Driven Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Driven Brands Bundle

Driven Brands operates in a dynamic automotive aftermarket landscape, facing intense competition and evolving customer demands. Understanding the intricate interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this market.

The complete report reveals the real forces shaping Driven Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive aftermarket, a sector Driven Brands operates within, is characterized by a vast and often fragmented supplier base. This means that for many of the parts and services the company requires, there isn't one dominant supplier that can dictate terms. For instance, in 2024, the global automotive aftermarket was projected to reach over $500 billion, with a significant portion comprised of independent aftermarket suppliers rather than a few large, controlling entities.

Driven Brands' broad operational scope, spanning maintenance, paint, collision repair, and car wash services, naturally spreads its purchasing across a wide array of product categories and service providers. This diversification inherently lowers its dependence on any single supplier for any given component or consumable. For example, a collision center might source paint from one set of suppliers, while a car wash operation relies on different chemical providers, further fragmenting the supplier landscape for the company.

This fragmented environment empowers Driven Brands to negotiate effectively for standard parts and consumables. The ability to easily switch between multiple suppliers for items like filters, fluids, or cleaning agents allows the company to secure competitive pricing and favorable terms. In 2023, industry reports indicated that companies with strong purchasing power in fragmented markets could achieve cost savings of 5-10% on routine supplies.

Driven Brands' position as the largest automotive services company in North America, boasting over 4,400 locations, grants it considerable economies of scale. This extensive network allows for centralized procurement and bulk purchasing through its sophisticated supply chain management, directly impacting supplier relationships.

This significant buying power effectively counterbalances the bargaining power of individual suppliers. By consolidating demand and negotiating on behalf of its vast franchisee base, Driven Brands can secure more favorable pricing and terms, thereby reducing the leverage suppliers might otherwise hold.

The increasing demand for specialized parts and equipment, especially for electric vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), significantly bolsters supplier bargaining power. For instance, the intricate battery systems in EVs require highly specialized components with limited alternative manufacturers. This scarcity, coupled with the advanced technical expertise needed for their maintenance and calibration, can drive up costs for companies like Driven Brands. In 2024, the global EV market saw substantial growth, with sales projected to reach over 16 million units, highlighting the growing reliance on these specialized suppliers.

Impact of Technology on Supply Chain

The automotive repair sector, including companies like Driven Brands, faces a shifting supply chain dynamic due to technological advancements in vehicles, particularly electric vehicles (EVs). The increasing complexity of modern car components means fewer suppliers can produce these specialized parts, potentially increasing their bargaining power.

This technological evolution creates new opportunities for specialized repair services and parts, but it also concentrates the supply of advanced technologies. Driven Brands must effectively manage its supply chain to accommodate these evolving vehicle needs.

- Supplier Concentration: The need for highly specialized components, especially for EVs, can lead to a smaller pool of qualified suppliers.

- Technological Dependence: Reliance on a few key suppliers for advanced parts can grant them significant leverage.

- Adaptation Necessity: Driven Brands' success hinges on its ability to integrate new technologies and manage relationships with these increasingly specialized suppliers.

- Market Trends: As of early 2024, the global EV market continues its rapid expansion, underscoring the growing importance of specialized supply chains. For instance, battery technology suppliers are critical players in this evolving landscape.

Franchisee Supply Chain Support

Driven Brands leverages its extensive network to provide significant supply chain support to its franchisees. By centralizing procurement for parts and equipment, the company creates substantial collective buying power. This unified approach allows Driven Brands to negotiate more favorable terms with suppliers, a stark contrast to what individual, smaller automotive repair shops could achieve on their own.

This centralized management enhances Driven Brands' overall leverage in its dealings with suppliers. For instance, in 2023, Driven Brands managed a vast network of over 4,000 quick-service restaurants and automotive repair centers. This scale translates directly into stronger bargaining power, as suppliers recognize the significant volume of business Driven Brands represents.

- Standardization: Driven Brands facilitates the standardization of parts and equipment across its diverse franchise brands, simplifying procurement and ensuring quality.

- Collective Buying Power: The company's aggregated purchasing volume grants franchisees a stronger negotiating position with suppliers than they would have individually.

- Supplier Relationships: Driven Brands actively cultivates relationships with key suppliers, further solidifying its ability to secure competitive pricing and reliable supply chains.

- Efficiency Gains: Centralized supply chain management contributes to operational efficiencies for franchisees, reducing costs and improving inventory management.

Driven Brands benefits from a largely fragmented supplier base for standard automotive parts and consumables, allowing for competitive negotiation. However, the increasing complexity of vehicles, particularly electric models and those with advanced driver-assistance systems, is concentrating the supply of specialized components. This trend, coupled with the rapid growth of the EV market, which saw over 16 million units sold globally in 2024, is beginning to shift leverage towards a smaller group of specialized suppliers.

The company's substantial buying power, derived from its 4,400+ locations, enables it to secure favorable terms for common parts. Yet, the necessity of sourcing advanced technologies from a limited number of manufacturers for EVs and ADAS creates potential vulnerabilities. For instance, battery technology suppliers are becoming critical players, and their specialized nature grants them increased bargaining power.

Driven Brands' strategy of centralized procurement for its franchisees amplifies its collective buying power, a significant advantage over individual repair shops. This scale, evident in its 2023 network of over 4,000 locations, solidifies its negotiating position. Nevertheless, managing relationships with increasingly specialized suppliers for new vehicle technologies remains a key challenge in balancing this power dynamic.

| Factor | Impact on Driven Brands | Supplier Leverage |

| Fragmented Supplier Base (Standard Parts) | Lowers costs, enables easy switching | Low |

| Specialized Components (EVs, ADAS) | Increases reliance on fewer suppliers | Increasing |

| Centralized Procurement & Scale (4,000+ locations) | Amplifies buying power, secures favorable terms | Lowers relative supplier power |

| EV Market Growth (16M+ units in 2024) | Drives demand for specialized parts | Increases |

What is included in the product

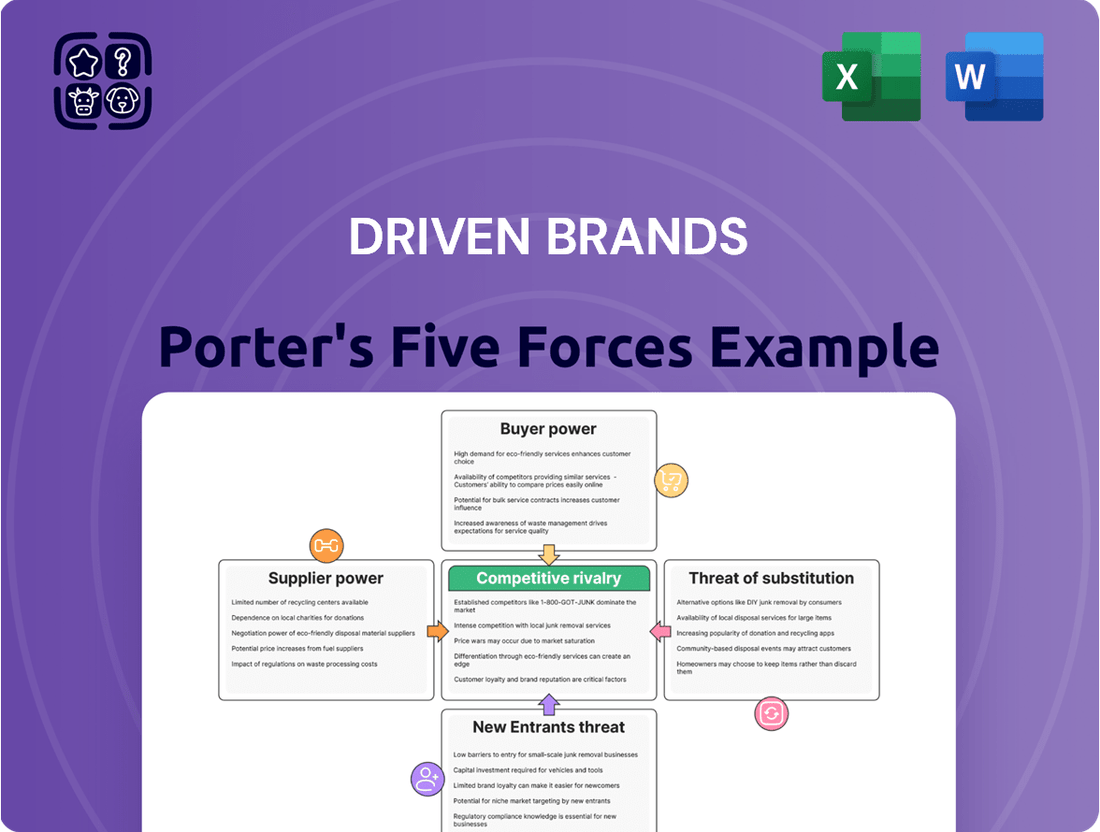

This analysis dissects the competitive landscape for Driven Brands by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive aftermarket industry.

Instantly visualize competitive intensity across the auto aftermarket with a clear, actionable spider chart of Driven Brands' Porter's Five Forces.

Customers Bargaining Power

Customers in the automotive services market, especially for essential maintenance and repairs, are feeling the pinch from economic factors like inflation and rising interest rates. This makes them more mindful of their spending, giving them greater leverage to seek out the best value. For instance, in 2024, consumer spending on vehicle maintenance and repair saw a noticeable shift towards value-oriented services as households managed tighter budgets.

This increased price sensitivity means Driven Brands needs to carefully consider its pricing strategies. Balancing high-quality service with competitive pricing is crucial for keeping customers loyal. If prices become too high, customers may explore alternative service providers or delay non-critical repairs, impacting Driven Brands' revenue and market share.

The automotive services market is incredibly fragmented, meaning customers have a lot of options. Think about it: there are countless independent repair shops, dealerships, and other franchise operations out there. This sheer volume of choices directly boosts the bargaining power of customers.

Because so many providers are vying for business, customers can easily jump ship if they feel they aren't getting a fair price or good service. This intense competition forces companies like Driven Brands to be highly responsive to customer needs and pricing expectations.

In 2024, the automotive aftermarket services sector continued to see robust activity. For instance, the U.S. automotive aftermarket industry was projected to reach over $400 billion in sales, highlighting the competitive landscape Driven Brands operates within and the significant leverage customers hold due to these numerous alternatives.

Brand loyalty in the automotive repair industry has seen a noticeable decline. Data from 2024 indicates that a significant percentage of consumers are actively comparing prices and service offerings across different providers, rather than sticking with a single brand. This shift directly amplifies customer bargaining power.

This erosion of loyalty means customers are not as beholden to a particular automotive service provider, giving them more leverage when choosing where to get their vehicles serviced. They can more easily switch to competitors if they perceive better value or service elsewhere.

To combat this, Driven Brands must prioritize delivering outstanding customer experiences and implementing robust loyalty programs. These initiatives are crucial for retaining customers and mitigating the increased bargaining power stemming from reduced brand attachment.

Digitalization and Transparency

The automotive aftermarket's digital transformation, including the growth of e-commerce, significantly boosts customer bargaining power. This increased transparency allows consumers to readily compare pricing, service quality, and customer reviews across various providers. For instance, in 2024, platforms like RepairPal and Yelp provided millions of users with detailed information, enabling them to make more informed decisions and negotiate better terms.

Online booking systems and readily available service histories further empower customers. They can easily research and select providers based on convenience and perceived value, diminishing the reliance on any single provider. Driven Brands needs to ensure its digital platforms are user-friendly and offer competitive pricing and service information to retain customers in this environment.

- Digital Transparency: Customers can easily compare pricing and service reviews online, increasing their leverage.

- E-commerce Growth: Online platforms facilitate easy appointment booking and information access, strengthening customer choice.

- Informed Decision-Making: Access to data empowers customers to negotiate effectively with service providers.

- Competitive Pressure: Driven Brands must maintain a strong digital presence to counter the increased bargaining power of informed consumers.

Convenience and Service Expectations

Customers today have higher expectations for convenience, wanting services that are readily available and easy to access. This includes things like mobile repair options and the ability to book appointments online. For instance, a 2024 survey indicated that over 65% of consumers would switch to a service provider offering more convenient booking and service options. Driven Brands aims to capture this by growing its service footprint and offering integrated solutions, but if they fall short, customers have plenty of other choices.

The bargaining power of customers is significantly influenced by their convenience and service expectations. In 2024, the demand for on-demand and easily accessible services has surged. Customers are increasingly looking for quick solutions, proximity, and digital conveniences like mobile repair services and online scheduling. Companies that can effectively meet these demands, such as Driven Brands through its network expansion and comprehensive offerings, are better positioned to retain customers. However, a failure to adapt to these evolving expectations can shift power towards the customer, encouraging them to explore alternative providers who offer greater convenience.

- Customer Convenience Priority: A significant majority of consumers, estimated at over 60% in recent 2024 market research, now rank convenience as a primary factor when choosing service providers.

- Digital Service Expectations: The demand for online booking and mobile service options continues to grow, with platforms offering these features seeing a notable increase in customer engagement.

- Impact on Provider Choice: Service providers that fail to offer convenient solutions risk losing customers to competitors who better meet these evolving needs.

- Driven Brands' Strategy: Driven Brands' expansion of its service center network and focus on integrated solutions directly addresses these customer demands, aiming to mitigate the bargaining power of customers by enhancing convenience.

Customers in the automotive services market, particularly for essential maintenance, are increasingly price-sensitive due to economic pressures like inflation in 2024. This sensitivity grants them more leverage to seek value, potentially delaying non-critical repairs or switching providers if prices are perceived as too high. The highly fragmented nature of the market, with numerous independent shops and dealerships, further amplifies this customer bargaining power.

Brand loyalty has also diminished, with consumers actively comparing options in 2024, as evidenced by the U.S. automotive aftermarket industry's projected sales exceeding $400 billion, indicating a competitive landscape. Digital transparency, fueled by online review platforms and booking systems, empowers customers to make informed decisions and negotiate effectively, forcing companies like Driven Brands to prioritize competitive pricing and superior customer experiences.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | Increased leverage to seek best value | Consumer spending on vehicle maintenance shifted towards value-oriented services. |

| Market Fragmentation | Numerous alternatives available | U.S. automotive aftermarket industry projected over $400 billion in sales. |

| Brand Loyalty Erosion | Easier switching between providers | Significant percentage of consumers actively comparing prices and services. |

| Digital Transparency | Informed decision-making and negotiation | Platforms like RepairPal and Yelp provided millions of users with detailed information. |

What You See Is What You Get

Driven Brands Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Driven Brands, detailing the competitive landscape and strategic positioning within its industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The automotive services market is incredibly fragmented and fiercely competitive. Think of it as a vast landscape with many players, from big national brands you see everywhere to smaller, local repair shops and even the service departments at car dealerships. Driven Brands, being the largest automotive services company in North America, finds itself in the thick of this rivalry across all its service areas, whether it's routine maintenance, fixing dents and scratches, or paint jobs.

This intense competition means companies like Driven Brands are constantly battling for customers and market share. It naturally puts downward pressure on prices, as businesses try to offer the best value to attract and keep clients. In 2024, the automotive repair market in the US alone was valued at over $100 billion, highlighting the sheer scale and the competitive intensity within this sector.

Driven Brands faces intense competition in the automotive aftermarket, particularly in the quick oil change sector where Valvoline stands as a significant direct rival. Beyond major franchises, a vast landscape of independent shops and smaller franchise systems also vie for market share, intensifying the rivalry.

The company’s strategy of brand diversification, encompassing automotive repair, paint, and collision services, offers a buffer. However, performance isn't uniform across its portfolio. For instance, Take 5 Oil Change has demonstrated robust expansion, a positive sign amidst challenging market conditions, while certain segments within Franchise Brands have experienced downturns, reflecting the distinct competitive pressures each service line encounters.

Competition within the automotive service industry is frequently localized, meaning that the opening of new service centers intensifies rivalry in specific geographic areas. Driven Brands' strategic expansion of its service center network directly fuels this localized competitive landscape.

To sustain profitability and market share, Driven Brands must continuously evaluate local market saturation and the activities of competing service providers. For instance, in 2024, the automotive repair market saw continued growth, with independent shops often dominating local markets, presenting a challenge for larger consolidated brands.

Impact of Consolidation

The automotive aftermarket is experiencing significant consolidation, with private equity firms and major companies actively acquiring smaller businesses. This trend concentrates market share among fewer, larger entities, enhancing their competitive capabilities and influence. Driven Brands, a prominent consolidator itself, must contend with this dynamic, as these larger, well-resourced competitors present a more substantial competitive challenge.

This consolidation means that the competitive landscape for Driven Brands is increasingly defined by a smaller number of powerful players. For instance, in 2024, private equity continued to be a major driver, with numerous deals announced across various segments of the automotive aftermarket, from collision repair to car washes. This activity strengthens the market position of acquirers.

- Increased Market Power: Larger consolidated entities can leverage economies of scale in purchasing, marketing, and operations, potentially leading to price advantages.

- Reduced Number of Competitors: As consolidation progresses, the sheer number of independent businesses diminishes, intensifying rivalry among the remaining larger players.

- Enhanced Resource Allocation: Acquired businesses often benefit from increased capital for technology upgrades, expansion, and talent development, making them formidable rivals.

- Strategic Acquisitions by Driven Brands: Driven Brands' own strategy of acquiring brands, such as its expansion in 2024 within the quick lube sector, positions it to compete effectively within this consolidating environment.

Service Differentiation and Technology Adoption

The automotive service industry is characterized by intense competition, where differentiation through service quality, speed, and convenience is paramount. Driven Brands, like its peers, must continually invest in advanced training and equipment to service increasingly complex vehicles, such as electric vehicles (EVs) and those equipped with Advanced Driver-Assistance Systems (ADAS). For instance, by mid-2024, the global EV market share continued its upward trajectory, with projections indicating further significant growth, demanding specialized technician skills and diagnostic tools.

Consumer expectations are also evolving, with a growing demand for seamless digital engagement, from online booking to transparent communication. Driven Brands' strategic adoption of technology, including robust digital platforms and customer relationship management (CRM) systems, directly impacts its ability to meet these expectations and maintain a competitive edge. This technological integration is not merely about convenience but is becoming a core component of service delivery and customer loyalty in the 2024 landscape.

- Service Quality: Maintaining high standards in repairs and customer interactions is a key differentiator.

- Technological Advancement: Adapting to EV and ADAS technologies requires ongoing investment in training and specialized equipment.

- Digital Engagement: Providing user-friendly digital platforms for booking, tracking, and payment enhances customer experience.

- Convenience and Speed: Offering efficient service turnaround times and accessible locations remains a critical competitive factor.

The competitive rivalry within the automotive services sector is exceptionally high, driven by a fragmented market and the presence of numerous national brands, independent shops, and dealership service centers. Driven Brands, as the largest player, faces constant pressure to attract and retain customers, which often translates to competitive pricing strategies.

In 2024, the US automotive repair market, valued at over $100 billion, exemplifies this intense competition, with players like Valvoline directly challenging Driven Brands, particularly in quick oil changes. This rivalry extends across all service segments, forcing companies to differentiate through quality, speed, and digital engagement to maintain market share.

The industry's trend towards consolidation, fueled by private equity, further intensifies rivalry among larger entities. These consolidated businesses benefit from economies of scale and enhanced resource allocation, making them formidable competitors. Driven Brands' own acquisition strategy in 2024, notably in the quick lube sector, aims to bolster its position within this consolidating landscape.

| Key Competitor Type | Competitive Pressure | Impact on Driven Brands |

|---|---|---|

| National Brands (e.g., Valvoline) | Direct competition, price wars | Pressure on pricing, need for service differentiation |

| Independent Shops | Localized competition, established customer loyalty | Challenge in gaining market share in specific areas |

| Dealership Service Centers | Brand loyalty, manufacturer-backed services | Competition for specialized repairs and maintenance |

| Consolidated Entities (PE-backed) | Economies of scale, aggressive expansion | Increased market power, need for strategic acquisitions and operational efficiency |

SSubstitutes Threaten

The threat of do-it-yourself (DIY) repairs presents a notable challenge for companies like Driven Brands. Many vehicle owners are increasingly taking on simpler maintenance tasks themselves, such as oil changes, tire rotations, and air filter replacements. This trend is fueled by the widespread availability of online tutorials, readily accessible auto parts, and increasingly user-friendly DIY tools.

For routine maintenance services, which form a core offering for many Driven Brands' businesses, this DIY inclination can directly impact demand. For instance, a 2024 survey indicated that approximately 35% of car owners perform at least one basic maintenance task annually, a figure that has seen a steady increase over the past five years.

The increasing adoption of electric vehicles (EVs) presents a significant substitute threat to traditional automotive maintenance services. EVs, with their simpler powertrains, require fewer routine services like oil changes and exhaust system repairs. For instance, by the end of 2023, EV sales in the US had already surpassed 1.2 million units, a substantial increase from previous years.

This technological shift means that a growing segment of the vehicle market will bypass many of the core services that have historically driven revenue for companies like Driven Brands. While EVs introduce new maintenance needs, such as battery diagnostics and specialized electrical system repairs, the overall reduction in component wear and tear poses a long-term substitute for a portion of their conventional service offerings.

The increasing durability and longevity of modern vehicles present a significant threat of substitutes for automotive repair businesses like Driven Brands. Cars are being engineered to last longer, meaning customers may not need as many major repairs as they once did. For instance, advancements in materials and manufacturing mean a vehicle might reach 200,000 miles with fewer critical component failures than a car from a decade or two ago.

While an older fleet might seem like a boon for repair shops, the enhanced reliability of newer models can actually delay the need for certain complex and high-margin services. This trend could subtly reduce the overall demand for some types of automotive repairs, forcing companies to adapt their service offerings or focus on preventative maintenance.

Public Transportation and Ride-Sharing

The increasing adoption of public transportation and ride-sharing services presents a significant threat of substitutes for automotive maintenance and repair providers like Driven Brands. As more individuals opt for these alternatives, the overall need for personal vehicle ownership and, consequently, vehicle maintenance decreases. This shift directly impacts the demand for services such as oil changes, tire rotations, and collision repair.

For instance, in 2024, urban mobility trends continue to favor shared and public transit. Cities are investing heavily in expanding public transport networks and integrating ride-sharing platforms more seamlessly. This reduces the necessity for individuals to own and maintain private vehicles, thereby shrinking the addressable market for aftermarket automotive services.

- Reduced Vehicle Usage: A decline in personal car miles driven directly correlates to fewer maintenance needs, impacting revenue streams for repair shops.

- Shifting Consumer Preferences: Growing environmental consciousness and cost-saving motivations encourage a move away from private car ownership towards more sustainable and economical transport options.

- Market Size Impact: The overall market for automotive aftermarket services could see a contraction if these substitution trends persist and accelerate.

Predictive Maintenance and Telematics

The rise of predictive maintenance and telematics presents a significant threat of substitutes for traditional automotive repair services. As vehicles become more connected, sophisticated sensors and data analytics can anticipate component failures, shifting demand from reactive repairs to proactive, scheduled interventions. For instance, by 2024, the global telematics market was projected to reach over $300 billion, indicating a strong trend towards data-driven vehicle management.

This technological shift means that services focusing on emergency or unexpected repairs might see reduced demand. Instead, customers could opt for manufacturers or specialized providers offering integrated predictive maintenance solutions. This could directly impact the revenue streams of companies like Driven Brands if they do not adapt their service offerings.

- Predictive Maintenance: Utilizes vehicle data to forecast potential issues, reducing the need for unplanned service.

- Telematics Growth: The expanding telematics market signifies a growing reliance on connected vehicle technology for maintenance insights. In 2023, the automotive telematics market was valued at approximately $100 billion, with significant growth expected.

- Shift in Demand: A move from reactive, unscheduled repairs to proactive, scheduled maintenance could erode demand for traditional repair shops.

- Competitive Response: Driven Brands needs to integrate similar technologies to offer competitive, forward-looking maintenance solutions and retain customer loyalty.

The threat of substitutes for Driven Brands is multifaceted, encompassing DIY solutions, the rise of electric vehicles (EVs), increased vehicle longevity, and the growing adoption of alternative transportation. These substitutes directly challenge traditional revenue streams by reducing the need for routine maintenance and repairs.

The increasing adoption of EVs, for example, means fewer oil changes and exhaust system repairs, a significant shift given that EV sales surpassed 1.2 million units in the US by the end of 2023. Similarly, advancements in vehicle manufacturing mean cars are lasting longer, with many reaching 200,000 miles requiring fewer major interventions.

Furthermore, the trend towards public transportation and ride-sharing services, supported by significant urban mobility investments in 2024, reduces personal vehicle usage and thus maintenance demand. The growth of telematics and predictive maintenance, with the global market projected to exceed $300 billion in 2024, also shifts demand from reactive repairs to proactive, data-driven solutions.

| Substitute Category | Key Driver | Impact on Driven Brands | Relevant Data Point (2023-2024) |

|---|---|---|---|

| DIY Maintenance | Online tutorials, accessible parts | Reduced demand for basic services | ~35% of car owners perform DIY maintenance annually (2024) |

| Electric Vehicles (EVs) | Simpler powertrains, fewer routine services | Bypass traditional maintenance needs | Over 1.2 million EVs sold in US (End of 2023) |

| Vehicle Longevity | Improved materials and manufacturing | Delayed need for complex repairs | Modern vehicles reaching 200,000 miles with fewer failures |

| Alternative Transport | Public transit, ride-sharing | Decreased personal vehicle ownership and usage | Continued investment in urban mobility networks (2024) |

| Predictive Maintenance/Telematics | Connected vehicle data, sensors | Shift from reactive to proactive maintenance | Global telematics market projected over $300 billion (2024) |

Entrants Threaten

The automotive services industry, particularly for established players like Driven Brands, presents a formidable barrier to new entrants due to the sheer capital required for physical infrastructure. Establishing a new automotive service center demands significant upfront investment in real estate acquisition or long-term leases, construction or extensive renovations to meet brand standards, and the purchase of specialized tools and diagnostic equipment. For instance, setting up a single full-service auto repair shop can easily cost upwards of $250,000 to $500,000, encompassing everything from bay equipment to office furnishings.

Driven Brands, with its vast portfolio of brands like Meineke, Maaco, and Take 5 Oil Change, has already secured prime locations and built a substantial physical footprint across North America. This existing network of over 4,000 locations creates a significant hurdle for any newcomer aiming to achieve comparable market reach and visibility. The high capital intensity inherently limits the ability of smaller, less-funded competitors to scale their operations rapidly, making it challenging to compete directly with established brands that benefit from economies of scale and brand recognition.

The automotive repair sector, and by extension Driven Brands, faces a substantial need for skilled technicians. This demand is amplified by the growing complexity of vehicles, particularly with the integration of electric vehicle (EV) technology and advanced driver-assistance systems (ADAS). New companies entering this market would need to commit significant resources to recruit and train personnel capable of handling these sophisticated repairs.

This necessity for specialized expertise presents a considerable barrier to entry. For instance, a recent report indicated a shortage of over 40,000 qualified automotive technicians in the US alone, a number projected to grow. New entrants must therefore either acquire existing skilled workforces or undertake extensive, costly training programs to develop their own, impacting their initial capital outlay and operational readiness.

Established players like Driven Brands leverage significant brand recognition and deep-seated customer trust, cultivated over extensive operational histories. Newcomers face a substantial hurdle, requiring considerable investment in marketing and a prolonged period to forge a comparable reputation and customer loyalty. While customer loyalty is dynamic, it remains a tangible advantage for incumbent firms.

Franchise Model Advantages

The franchise model, while a powerful growth engine for franchisors like Driven Brands, inherently acts as a significant barrier to entry for purely independent new businesses. Potential entrepreneurs are often drawn to the established brand recognition, proven operational blueprints, and centralized supply chain advantages that franchise systems offer, making it more appealing to join an existing network than to build a business from the ground up. This structured pathway significantly curtails the threat of new, unaligned competitors entering the market.

For instance, Driven Brands' extensive portfolio, encompassing brands like Meineke Car Care Centers and MAACO, benefits from economies of scale in purchasing and marketing that an independent startup would struggle to replicate. In 2023, Driven Brands reported over 4,000 locations across its various brands, demonstrating the widespread adoption and appeal of its franchise structure. This scale provides significant leverage in supplier negotiations and national advertising campaigns, advantages that are difficult for new, independent entrants to overcome.

The operational support and training provided by franchisors also reduce the learning curve and initial investment risks for franchisees. This streamlined entry process, coupled with the brand equity already built by the franchisor, makes it less attractive for new capital to enter the market through entirely independent ventures. For example, the automotive repair sector, where Driven Brands has a strong presence, often requires specialized equipment and technical expertise, which franchisors help to standardize and facilitate.

- Franchise Model Barrier: The structured nature of franchising limits the threat of independent new entrants by offering established systems.

- Driven Brands Scale: With over 4,000 locations in 2023, Driven Brands leverages its size for competitive advantages.

- Attractiveness of Franchising: Established models, operational support, and supply chain benefits draw entrepreneurs to franchise systems.

- Reduced Startup Risk: Franchising offers a less risky and more streamlined entry compared to independent business creation.

Regulatory Compliance and Environmental Standards

The automotive services sector faces significant hurdles due to stringent regulatory compliance and evolving environmental standards. New entrants must invest heavily to meet requirements concerning vehicle emissions, hazardous waste disposal, and operational safety, as mandated by bodies like the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA).

Navigating this complex web of regulations adds substantial upfront costs and demands specialized expertise, acting as a considerable barrier to entry. For instance, in 2024, the average cost for a new automotive repair facility to achieve full compliance with EPA regulations regarding refrigerant handling and waste oil disposal could range from $10,000 to $30,000, depending on the scale of operations.

- Increased Capital Investment: Compliance with environmental regulations, such as those for managing used oil and battery disposal, necessitates specialized equipment and training, increasing initial startup costs for new businesses.

- Operational Complexity: Adhering to safety protocols and emissions standards requires ongoing monitoring, record-keeping, and potential certifications, adding layers of operational complexity that can be challenging for new market participants.

- Deterrent to New Entrants: The significant financial and knowledge burden associated with regulatory compliance can discourage potential new competitors from entering the automotive services market, thereby protecting established players.

The threat of new entrants into the automotive services market, where Driven Brands operates, is significantly mitigated by several factors. High capital requirements for establishing physical locations, acquiring specialized equipment, and adhering to stringent regulatory standards create substantial upfront costs. Furthermore, the established brand recognition and extensive franchise networks of companies like Driven Brands, which boasted over 4,000 locations in 2023, offer a competitive advantage that is difficult for newcomers to overcome.

The need for skilled technicians, particularly with the rise of electric vehicles and advanced automotive technology, presents another barrier. New entrants must invest heavily in recruitment and training to meet this demand, a challenge exacerbated by a projected shortage of over 40,000 qualified automotive technicians in the US. The attractiveness of proven franchise models, which provide operational support and brand equity, also steers potential entrepreneurs away from independent startups.

| Barrier Type | Description | Estimated Cost/Impact (Illustrative) |

| Capital Investment (Infrastructure) | Real estate, construction, equipment for service centers. | $250,000 - $500,000+ per location. |

| Skilled Labor Acquisition | Recruitment and training for complex vehicle repairs (EV, ADAS). | Significant investment in training programs; technician shortage impacts availability. |

| Brand Recognition & Loyalty | Building customer trust and awareness against established brands. | Substantial marketing spend over extended periods. |

| Regulatory Compliance | Meeting EPA, OSHA, and environmental standards. | $10,000 - $30,000+ for initial compliance (2024 estimates). |

| Franchise Model Advantages | Leveraging established systems, supply chains, and brand equity. | New entrants often find it more feasible to join existing franchises than build independently. |

Porter's Five Forces Analysis Data Sources

Our Driven Brands Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary market research, industry-specific trade publications, and publicly available financial statements from competitors and suppliers.