Dover Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dover Bundle

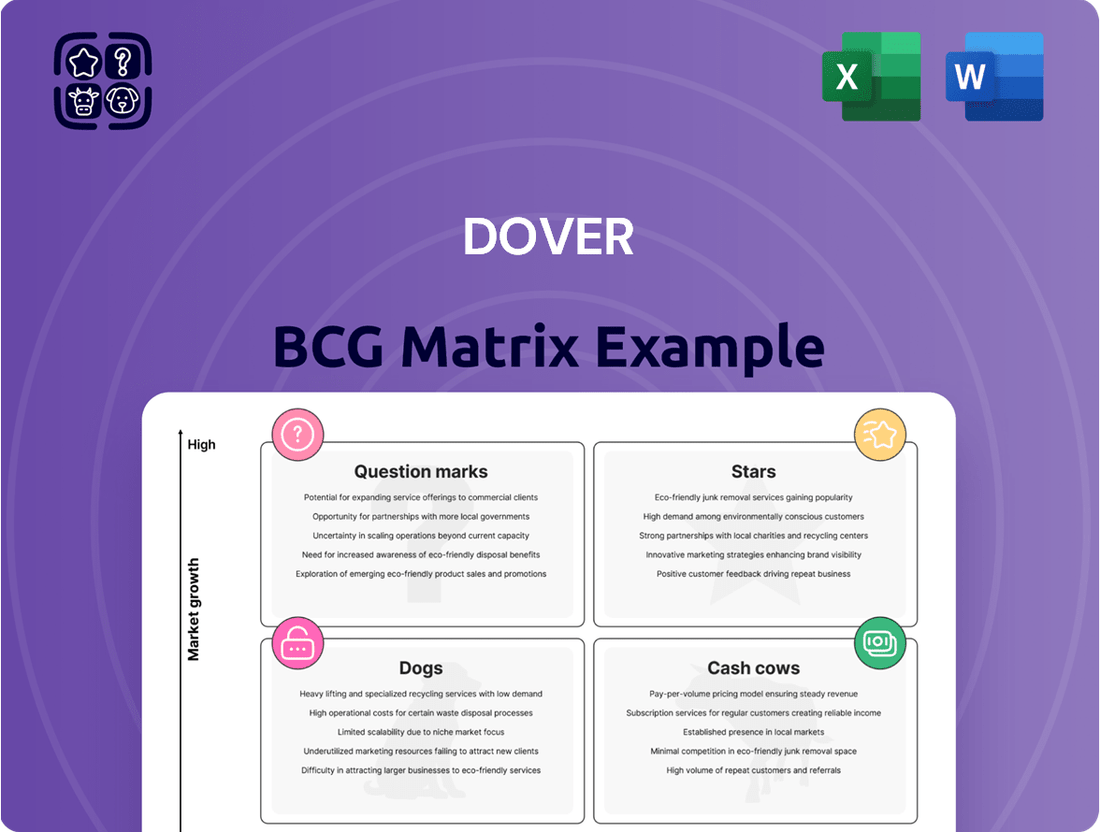

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview offers a glimpse into its Stars, Cash Cows, Dogs, and Question Marks, highlighting key areas for potential growth and concern. To truly unlock strategic advantage and make informed decisions about resource allocation and future investments, dive into the complete BCG Matrix report. It's your essential guide to navigating market dynamics and optimizing your business for success.

Stars

Dover's Clean Energy Components segment is a significant growth engine, driven by robust shipments. This sector is experiencing a surge due to worldwide decarbonization efforts and the ongoing energy transition, pointing to substantial growth prospects and strong order pipelines heading into 2025.

Dover's Pumps & Process Solutions segment is seeing impressive double-digit growth in single-use biopharma components. This surge is fueled by the booming healthcare and life sciences sectors, which are increasingly adopting these flexible and sterile solutions. This trend is a major contributor to Dover's robust financial performance and improved profit margins.

Dover's data center thermal connectors, specifically those designed for liquid cooling solutions, represent a star in their business portfolio. This segment experienced an impressive triple-digit growth rate in the first quarter of 2025, underscoring its significant market traction.

The burgeoning demand for artificial intelligence infrastructure is the primary catalyst behind this surge. As AI workloads intensify, the need for efficient thermal management in data centers becomes paramount, directly benefiting Dover's innovative connector products.

This rapid expansion firmly places data center thermal connectors within Dover's high-growth category, indicating a strong future outlook driven by technological advancements and market needs.

Retail Fueling Equipment (Below-Ground)

The North American market for below-ground retail fueling equipment is experiencing a noticeable rebound. After a couple of years of subdued activity, order volumes are now demonstrating strength, signaling a positive trend for this essential segment of energy infrastructure.

This recovery is translating into gains in market share for key players. The robust demand for these critical components, often installed underground at gas stations, is contributing to healthy margin performance for manufacturers.

- Market Recovery: North American below-ground retail fueling equipment sales are on an upswing after a recent dip.

- Robust Order Activity: Manufacturers are seeing a significant increase in new orders for these essential components.

- Market Share Growth: The segment's recovery suggests expanding market share for companies supplying these solutions.

- Margin Performance: Increased sales volumes are leading to solid financial results and improved profit margins.

Serialization Software in Imaging & Identification

The Imaging & Identification segment is experiencing significant growth, largely driven by its serialization software offerings. This surge is a direct result of the escalating need for secure and traceable supply chains across various industries.

Dover's serialization software is a key contributor to the segment's organic expansion, allowing the company to solidify a strong market position. This digital solution is well-aligned with market trends demanding greater connectivity and safety.

- Serialization software in imaging and identification is a high-growth area for Dover.

- Demand for connected and safe supply chains is fueling this expansion.

- Dover is capturing a significant market share in this digital solutions space.

Dover's data center thermal connectors are a prime example of a Star in the BCG matrix. These components are experiencing rapid, triple-digit growth, driven by the increasing demand for AI infrastructure and its associated thermal management needs. This positions them as a high-growth, high-market-share product for Dover.

| Segment | Growth Rate (Q1 2025) | Key Driver | Market Position |

|---|---|---|---|

| Data Center Thermal Connectors | Triple-digit | AI infrastructure demand, liquid cooling | Star |

| Clean Energy Components | Robust shipments | Decarbonization, energy transition | Star |

| Pumps & Process Solutions (Biopharma) | Double-digit | Healthcare/life sciences adoption | Star |

| Imaging & Identification (Serialization Software) | Significant growth | Supply chain traceability | Star |

| Below-ground Retail Fueling Equipment | Rebounding | Market recovery, infrastructure demand | Question Mark/Rising Star |

What is included in the product

Strategic overview of product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

The Dover BCG Matrix provides a clear, one-page overview, instantly clarifying which business units require attention.

Cash Cows

Dover's industrial pumps business, a key component of its Pumps & Process Solutions segment, demonstrated robust performance throughout 2024. This segment has consistently been a reliable revenue and profit generator for Dover.

As a mature product line, industrial pumps are characterized by stable demand and consistent cash flow, making them a significant contributor to Dover's overall financial stability. This dependable performance solidifies their position as a cash cow.

Precision Components, a key player within Dover's Pumps & Process Solutions segment, exhibits robust engagement with the gas and steam turbine sectors. These markets are currently demonstrating strong performance, indicating a favorable environment for this business unit.

This strategic positioning suggests that Precision Components likely commands a significant market share. Its established presence in mature industries points to a consistent and reliable generation of cash flow, a hallmark of a Cash Cow in the BCG matrix.

Dover's core marking and coding solutions, a key part of its Imaging & Identification segment, are showing impressive, widespread growth across the globe. This isn't just a small uptick; it's broad-based, meaning it's happening everywhere and with all their different products in this category.

This segment is likely a classic cash cow. Think of it as a reliable money-maker for Dover. It probably holds a significant chunk of the market, meaning many customers choose their marking and coding products. Because it's so established, it generates steady cash flow without needing massive new investments to keep growing.

Vehicle Services Business (Engineered Products)

Dover's vehicle services business, a significant component of its Engineered Products segment, demonstrated notable gains in profitability throughout 2024. This improvement highlights effective operational strategies and a robust demand for its offerings.

Despite a slight revenue dip in the Engineered Products segment during the second quarter of 2025, the vehicle services division continued to be a strong performer. Its improved margins underscore its resilience and competitive standing in the market.

- Profitability Surge: The vehicle services unit saw substantial profit enhancements in 2024, reflecting operational efficiencies and strong market demand.

- Resilient Revenue Contribution: Even with a segment-wide revenue decline in Q2 2025, vehicle services maintained its importance as a key revenue driver.

- Margin Expansion: Improved profit margins within this business unit indicate a strengthening market position and successful cost management.

Fluid Transport Solutions

Fluid Transport Solutions, a key component of Dover's Clean Energy & Fueling segment, demonstrates robust shipment volumes and contributes favorably to the company's overall margin performance.

These solutions likely cater to established markets characterized by stable, predictable demand, positioning them as dependable cash generators for Dover. In 2024, Dover reported that its Engineered Products segment, which includes fluid handling technologies, saw organic revenue growth, underscoring the strength of these mature product lines.

- Strong Shipment Performance: Fluid Transport Solutions are experiencing high shipment numbers, indicating consistent market penetration and demand.

- Positive Margin Contribution: These products are positively impacting Dover's overall margin, suggesting efficient production and pricing power.

- Mature Market Presence: The reliable demand points to the segment serving mature industries where Dover holds a strong, established position.

- Cash Generation: As cash cows, these solutions provide stable earnings that can be reinvested in other areas of Dover's business.

Dover's industrial pumps business consistently generates strong, stable cash flow, a hallmark of a cash cow. In 2024, this segment's performance underscored its role as a reliable profit contributor, benefiting from mature markets with predictable demand.

Precision Components, within the Pumps & Process Solutions segment, also functions as a cash cow. Its significant market share in established sectors like gas and steam turbines ensures a steady stream of revenue, reinforcing its cash-generating capabilities.

Dover's marking and coding solutions are prime examples of cash cows, enjoying widespread growth and holding substantial market share. This established segment provides consistent cash flow without requiring significant new investment.

The vehicle services business within Engineered Products has proven its cash cow status through enhanced profitability in 2024 and resilience in Q2 2025. Its strong margins reflect a competitive edge and efficient operations.

Fluid Transport Solutions, part of the Clean Energy & Fueling segment, contributes positively to margins with robust shipment volumes. These solutions serve mature markets, solidifying their position as dependable cash generators for Dover.

| Dover Segment/Business Unit | BCG Category | 2024 Performance Indicator | Market Position | Cash Flow Generation |

|---|---|---|---|---|

| Industrial Pumps | Cash Cow | Robust revenue and profit generation | Established, stable demand | Consistent, reliable |

| Precision Components | Cash Cow | Strong engagement in gas/steam turbines | Significant market share | Steady and predictable |

| Marking & Coding Solutions | Cash Cow | Widespread global growth | Substantial market share | Stable, low reinvestment needs |

| Vehicle Services | Cash Cow | Notable profit gains, resilient revenue | Competitive standing | Strong and enhancing |

| Fluid Transport Solutions | Cash Cow | Robust shipment volumes, positive margin impact | Mature markets, established presence | Dependable earnings |

Full Transparency, Always

Dover BCG Matrix

The Dover BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready strategic tool ready for immediate application in your business planning. You're getting the exact same professional report, designed for clarity and impactful decision-making, that you can instantly download and utilize.

Dogs

Environmental Solutions Group, when analyzed through the lens of the BCG matrix, likely occupied the 'Dog' quadrant. Dover's decision to sell this segment in October 2024 for $1.5 billion underscores its classification as a low-growth, low-market share business.

Divesting 'Dogs' like Environmental Solutions Group is a strategic move to exit underperforming areas. This action not only cleans up the company's portfolio but also liberates capital that might have been tied up in a business with limited future prospects, allowing for reallocation to more promising ventures.

Dover's divestiture of De-Sta-Co in the first quarter of 2024, and the subsequent comparable period in the first quarter of 2025, significantly impacted its reported GAAP earnings. This absence of a gain on disposition points to a strategic exit from a business unit that likely underperformed.

The move suggests De-Sta-Co was categorized as a 'Dog' within Dover's BCG matrix, indicating low market share and low market growth. Such divestitures are common when companies aim to streamline operations and focus resources on more promising segments.

Shipments of heat exchangers for European heat pumps saw a decline in Q1 2025, impacting Dover's Climate & Sustainability Technologies segment. This trend points to a market with limited growth potential.

Given these challenging market dynamics and potential low market share, Dover's heat exchanger business for European heat pumps may be classified as a 'Dog' in the BCG matrix. This suggests a need for careful strategic consideration, potentially involving divestment or significant restructuring to improve performance.

Long Cycle Polymer Processing Equipment

The long cycle polymer processing equipment sector experienced a downturn, with sales declining year-over-year in the first quarter of 2025. This performance indicates a market characterized by slow growth, potentially signaling a weakening competitive position for Dover within this segment. Consequently, this business unit aligns with the characteristics of a question mark in the BCG matrix, requiring careful strategic consideration.

Dover's long cycle polymer processing equipment business faced headwinds in early 2025. For instance, industry reports from Q1 2025 indicated a contraction in capital expenditures by major polymer manufacturers, directly impacting demand for new processing machinery. This challenging environment suggests that Dover's market share may be eroding, a common trait for businesses in low-growth industries that are not market leaders.

- Market Growth: Low, with a year-over-year decline observed in Q1 2025.

- Dover's Market Share: Potentially declining, given the market conditions.

- BCG Classification: Likely a Question Mark, necessitating strategic evaluation.

Food Retail Refrigeration Cases

Food retail refrigeration cases, part of Dover's Climate & Sustainability Technologies segment, experienced a revenue decline in Q1 2025. This downturn suggests a mature, low-growth market where Dover might hold a smaller market share.

This performance profile strongly indicates that food retail refrigeration cases would be classified as a 'Dog' within the BCG matrix. Such products typically generate low profits and offer limited growth potential, requiring careful management or divestment.

- Market Position: Likely low market share in a slow-growing sector.

- Revenue Trend: Q1 2025 saw a decline in this product category.

- BCG Classification: Categorized as a 'Dog' due to low growth and potential low profitability.

- Strategic Implication: Dover may need to re-evaluate its investment and strategy for this segment.

Businesses classified as 'Dogs' in the BCG matrix typically exhibit low market share in low-growth industries. Dover's strategic divestment of Environmental Solutions Group for $1.5 billion in October 2024 and De-Sta-Co in Q1 2024 aligns with exiting these underperforming segments. This allows capital reallocation to more promising areas.

The decline in heat exchanger shipments for European heat pumps in Q1 2025, coupled with a revenue decrease in food retail refrigeration cases during the same period, suggests these businesses may also be 'Dogs'. These segments face limited growth potential and potentially declining market share.

Divesting 'Dogs' is a common strategy to streamline operations and improve overall portfolio performance. By shedding these low-return assets, companies like Dover can focus resources on segments with higher growth prospects and market leadership potential.

The strategic exits from Environmental Solutions Group and De-Sta-Co in 2024, along with the observed downturns in specific product lines in early 2025, highlight Dover's proactive approach to managing its business portfolio against market realities.

| Business Segment | BCG Classification (Likely) | Key Indicators | Strategic Action |

|---|---|---|---|

| Environmental Solutions Group | Dog | Low growth, low market share | Divested October 2024 ($1.5 billion) |

| De-Sta-Co | Dog | Underperforming, low growth potential | Divested Q1 2024 |

| Heat Exchangers (European Heat Pumps) | Dog | Declining shipments Q1 2025, low market growth | Potential strategic review/divestment |

| Food Retail Refrigeration Cases | Dog | Revenue decline Q1 2025, mature market | Potential strategic review/divestment |

Question Marks

CO2 refrigeration systems represent a prime example of a 'Question Mark' within Dover's portfolio, according to the BCG matrix framework. While the broader Climate & Sustainability Technologies segment faced revenue headwinds, CO2 systems specifically achieved record quarterly volumes in the first quarter of 2025. This surge indicates a rapidly expanding market with significant future potential.

However, the overall revenue decline in the climate technologies segment suggests that Dover's current market share in this wider arena is relatively low. This disparity positions CO2 systems as a high-potential, yet underdeveloped, product line. The company must invest strategically to capitalize on this growth trend and increase its penetration in the burgeoning CO2 refrigeration market.

Dover's strategic push into cryogenic components for clean energy and fueling positions this area as a 'Question Mark' in its BCG matrix. The company has actively invested, both internally and through acquisitions, to build a strong foundation in this burgeoning sector.

The market for cryogenic components is experiencing robust growth, driven by demand in critical sectors like space launch and liquefied natural gas (LNG) infrastructure. For instance, the global LNG market was valued at approximately $100 billion in 2023 and is projected to grow significantly, indicating substantial opportunity.

While the growth trajectory is promising, Dover's market share in this relatively new and evolving space might still be developing. This combination of high market growth and potentially lower current market share is the defining characteristic of a 'Question Mark' in the BCG framework, requiring careful strategic consideration and investment.

Within Dover's Imaging & Identification segment, digital textile and soft signage printing solutions are positioned as question marks. These markets are experiencing rapid evolution and growth, indicating significant future potential.

Dover is actively developing innovative printing technologies to capture share in these emerging sectors. For instance, the global digital textile printing market was valued at approximately $2.7 billion in 2023 and is projected to reach $6.6 billion by 2030, exhibiting a compound annual growth rate of over 13%. This rapid expansion suggests a high-growth environment where Dover's current market penetration might still be relatively low as buyers explore new applications.

Hydrogen Infrastructure Components

Dover's involvement in hydrogen infrastructure components positions it within a rapidly expanding market, characterized by significant growth potential. The company's strategic expansion of its hydrogen valve product line suggests a deliberate move to capture a share of this emerging sector.

Given that the hydrogen market is still in its developmental stages, Dover's position can be viewed as a Question Mark within the BCG matrix. This classification reflects the substantial investment required to build market presence and the inherent uncertainty associated with early-stage market penetration.

Key components within hydrogen infrastructure that Dover is likely focusing on include:

- High-pressure valves: Essential for the safe and efficient transport and storage of hydrogen.

- Regulators and fittings: Critical for controlling hydrogen flow and ensuring system integrity.

- Dispensing equipment: Necessary for hydrogen refueling stations, a key growth area.

The global hydrogen market is projected to reach hundreds of billions of dollars in the coming years, with significant government and private investment fueling its development. For instance, by 2030, the market could be valued at over $250 billion, with substantial growth in transportation and industrial applications.

EV Charging Infrastructure

Dover's Clean Energy & Fueling segment includes electric vehicle (EV) charging infrastructure, a sector experiencing rapid expansion. While the overall EV market is a high-growth area, Dover's precise market share within this dynamic and evolving landscape might still be developing, placing it in the 'Question Mark' category of the BCG matrix. This classification suggests significant potential for growth, but also acknowledges the need for strategic investment and careful market positioning to capitalize on emerging opportunities.

The global EV charging infrastructure market was valued at approximately $30 billion in 2023 and is projected to reach over $150 billion by 2030, indicating a substantial growth trajectory. For Dover, this presents a classic 'Question Mark' scenario: a market with immense promise but where current competitive standing may not yet be dominant. Success hinges on strategic investments in technology, partnerships, and market penetration to convert this potential into market leadership.

- High Growth Potential: The burgeoning EV market fuels demand for charging solutions, creating a fertile ground for expansion.

- Market Share Uncertainty: Dover's current position in this rapidly evolving EV charging space may not yet be established, necessitating strategic focus.

- Investment Required: Significant capital and strategic planning are likely needed to solidify Dover's presence and capture market share.

- Future Upside: Successful navigation of the 'Question Mark' phase could lead to substantial returns and a leading position in a critical future industry.

Question Marks represent business units or products with low market share in high-growth industries. Dover's CO2 refrigeration systems, cryogenic components for clean energy, digital textile printing, hydrogen infrastructure components, and EV charging infrastructure all fit this profile. These areas demand significant investment to increase market share and capitalize on their substantial growth potential.

| Product/Segment | Market Growth | Dover's Market Share | BCG Classification | Strategic Implication |

| CO2 Refrigeration Systems | High | Low to Moderate | Question Mark | Invest for growth, build share |

| Cryogenic Components (Clean Energy) | High | Developing | Question Mark | Strategic investment, R&D |

| Digital Textile Printing | High | Developing | Question Mark | Technology innovation, market penetration |

| Hydrogen Infrastructure Components | High | Early Stage | Question Mark | Capital investment, market development |

| EV Charging Infrastructure | High | Developing | Question Mark | Strategic partnerships, technology adoption |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry reports, and market research to provide accurate strategic insights.