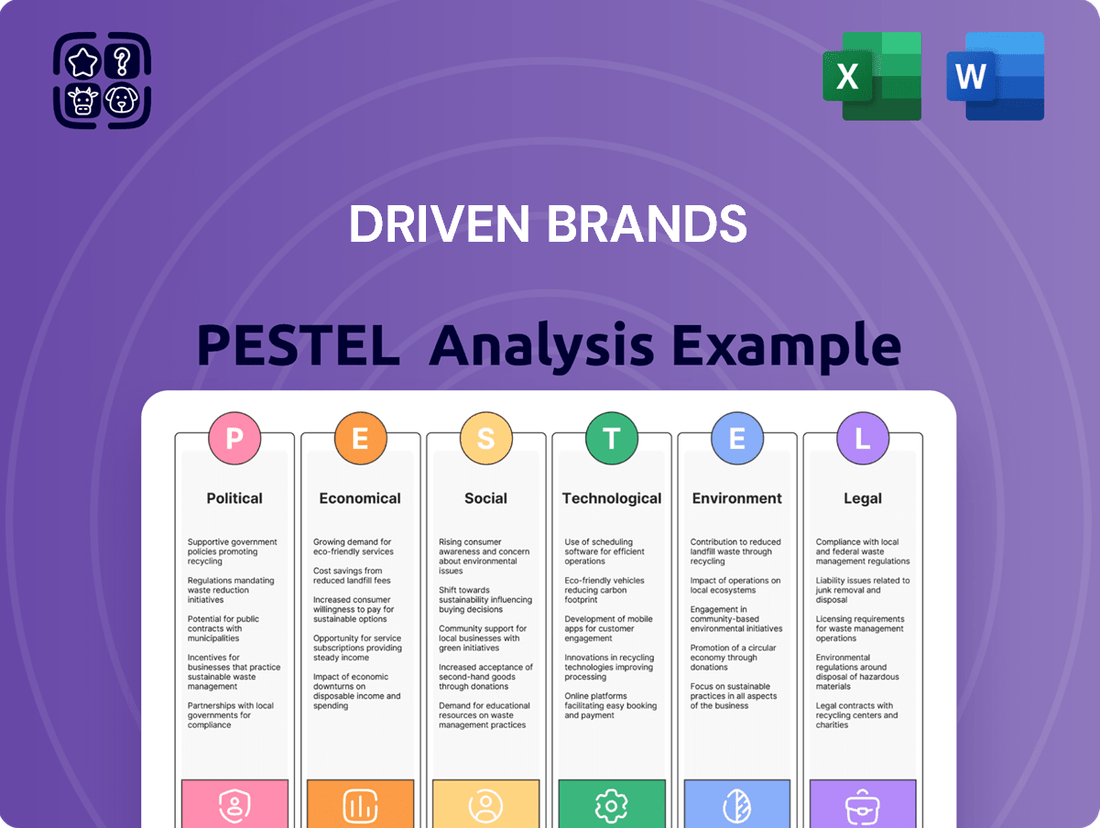

Driven Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Driven Brands Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Driven Brands's future. Our expertly crafted PESTLE analysis provides actionable insights into market dynamics, regulatory shifts, and consumer behavior. Gain a competitive edge by understanding these external forces. Download the full version now for a comprehensive strategic advantage.

Political factors

Government regulations on emissions and vehicle standards are significantly reshaping the automotive landscape. For instance, the U.S. Environmental Protection Agency's (EPA) proposed multi-pollutant emissions standards for model years 2027 and beyond aim to accelerate the adoption of cleaner vehicles. This regulatory push is directly influencing the types of vehicles consumers are purchasing, leading to a growing demand for electric and hybrid models.

This shift in vehicle technology has a direct impact on the automotive aftermarket services sector. Driven Brands, a major player in this space, must anticipate and adapt to the increasing need for specialized maintenance and repair services for electric and hybrid vehicles. Failure to do so could result in a competitive disadvantage as the market transitions.

To remain competitive and compliant, Driven Brands needs to ensure its franchisees are equipped to handle these evolving vehicle technologies. This includes investing in technician training programs focused on electric vehicle (EV) diagnostics and repair, as well as ensuring access to the necessary specialized tools and equipment. For example, by 2025, it's projected that over 20% of new vehicle sales in the US could be electric, highlighting the urgency for service providers to adapt.

The growing 'Right to Repair' movement, championed by legislation like the proposed REPAIR Act, seeks to grant vehicle owners and independent repair shops broader access to critical diagnostic data, specialized tools, and replacement parts. This legislative push could significantly intensify competition for franchised dealerships.

However, for Driven Brands, this trend presents a potential boon to its franchise model by fostering a larger, more robust market for independent automotive service providers. As of early 2025, over 30 states have introduced or are considering 'Right to Repair' legislation, highlighting the increasing momentum of this movement.

Staying abreast of these evolving legislative landscapes is paramount for Driven Brands' strategic planning, allowing for proactive adaptation and capitalizing on emerging opportunities within the independent automotive service sector.

Global trade policies and tariffs on automotive parts directly influence Driven Brands' supply chain. For instance, the US imposed tariffs on steel and aluminum in 2018, which increased costs for many manufacturers, including those supplying the automotive aftermarket. This can translate to higher material costs for Driven Brands' franchisees, impacting their profitability and potentially leading to adjustments in service pricing.

Fluctuations in trade agreements and tariffs can disrupt the availability and cost of essential components. If new tariffs are introduced or existing ones are altered, Driven Brands might need to re-evaluate its sourcing strategies, potentially seeking alternative suppliers or markets to mitigate increased operational expenses. The automotive aftermarket, in particular, relies on a consistent and cost-effective supply of parts, making it sensitive to these policy shifts.

Government Incentives for EV Adoption

Government incentives and infrastructure investments are accelerating electric vehicle (EV) adoption, directly reshaping the automotive service sector. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for EV purchases, aiming to boost sales by hundreds of thousands of units annually through 2030. This policy, coupled with substantial federal funding allocated for the expansion of public charging infrastructure, is creating a more favorable environment for EV ownership.

While EVs typically require less traditional maintenance, such as oil changes, this transition opens up new service avenues. Driven Brands can leverage these shifts by focusing on specialized services like battery diagnostics, electric motor repair, and the maintenance of charging equipment. The market for EV servicing is projected to grow substantially; some analysts estimate the global EV maintenance market could reach over $70 billion by 2027, presenting a significant opportunity.

- Government Support: The US government has committed billions to EV charging infrastructure and offers consumer tax credits, such as up to $7,500 for new EVs purchased in 2024.

- Market Shift: EV sales in the US saw a significant increase, accounting for approximately 7.6% of all new vehicle sales in 2023, up from 5.8% in 2022.

- New Service Demands: The growing EV fleet necessitates specialized technician training and equipment for battery health checks, power electronics, and charging system repairs.

- Opportunity for Driven Brands: Proactive investment in training and technology can position Driven Brands to capture a larger share of the evolving automotive aftermarket.

Political Stability and Geopolitical Events

Political stability in key markets is crucial for Driven Brands. For instance, the United States, a major operating region, maintained a relatively stable political climate throughout 2024, supporting consistent consumer spending on automotive services. However, ongoing geopolitical tensions, such as those in Eastern Europe and the Middle East, can indirectly affect supply chain costs and consumer confidence globally, potentially impacting Driven Brands' operational efficiency and expansion strategies.

Geopolitical events can create volatility. The automotive aftermarket, including services offered by Driven Brands, is sensitive to economic conditions influenced by international relations. For example, disruptions to global trade routes or increased energy prices stemming from conflicts can raise operating expenses and potentially dampen consumer demand for discretionary services. Driven Brands' resilience depends on its ability to navigate these external political pressures.

- US Political Stability: The US presidential election cycle in 2024, while generating political discourse, did not lead to significant disruptions in consumer spending on automotive maintenance and repair, a core market for Driven Brands.

- Global Supply Chain Impact: Persistent geopolitical risks in 2024 continued to pose challenges to global supply chains, potentially affecting the availability and cost of automotive parts and supplies for Driven Brands' franchise network.

- Market Confidence: Broader geopolitical instability can erode consumer confidence, leading to reduced discretionary spending on services like car washes and auto repair, areas where Driven Brands operates.

Government regulations are increasingly focused on environmental standards and vehicle emissions, directly impacting the automotive aftermarket. The push for electric vehicles (EVs) is a prime example, with policies like the Inflation Reduction Act of 2022 offering substantial tax credits for EV purchases, projected to boost sales significantly through 2030. This trend necessitates that companies like Driven Brands adapt their service offerings and technician training to accommodate EV maintenance and repair, including battery diagnostics and charging equipment servicing.

The "Right to Repair" movement is gaining legislative traction across multiple states, aiming to provide consumers and independent shops with greater access to vehicle data and parts. This could foster a more competitive landscape for automotive services, potentially benefiting Driven Brands' franchise model by expanding the overall market for independent repair providers.

Political stability in key markets like the United States has generally supported consistent consumer spending on automotive services throughout 2024. However, ongoing geopolitical tensions can indirectly influence supply chain costs and consumer confidence, creating potential volatility for Driven Brands' operations and expansion plans.

| Policy/Factor | Impact on Driven Brands | 2024/2025 Data/Projection |

|---|---|---|

| EV Mandates & Incentives | Increased demand for specialized EV services; need for technician training. | US EV sales reached ~7.6% of new vehicle sales in 2023; tax credits up to $7,500 in 2024. |

| Right to Repair Legislation | Potential for increased competition but also market expansion for independent services. | Over 30 US states considering or introducing 'Right to Repair' legislation as of early 2025. |

| Geopolitical Stability | Impacts supply chain costs and consumer confidence, affecting operational efficiency. | US political climate remained relatively stable in 2024, but global tensions persist. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Driven Brands across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats.

Provides a clear and actionable summary of external factors impacting Driven Brands, enabling proactive strategy development and mitigating potential risks.

Economic factors

Inflationary pressures in 2024 and 2025 are influencing consumer spending on automotive services. While some Driven Brands services are discretionary, many, like essential maintenance, are less so. For instance, the US Consumer Price Index (CPI) for all items saw an increase of 3.4% year-over-year in April 2024, highlighting the rising cost of living.

This economic climate might cause consumers to delay non-essential repairs or look for cheaper alternatives. However, the elevated prices of new and used vehicles, with the average used car price still significantly higher than pre-pandemic levels, encourage owners to retain their current vehicles longer. This trend directly boosts demand for maintenance and repair services, a core area for Driven Brands.

Driven Brands' diverse service offerings, including essential areas like collision repair and quick lube, provide a degree of stability amidst economic uncertainty. For example, the automotive repair and maintenance market in the US was valued at approximately $115 billion in 2023 and is projected to grow steadily, indicating a resilient demand for these services.

Fluctuations in interest rates directly influence consumer spending on vehicles and a franchisee's ability to secure capital. For instance, the Federal Reserve's benchmark rate, which impacts broader lending costs, remained at 5.25%-5.50% through early 2024, a level that can make car loans more expensive.

Higher borrowing costs can dampen demand for new vehicles, potentially leading consumers to hold onto older cars longer, increasing the need for maintenance services offered by Driven Brands. Conversely, elevated interest rates can increase the cost of capital for franchisees looking to expand or invest in new technologies, potentially slowing growth.

In 2024, the average interest rate for a new car loan hovered around 7-8%, significantly higher than in previous years, which could push more consumers towards repair services. This environment presents a dual-edged sword for Driven Brands, potentially boosting service revenue while moderating franchise expansion.

The automotive service sector, including Driven Brands' operations, grapples with a significant deficit of qualified technicians. This scarcity directly translates to higher wages and benefits needed to attract and retain talent, potentially increasing operational expenses for franchisees. For instance, a 2024 report indicated a projected shortage of over 100,000 automotive technicians in the U.S. by 2026, a trend that has been building for years.

This shortage is compounded by demographic shifts, with many experienced technicians approaching retirement age and a declining interest among younger generations in pursuing vocational trades. This creates a dual challenge: replacing departing workers and expanding the available talent pool. Data from the Bureau of Labor Statistics consistently shows a slower growth rate in new entrants to automotive repair fields compared to the demand.

Driven Brands, to maintain service levels and efficiency across its network, must proactively mitigate these labor cost and availability pressures. Strategic initiatives could include enhanced apprenticeship and training programs designed to upskill existing staff and attract new talent, alongside offering competitive compensation packages. Exploring and integrating advanced diagnostic tools and automation could also help offset labor constraints by improving technician productivity.

Growth of the Automotive Aftermarket

The automotive aftermarket is experiencing robust growth, largely fueled by the increasing average age of vehicles and a consumer inclination towards repairing rather than replacing them. This shift directly supports businesses like Driven Brands, which specialize in maintenance and repair services.

Projections indicate the global automotive aftermarket will continue its upward trajectory, reaching an estimated $804.87 billion by 2030. This expansion presents substantial opportunities for market players.

- Sustained Demand: The aging vehicle fleet ensures a consistent need for parts and services.

- Repair Preference: Consumers are increasingly opting for repairs, boosting the aftermarket sector.

- Market Size: The global automotive aftermarket is forecast to hit $804.87 billion by 2030.

- Opportunity: This growth provides significant avenues for expansion for companies like Driven Brands.

E-commerce and Digitalization Trends

The automotive aftermarket is seeing a strong move towards online shopping for parts and accessories. For Driven Brands, this means embracing digital tools. They can enhance customer experience by offering online appointment booking and service status updates.

By integrating digital platforms, Driven Brands can better cater to modern consumer habits. This adaptation is crucial for staying competitive in a market where e-retailing is growing. For instance, online auto parts sales in the US were projected to reach over $20 billion in 2024.

- Online sales of auto parts and accessories are a growing segment.

- Digital integration can improve customer convenience and engagement.

- Driven Brands can explore online sales of select merchandise.

- Adapting to e-commerce trends is vital for market relevance.

Economic factors significantly shape the automotive service industry. Inflationary pressures in 2024 and 2025 are impacting consumer spending, yet the rising costs of new and used vehicles encourage owners to maintain their current cars longer, boosting demand for services like those offered by Driven Brands. For example, the US CPI rose 3.4% year-over-year in April 2024.

Interest rates also play a crucial role. Higher rates, with the Federal Reserve's benchmark rate holding at 5.25%-5.50% through early 2024, can make car loans more expensive, further incentivizing vehicle repairs over new purchases. However, these rates also increase capital costs for franchisees, potentially moderating expansion.

The automotive aftermarket, a key sector for Driven Brands, is experiencing robust growth, projected to reach $804.87 billion globally by 2030. This is driven by an aging vehicle fleet and a consumer preference for repair over replacement, creating substantial opportunities for companies in this space.

Preview Before You Purchase

Driven Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Driven Brands delves into the Political, Economic, Social, Technological, Legal, and Environmental factors shaping its strategic landscape. Understand the key external forces impacting Driven Brands' operations and future growth.

Sociological factors

Consumer preferences are definitely shifting. We're seeing a rise in shared mobility options and subscription services, which could mean less emphasis on outright vehicle ownership for some, particularly younger demographics. This trend towards mobility-as-a-service is a significant change to watch.

However, it's not all about new models. The demand for used cars remains robust, and importantly, the average age of vehicles on the road is increasing. In 2023, the average age of light vehicles in operation in the U.S. reached a new record of 12.6 years, according to S&P Global Mobility. This aging fleet directly translates to a greater need for maintenance and repair services, a core area for Driven Brands.

Driven Brands needs to navigate these evolving consumer desires carefully. Understanding that some segments are moving towards shared services while others are investing more in maintaining older vehicles is key to tailoring marketing and service packages effectively. This nuanced approach will be crucial for capturing different customer needs in the automotive aftermarket.

Consumers are increasingly prioritizing vehicle upkeep for safety and to extend the lifespan of their cars, particularly as the average age of vehicles on the road continues to climb. For instance, in 2024, the average age of vehicles in the United States reached an all-time high of 12.5 years, underscoring this trend.

This growing consciousness directly fuels demand for essential services like oil changes, tire rotations, and brake checks, which form the backbone of Driven Brands' franchise operations. A proactive approach to educating customers about the benefits of preventive maintenance can further stimulate this demand.

The automotive repair industry faces a critical demographic challenge. In 2024, the average age of an automotive technician in the U.S. is approaching 50, with a noticeable decline in younger individuals entering the trade. This aging workforce, coupled with a shrinking pipeline of new talent, directly impacts Driven Brands' ability to staff its numerous franchise locations with qualified technicians. This labor shortage is projected to worsen, with some estimates suggesting a deficit of over 100,000 technicians by 2028.

Driven Brands must actively address this trend by implementing robust recruitment and training programs. Focusing on apprenticeships and vocational school partnerships can attract emerging talent, while enhanced compensation and improved working conditions are vital for retaining experienced technicians. For instance, investing in advanced diagnostic training can make these roles more appealing to a tech-savvy younger generation.

Influence of Digital Connectivity and Social Media

The increasing reliance on digital platforms and social media significantly shapes consumer behavior in the automotive service sector. Customers actively use these channels to research service providers, scrutinize online reviews, and engage directly with brands. For Driven Brands, this presents a crucial opportunity to implement targeted marketing campaigns, cultivate brand loyalty, and proactively manage customer feedback, with platforms like Yelp and Google Reviews becoming key decision-making tools for consumers.

A robust digital footprint and adept social media engagement are no longer optional but critical for acquiring and retaining customers. In 2024, for instance, over 70% of consumers reported using social media for brand discovery and research, underscoring the need for Driven Brands to maintain an active and responsive online presence. This includes leveraging platforms for customer service, sharing valuable content, and running digital advertising that resonates with target demographics.

- Digital Research Dominance: A significant majority of consumers, often exceeding 80%, now initiate their search for automotive services online, relying heavily on search engines and review sites.

- Social Media Influence: Platforms like Facebook and Instagram are increasingly used by consumers to gather information about automotive brands, with user-generated content and influencer recommendations playing a substantial role in purchasing decisions.

- Reputation Management: Online reviews and social media sentiment directly impact brand perception and customer acquisition; Driven Brands must actively monitor and respond to feedback to maintain a positive online reputation.

- Engagement for Loyalty: Proactive digital engagement, such as personalized offers and responsive customer service via social channels, fosters stronger customer relationships and encourages repeat business.

Demand for Convenience and Speed of Service

Modern consumers, across demographics, increasingly value their time, making convenience and speed paramount in their purchasing decisions, including automotive services. This trend is particularly evident in the automotive maintenance and repair sector, where busy schedules often dictate a preference for quick, efficient solutions. For instance, a 2024 survey by Consumer Reports indicated that over 60% of car owners consider the speed of service a major factor when choosing a repair shop.

Driven Brands, with its portfolio including brands like Meineke Car Care Centers and Take 5 Oil Change, is strategically positioned to capitalize on this demand. Their business model often emphasizes streamlined service processes, from online booking to efficient in-bay operations, designed to minimize customer wait times. The proliferation of quick-lube and express car wash services directly addresses this consumer need for rapid, hassle-free maintenance.

Meeting these expectations is crucial for fostering customer loyalty and driving repeat business. Businesses that offer accessible locations, transparent pricing, and a consistently fast service experience are likely to gain a competitive edge. Driven Brands' investment in technology and operational efficiency aims to ensure that customers can get back on the road quickly, reinforcing the appeal of their service offerings.

- Consumer Prioritization: Over 60% of car owners in a 2024 survey cited speed of service as a key factor in choosing a repair shop.

- Driven Brands' Alignment: Brands like Take 5 Oil Change and Meineke are designed for quick, efficient customer service.

- Business Impact: Streamlined processes and accessibility are vital for attracting and retaining customers seeking convenience.

Societal trends significantly influence the automotive aftermarket. Consumers are increasingly prioritizing vehicle longevity, with the average age of cars on the road in the U.S. reaching a record 12.6 years in 2023, driving demand for maintenance. Simultaneously, a critical demographic shift is occurring within the technician workforce, with the average age nearing 50 in 2024 and a shortage of younger talent projected to reach over 100,000 by 2028.

Digital engagement is paramount, as over 70% of consumers use social media for brand discovery in 2024. Convenience and speed are also key, with more than 60% of car owners in a 2024 survey prioritizing quick service. Driven Brands' focus on efficient operations and accessible brands like Take 5 Oil Change directly addresses these consumer needs.

| Sociological Factor | Trend Description | Impact on Driven Brands | Supporting Data (2023-2024) |

| Vehicle Ownership & Maintenance | Aging vehicle fleet increases demand for repairs. | Boosts demand for Driven Brands' core services. | Average vehicle age in U.S. reached 12.6 years (2023). |

| Demographics & Workforce | Aging technician population and shortage of new talent. | Challenges staffing and operational capacity. | Average U.S. technician age nearing 50; projected deficit of 100,000+ by 2028. |

| Digital Consumer Behavior | High reliance on online research and social media for service selection. | Necessitates strong digital marketing and reputation management. | Over 70% of consumers use social media for brand discovery. |

| Consumer Values | Prioritization of convenience and speed in service delivery. | Favors brands with streamlined, efficient service models. | Over 60% of car owners consider speed a major factor in choosing a shop. |

Technological factors

The shift towards electric vehicles (EVs), even with a recent moderation in sales growth, fundamentally reshapes the automotive service landscape. While EVs eliminate the need for traditional services like oil changes, their complexity demands new expertise in battery health, electric powertrain repair, and charging station maintenance.

This evolving demand necessitates significant investment from companies like Driven Brands. For instance, by the end of 2024, it's projected that over 3 million EVs will be on U.S. roads, creating a growing need for specialized technicians and diagnostic tools. Without adapting, businesses risk falling behind in this critical market segment.

Modern vehicles are packed with sophisticated Advanced Driver Assistance Systems (ADAS) and depend significantly on software. This means specialized diagnostic tools, calibration gear, and technician training are now essential for repairs and upkeep. For instance, the global ADAS market was valued at approximately $29.4 billion in 2023 and is projected to reach $74.8 billion by 2030, highlighting the rapid growth in this technology.

Driven Brands' franchisees must embrace these advancements by developing expertise in these cutting-edge technologies. This adaptation is crucial to effectively service the expanding number of technologically advanced vehicles entering the market, ensuring they can meet the evolving needs of vehicle owners and maintain a competitive edge.

The automotive aftermarket is rapidly embracing digital transformation, with AI and IoT becoming integral to vehicle diagnostics and operational efficiency. For instance, AI-powered vision systems are revolutionizing damage inspection, significantly boosting speed and precision in assessments.

Driven Brands can capitalize on these advancements to streamline service workflows, elevate customer experiences, and secure a stronger market position. The increasing adoption of AI in diagnostics, with projections showing substantial growth in the AI in automotive market, offers significant opportunities for optimization.

Evolution of Vehicle Connectivity and Over-the-Air (OTA) Updates

The automotive industry is rapidly embracing connected vehicle technology, with features like remote diagnostics and over-the-air (OTA) software updates becoming standard. This shift allows for remote issue resolution, fundamentally changing the repair landscape. For Driven Brands, this presents a dual challenge and opportunity: staying ahead of technological advancements to offer specialized diagnostic and software troubleshooting services.

By 2025, it's projected that over 90% of new vehicles sold globally will be connected, a significant jump from previous years. This connectivity enables manufacturers and service providers to push software updates remotely, addressing bugs and even enhancing vehicle performance without a physical visit to a service center. Driven Brands must adapt its service model to capitalize on this trend, potentially offering premium software upgrade packages or advanced remote diagnostics.

- Connected Car Penetration: Projections indicate over 90% of new vehicles sold globally will be connected by 2025.

- OTA Update Growth: The market for OTA automotive software updates is expected to reach billions of dollars annually by the mid-2020s.

- New Service Opportunities: This evolution creates demand for specialized skills in vehicle software and network diagnostics.

- Customer Expectations: Consumers increasingly expect seamless digital integration and remote service capabilities in their vehicles.

New Materials and Manufacturing Techniques

The automotive sector's embrace of novel materials like advanced composites and high-strength steels is reshaping vehicle construction. This trend necessitates significant investment in specialized training and equipment for collision repair specialists. Driven Brands' extensive network, including CARSTAR and Maaco, must proactively integrate these new technologies to maintain competitive repair capabilities and customer satisfaction.

The increasing adoption of lightweight materials, such as carbon fiber composites and aluminum alloys, is a key technological driver. For instance, the 2025 model year vehicles are expected to feature a higher percentage of these materials compared to previous years, impacting repair complexity and cost. This evolution demands continuous upskilling of technicians and upgrades to diagnostic and repair tools across Driven Brands' collision centers.

- Material Innovation: Automotive manufacturers are increasingly using lightweight composites and advanced alloys, with projections indicating continued growth in their application through 2025.

- Repair Complexity: The use of these new materials escalates the complexity and required expertise for collision repairs, necessitating specialized training.

- Equipment Investment: Repair facilities must invest in new tools and technologies, such as specialized welders and diagnostic equipment, to effectively handle these advanced materials.

- Competitive Adaptation: Driven Brands' collision repair brands, like Maaco and CARSTAR, must adapt by investing in technician training and equipment to remain leaders in the evolving automotive repair landscape.

The automotive industry's technological evolution, particularly the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), presents both challenges and opportunities for Driven Brands. By 2025, projections suggest over 90% of new vehicles sold globally will be connected, driving demand for specialized software and diagnostic skills. The increasing use of advanced materials like carbon fiber also necessitates updated repair techniques and equipment.

Driven Brands must invest in technician training and new diagnostic tools to service these increasingly complex vehicles. For instance, the ADAS market, valued at approximately $29.4 billion in 2023, is expected to grow significantly, underscoring the need for specialized expertise. AI integration in diagnostics further enhances efficiency, with AI-powered vision systems revolutionizing damage assessment.

Legal factors

The Environmental Protection Agency (EPA) imposes rigorous standards on automotive repair businesses concerning waste disposal, chemical usage, and air emissions. These regulations cover the handling of substances in repair materials, like paints and adhesives, and the proper disposal of hazardous waste.

Driven Brands and its network of franchisees must adhere to these environmental mandates, which are subject to change. Non-compliance can lead to significant penalties, impacting operational continuity and brand reputation. For instance, in 2023, the EPA collected over $1.2 billion in fines for environmental violations, highlighting the financial risks involved.

Consumer protection laws are crucial in the automotive service sector, dictating standards for repair quality, pricing transparency, and warranty fulfillment. These regulations are designed to safeguard consumers from deceptive practices and substandard workmanship. For Driven Brands, operating a franchise model means ensuring every location consistently upholds these consumer protection mandates to preserve its brand image and customer loyalty. In 2024, the Federal Trade Commission (FTC) continued to emphasize fair practices in auto repair, with consumer complaints often focusing on undisclosed charges and unnecessary repairs.

Driven Brands, as a franchisor, navigates a complex web of franchise laws and regulations. These rules, varying by jurisdiction, dictate essential aspects of the franchisor-franchisee relationship, including pre-sale disclosures, contract terms, and operational standards. For instance, the Federal Trade Commission's Franchise Rule in the United States mandates detailed disclosure documents, ensuring potential franchisees have critical information before investing.

Compliance is paramount for maintaining the integrity and expansion of Driven Brands' franchise system. Failure to adhere to these legal frameworks, such as those governing termination or intellectual property protection, can lead to significant legal challenges and financial penalties, impacting brand reputation and operational continuity. In 2024, the franchise sector continued to see increased scrutiny on compliance, with regulatory bodies actively enforcing disclosure and fair dealing practices.

Labor Laws and Workforce Regulations

Labor laws, such as minimum wage requirements and workplace safety regulations, directly influence Driven Brands' operational expenses and how they manage their workforce, including their franchisees. For instance, the U.S. federal minimum wage remains at $7.25 per hour, but many states and cities have enacted significantly higher rates, impacting labor costs for service centers.

The automotive technician field is experiencing a notable shortage, making adherence to fair labor practices and investment in secure work environments essential for attracting and keeping skilled employees. In 2024, the Bureau of Labor Statistics projected a 5% growth for automotive service technicians and mechanics, highlighting the competitive nature of recruitment.

- Minimum Wage Impact: State-level minimum wage increases, like those seen in California and New York, directly raise labor costs for Driven Brands' service centers.

- Worker Safety Compliance: Adherence to OSHA (Occupational Safety and Health Administration) standards is crucial to prevent accidents and associated liabilities, which can be costly.

- Talent Acquisition & Retention: Competitive wages, benefits, and safe working conditions are key differentiators in attracting and retaining qualified automotive technicians amidst ongoing labor market challenges.

- Employment Practice Scrutiny: Evolving regulations around hiring, termination, and anti-discrimination practices require ongoing vigilance to ensure compliance across all Driven Brands locations.

Vehicle Safety Standards and Recalls

Government-mandated vehicle safety standards, such as those set by the National Highway Traffic Safety Administration (NHTSA) in the US, directly influence the types of maintenance and repair services offered by Driven Brands. These standards dictate everything from airbag deployment systems to tire pressure monitoring, ensuring a baseline level of safety for consumers.

Manufacturer recalls, a common occurrence in the automotive industry, can significantly impact service center operations. For instance, in 2023, the NHTSA reported over 900 vehicle recalls affecting millions of vehicles in the United States. Driven Brands' franchisees must be prepared to handle these recall-related repairs, which require specific parts inventory and technician training to comply with manufacturer specifications and regulatory oversight.

- NHTSA oversees vehicle safety standards in the US.

- Millions of vehicles are subject to recalls annually.

- Recalls necessitate specialized parts and technician expertise.

- Compliance with recall procedures is crucial for service centers.

Driven Brands must navigate a dynamic legal landscape, encompassing consumer protection, franchise regulations, and labor laws. Ensuring consistent adherence across all franchise locations is critical for maintaining brand reputation and avoiding costly penalties, especially as regulatory bodies like the FTC increase scrutiny on fair practices in 2024.

Government-mandated vehicle safety standards, like those from NHTSA, directly shape the repair services offered. The frequency of recalls, with over 900 reported in the US in 2023 affecting millions of vehicles, necessitates specialized parts and training for Driven Brands' franchisees to ensure compliance and customer safety.

Environmental regulations, particularly concerning waste disposal and chemical usage from the EPA, impose strict operational requirements. Non-compliance risks significant fines, as evidenced by the EPA collecting over $1.2 billion in environmental violation fines in 2023, underscoring the financial implications of environmental stewardship.

Environmental factors

The accelerating global adoption of electric vehicles (EVs) and increasingly stringent emissions regulations are fundamentally reshaping the automotive aftermarket. By 2024, EV sales are projected to reach over 15 million units globally, a significant leap that directly impacts traditional service models.

While this transition promises reduced tailpipe emissions, it introduces novel challenges, particularly concerning the responsible management and recycling of EV batteries, a critical environmental concern. Furthermore, the specialized nature of EV maintenance and repair necessitates investment in new training and equipment for technicians.

Driven Brands must proactively adapt its service offerings and operational infrastructure to effectively cater to the growing EV market. This includes developing expertise in battery diagnostics, repair, and end-of-life management, ensuring the company remains competitive and sustainable in this evolving landscape.

Automotive service centers, including those under the Driven Brands umbrella, produce hazardous waste like used oils, coolants, batteries, and tires. These materials require careful handling and disposal to prevent environmental contamination.

Environmental regulations, such as the Resource Conservation and Recovery Act (RCRA) in the United States, dictate strict protocols for managing these wastes. Non-compliance can lead to significant fines, with penalties for improper hazardous waste disposal often reaching tens of thousands of dollars per violation.

Driven Brands and its franchisees must therefore maintain comprehensive waste management and recycling programs. For instance, many states mandate specific recycling rates for used motor oil, with some requiring service centers to collect and recycle a substantial portion of the oil they drain.

Consumers increasingly prioritize sustainability, with a significant portion actively choosing brands demonstrating environmental responsibility. This trend is a major driver for companies like Driven Brands to integrate eco-friendly practices, such as sourcing sustainable materials and optimizing energy usage across their franchise network.

By embracing these practices, Driven Brands can tap into a growing market segment and build brand loyalty. For instance, in 2024, studies indicated that over 60% of consumers consider a brand's sustainability efforts when making purchasing decisions, a figure expected to rise.

Impact of Climate Change and Extreme Weather Events

Climate change is increasingly manifesting in more frequent and severe weather events, posing direct risks to Driven Brands' operations. For instance, increased flooding or intense storms can lead to greater vehicle damage, potentially boosting demand for collision repair services. However, these same events can severely disrupt the supply chains for essential parts, impacting the efficiency and cost of repairs.

The logistical challenges presented by extreme weather are a significant concern for Driven Brands. Disruptions to transportation networks can delay the delivery of necessary components, affecting turnaround times for repairs and customer satisfaction. This underscores the need for enhanced resilience in the company's operational and supply chain strategies to mitigate these impacts.

Consider the following specific impacts:

- Increased Vehicle Damage: A rise in severe weather events, such as hurricanes and hailstorms, directly correlates with a higher volume of vehicles requiring collision repair. For example, the National Insurance Crime Bureau reported a significant increase in weather-related auto insurance claims in recent years, a trend expected to continue.

- Supply Chain Vulnerabilities: Extreme weather can cripple transportation infrastructure, leading to delays and increased costs for parts delivery. This was evident in the aftermath of major storms in 2023 and 2024, where supply chain disruptions impacted various industries, including automotive aftermarket services.

- Operational Disruptions: Direct damage to repair facilities from floods, high winds, or wildfires can lead to temporary or prolonged closures, impacting revenue and service availability.

- Shifting Demand Patterns: While extreme weather may increase repair demand, it can also lead to localized economic downturns that affect consumer spending on non-essential services, creating a complex demand dynamic.

Resource Scarcity and Supply Chain Sustainability

Driven Brands, like many in the automotive aftermarket, faces growing concerns over resource scarcity. The extraction of raw materials for automotive parts, such as metals and plastics, is increasingly scrutinized for its environmental footprint, potentially impacting the availability and cost of essential supplies. For instance, global demand for critical minerals used in vehicle components continues to rise, with projections indicating significant increases in demand for metals like lithium and cobalt by 2030, directly affecting supply chain stability.

To navigate these challenges, Driven Brands must prioritize supply chain sustainability. This involves a strategic shift towards partnering with suppliers who demonstrate strong environmental, social, and governance (ESG) credentials. The company can also explore innovative solutions like incorporating remanufactured parts into its offerings, which not only reduces reliance on virgin resources but can also provide cost-effective alternatives for consumers. The remanufacturing market is projected to see substantial growth, with some segments expected to expand by over 5% annually in the coming years.

- Resource Scarcity Impact: Rising global demand for key automotive materials, like rare earth elements, is projected to increase sourcing costs and potentially limit availability.

- Supply Chain Focus: Driven Brands is increasingly evaluating suppliers based on their sustainability practices, aiming to secure more reliable and ethically sourced components.

- Circular Economy Adoption: The company is exploring the integration of remanufactured parts, a growing market segment that offers environmental benefits and potential cost savings.

- Regulatory Landscape: Evolving environmental regulations globally are pushing for greater transparency and accountability in supply chains, influencing material sourcing and waste management.

The automotive sector's environmental footprint is under increasing scrutiny, pushing companies like Driven Brands towards greener practices. The rise of electric vehicles (EVs), projected to represent over 15 million global sales in 2024, necessitates new service capabilities and responsible battery management. Furthermore, stringent regulations on hazardous waste disposal, such as those under RCRA, demand meticulous waste management protocols, with non-compliance potentially incurring fines of tens of thousands of dollars per violation.

PESTLE Analysis Data Sources

Our Driven Brands PESTLE analysis is constructed using a comprehensive blend of publicly available data from government agencies, reputable financial institutions, and leading industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and credible information.