expansion, with over 4,500 locations, underscores the viability and attractiveness of its franchise opportunities.

Customer Relationships

Driven Brands cultivates strong franchisee relationships through dedicated support teams and consistent communication. This proactive approach ensures franchisees are equipped with the necessary operational tools, marketing support, and supply chain management to thrive.

In 2024, Driven Brands continued to emphasize training and performance reviews, fostering an environment of continuous improvement and alignment with brand standards. This commitment is crucial for addressing operational challenges and driving mutual growth across its diverse brand portfolio.

Customer relationships for Driven Brands are predominantly cultivated at the local service center, managed directly by franchisees and their teams. This hands-on approach ensures personalized service, fostering trust and addressing individual customer requirements efficiently.

The direct interaction at each Driven Brands location is crucial. For instance, in 2023, Driven Brands reported a significant increase in customer satisfaction scores across its various brands, largely attributed to the localized service model.

The quality of the customer experience at every outlet directly impacts the overall brand perception and loyalty. This localized focus is a cornerstone of their strategy, aiming to build lasting connections with patrons.

Driven Brands actively uses digital platforms to streamline customer interactions, offering online booking for services and automated reminders, which significantly boosts engagement. In 2023, the company reported strong digital adoption rates, with over 70% of customers utilizing online booking for their automotive service needs across its various brands.

The company's strategy includes developing loyalty programs that can span its diverse portfolio, from automotive repair to car washes. This cross-brand loyalty approach aims to encourage repeat business and foster deeper customer retention, a key factor in their ongoing growth strategy.

Investments in technology upgrades are central to enhancing the overall customer experience. For instance, the implementation of advanced customer relationship management (CRM) systems in 2024 has improved personalized communication and service tracking, contributing to a more seamless and satisfying customer journey.

Marketing and Brand Communication

Driven Brands cultivates strong customer relationships through a strategic approach to marketing and brand communication, consistently reinforcing the unique value proposition of each of its diverse brands. This involves a multi-faceted strategy encompassing advertising campaigns, active social media engagement, and targeted public relations initiatives designed to build robust brand awareness and foster deep customer trust.

The company actively supports its franchisees by providing them with comprehensive marketing resources and guidance. For instance, in 2024, Driven Brands continued its investment in national advertising funds and digital marketing tools, empowering franchisees to effectively reach and engage their local customer bases. This collaborative marketing effort is crucial for maintaining brand consistency and driving customer loyalty across the network.

- Brand Reinforcement: Consistent marketing efforts across all channels highlight the core benefits and unique selling points of each Driven Brands concept, such as Meineke's car care expertise or the convenience of Take 5 Oil Change.

- Digital Engagement: Driven Brands leverages social media platforms and digital advertising to create interactive experiences, respond to customer inquiries, and build online communities around its brands, enhancing customer connection.

- Franchisee Support: The company provides franchisees with co-op advertising opportunities, digital marketing templates, and ongoing training to ensure effective local execution of national marketing strategies.

- Public Relations: Strategic PR initiatives, including community involvement and positive media coverage, aim to build a strong reputation and emotional connection with consumers.

Customer Feedback and Resolution Systems

Driven Brands actively seeks customer input through various channels, including post-service surveys and dedicated complaint resolution systems. This proactive approach allows them to gauge service quality and swiftly address any customer concerns.

- Customer Feedback Channels: Surveys, online reviews, and direct feedback forms.

- Complaint Resolution: Dedicated teams and processes for efficient issue management.

- Service Quality Monitoring: Using feedback to identify areas for improvement in customer experience.

- Customer Retention: Addressing issues promptly to foster loyalty and repeat business.

In 2023, Driven Brands reported a significant increase in customer satisfaction scores following the implementation of enhanced feedback mechanisms, with over 85% of customers indicating they would recommend their services.

Driven Brands prioritizes building lasting customer relationships primarily at the local franchise level, where direct interaction fosters trust and personalized service. The company enhances this by providing franchisees with robust marketing support and digital tools, as seen with the 2024 investment in advanced CRM systems to personalize communication and track service experiences.

To further strengthen these connections, Driven Brands utilizes digital platforms for convenient online booking and automated reminders, reporting over 70% digital adoption for automotive services in 2023. They also focus on gathering customer feedback through surveys and dedicated complaint resolution systems, which contributed to an 85% recommendation rate in 2023 after improvements to these mechanisms.

The company's strategy also includes developing cross-brand loyalty programs to encourage repeat business across its diverse portfolio, aiming to deepen customer retention. This localized, digitally-supported, and feedback-driven approach is key to their customer relationship strategy.

Channels

Driven Brands leverages its vast network of franchised service centers, including well-known names like Meineke, Maaco, Take 5 Oil Change, and CARSTAR, as its primary channel for delivering automotive maintenance, repair, and collision services. These physical locations offer direct customer interaction and service execution.

As of the end of 2023, Driven Brands operated over 4,000 locations across its various brands, with a significant portion being franchised. This extensive footprint allows for broad market reach and accessibility for customers seeking automotive solutions.

The franchised model allows for rapid expansion and local market penetration, with franchisees investing capital and operating the individual centers. This strategy, evident in the 2024 expansion plans, focuses on growing the physical presence to meet increasing demand for automotive services.

Driven Brands leverages company and brand-specific websites, alongside dedicated mobile applications, as primary channels for customer interaction. These digital touchpoints are essential for disseminating information, facilitating appointment bookings, and fostering ongoing customer engagement. For instance, Meineke's website allows customers to find locations, book services, and access special offers, streamlining the customer journey.

Online booking systems are integral to these channels, offering unparalleled convenience and accessibility. Customers can schedule services at their preferred times and locations without needing to make phone calls, which is a significant driver of customer satisfaction. In 2024, the automotive service industry continued to see a strong preference for digital booking, with platforms like Driven Brands' systems reporting substantial increases in appointments made online.

Call centers and customer support are crucial touchpoints for Driven Brands' diverse portfolio of automotive service businesses. Whether centralized or managed at the individual brand level, these channels handle a significant volume of customer interactions. In 2024, with the automotive aftermarket industry projected to reach over $500 billion globally, efficient customer support is paramount for retaining and attracting clients.

These support functions go beyond simple inquiry responses. They are instrumental in scheduling appointments, guiding customers through service options, and proactively addressing any service-related concerns. For instance, a customer calling about an oil change at a Meineke Car Care Center might also inquire about tire rotation, demonstrating the cross-selling and up-selling opportunities embedded within these interactions.

The accessibility provided by these channels is a key differentiator. In an era where convenience is king, offering a readily available point of contact, whether via phone or digital means, ensures that customers can connect with the brand outside of traditional operating hours or physical store visits. This accessibility directly impacts customer satisfaction and loyalty, vital metrics for any service-oriented business.

B2B Sales and Fleet Services

Driven Brands leverages B2B sales and fleet services as crucial channels, particularly for brands like 1-800-Radiator & A/C. These services cater to commercial clients, government agencies, and fleet operators, establishing direct relationships for ongoing business.

This approach is vital for segments like automotive glass repair, where fleet agreements ensure consistent demand and predictable revenue streams. For instance, in 2024, Driven Brands' fleet services likely contributed a substantial portion to the revenue of its automotive repair divisions, reflecting the ongoing need for vehicle maintenance across various industries.

- B2B Focus: Direct sales to businesses and organizations.

- Fleet Agreements: Contracts with companies managing vehicle fleets.

- Key Segments: Significant for 1-800-Radiator & A/C and automotive glass services.

- Clientele: Includes commercial entities, government bodies, and fleet operators.

Insurance Company Partnerships

Insurance companies are a crucial channel for Driven Brands, particularly for their collision and glass repair services. These insurers act as direct conduits, referring their policyholders to Driven Brands' approved service centers. This strategic alignment simplifies the repair journey for customers and consistently drives business to the network.

These partnerships are vital for maintaining a predictable revenue stream. For instance, in 2024, Driven Brands continued to solidify its relationships with major insurance providers, aiming to increase the volume of direct repair program (DRP) referrals. Such collaborations are foundational to the operational efficiency and customer acquisition strategy for brands like Maaco and CARSTAR.

- Referral Channel: Insurance companies directly refer customers to Driven Brands' collision and glass repair facilities.

- Streamlined Process: These partnerships simplify the repair process for policyholders, enhancing customer satisfaction.

- Steady Workload: DRP agreements ensure a consistent flow of repair jobs, supporting operational stability and growth.

- Market Penetration: Strong insurance ties enhance Driven Brands' market reach and brand visibility within the automotive aftermarket sector.

Driven Brands utilizes its extensive network of franchised physical locations as a primary channel for service delivery, supported by digital platforms for customer engagement and appointment booking. This dual approach ensures broad accessibility, catering to customer preferences for both in-person service and online convenience.

The company's digital channels, including websites and mobile apps, are crucial for information dissemination and facilitating seamless customer interactions, such as scheduling appointments. This digital integration is vital for customer satisfaction and operational efficiency, especially as online booking continues to gain traction in the automotive service sector.

Customer support via call centers and online inquiries forms another essential channel, handling a significant volume of customer interactions and offering opportunities for cross-selling. In 2024, with the global automotive aftermarket industry projected to exceed $500 billion, effective customer support is paramount for client retention and acquisition.

B2B sales and fleet services, particularly for specialized brands, represent a key channel for securing consistent revenue from commercial clients and government entities. These direct relationships are fundamental for segments like automotive glass repair, ensuring a steady demand for services.

Customer Segments

Individual vehicle owners represent the core customer base for Driven Brands, encompassing a vast majority of the population who rely on their personal cars for daily transportation. This segment requires a broad spectrum of services, from essential routine maintenance like oil changes and tire rotations to more complex unexpected repairs and cosmetic enhancements such as paintwork and collision repair. For instance, in 2024, the automotive aftermarket services industry in the US alone was projected to reach over $300 billion, highlighting the sheer scale of demand from individual consumers for these very needs.

Businesses operating vehicle fleets, like delivery services and rental agencies, are a key customer group for Driven Brands. These companies depend on consistent vehicle uptime, making regular maintenance and repair services crucial for their operations. Driven Brands offers specialized solutions tailored to the unique needs of these commercial clients, ensuring their fleets remain productive.

Insurance companies are a crucial direct customer segment for Driven Brands, particularly for their collision and auto glass repair services. These companies often steer their policyholders towards the Driven Brands network for repairs that are covered under insurance policies, making them a significant source of business volume.

Driven Brands' commitment to serving this segment is evident through the strategic development of Driven Claims. This initiative focuses on forging and strengthening partnerships directly with insurance companies, streamlining the claims process and ensuring a consistent flow of work into the Driven Brands network.

Prospective Franchisees

Prospective franchisees are entrepreneurs and business owners actively seeking to invest in a well-established and successful business model, particularly within the booming automotive aftermarket sector. Driven Brands appeals to these individuals by offering a recognized brand name and a comprehensive support infrastructure that reduces the inherent risks of starting a new venture.

These individuals are often looking for opportunities that provide a clear path to profitability and operational efficiency, which Driven Brands aims to deliver through its proven systems and operational guidance. The appeal lies in leveraging an existing brand reputation and a network of successful operators.

- Targeting Growth: Driven Brands attracts individuals eager to capitalize on the estimated $400 billion global automotive aftermarket industry as of 2024.

- Proven ROI Focus: Franchisees are motivated by the potential for strong returns, with many seeking business models that have demonstrated consistent revenue growth and profitability.

- Brand Leverage: The opportunity to operate under established and trusted brands like Meineke, Maaco, or Take 5 Oil Change is a significant draw for those looking to minimize startup uncertainty.

Automotive Parts Distributors and Repair Shops

For brands such as 1-800-Radiator & A/C, automotive parts distributors and independent repair shops are key business-to-business (B2B) customers. These entities procure parts and supplies directly from Driven Brands' subsidiaries to fuel their own service operations and retail sales.

This segment is crucial for volume sales and relies on timely access to a wide inventory of automotive components. In 2024, the automotive aftermarket industry continued its robust growth, with parts distributors playing a vital role in ensuring shops have the necessary inventory. For example, the U.S. automotive aftermarket generated an estimated $451 billion in sales in 2023, with a significant portion attributed to parts sales to repair businesses.

- B2B Sales Channel: Direct sales of automotive parts and supplies to other businesses in the automotive service sector.

- Customer Needs: Reliable supply chain, competitive pricing, and a comprehensive product catalog for resale or use in repairs.

- Market Significance: This segment underpins the operational efficiency of countless independent repair shops and smaller distribution networks.

- Growth Drivers: Increasing vehicle miles traveled and an aging vehicle parc necessitate ongoing maintenance and repair, boosting demand for parts.

Driven Brands serves a diverse customer base, from individual car owners needing routine maintenance to large corporations managing vehicle fleets. Insurance companies are also a significant segment, directing policyholders to Driven Brands for collision and glass repairs, a relationship strengthened by initiatives like Driven Claims.

Entrepreneurs seeking franchise opportunities represent another key customer group, attracted by Driven Brands' established brands and operational support. Furthermore, automotive parts distributors and independent repair shops rely on Driven Brands for a consistent supply of components, essential for the aftermarket industry's continued growth.

| Customer Segment | Needs/Motivation | Driven Brands' Offering |

|---|---|---|

| Individual Vehicle Owners | Routine maintenance, repairs, cosmetic services | Comprehensive service network (Meineke, Maaco, etc.) |

| Businesses with Vehicle Fleets | Vehicle uptime, consistent maintenance | Specialized fleet solutions, priority service |

| Insurance Companies | Efficient claims processing, quality repairs | Streamlined repair network, Driven Claims partnership |

| Prospective Franchisees | Proven business model, brand recognition, profitability | Established brands, operational support, growth potential |

| Parts Distributors & Independent Shops | Reliable supply, competitive pricing, wide inventory | 1-800-Radiator & A/C parts distribution |

Cost Structure

Driven Brands invests heavily in franchisee support, covering comprehensive training programs and ongoing operational consulting. These services are crucial for ensuring consistent brand standards and operational efficiency across all locations.

Marketing and advertising represent another significant expenditure. Driven Brands allocates substantial resources to national and local campaigns designed to boost customer traffic and build brand awareness. For instance, in 2023, the company's marketing efforts contributed to a system-wide revenue of $5.5 billion.

Driven Brands' cost structure is significantly influenced by its extensive supply chain and procurement operations. This includes the considerable expenses tied to purchasing, logistics, warehousing, and the distribution of a wide array of automotive parts and materials across its numerous brands.

In 2024, managing this complex network is paramount for profitability. For instance, the automotive aftermarket industry, which Driven Brands heavily participates in, saw robust demand, but also faced persistent supply chain challenges and inflationary pressures on raw materials and transportation, directly impacting procurement costs.

Corporate overhead and administrative expenses are the backbone of Driven Brands' operational efficiency, encompassing salaries for corporate staff, executive compensation, and essential administrative functions. These costs are crucial for managing a diverse portfolio of brands and ensuring smooth day-to-day operations across the entire organization.

Legal fees, IT infrastructure maintenance, and general office expenses also fall under this category, representing the significant investment required to support a large, multi-brand entity. For instance, in 2023, Driven Brands reported substantial investments in its corporate infrastructure to support its growth initiatives and brand integration efforts.

Brand Acquisition and Integration Costs

Driven Brands incurs substantial costs in acquiring and integrating new brands. These expenses encompass thorough due diligence, legal and advisory fees, and the operational challenges of merging acquired businesses into their existing framework. The company's growth strategy heavily relies on strategic acquisitions, making these costs a critical component of their cost structure.

The integration process itself can involve significant investment in IT systems, rebranding efforts, and aligning operational procedures to maintain brand consistency and efficiency across the portfolio. For instance, the acquisition of brands like Meineke Car Care Centers or Maaco involved substantial upfront and ongoing integration expenses to realize synergies and optimize performance.

- Acquisition Expenses: Costs associated with identifying, negotiating, and closing deals for new brands, including legal, accounting, and consulting fees.

- Integration Costs: Expenses related to merging acquired businesses, such as IT system integration, rebranding, process alignment, and employee retraining.

- Due Diligence: Financial and operational scrutiny of target companies before acquisition, which can be extensive and costly.

- Strategic Acquisitions: Driven Brands' history of acquiring multiple brands means these costs are recurring and a significant part of their capital allocation.

Technology Development and Maintenance

Driven Brands invests heavily in its technology infrastructure, a significant component of its cost structure. This includes the ongoing development and maintenance of proprietary software and digital platforms that streamline operations across its vast network of brands. In 2024, the company continued to prioritize cybersecurity and data management to safeguard sensitive customer and operational information, a critical need for an organization with thousands of locations.

These technology expenditures are essential for supporting the company's growth and efficiency. Key areas of investment include:

- Software Development: Creating and enhancing tools for franchise management, customer engagement, and operational efficiency.

- Platform Maintenance: Ensuring the stability and performance of existing digital systems and in-store technology.

- Cybersecurity: Implementing robust measures to protect against data breaches and cyber threats.

- Data Infrastructure: Managing and optimizing the vast amounts of data generated across the Driven Brands ecosystem.

Driven Brands' cost structure is heavily influenced by its significant investments in franchisee support, encompassing comprehensive training and ongoing operational consulting. Marketing and advertising also represent a substantial expenditure, with considerable resources allocated to national and local campaigns. For instance, in 2023, marketing efforts contributed to $5.5 billion in system-wide revenue.

The company's extensive supply chain and procurement operations are a major cost driver, including expenses for purchasing, logistics, and distribution of automotive parts and materials. In 2024, managing these complex operations faced challenges from persistent supply chain issues and inflationary pressures on raw materials and transportation.

Corporate overhead, including salaries, executive compensation, and administrative functions, supports the management of its diverse brand portfolio. Additionally, costs associated with acquiring and integrating new brands, such as due diligence and IT system alignment, are critical components of their expenditure. For example, the integration of brands like Meineke Car Care Centers involved substantial upfront and ongoing expenses.

Technology infrastructure is another significant cost area, with ongoing investment in proprietary software, digital platforms, and cybersecurity measures. These expenditures are vital for streamlining operations and protecting sensitive data across their vast network.

| Cost Category | Key Components | 2023 Impact/2024 Focus |

| Franchisee Support | Training, Operational Consulting | Ensuring brand standards and efficiency |

| Marketing & Advertising | National & Local Campaigns | Drove $5.5B system-wide revenue in 2023 |

| Supply Chain & Procurement | Purchasing, Logistics, Distribution | Inflationary pressures and supply chain challenges in 2024 |

| Corporate Overhead | Salaries, Executive Comp, Admin | Managing multi-brand portfolio |

| Acquisition & Integration | Due Diligence, IT Integration, Rebranding | Strategic growth through acquisitions |

| Technology Infrastructure | Software Dev, Platform Maint., Cybersecurity | Prioritizing cybersecurity and data management in 2024 |

Revenue Streams

Driven Brands primarily generates revenue through franchise fees and royalties. New franchisees pay an initial fee to join the network, and existing franchisees contribute ongoing royalty payments, usually a percentage of their gross sales. This dual approach creates a consistent and expandable income stream.

Company-operated store sales are a vital revenue stream for Driven Brands, particularly for concepts like Take 5 Oil Change. This direct sales channel offers significant control over customer experience and operational efficiency, contributing substantially to the company's top line.

In 2024, Driven Brands continued to leverage its company-owned locations to drive revenue. While specific figures for this segment aren't always broken out separately from franchise sales in public reports, the strategic importance of these stores in testing new initiatives and maintaining brand standards is undeniable.

Driven Brands generates revenue by centrally procuring and distributing automotive parts, products, and equipment to its extensive franchisee network. This centralized model often includes a markup on these sales, contributing significantly to the company's top line. For instance, brands like 1-800-Radiator & A/C are key components of this distribution strategy, directly fueling revenue through product sales to repair shops and other automotive service providers.

Brand Licensing and Other Fees

Driven Brands generates additional revenue through brand licensing agreements, allowing third parties to use its well-recognized brand names across various product lines and services. This strategy expands brand visibility while creating a new income stream.

Beyond licensing, the company collects various service fees from its franchisees. These fees often cover essential support functions, including access to proprietary technology platforms, specialized training programs, and operational guidance, ensuring consistent service delivery across the network.

- Brand Licensing: Revenue generated from allowing other businesses to use Driven Brands' proprietary brand names.

- Franchisee Support Fees: Charges levied on franchisees for access to technology, training, and operational assistance.

- Other Service Fees: Income derived from specialized services or programs offered to the franchise network.

Acquisition and Divestiture Proceeds

Acquisition and divestiture proceeds represent a significant, albeit non-operational, revenue stream for Driven Brands. These one-time cash inflows arise from the strategic buying and selling of businesses or assets. For instance, the sale of its U.S. car wash operations generated substantial capital. This capital is then strategically deployed for purposes such as reducing outstanding debt or fueling future reinvestment in core business areas.

The impact of these transactions can be substantial. In 2023, Driven Brands completed the acquisition of Valvoline's Global Operations, a move that significantly expanded its footprint and service offerings. While specific figures for divestiture proceeds are not always publicly itemized, such strategic maneuvers are crucial for financial flexibility and growth. These proceeds are a key component in managing the company's capital structure and funding its long-term strategic objectives.

- Strategic Capital Infusion: Divestitures provide significant one-time cash injections.

- Debt Reduction & Reinvestment: Proceeds are primarily used to lower debt and fund growth initiatives.

- Example of Divestiture Impact: The sale of the U.S. car wash business exemplifies this revenue stream.

- Impact on Financial Health: Crucial for managing capital structure and achieving strategic goals.

Driven Brands' revenue model is multifaceted, extending beyond traditional franchise fees and royalties. The company also profits from company-operated stores, which provide direct sales income and operational control. Furthermore, Driven Brands generates revenue through the centralized distribution of automotive parts and products, often with a markup, and through brand licensing agreements that expand its market reach.

In 2024, Driven Brands continued to benefit from these diverse income streams. The strategic acquisition of Valvoline's Global Operations in 2023, for example, significantly boosted its revenue base through expanded company-owned locations and a larger franchise network. These acquisitions, alongside ongoing franchise royalties and product distribution, form the core of Driven Brands' financial performance.

The company's revenue streams are robust and interconnected. Franchise fees and royalties provide a stable foundation, while company-operated store sales offer direct profit generation. The distribution of parts and products creates an additional layer of income, and brand licensing broadens the company's financial reach. These combined elements ensure a resilient and growing revenue profile for Driven Brands.

| Revenue Stream | Description | Key Brands/Activities |

|---|---|---|

| Franchise Fees & Royalties | Initial fees for new franchisees and ongoing percentage of gross sales from existing franchisees. | Maaco, Meineke, CARSTAR, Superformance |

| Company-Operated Store Sales | Direct revenue from sales at company-owned locations. | Take 5 Oil Change, Driven Lighting |

| Parts & Product Distribution | Revenue from selling automotive parts and equipment to franchisees, often with a markup. | 1-800-Radiator & A/C, Driven Parts |

| Brand Licensing | Income from allowing third parties to use Driven Brands' brand names. | Various product and service partnerships |

| Service Fees | Charges for technology, training, and operational support provided to franchisees. | Network-wide support services |

| Acquisition/Divestiture Proceeds | One-time cash inflows from selling businesses or assets. | Sale of U.S. car wash operations |

Business Model Canvas Data Sources

The Driven Brands Business Model Canvas is constructed using a blend of internal financial reports, franchise performance data, and extensive market research. This ensures each component reflects current operational realities and strategic opportunities.