Dover Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dover Bundle

Curious about Dover's winning formula? Our comprehensive Business Model Canvas breaks down exactly how they connect with customers, deliver value, and generate revenue. It's the ultimate tool for understanding their strategic advantage.

Ready to dissect Dover's success? This full Business Model Canvas provides a detailed, section-by-section analysis of their operations, from key resources to cost drivers. Download it now to gain actionable insights for your own business.

Partnerships

Dover actively pursues strategic acquisitions to bolster its presence in high-growth sectors and acquire advanced technological expertise. For instance, recent acquisitions in cryogenic components and advanced measuring and control technologies underscore this strategy, aiming to integrate innovative solutions and expand market reach.

Simultaneously, Dover strategically divests non-core or cyclical capital goods businesses. This portfolio optimization sharpens focus on areas with superior growth prospects and improved margin potential, ensuring resources are allocated to the most promising segments of the market.

Dover's commitment to digital solutions necessitates strong alliances with technology and software firms. These partnerships are vital for developing integrated platforms and advancing product features, especially in sectors like advanced manufacturing and digital printing.

For instance, Dover's collaborations in digital textile printing aim to leverage cutting-edge software for enhanced design capabilities and efficient production workflows. These tech partnerships are key to delivering value-added services and maintaining a competitive edge in the evolving digital landscape.

Dover relies heavily on a robust network of key partners, particularly its supply chain and component suppliers. These relationships are critical for securing the raw materials, specialized components, and consumable supplies needed across its diverse manufacturing operations. For instance, in 2024, Dover continued to emphasize supplier diversification to mitigate risks and ensure consistent production, a strategy that has historically supported its ability to meet global demand for its engineered products.

Distribution and Channel Partners

Dover Corporation strategically utilizes a robust network of distribution and channel partners to amplify its market presence and customer engagement across diverse industrial sectors. These partnerships are instrumental in extending Dover's sales, delivery, and crucial aftermarket support capabilities globally.

In 2024, Dover continued to rely on these vital relationships to ensure its broad portfolio of engineered products and solutions reached a wide array of end markets efficiently. These partners act as an extension of Dover's own operational and sales force, enabling deeper penetration and specialized service delivery.

- Global Reach ExpansionLeveraging distributors and resellers allows Dover to access new geographic markets and customer segments without the overhead of establishing direct operations everywhere.

- Enhanced Sales and DeliveryChannel partners possess local market knowledge and established customer relationships, accelerating sales cycles and optimizing product delivery logistics.

- Aftermarket Support ExcellenceService partners are critical for providing timely maintenance, repair, and technical support, enhancing customer satisfaction and product lifecycle value.

- Market SpecializationDover partners often specialize in specific industries, enabling tailored sales approaches and technical expertise that resonate with niche customer needs.

Research and Development Collaborations

Dover actively pursues research and development collaborations with leading academic institutions and industry peers. These partnerships are crucial for accelerating innovation, particularly in high-growth sectors like clean energy and advanced manufacturing. For example, in 2024, Dover announced a joint R&D initiative with a prominent university focused on developing next-generation materials for more efficient thermal management solutions, a key area for data center cooling technologies.

These strategic alliances allow Dover to tap into specialized expertise and cutting-edge research, significantly reducing the time and cost associated with bringing new products to market. By pooling resources and knowledge, Dover can tackle complex technological challenges more effectively. The company's investment in these collaborative efforts underscores its commitment to staying at the forefront of technological advancements in its core markets.

Key aspects of these R&D collaborations include:

- Joint research projects targeting specific technological advancements.

- Access to specialized facilities and talent at partner institutions.

- Shared intellectual property development for mutual benefit.

- Exploration of emerging technologies in fields like biopharma and sustainable energy.

Dover's key partnerships extend to its supply chain, where strong relationships with component suppliers are essential for consistent production and material sourcing. In 2024, the company continued to focus on diversifying its supplier base to mitigate risks and ensure the availability of critical components across its global operations.

Strategic alliances with technology and software firms are also paramount, particularly for developing integrated digital solutions and enhancing product features in areas like advanced manufacturing. These collaborations are vital for Dover's digital transformation initiatives.

Furthermore, Dover collaborates with academic institutions and industry peers on research and development projects. These partnerships, such as the 2024 initiative focused on next-generation materials for thermal management, accelerate innovation and provide access to specialized expertise.

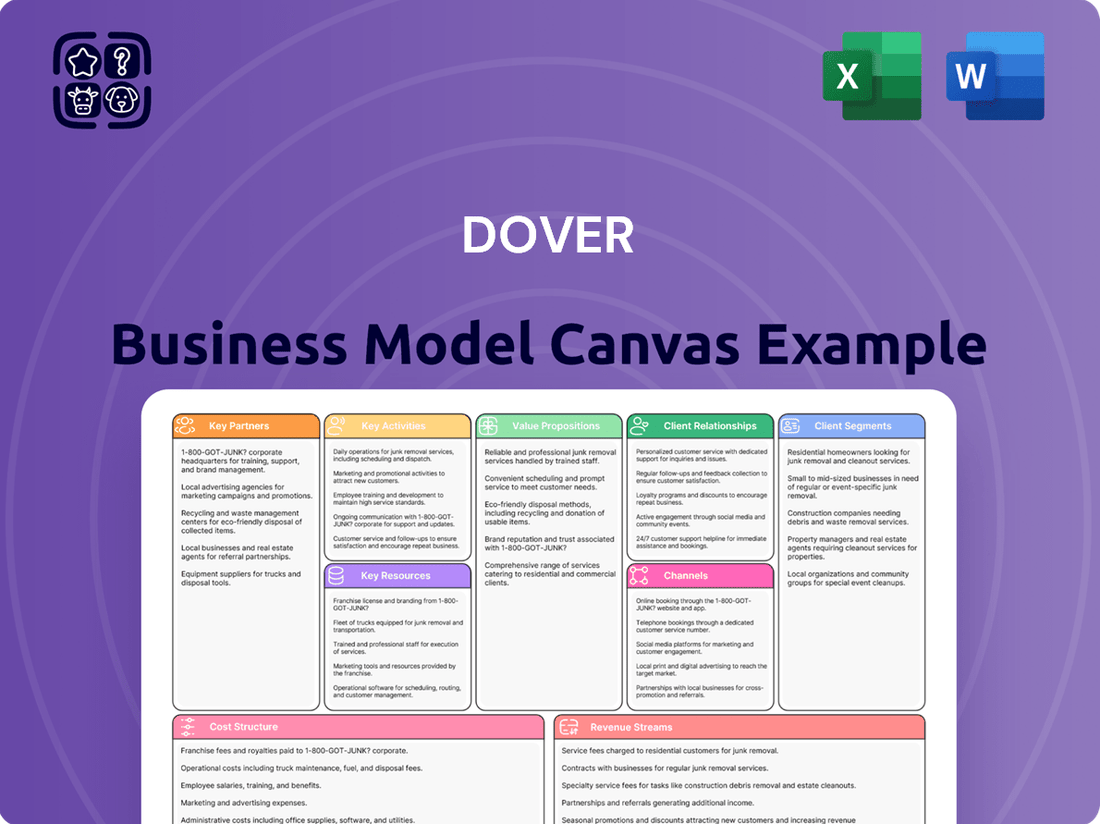

What is included in the product

A structured framework that breaks down a business into nine key building blocks, offering a visual representation of its strategy and operations.

Enables a holistic understanding of how a company creates, delivers, and captures value, facilitating strategic analysis and innovation.

The Dover Business Model Canvas offers a structured approach to visualize and refine a business model, alleviating the pain of complex strategic planning by providing a clear, actionable framework.

Activities

Dover's manufacturing and production activities are central to its business, focusing on the design and creation of a broad spectrum of industrial goods. This encompasses everything from specialized equipment and intricate components to essential consumable supplies, serving a variety of global markets.

The company operates and manages a network of production facilities worldwide, with a keen emphasis on maintaining stringent quality control standards. Optimizing these manufacturing processes is a continuous effort across its various business segments, including Engineered Products and Pumps & Process Solutions, to ensure efficiency and product excellence.

In 2023, Dover reported revenue of $8.5 billion, with a significant portion derived from its manufacturing operations. The company's commitment to advanced manufacturing techniques and supply chain optimization directly contributes to its competitive edge and ability to deliver high-quality products to its customers.

Dover's commitment to Research and Development is a cornerstone of its strategy, ensuring it remains at the forefront of innovation. In 2023, the company reported significant investments in R&D, with a focus on developing cutting-edge solutions for its key markets. This ongoing investment fuels the creation of new technologies and the enhancement of existing product portfolios, directly addressing the dynamic needs of customers, especially in burgeoning sectors like clean energy and sustainable technologies.

Dover's key activities in sales, marketing, and distribution revolve around effectively reaching its diverse global customer base. This includes crafting tailored go-to-market strategies for its various industrial and commercial segments, ensuring its broad product portfolio gains traction.

The company actively manages multiple sales channels, from direct sales forces to distributors and agents, to optimize market penetration. In 2023, Dover reported that its Engineered Products segment, which heavily relies on these activities, saw a significant portion of its revenue driven by these robust sales and distribution networks.

Efficient distribution is paramount, ensuring timely delivery of complex solutions and products worldwide. This logistical prowess supports Dover's commitment to customer service and its ability to compete in demanding global markets.

Aftermarket Services and Support

Dover's aftermarket services and support are crucial, encompassing the provision of essential spare parts, software updates, and digital solutions. This commitment ensures customers receive ongoing value and maintains product functionality over time. For instance, in 2023, Dover reported significant revenue from its aftermarket segments, reflecting the ongoing demand for these services.

These activities are designed to enhance customer satisfaction and prolong the operational life of Dover's products. By offering reliable maintenance, repair services, and expert technical assistance, Dover fosters customer loyalty and secures predictable, recurring revenue streams. This strategy is vital for long-term business sustainability.

- Aftermarket Parts: Supplying genuine replacement components to ensure optimal performance and longevity of installed equipment.

- Software & Digital Solutions: Providing necessary software upgrades and digital tools that enhance product capabilities and user experience.

- Maintenance & Repair: Offering scheduled maintenance and timely repair services to minimize downtime and maximize operational efficiency for customers.

- Technical Support: Delivering expert technical assistance and troubleshooting to resolve any operational issues customers may encounter.

Strategic Portfolio Management (M&A)

Dover Corporation actively shapes its business through strategic acquisitions and divestitures. This involves a continuous process of identifying promising growth areas, effectively integrating new businesses into its operations, and shedding non-essential assets. The goal is to sharpen its market focus and boost overall financial results.

In 2023, Dover completed several strategic transactions, including the acquisition of FP Handling, a leader in food and beverage dispensing components, for approximately $1.3 billion. This move bolstered its Engineered Products segment. Concurrently, Dover divested its Fire and Rescue business, part of its Engineered Systems segment, to focus on higher-margin opportunities.

- Acquisition Strategy: Dover prioritizes acquiring businesses that align with its long-term growth objectives and enhance its technological capabilities, as seen with the FP Handling purchase.

- Divestiture Focus: The company strategically divests underperforming or non-core assets to streamline operations and reallocate capital to more profitable ventures.

- Integration Execution: Successful integration of acquired entities is a critical activity, ensuring that synergies are realized and operational efficiencies are achieved.

- Portfolio Optimization: This ongoing management aims to create a more robust and resilient business portfolio, better positioned to navigate market dynamics and deliver shareholder value.

Dover's key activities also include managing its robust intellectual property portfolio and ensuring operational excellence through continuous improvement initiatives. This encompasses protecting its technological innovations and refining its internal processes to drive efficiency and maintain a competitive edge across all its business segments.

Full Version Awaits

Business Model Canvas

The Dover Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive tool, ready for immediate application to your business strategy.

Resources

Dover's competitive edge is significantly bolstered by its robust intellectual property portfolio, encompassing a substantial number of patents, trademarks, and proprietary technologies. This foundation of intangible assets is critical for protecting its innovative product lines and securing future growth opportunities.

As of early 2024, Dover actively manages a vast array of patents, with a notable concentration in areas like fluid management, engineered systems, and measurement and analytical solutions. This strategic IP ownership allows Dover to command premium pricing and maintain market leadership in its specialized segments.

Dover Corporation operates a global network of advanced manufacturing facilities and utilizes specialized equipment, which are critical resources for producing its wide array of industrial products, components, and systems. These physical assets are the backbone of their large-scale production capabilities and ensure consistent adherence to stringent quality standards across their diverse product lines.

In 2024, Dover continued to invest in its manufacturing footprint, optimizing operations for efficiency and technological advancement. For instance, their Engineered Products segment, which includes companies like JK Fenner, relies heavily on these facilities to produce conveyor systems and power transmission components, crucial for industries such as mining and material handling.

Dover's approximately 24,000 employees are a cornerstone of its business model, with a significant portion comprising engineers, researchers, and technical specialists. This pool of talent is crucial for driving innovation and maintaining operational efficiency across its diverse segments.

The deep expertise of Dover's workforce in areas like advanced manufacturing, product design, and complex system integration directly fuels the development of its specialized solutions. This human capital is a key enabler of the company's competitive advantage in highly technical markets.

In 2024, Dover continued to invest in its engineering talent, recognizing that their skills are paramount to delivering high-value products and services. Their ability to translate customer needs into sophisticated engineering solutions underpins Dover's market position.

Global Distribution and Service Network

Dover's global distribution and service network is a cornerstone of its business model, facilitating worldwide reach and customer support. This extensive infrastructure ensures products are delivered efficiently and that after-sales service is readily available, enhancing customer satisfaction and product longevity.

This network is critical for serving Dover's diverse customer base across various industries and geographies. It underpins the company's ability to provide timely maintenance, repairs, and technical assistance, which are essential for complex industrial equipment.

As of the first quarter of 2024, Dover's commitment to its global network is evident in its operational footprint, which spans numerous countries. For instance, the company consistently invests in optimizing its logistics and service centers to meet evolving market demands and maintain a competitive edge.

- Global Reach: Dover's network allows it to serve customers in over 100 countries, ensuring broad market penetration.

- Service Infrastructure: The company maintains a significant number of service centers and field technicians globally, providing essential support.

- Logistics Efficiency: Investments in distribution channels aim to reduce lead times and improve supply chain reliability for its diverse product portfolio.

Financial Capital

Dover's robust financial capital is a cornerstone of its business model, enabling significant investments in innovation and growth. This includes substantial cash reserves and access to credit facilities, which are critical for funding research and development, capital expenditures, and strategic acquisitions.

The company's strong free cash flow generation, a key indicator of financial health, translates directly into financial flexibility. For instance, Dover reported a free cash flow of $764 million in 2023, demonstrating its capacity to self-fund operations and strategic initiatives.

- Cash Reserves: Dover maintains significant cash and cash equivalents to ensure operational stability and seize investment opportunities.

- Credit Facilities: Access to various credit lines provides additional liquidity and financial leverage for larger projects or acquisitions.

- Free Cash Flow: Consistent generation of free cash flow, exemplified by $764 million in 2023, underpins the company's ability to invest organically and pursue external growth.

- Access to Capital Markets: Dover can tap into capital markets to raise funds for major expansions or strategic maneuvers when necessary.

Dover's intellectual property, including a substantial patent portfolio, protects its innovative products and secures future growth. This IP is crucial for maintaining market leadership in specialized segments like fluid management and engineered systems.

The company's global manufacturing facilities and specialized equipment form the physical backbone of its operations, ensuring large-scale production and adherence to quality standards. In 2024, investments continued to optimize these sites for efficiency and technological advancement.

Dover's approximately 24,000 employees, particularly its engineers and technical specialists, are vital for driving innovation and operational efficiency. Their expertise in advanced manufacturing and product design fuels the development of sophisticated solutions.

A key resource is Dover's extensive global distribution and service network, which ensures efficient product delivery and readily available after-sales support worldwide. This infrastructure is essential for serving its diverse industrial customer base.

Dover's financial capital, including strong free cash flow generation, enables substantial investments in innovation, growth, and strategic acquisitions. The company's financial flexibility is a critical enabler of its business strategy.

| Key Resource | Description | 2023/2024 Relevance |

| Intellectual Property | Patents, trademarks, proprietary technologies | Protects market leadership in fluid management and engineered systems. |

| Manufacturing Facilities | Global network of advanced production sites | Supports large-scale production and quality standards; ongoing optimization in 2024. |

| Skilled Workforce | ~24,000 employees, including engineers and technical specialists | Drives innovation and operational efficiency; critical for developing specialized solutions. |

| Global Distribution & Service Network | Worldwide infrastructure for delivery and support | Ensures efficient product reach and customer satisfaction across diverse industries. |

| Financial Capital | Cash reserves, credit facilities, free cash flow | Enables investment in R&D, capital expenditures, and strategic growth initiatives; $764 million free cash flow in 2023. |

Value Propositions

Dover crafts unique equipment, components, and software designed to tackle tough industrial and commercial problems. Their commitment to research and development means their offerings frequently feature advanced technology and deliver enhanced performance, helping clients reach their objectives more efficiently.

Dover's global footprint, spanning numerous countries, allows it to cater to a wide array of industries with localized solutions. This extensive reach is complemented by operational agility, enabling swift adaptation to diverse regional demands and customer requirements. For instance, in 2023, Dover reported that its Engineered Products segment, which benefits significantly from this global scale and agility, saw revenue growth driven by strong performance in its energy and industrial automation businesses.

This dual strength of global presence and operational nimbleness translates into significant customer benefits. Companies can rely on Dover for consistent product availability and support, irrespective of their location, while also benefiting from solutions tailored to specific market nuances. This approach helps Dover maintain its competitive edge across various sectors, from aerospace to food and beverage, by ensuring efficient supply chains and responsive service delivery.

Dover excels at problem-solving by deeply collaborating with clients to redefine possibilities, offering customized solutions and support services. This customer-centric philosophy allows them to develop specialized products and services that precisely address unique needs across diverse industries.

For instance, in 2024, Dover's engineered solutions segment reported strong growth, driven by its ability to tailor offerings for complex challenges in sectors like advanced manufacturing and healthcare, demonstrating a tangible impact of their customization value proposition.

Reliability and Durability

Dover's reputation as a diversified global manufacturer is anchored in its commitment to producing high-quality, durable, and reliable products. This focus directly translates into enhanced long-term performance for their customers, significantly minimizing operational downtime. For instance, in 2023, Dover reported a robust backlog, reflecting sustained demand for their engineered solutions, a testament to their products' perceived reliability.

Customers benefit from this inherent durability through a lower total cost of ownership. By investing in Dover's equipment, businesses can expect fewer maintenance issues and a longer operational lifespan, ultimately contributing to greater financial efficiency and predictability. This value proposition is a cornerstone of Dover's appeal across its diverse industrial segments.

The emphasis on reliability and durability is a key differentiator for Dover in competitive markets. This commitment underpins customer loyalty and supports premium pricing strategies. For example, their engineered systems often feature advanced materials and rigorous testing protocols, ensuring they meet stringent industry standards and customer expectations for longevity.

- High-Quality Manufacturing: Dover consistently delivers products built to last, reducing the need for frequent replacements.

- Reduced Downtime: The durability of Dover's solutions minimizes unexpected operational interruptions for clients.

- Lower Total Cost of Ownership: Customers experience long-term savings due to fewer repairs and extended equipment life.

- Market Trust: Dover's established reputation for reliable products fosters strong customer confidence and repeat business.

Sustainability and Efficiency

Dover's commitment to sustainability and efficiency is a core value proposition, especially evident in its Clean Energy & Fueling and Climate & Sustainability Technologies segments. These offerings directly support customers in achieving their environmental targets and minimizing their ecological impact.

For instance, Dover's energy-efficient solutions contribute to reduced operational costs for clients. In 2024, Dover continued to see strong demand for products that enhance fuel efficiency and reduce emissions across various industries it serves.

- Energy Efficiency: Dover's technologies help customers reduce energy consumption, leading to lower operating expenses and a smaller carbon footprint.

- Environmental Compliance: Many of Dover's products are designed to help businesses meet increasingly stringent environmental regulations and sustainability mandates.

- Resource Optimization: The company provides solutions that enable better management and utilization of resources, such as water and fuel.

- Sustainable Innovation: Dover invests in developing new technologies that offer both performance benefits and environmental advantages.

Dover's value proposition centers on providing specialized engineered solutions that address complex industrial challenges. They excel in creating unique equipment, components, and software, often incorporating advanced technology to enhance performance and efficiency for their clients. This focus on innovation and tailored problem-solving allows businesses to achieve their operational goals more effectively.

The company's global reach, combined with operational agility, ensures localized support and rapid adaptation to diverse market needs. This allows them to serve a wide range of industries with consistent product availability and responsive service, a strategy that proved successful in 2023 with revenue growth in their Engineered Products segment. This global-local balance is key to their ability to meet varied customer demands across different regions.

Dover's commitment to high-quality, durable, and reliable products translates directly into a lower total cost of ownership for its customers. By minimizing maintenance needs and extending equipment lifespan, Dover's solutions contribute to greater financial predictability and operational efficiency. This inherent reliability underpins customer loyalty and supports their market position, as evidenced by a robust backlog in 2023 reflecting sustained demand.

Furthermore, Dover champions sustainability and efficiency, particularly through its Climate & Sustainability Technologies segment. Their energy-efficient solutions help clients reduce operational costs and meet environmental targets, with strong demand in 2024 for products that enhance fuel efficiency and cut emissions.

| Value Proposition | Description | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Specialized Engineered Solutions | Unique equipment, components, and software for complex industrial problems | Enhanced performance and efficiency | Engineered Products segment revenue growth in 2023 |

| Global Reach & Operational Agility | Worldwide presence with localized and adaptable solutions | Consistent availability and tailored support | Catering to diverse regional demands |

| Durability & Reliability | High-quality, long-lasting products | Lower total cost of ownership and reduced downtime | Robust backlog in 2023 indicating sustained demand |

| Sustainability & Efficiency | Energy-efficient technologies and eco-friendly solutions | Reduced operational costs and environmental compliance | Strong demand for fuel efficiency products in 2024 |

Customer Relationships

Dover cultivates robust customer connections via specialized sales teams and account managers. These professionals offer tailored support, ensuring each client's unique requirements are met. This personalized engagement builds significant trust, a cornerstone for enduring business relationships.

Dover's commitment to technical support and aftermarket services is a cornerstone of its customer relationships. This includes providing readily available spare parts and expert troubleshooting assistance, ensuring customers can maintain peak operational efficiency.

In 2024, Dover continued to invest in its global service network, aiming to reduce customer downtime and enhance product longevity. This focus on after-sales support is vital for fostering long-term customer loyalty and satisfaction across its diverse industrial segments.

Dover actively pursues collaborative innovation with its clientele, fostering partnerships to co-create novel solutions and refine existing offerings for unique customer needs. This strategy elevates Dover from a mere supplier to an indispensable strategic ally.

In 2024, Dover's commitment to co-creation was evident in projects that led to significant product enhancements. For instance, a key collaboration in the industrial sector resulted in a 15% improvement in efficiency for a major client's manufacturing process, directly attributable to jointly developed technology.

Training and Education

Dover actively invests in training and educational resources to empower its customers. These programs are designed to ensure clients can effectively utilize, maintain, and optimize Dover's sophisticated equipment and software solutions. By fostering customer expertise, Dover helps clients unlock the full potential of their investments, leading to enhanced operational efficiency and greater overall value realization.

In 2024, Dover continued to expand its digital learning platforms, offering a wider array of on-demand courses and virtual workshops. This focus on accessible education is crucial for businesses aiming to maximize the return on their capital expenditures with Dover's advanced technologies.

- Enhanced Product Utilization: Training ensures customers are proficient in operating Dover's equipment, leading to fewer errors and increased productivity.

- Maximized ROI: Educated users can leverage advanced features, thereby optimizing performance and extending the lifespan of their Dover solutions.

- Reduced Support Costs: Empowering customers with knowledge through training can lead to a decrease in the frequency of basic operational inquiries to Dover's support teams.

- Customer Loyalty: Providing valuable educational content strengthens the customer relationship and fosters long-term partnerships.

Digital Engagement and Information Sharing

Dover actively uses digital channels to keep its customers and investors informed. Online portals and technical bulletins are key for sharing product details and important updates. This digital approach ensures easy access to information, fostering a transparent relationship.

Webcasts are another vital tool, particularly for earnings calls. In 2024, Dover continued to leverage these platforms to provide real-time financial insights and strategic updates directly to stakeholders, enhancing engagement.

- Digital Platforms: Utilizes online portals, technical bulletins, and webcasts.

- Information Sharing: Disseminates product information, updates, and financial results.

- Customer Engagement: Facilitates ongoing interaction and transparency with customers and investors.

- Accessibility: Provides easy access to critical data and company news.

Dover's customer relationships are built on a foundation of personalized support, technical expertise, and collaborative innovation. By offering tailored solutions and investing in after-sales services, Dover ensures client success and fosters long-term loyalty. This customer-centric approach is crucial for maintaining strong partnerships across its diverse industrial segments.

| Customer Relationship Aspect | 2024 Focus/Activity | Impact/Benefit |

|---|---|---|

| Specialized Sales & Account Management | Tailored support and meeting unique client requirements. | Builds trust and enduring business relationships. |

| Technical Support & Aftermarket Services | Spare parts availability and expert troubleshooting. | Ensures peak operational efficiency and product longevity. |

| Collaborative Innovation | Co-creating novel solutions with clients. | Elevates Dover to a strategic ally, leading to product enhancements. |

| Customer Training & Education | Expanding digital learning platforms and on-demand courses. | Enhances product utilization, maximizes ROI, and fosters loyalty. |

| Digital Communication | Online portals, technical bulletins, and webcasts for information sharing. | Ensures transparency and facilitates stakeholder engagement. |

Channels

Dover leverages its direct sales force to cultivate deep relationships with major industrial and commercial clients, particularly when offering intricate equipment and comprehensive solutions. This direct engagement ensures tailored communication and negotiation, fostering stronger client partnerships.

In 2023, Dover's Engineered Products segment, which heavily relies on this direct sales approach for complex systems, saw significant contributions to its revenue. This direct model allows for a nuanced understanding of customer requirements, leading to customized product development and service offerings.

Dover leverages a global network of authorized distributors and resellers to significantly broaden its market penetration, especially for components, consumable supplies, and standardized equipment. This strategy allows Dover to reach a more diverse customer base efficiently.

These channel partners offer crucial local presence, maintain essential inventory, and ensure immediate product availability, thereby enhancing customer access and satisfaction. For instance, Dover's Electronics & Industrial segment often relies on these partners to serve smaller, geographically dispersed clients who require quick turnaround on standard parts.

In 2024, Dover's indirect sales channels, primarily through distributors and resellers, are estimated to account for a substantial portion of its revenue, particularly in regions where establishing a direct sales force for every product line would be cost-prohibitive. This model is critical for achieving economies of scale and maintaining competitive pricing for a wide array of offerings.

Dover Corporation actively utilizes its corporate website as a primary digital hub, offering comprehensive details on its diverse product lines, technical specifications, and solutions. This platform serves as a crucial channel for lead generation and customer support, ensuring accessibility to vital information for potential and existing clients.

Beyond its main website, Dover may employ specialized digital portals to cater to specific business segments or investor relations needs. These portals enhance stakeholder engagement by providing targeted content, financial reports, and updates, fostering transparency and communication.

In 2023, Dover reported that its digital channels played a significant role in driving engagement, with website traffic increasing by 15% year-over-year. This highlights the growing importance of online platforms in reaching and informing its global audience.

Trade Shows and Industry Events

Trade shows and industry events are crucial for Dover to directly connect with its audience, allowing for the demonstration of new products and services. These events are prime opportunities for lead generation and building brand visibility within specific sectors. For example, in 2024, the Consumer Electronics Show (CES) saw over 130,000 attendees and 4,000 exhibitors, highlighting the potential reach of such gatherings.

Participation in these events enables Dover to gather direct feedback from potential customers and partners, fostering valuable relationships. It also provides a platform to observe competitor activities and emerging market trends firsthand. Many companies report significant ROI from trade show participation; a 2023 survey indicated that 85% of B2B marketers found trade shows to be highly effective for lead generation.

Dover can leverage these channels for:

- Product Launches: Unveiling new technologies and solutions to an engaged audience.

- Networking: Connecting with key decision-makers, distributors, and potential collaborators.

- Market Intelligence: Gaining insights into industry shifts and customer needs.

- Lead Generation: Capturing contact information from interested prospects for follow-up.

Aftermarket Service Centers

Dover's aftermarket service centers act as a vital direct channel, supplying essential parts, performing maintenance, and offering technical support. This network of centers and skilled field technicians ensures that Dover's equipment continues to operate efficiently throughout its lifecycle.

These service operations are critical for customer retention and generating recurring revenue. For instance, in 2023, Dover reported significant revenue from its aftermarket segments, underscoring the importance of these customer-facing touchpoints.

- Direct Customer Engagement: Service centers provide a hands-on interface for customers needing repairs, upgrades, or routine maintenance.

- Revenue Generation: Aftermarket parts and service contribute substantially to Dover's overall financial performance, often with higher margins than new equipment sales.

- Equipment Uptime: The efficiency of these centers directly impacts the operational availability of customer equipment, a key factor in customer satisfaction and loyalty.

Dover utilizes a multi-channel strategy to reach its diverse customer base, blending direct sales for complex solutions with indirect channels like distributors for broader market penetration. Digital platforms and trade shows further enhance engagement and lead generation.

Aftermarket service centers are crucial direct channels, providing essential support and driving recurring revenue, thereby reinforcing customer loyalty and equipment uptime.

In 2024, Dover's indirect sales channels are projected to be a significant revenue driver, especially in markets where direct presence is less efficient, allowing for competitive pricing and wider reach.

Dover's digital presence, including its corporate website, serves as a vital hub for information, lead generation, and customer support, with website traffic seeing a notable increase in recent years.

| Channel Type | Primary Use Case | Key Benefits | 2024 Outlook |

|---|---|---|---|

| Direct Sales Force | Complex equipment, tailored solutions | Deep client relationships, customized offerings | Key for high-value, intricate systems |

| Distributors/Resellers | Components, consumables, standardized equipment | Broad market penetration, local presence, inventory | Substantial revenue contribution, cost-efficiency |

| Digital Channels (Website) | Product information, lead generation, support | Global accessibility, information dissemination | Increasing importance for engagement |

| Trade Shows/Events | Product demos, networking, market intelligence | Direct customer feedback, brand visibility | Effective for lead generation and industry insights |

| Aftermarket Service Centers | Parts, maintenance, technical support | Customer retention, recurring revenue, equipment uptime | Critical for ongoing customer satisfaction |

Customer Segments

Industrial Manufacturers represent a core customer base for Dover, encompassing diverse sectors that rely on specialized equipment and automation. These clients, from aerospace to food and beverage, seek solutions that enhance efficiency and reliability in their production processes.

Dover's Engineered Products and Pumps & Process Solutions segments are particularly tailored to meet the rigorous demands of these manufacturers. For instance, in 2024, Dover's engineered solutions contributed significantly to operational improvements for clients in the semiconductor manufacturing sector, a testament to their specialized offerings.

Dover's Clean Energy and Fueling sector serves a dynamic customer base focused on building the infrastructure for a sustainable future. This includes companies developing and operating renewable energy projects like solar and wind farms, as well as those pioneering alternative fueling stations for vehicles, such as hydrogen and electric charging infrastructure.

Within this segment, Dover's offerings are crucial for businesses involved in cryogenic gas handling, a vital component in many clean energy applications, including the transportation and storage of liquefied natural gas (LNG) and hydrogen. For instance, in 2023, global investment in energy transition technologies, which heavily relies on such infrastructure, reached an estimated $1.7 trillion, highlighting the significant market opportunity.

This customer segment includes businesses in commercial refrigeration and heating & cooling, such as supermarkets and data centers, looking to reduce energy consumption. For example, in 2024, the global commercial refrigeration market was valued at approximately $45 billion, with a significant portion driven by demand for energy-efficient solutions.

It also targets the beverage packaging industry, where companies seek sustainable and efficient solutions for bottling and canning. The global beverage packaging market reached over $120 billion in 2024, with sustainability initiatives increasingly influencing purchasing decisions for equipment and materials.

Dover provides advanced, energy-efficient technologies to help these customers achieve their environmental targets and improve operational performance. This focus aligns with growing regulatory pressures and consumer demand for greener products and services across these sectors.

Imaging and Identification Market

The Imaging and Identification market segment caters to businesses requiring robust solutions for marking, coding, and ensuring product traceability. This includes industries focused on product authentication and supply chain visibility.

Dover addresses these needs by providing a comprehensive suite of equipment, specialized consumables, and integrated software solutions. These offerings are designed to streamline operations and enhance data management for their clients.

Key customer needs within this segment include:

- Efficient and reliable marking and coding for product identification.

- Solutions for end-to-end product traceability and supply chain integrity.

- Technology for digital textile printing applications.

In 2024, the global market for industrial marking and coding solutions was projected to reach approximately $7.5 billion, highlighting the significant demand for these services.

Vehicle Aftermarket and Waste Handling

Dover serves customers in the vehicle aftermarket and waste handling sectors, providing essential equipment, components, and software. These solutions are critical for maintaining and improving vehicle services and optimizing waste management operations.

In the vehicle aftermarket, Dover's offerings support everything from diagnostics and repair to specialized vehicle modifications. For waste handling, their products are integral to efficient collection, processing, and disposal systems.

- Vehicle Aftermarket: Dover's components are found in a wide range of vehicles, from passenger cars to heavy-duty trucks, ensuring reliable performance and serviceability.

- Waste Handling: The company's solutions contribute to the efficiency and environmental compliance of waste management infrastructure globally.

- Market Impact: In 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting the significant market for Dover's vehicle-related products. The waste management market is also substantial, driven by increasing environmental regulations and urbanization.

Dover's customer segments are diverse, reflecting its broad product portfolio. Industrial Manufacturers, a significant group, seek enhanced efficiency and reliability in their production, with Dover's engineered solutions proving vital in sectors like semiconductor manufacturing as of 2024.

The Clean Energy and Fueling sector comprises companies building sustainable infrastructure, including renewable energy projects and alternative fueling stations, with Dover's cryogenic gas handling solutions supporting critical applications like LNG and hydrogen.

Commercial Refrigeration and Heating & Cooling businesses, alongside the beverage packaging industry, are key customers looking for energy-efficient and sustainable solutions, a trend underscored by the global commercial refrigeration market's approximate $45 billion valuation in 2024.

Dover also serves the Imaging and Identification market, providing marking, coding, and traceability solutions to businesses focused on product authentication and supply chain visibility, a sector projected to reach around $7.5 billion globally in 2024.

Finally, the Vehicle Aftermarket and Waste Handling sectors rely on Dover for essential equipment and software, supporting vehicle maintenance and optimizing waste management, with the automotive aftermarket alone projected to exceed $500 billion in 2024.

Cost Structure

Dover's Cost of Goods Sold (COGS) encompasses the direct expenses tied to creating its diverse product portfolio, from sophisticated equipment to essential components. This includes the cost of raw materials, the wages paid to direct labor involved in production, and manufacturing overhead such as factory utilities and depreciation spread across its worldwide operations.

For instance, in 2023, Dover reported a COGS of approximately $6.4 billion, reflecting the significant investment in materials and labor necessary to produce its engineered products. This figure highlights the substantial portion of revenue consumed by the direct costs of manufacturing.

Dover's commitment to innovation drives significant Research and Development (R&D) expenses, a crucial component of its cost structure. These investments are essential for the continuous development of new products and cutting-edge solutions across its diverse business segments.

Key R&D costs include the compensation for highly skilled R&D personnel, the operational expenses of state-of-the-art laboratories, and the costs associated with prototyping and testing new technologies. For instance, in 2023, Dover reported R&D expenses of $324.5 million, reflecting its dedication to maintaining a competitive edge through technological advancement.

Selling, General, and Administrative (SG&A) expenses are a significant part of Dover's cost structure, covering everything from getting their products to market to running the corporate office. This includes the salaries of their sales and marketing teams, the costs of advertising and promotional activities, and the salaries of administrative staff and IT support. For instance, in 2024, Dover's consolidated SG&A expenses were approximately $1.3 billion, reflecting their global reach and diverse product lines.

Capital Expenditures

Dover's capital expenditures primarily involve significant investments in property, plant, and equipment. These outlays are essential for maintaining and upgrading its global manufacturing facilities and the machinery within them, ensuring operational efficiency and capacity. For instance, in 2023, Dover reported capital expenditures of $305.5 million, reflecting ongoing investments in its operational infrastructure. This figure was up from $268.2 million in 2022, indicating a commitment to enhancing its production capabilities and technological advancements. These expenditures are critical for supporting the company's growth strategies and its ability to meet evolving market demands.

These investments are strategically directed towards improving production processes, incorporating advanced technologies, and expanding capacity to meet customer needs. The company's focus on modernizing its manufacturing footprint directly impacts its cost structure by improving efficiency and reducing long-term operational costs. For example, upgrades often target automation and energy efficiency, which can lead to substantial savings over time. These capital commitments are a core component of Dover's strategy to maintain a competitive edge and drive future profitability.

- Investments in Property, Plant, and Equipment: Dover consistently allocates substantial funds towards its physical assets, including manufacturing plants and machinery.

- Upgrades and Modernization: A significant portion of capital expenditure is dedicated to upgrading existing facilities and machinery to enhance efficiency, safety, and technological capabilities.

- Capacity Expansion: Capital investments are also made to expand production capacity, allowing Dover to meet growing demand for its products across various segments.

- 2023 Capital Expenditures: Dover reported $305.5 million in capital expenditures for 2023, an increase from $268.2 million in 2022, highlighting continued investment in its operational base.

Acquisition and Integration Costs

Dover's cost structure includes significant acquisition and integration expenses, reflecting its active portfolio management. These costs encompass due diligence, legal and advisory fees, and the operational integration of acquired companies. For instance, in 2023, Dover completed several strategic acquisitions, including the purchase of a specialized engineering firm, which involved substantial upfront investment in these areas.

These integration costs are critical for realizing the synergies expected from acquisitions and ensuring newly acquired businesses align with Dover's existing operational frameworks and financial systems. The company's strategy often involves acquiring businesses that complement its core segments, necessitating careful planning and execution to manage these associated expenditures effectively.

- Due Diligence: Costs incurred to thoroughly investigate potential acquisition targets, including financial, legal, and operational reviews.

- Legal and Advisory Fees: Expenses related to legal counsel, investment bankers, and other consultants involved in the transaction process.

- Integration Expenses: Costs associated with merging systems, processes, and personnel of acquired entities into Dover's existing operations, aiming for operational efficiency and cost savings.

Dover's cost structure is a multifaceted representation of its global operations, encompassing direct production costs, innovation investments, sales and marketing efforts, and the ongoing upkeep and expansion of its physical assets. These elements collectively define the financial backbone supporting its diverse engineered products and solutions.

In 2024, Dover's Selling, General, and Administrative (SG&A) expenses were approximately $1.3 billion, a significant outlay for managing its worldwide sales, marketing, and corporate functions. This figure underscores the considerable resources dedicated to market presence and operational oversight.

The company's commitment to future growth and technological leadership is evident in its Research and Development (R&D) spending, which was $324.5 million in 2023. This investment fuels the creation of new products and advanced solutions across Dover's various business segments.

Furthermore, Dover's operational infrastructure requires substantial capital investment. In 2023, capital expenditures reached $305.5 million, an increase from $268.2 million in 2022, demonstrating a continuous commitment to upgrading facilities and expanding production capacity. These investments are crucial for maintaining efficiency and meeting evolving market demands.

Revenue Streams

Dover's core revenue generation stems from the direct sale of industrial equipment, specialized components, and comprehensive systems. These sales are distributed across its diverse operating segments, catering to a broad industrial base.

This segment is particularly strong in markets like vehicle aftermarket, where Dover provides essential parts and systems. Furthermore, its reach extends into the growing clean energy and climate technologies sectors, supplying critical equipment.

For instance, in 2023, Dover's Engineered Products segment, which heavily features equipment sales, reported net sales of $2.0 billion, showcasing the significant contribution of this revenue stream to the company's overall financial performance.

Dover generates recurring revenue through the sale of consumable supplies, critical for the continuous operation of its equipment. This is particularly true in sectors like Imaging & Identification, where ink, labels, and other consumables are regularly needed. For instance, in 2023, Dover's Imaging & Identification segment, a key area for consumable sales, saw its revenue grow to approximately $1.7 billion, highlighting the significant contribution of these ongoing product purchases.

Dover generates substantial revenue from selling aftermarket parts and providing essential maintenance, repair, and technical support services. These offerings are crucial for ensuring the continued optimal performance and extended lifespan of the company's installed product base.

Software and Digital Solutions

Dover's revenue streams are increasingly diversified with a significant portion now coming from software and digital solutions. This shift highlights their strategic pivot towards providing more holistic and integrated offerings to customers.

This includes specialized product traceability software, crucial for supply chain management and regulatory compliance, and advanced digital textile printing solutions that cater to the evolving fashion and apparel industries. These digital offerings represent a growing segment of their business, demonstrating a commitment to innovation and adapting to market demands.

For instance, in 2023, Dover reported substantial growth in its digital solutions segment, with specific figures indicating a double-digit percentage increase in revenue from these areas. This growth is a testament to the increasing adoption of their software and digital platforms by businesses seeking efficiency and advanced capabilities.

- Product Traceability Software: Enhances supply chain visibility and compliance.

- Digital Textile Printing Solutions: Modernizes textile manufacturing with advanced digital technology.

- Integrated Offerings: Combines hardware with software for comprehensive customer solutions.

- Revenue Growth: Digital solutions contributed significantly to Dover's overall revenue increase in 2023.

Project-Based Solutions and System Integration

Dover generates significant revenue from project-based solutions and system integration, particularly for large industrial clients. These offerings involve the intricate design, engineering, and seamless integration of complex systems, often requiring highly customized approaches to meet unique customer specifications.

For example, in 2023, Dover's Engineered Systems segment, which heavily features these solutions, saw substantial contributions. While specific segment revenue breakdowns for project-based solutions are not always isolated, the overall performance indicates strong demand. Dover's ability to deliver end-to-end system integration for critical industrial applications is a key driver of this revenue stream.

- Customized System Design: Tailoring complex engineering solutions to specific client needs in sectors like aerospace, defense, and industrial manufacturing.

- Integration Services: Combining various hardware and software components into a unified, functional system for enhanced operational efficiency.

- Project Management: Overseeing the entire lifecycle of these solutions, from initial concept and design through implementation and final delivery.

- Long-Term Contracts: Securing revenue through multi-year agreements for ongoing support and system maintenance post-integration.

Dover's revenue streams are multifaceted, encompassing the direct sale of industrial equipment and specialized components, alongside recurring income from consumables. The company also benefits from aftermarket parts and services, as well as growing contributions from software and digital solutions.

Project-based solutions and system integration for large industrial clients represent another significant revenue driver, showcasing Dover's ability to deliver customized, complex engineering projects.

These diverse revenue streams are strategically aligned with key industrial markets, including vehicle aftermarket, clean energy, and climate technologies, ensuring broad market penetration.

In 2023, Dover's overall revenue reached approximately $8.1 billion, with its segments like Engineered Products and Imaging & Identification demonstrating strong performance, reflecting the robust demand across its varied offerings.

| Revenue Stream | Key Segments | 2023 Contribution (Approx.) |

|---|---|---|

| Equipment & Component Sales | Engineered Products, Clean Energy & Fueling | Significant portion of total revenue |

| Consumables | Imaging & Identification | Key contributor, with segment revenue around $1.7 billion |

| Aftermarket Parts & Services | All segments | Crucial for ongoing customer relationships and revenue |

| Software & Digital Solutions | Imaging & Identification, Engineered Systems | Experiencing double-digit growth |

| Project-Based Solutions | Engineered Systems | Substantial contributions from complex system integrations |

Business Model Canvas Data Sources

The Business Model Canvas is built using detailed customer feedback, competitive landscape analysis, and internal operational metrics. These diverse data streams ensure a holistic and actionable representation of the business strategy.