Dover SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dover Bundle

Dover's market position is shaped by its strong engineering heritage and diverse portfolio, but it also faces evolving industry demands. Our comprehensive SWOT analysis delves into these critical factors, providing a clear roadmap for success.

Want the full story behind Dover's competitive advantages, potential challenges, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Dover's strength lies in its broad reach across diverse industrial and commercial sectors. This includes key areas like Engineered Products, Clean Energy & Fueling, and Climate & Sustainability Technologies. This wide spread naturally cushions the company against downturns in any single market.

This diversification is a significant advantage, allowing Dover to maintain steady performance. For instance, the company saw strong results in its Clean Energy & Fueling and Pumps & Process Solutions segments throughout 2024 and into Q1 2025, demonstrating its ability to offset weaker areas with stronger ones.

Dover has consistently delivered robust financial results, a key strength that underpins its market position. In 2024, the company reported revenues of $7.7 billion, showcasing its stable revenue streams. This consistent performance is further evidenced by a 4% increase in adjusted earnings per share (EPS) compared to the previous year, highlighting operational efficiency and effective cost management.

A significant aspect of Dover's financial strength is its impressive cash flow generation. The company generated $920 million in free cash flow during 2024. This substantial cash generation provides Dover with considerable financial flexibility, enabling strategic investments in growth initiatives, potential acquisitions, and the return of capital to shareholders through dividends and share buybacks.

Dover's strategic emphasis on high-growth areas like Clean Energy Components and Precision Components is a significant strength. These sectors are bolstered by strong, long-term market trends, positioning Dover to capitalize on substantial opportunities.

The company's investment in platforms such as Single-Use Biopharma and Liquid Cooling aligns with critical secular tailwinds, including advancements in biopharmaceutical development and the increasing demand for efficient data center operations.

This focused approach allows Dover to not only capture current market demand but also to drive sustained future growth by being at the forefront of innovation in these vital sectors.

Proven M&A Strategy and Integration Capabilities

Dover's proven M&A strategy is a significant strength, characterized by a consistent history of executing strategic acquisitions and divestitures. This approach has been instrumental in refining its business portfolio and increasing exposure to high-growth market segments. The company's robust M&A pipeline, bolstered by approximately $1.5 billion in available capital as of early 2025, positions it for continued expansion and technological advancement.

Recent acquisitions, such as Pump Products and Sikora in 2025, underscore Dover's active pursuit of inorganic growth opportunities. With over 50 acquisitions successfully integrated historically, Dover demonstrates a strong capability in identifying, executing, and realizing value from these strategic moves, further solidifying its market position and competitive edge.

- Track Record: Over 50 successful acquisitions completed historically.

- Financial Capacity: Approximately $1.5 billion in capital available for M&A as of early 2025.

- Strategic Focus: Acquisitions aimed at enhancing portfolio and targeting high-growth markets.

- Recent Activity: Integration of Pump Products and Sikora in 2025 exemplifies ongoing M&A momentum.

Strong Operational Efficiency and Margin Expansion

Dover has demonstrated remarkable operational efficiency, consistently enhancing its profit margins. This success is driven by diligent cost management and strategic productivity enhancements across its various business segments.

The company's focus on a favorable product mix, particularly from its higher-margin platforms, has been a key factor in achieving robust financial performance. This strategic product positioning directly contributes to improved profitability.

Dover achieved a significant milestone in Q1 2025, reporting a record adjusted EBITDA margin of 24%. This figure underscores the effectiveness of their operational strategies and margin expansion efforts.

- Operational Execution: Consistent strong performance in day-to-day business activities.

- Margin Improvement: Increased profitability across different company divisions.

- Cost Management: Effective control and reduction of operational expenses.

- Record Q1 2025 Adjusted EBITDA Margin: Achieved 24%, highlighting peak efficiency.

Dover's diversified business model across multiple industrial sectors acts as a significant strength, providing resilience against market volatility. This broad market presence, evident in segments like Engineered Products and Clean Energy & Fueling, ensures stability. The company's ability to leverage strong performance in areas such as Clean Energy & Fueling and Pumps & Process Solutions in 2024 and early 2025 helps offset weaker performance in other divisions.

Financial robustness is a core strength, with Dover reporting $7.7 billion in revenue for 2024 and a 4% increase in adjusted EPS year-over-year, indicating efficient operations and cost control. The company's substantial free cash flow generation, totaling $920 million in 2024, provides significant financial flexibility for strategic investments and shareholder returns.

Dover's strategic focus on high-growth sectors like Clean Energy Components and Precision Components, driven by long-term market trends, positions it for sustained future growth. Investments in platforms such as Single-Use Biopharma and Liquid Cooling further capitalize on critical secular tailwinds, including biopharmaceutical advancements and data center demands.

The company's proven M&A strategy, marked by over 50 historical acquisitions and approximately $1.5 billion in available capital by early 2025, is a key strength. Recent integrations like Pump Products and Sikora in 2025 demonstrate an active pursuit of inorganic growth, enhancing its portfolio and market position.

Dover exhibits strong operational efficiency, consistently improving profit margins through effective cost management and productivity enhancements, particularly from higher-margin product lines. This is underscored by a record Q1 2025 adjusted EBITDA margin of 24%, reflecting peak operational effectiveness.

| Metric | 2024 Data | Early 2025 Data | Significance |

|---|---|---|---|

| Revenue | $7.7 billion | N/A (Ongoing) | Demonstrates broad market reach and stable income. |

| Adjusted EPS Growth | +4% YoY | N/A (Ongoing) | Indicates operational efficiency and cost management. |

| Free Cash Flow | $920 million | N/A (Ongoing) | Provides financial flexibility for growth and returns. |

| M&A Capital Availability | N/A | ~$1.5 billion | Supports strategic inorganic growth and portfolio enhancement. |

| Q1 2025 Adjusted EBITDA Margin | N/A | 24% (Record) | Highlights peak operational efficiency and margin expansion. |

What is included in the product

Delivers a strategic overview of Dover’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, turning potential weaknesses into opportunities.

Weaknesses

While Dover Corporation has made strides in diversifying its business, certain segments remain tethered to the ebb and flow of industrial and commercial markets. These sectors can be quite sensitive to shifts in the broader economy, meaning demand can fluctuate significantly based on macroeconomic trends.

For instance, the company's exposure to markets like construction and manufacturing, which are often tied to capital expenditure cycles, means that downturns in these areas can directly impact revenue. Despite efforts to pivot towards more resilient, high-growth sectors, the inherent cyclicality of some of its core businesses presents an ongoing challenge.

Dover's diversified global manufacturing footprint, encompassing numerous operating companies, presents a significant weakness in its complex organizational structure. This intricate setup can hinder efficient communication and slow down decision-making processes across its various segments and geographical regions.

The sheer scale and diversity of Dover's operations can lead to inefficiencies in resource allocation. For instance, coordinating capital expenditures or R&D investments across disparate business units might not always be optimized, potentially impacting overall profitability and strategic agility.

Dover's operational model in manufacturing and solutions often demands substantial capital for equipment, facilities, and research. This continuous investment, while crucial for growth and efficiency, can place pressure on short-term free cash flow, a factor evident in their Q1 2025 financial reporting.

Integration Risks of Acquisitions

While Dover's acquisition strategy is a recognized strength, it introduces significant integration risks. Successfully merging new businesses, their technologies, and corporate cultures can be challenging. For instance, if the integration of a newly acquired company's IT systems is not seamless, it could lead to operational disruptions and increased costs, potentially eroding the expected financial benefits of the deal.

Failure to effectively integrate acquired entities can result in several negative outcomes. These include:

- Operational Disruptions: Mismatched processes or systems can hinder day-to-day operations.

- Cost Overruns: Unexpected expenses during the integration phase can impact profitability.

- Failure to Realize Synergies: The anticipated cost savings or revenue enhancements may not materialize.

- Cultural Clashes: Differences in organizational culture can lead to employee dissatisfaction and reduced productivity.

In 2023, for example, many industrial conglomerates faced challenges in realizing the full value of acquisitions due to integration complexities, with some reporting integration-related costs exceeding initial estimates by up to 15%.

Intense Competitive Landscape

Dover faces a highly competitive environment across its diverse industrial segments. This includes intense pressure from broad industrial conglomerates and focused, specialized companies. For instance, in the Engineered Products segment, Dover competes with players like Illinois Tool Works and Eaton, both of which have significant market share and R&D capabilities.

Sustaining market leadership necessitates constant product development and cost management. In 2024, the industrial sector saw increased price competition, impacting margins for many players, including Dover. Maintaining strong customer loyalty is also paramount, as switching costs can be relatively low in some of Dover's product categories.

- Intense rivalry from diversified industrial giants.

- Competition from specialized niche market players.

- Need for continuous innovation to maintain edge.

- Pressure to maintain competitive pricing strategies.

Dover's complex, decentralized structure, with numerous operating companies, can lead to communication breakdowns and slower decision-making. This fragmentation can also result in suboptimal resource allocation, as coordinating investments across diverse units becomes challenging. For example, in 2024, managing the capital allocation across Dover's various segments required careful balancing to avoid inefficiencies.

The company's reliance on cyclical industries like construction and manufacturing exposes it to demand volatility. Downturns in these sectors directly impact revenue, even with efforts to diversify into more stable areas. This inherent sensitivity to economic cycles was a notable concern for investors throughout 2024, particularly as global industrial production experienced fluctuations.

Dover's significant capital expenditure requirements for its manufacturing operations can strain short-term free cash flow. Continuous investment in equipment and facilities, while necessary for competitiveness, presents a constant financial balancing act. This was evident in their Q1 2025 financial reports, highlighting the ongoing need to manage cash flow effectively amidst these investments.

The company faces substantial integration risks with its acquisition strategy. Merging new businesses, technologies, and cultures can be difficult, potentially leading to operational disruptions, cost overruns, and a failure to achieve expected synergies. In 2023, many industrial firms reported integration costs that exceeded initial projections by as much as 15%, underscoring this common challenge.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Organizational Complexity | Decentralized structure with numerous operating companies. | Hindered communication, slower decision-making, inefficient resource allocation. | Coordinating capital expenditures across diverse segments in 2024 required careful management to avoid inefficiencies. |

| Market Cyclicality | Exposure to sensitive industrial and commercial markets. | Demand volatility, direct impact on revenue during economic downturns. | Global industrial production fluctuations in 2024 highlighted sensitivity to economic cycles. |

| Capital Intensity | Substantial capital needs for manufacturing operations. | Pressure on short-term free cash flow, ongoing financial balancing act. | Q1 2025 financial reports indicated ongoing cash flow management challenges due to capital investments. |

| Acquisition Integration Risks | Challenges in merging new businesses, technologies, and cultures. | Operational disruptions, cost overruns, failure to realize synergies. | Integration costs for industrial acquisitions in 2023 sometimes exceeded initial estimates by up to 15%. |

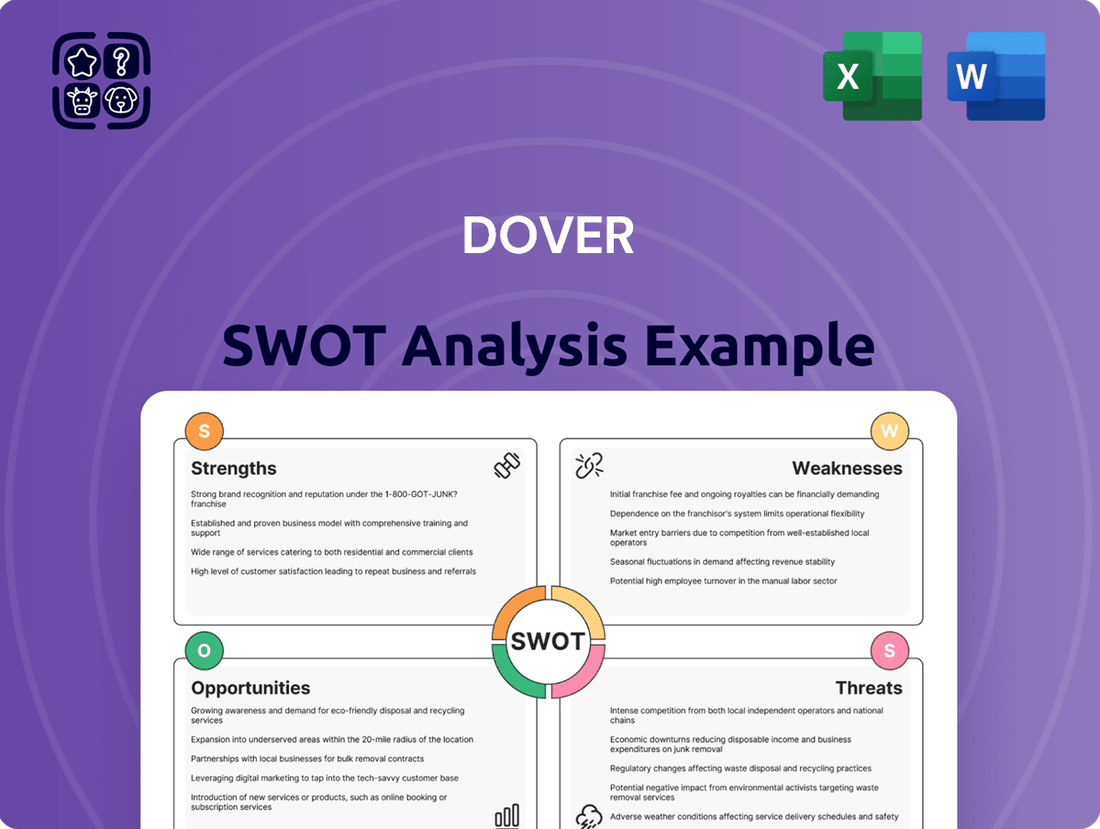

Preview Before You Purchase

Dover SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global drive towards decarbonization and environmental responsibility is a major tailwind for Dover. The company's existing strengths in its Clean Energy & Fueling and Climate & Sustainability Technologies divisions directly align with this trend, offering significant growth potential.

Dover is strategically positioned to benefit from the increasing demand for energy-efficient solutions and components. For instance, the market for CO2 refrigeration systems, a key area for Dover, is projected to grow substantially, driven by regulatory pressures and consumer demand for greener alternatives. In 2024, the global renewable energy market was valued at over $1.5 trillion and is expected to continue its upward trajectory.

The biopharmaceutical industry's rapid expansion, especially the demand for single-use components, presents a significant opportunity for Dover's Pumps & Process Solutions. This growth is fueled by innovations in drug manufacturing and the increasing need for sterile, efficient production methods. For instance, the global biopharmaceutical market was valued at over $400 billion in 2023 and is projected to continue its upward trajectory.

Dover has a significant opportunity to expand its digital solutions and Internet of Things (IoT) capabilities. By integrating connected products, sensors, and advanced digital controls across its diverse business segments, the company can unlock new revenue streams and deepen customer relationships. For instance, the company's recent investments in digital transformation are aimed at creating more value through data analytics and remote service offerings.

Penetration into Data Center and Liquid Cooling Markets

The burgeoning demand for data center capacity, fueled by AI and cloud computing, presents a substantial opportunity for Dover. The global data center market was valued at approximately $240 billion in 2023 and is projected to reach over $400 billion by 2028, showcasing robust expansion.

Dover's expertise in engineered components, particularly its thermal management solutions and precision fluid handling, aligns perfectly with the increasing adoption of liquid cooling technologies in data centers. These advanced cooling systems are crucial for managing the heat generated by high-density computing, a trend that is only accelerating.

- AI and HPC Drive Demand: The surge in artificial intelligence and high-performance computing workloads necessitates more efficient heat dissipation, directly benefiting liquid cooling solutions.

- Strategic Component Fit: Dover's precision connectors and thermal management products are integral to the infrastructure required for advanced data center cooling.

- Market Growth Projections: The liquid cooling market segment within data centers is expected to grow at a compound annual growth rate (CAGR) exceeding 20% in the coming years, indicating substantial revenue potential.

Strategic Acquisitions in High-Priority Growth Areas

Dover's robust financial position allows for strategic acquisitions in key growth sectors, bolstering market presence and technological advancement. This approach is particularly relevant given the ongoing consolidation trends observed in many of Dover's target markets throughout 2024 and into 2025.

Targeted mergers and acquisitions can significantly accelerate Dover's entry into and expansion within high-priority platforms, thereby enhancing its competitive edge. For instance, acquisitions in areas like advanced filtration or specialized engineered products could quickly integrate new technologies and customer bases.

- Accelerated Market Penetration: Acquisitions can provide immediate access to established customer networks and distribution channels in high-growth segments.

- Enhanced Technological Capabilities: Purchasing companies with innovative technologies allows Dover to quickly integrate cutting-edge solutions, such as advanced materials or digital sensing capabilities.

- Profitability Boost: Integrating acquired entities that operate in high-margin sectors can directly contribute to improved overall profitability, especially if synergies are realized effectively.

Dover is well-positioned to capitalize on the global push for sustainability, with its Clean Energy & Fueling and Climate & Sustainability Technologies segments poised for growth. The increasing demand for energy-efficient solutions, such as CO2 refrigeration systems, presents a significant opportunity, with the global renewable energy market exceeding $1.5 trillion in 2024.

The biopharmaceutical sector's expansion, particularly the need for single-use components in drug manufacturing, offers a substantial growth avenue for Dover's Pumps & Process Solutions. This market, valued at over $400 billion in 2023, is driven by innovation and the demand for sterile production.

Dover can enhance its offerings by expanding digital solutions and IoT capabilities across its segments, creating new revenue streams through data analytics and remote services. Furthermore, the burgeoning data center market, projected to reach over $400 billion by 2028, presents a key opportunity, especially with Dover's expertise in thermal management for liquid cooling solutions, a segment expected to grow at over 20% CAGR.

Strategic acquisitions in high-growth sectors can accelerate Dover's market penetration and technological advancement, especially given market consolidation trends observed in 2024-2025. These acquisitions can enhance capabilities and profitability by integrating innovative technologies and established customer bases.

| Opportunity Area | Key Driver | Dover Segment Relevance | Market Data Point |

|---|---|---|---|

| Decarbonization & Sustainability | Global regulatory push, consumer demand | Clean Energy & Fueling, Climate & Sustainability Technologies | Renewable energy market >$1.5 trillion (2024) |

| Biopharmaceutical Growth | Drug manufacturing innovation, sterile production needs | Pumps & Process Solutions | Biopharmaceutical market >$400 billion (2023) |

| Data Center Expansion (Liquid Cooling) | AI, cloud computing, high-density computing | Engineered Products (Thermal Management) | Data center market ~$240 billion (2023), Liquid cooling CAGR >20% |

| Digital Transformation & IoT | Data analytics, remote services, efficiency | All segments | Investment in digital transformation |

| Strategic Acquisitions | Market consolidation, accelerated growth | All segments | Observed market consolidation (2024-2025) |

Threats

A global economic slowdown presents a significant threat to Dover. For instance, if major economies like the US or China experience a contraction, demand for Dover's products, which serve diverse sectors from construction to electronics, could plummet. This could translate into fewer large-scale projects and a general decrease in industrial output, directly impacting Dover's order book and revenue streams.

Prolonged market volatility, characterized by sharp price swings and investor uncertainty, also poses a risk. This environment can make it difficult for Dover's customers to plan investments and capital expenditures, leading to delayed or canceled orders. In 2024, many industrial companies faced headwinds from fluctuating commodity prices and interest rate hikes, which could similarly affect Dover's ability to forecast and maintain stable growth.

Ongoing global supply chain challenges, including raw material shortages and logistics issues, present a significant threat to Dover's manufacturing. For instance, the cost of shipping containers saw a substantial increase in late 2023 and early 2024, impacting companies reliant on global logistics. These disruptions can delay production schedules and increase operational expenses.

Inflationary pressures on both raw materials and labor are also a concern for Dover. As of early 2024, inflation rates in key manufacturing regions remained elevated, directly impacting input costs. If Dover cannot pass these increased costs onto customers through pricing adjustments, profit margins could be squeezed, affecting overall financial performance.

The industrial manufacturing landscape is notoriously competitive, placing significant pricing and market share pressure on Dover. In 2023, the company navigated a challenging environment where competitors' agility in innovation and aggressive pricing tactics directly impacted its ability to sustain market dominance and profitability across various segments.

Regulatory Changes and Trade Policies

Regulatory shifts and evolving trade policies present a significant threat to Dover. Changes in environmental regulations, for example, could necessitate costly upgrades to manufacturing processes or product designs. In 2024, the global regulatory landscape continues to tighten, with increased focus on sustainability and emissions, potentially impacting Dover's operational expenditures.

Trade policies, including tariffs and import/export restrictions, directly affect Dover's supply chain and market access. For instance, new tariffs imposed on key components sourced internationally could increase production costs, thereby impacting profit margins. The ongoing trade disputes and potential for new tariffs in major markets like the US and China in 2024-2025 remain a concern.

- Increased Compliance Costs: New environmental mandates could require substantial investment in cleaner technologies and processes.

- Supply Chain Disruptions: Tariffs and trade barriers can disrupt the flow of raw materials and finished goods, leading to production delays and increased logistics expenses.

- Market Access Limitations: Protectionist trade policies in certain regions could hinder Dover's ability to sell its products, impacting revenue streams.

- Uncertainty in Planning: The dynamic nature of regulatory and trade policy changes creates an environment of uncertainty, making long-term strategic planning more challenging.

Technological Disruption and Rapid Innovation

The relentless pace of technological change presents a significant challenge for Dover. While the company invests in innovation, failing to keep up with rapid advancements in areas like digital manufacturing, automation, and advanced materials could leave its product lines vulnerable. For instance, the industrial automation sector, a key market for Dover, saw global spending projected to reach $225 billion in 2024, indicating intense competition and the need for continuous technological integration.

Emerging technologies from agile competitors or new market entrants pose a direct threat of disruption. If Dover's offerings are perceived as outdated or less efficient compared to newer, technologically superior solutions, market share could erode. The rise of AI-powered predictive maintenance in industrial equipment, for example, could challenge traditional service models if not proactively addressed.

Key areas of concern include:

- Digitalization of Industrial Processes: Competitors integrating advanced IoT and data analytics into their equipment could offer superior performance and efficiency, potentially displacing Dover's current offerings.

- Additive Manufacturing (3D Printing): The growing adoption of 3D printing for complex components could disrupt traditional manufacturing supply chains and product designs in sectors where Dover operates.

- Sustainable Technologies: A rapid shift towards more environmentally friendly technologies in industries like energy and transportation could render existing Dover products obsolete if the company doesn't pivot its R&D and product portfolio quickly enough.

Dover faces significant threats from a potential global economic slowdown, which could reduce demand across its diverse customer base. Additionally, persistent supply chain disruptions and inflationary pressures on raw materials and labor are impacting operational costs and potentially squeezing profit margins. The company must also contend with intense competition, regulatory shifts, and the rapid pace of technological change that could render its products or services obsolete.

SWOT Analysis Data Sources

This Dover SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry forecasts to provide a clear and actionable strategic overview.