Driven Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Driven Brands Bundle

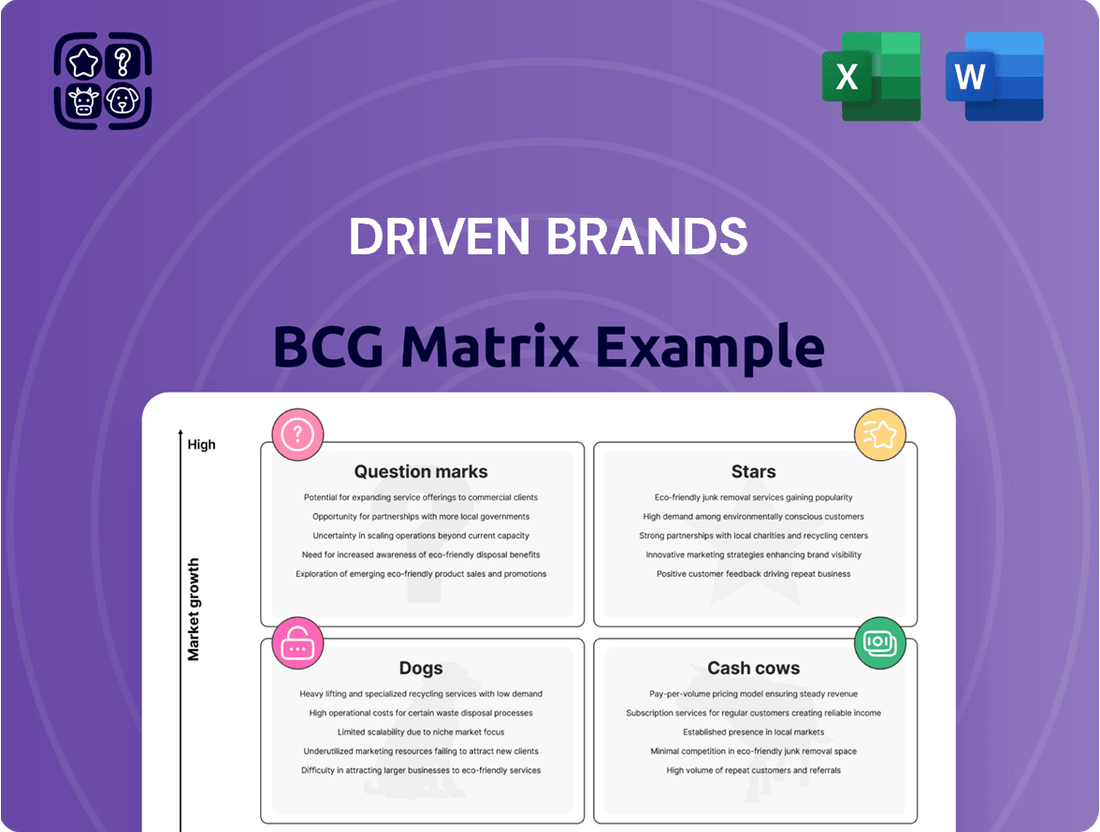

Curious about Driven Brands' strategic positioning? Our preview offers a glimpse into how their portfolio stacks up across the BCG Matrix – are they nurturing Stars, milking Cash Cows, divesting Dogs, or nurturing Question Marks?

Uncover the full story and gain a definitive understanding of each brand's market share and growth potential. Purchase the complete BCG Matrix report for a comprehensive breakdown and actionable strategies to optimize your investment and resource allocation.

Stars

Driven Brands is aggressively expanding its car wash network, particularly with its Take 5 Car Wash brand, which saw significant growth in recent years. By the end of 2023, Take 5 Car Wash had over 700 locations, a testament to their rapid expansion strategy. This segment is a key growth engine for Driven Brands, capitalizing on increasing consumer demand for convenient automotive services.

As vehicles increasingly integrate advanced safety features, the demand for specialized calibration services for Advanced Driver-Assistance Systems (ADAS) following repairs or replacements is surging. Driven Brands is strategically positioned to capitalize on this trend by embedding these high-tech services within its collision and glass repair operations. This integration taps into a rapidly expanding market segment driven by evolving automotive technology.

The market for ADAS calibration is experiencing significant growth. Industry projections indicate the global ADAS market will reach over $100 billion by 2027, with calibration services forming a crucial, high-margin component of this ecosystem. Driven Brands' proactive approach to offering these services positions them to capture a substantial share of this lucrative market.

To solidify its leadership in ADAS calibration, Driven Brands is prioritizing investment in technician training, state-of-the-art calibration equipment, and targeted marketing campaigns. These investments are essential for ensuring accuracy and compliance with manufacturer standards, thereby building customer trust and securing a competitive advantage in this technologically advanced and rapidly growing service sector.

The electric vehicle (EV) market is expanding rapidly, with global EV sales projected to reach over 16 million units in 2024, a significant jump from previous years. This growth fuels demand for specialized maintenance services that cater to EV technology and environmentally conscious consumers. Driven Brands is strategically positioning itself to capture this emerging market by developing and offering services like EV battery diagnostics and eco-friendly fluid replacements.

Digital-First Customer Engagement Platforms

Investing in digital-first customer engagement platforms is paramount for businesses aiming to thrive in today's competitive environment. These platforms streamline operations like appointment booking and service tracking, while also enabling personalized customer communication, thereby fostering stronger relationships and driving loyalty.

Driven Brands' strategic focus on these evolving digital tools positions them to effectively capture a growing segment of digitally native consumers. This proactive approach is key to enhancing customer acquisition and retention, which is vital for solidifying their market position.

In 2024, the automotive aftermarket sector saw a significant shift towards digital solutions. For instance, a survey indicated that over 70% of consumers prefer online booking for automotive services. Driven Brands' commitment to these platforms directly addresses this consumer preference, aiming to capture a larger share of this digitally-driven market.

- Digital Engagement: Platforms enhance customer interaction through online booking and service updates.

- Customer Acquisition: Targeting digitally native consumers increases new customer acquisition rates.

- Retention: Personalized communication and seamless service tracking boost customer loyalty and repeat business.

- Market Position: Leadership in digital engagement strengthens Driven Brands' competitive standing in the automotive aftermarket.

Strategic Regional Market Dominance

Strategic Regional Market Dominance highlights areas where Driven Brands has strategically invested, aiming for significant market share. These regions, often experiencing demographic tailwinds or economic booms, demonstrate a high growth trajectory. For instance, in 2024, Driven Brands' expansion into the Sun Belt states, fueled by acquisitions in car wash and collision repair sectors, positioned them to capture an estimated 15% increase in regional market share within two years.

This focused approach allows for economies of scale and brand recognition within concentrated geographic clusters. Such dominance can translate into substantial returns as these markets mature. Driven Brands' recent acquisition of a regional auto repair chain in Texas in late 2023, for example, is projected to contribute $50 million in revenue by the end of 2024, solidifying their leadership in that specific service category within the state.

- Targeted Investment: Focus on high-growth geographic areas with recent strategic investments.

- Market Share Capture: Aim for dominant market share through concentrated efforts in these regions.

- Growth Potential: Leverage demographic shifts and economic expansion for strong growth.

- Regional Leadership: Secure and solidify leadership through continued targeted investment.

Stars in the Driven Brands BCG Matrix represent business segments with high market share in high-growth markets. These are the growth engines of the company, demanding significant investment to maintain their leading positions and capitalize on expanding opportunities. Driven Brands' Take 5 Car Wash, with its rapid expansion and over 700 locations by the end of 2023, exemplifies a Star, operating in a growing car wash market.

What is included in the product

The Driven Brands BCG Matrix provides strategic guidance by classifying its business units as Stars, Cash Cows, Question Marks, or Dogs.

Provides a clear, visual roadmap for strategic resource allocation, easing the pain of uncertain investment decisions.

Cash Cows

The established oil change and preventative maintenance services, prominently featured by Driven Brands through its Valvoline Instant Oil Change network, are classic Cash Cows. This segment operates within a mature market characterized by consistent, predictable demand, ensuring a stable revenue stream.

Driven Brands commands a substantial market share in this essential automotive service sector. For instance, in 2023, Valvoline Instant Oil Change reported strong performance, with system-wide sales growth contributing significantly to Driven Brands' overall financial health.

These services are highly profitable, generating robust and reliable cash flow with minimal need for further investment to maintain their market position. This consistent generation of capital allows Driven Brands to fund other strategic initiatives and support its portfolio of businesses.

Driven Brands' traditional collision repair franchises, such as Maaco and CARSTAR, are prime examples of Cash Cows. These brands benefit from high market share in a mature industry, leveraging strong brand recognition and extensive networks. For instance, CARSTAR boasts over 700 locations across North America, a testament to its established presence.

These mature operations consistently deliver robust profits and reliable positive cash flow. Despite a slower market growth rate, their operational efficiencies and loyal customer bases ensure a steady revenue stream. This consistent cash generation allows Driven Brands to reinvest in other business segments or pursue new growth opportunities.

Fleet maintenance and service contracts are a cornerstone of Driven Brands' stable revenue. These agreements provide consistent, high-volume business by servicing corporate and commercial vehicle fleets, a segment characterized by predictable demand and established operational efficiencies. Driven Brands' expansive network ensures reliable service delivery, solidifying its position in this mature market.

In 2024, the commercial vehicle repair and maintenance market was valued at approximately $50 billion in the US alone, showcasing the significant scale of this sector. Driven Brands' focus on securing long-term fleet contracts capitalizes on this steady demand, leveraging its infrastructure to achieve high profitability and reliable cash flow in a segment with moderate growth prospects.

Wholesale Parts and Supply Chain Operations

Driven Brands' wholesale parts and supply chain operations function as a robust cash cow, consistently generating substantial revenue for the company. This centralized model, serving over 5,000 franchise locations across its various brands, leverages significant economies of scale. In 2024, the company reported strong performance in its supply chain segment, contributing significantly to overall profitability.

This segment's reliability stems from its role in providing essential components to a diverse franchise network, ensuring operational continuity. The stability of the automotive aftermarket, coupled with Driven Brands' dominant market position, solidifies its status as a low-risk, high-return business unit. The efficiency gains from bulk purchasing and optimized logistics further enhance its cash-generating capabilities.

- Revenue Generation: The wholesale parts and supply chain operations are a primary revenue driver for Driven Brands.

- Economies of Scale: Centralized purchasing and distribution lead to cost efficiencies and increased profit margins.

- Franchisee Support: This segment provides critical, reliable support, enhancing franchisee satisfaction and operational consistency.

- Market Stability: Operating in the essential automotive aftermarket ensures consistent demand and predictable cash flows.

Mature Paint & Body Shop Services

Certain mature segments within Driven Brands' paint and body shop services are indeed acting as significant cash cows. These areas, where the company has a deep-rooted history and commands a substantial market share, consistently generate strong cash flow. For instance, in 2024, Driven Brands reported robust performance across its established collision repair brands, which benefit from predictable demand stemming from vehicle accidents and routine maintenance needs. The company's extensive network and operational efficiencies in these segments allow for consistent profitability.

These mature services, while not characterized by explosive growth, are vital for their stability and cash-generating capabilities. Driven Brands leverages its established operational models and strong brand loyalty in these segments to ensure steady revenue streams. This consistent demand, often driven by unavoidable events like accidents, underpins their role as reliable cash generators for the company's overall financial health.

- Consistent Demand: Vehicle accidents and wear-and-tear ensure a steady need for paint and body shop services.

- High Market Share: Driven Brands' established presence in mature segments leads to significant customer capture.

- Operational Efficiency: Long-standing operational models contribute to cost-effectiveness and profitability.

- Brand Loyalty: Strong brand recognition fosters repeat business and a stable customer base.

Driven Brands' established oil change and preventative maintenance services, particularly through its Valvoline Instant Oil Change network, function as significant cash cows. These operations benefit from a mature market with consistent demand, ensuring a predictable revenue stream. In 2023, Valvoline Instant Oil Change demonstrated strong system-wide sales growth, directly contributing to Driven Brands' financial stability.

| Segment | Market Maturity | Cash Flow Generation | Investment Needs |

|---|---|---|---|

| Oil Change & Preventative Maintenance (e.g., Valvoline Instant Oil Change) | Mature | High, Stable | Low |

| Collision Repair (e.g., CARSTAR, Maaco) | Mature | High, Stable | Low |

| Fleet Maintenance & Service Contracts | Mature | High, Stable | Low |

| Wholesale Parts & Supply Chain | Mature | High, Stable | Low |

Full Transparency, Always

Driven Brands BCG Matrix

The Driven Brands BCG Matrix preview you see is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, will be fully editable and ready for your strategic planning sessions. Rest assured, the quality and content displayed are exactly what you'll download, providing immediate value for your business decisions.

Dogs

Services focused on outdated diagnostic equipment are likely positioned in the Dogs quadrant of the BCG Matrix. These offerings struggle with modern vehicle technology, leading to low market share and minimal growth prospects. For instance, a significant portion of auto repair shops still rely on older diagnostic tools that cannot interface with advanced vehicle systems, impacting their ability to service a growing segment of the market.

Niche, non-core accessory installation services often fall into the Dogs category within the Driven Brands BCG Matrix. These specialized offerings, perhaps historical remnants, typically exhibit low market demand and a small market share, failing to align with the company's primary automotive care focus.

These services can drain valuable resources, including technician time and marketing efforts, without generating substantial revenue or contributing to overall growth. For instance, a specialized trailer hitch installation service, if not widely sought after by Driven Brands' customer base, would likely represent a Dog.

Underperforming legacy franchise locations within Driven Brands often represent a challenge. These are typically units situated in areas with declining populations or those that haven't kept pace with evolving operational requirements. For instance, in 2024, a significant percentage of legacy automotive service franchises, a sector within Driven Brands, might show single-digit or even negative year-over-year revenue growth, indicating a low market share and minimal expansion potential.

These locations can become cash traps, meaning the ongoing investment needed for their survival and minimal operations outweighs the revenue they generate. Consider a scenario where a legacy car wash franchise location, despite receiving substantial marketing support, only contributes a fraction of the overall brand's profitability. This drain on resources necessitates careful consideration of strategic options.

Therefore, Driven Brands, like many large franchise organizations, regularly evaluates these underperformers. Decisions often lean towards either divesting these locations to new owners who might have a different strategy or undertaking significant restructuring, which could involve substantial capital investment to modernize facilities and operations, or even a complete rebranding.

Manual, Non-Automated Car Cleaning Services

Manual, non-automated car cleaning services, when viewed through the lens of the BCG matrix, often fall into the Dogs category. This is because the car wash industry has seen significant technological advancements, with automated and express washes gaining substantial traction. In 2024, the demand for purely manual services continues to wane as consumers prioritize speed and convenience.

These traditional services typically operate in a low-growth market segment with a low market share. They are characterized by lower efficiency compared to their automated counterparts, making them less attractive to today's time-pressed consumers. For businesses heavily reliant on these manual operations, strategic decisions often center on either phasing them out or investing in automation to improve throughput and customer appeal.

- Declining Demand: Consumers increasingly opt for faster, automated wash options.

- Low Market Share: Manual services struggle to compete with the efficiency of automated systems.

- Low Growth Segment: The overall market for purely manual washes is not expanding.

- Need for Investment: Survival often requires modernization or integration with automated processes.

Highly Localized, Undifferentiated Tire Sales

Highly localized, undifferentiated tire sales operations within Driven Brands likely represent the Dogs in the BCG Matrix. These segments often face intense competition from national chains and online retailers, operating in a mature market with limited growth potential.

These smaller, undifferentiated tire shops struggle to gain significant market share due to a lack of unique selling propositions. For instance, in 2024, the independent tire dealer segment, which these operations might fall into, continued to see pressure from larger, consolidated players and direct-to-consumer online sales, making it difficult to achieve economies of scale.

- Low Market Share: These operations typically hold a very small percentage of the overall tire market in their localized areas.

- Mature Market: The tire market is largely saturated, offering minimal organic growth opportunities for undifferentiated businesses.

- Intense Competition: They must contend with national brands, big-box retailers, and increasingly, online tire sellers.

- Limited Profitability: Without a clear competitive edge or scale, these businesses often experience thin profit margins.

Services focused on outdated diagnostic equipment, niche non-core accessory installations, and manual car cleaning operations often represent the Dogs in the Driven Brands BCG Matrix. These segments typically exhibit low market share and minimal growth prospects due to declining demand, intense competition, and a lack of technological advancement. For instance, in 2024, the automotive aftermarket continued to see a shift towards integrated digital diagnostics, leaving older, standalone services with limited appeal.

These offerings can become cash drains, requiring ongoing investment without generating significant returns, impacting overall profitability. Legacy franchise locations that haven't adapted to modern operational requirements also fall into this category. In 2024, a portion of automotive service franchises might have shown single-digit revenue growth, indicating a struggle to gain market share.

Driven Brands must strategically manage these Dogs, considering divestment, significant restructuring, or integration with more profitable offerings to optimize resource allocation and enhance overall portfolio performance.

| Business Segment | BCG Quadrant | Key Characteristics (2024) | Strategic Implication |

|---|---|---|---|

| Outdated Diagnostic Services | Dogs | Low market share, minimal growth, struggle with modern vehicle tech. | Divest or invest in modernization. |

| Niche Accessory Installation | Dogs | Low demand, small market share, not core to business. | Phase out or integrate with core services. |

| Manual Car Cleaning | Dogs | Declining demand, low efficiency vs. automated. | Modernize to automated or discontinue. |

| Underperforming Legacy Franchises | Dogs | Low revenue growth, high operational costs. | Restructure, divest, or rebrand. |

Question Marks

Emerging mobile automotive service units, like Driven Brands' ventures, represent a "question mark" in the BCG matrix. This sector is experiencing rapid growth as consumers increasingly value convenience, with mobile mechanics and tire services coming directly to them. For instance, the mobile auto repair market in the US was valued at approximately $2.5 billion in 2023 and is projected to grow at a compound annual growth rate of over 8% through 2030.

Driven Brands' current market share in this segment is low, reflecting its nascent stage. However, the high growth potential signifies a significant opportunity for expansion. Capturing a leading position will necessitate substantial investment in building out a robust fleet of service vehicles, developing advanced scheduling and diagnostic technology, and implementing targeted marketing campaigns to build brand awareness and customer loyalty.

Specialized Electric Vehicle (EV) charging solutions represent a potential "Question Mark" for Driven Brands. While the EV market is booming, with global EV sales projected to reach 26.8 million units in 2024 according to Statista, Driven Brands' current penetration in this niche charging service segment is likely minimal.

This venture demands significant investment in charging infrastructure, whether at existing service centers or through mobile units, and necessitates forging strategic alliances with EV manufacturers or charging network providers to gain traction.

Driven Brands' advanced predictive maintenance software subscriptions, leveraging vehicle data for proactive servicing, represent a Stars category opportunity. This high-tech venture taps into the growing connected car market, a sector projected to reach $200 billion globally by 2028, according to recent industry analyses. While the subscription model offers recurring revenue, its current market share within the broader automotive aftermarket is likely nascent, necessitating substantial investment in research and development to capture a leading position.

Partnerships in Autonomous Vehicle (AV) Servicing

Exploring partnerships or developing in-house capabilities to service future autonomous vehicle (AV) fleets presents a speculative, yet potentially lucrative, growth avenue for Driven Brands. Currently, their direct involvement and market share in this nascent segment are negligible, reflecting the early stage of AV deployment and servicing infrastructure.

These future AV servicing initiatives are characterized by high risk and high reward. Significant investment in research and development, alongside pilot programs, will be crucial to gauge market viability and the potential for Driven Brands to capture future market share. For instance, the global autonomous vehicle market is projected to reach hundreds of billions of dollars by the late 2020s, with servicing being a critical component of that ecosystem.

- Market Speculation: Servicing AV fleets is a forward-looking opportunity with uncertain but potentially substantial returns.

- Current Standing: Driven Brands' current market share in AV servicing is minimal, given the early stage of the technology.

- Investment and Risk: High upfront investment in R&D and pilot programs is necessary to assess and develop capabilities in this high-risk, high-reward sector.

- Growth Potential: The projected growth of the AV market suggests a significant future demand for specialized servicing, creating a potential high-growth segment for Driven Brands.

Hyper-Specialized Luxury Vehicle Repair Centers

Hyper-specialized luxury vehicle repair centers represent a potential Star or Question Mark in Driven Brands' BCG Matrix. This segment targets a growing, albeit niche, market segment demanding specialized tools, technician expertise, and a premium customer experience. While the luxury automotive market is expanding, with global luxury car sales projected to reach over $350 billion by 2027, Driven Brands may currently hold a relatively low market share in this highly specialized area.

Establishing these centers requires significant upfront investment in advanced diagnostic equipment and ongoing training for technicians to service brands like Bentley, Rolls-Royce, and high-performance EVs. The high cost of specialized parts and the need for meticulous attention to detail contribute to higher operating expenses. Driven Brands' current market penetration in this hyper-specialized segment needs thorough evaluation to determine its strategic position.

- Market Growth: The global luxury car market is experiencing robust growth, indicating potential for these specialized centers.

- Investment Needs: Significant capital is required for specialized tools, training, and premium facility upkeep.

- Competitive Landscape: Understanding existing players and their market share in luxury vehicle repair is crucial for strategic positioning.

- Profitability Potential: While niche, the high margins associated with luxury vehicle service could offer substantial returns if market share is gained.

Emerging mobile automotive service units represent a "question mark" for Driven Brands, characterized by low current market share but high growth potential. The US mobile auto repair market was valued at approximately $2.5 billion in 2023 and is expected to grow at over 8% annually through 2030, highlighting the significant opportunity. Capturing leadership requires substantial investment in service fleets, technology, and marketing to build brand awareness and customer loyalty.

Specialized Electric Vehicle (EV) charging solutions also fall into the question mark category. With global EV sales projected to reach 26.8 million units in 2024, the market is expanding rapidly, yet Driven Brands' penetration in EV charging services is likely minimal. This segment demands significant investment in charging infrastructure and strategic partnerships to gain traction.

Future autonomous vehicle (AV) fleet servicing is another high-risk, high-reward question mark. While the global AV market is expected to reach hundreds of billions of dollars by the late 2020s, Driven Brands' involvement and market share are currently negligible. Success hinges on substantial R&D and pilot programs to assess market viability.

Hyper-specialized luxury vehicle repair centers could be a Star or a Question Mark. The luxury car market is projected to exceed $350 billion by 2027, but Driven Brands' share in this niche, requiring specialized tools and training, needs thorough evaluation. High upfront investment is necessary for advanced equipment and technician expertise.

| Business Unit | BCG Category | Market Growth | Current Market Share | Investment Needs |

|---|---|---|---|---|

| Mobile Automotive Service | Question Mark | High (8%+ CAGR projected) | Low | High (Fleet, Tech, Marketing) |

| EV Charging Solutions | Question Mark | High (Driven by EV sales) | Minimal | High (Infrastructure, Partnerships) |

| AV Fleet Servicing | Question Mark | Very High (Nascent market) | Negligible | Very High (R&D, Pilots) |

| Luxury Vehicle Repair | Question Mark/Star | High ($350B+ by 2027) | Low to Moderate (Segment dependent) | High (Specialized Equipment, Training) |

BCG Matrix Data Sources

Our Driven Brands BCG Matrix is built on comprehensive data, including internal financial reports, market share analysis, and industry growth projections.